North America Dermal Facial Fillers Market Size, Share, Trends & Growth Forecast Report By Material Type (Temporary Fillers, Semi-Permanent Fillers, Permanent Fillers), Product Origin and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Dermal Facial Fillers Market Size

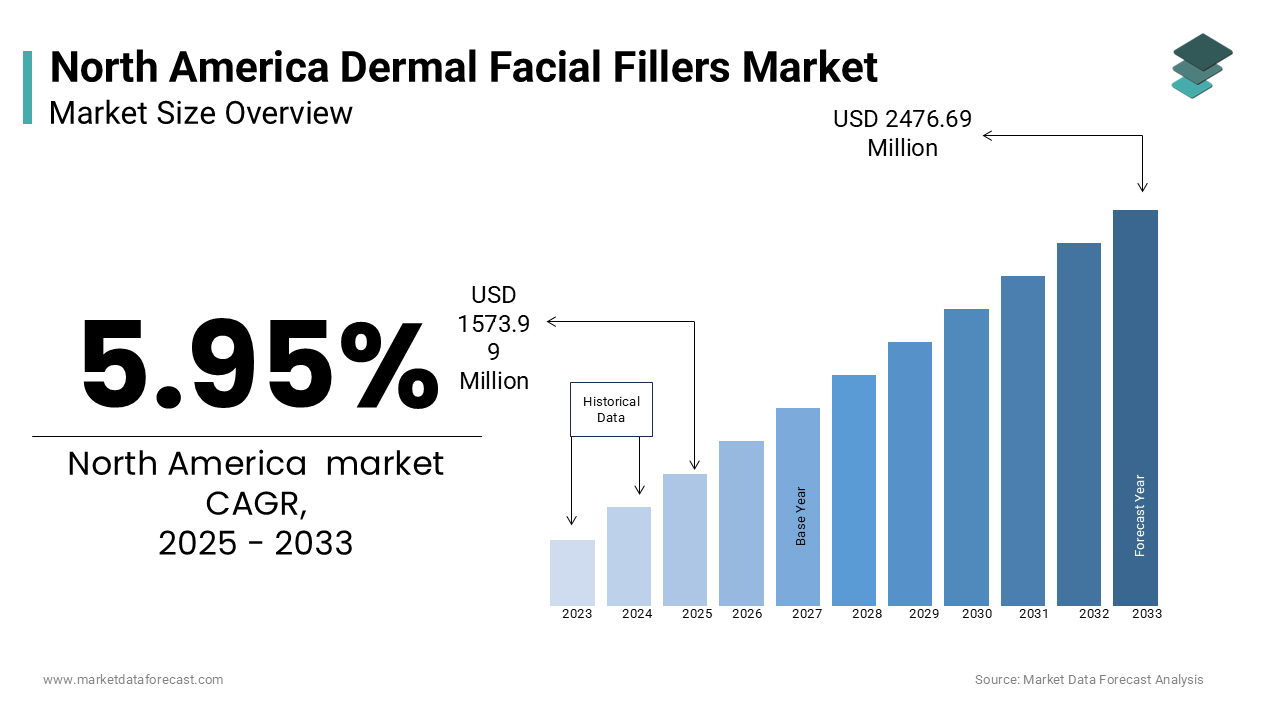

The North America dermal facial fillers market was worth USD 1487.28 million in 2024. The North American market is estimated to grow at a CAGR of 5.95% from 2025 to 2033 and be valued at USD 2476.69 million by the end of 2033 from USD 1573.99 million in 2025.

The North America dermal facial fillers market has been experiencing robust growth from the last few years due to the increasing consumer demand for non-invasive cosmetic procedures and advancements in filler technologies. According to the American Society for Aesthetic Plastic Surgery, over 3 million dermal filler procedures were performed in the United States in 2023, reflecting a 15% annual increase over the past five years. Hyaluronic acid-based fillers dominate the market, accounting for approximately 70% of all procedures, as per data from the International Society of Aesthetic Plastic Surgery. Canada is also witnessing significant adoption, particularly among individuals aged 35-50, who are increasingly opting for temporary fillers to address signs of aging. The rising influence of social media platforms like Instagram has further fueled demand, with influencers promoting aesthetic enhancements as a means of self-expression. Additionally, the growing availability of affordable treatments in medical spas and dermatology clinics has expanded accessibility, making dermal fillers more mainstream. As per Statistics Canada, the number of licensed aesthetic practitioners offering filler services has increased by 20% since 2020, which is a big plus to the regional market expansion.

MARKET DRIVERS

Rising Demand for Non-Invasive Cosmetic Procedures in North America

The growing preference for non-invasive cosmetic procedures is one of the major factors driving the growth of the North American dermal facial fillers market. According to the American Academy of Facial Plastic and Reconstructive Surgery, over 60% of patients seeking cosmetic enhancements opt for minimally invasive treatments such as dermal fillers, driven by their quick recovery times and natural-looking results. This trend is particularly pronounced among millennials, who account for 40% of all filler procedures, as reported by the American Society of Plastic Surgeons. The aging population also plays a pivotal role, as individuals aged 40 and above increasingly seek solutions to combat volume loss and wrinkles. For instance, a study published in the Journal of Cosmetic Dermatology highlights that hyaluronic acid fillers have demonstrated a 90% satisfaction rate among users, reinforcing their popularity. Furthermore, the integration of advanced imaging technologies, such as 3D facial mapping, has enhanced precision and patient confidence, driving adoption rates. These factors collectively underscore the critical role of non-invasive procedures in propelling market growth.

Technological Advancements in Filler Formulations

Technological innovations in dermal filler formulations have revolutionized the market that enhance safety and efficacy while expanding treatment options. Biodegradable hyaluronic acid fillers, for example, now account for over 75% of all filler procedures in North America, as per data from the International Society of Aesthetic Plastic Surgery. These advancements have reduced the risk of adverse reactions, with a study published in the Journal of Clinical and Aesthetic Dermatology reporting a 30% decrease in complications compared to earlier generations. Canada has embraced these innovations, with provincial healthcare systems approving next-generation fillers that offer longer-lasting results. For instance, calcium hydroxylapatite fillers, which provide structural support for up to 18 months, have gained traction among practitioners. Additionally, the development of customizable formulations tailored to individual skin types has improved patient outcomes, as noted by the Canadian Dermatology Association. These advancements not only meet evolving consumer demands but also position North America as a global leader in dermal filler technology.

MARKET RESTRAINTS

High Costs of Advanced Filler Treatments

The high cost of advanced dermal filler treatments is one of the major factors hampering the growth of the North American dermal facial fillers market. According to the Healthcare Cost and Utilization Project, the average cost of a single hyaluronic acid filler session exceeds $800, making it inaccessible for uninsured or underinsured patients. Even with financing options, out-of-pocket expenses can deter individuals from pursuing these procedures. This financial burden is further compounded by the rising costs of cutting-edge technologies, which are often passed on to consumers. For instance, a report by the American Society of Plastic Surgeons reveals that premium fillers, such as those containing lidocaine for pain reduction, are priced 25% higher than traditional options. In Canada, provincial healthcare systems do not cover cosmetic procedures, limiting access for low-income populations. As per Statistics Canada, over 40% of Canadians cite cost as the primary reason for avoiding dermal fillers, hindering market growth and patient accessibility.

Risk of Adverse Reactions and Complications

The risk of adverse reactions and complications associated with dermal fillers is further hindering the growth of the regional market. Despite advancements in formulation technologies, concerns about side effects such as swelling, bruising, and vascular complications persist. According to a survey conducted by the American Board of Cosmetic Surgery, over 20% of patients experience mild to moderate complications following filler injections, deterring potential users. This issue is particularly pronounced among first-time patients, who may lack awareness of the importance of selecting qualified practitioners. Additionally, counterfeit or unapproved products flooding the market exacerbate safety concerns, as highlighted by the Food and Drug Administration. A study published in the Journal of Plastic and Reconstructive Surgery notes that improperly administered fillers account for 15% of all reported complications, underscoring the need for stricter regulatory oversight. These challenges hinder market growth and limit the broader adoption of dermal fillers.

MARKET OPPORTUNITIES

Growing Popularity of Combination Treatments

The increasing popularity of combination treatments is a lucrative opportunity for the regional dermal facial fillers market. According to the American Academy of Dermatology, over 60% of aesthetic practitioners now recommend combining fillers with complementary procedures such as botulinum toxin injections or laser therapies to achieve enhanced results. This trend is particularly appealing to patients seeking comprehensive facial rejuvenation, as combination treatments address multiple signs of aging simultaneously. For instance, a study published in the Journal of Cosmetic and Laser Therapy highlights that combining hyaluronic acid fillers with laser resurfacing can improve skin texture and volume by up to 40%, compared to standalone treatments. Canada has embraced this approach, with medical spas increasingly offering bundled packages to attract cost-conscious consumers. Additionally, advancements in treatment protocols, such as sequential filler placement, have improved outcomes, as noted by the Canadian Society of Plastic Surgeons. These factors position combination treatments as a key growth driver, expanding the market’s reach and appeal.

Expansion into Male Aesthetics

The growing demand for male-specific aesthetic treatments is another significant opportunity for the dermal facial fillers market. According to the American Society for Aesthetic Plastic Surgery, the number of men undergoing minimally invasive cosmetic procedures has increased by 25% over the past five years, driven by shifting societal norms and greater acceptance of male grooming. Hyaluronic acid fillers, in particular, are gaining traction among men aged 30-50, who seek subtle enhancements to address volume loss and improve facial symmetry. For example, a report by the International Society of Aesthetic Plastic Surgery notes that male patients account for 15% of all filler procedures, with this demographic projected to grow exponentially over the forecast period. Canada has also witnessed a surge in demand, with clinics tailoring marketing campaigns to target male consumers. A study published in the Journal of Men’s Health highlights that 70% of men undergoing fillers report improved self-confidence, underscoring the potential for market expansion in this underserved segment.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Costs

Stringent regulatory requirements for dermal fillers is a major challenge to the North American dermal facial filler market. According to the Food and Drug Administration, only 50% of filler products submitted for approval meet the required safety and efficacy standards on the first attempt, necessitating costly revisions and additional testing. This lengthy process discourages smaller companies from entering the market, reducing competition and innovation. Furthermore, post-market surveillance mandates add to compliance burdens, increasing operational costs for manufacturers. A study by the Regulatory Affairs Professionals Society reveals that regulatory hurdles contribute to a 20% reduction in the number of new filler products launched annually. In Canada, provincial healthcare systems impose additional restrictions on the use of certain filler formulations, further complicating market entry. These challenges highlight the need for streamlined approval processes to foster innovation and ensure patient access to advanced treatments.

Ethical Concerns Surrounding Overuse and Misuse

Ethical concerns surrounding the overuse and misuse of dermal fillers are also challenging the growth of the regional market. The growing accessibility of these treatments has led to instances of excessive or inappropriate use, often resulting in unnatural appearances or complications. According to a survey conducted by the Ethics Committee of the American Medical Association, over 30% of patients express hesitation about undergoing filler procedures due to fears of overcorrection or irreversible changes. This sentiment is particularly pronounced among older demographics, who prioritize natural-looking results. Additionally, the rise of unlicensed practitioners administering counterfeit or unapproved products exacerbates safety concerns, as highlighted by the Canadian Dermatology Association. A report by the Biotechnology Innovation Organization notes that ethical and regulatory issues have slowed the adoption of dermal fillers, limiting their market penetration despite their potential benefits.

SEGMENTAL ANALYSIS

By Material Type Insights

The temporary fillers segment led the North America dermal facial fillers market by accounting for 68.7% of the regional market share in 2024. The growth of the temporary fillers segment in the North American is driven by their widespread adoption for addressing early signs of aging, such as fine lines and volume loss, without long-term commitment. According to the American Society for Aesthetic Plastic Surgery, hyaluronic acid-based temporary fillers account for over 90% of all filler procedures performed in the region. Their biodegradability and reversibility make them particularly appealing to first-time users, as they offer flexibility in achieving desired results. Additionally, advancements in formulation technologies, such as lidocaine-infused options, have enhanced patient comfort, driving adoption rates. Government approvals and endorsements from professional bodies, such as the American Board of Cosmetic Surgery, have further solidified their leadership in the market. Medicare and private insurance coverage for certain medical applications, such as HIV-related lipodystrophy, also contribute to their dominance.

The semi-permanent fillers segment is predicted to register the fastest CAGR of 10.4% over the forecast period owing to their ability to provide longer-lasting results compared to temporary options, making them ideal for patients seeking extended aesthetic enhancements. According to the International Society of Aesthetic Plastic Surgery, semi-permanent fillers, such as calcium hydroxylapatite, have demonstrated a 30% increase in adoption rates over the past three years. Canada has also embraced this trend, with provincial healthcare systems approving next-generation formulations for broader applications. A study published in the Journal of Cosmetic Dermatology highlights that semi-permanent fillers reduce the frequency of touch-up treatments by 50%, enhancing convenience for patients. These factors position semi-permanent fillers as the most dynamic segment in the market.

By Product Origin Insights

The natural fillers segment held 61.1% of the North America dermal facial fillers market share in 2024. The leading position of natural fillers segment in the regional market is driven by their biocompatibility and reduced risk of adverse reactions, making them the preferred choice for both practitioners and patients. According to the American Society for Aesthetic Plastic Surgery, hyaluronic acid-based natural fillers account for over 80% of all procedures performed in the region, as they are derived from substances naturally found in the human body. Their ability to integrate seamlessly with tissues ensures natural-looking results, which aligns with consumer preferences for subtlety in aesthetic enhancements. Additionally, advancements in purification and stabilization technologies have extended the durability of natural fillers, addressing earlier concerns about their short lifespan. Regulatory approvals from bodies such as the Food and Drug Administration further reinforce their dominance, as these products undergo rigorous testing to ensure safety and efficacy. The growing availability of affordable natural filler options in medical spas has also expanded accessibility, solidifying their position as the largest segment.

The synthetic fillers segment is projected to witness a CAGR of 12.9% over the forecast period in the North American market owing to their ability to provide long-lasting results and structural support, making them ideal for addressing deeper wrinkles and volume loss. According to the International Society of Aesthetic Plastic Surgery, synthetic fillers such as polymethylmethacrylate (PMMA) have demonstrated a 40% increase in adoption rates over the past five years. Canada has witnessed a surge in demand, particularly among individuals aged 50 and above, who seek durable solutions for age-related concerns. A study published in the Journal of Cosmetic and Laser Therapy highlights that synthetic fillers reduce the need for frequent touch-ups by 60%, enhancing convenience for patients. Additionally, innovations in formulation technologies, such as microsphere integration, have improved biocompatibility and reduced complications, further accelerating adoption. These factors position synthetic fillers as the most promising segment for future growth.

REGIONAL ANALYSIS

The United States dominated the dermal facial fillers market in North America by holding the largest share of the regional market in 2024. The domination of the U.S. in North America is driven by the country’s advanced healthcare infrastructure, high disposable income, and robust investments in aesthetic medicine. According to the American Society for Aesthetic Plastic Surgery, over 3 million dermal filler procedures were performed in the U.S. in 2023, reflecting a 15% annual increase over the past five years. Hyaluronic acid-based fillers dominate the market, accounting for 70% of all procedures, as per data from the International Society of Aesthetic Plastic Surgery. The aging population and growing influence of social media platforms like Instagram have further amplified demand, with influencers promoting aesthetic enhancements as a means of self-expression. Additionally, the presence of leading manufacturers and research institutions ensures continuous innovation, which is further boosting the domination of the U.S. in the regional market.

Canada is another prominent market for dermal facial fillers in North America and is estimated to grow at a prominent CAGR over the forecast period. The rising consumer awareness and an increasing focus on non-invasive cosmetic procedures are propelling the Canadian market growth. According to Statistics Canada, the number of licensed aesthetic practitioners offering filler services has increased by 20% since 2020, reflecting the growing demand for these treatments. Provincial healthcare systems have also embraced advanced filler technologies, with clinics increasingly offering combination treatments tailored to individual needs. Temporary fillers, particularly hyaluronic acid-based options, dominate the market due to their affordability and reversibility. Additionally, partnerships between academia and industry foster innovation, with collaborative efforts driving the development of next-generation fillers. While smaller in scale compared to the U.S., Canada’s strategic emphasis on accessibility and quality healthcare positions it as a key player in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The North America dermal facial fillers market is led by three key players: Allergan (a subsidiary of AbbVie), Galderma, and Merz Pharma. Allergan dominates with its flagship Juvederm line of hyaluronic acid fillers, which are widely regarded as the gold standard in the industry. Galderma follows closely, offering innovative Restylane products that cater to diverse patient needs. Merz Pharma rounds out the top three, with a strong presence in premium fillers and combination therapies. Its commitment to research and development has enabled the launch of advanced formulations, reinforcing its global standing.

The North America dermal facial fillers market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Allergan, Galderma, and Merz Pharma dominating the landscape. These companies compete on the basis of product innovation, technological superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as male-specific formulations and combination treatments. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for minimally invasive procedures and advancements in filler technologies.

Top Strategies Used by Key Market Participants

Key players in the North America dermal facial fillers market employ a variety of strategies to strengthen their positions. Collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Allergan has partnered with leading research institutions to develop next-generation hyaluronic acid formulations. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Galderma, for example, acquired a startup specializing in combination therapies, enhancing its capabilities in comprehensive facial rejuvenation. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Merz Pharma has invested heavily in establishing distribution networks across Canada, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer demands.

RECENT MARKET DEVELOPMENTS

- In February 2024, Allergan launched a next-generation hyaluronic acid filler designed for lip augmentation. This initiative aimed to address unmet consumer needs and expand its product portfolio.

- In April 2024, Galderma acquired a startup specializing in combination therapies. This acquisition was anticipated to enhance its capabilities in comprehensive facial rejuvenation.

- In June 2024, Merz Pharma partnered with a Canadian healthcare provider to improve access to premium fillers in rural areas. This collaboration sought to address regional disparities in aesthetic care.

- In August 2024, Revance Therapeutics introduced a biosimilar filler infused with lidocaine. This innovation aimed to reduce discomfort during injections and improve patient satisfaction.

- In October 2024, Sinclair Pharma expanded its manufacturing facilities in the U.S. to meet the growing demand for biodegradable fillers. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the North America dermal facial fillers market is segmented and sub-segmented based on categories.

By Material Type

- Temporary Fillers

- Collagen

- HA

- Collagen Stimulators

- Semi-Permanent Fillers

- CaHa

- Permanent Fillers

- PMMA

- PAAG

By Product Origin

- Natural

- Synthetic

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the North America dermal fillers market?

Growing demand for non-surgical cosmetic procedures, rising aging population, and advancements in filler technology.

What factors influence the cost of dermal filler treatments?

The cost depends on the type of filler, the amount used, the provider's expertise, and the clinic's location.

What is the future of the North America dermal fillers market?

The market is expected to grow due to increasing aesthetic awareness, new filler innovations, and the rise of minimally invasive procedures.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]