North America Clinical Laboratory Tests Market Research Report - Segmented By Complete Blood Count (CBC) ,HGB/HCT Testing ) End-Use ( Central Laboratories, Primary Clinics ) & Country (The United States, Canada and Rest of North America) – Industry Analysis on Size, Share, Trends & Growth Forecast (2024 to 2033)

North America Clinical Laboratory Tests Market Size

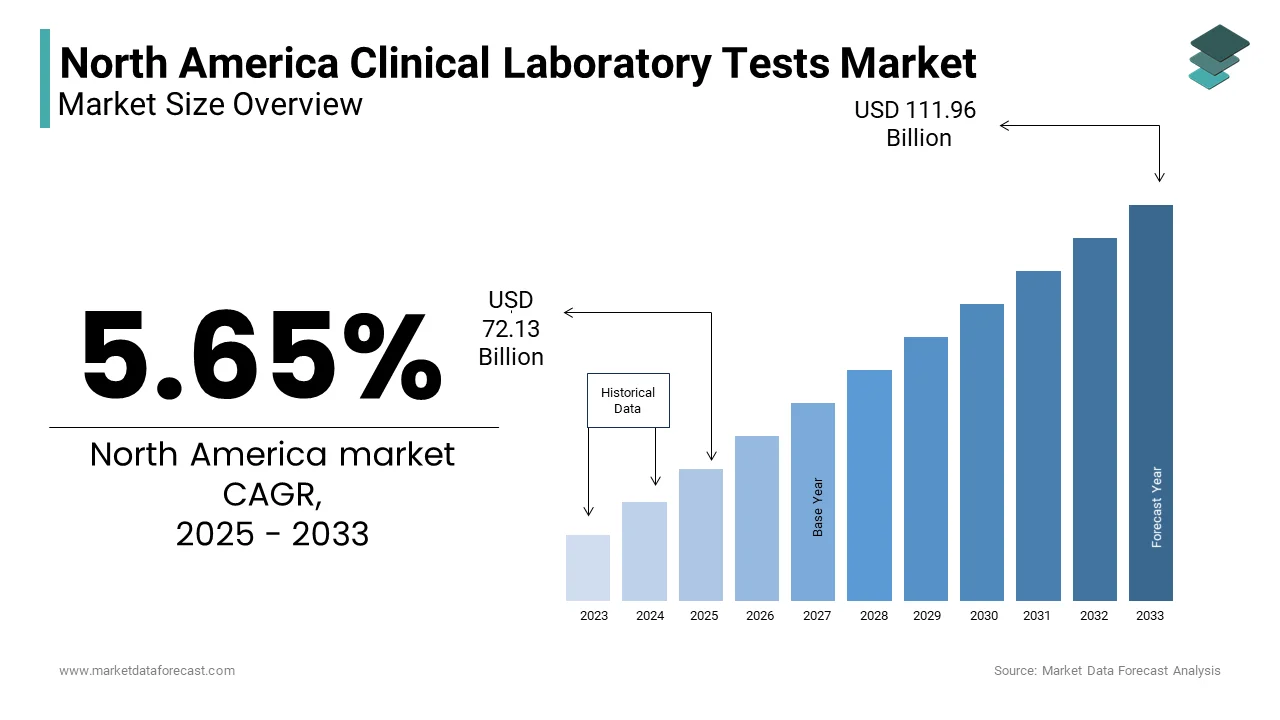

The North America Clinical Laboratory Tests Market Size was valued at USD 68.27 billion in 2024. The North America Clinical Laboratory Tests Market size is expected to have 5.65 % CAGR from 2025 to 2033 and be worth USD 111.96 billion by 2033 from USD 72.13 billion in 2025.

The North America clinical laboratory test market is a cornerstone of the region's healthcare ecosystem, driven by an aging population, rising prevalence of chronic diseases, and advancements in diagnostic technologies. According to the Centers for Disease Control and Prevention (CDC), approximately 70% of medical decisions are influenced by laboratory test results, underscoring their critical role in patient care. The United States spearheads the regional market. Canada follows by leveraging its robust healthcare infrastructure and government initiatives to enhance diagnostic capabilities.

The market is further propelled by the increasing demand for preventive healthcare, with routine tests such as complete blood count (CBC) and HGB/HCT testing becoming standard practice. As per the American Hospital Association, over 13 billion laboratory tests are performed annually in the U.S., reflecting the sector's scale. Additionally, the integration of artificial intelligence (AI) and automation in laboratory workflows has improved efficiency and accuracy fostering market growth. These factors collectively create a dynamic environment for the expansion of the clinical laboratory test market in North America.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

Chronic diseases such as diabetes, cardiovascular disorders, and cancer are significant contributors to the growth of the North America clinical laboratory test market. The American Diabetes Association states that, over 37 million Americans were diagnosed with diabetes in 2023 necessitating regular monitoring through HbA1c and glucose testing. Similarly, cardiovascular diseases account for nearly 697,000 deaths annually in the U.S., as stated by the CDC driving demand for lipid profile and cardiac biomarker tests. Furthermore, the National Cancer Institute reports that over 1.9 million new cancer cases were diagnosed in 2023 exhibiting the need for tumor marker analysis and genetic testing. These statistics brings to light the indispensable role of laboratory diagnostics in managing chronic conditions and thereby fueling market expansion.

Advancements in Diagnostic Technologies

Technological advancements have revolutionized the clinical laboratory test market, enhancing accuracy and accessibility. Innovations such as point-of-care testing (POCT) devices and next-generation sequencing (NGS) have streamlined diagnostic workflows, reducing turnaround times. To add to this, the adoption of AI-driven analytics has improved test result interpretation, enabling personalized treatment plans. For instance, IBM Watson Health's AI solutions have been integrated into several U.S. laboratories, boosting operational efficiency. These technological breakthroughs not only enhance patient outcomes but also drive the market's upward trajectory.

MARKET RESTRAINTS

High Costs of Advanced Testing

A key barrier to the growth of the North America clinical laboratory test market is the high cost associated with advanced diagnostic technologies. Cutting-edge tests such as NGS and molecular diagnostics require significant investment in equipment, reagents, and skilled personnel. This financial burden often limits accessibility, particularly for smaller clinics and rural healthcare facilities. Besides, reimbursement challenges exacerbate the issue, as insurers frequently impose stringent criteria for coverage. A survey conducted by the American Medical Association revealed that over 60% of physicians cited reimbursement issues as a major obstacle to adopting advanced diagnostic tools. These factors collectively restrain market growth.

Regulatory and Compliance Challenges

Strict regulatory requirements pose another significant restraint for the clinical laboratory test market in North America. Regulatory agencies such as the FDA and CLIA mandate rigorous validation processes to ensure the safety and efficacy of diagnostic tests. In line with a report by Deloitte, the average timeline for gaining regulatory approval for a new diagnostic test is approximately 18 months significantly delaying market entry. Furthermore, compliance with quality control standards adds operational complexity and cost. For example, maintaining CLIA certification requires continuous monitoring and adherence to strict protocols, which can strain resources. A study published by the Journal of Clinical Pathology brought to attention that over 30% of laboratories face compliance-related challenges. These hurdles not only increase operational burdens but also impede innovation and market expansion.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Remote Diagnostics

The rapid adoption of telemedicine presents a transformative opportunity for the North America clinical laboratory test market. Telehealth platforms enable remote consultations and diagnostic test ordering, expanding access to underserved populations. According to the American Telemedicine Association, telehealth utilization increased by over 38 times pre-pandemic levels in 2023 showcasing the sector's momentum. This trend has spurred demand for home-based diagnostic kits and portable laboratory devices facilitating decentralized testing. For instance, companies like Labcorp and Quest Diagnostics have launched direct-to-consumer testing services, enabling patients to order tests online and receive results remotely. These innovations align with the growing preference for convenience and self-management, creating a fertile ground for market expansion.

Integration of AI and Big Data Analytics

The integration of AI and big data analytics offers unprecedented opportunities for the clinical laboratory test market. AI-driven algorithms can analyze vast datasets to identify patterns and predict disease outcomes, enhancing diagnostic accuracy. The findings of a report by McKinsey & Company reveals that AI applications in healthcare could generate up to $100 billion annually in the U.S. by 2025. For example, Google Health's DeepMind platform has demonstrated success in predicting acute kidney injury using laboratory data improving early intervention rates. On top of that, big data analytics enables population health management by identifying at-risk individuals and tailoring preventive strategies. These advancements not only improve patient outcomes but also position AI as a key driver of market growth.

MARKET CHALLENGES

Ethical Concerns Surrounding Genetic Testing

Ethical concerns surrounding genetic testing represent a significant challenge for the North America clinical laboratory test market. Public skepticism about data privacy and potential misuse of genetic information can hinder adoption. A survey by the Pew Research Center notes that over 50% of Americans expressed concerns about the security of their genetic data, particularly regarding third-party access. Also, regulatory frameworks governing genetic testing remain fragmented, creating ambiguity for stakeholders. For instance, the Genetic Information Nondiscrimination Act (GINA) protects against employment and insurance discrimination but does not address broader privacy issues. These ethical and regulatory uncertainties pose reputational risks and may deter patients from undergoing genetic testing, impeding market progress.

Workforce Shortages in Laboratory Settings

A subsequent pressing challenge is the shortage of skilled professionals in clinical laboratories, which threatens operational efficiency and service quality. As indicated by the American Society for Clinical Pathology (ASCP), the U.S. faces a projected shortfall of over 11,000 laboratory professionals by 2025. This gap is exacerbated by an aging workforce, with over 50% of current laboratory staff nearing retirement age. Beyond this, the complexity of modern diagnostic technologies requires specialized training which is often lacking in educational programs. A study by the National Institutes of Health emphasized that only 30% of laboratory positions are filled within six months, displaying the urgency of addressing this issue. These workforce shortages not only delay test processing but also compromise patient care posing a formidable challenge for market participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.65 % |

|

Segments Covered |

By Type, End-Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Quest Diagnostics, Inc., Laboratory Corporation of America, LLC, Eurofins Scientific |

SEGMENTAL ANALYSIS

By Type Insights

The complete blood count (CBC) testing segment dominated the North America clinical laboratory test market by capturing 36.8% of the total market share in 2024. This influence over the market is due to the widespread use of CBC in diagnosing and monitoring a variety of conditions including anemia, infections, and blood disorders. The simplicity and affordability of CBC tests make them accessible across diverse healthcare settings, from primary care clinics to large hospitals. By way of further evidence, the increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders has amplified demand, as stated by the CDC. For instance, over 70% of diabetic patients undergo regular CBC testing to monitor complications. These factors collectively reinforce CBC's leadership position in the market.

The HGB/HCT testing is the fastest-growing segment, with a projected CAGR of 8.5% during the forecast period. This growth is fueled by the rising incidence of anemia and other hematological disorders, particularly among women and elderly populations. According to the World Health Organization, anemia affects over 1.6 billion people globally, with North America accounting for a significant share. To add to this, advancements in automated hematology analyzers have enhanced the accuracy and efficiency of HGB/HCT testing driving adoption. For example, Sysmex Corporation's XN-Series analyzers have gained popularity for their ability to process high volumes with minimal errors. These innovations position HGB/HCT testing as a rapidly emerging segment in the market.

By End-Use Insights

The central laboratories held the largest share and accounted for 60.7% of the North America clinical laboratory test market in 2024. The visibility of the segment is attributed to their ability to handle high-volume testing with standardized protocols, ensuring consistency and reliability. Central labs are widely utilized for clinical trials and large-scale screening programs, as stated by the National Institutes of Health. For instance, over 70% of clinical trial samples are processed in central laboratories showcasing their critical role in research and development. Beyond this, economies of scale and advanced automation capabilities make central labs a preferred choice for biopharmaceutical companies. These factors collectively drive the segment's leadership in the market.

Primary clinics are the quickly expanding end-use category, with a calculated CAGR of 9.2% from 2025 to 2033. This progress is propelled by the increasing emphasis on preventive healthcare and the decentralization of diagnostic services. As per the American Academy of Family Physicians, over 80% of preventive screenings are conducted in primary care settings, underscoring their importance. Beyond this, the adoption of point-of-care testing (POCT) devices has expanded diagnostic capabilities in clinics, enabling rapid results and timely interventions. For example, Abbott Laboratories' i-STAT system has gained traction for its ability to perform multiple tests at the bedside. These dynamics position primary clinics as a key growth driver in the market.

COUNTRY LEVEL ANALYSIS

The U.S. continues to anchor the North American clinical laboratory test market with a commanding 81.2% share in 2024. This supremacy is stimulated by the country’s robust healthcare infrastructure, coupled with substantial investments in R&D. For instance, the National Institutes of Health (NIH) allocated $47.4 billion to biomedical research in 2023 fostering innovation in diagnostic technologies. The U.S. is home to over 250,000 clinical laboratories, many of which specialize in advanced testing such as molecular diagnostics and genetic profiling. Additionally, the Affordable Care Act (ACA) has increased access to preventive services, driving demand for routine tests like CBC and lipid panels. These factors collectively reinforce the U.S.'s dominance in the regional market.

Canada's clinical testing landscape is expanding at a steady pace which is supported by its universal healthcare system and focus on innovation. The country holds approximately 10% of the regional market share, as stated by Allied Market Research. Canada's leadership is driven by government initiatives such as the Canadian Partnership Against Cancer, which has invested over 500 million in cancer diagnostics since 2010. The Canadian healthcare sector benefits from a collaborative environment that fosters advancements in laboratory testing. For example, the University of Toronto's contributions to AI-driven diagnostics have enhanced test accuracy and efficiency. These innovations position Canada as a key contributor to regional growth.

The Rest of North America is led by Mexico and smaller Caribbean economies which is quickly emerging as the region's fastest-expanding clinical lab market to clock a projected CAGR of 6.7% through 2023. While smaller in scale, this section of the market is becoming popular due to increasing investments in healthcare infrastructure and diagnostic capabilities. Mexico in particular has come up as a hub for contract research organizations (CROs), with over 50 facilities specializing in clinical trials. Also, the Mexican government's focus on fostering innovation, exemplified by the National Council of Science and Technology (CONACYT), has spurred advancements in laboratory testing. Beyomd this, collaborations with U.S.-based firms have facilitated knowledge transfer enhancing local capabilities. These dynamics show the potential for growth in this segment.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a vital role in the North American clinical laboratory tests market profiled in this report are Quest Diagnostics, Inc., Laboratory Corporation of America, LLC, Eurofins Scientific, Fresenius Medical Care, NeoGenomics Laboratories Inc., Siemens Healthineers, OPKO Health, Inc., Abbott Laboratories, Inc., Charles River Laboratories International, Inc., Sonic Healthcare Ltd., and Genoptix, Inc.

The North America clinical laboratory test market is characterized by intense competition, with key players vying for technological superiority and market dominance. Companies like Labcorp, Quest Diagnostics, and Mayo Clinic Laboratories lead the charge, leveraging their expertise in precision medicine and molecular diagnostics. The competitive landscape is shaped by rapid advancements in AI-driven analytics and increasing demand for preventive healthcare. Strategic collaborations and investments in R&D further intensify rivalry, driving innovation and market expansion.

Top Players in the Market

Labcorp

Labcorp occupies a leading position in the North America clinical laboratory test market, renowned for its comprehensive portfolio of diagnostic services. The company's strength lies in its ability to provide end-to-end solutions, from routine testing to advanced genomic analysis. Its acquisition of Chiltern International in 2018 significantly expanded its clinical trial capabilities, enabling it to cater to a diverse client base. With a strong emphasis on innovation, Labcorp consistently introduces cutting-edge tools, such as its BeaconLBS platform, which enhances test ordering and result interpretation.

Quest Diagnostics

Quest Diagnostics is a prominent player known for its expertise in precision medicine and molecular diagnostics. The company's strengths include its proprietary technologies, which improve test accuracy and turnaround times. Quest's focus on sustainability and quality has earned it a reputation as a trusted partner for healthcare providers. Its collaboration with academic institutions and industry leaders has fostered advancements in liquid biopsy testing, further solidifying its market position.

Mayo Clinic Laboratories

Mayo Clinic Laboratories excels in providing specialized diagnostic solutions, catering to the growing demand for rare disease testing and personalized medicine. The company's strengths lie in its state-of-the-art facilities and extensive experience in rare disease diagnostics. Mayo Clinic's investment in digitalization and automation has streamlined testing workflows, enhancing efficiency. Its global presence and commitment to innovation make it a key contributor to the market.

Top strategies used by the key market participants

Key players in the North America clinical laboratory test market employ strategic initiatives such as mergers and acquisitions, product launches, and collaborations to strengthen their foothold. For instance, Labcorp acquired Personal Genome Diagnostics in 2021, expanding its genomic testing capabilities. Similarly, Quest Diagnostics partnered with IBM Watson Health in 2023 to co-develop AI-driven diagnostic tools. These strategies enable companies to diversify their offerings and tap into emerging opportunities, ensuring sustained growth.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Labcorp launched a new line of genomic testing services, enhancing diagnostic capabilities.

- In June 2023, Quest Diagnostics introduced AI-driven analytics tools for predictive diagnostics, boosting efficiency.

- In August 2023, Mayo Clinic expanded its rare disease testing portfolio, increasing accessibility.

- In October 2023, BioReference Laboratories acquired a telehealth platform, strengthening its remote testing services.

- In December 2023, Sonic Healthcare partnered with a biotech firm to co-develop scalable diagnostic solutions.

MARKET SEGMENTATION

This research report on the north american clinical laboratory tests market has been segmented and sub-segmented into the following.

By Type

- Complete Blood Count (CBC)

- HGB/HCT Testing

By End-Use

- Central Laboratories

- Primary Clinics

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

Which country in North America dominates the clinical laboratory tests market?

The United States holds the largest market share, followed by Canada and Mexico, due to high healthcare spending and advanced infrastructure.

What is the future outlook for the North American clinical laboratory tests market?

The market is expected to grow significantly, driven by technological advancements, increasing disease burden, and expanding healthcare access.

What are the key factors driving North American clinical laboratory tests market growth?

Rising prevalence of chronic diseases (diabetes, cardiovascular, cancer),Increased demand for early disease detection ,Technological advancements in diagnostic testing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]