North America Construction Equipment Market Size, Share, Trends & Growth Forecast Report Segmented By Product, Equipment Type, Propulsion Type, Engine Capacity, Power Output And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Construction Equipment Market Size

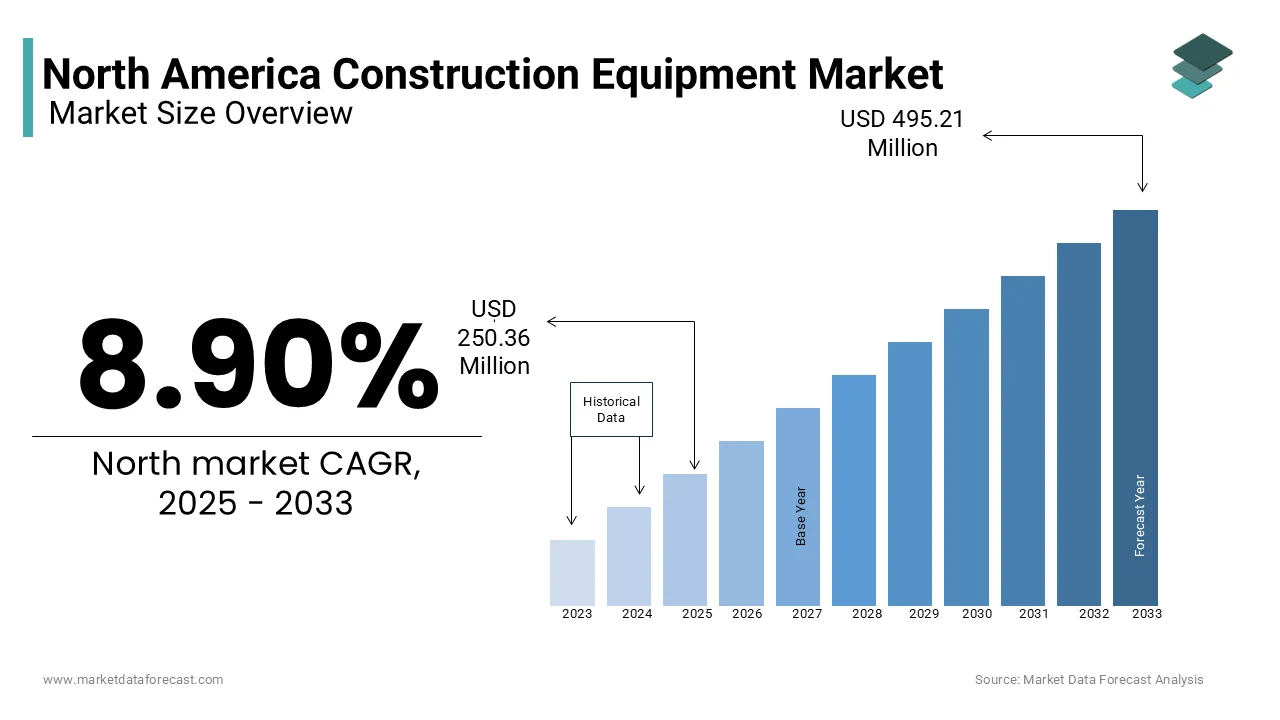

The North America construction equipment market size was valued at USD 229.9 million in 2024 and is anticipated to reach USD 250.36 million in 2025 from USD 495.21 million by 2033, growing at a CAGR of 8.90% during the forecast period from 2025 to 2033.

Construction equipment includes heavy equipment such as excavators, bulldozers, cranes, and loaders, as well as compact machinery like skid-steer loaders and mini-excavators. The increasing demand for construction equipment is fueled by ongoing investments in public infrastructure, residential and commercial construction, and the need for modernization of existing facilities in North America. According to the American Society of Civil Engineers, the U.S. alone requires an estimated $4.5 trillion in infrastructure investments by 2025 to address aging infrastructure. As the construction industry continues to evolve, the North America construction equipment market is poised for significant growth, reflecting the critical role of machinery in facilitating construction activities and enhancing productivity.

MARKET DRIVERS

Urbanization and Infrastructure Development in North America

Urbanization and infrastructure development is one of the key factors driving the growth of the North America construction equipment market. As cities expand and populations grow, there is an increasing need for new infrastructure, including roads, bridges, and public transportation systems. According to the U.S. Census Bureau, over 80% of the U.S. population now resides in urban areas, leading to heightened demand for residential and commercial construction. The American Society of Civil Engineers estimates that the U.S. will require approximately $4.5 trillion in infrastructure investments by 2025 to maintain and improve its infrastructure. This surge in construction activity directly correlates with the demand for construction equipment, as contractors and builders require advanced machinery to complete projects efficiently and effectively. Additionally, government initiatives aimed at improving infrastructure, such as the Infrastructure Investment and Jobs Act, are expected to further stimulate the market. As urbanization continues to drive construction needs, the North America construction equipment market is positioned for robust growth, fueled by the demand for innovative and efficient machinery.

Technological Advancements in Equipment

Technological advancements in construction equipment are further propelling the growth of the North America construction equipment market. Innovations such as telematics, automation, and advanced materials are transforming the capabilities of construction machinery, enhancing efficiency, safety, and productivity. The integration of telematics allows for real-time monitoring of equipment performance, enabling operators to optimize usage and reduce downtime. Furthermore, the rise of electric and hybrid construction equipment is addressing environmental concerns and regulatory pressures, as companies seek to reduce their carbon footprints. The increasing adoption of autonomous machinery is also revolutionizing construction processes, allowing for greater precision and reduced labor costs. As these technological advancements continue to evolve, they are expected to drive the growth of the North America construction equipment market, enabling companies to meet the demands of modern construction projects more effectively.

MARKET RESTRAINTS

High Initial Costs of Equipment

High initial costs of construction equipment are primarily restraining the growth of the North America construction equipment market. The purchase price of heavy machinery can be substantial, often ranging from tens of thousands to millions of dollars, depending on the type and specifications of the equipment. According to a report by the Association of Equipment Manufacturers, the average cost of a new excavator can exceed $100,000, while larger models can reach upwards of $500,000. This financial burden can deter small and medium-sized construction firms from investing in new equipment, limiting their competitiveness in the market. Additionally, the costs associated with maintenance, insurance, and financing further compound the financial challenges faced by construction companies. As a result, many firms may opt for renting equipment instead of purchasing, which can impact the overall growth of the market. Addressing the issue of high initial costs through financing options, leasing programs, and government incentives will be crucial for expanding the adoption of construction equipment in North America.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are further hampering the growth of the North America construction equipment market. The construction industry is subject to stringent regulations governing equipment safety, emissions, and operational standards. According to the Occupational Safety and Health Administration, compliance with safety regulations can require significant investments in training, equipment modifications, and documentation. These compliance costs can be particularly burdensome for smaller construction firms, which may lack the resources to navigate complex regulatory frameworks. Additionally, the increasing emphasis on environmental sustainability is prompting stricter emissions standards for construction equipment, necessitating investments in cleaner technologies. As manufacturers strive to meet these evolving regulations, they may face challenges in balancing compliance costs with competitive pricing. To mitigate these challenges, industry stakeholders must work collaboratively to develop clear guidelines and support systems that facilitate compliance while promoting innovation and safety in the construction equipment market.

MARKET OPPORTUNITIES

Growth in Green Building Initiatives

The growth in green building initiatives is a promising opportunity for the North America construction equipment market. As environmental concerns become increasingly prominent, there is a rising demand for sustainable construction practices that minimize ecological impact. According to the U.S. Green Building Council, the green building market is projected to reach $300 billion by 2025, driven by the increasing adoption of environmentally friendly materials and practices. Construction equipment that meets green standards, such as energy-efficient machinery and equipment with lower emissions, is becoming essential for contractors aiming to achieve green certifications. The emphasis on sustainability is prompting manufacturers to innovate and develop equipment that aligns with these initiatives, such as electric and hybrid machinery. As the demand for green building solutions continues to rise, the North America construction equipment market is well-positioned to capitalize on this trend, fostering growth and innovation in sustainable construction practices.

Increasing Investment in Infrastructure Development

Increasing investment in infrastructure development is another notable opportunity for the North America construction equipment market. Governments at both federal and state levels are prioritizing infrastructure projects to address aging facilities and improve transportation networks. According to the American Society of Civil Engineers, the U.S. requires an estimated $4.5 trillion in infrastructure investments by 2025 to maintain and enhance its infrastructure. This influx of funding is expected to drive significant construction activity, leading to heightened demand for construction equipment. Additionally, public-private partnerships are becoming more prevalent, further stimulating investment in infrastructure projects. As construction companies ramp up their operations to meet these demands, the need for advanced machinery and equipment will grow, providing substantial opportunities for manufacturers and suppliers in the construction equipment market. By aligning their offerings with the needs of infrastructure development, stakeholders can position themselves for success in this expanding market.

MARKET CHALLENGES

Economic Uncertainty and Market Volatility

Economic uncertainty and market volatility are significant challenges to the North America construction equipment market. Fluctuations in economic conditions can impact construction budgets and investment decisions, leading to delays or cancellations of projects. According to the U.S. Bureau of Economic Analysis, the construction industry experienced a contraction of 6.6% in GDP during the COVID-19 pandemic, which significantly affected equipment demand. As businesses navigate uncertain economic landscapes, they may prioritize cost-cutting measures, potentially leading to reduced spending on construction equipment. Additionally, market volatility can result in fluctuating prices for raw materials and labor, further complicating project planning and execution. To mitigate these challenges, industry stakeholders must remain agile and adaptable, focusing on building strong relationships with clients and offering flexible solutions that align with changing market conditions. By addressing the impacts of economic uncertainty, the construction equipment market can better position itself for sustained growth.

Supply Chain Disruptions

Supply chain disruptions is another major challenge for the North America construction equipment market. The COVID-19 pandemic has exposed vulnerabilities in global supply chains, leading to shortages of critical components and materials required for equipment production. According to the Association of Equipment Manufacturers, the semiconductor shortage alone resulted in the loss of over 1.3 million vehicle sales in North America in 2021, impacting the availability of construction equipment. These disruptions can hinder the ability of manufacturers to meet consumer demand, particularly during peak construction seasons when equipment is in high demand. Furthermore, the reliance on global supply chains for raw materials raises concerns about sustainability and ethical sourcing. As the demand for construction equipment continues to rise, addressing supply chain challenges will be crucial for ensuring the timely production and delivery of equipment. Manufacturers must explore strategies to enhance supply chain resilience, including diversifying suppliers and investing in local production capabilities, to mitigate the risks associated with supply chain disruptions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.90% |

|

Segments Covered |

By Product, Equipment Type, Propulsion Type, Engine Capacity, Power Output And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Caterpillar, Inc, CNH Industrial America LLC., Deere & Company, Doosan Corporation, Escorts Limited, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators Ltd., Komatsu Ltd., KUBOTA Corporation, LIEBHERR, MANITOU Group, SANY Group, Terex Corporation, AB Volvo, Wacker Neuson SE, XCMG Group, Zoomlion Heavy Industry Science&Technology Co., Ltd. |

SEGMENTAL ANALYSIS

By Product

The earth moving machinery segment dominated the construction equipment market in North American by accounting for 39.8% of the regional market share in 2024. The dominance of earth moving machinery segment in the North American market is primarily driven by the extensive use of earth moving equipment in various construction projects, including residential, commercial, and infrastructure development. According to the Association of Equipment Manufacturers, the demand for earth moving machinery, such as excavators, bulldozers, and backhoes, has surged due to ongoing investments in infrastructure and urban development. The importance of this segment is underscored by its critical role in site preparation, grading, and excavation, which are essential processes in construction. Additionally, advancements in technology, such as the integration of telematics and automation, are enhancing the efficiency and productivity of earth moving machinery, making it an attractive choice for contractors. As the construction industry continues to expand, the earth moving machinery segment is expected to maintain its leading position in the North America construction equipment market, driving overall growth and innovation.

The material handling machinery segment is emerging as the fastest-growing category within the North America construction equipment market and is predicted to grow at a CAGR of 5.7% over the forecast period. The rise of e-commerce, increasing need for streamlined supply chain operations and growing demand for efficient and safe handling of materials in construction and logistics operations are majorly driving the growth of the material handling machinery segment in the North American market. The importance of material handling machinery, such as forklifts, pallet jacks, and conveyor systems, is underscored by its ability to enhance productivity and reduce labor costs in construction projects. Additionally, the growing emphasis on workplace safety and ergonomics is prompting companies to invest in advanced material handling solutions that minimize the risk of injuries. As the market for material handling machinery continues to expand, it presents significant opportunities for manufacturers to innovate and cater to the evolving needs of the construction and logistics sectors.

By Equipment Type

The heavy construction equipment led the market by holding 65.7% of the North American market share in 2024. The domination of heavy construction equipment segment in the North American market is primarily driven by the extensive use of heavy machinery in large-scale construction projects, including infrastructure development, road construction, and commercial building projects. According to the American Society of Civil Engineers, the U.S. requires significant investments in infrastructure, which is expected to drive demand for heavy construction equipment. Additionally, advancements in technology, such as telematics and automation, are enhancing the performance and safety of heavy construction equipment, making it an attractive choice for contractors. As the construction industry continues to grow, the heavy construction equipment segment is expected to maintain its leading position in the North America construction equipment market, driving overall growth and innovation.

The compact construction equipment segment is predicted to witness the fastest CAGR of 7.7% over the forecast period owing to the increasing demand for versatile and maneuverable equipment in urban construction and landscaping projects. The rise of small-scale construction projects and the need for equipment that can operate in confined spaces are further expected to drive the expansion of compact construction equipment segment in the North American market over the forecast period. The importance of compact construction equipment, such as mini-excavators, skid-steer loaders, and compact track loaders, is underscored by its ability to perform a wide range of tasks while occupying minimal space. Additionally, the growing emphasis on efficiency and productivity in construction operations is prompting contractors to invest in compact equipment that can enhance workflow and reduce labor costs. As the market for compact construction equipment continues to expand, it presents significant opportunities for manufacturers to innovate and meet the evolving needs of the construction industry.

By Propulsion Type

The internal combustion engines (ICE) had the leading share of the North America construction equipment market in 2024. The leading position of ICE segment in the North American region is primarily driven by the widespread use of ICE-powered machinery in construction applications, where performance and power are critical. According to the Association of Equipment Manufacturers, the majority of heavy construction equipment, including excavators, bulldozers, and cranes, continues to rely on ICE technology due to its established reliability and efficiency. The importance of ICE in the construction equipment market is underscored by its ability to deliver high torque and power output, essential for demanding construction tasks. Additionally, advancements in engine technology, such as improved fuel efficiency and reduced emissions, are enhancing the appeal of ICE-powered equipment. As the construction industry continues to expand, the ICE segment is expected to maintain its leading position in the North America construction equipment market, driving overall growth and innovation.

The electric propulsion segment is anticipated to witness a CAGR of 9.12% over the forecast period owing to the increasing demand for environmentally friendly and sustainable construction practices. The rise of green building initiatives and regulatory pressures to reduce emissions are also aiding the expansion of the electric propulsion segment in the European market. The importance of electric propulsion in the construction equipment market is underscored by its ability to provide quieter operation, lower operating costs, and reduced environmental impact. Additionally, advancements in battery technology are enhancing the performance and range of electric construction equipment, making it a viable alternative to traditional ICE machinery. As the market for electric propulsion continues to expand, it presents significant opportunities for manufacturers to innovate and cater to the evolving needs of the construction industry.

By Engine Capacity

The 250-500 horsepower (HP) segment held the largest share of the North America construction equipment market in 2024. The dominating position of 250-500 HP segment in the North American market is primarily driven by the versatility and power offered by equipment in this horsepower range, which is ideal for a wide variety of construction applications, including earthmoving, material handling, and heavy lifting. According to the Association of Equipment Manufacturers, equipment in the 250-500 HP range is commonly used in large-scale construction projects, such as road construction and infrastructure development, where robust performance is essential. The importance of this segment is underscored by its ability to balance power and efficiency, making it a preferred choice for contractors seeking reliable machinery that can handle demanding tasks. Additionally, advancements in engine technology are enhancing the fuel efficiency and emissions performance of equipment in this category, further driving its adoption. As the construction industry continues to grow, the 250-500 HP segment is expected to maintain its leading position in the North America construction equipment market, supporting overall growth and innovation.

The more than 500 horsepower segment is projected to grow at a healthy CAGR in the North American market over the forecast period owing to the increasing demand for high-capacity machinery in large-scale construction and mining operations, where significant power is required to perform heavy-duty tasks. According to industry data, the demand for equipment exceeding 500 HP is expected to rise as infrastructure projects expand and the need for efficient material handling increases. The importance of this segment is underscored by its ability to deliver exceptional performance in challenging environments, making it essential for contractors involved in major construction projects. Additionally, advancements in technology, such as improved fuel efficiency and enhanced safety features, are making high-capacity equipment more appealing to contractors. As the market for construction equipment with more than 500 HP continues to expand, it presents significant opportunities for manufacturers to innovate and meet the evolving needs of the construction industry.

By Power Output

The 201-400 horsepower (HP) segment held the leading share of the North American market in 2024. The versatility and efficiency of equipment within this power range that is well-suited for a variety of construction applications, including excavation, grading, and material handling, is one of the key factors driving the growth of the 201-400 HP segment in the North American market. According to the Association of Equipment Manufacturers, equipment in the 201-400 HP range is commonly used in both commercial and residential construction projects, where a balance of power and maneuverability is essential. The ability to perform effectively in diverse environments is making it a preferred choice for contractors seeking reliable machinery that can handle a range of tasks, which is further boosting the expansion of 201-400 HP segment in the North American market. Additionally, advancements in engine technology are enhancing the fuel efficiency and emissions performance of equipment in this category, further driving its adoption. As the construction industry continues to grow, the 201-400 HP segment is expected to maintain its leading position in the North America construction equipment market, supporting overall growth and innovation.

The more than 401 horsepower segment is predicted to witness a prominent CAGR over the forecast period in the North American market owing to the increasing demand for high-capacity machinery in large-scale construction and mining operations, where significant power is required to perform heavy-duty tasks. According to industry data, the demand for equipment exceeding 401 HP is expected to rise as infrastructure projects expand and the need for efficient material handling increases. Additionally, advancements in technology, such as improved fuel efficiency and enhanced safety features, are making high-capacity equipment more appealing to contractors. As the market for construction equipment with more than 401 HP continues to expand, it presents significant opportunities for manufacturers to innovate and meet the evolving needs of the construction industry.

COUNTRY ANALYSIS

The United States accounted for the lion share of the North America construction equipment market in 2024. The domination of the U.S. in the North American market is majorly driven by a robust construction sector, significant investments in infrastructure, and a well-established manufacturing base. According to the U.S. Bureau of Economic Analysis, the construction industry contributed over $1.4 trillion to the U.S. economy in 2021, highlighting its critical role in economic growth. The extensive network of distribution channels and retail outlets further supports the growth of the construction equipment market in the U.S. Additionally, the increasing focus on infrastructure development, particularly in urban areas, is prompting contractors to invest in advanced machinery that enhances productivity and efficiency. As the U.S. continues to lead in construction activity and equipment consumption, it plays a pivotal role in shaping the future of the North America construction equipment market.

Canada is a prominent market for construction equipment in North America. The Canadian construction equipment market has experienced steady growth, driven by a strong commitment to infrastructure development and government initiatives aimed at improving transportation networks. According to Statistics Canada, the construction industry in Canada generated over CAD 140 billion in revenue in 2021, reflecting a growing demand for construction services and equipment. The Canadian government's investments in public infrastructure projects, such as roads, bridges, and public transit, are further stimulating the market. Additionally, the increasing focus on sustainable construction practices is prompting contractors to adopt advanced equipment that meets environmental standards. As Canada continues to prioritize infrastructure development and sustainability, the construction equipment market is well-positioned for continued expansion, reflecting the nation's commitment to economic growth and innovation.

Mexico is emerging as a growing player in the North America construction equipment market. The increasing demand for construction equipment in Mexico is driven by significant investments in infrastructure and urban development projects. The Mexican government's commitment to infrastructure development, including road construction and housing projects, is enhancing the appeal of construction equipment. Additionally, the rise of private investments in construction and real estate is further driving demand for advanced machinery. As the market continues to develop, Mexico presents significant opportunities for growth, particularly in the context of cross-border trade and the increasing interest in sustainable construction practices.

KEY MARKET PLAYERS

Caterpillar, Inc, CNH Industrial America LLC., Deere & Company, Doosan Corporation, Escorts Limited, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators Ltd., Komatsu Ltd., KUBOTA Corporation, LIEBHERR, MANITOU Group, SANY Group, Terex Corporation, AB Volvo, Wacker Neuson SE, XCMG Group, Zoomlion Heavy Industry Science&Technology Co., Ltd. are the market players that are dominating the north America construction equipment market.

MARKET SEGMENTATION

This research report on the North America construction equipment market is segmented and sub-segmented into the following categories.

By Product

-

- Earth Moving Machinery

- Excavators

- Wheel

- Crawler

- Loaders

- Backhoe Loaders

- Skid Steer Loaders

- Crawler/Track Loaders

- Wheeled Loaders

- Dump Trucks

- Moto Graders

- Dozers

- Wheel

- Crawler

- Excavators

- Material Handling Machinery

- Crawler Cranes

- Trailer Mounted Cranes

- Truck Mounted Cranes

- Forklift

- Concrete and Road Construction Machinery

- Concrete Mixer & Pavers

- Construction Pumps

- Others

- Earth Moving Machinery

By Equipment Type

-

- Heavy Construction Equipment

- Compact Construction Equipment

By Propulsion Type

-

- ICE

- Electric

- CNG/LNG

By Engine Capacity

-

- Up to 250 HP

- 250-500 HP

- More than 500 HP

By Power

-

- <100 HP

- 101-200 HP

- 201-400 HP

- >401 HP

By Country

- US

- Canada

- Rest of North America

Frequently Asked Questions

How is the construction equipment market performing in North America?

The market is growing due to increasing infrastructure projects, urbanization, and advancements in construction technology.

What are the main factors influencing the demand for construction equipment?

Factors include government investments in infrastructure, rising residential and commercial construction, and the adoption of automation in equipment.

Which types of construction equipment are most in demand?

Excavators, loaders, bulldozers, cranes, and compact construction equipment are among the most sought-after due to their versatility and efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]