North America Construction Equipment Rental Market Size, Share, Trends & Growth Forecast Report Segmented By Product And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Construction Equipment Rental Market

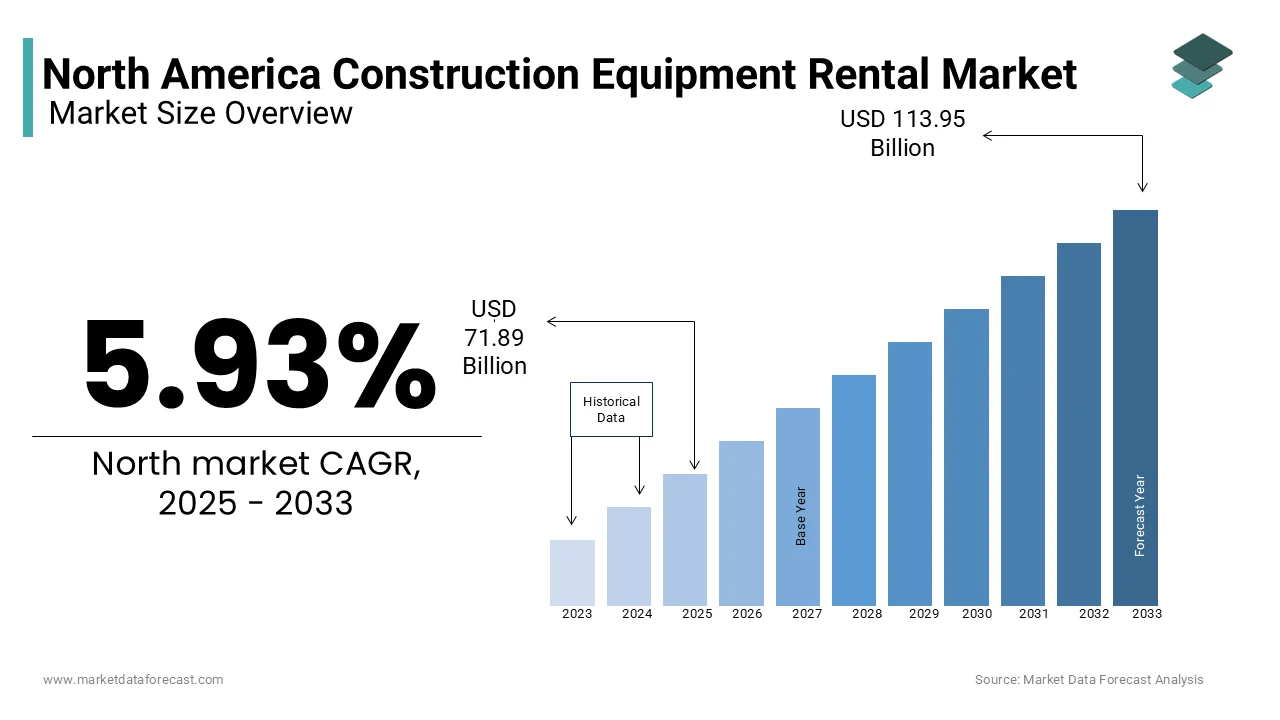

The North America construction equipment rental market was valued at USD 67.86 billion in 2024 and is anticipated to reach USD 71.89 billion in 2025 from USD 113.95 billion by 2033, growing at a CAGR of 5.93% during the forecast period from 2025 to 2033.

The North America construction equipment rental market involves a wide array of equipment including earth-moving machinery, material handling tools, and concrete and road construction equipment which are essential for various construction projects. The rental model has gained traction due to its cost-effectiveness, flexibility, and the ability to access advanced machinery without the burden of ownership. This progress is supported by several factors, including increased infrastructure spending, a booming construction sector, and a growing preference for rental solutions over outright purchases. The market features a mix of large rental companies and regional players, each vying for market share in a competitive landscape. The construction industry continues to evolve so, the rental market is expected to adapt by incorporating technological advancements and sustainability practices to meet the changing demands of customers.

MARKET DRIVERS

Increased Infrastructure Investment

Significant increase in infrastructure investment across the region is among the main drivers of the North America construction equipment rental market. Governments at both federal and state levels are prioritizing infrastructure development to enhance transportation networks, utilities, and public facilities. According to the American Society of Civil Engineers, the United States alone requires an estimated $4.5 trillion in infrastructure investments by 2025 to address aging infrastructure and meet future demands. This substantial funding is expected to spur construction activities is leading to an elevated demand for rental equipment. The rental model allows construction firms to get the latest machinery without the financial burden of purchasing makes it an attractive option as projects scale up. Furthermore, the ongoing recovery from the COVID-19 pandemic has led to increased spending on infrastructure as part of economic stimulus packages, further propelling the rental market. Infrastructure projects are gaining momentum and consequently, the construction equipment rental market is poised for robust growth is driven by the need for efficient and flexible equipment solutions, as highlighted by the U.S. Bureau of Economic Analysis.

Growth of the Construction Sector

The growth of the construction sector in North America is another significant driver of the construction equipment rental market. The construction industry has been experiencing a resurgence fuelled by rising demand for residential, commercial, and industrial projects. As per the U.S. Census Bureau, construction spending in the United States reached approximately $1.6 trillion in 2022 marking a 10% increase from the previous year. This upward trend is expected to continue, with projections indicating that construction spending will surpass $1.8 trillion by 2025. The increasing complexity of construction projects necessitates the use of specialized equipment, which often leads contractors to opt for rental solutions to meet their specific needs. Also, the pattern towards urbanization and the development of smart cities are driving demand for advanced construction technologies and equipment.

MARKET RESTRAINTS

Fluctuating Demand

Fluctuating demand for construction services can lead to uncertainty in rental revenues which is restraining the development of the North America construction equipment rental market. The construction industry is inherently cyclical and is influenced by economic conditions, interest rates, and government policies. During economic downturns, construction activities may decline during the economic downturns resulting in reduced demand for rental equipment. According to the Associated General Contractors of America, the construction industry experienced a contraction of approximately 5% during the economic downturn caused by the COVID-19 pandemic turning to a temporary decline in rental revenues. This volatility can pose challenges for rental companies, as they must manage their inventory and pricing strategies to remain competitive while navigating periods of low demand. Further, the uncertainty surrounding future infrastructure spending and potential changes in government policies can further exacerbate this issue. As a result, rental companies may face difficulties in maintaining consistent revenue streams, which could hinder their ability to invest in new equipment and technologies, as highlighted by the Construction Industry Institute.

High Maintenance Costs

A notable restraint impacting the North America construction equipment rental market is the high maintenance costs associated with rental equipment. Rental companies are responsible for the upkeep and servicing of their fleets to ensure safety and operational efficiency. The industry estimates states that maintenance costs can account for up to 15% of total rental expenses. These costs can be particularly burdensome for smaller rental firms that may lack the resources to invest in comprehensive maintenance programs. Besides that the increasing complexity of modern construction equipment, which often incorporates advanced technologies, can lead to higher repair and maintenance costs. As equipment ages, the likelihood of breakdowns and the need for repairs increases, further straining rental companies' financial resources. This challenge can result in higher rental rates for customers, potentially driving them to seek alternative solutions, such as purchasing equipment outright. Consequently, the burden of maintenance costs can limit the growth potential of the rental market, as companies must balance the need for a reliable fleet with the financial implications of upkeep, as noted by the Equipment Leasing and Finance Association.

MARKET OPPORTUNITIES

Technological Advancements

The North America construction equipment rental market is poised to benefit significantly from technological advancements that enhance operational efficiency and customer experience. The integration of telematics, IoT (Internet of Things), and automation in construction equipment is revolutionizing the rental landscape. A report by McKinsey & Company revels that the adoption of digital technologies in construction could lead to productivity gains of up to 15%. Telematics systems enable rental companies to monitor equipment usage, track maintenance needs, and optimize fleet management and is resulting in reduced downtime and improved service delivery. Furthermore, the rise of autonomous machinery is expected to transform construction operations, allowing for safer and more efficient project execution. As construction firms increasingly seek to leverage technology to improve productivity and reduce costs, the demand for technologically advanced rental equipment is likely to surge. This trend presents a significant opportunity for rental companies to differentiate themselves by offering state-of-the-art equipment equipped with the latest technologies, thereby enhancing their competitive advantage in the market.

Sustainability Initiatives

The growing emphasis on sustainability and environmentally friendly practices in the construction industry represents another major opportunity for the North America construction equipment rental market. As regulatory pressures and consumer preferences shift towards greener solutions, construction firms are increasingly seeking to reduce their carbon footprints. As per the U.S. Green Building Council, the green building business is projected to reach $1 trillion by 2023 is backed by the demand for sustainable construction practices. Rental companies can capitalize on this trend by offering eco-friendly equipment options, such as electric or hybrid machinery, which align with the sustainability goals of their clients. Additionally, the rental model itself promotes sustainability by reducing the need for equipment ownership, thereby minimizing resource consumption and waste. Construction firms are aiming for sustainability in their operations, the use for rental solutions that support these initiatives is expected to grow that is providing rental companies with a unique opportunity to position themselves as leaders in the green construction movement, as stresses by the World Green Building Council.

MARKET CHALLENGES

Competition from Alternative Solutions

The North America construction equipment rental market faces significant challenges from alternative solutions such as equipment leasing and purchasing. As construction firms evaluate their operational strategies, some may opt for leasing equipment instead of renting, particularly for long-term projects. Leasing arrangements often provide more favourable terms for extended use, allowing companies to maintain equipment for longer periods without the need for frequent returns. According to the Equipment Leasing and Finance Association, the leasing market has seen steady growth, with a projected increase of 5% annually. This trend poses a challenge for rental companies, as they must compete with leasing options that may offer lower overall costs for customers. Additionally, the increasing availability of used equipment for purchase can further divert potential rental customers, as firms may find it more economical to invest in pre-owned machinery rather than renting.

Economic Uncertainty

Economic uncertainty is a pervasive challenge that impacts the North America construction equipment rental market. Fluctuations in economic conditions, such as changes in interest rates, inflation, and geopolitical events, can significantly influence construction spending and, consequently, rental demand. According to the National Bureau of Economic Research, economic downturns can lead to reduced investment in construction projects, resulting in decreased demand for rental equipment. The unpredictability of economic cycles can create challenges for rental companies in forecasting demand and managing their fleets effectively. Additionally, rising material costs and labor shortages can further exacerbate economic uncertainty, leading to project delays and cancellations. As construction firms navigate these challenges, they may become more cautious in their equipment rental decisions, opting for short-term rentals or delaying purchases altogether. This cautious approach can hinder the growth potential of the rental market, as companies grapple with the implications of economic fluctuations on their operations, as noted by the Construction Financial Management Association.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.93% |

|

Segments Covered |

By Product Type And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Loxam, Boels Rental, Ramirent, Kiloutou, Cramo, Mateco Group, HSS Hire, Zeppelin Rental, Riwal, Speedy Hire. |

SEGMENTAL ANALYSIS

By Product Insights

The earth-moving equipment segment is distinguished as the largest contributor by commanding a market share of 47.3% in 2024. This superiority is basically driven by the extensive use of earth-moving machinery in various construction projects including residential, commercial, and infrastructure developments. The industry estimates suggest that the earth-moving equipment segment is projected to reach a valuation of $20 billion by 2025 and is fuelled by the increasing demand for excavation, grading, and site preparation activities. The versatility of earth-moving equipment like excavators, bulldozers, and backhoes makes it essential for contractors seeking to optimize their operations and enhance productivity. Moreover, the ongoing infrastructure investment initiatives across North America are expected to further bolster the demand for earth-moving equipment rentals, as construction firms require reliable machinery to execute large-scale projects efficiently.

The fastest-growing segment within the North America construction equipment rental market is the material handling equipment category which is projected to grow at a CAGR of 7.3% during the forecast period. This sudden rise can be due to the rising complexity of construction projects that require efficient material handling solutions. The expansion of e-commerce and the demand for logistics and warehousing facilities have also contributed to the growing need for material handling equipment, such as forklifts, pallet jacks, and aerial work platforms. Construction firms seek to enhance their operational efficiency and streamline material handling processes, so, the demand for rental solutions in this segment is anticipated to rise significantly.

COUNTRY ANALYSIS

The United States dominated in the North America construction equipment rental market by holding a market share of approximately 80.9% in 2024. The U.S. construction industry is viewed by its size and diversity, with significant investments in residential, commercial, and infrastructure projects. According to the U.S. Census Bureau, construction spending in the United States reached approximately $1.6 trillion in 2022 is reflecting a robust growth trajectory. The demand for rental equipment is driven by the need for flexibility and cost-effectiveness because contractors increasingly prefer to rent rather than purchase equipment outright. Over and above that, the ongoing infrastructure initiatives, such as the Biden administration's proposed investments in transportation and utilities, are expected to further stimulate the rental market.

Canada is seeing a steady rise in the North America construction equipment rental sector, with growth gaining momentum as more small and medium-sized businesses turn to rentals for flexibility and affordability. The Canadian construction industry is supported by investments in residential and commercial projects, as well as infrastructure development. As per the Statistics Canada, construction spending in the country reached CAD 300 billion in 2022, with projections indicating continued growth in the coming years. The demand for rental equipment in Canada is influenced by the need for specialized machinery to meet the diverse requirements of construction projects. Also, the increasing focus on sustainability and green building practices is prompting construction firms to seek rental solutions that align with their environmental goals.

The rest of North America, which includes countries such as Mexico and various Caribbean nations, is still in the early stages but growing quickly in the construction equipment rental market. The construction industry in Mexico has been gaining momentum is driven by government investments in infrastructure and housing projects. According to the Mexican National Institute of Statistics and Geography, construction spending in Mexico reached approximately MXN 1 trillion in 2022, reflecting a growing demand for rental equipment. The rental market in this region is characterized by a mix of local and international players, each vying for market share in a competitive landscape. As the construction sector in Mexico and neighbouring countries continues to expand, the demand for rental solutions is expected to rise, providing opportunities for growth in the North American construction equipment rental market. The increasing focus on infrastructure development and urbanization in these regions is likely to drive the adoption of rental equipment, further enhancing the market's potential.

KEY MARKET PLAYERS

Loxam, Boels Rental, Ramirent, Kiloutou, Cramo, Mateco Group, HSS Hire, Zeppelin Rental, Riwal, Speedy Hire. are the market players that are dominating the Europe construction equipment rental market.

MARKET SEGMENTATION

This research report on the North America construction equipment rental market is segmented and sub-segmented into the following categories.

By Product

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What makes equipment rental a preferred choice over purchasing in North America?

Renting eliminates high upfront costs, lowers maintenance burdens, and provides access to advanced machinery on demand.

Which construction machines are frequently rented across North America?

Heavy equipment such as excavators, cranes, backhoes, skid steers, and aerial lifts are among the most rented.

What industries contribute the most to the growth of construction equipment rentals?

Infrastructure development, commercial and residential construction, and energy sectors (oil, gas, renewables) drive demand.

Who are the leading service providers in the construction equipment rental market?

United Rentals, Sunbelt Rentals, Herc Rentals, and H&E Equipment Services are some of the top players.

How is innovation shaping the future of construction equipment rentals?

The rise of smart fleet management, IoT tracking, and AI-based predictive maintenance is revolutionizing efficiency and cost-effectiveness.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]