North America Data Center Power Market Size, Share, Trends & Growth Forecast Report By Components (Solution and Services), End-User Type, Data center sizes, Verticals, and Country (The United States, Canada, and Rest of North America), Industry Analysis From 2024 to 2033

North America Data Center Power Market Size

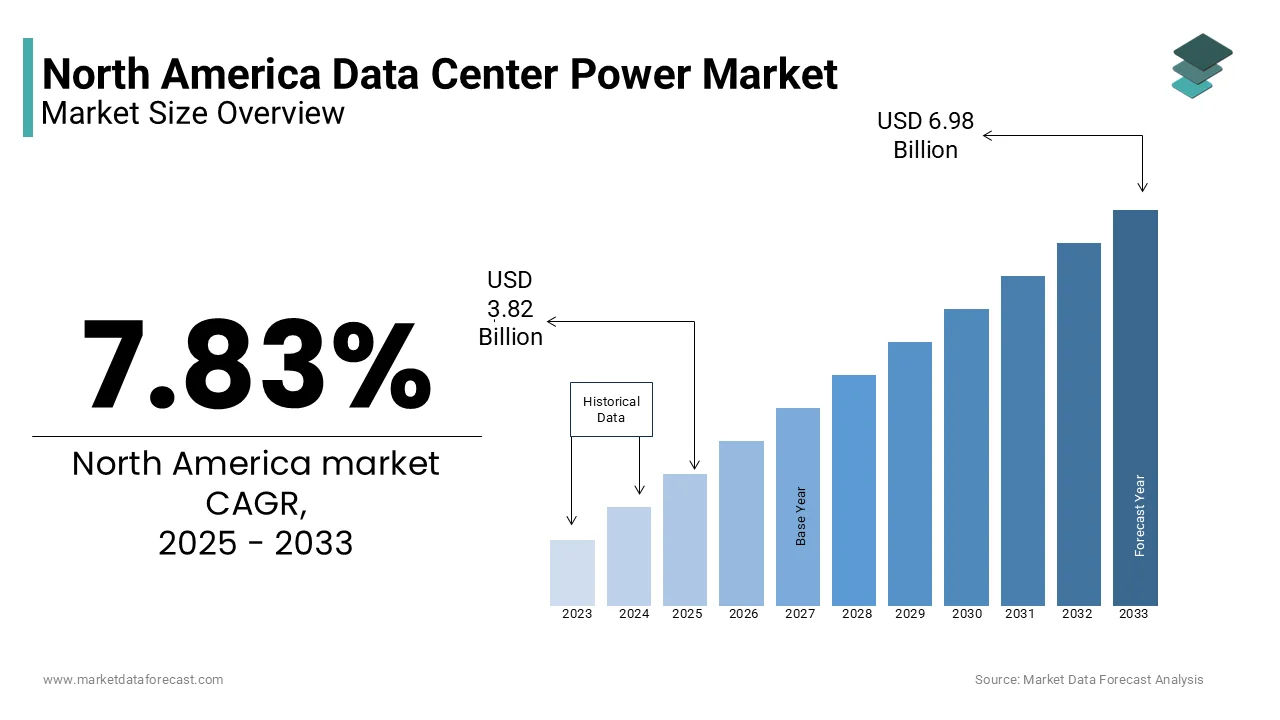

The North America data center power market was worth USD 3.54 billion in 2024. The North America market is projected to reach USD 6.98 billion by 2033 from USD 3.82 billion in 2025, rising at a CAGR of 7.83% from 2025 to 2033.

The North America data center power is the backbone of the digital economy where data centers require substantial energy resources to support their operations, including servers, cooling systems, and networking equipment. The increasing reliance on cloud computing, big data analytics, and the Internet of Things (IoT) has propelled the demand for data center services, thereby intensifying the need for reliable and efficient power solutions.

In 2022, it was estimated that data centers in North America consumed approximately 70 billion kilowatt-hours of electricity, accounting for about 2% of the total electricity consumption in the region. This figure elevates the significant energy footprint of these facilities. According to the U.S. Energy Information Administration, the average electricity price in the United States was around $0.13 per kilowatt-hour, which influences operational costs for data center operators. The growing emphasis on sustainability has also led to a surge in the adoption of renewable energy sources, with many data centers aiming for carbon neutrality by 2030. According to a report by the International Energy Agency, renewable energy sources accounted for nearly 20% of the total electricity generation in the U.S. in 2021 by a shift towards greener energy solutions in the data center power market.

MARKET DRIVERS

Rising Demand for Cloud Services

The surge in cloud computing adoption is a major driver of the North America data center power market. The demand for data center capacity has skyrocketed as businesses increasingly migrate to cloud-based solutions. This growth is due to the enhanced power infrastructure to support the increased computational and storage needs of cloud services. According to the U.S. Energy Information Administration, data centers are projected to consume 73 billion kilowatt-hours of electricity by 2025.

Focus on Sustainability and Energy Efficiency

Another significant driver is the growing emphasis on sustainability and energy efficiency within the data center sector. Many operators are adopting renewable energy sources to reduce their carbon footprint and comply with stringent environmental regulations. According to the U.S. Environmental Protection Agency, data centers accounted for about 2% of total U.S. greenhouse gas emissions in 2021 by prompting a shift towards greener practices. By 2025, it is estimated that over 50% of data centers in North America will utilize renewable energy sources, such as solar and wind, to power their operations. Additionally, initiatives aimed at improving Power Usage Effectiveness (PUE) are gaining traction, with many facilities targeting a PUE of 1.2 or lower, which reflects a commitment to operational efficiency and sustainability.

MARKET RESTRAINTS

High Energy Costs

One of the significant restraints on the North America data center power market is the rising cost of electricity. The operators face escalating operational expenses as data centers expand and their energy consumption increases. According to the U.S. Energy Information Administration, the average retail price of electricity in the United States was approximately $0.13 per kilowatt-hour in 2022, with some regions experiencing even higher rates. This financial burden can deter investment in new data center facilities or upgrades to existing infrastructure. Additionally, fluctuations in energy prices can create uncertainty for operators by making it challenging to forecast operational costs accurately. Consequently, high energy costs can limit the growth potential of the data center power market in North America.

Regulatory Challenges

The regulatory challenges also pose a significant restraint on the North America data center power market. Data center operators must navigate a complex landscape of federal, state, and local regulations concerning energy consumption, emissions, and land use. The U.S. Environmental Protection Agency has implemented various regulations aimed at reducing greenhouse gas emissions, which can impose additional compliance costs on data center operators. For instance, the Clean Power Plan, although currently under review, has the potential to affect energy sourcing and operational practices significantly. Moreover, local zoning laws can restrict the construction of new data centers, particularly in areas with limited infrastructure. These regulatory hurdles can slow down the expansion of data center facilities and increase operational complexities for existing operators.

MARKET OPPORTUNITIES

Adoption of Renewable Energy Sources

The increasing shift towards renewable energy presents a significant opportunity for the North America data center power market. Many data centers are investing in solar, wind, and other renewable energy sources as organizations strive to meet sustainability goals. According to the U.S. Department of Energy, renewable energy accounted for approximately 20% of total electricity generation in the United States in 2021, and this figure is expected to rise as technology advances and costs decrease. The data centers can not only reduce their carbon footprint but also mitigate the impact of fluctuating energy prices. This transition aligns with the growing demand for environmentally responsible practices by positioning data centers as leaders in sustainability.

Technological Advancements in Energy Efficiency

Technological advancements in energy efficiency represent another promising opportunity for the North America data center power market. Innovations such as advanced cooling systems, energy-efficient hardware, and artificial intelligence-driven energy management solutions are transforming how data centers operate. The U.S. Department of Energy has reported that implementing energy-efficient technologies can reduce data center energy consumption by up to 30%. Furthermore, the rise of edge computing is driving the need for smaller, more efficient data centers that can operate closer to the source of data generation. This trend not only enhances performance but also reduces latency and energy costs. As operators adopt these technologies, they can achieve significant operational savings while meeting the increasing demand for data processing and storage.

MARKET CHALLENGES

Infrastructure Limitations

One of the major challenges facing the North America data center power market is the existing limitations in infrastructure. Many regions, particularly those experiencing rapid growth in data center development, struggle with inadequate power supply and grid capacity. The North American Electric Reliability Corporation has indicated that certain areas may face reliability issues due to increased demand from data centers, which can strain local power grids. For instance, in 2022, the California Independent System Operator reported that the state’s energy demand could exceed supply during peak periods, leading to potential outages. This infrastructure inadequacy can hinder the expansion of data centers and increase operational risks by making it essential for stakeholders to invest in grid enhancements and energy storage solutions.

Skilled Labor Shortage

Another significant challenge in the North America data center power market is the shortage of skilled labor. The demand for qualified professionals in areas such as energy management, IT infrastructure, and data center operations has surged as the industry evolves with new technologies and practices, The U.S. Bureau of Labor Statistics projects that employment in computer and information technology occupations will grow by 13% from 2020 to 2030, significantly faster than the average for all occupations. However, the current workforce is not adequately prepared to meet this demand is leading to a skills gap that can impede operational efficiency and innovation. This shortage can result in increased labor costs and delays in project implementation by ultimately affecting the competitiveness of data center operators in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.83% |

|

Segments Covered |

By Components, End-User Type, Data center sizes, Verticals, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Vertiv Group Corp., ABB Ltd, Schneider Electric, Tripp Lite (Eaton), Raritan Inc. (Legrand), Enlogic (nvent), Kohler Co., LayerZero Power Systems, Toshiba International Corporation, Siemens AG, Cummins Inc., and Legrand. |

SEGMENT ANALYSIS

By Components Insights

The solutions segment dominated the North American data center power market with a share of 63.9% in 2024 with the widespread adoption of advanced power infrastructure, including uninterruptible power supply (UPS) systems and precision cooling solutions. The importance of this segment lies in its role in ensuring operational reliability, with data centers requiring 24/7 uptime to support critical applications. According to the Department of Energy, energy-efficient solutions have reduced power usage effectiveness (PUE) ratios to an average of 1.5.

The services segment is growing at faster rate with a projected CAGR of 12.3% throughout the forecast period. This growth is fueled by the increasing complexity of data center operations and the need for maintenance, monitoring, and optimization of power systems. Rising energy costs and regulatory pressures are pushing operators to adopt managed services for sustainability. According to the Environmental Protection Agency, service-based energy management has improved efficiency by 20% in recent years. The demand for consulting and integration services rises by emphasizing their role in achieving net-zero emissions goals.

By End-User Type Insights

The hyperscale data centers segment dominated the North American data center power market by capturing 40.3% of the total market share in 2024 due to the exponential growth in cloud computing and AI workloads, which require massive computational power and energy efficiency. These facilities are designed to scale rapidly, with some hyperscale centers consuming up to 100 megawatts of power, equivalent to powering 80,000 homes. According to the International Energy Agency, hyperscale facilities achieve a Power Usage Effectiveness (PUE) as low as 1.1 by making them more efficient than traditional setups. This segment’s importance lies in its ability to meet surging demand while optimizing energy use.

The cloud providers segment is attributed in holding the prominent CGAR of 15.2% during the forecast period. This rapid expansion is driven by the increasing adoption of hybrid and multi-cloud strategies among businesses, alongside rising investments in digital transformation. According to the U.S. Environmental Protection Agency, cloud-based infrastructure reduces energy consumption by up to 30% compared to on-premises solutions that further fuels its growth. Additionally, cloud providers are aggressively adopting renewable energy, with companies like Amazon Web Services committing to powering operations with 100% renewable energy by 2025. This segment's importance lies in its role as a catalyst for sustainability and technological innovation by enabling scalable, cost-effective IT solutions across industries.

By Data center sizes Insights

The large data centers segment dominated the North American data center power market by accounting for over 60.4% of the total share in 2024. The rising demand for hyperscale facilities driven by cloud service providers like Amazon Web Services and Microsoft Azure is ascribed to boost the growth of the market. These facilities require robust power infrastructure, with an average large data center consuming 20-50 MW of power annually. Their importance lies in supporting high-performance computing and AI applications. According to the U.S. Energy Information Administration, these facilities are pivotal in driving digital economies, with their energy-efficient designs reducing operational costs despite their immense power needs.

The small and medium-sized data centers segment is attributed in registering a CAGR of 8.5% from 2025 to 2033. This growth is fueled by increasing adoption among SMEs and edge computing applications requiring localized processing. A report by the Environmental Protection Agency have shown that these data centers consume approximately 10-15 MW annually by making them ideal for integrating renewable energy solutions like solar panels. Their scalability and lower upfront costs make them attractive for businesses seeking flexibility. Furthermore, the rise of IoT devices has amplified their importance, as they reduce latency by processing data closer to end-users, ensuring faster response times.

By Verticals Insights

The IT and Telecommunication segment dominated the North American data center power market by holding 45.6% of the share in 2024. The exponential growth in cloud computing, 5G deployment, and IoT devices requires robust data processing capabilities that is escalating the growth of this segment. According to the Federal Communications Commission, over 97% of Americans now use advanced telecommunications services is driving demand for high-capacity data centers. According to the International Data Corporation, global data creation will reach 180 zettabytes by 2025, with a significant portion processed in North America.

The healthcare sector is anticipated to grow with an estimated CAGR of 15.2% in the foreseen years. This rapid growth is fueled by the adoption of electronic health records (EHRs), telemedicine, and AI-driven diagnostics, which collectively generated over 2,314 petabytes of healthcare data in 2022 alone, as reported by the National Institutes of Health. Furthermore, the Centers for Medicare & Medicaid Services (CMS) studies have shown that the U.S. healthcare spending reached $4.3 trillion in 2021. The data centers are vital for securely managing sensitive patient information while ensuring compliance with HIPAA regulations with the rise of personalized medicine and remote patient monitoring.

REGIONAL ANALYSIS

The United States dominated the North American data center power market with 65.7% of the regional market share in 2024, which is driven by its status as a global technology hub, with over 2,600 data centers operational nationwide, according to the Federal Communications Commission. The country’s robust IT infrastructure supports industries like cloud computing, AI, and e-commerce, which collectively consumed 73 billion kilowatt-hours of electricity in 2020, as per Lawrence Berkeley National Laboratory. The U.S. remains pivotal to sustaining digital innovation and economic growth with hyperscale facilities proliferating.

Canada is the fastest North American data center power market with a projected CAGR of 12.4% from 2025 to 2033. This growth is fueled by its colder climate, which reduces cooling costs, and abundant renewable energy sources, with hydroelectricity contributing over 60% of its energy mix, as stated by Statistics Canada. The Canadian government’s commitment to achieving net-zero emissions by 2050 has attracted investments in green data centers. Additionally, the rise of multinational tech companies establishing operations in cities like Toronto and Montreal escalates its strategic importance. Canada’s focus on sustainability positions it as a critical player in shaping eco-friendly data center ecosystems globally.

KEY MARKET PLAYERS

The major players in the North America data center power market include Vertiv Group Corp., ABB Ltd, Schneider Electric, Tripp Lite (Eaton), Raritan Inc. (Legrand), Enlogic (nvent), Kohler Co., LayerZero Power Systems, Toshiba International Corporation, Siemens AG, Cummins Inc., and Legrand.

TOP 3 PLAYERS IN THE MARKET

Vertiv Group Corp.

Vertiv Group Corp. is a prominent leader in the North American data center power market, widely recognized for its comprehensive portfolio of thermal management, UPS systems, and power distribution solutions. The company’s cutting-edge innovations, such as its Liebert and Chloride series, have set industry standards for energy efficiency and reliability. Vertiv has established itself as a key enabler of edge computing and hyperscale facilities, supporting the growing demand for cloud services and digital transformation. Its commitment to sustainability is reflected in its development of technologies that integrate renewable energy sources into data center operations, making it a cornerstone of modern IT infrastructure.

ABB Ltd

ABB Ltd is a major player in the North American data center power market, known for its expertise in electrification, automation, and robotics. The company provides advanced solutions such as low- and medium-voltage switchgear, uninterruptible power supply (UPS) systems, and smart grid technologies. ABB’s focus on sustainability is evident through its initiatives to optimize energy consumption and reduce carbon footprints across industries. By leveraging artificial intelligence and IoT, ABB has introduced tools that enhance power usage effectiveness (PUE) in data centers, ensuring optimal performance and reliability. Its dominance in digitalization and energy-efficient technologies has made it a trusted partner for modernizing critical infrastructure.

Schneider Electric

Schneider Electric is a leading innovator in the North American data center power market, offering end-to-end solutions through its EcoStruxure platform. The company specializes in power management, cooling systems, and real-time monitoring tools, enabling data centers to achieve superior efficiency and resilience. Schneider Electric has been at the forefront of promoting sustainable practices, with initiatives aimed at reducing environmental impact and advancing green technologies. Its modular data center solutions have revolutionized deployment processes, providing faster and more cost-effective options for operators. By prioritizing innovation and sustainability, Schneider Electric continues to shape the evolution of energy-efficient data centers globally.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Innovation and Product Diversification

Leading companies like Vertiv Group Corp. and Schneider Electric have prioritized research and development to introduce cutting-edge solutions tailored to modern data center needs. For instance, Vertiv has focused on developing advanced UPS systems and thermal management technologies that improve energy efficiency and support edge computing deployments. Similarly, Schneider Electric’s EcoStruxure platform integrates IoT, AI, and real-time monitoring to optimize power usage and enhance operational resilience. By offering modular and scalable solutions, these companies cater to the growing demand for flexible and future-ready infrastructure.

Strategic Partnerships and Collaborations

Key players have formed alliances with technology providers, cloud service operators, and government agencies to expand their reach and capabilities. For example, ABB Ltd has collaborated with major hyperscale data center operators to deploy smart grid technologies and renewable energy integration solutions. Such partnerships enable companies to access new markets, leverage complementary expertise, and deliver comprehensive solutions that align with industry trends like digital transformation and sustainability.

Mergers and Acquisitions

Acquisitions have been a critical strategy for companies aiming to consolidate their market presence and diversify their offerings. For instance, Legrand’s acquisition of Raritan Inc. expanded its portfolio of power distribution and monitoring solutions, enhancing its ability to serve data center clients. Similarly, Eaton’s acquisition of Tripp Lite bolstered its position in the power management segment, enabling it to offer a broader range of products and services.

Sustainability and Green Initiatives

Sustainability has become a cornerstone of competitive strategy in this market. Companies like Schneider Electric and ABB are investing heavily in eco-friendly technologies, such as liquid cooling systems, microgrids, and renewable energy integration. These efforts not only align with regulatory requirements but also appeal to environmentally conscious customers seeking to reduce their carbon footprints. By championing green innovations, these players reinforce their dominance in driving sustainable practices across the industry.

COMPETITIVE LANDSCAPE

The North American data center power market is characterized by intense competition, driven by the rapid expansion of digital infrastructure and the growing demand for energy-efficient solutions. The market is highly consolidated, with key players such as Vertiv Group Corp., ABB Ltd, Schneider Electric, Eaton, and Siemens AG dominating the landscape. These companies leverage their technological expertise, extensive product portfolios, and global reach to maintain their competitive edge. Innovation remains a critical differentiator, with firms investing heavily in R&D to develop advanced UPS systems, intelligent power management platforms, and sustainable cooling technologies that align with the evolving needs of hyperscale facilities and edge computing environments.

In addition to innovation, competitive strategies include mergers and acquisitions, partnerships, and geographic expansion. For instance, companies like Legrand and Eaton have strengthened their market positions through strategic acquisitions, enabling them to offer comprehensive solutions that cater to diverse customer requirements. Furthermore, sustainability has emerged as a key battleground, with firms striving to integrate renewable energy sources and reduce carbon footprints to meet stringent environmental regulations and customer expectations.

Despite the dominance of established players, smaller firms and startups are gaining traction by offering niche solutions, such as modular designs and AI-driven energy optimization tools. This dynamic competitive environment fosters continuous advancements, ensuring that the North American data center power market remains at the forefront of technological progress and sustainability dominance. As demand for digital services grows, competition will likely intensify further, driving innovation and operational excellence across the industry.

RECENT MARKET DEVELOPMENTS

- In December 2024, Vertiv acquired centrifugal chiller technology from BiXin Energy. This acquisition is expected to broaden its global solutions portfolio in support of high-performance computing and AI applications.

- In October 2024, Vertiv introduced the Liebert® APM2, a modular high power density, online, three-phase uninterruptible power supply (UPS) system. This launch aims to enhance power reliability for dynamic computing environments in North America.

- In November 2021, Vertiv acquired E+I Engineering, a global provider of electrical switchgear and power distribution systems. This acquisition strengthened Vertiv’s data center power infrastructure offerings.

- In February 2020, Vertiv became a publicly traded company on the New York Stock Exchange (NYSE: VRT) through a merger with GS Acquisition Holdings. This transition aimed to accelerate Vertiv’s growth in the data center sector.

- In December 2023, Vertiv acquired CoolTera Ltd., a provider of coolant distribution infrastructure for data center liquid cooling technology. This acquisition strengthened Vertiv’s thermal management portfolio for high-density compute cooling requirements.

MARKET SEGMENTATION

This research report on the North America data center power market is segmented and sub-segmented into the following categories.

By Components

- Solution

- Power distribution

- Power monitoring

- Power backup

- Cabling infrastructure

- Services

- Design and consulting

- Integration and deployment

- Support and maintenance

By End-User Type

- Enterprises

- Colocation providers

- Cloud providers

- Hyperscale data centers

By Data center sizes

- Small and Medium-sized data center

- Large data center

By Verticals

- BFSI

- IT and Telecommunication

- Media and Entertainment

- Healthcare

- Government and Defense

- Retail

- Manufacturing

- Others (Energy, research and academia, and transport and logistics)

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What is driving the growth of the North America data center power market?

The market is growing due to increasing cloud computing adoption, rising data consumption, and the expansion of hyperscale data centers.

Which industries are major contributors to data center power demand?

The IT & telecom, banking & financial services, healthcare, and government sectors are the largest consumers of data center power.

What are the latest innovations in data center power management?

Innovations include AI-driven power optimization, lithium-ion battery adoption, and advanced energy monitoring systems.

What is the future outlook for the North America data center power market?

The market is expected to grow due to increased investments in hyperscale and sustainable data centers, alongside advancements in energy efficiency technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]