North America Consumer Electronics Market Research Report – Segmented By Product (Smartphones, Tablets ) Distribution Channel ( Retail stores, E-commerce platforms ) Price Range (Budget ,Mid-range) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Consumer Electronics Market Size

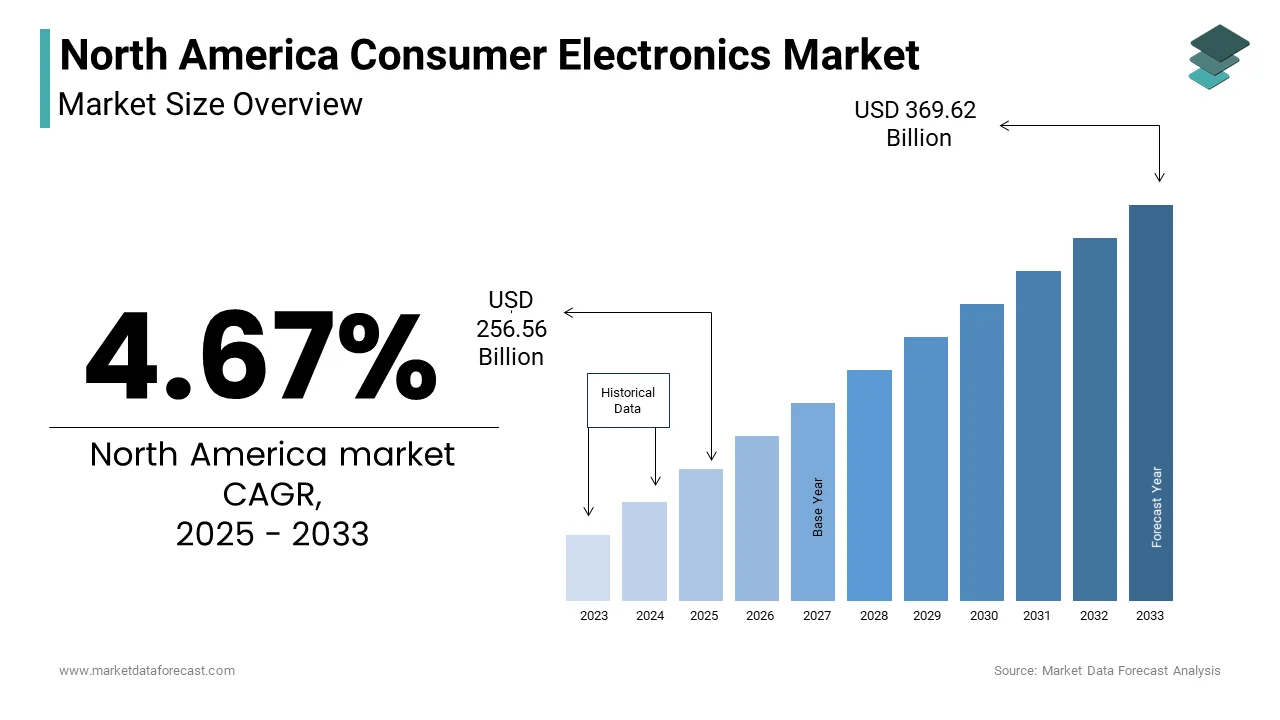

The North America Consumer Electronics Market Size was valued at USD 245.11 billion in 2024. The North America Consumer Electronics Market size is expected to have 4.67 % CAGR from 2025 to 2033 and be worth USD 369.62 billion by 2033 from USD 256.56 billion in 2025.

The North America consumer electronics market stands as a vibrant and transformative industry and is fueled by technological breakthroughs, evolving consumer demands, and the growing integration of smart devices into daily routines. Consumer electronics encompass a broad spectrum of products, ranging from smartphones, tablets, and laptops to advanced wearables, gaming consoles, and smart home systems. These products have become indispensable in modern life, offering convenience, connectivity, and entertainment. Moreover, North America emerged as a global leader in this sector by contributing nearly a major share of the worldwide consumer electronics revenue. The United States dominates the market, with Canada also showing significant growth due to urbanization and an increasingly tech-savvy population.

The rollout of 5G networks has been a game-changer, enabling faster connectivity and driving demand for IoT-enabled devices. A report by the Consumer Technology Association shows that over 85% of U.S. households now own at least one smart device is spotlighting the widespread adoption of these technologies. Beyond market trends, consumer electronics have profoundly influenced societal habits. For instance, Pew Research Center notes that nearly 97% of Americans own some form of mobile phone, with smartphones being the most prevalent. Additionally, the shift toward remote work and online learning post-pandemic has surged demand for laptops and tablets, with Deloitte reporting a 20% rise in such purchases during 2022.

Consumer electronics also shape cultural behaviors. Nielsen reveals that the average American spends approximately 5 hours daily watching television or engaging with streaming platforms. On the environmental front, the Environmental Protection Agency estimates that electronic waste in the U.S. exceeds 2 million tons annually, emphasizing the urgent need for sustainable practices in manufacturing and disposal.

MARKET DRIVERS

Technological Advancements Fueling Growth

The North America consumer electronics market is being driven significantly by rapid technological progress. Innovations like 5G, artificial intelligence, and IoT have transformed everyday devices, making them smarter and more efficient. For example, over 200 million 5G subscriptions were active in North America by the end of 2023 is boosting demand for compatible gadgets such as smartphones and smart home systems. AI-powered devices, including voice assistants and robotic vacuums, are also gaining popularity. These advancements not only meet consumer expectations for convenience but also open up new opportunities for manufacturers to innovate and expand their product lines.

Growing Popularity of Smart Home Technology

Another major driver is the increasing adoption of smart home devices across North America. Products like smart speakers, thermostats, lighting, and security systems are becoming household essentials due to their ability to simplify daily tasks and save energy. The Consumer Technology Association states that smart home device sales in the U.S. hit $14 billion in 2023, with over 40% of homes owning at least one such device. Brands like Amazon Echo and Google Nest dominate this space, trusted by consumers for their reliability. Deloitte adds that 60% of North Americans prioritize energy efficiency when buying electronics, further driving demand for smart appliances. By integrating these devices with AI and voice control, manufacturers are enhancing user experiences and encouraging wider adoption.

MARKET RESTRAINTS

High Prices Limit Accessibility

One key restraint is the high cost of advanced electronics, which makes them inaccessible to many consumers. Premium products, such as top-tier smartphones, laptops, and smart home systems, often come with hefty price tags that deter budget-conscious buyers. The U.S. Bureau of Labor Statistics notes that spending on electronics accounts for about 3% of total household expenses, with wealthier families making up the majority of purchases. Rising costs of raw materials like semiconductors and rare earth metals have worsened the issue. Bloomberg reports that the global semiconductor shortage during 2022-2023 pushed production costs up by 20% is leading to higher retail prices. This pricing barrier limits market reach, especially among lower-income groups, slowing overall growth.

Environmental Challenges and E-Waste Concerns

Environmental issues, particularly electronic waste, present a significant challenge for the consumer electronics market in North America. Frequent upgrades and shorter product lifespans contribute to massive e-waste generation. The Environmental Protection Agency estimates that over 2 million tons of e-waste are discarded annually in the U.S., yet less than 20% is recycled properly. Improper disposal releases harmful substances like lead and mercury into the environment, posing health risks. The World Economic Forum notes that this growing problem has increased public awareness and regulatory pressure on companies to adopt sustainable practices. While consumers are demanding eco-friendly options, affordable alternatives remain scarce. Addressing these challenges requires innovative recycling methods and greener manufacturing processes to reduce long-term environmental impacts.

MARKET OPPORTUNITIES

Adoption of Augmented Reality (AR) and Virtual Reality (VR)

The incorporation of AR and VR technologies in North America is opening doors to transformative opportunities across various fields. These tools are increasingly being used for purposes beyond entertainment, such as education and professional training. For instance, PwC projects that the application of VR in workforce training could enhance global productivity by $294 billion by 2030, with North America at the forefront due to its advanced technological ecosystem. Additionally, the American Psychological Association states the role of immersive VR in mental health treatment and is noting that over 20% of U.S. clinics now use VR-based therapies to address conditions like anxiety and PTSD. Also, more than 60% of North American consumers are interested in using AR for virtual try-ons, such as previewing furniture or clothing before purchasing. These examples showcase how AR and VR are addressing practical challenges while fostering innovation in diverse areas.

Growth of Wearable Health Devices

Wearable health devices are becoming instrumental in promoting healthier lifestyles and reducing healthcare costs in North America. These gadgets go beyond basic fitness tracking, offering features like monitoring blood oxygen levels and stress patterns. The Centers for Disease Control and Prevention reports that chronic diseases account for 90% of the $4.1 trillion spent annually on healthcare in the U.S., underscoring the importance of preventive care. Wearables empower individuals to take charge of their health, with Fitbit data revealing that users who track their activity tend to walk an additional 2,000 steps daily. Deloitte further notes that over 70% of North Americans aged 18-34 own a wearable device, reflecting the younger generation's focus on wellness. This trend not only encourages healthier habits but also has the potential to ease the financial burden on the healthcare system over time.

MARKET CHALLENGES

Impact of Supply Chain Disruptions

Supply chain disruptions have far-reaching consequences that extend beyond the electronics industry, affecting critical sectors like healthcare and transportation. The U.S. Department of Commerce reports that semiconductor shortages have delayed the production of essential medical devices, including MRI machines and ventilators is impacting patient care during emergencies. Similarly, the automotive sector has faced significant setbacks, with the Alliance for Automotive Innovation estimating that over 1.5 million vehicles went unbuilt in North America in 2022 due to chip shortages. A study by the University of California, Berkeley, highlights the personal toll of these disruptions are revealing that 30% of U.S. households struggled to purchase necessary electronics like laptops for remote work or online learning. These challenges underscore the urgent need for stronger, more resilient supply chains to ensure societal stability.

Rising Cybersecurity Risks in Connected Devices

The proliferation of connected devices has introduced alarming cybersecurity risks, posing threats to both individual privacy and broader societal security. NortonLifeLock reports that nearly 60% of North American households own at least one smart home device, yet only 30% regularly update their software to protect against vulnerabilities. This oversight leaves millions of devices susceptible to hacking, as demonstrated by research from the University of Maryland, which found that IoT devices face an average of 5,200 cyberattack attempts per month. The FBI warns that compromised devices can be exploited in large-scale attacks, such as Distributed Denial of Service (DDoS), which impacted over 100,000 devices in a single incident in 2023.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.67 % |

|

Segments Covered |

By Product ,Distribution Channel , Price Range and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Apple Inc, Asustek Computer Inc DR, BlackBerry Ltd, Canon Inc, Dell Technologies Inc |

SEGMENTAL ANALYSIS

By Product Insights

In 2024, smartphones emerged as the biggest segment in the North America consumer electronics market by capturing a 45.1% share. This dominance is credited by their role as essential tools for communication, entertainment, and productivity. The U.S. Census Bureau noted that over 90% of households owned at least one smartphone, showcasing how deeply integrated these devices had become in daily life. Smartphones also served as central hubs for other technologies like wearables and smart home gadgets. Additionally, the Federal Communications Commission noted that 70% of smartphone users in North America had adopted 5G by 2024 is driving demand for advanced models. Their versatility, affordability, and ability to connect with other devices made them indispensable.

Looking ahead, wearables are projected to be the fastest-growing segment, with a CAGR of 12.5% from 2025 to 2033. This rapid expansion will be fueled by rising health awareness and technological advancements. Devices such as smartwatches and fitness trackers allow users to monitor vital metrics like heart rate, sleep quality, and physical activity, appealing to health-conscious individuals. Deloitte forecasts that over 80 million people in North America will use wearables by 2026, up from 50 million in 2023. The aging population is another key factor, as older adults increasingly adopt these gadgets for safety and wellness monitoring. Wearables’ seamless integration with smartphones and smart home systems adds to their appeal. Their focus on promoting healthier lifestyles and convenience ensures they will play a crucial role in shaping the future of consumer electronics.

By Distribution Channel Insights

In 2024, e-commerce platforms stood out as the leading distribution channel in the North America consumer electronics market by holding a 55.2% share. This was due to the unmatched convenience and extensive product variety these platforms offered. Online retailers like Amazon and Best Buy’s digital storefronts became go-to destinations for shoppers. The U.S. Census Bureau revealed that over 85% of consumers in North America made online purchases at least once a month in 2024, showcasing the growing reliance on digital shopping. Free shipping options and hassle-free return policies further boosted their appeal. According to the Federal Trade Commission, 70% of electronics bought during holiday seasons were purchased online, underscoring the channel’s critical role in shaping consumer behavior.

Whereas, direct-to-consumer channels are projected to be the fastest-growing segment, with a CAGR of 15.2% from 2025 to 2033. This growth will be driven by brands selling directly to customers through their websites and apps, cutting out middlemen. Deloitte noted that over 60% of shoppers prefer buying directly from brands, citing better customer support and exclusive offers as key motivators. Subscription-based models for devices like smart home gadgets and wearables are also gaining popularity, with Salesforce predicting a 20% rise in subscriptions by 2026. Younger demographics, such as millennials and Gen Z, are fueling this trend due to their desire for tailored experiences. By fostering closer connections with buyers, direct-to-consumer channels not only enhance brand loyalty but also pave the way for sustainable growth in the electronics market.

By Price Range Insights

The mid-range segment emerged as the leading category in the North America consumer electronics market by capturing a 45.2% share in 2024. This segment’s success was driven by its ability to strike a balance between affordability and advanced features, making it appealing to a wide range of consumers. The U.S. Census Bureau revealed that over 60% of households favored mid-range devices for their cost-effectiveness and reliable performance. These products catered to individuals seeking quality without the high price tags associated with premium options. The Consumer Technology Association also noted a 30% surge in mid-range gadget sales during back-to-school promotions, underscoring their importance for students and professionals. Their versatility and accessibility made them a cornerstone of the electronics market.

Looking ahead, the budget segment is projected to experience the fastest growth, with a CAGR of 10.2% from 2025 to 2033. This expansion will be fueled by rising demand for affordable electronics among cost-conscious buyers, including younger consumers and low-income families. Deloitte forecasts that over 50% of first-time gadget purchasers will choose budget-friendly options by 2026. Economic challenges such as inflation and financial uncertainty have further pushed shoppers to prioritize value over luxury. Additionally, the Federal Reserve Bank of New York stated that spending on essential electronics like entry-level smartphones and TVs increased by 25% in 2024 is reflecting sustained interest in this segment. By offering functional yet affordable solutions, the budget segment is set to play a pivotal role in expanding access to technology across diverse demographics.

Country Level Analysis

The United States stood out as the largest player in the North America consumer electronics market, accounting for a commanding 85.2% of the total market share in 2024. This leadership was underpinned by the nation’s advanced technological ecosystem, high levels of disposable income, and widespread adoption of innovative devices. Data from the U.S. Census Bureau revealed that over 90% of households in the country owned at least one smartphone, showcasing the deep integration of technology into everyday life. Government initiatives like the CHIPS Act, which allocated $52 billion to bolster domestic semiconductor manufacturing, further strengthened the U.S. position. The emphasis on innovation attracted significant investments in AI-powered gadgets, IoT systems, and smart home solutions, enabling the U.S. to shape global trends. Its dominance not only reflected its economic clout but also cemented its role as a global leader in consumer electronics.

Looking ahead, Canada is set to emerge as the fastest-growing market in the North America consumer electronics sector, with an anticipated CAGR of 7.8% between 2025 and 2033. This impressive growth will be fueled by several key factors. Urbanization is expected to play a major role, with projections indicating that over 82% of Canadians will reside in urban areas by 2030, driving demand for connected devices. Rising disposable incomes, combined with government incentives for sustainable technologies, have already sparked a surge in adoption. For example, Natural Resources Canada reported that subsidies for energy-efficient appliances led to a 20% increase in smart home device purchases since 2023. Additionally, the aging population has driven demand for health-focused wearables, with Deloitte forecasting a 30% rise in wearable sales by 2026. Canada’s focus on eco-friendly innovations and digital transformation will not only accelerate its growth but also position it as a pioneer in sustainable consumer electronics

Top 3 Players in the market

Apple Inc.

At the forefront of the North America consumer electronics market stands Apple Inc., a company renowned for its ability to blend innovation with elegance. Its product range, which spans devices like the iPhone, MacBook, Apple Watch, and AirPods, has redefined modern technology usage. Apple’s distinct approach lies in its focus on creating a unified ecosystem where devices, software, and services work together harmoniously. This interconnected experience has resonated deeply with consumers, fostering unwavering brand loyalty. Beyond hardware, Apple has excelled in offering digital solutions that enhance convenience, such as its suite of apps and cloud services. By consistently introducing groundbreaking features and prioritizing user-centric design, Apple has not only influenced consumer expectations but also set a high standard for competitors to follow.

Samsung Electronics

Samsung Electronics has emerged as a pivotal player in the North America consumer electronics landscape, thanks to its versatile product offerings and commitment to technological progress. The company’s lineup, which includes smartphones, televisions, home appliances, and wearable gadgets, addresses a wide spectrum of consumer preferences. Samsung’s dedication to research and development has enabled it to lead in areas like display innovation, crafting screens that deliver unparalleled visual clarity. Its products strike a balance between cutting-edge features and accessibility, appealing to diverse audiences. Furthermore, Samsung’s growing emphasis on eco-friendly practices underscores its vision for a sustainable future. Through its ability to adapt to changing consumer needs and pioneer new technologies, Samsung continues to play a vital role in driving the market’s evolution.

Microsoft Corporation

Microsoft Corporation has etched a notable position in the North America consumer electronics arena, particularly through its influence on productivity tools and gaming platforms. Its Surface series, encompassing tablets and laptops, has gained acclaim for combining sleek design with robust performance, catering to professionals and casual users alike. In the gaming sphere, Microsoft’s Xbox consoles have become synonymous with immersive entertainment, fostering a thriving community of gamers and creators. Beyond hardware, the company’s software innovations, including its operating systems and cloud-based tools, have expanded the capabilities of countless devices. By focusing on empowering users to achieve more, Microsoft has significantly contributed to shaping how people interact with technology, blending utility with creativity in unique ways.

Top strategies used by the key market participants

Innovation-Driven Product Development

A core approach adopted by leading companies in the North America consumer electronics market revolves around innovation-driven product development. These organizations prioritize creating cutting-edge solutions by integrating advanced technologies and anticipating shifts in consumer preferences. This strategy involves not only refining existing products but also exploring entirely new categories that redefine how people interact with technology. By expanding their offerings to include devices like smart wearables, home automation tools, and immersive entertainment systems, these players cater to a wide range of lifestyles and needs. Their focus on pushing technological boundaries ensures they stay ahead of competitors while establishing themselves as pioneers in the industry.

Building Alliances for Mutual Growth

Another key strategy employed by major players in the consumer electronics sector is the establishment of alliances to drive mutual growth. These collaborations often involve partnering with tech startups, research labs, or even other industry leaders to combine expertise and resources. Such partnerships enable companies to accelerate the development of groundbreaking technologies and bring them to market more efficiently. Additionally, these alliances help businesses access new customer bases and geographic regions, broadening their influence. By working together, companies can achieve more than they could independently, fostering innovation while reducing costs and operational challenges.

Commitment to Environmental Responsibility

Environmental responsibility has become a defining strategy for prominent players in the North America consumer electronics market. Recognizing the growing demand for sustainable practices, companies are embedding eco-conscious initiatives into their operations. This includes designing energy-efficient devices, incorporating recyclable materials, and launching programs to minimize electronic waste. By prioritizing sustainability, these organizations align themselves with global environmental goals and resonate with consumers who value ethical consumption. Such efforts not only enhance brand reputation but also foster deeper connections with customers who appreciate meaningful contributions to the planet’s well-being.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America consumer electronics market are Apple Inc, Asustek Computer Inc DR, BlackBerry Ltd, Canon Inc, Dell Technologies Inc Ordinary Shares - Class C, Alphabet Inc Class A, HP Inc, HTC Corp DR, Huawei Technologies, Lenovo Group Ltd, LG Electronics Inc ADR, Motorola Solutions Inc, Nikon Corp, Panasonic Holdings Corp, Samsung Electronics Co Ltd, Seagate Technology Holdings PLC, Sony Group Corp, Toshiba Corporation, ZTE Corp Class H

The North America consumer electronics market is a busy and competitive space where many big and small companies try to attract customers. This market includes products like smartphones, laptops, televisions, smart home devices, and gaming consoles. Companies in this industry are always working hard to create better and more exciting products to stay ahead of their competitors. The competition is so strong because people in North America love using the latest technology, and they expect high-quality gadgets that make life easier or more fun.

Big brands like Apple, Samsung, and Microsoft lead the market because they have the money and skills to develop advanced products. These companies spend a lot on research to come up with new ideas and features. At the same time, smaller companies also try to compete by offering cheaper or unique products that appeal to specific groups of people. For example, some focus on eco-friendly gadgets, while others target gamers or people who want simple, affordable electronics.

To win customers, companies use clever strategies like advertising, special offers, and partnerships. They also focus on creating complete ecosystems where their products work well together, making it harder for customers to switch to other brands. However, competition is not just about making products; it’s also about solving problems like electronic waste and ensuring fair prices. Overall, the North America consumer electronics market is a mix of innovation, creativity, and challenges as companies fight to stay popular and meet customer needs.

RECENT HAPPENINGS IN THE MARKET

In January 2025, Nvidia unveiled the GeForce RTX 50 Series GPUs, powered by the new Blackwell AI chip. This launch is expected to revolutionize AI-driven rendering for gamers, developers, and creators.

In January 2025, Samsung Electronics received the 2025 Circana Consumer Electronics Leader Award for achieving the top U.S. Retail Dollar Share in the Total Monitors category. This recognition highlights Samsung’s leadership and growth in the competitive display market.

In January 2025, YESOUL showcased its latest fitness equipment, including the G1M Plus Bike and R1M Plus Rowing Machine, at the Consumer Electronics Show (CES) in Las Vegas. These innovations aim to enhance home workout experiences with immersive and smart technology.

In January 2025, Apple announced the upcoming launch of the Apple Command Centre, a smart home device featuring an AI-powered display, and the Apple Camera, a smart home security camera. These products are anticipated to expand Apple's smart home ecosystem and enhance user convenience.

In June 2025, Nintendo is set to release the Switch 2 console, featuring a larger 7.9-inch 1080p screen, magnetic Joy-Con 2 controllers, and backward compatibility with existing Switch games. This upgrade is expected to offer a more advanced gaming experience for users.

MARKET SEGMENTATION

This research report on the North America consumer electronics market has been segmented and sub-segmented into the following categories.

By Product

- Smartphones

- Wearables

By Distribution Channel

- Retail stores

- E-commerce platforms

- Direct-to-consumer channels

By Price Range

- Budget

- Mid-range

- Premium

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the current size of the North America consumer electronics market?

The market size fluctuates yearly but is valued at hundreds of billions of dollars, driven by demand for smartphones, wearables, smart home devices, and gaming consoles.

What are the major trends shaping the consumer electronics market in North America?

Key trends include 5G adoption, AI-driven smart devices, AR/VR technology, eco-friendly electronics, and the integration of IoT in household appliances.

What are the biggest challenges facing the consumer electronics market in North America?

Challenges include supply chain disruptions, semiconductor shortages, increasing competition, cybersecurity concerns, and environmental regulations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]