North America Dark Chocolate Market Size, Share, Trends & Growth Forecast Report By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, and Others), and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Dark Chocolate Market Size

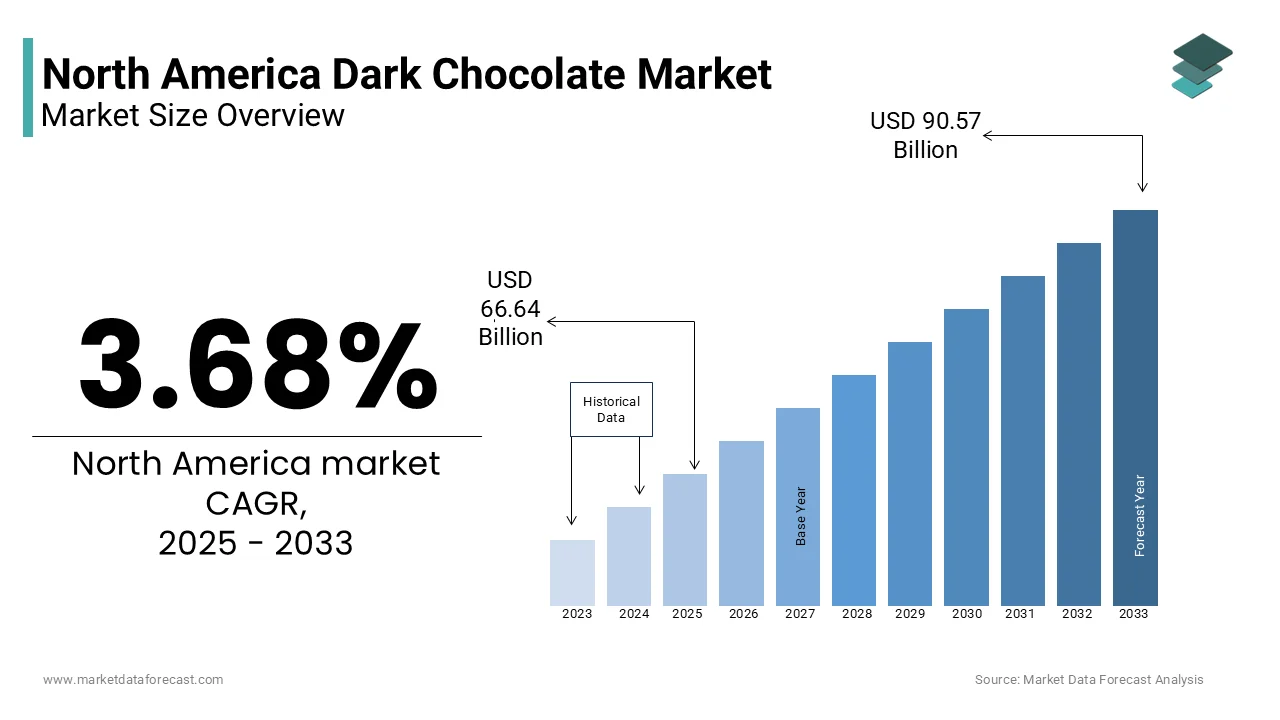

The Dark Chocolate market size in North America was valued at USD 21.66 billion in 2024 and is predicted to be worth USD 90.57 billion by 2033 from USD 66.64 billion in 2025 and grow at a CAGR of 3.68% from 2025 to 2033.

Dark chocolate is often lauded for its potential health benefits, including antioxidant properties and cardiovascular health support, making it a popular choice among health-conscious consumers. The market has experienced significant growth, driven by increasing consumer awareness of the health benefits associated with dark chocolate, as well as the rising demand for premium and artisanal chocolate products. This market expansion is further fuelled by the expanding range of dark chocolate offerings, including organic, fair trade, and specialty varieties. As people continue to seek indulgent yet healthier snack options, the dark chocolate market in North America is poised for r to evolving consumer preferences.

MARKET DRIVERS

Growing Health Consciousness Among Consumers

The growing health consciousness among consumers is a significant driver of the North America dark chocolate market. As individuals become more aware of the importance of nutrition and its impact on overall health, there is a marked shift towards healthier snacking options. According to a survey conducted by the National Confectioners Association, 70% of consumers consider dark chocolate to be a healthier alternative to other types of chocolate that is primarily due to its higher cocoa content and lower sugar levels. Dark chocolate is rich in flavonoids which are known for their antioxidant properties and potential cardiovascular benefits. This perception of dark chocolate as a guilt-free indulgence has led to increased demand, particularly among millennials and health-conscious consumers. Also, the rise of clean label products, where consumers seek transparency in ingredient sourcing, has further propelled the popularity of dark chocolate, as many brands emphasize natural ingredients and ethical sourcing practices.

Expansion of Premium and Artisanal Chocolate Segments

The expansion of the premium and artisanal chocolate segments represents another key driver propelling the North America dark chocolate market. As consumers increasingly seek high-quality, unique, and indulgent chocolate experiences, the demand for premium dark chocolate products has surged. Artisanal chocolate brands are gaining popularity for their emphasis on craftsmanship, quality ingredients, and innovative flavor combinations. The rising wave of gifting premium chocolates during holidays and special occasions further fuels the demand for dark chocolate products. Furthermore, the rise of e-commerce platforms has made it easier for consumers to access a diverse range of premium and artisanal dark chocolate offerings.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints affecting the North America dark chocolate market is the high production costs associated with premium cocoa and chocolate ingredients. The price of cocoa has been subject to fluctuations due to various factors, including climate change, supply chain disruptions, and geopolitical issues in cocoa-producing regions. As per the International Cocoa Organization, cocoa prices have seen significant volatility, with prices reaching as high as $3,000 per metric ton in recent years. This volatility can impact the production costs for dark chocolate manufacturers, leading to increased prices for end consumers. Moreover, the sourcing of high-quality, ethically produced cocoa can further elevate production costs, particularly for brands that emphasize sustainability and fair trade practices. These high production costs can result in elevated retail prices for dark chocolate products, potentially limiting their accessibility to price-sensitive consumers. Dark chocolate producers must focus on optimizing their production processes and exploring cost-effective sourcing strategies to tackle this problem.

Competition from Alternative Snacks

A grave restraint derailing the growth of the North America dark chocolate market is the intense competition from alternative snacks and confectionery products. The market for snacks is highly saturated, with numerous established brands offering a wide variety of options, including healthier alternatives such as protein bars, fruit snacks, and nut-based products. Many consumers may opt for these alternatives due to their perceived health benefits or lower calorie counts, which can pose a challenge for dark chocolate producers. Also, the marketing and branding efforts of established snack companies can overshadow newer entrants in the dark chocolate segment. So, dark chocolate brands must focus on differentiating their products through unique flavors, health benefits, and sustainable sourcing practices to resolve this issue.

MARKET OPPORTUNITIES

Rising Demand for Organic and Fair-Trade Products

The rising demand for organic and fair-trade products presents a significant opportunity for growth in the North America dark chocolate market. As consumers become more conscious of the environmental and social impacts of their purchasing decisions, there is a growing preference for products that align with their values. In line with the Organic Trade Association, organic food sales in the United States reached $62 billion in 2020 is illustrating a 12.4% increase from the previous year. The brands that give organic and fair-trade certifications can attract health-conscious consumers who prioritize sustainability and ethical sourcing. The increasing availability of organic cocoa and the growing number of brands committed to fair-trade practices further support this trend.

Expansion of E-commerce and Online Retail

The expansion of e-commerce and online retail channels represents another major opportunity for growth in the North America dark chocolate market. The COVID-19 pandemic has accelerated the shift towards online shopping, with consumers increasingly turning to digital platforms for their grocery and snack purchases. Dark chocolate companies can leverage e-commerce platforms to reach a wider audience and offer a diverse range of products including premium and artisanal options that may not be available in traditional retail settings. Apart from this, the rise of subscription services for gourmet foods and snacks is further driving the demand for online sales of dark chocolate.

MARKET CHALLENGES

Supply Chain Disruptions

A serious challenge in front of the North America dark chocolate market is the potential for supply chain disruptions and particularly in the sourcing of cocoa. The cocoa supply chain is vulnerable to various factors covering climate change, political instability in cocoa-producing regions, and fluctuations in global demand. As detailed in a report issued by the International Cocoa Organization, the cocoa trade has seen great volatility, with production levels affected by adverse weather conditions and diseases affecting cocoa crops. These disruptions can lead to shortages and increased prices for cocoa, impacting the production costs for dark chocolate manufacturers. Besides, the COVID-19 pandemic has showed the fragility of global supply chains, leading to delays and increased transportation costs. The producers of this must develop robust supply chain strategies that prioritize sustainability and resilience to mitigate these risks.

Consumer Price Sensitivity

A further severe challenge impacting the North America dark chocolate market is consumer price sensitivity. As the market continues to grow, consumers are increasingly seeking value for their money, particularly in a competitive landscape filled with various snack options. According to a study, 60% of consumers reported that price is a significant factor in their purchasing decisions when it comes to snacks and confectionery products. This price sensitivity can pose a challenge for dark chocolate producers, particularly those offering premium or artisanal products that may come with higher price points. Additionally, economic fluctuations and uncertainties can further impact consumer spending habits, leading to a preference for more affordable alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.68% |

|

Segments Covered |

By Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Lindt & Sprüngli, Ghirardelli Chocolate Company, Godiva Chocolatier, Ferrero International SA, Mars Incorporated, Mondelēz International Inc., Nestlé SA, and The Hershey Company, and others |

SEGMENTAL INSIGHTS

By Distribution Channel Insights

The supermarkets and hypermarkets segment remained the largest category by accounting for 55% of the total market share in 2024. This authority can be linked to the extensive reach and convenience offered by these retail formats which give consumers with a wide variety of dark chocolate options under one roof. Based on a report , the grocery store industry in the United States generates approximately $800 billion in revenue annually, with a significant portion attributed to confectionery sales. Supermarkets and hypermarkets often feature dedicated sections for chocolate products are making it easier for consumers to find and purchase dark chocolate. The growing trend of health-conscious shopping further propels the demand for dark chocolate in these retail environments, as consumers increasingly seek nutritious options while grocery shopping.

Online retail channel is the quickly expanding segment in the North America dark which is projected to experience a CAGR of 31.5% from 2025 to 2033. This rise can be attributed to the increasing consumer preference for online shopping, particularly in the wake of the COVID-19 pandemic, which has accelerated the shift towards e-commerce. These platforms offer consumers the convenience of purchasing dark chocolate from the comfort of their homes, often with the added benefit of home delivery. Besides, the rise of subscription services for gourmet chocolates is further driving the demand for online sales.

REGIONAL ANALYSIS

The United States led the regional landscape in the North America dark chocolate market and commanded a market share of 69.9% in 2024. This rule can be linked to the country's advanced retail infrastructure and the presence of major chocolate brands driving innovation in the dark chocolate segment. According to the National Confectioners Association, the U.S. chocolate business is estimated to reach $22 billion by 2025, with dark chocolate accounting for a significant portion of this growth. The U.S. market is defined by substantial investments in marketing and distribution and si leading to the introduction of a wide variety of dark chocolate options that cater to diverse consumer preferences. Additionally, the increasing focus on health and wellness among American consumers further propels the demand for dark chocolate.

Canada shows the highest growth momentum in the North America dark chocolate market and is projected to achieve a CAGR of 9.3% during the forecast timeframe. This is fuelled by the increasing demand for dark chocolate driven by the expansion of the health and wellness sector and the rising adoption of premium chocolate products. As outlined by Statistics Canada, the Canadian chocolate sphere is predicted to expand by 5% annually and is making opportunities for dark chocolate producers. Also, the Canadian market reflects a strong attention to the quality and sustainability, with consumers increasingly recognizing the importance of dark chocolate in enhancing their nutrition. Furthermore, government initiatives aimed at promoting healthy eating and local sourcing further support this trend.

The rest of North America, which includes countries such as Mexico, displays moderate development in the dark chocolate market. This segment is witnessing growth supported by the increasing demand for dark chocolate and the expansion of the retail sector in the region. The market is characterized by a focus on affordability and accessibility, with organizations seeking cost-effective dark chocolate solutions that enhance consumer health. Additionally, the rising awareness of the importance of nutrition and wellness is driving the adoption of dark chocolate among Mexican consumers.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Lindt & Sprüngli, Ghirardelli Chocolate Company, Godiva Chocolatier, Ferrero International SA, Mars Incorporated, Mondelēz International Inc., Nestlé SA, and The Hershey Company are playing dominating role in the North America dark chocolate market.

The competition in the North America dark chocolate market is characterized by a dynamic landscape where innovation, quality, and consumer engagement are paramount. Major players are continuously striving to differentiate themselves through unique product offerings and effective marketing strategies. The market is witnessing a surge in the adoption of dark chocolate, driven by increasing consumer demand for healthier and more indulgent snack options. As organizations prioritize health and wellness, companies that provide high-quality, flavorful, and functional dark chocolate products are gaining a competitive edge.

Furthermore, the presence of both established brands and emerging startups fosters a competitive environment that encourages rapid product development and innovation. The ongoing trend of health-conscious consumption is further intensifying competition, as consumers seek out new and exciting flavors and formulations.

TOP PLAYERS IN THE MARKET

Lindt & Sprüngli

Lindt & Sprüngli is a leading player in the North America dark chocolate market, known for its premium quality chocolate products. The company offers a wide range of dark chocolate options, including bars, truffles, and seasonal products, catering to the growing demand for high-quality chocolate. Lindt's commitment to quality and craftsmanship has positioned it as a dominant force in the dark chocolate market, with a significant share of the North American landscape.

Ghirardelli Chocolate Company

Ghirardelli Chocolate Company is another major player in the North America dark chocolate market, recognized for its rich and indulgent dark chocolate products. The company offers a variety of dark chocolate bars, baking products, and seasonal treats, appealing to both consumers and culinary professionals. Ghirardelli's focus on quality ingredients and innovative flavors has enabled it to capture a significant share of the market.

Godiva Chocolatier

Godiva Chocolatier is a prominent player in the North America dark chocolate market, specializing in luxury chocolate products. The company offers a range of dark chocolate options, including pralines, bars, and gift assortments, catering to the premium chocolate segment. Godiva's strong brand reputation and commitment to quality have made it a trusted choice for consumers seeking indulgent dark chocolate experiences.

STRATEGIES USED BY THE MARKET PLAYERS

Key players in the North America dark chocolate market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and product development, enabling companies to introduce new flavors and formulations that cater to evolving consumer preferences. For instance, Lindt & Sprüngli continuously expands its product line to include unique dark chocolate offerings that align with market trends.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Ghirardelli, for example, has formed alliances with various retailers to ensure a diverse range of high-quality dark chocolate products for its customers, allowing the brand to differentiate itself in a competitive landscape.

Furthermore, companies are increasingly prioritizing sustainability and ethical sourcing in their production processes. Godiva emphasizes its commitment to using responsibly sourced cocoa and environmentally friendly packaging, which resonates with health-conscious consumers.

Moreover, many key players are actively pursuing marketing initiatives to raise awareness of their products and educate consumers about the benefits of dark chocolate. By leveraging social media and influencer partnerships, these companies can effectively engage with their target audience and drive sales.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Lindt & Sprüngli announced the launch of a new line of dark chocolate bars infused with superfoods, targeting health-conscious consumers.

- In February 2024, Ghirardelli introduced a new range of dark chocolate baking products aimed at home bakers and culinary professionals.

- In March 2024, Godiva expanded its dark chocolate offerings to include a new collection of vegan chocolates, catering to the growing demand for plant-based options.

- In April 2024, Ferrero announced a partnership with a major retailer to enhance the distribution of its premium dark chocolate products across North America.

- In May 2024, Theo Chocolate launched a new marketing campaign focused on the ethical sourcing of its dark chocolate ingredients.

- In June 2024, Green & Black's introduced a new line of organic dark chocolate bars with unique flavor combinations, appealing to adventurous consumers.

- In July 2024, Endangered Species Chocolate announced a collaboration with a wildlife conservation organization to promote its dark chocolate products and support environmental initiatives.

- In August 2024, Alter Eco launched a new packaging design for its dark chocolate bars, emphasizing sustainability and eco-friendliness.

- In September 2024, Chocolove expanded its product line to include dark chocolate-covered fruits, targeting health-conscious snackers.

- In October 2024, Scharffen Berger announced a new partnership with a gourmet food distributor to increase the availability of its artisanal dark chocolate products.

MARKET SEGMENTATION

This research report on the North American Dark Chocolate market has been segmented and sub-segmented based on the following categories.

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the projected CAGR for the North America dark chocolate market from 2025 to 2033?

The dark chocolate market is expected to grow at a CAGR of 3.68% from 2025 to 2033

2. What factors are driving the growth of the North America dark chocolate market?

Rising awareness of the nutritional content and stress-relieving properties of dark chocolate, the expansion of online retail and e-commerce, and its suitability as a gifting option are driving market growth

3. What distribution channels are most common for dark chocolate in North America?

Supermarkets and hypermarkets, convenience stores, and non-grocery retailers are common distribution channels

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]