North America Controlled Release Fertilizers Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, And By Country (The US, Canada, And Rest of North America), Industry Analysis From (2025 to 2033)

North America Controlled Release Fertilizers Market Size

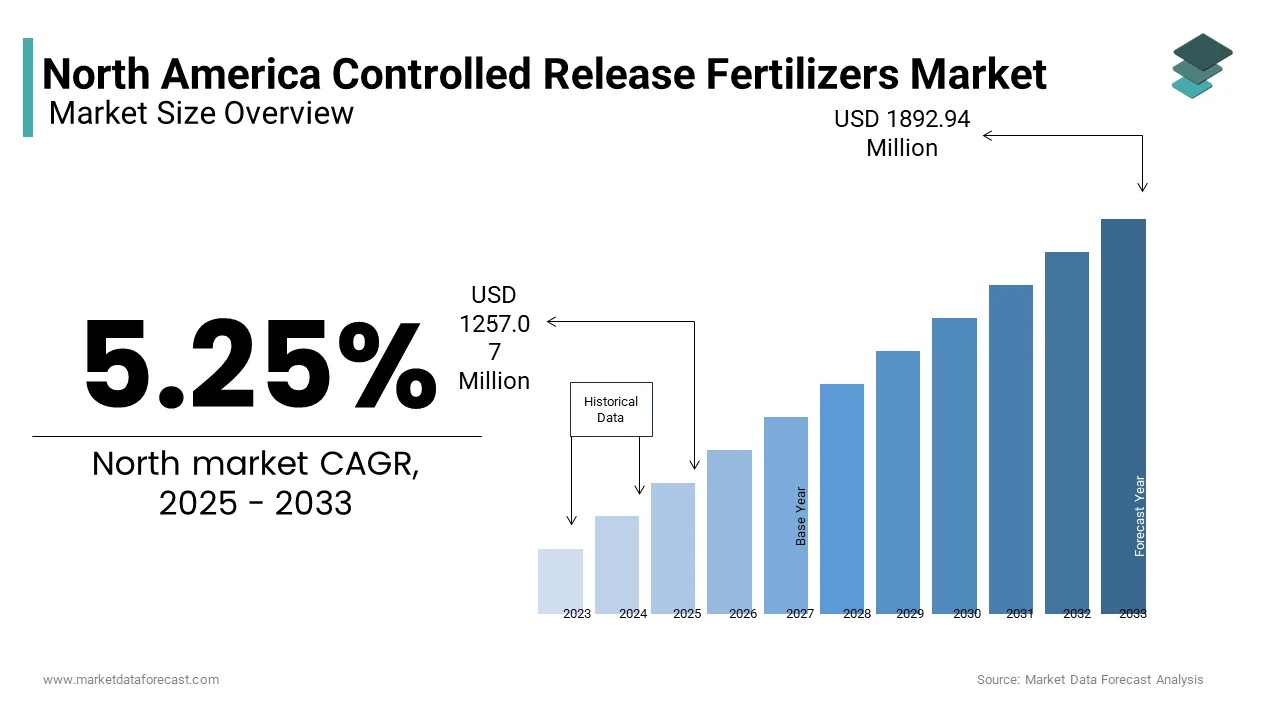

The North American controlled-release fertilizers market was valued at USD 1194.37 million in 2024 and is anticipated to reach USD 1257.07 million in 2025, from USD 1892.94 million by 2033, growing at a CAGR of 5.25% during the forecast period from 2025 to 2033. North America is the leading market for controlled-release fertilizers.

The North American controlled-release fertilizers (CRF) market growth is driven by growing environmental concerns and the need for sustainable farming practices. For instance, the U.S. Environmental Protection Agency (EPA) mandates reduced nitrogen runoff by encouraging farmers to adopt crop rotation practices. Canada’s focus on precision agriculture and organic farming has further propelled demand. Additionally, non-crop applications, such as turf and ornamental landscaping, are increasingly adopting CRFs for their controlled nutrient release properties.

MARKET DRIVERS

Growing Demand for Sustainable Agriculture

Sustainable agriculture is a key driver shaping the North American controlled-release fertilizers market. Farmers are increasingly adopting CRFs to minimize environmental impact while maximizing crop yields. According to the United Nations Food and Agriculture Organization, nitrogen runoff from conventional fertilizers contributes to water pollution in 40% of North American water bodies. To combat this, governments have implemented regulations promoting efficient nutrient management. Additionally, the rise of precision agriculture technologies has further amplified CRF adoption. This shift towards sustainability is expected to drive significant growth in the CRF market in the coming years.

Rising Focus on Crop Yield Enhancement

The rising focus on enhancing crop yields is another major driver fueling the North American controlled-release fertilizers market. According to the World Bank, the global population is projected to reach 9.7 billion by 2050, which escalates the pressure on farmers to produce more food using limited resources. CRFs offer a solution by providing a steady supply of nutrients over an extended period by ensuring optimal plant growth. Data from the National Agricultural Statistics Service reveals that crops treated with CRFs experience a yield increase of up to 25% compared to conventional fertilizers. This is beneficial for high-value crops like fruits, vegetables, and nuts, which dominate the agricultural landscape in California and Florida. Furthermore, the increasing adoption of CRFs in row crops such as corn and soybeans highlights their versatility.

MARKET RESTRAINTS

High Cost of Controlled-Release Fertilizers

The high cost of controlled-release fertilizers poses a significant challenge to their widespread adoption in North America. CRFs are typically 2-3 times more expensive than conventional fertilizers due to their advanced manufacturing processes and encapsulation technologies. This cost barrier limits market penetration in regions with lower-income farming communities. Additionally, fluctuations in raw material prices, such as polymers used for coating, will elevate production costs. As per a study by the American Chemistry Council, rising input costs forced 20% of CRF manufacturers to increase prices in 2022.

Limited Awareness Among Small-Scale Farmers

Limited awareness about the benefits of controlled-release fertilizers among small-scale farmers also acts as a restraint for the market. Many farmers in rural areas lack access to information about CRFs and their advantages over traditional fertilizers. This knowledge gap is compounded by inadequate extension services and training programs, which are essential for educating farmers about sustainable practices. Furthermore, cultural resistance to adopting new technologies slows down CRF adoption.

MARKET OPPORTUNITIES

Expansion into Non-Crop Applications

The expansion into non-crop applications presents a lucrative opportunity for the North America controlled release fertilizers market. Turf and ornamental landscaping, golf courses, and urban green spaces are increasingly adopting CRFs for their controlled nutrient release properties. Canada’s focus on urban greening initiatives, such as Toronto’s Green Streets program, has further amplified demand. Innovations in slow-release formulations tailored for non-crop applications have broadened their appeal. These attributes position non-crop applications as a high-growth segment within the market.

Technological Advancements in Coating Technologies

Technological advancements in coating technologies offer significant opportunities for the North America controlled release fertilizers market. Innovations in biodegradable and eco-friendly coatings align with regulatory requirements and consumer preferences for sustainable products. Additionally, advancements in nanotechnology have enabled precise control over nutrient release rates, enhancing product performance. These innovations not only improve efficiency but also open doors for premium pricing strategies.

MARKET CHALLENGES

Stringent Regulatory Frameworks

Stringent regulatory frameworks pose a significant challenge to the North American controlled-release fertilizers market. Governments across the region have imposed strict guidelines to ensure environmental safety and product efficacy. For instance, the U.S. Environmental Protection Agency mandates rigorous testing and certification for CRFs to ensure they meet nutrient management standards. Moreover, smaller players often lack the resources to adapt to these regulations by leading to reduced market participation. A study by the National Institute of Standards and Technology notes that 20% of regional manufacturers faced delays in product approvals due to non-compliance issues in 2022. Such regulatory pressures limit market expansion and innovation potential. These regulatory pressure hinder the growth of the North America controlled release fertilisers market.

Competition from Conventional Fertilizers

Intense competition from conventional fertilizers also acts as a challenge for the North American controlled-release fertilizers market. Conventional fertilizers remain widely adopted due to their affordability and established usage patterns. This creates a significant barrier for CRFs among cost-sensitive farmers. Additionally, misconceptions about the complexity of CRF application hinder adoption. A survey by the American Society of Agronomy reveals that 40% of farmers perceive CRFs as difficult to use, despite advancements in user-friendly formulations. These factors force manufacturers to invest heavily in marketing and education to differentiate CRFs and sustain market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.25% |

|

Segments Covered |

By Type, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

The Chisso Corporation, Shandong Shikefeng Chemical Industry Co. Ltd., Kingenta Ecological Engineering Group Co. Ltd., Scotts Miracle-Gro Company, Agrium, Yara International, Israel Chemicals Ltd. (Israel), Compo GmbH Co., Sociedad Quimica Y Minera S.A. and Haifa Chemicals Limited |

SEGMENTAL ANALYSIS

By Type Insights

The coated and encapsulated fertilizers dominated the North America controlled release fertilizers market with 45.4% of share in 2024. Their widespread adoption is attributed to their ability to provide controlled nutrient release over an extended period by ensuring optimal plant growth. Industries such as horticulture and turf management rely heavily on coated fertilizers to maintain a consistent nutrient supply. The U.S. Department of Agriculture emphasizes that 70% of high-value crops utilize coated fertilizers due to their efficiency and environmental benefits. Furthermore, advancements in polymer coatings have enabled manufacturers to offer eco-friendly variants by aligning with regulatory requirements.

The nitrogen stabilizers segment is likely to gain huge traction with a projected CAGR of 8.5% from 2025 to 2033. Their ability to reduce nitrogen loss and enhance soil fertility makes them ideal for row crops such as corn and wheat. Additionally, their compatibility with precision agriculture technologies has expanded their applicability in modern farming practices. Innovations in formulation technologies have further boosted demand, positioning nitrogen stabilizers as the segment with the highest growth potential.

By Application Insights

The crop-based applications segment held the dominant share of the North America controlled release fertilizers market in 2024. The dominance of this segment is driven by the proliferation of high-value crops, such as fruits, vegetables, and nuts, which require precise nutrient management. Additionally, the rise of precision agriculture has further amplified CRF adoption in row crops like corn and soybeans.

The non-crop-based applications segment is likely to register a significant CAGR of 9.2% from 2025 to 2033. The segment’s growth is fueled by the rise in urban landscaping and turf management activities. Canada’s focus on urban greening initiatives has further amplified demand. Innovations in slow-release formulations tailored for non-crop applications have broadened their appeal.

COUNTRY ANALYSIS

Top Countries In The Market

The United States was the top performer in the North America controlled release fertilizers (CRF) market by capturing 75.6% of the share in 2024. The growth of the market is attributed to its vast agricultural base, stringent environmental regulations, and a growing emphasis on sustainable farming practices. According to the U.S. Department of Agriculture, the agricultural sector contributes over USD 1.2 trillion annually to the economy, driving demand for advanced fertilizers like CRFs. For instance, the U.S. Environmental Protection Agency (EPA) mandates that farmers adopt efficient fertilizers to minimize water pollution, with CRFs emerging as a preferred choice due to their controlled nutrient release properties. Additionally, the rise of precision agriculture technologies has amplified CRF adoption in high-value crops such as fruits, vegetables, and nuts. Furthermore, non-crop applications, including turf management and urban landscaping, are increasingly adopting CRFs by creating a fertile ground for manufacturers.

Canada controlled the release fertilizers market was accounting in holding 20.4% of the share in 2024. Its growth trajectory is heavily influenced by precision agriculture initiatives and a strong focus on organic farming. The Canadian government’s commitment to reducing nitrogen runoff has significantly boosted demand for CRFs. According to the Canadian Environmental Law Association, CRFs reduce nitrogen leaching by up to 30% by aligning with regulatory requirements. Urban greening initiatives, such as Toronto’s Green Streets program, have further propelled demand for CRFs in turf and ornamental landscaping. Additionally, Canada’s cold climate necessitates fertilizers with extended nutrient release capabilities is making CRFs an ideal solution.

KEY MARKET PLAYERS

The North American market for controlled-release fertilizers is described as strong competition with a large number of big and small players. The Chisso Corporation, Shandong Shikefeng Chemical Industry Co. Ltd., Kingenta Ecological Engineering Group Co. Ltd., Scotts Miracle-Gro Company, Agrium, Yara International, Israel Chemicals Ltd. (Israel), Compo GmbH Co., Sociedad Quimica Y Minera S.A., and Haifa Chemicals Limited are some of the big players in controlled release fertilizer industry.

Top Players In The Market

Nutrien Ltd.

Nutrien Ltd. stands as the leading player in the North American controlled-release fertilizers market. The company’s dominance stems from its extensive product portfolio, which includes innovative CRF formulations tailored for diverse agricultural needs. Nutrien caters to both crop-based and non-crop-based applications, offering solutions that align with stringent environmental regulations. Its commitment to sustainability is evident in its eco-friendly product lines, which comply with EPA standards.

Yara International

Yara International is known for its cutting-edge technology and sustainability initiatives. Yara has carved a niche in the CRF market. The company invests heavily in research and development to innovate products that meet evolving consumer demands. In 2023, Yara launched a biodegradable CRF designed for eco-conscious consumers by targeting the growing demand for sustainable fertilizers. This aligns with global efforts to reduce plastic waste and promote green agriculture.

The Mosaic Company

The Mosaic company’s success is attributed to its strong brand recognition, extensive distribution network, and customer-centric approach. Mosaic offers a wide range of CRFs, from slow-release formulations for high-value crops to specialized solutions for turf and ornamental applications. In 2023, the company expanded its manufacturing facility in Monterrey, Mexico, to cater to the growing demand in emerging markets.

Top Strategies Used By Key Players Market

Key players in the North America controlled-release fertilizers market employ a variety of strategies to maintain their competitive edge and drive growth. Mergers and acquisitions are a primary strategy, enabling companies to expand their product portfolios and strengthen their market presence. Similarly, product innovation remains a cornerstone of growth, with companies investing heavily in research and development to introduce eco-friendly and high-performance solutions. Yara International launched a biodegradable CRF in 2023 by targeting the growing demand for sustainable products. Geographic expansion is another key strategy, as evidenced by The Mosaic Company’s expansion of its manufacturing facility in Mexico to tap into emerging markets. Strategic partnerships and collaborations also play a vital role by allowing companies to leverage each other’s strengths and access new customer bases.

COMPETITION OVERVIEW

The North American controlled-release fertilizers market is characterized by intense competition, with a mix of established multinational corporations and niche players vying for market share. The market’s fragmented nature encourages innovation, as companies strive to differentiate themselves through product quality, performance, and sustainability. Regulatory compliance plays a critical role, with stringent environmental regulations driving the adoption of low-VOC and eco-friendly formulations. Established players like Nutrien Ltd., Yara International, and The Mosaic Company dominate the market, leveraging their extensive resources, global reach, and technological expertise. However, smaller players focus on niche segments, offering specialized solutions tailored to specific industries or applications. The rise of e-commerce and digital marketing has further intensified competition by enabling smaller companies to reach a broader audience.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Nutrien Ltd. acquired Agrium, a leader in controlled-release fertilizers, to enhance its product portfolio and strengthen its position in the agricultural segment.

- In June 2023, Yara International launched a biodegradable controlled-release fertilizer designed for eco-conscious consumers by aligning with global sustainability goals.

- In March 2023, The Mosaic Company expanded its manufacturing facility in Monterrey, Mexico, to cater to the growing demand in emerging markets and enhance its geographic footprint.

- In January 2023, BASF partnered with a Canadian firm to develop advanced nitrogen stabilizers by focusing on reducing nitrogen leaching and improving soil fertility.

- In October 2022, AkzoNobel introduced a nanocoated controlled-release fertilizer for precision agriculture by addressing the need for efficient nutrient delivery in modern farming practices.

MARKET SEGMENTATION

This research report on the North America controlled release fertilizers market is segmented and sub-segmented into the following categories.

By Type

- Chemical Condensation Products

- Coated and Encapsulated Fertilizers

- Nitrogen Stabilizers

- And Other controlled-release fertilizers

By Application

- Crop Based

- Grains & Cereals,

- Oil seeds and Fruits & Vegetables.

- Non-Crop Based Fertilizers

- Turf & Ornamental Grass

- other non-crop-based fertilizers

By Country

- The USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

Why are CRFs important in North American farming?

They release nutrients slowly, matching crop needs and reducing waste in diverse climates.

How does North America’s environment affect CRF use?

Varying soils and weather make CRFs ideal for controlled, efficient nutrient delivery.

How do CRFs support sustainability?

They lower runoff, reduce emissions, and improve soil health with fewer applications.

What limits CRF adoption?

Higher costs and limited awareness among farmers are key barriers.

What’s the future of CRFs in North America?

Innovation in coatings and smart tech integration is making CRFs more efficient and affordable.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]