North America Ceramic Tiles Market Size, Share, Trends & Growth Forecast Report By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch-free Ceramic Tiles, Other Products), Application, End-Use and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Ceramic Tiles Market Size

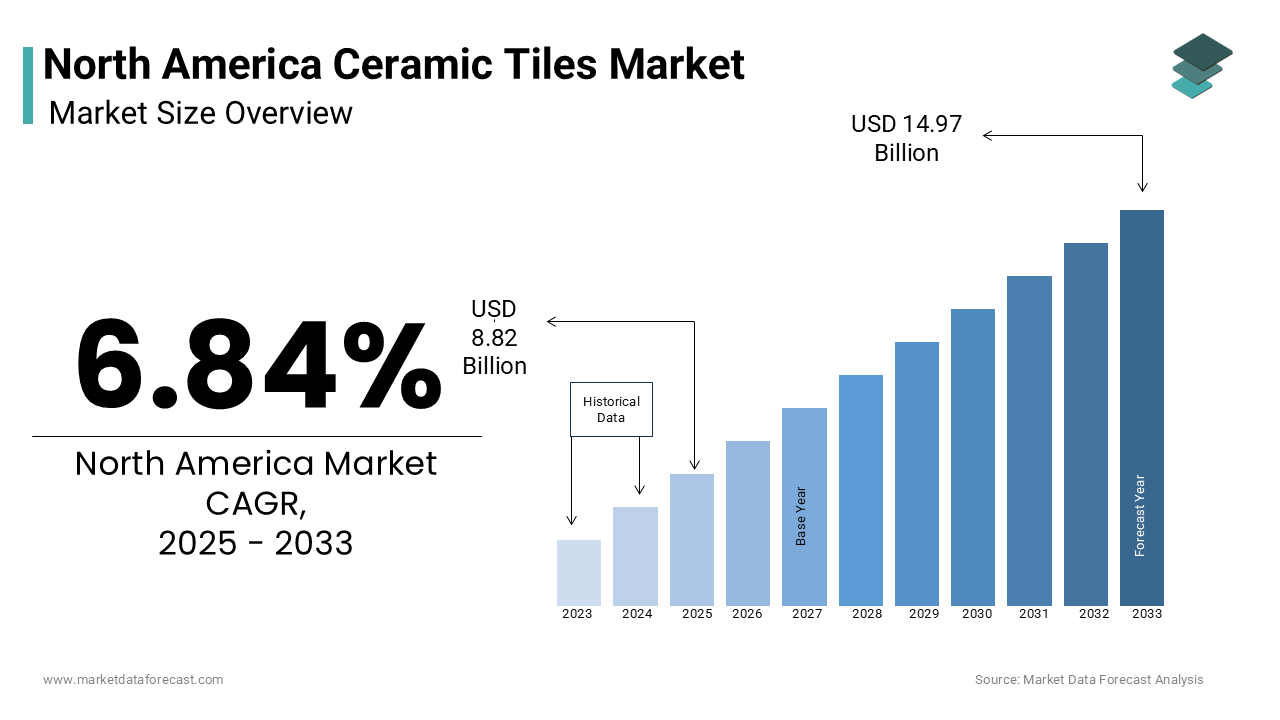

The North America ceramic tiles market was worth USD 8.26 billion in 2024. The North American market is estimated to grow at a CAGR of 6.84% from 2025 to 2033 and be valued at USD 14.97 billion by the end of 2033 from USD 8.82 billion in 2025.

The ceramic tiles are favored for their durability, aesthetic appeal, and ease of maintenance, making them a popular choice among consumers and builders alike. The market has witnessed significant growth due to the increasing demand for stylish and functional flooring solutions, that is driven by trends in home renovation and construction. The growth of this market is influenced by several factors with the rising popularity of sustainable building materials and the growing trend of open-concept living spaces that require versatile flooring options. Additionally, advancements in manufacturing technologies have led to the production of high-quality ceramic tiles that mimic natural materials, such as wood and stone that further enhancing their appeal.

MARKET DRIVERS

Increasing Demand for Sustainable and Eco-Friendly Building Materials

The North American ceramic tiles market is significantly driven by the growing preference for sustainable and eco-friendly building materials. According to the U.S. Green Building Council, green construction is expected to account for over 47% of all commercial construction projects in the U.S. by 2025. Ceramic tiles, being durable, recyclable, and energy-efficient during production are aligned with sustainability goals. According to the Environmental Protection Agency, buildings consume nearly 39% of total energy in the U.S. by creating a demand for materials that reduce energy usage. This trend is further supported by government incentives promoting green housing projects. For instance, the Department of Energy’s Better Buildings Initiative aims to reduce energy consumption by 20% across residential and commercial sectors is driving investments in eco-friendly materials like ceramic tiles.

Rising Urbanization and Infrastructure Development

Urbanization in North America is a key factor propelling the ceramic tiles market. The U.S. Census Bureau reports that urban areas in the United States grew by 9% between 2010 and 2020, with cities like New York and Los Angeles witnessing significant population influxes. This urban expansion has spurred demand for residential and commercial spaces by boosting the construction sector. The National Association of Home Builders estimates that housing starts in urban regions reached approximately 1.6 million units in 2022 by reflecting robust growth. Ceramic tiles are widely used in flooring, wall cladding, and decorative applications due to their aesthetic appeal and durability, making them indispensable in modern construction projects. Additionally, infrastructure development programs, such as the $1.2 trillion Bipartisan Infrastructure Law passed in 2021, which further accelerated the use of ceramic tiles in public spaces and transportation hubs.

MARKET RESTRAINTS

High Production Costs

One of the significant restraints is affecting the North America ceramic tiles market is the high production costs associated with manufacturing ceramic tiles. The production process involves several stages by including raw material extraction, processing, and firing, which can be capital-intensive. The production costs for ceramic tiles can account for up to 40% of the final retail price by making them relatively expensive compared to alternative flooring options in the coming years. This financial burden can deter potential buyers in price-sensitive markets.

Moreover, fluctuations in the prices of raw materials, such as clay and glaze, can further exacerbate cost challenges. The volatility of these materials is driven by global supply chain dynamics and geopolitical factors, can lead to unpredictable pricing for manufacturers. The companies may face difficulties in maintaining competitive pricing for ceramic tiles by limiting their market penetration. Addressing the issue of production costs will be crucial for the long-term sustainability and growth of the North America ceramic tiles market.

Competition from Alternative Flooring Options

Another notable restraint is the competition from alternative flooring options, which can impact the growth of the ceramic tiles market. While ceramic tiles are popular for their durability and aesthetic appeal, other materials, such as vinyl, laminate, and hardwood, are increasingly being used in residential and commercial applications. According to a report by the National Wood Flooring Association, the demand for alternative flooring materials has increased significantly, with many consumers opting for these options due to their lower production costs and sufficient performance characteristics. The growing popularity of these alternative materials can pose challenges for ceramic tile manufacturers in terms of market share and pricing. The demand for ceramic tiles may be affected as consumers and businesses continue to prioritize cost and performance.

MARKET OPPORTUNITIES

Growing Adoption of Smart Tiles with Advanced Functionalities

The North American ceramic tiles market is poised to benefit from the increasing adoption of smart tiles embedded with advanced functionalities such as temperature regulation and air purification. According to the U.S. Department of Energy, energy-efficient building materials can reduce heating and cooling costs by up to 30% by creating a strong demand for innovative solutions like smart tiles. These tiles integrate technologies like phase-changing materials (PCMs) to regulate indoor temperatures, aligning with sustainability goals. According to the National Renewable Energy Laboratory, buildings account for 74% of electricity consumption in the U.S. is driving interest in energy-saving innovations. Additionally, the Environmental Protection Agency emphasizes the importance of improving indoor air quality, which has led to the development of tiles with photocatalytic coatings that break down pollutants. Such advancements position smart tiles as a transformative opportunity in the construction sector.

Expanding Renovation and Remodeling Activities in Residential Spaces

The surge in home renovation and remodeling activities across North America presents a significant opportunity for the ceramic tiles market. The U.S. Census Bureau reports that spending on home improvements reached $420 billion in 2022 with a rise in homeownership rates and increased disposable incomes. The Joint Center for Housing Studies at Harvard University projects that remodeling expenditures will grow by 4% annually over the next few years, with kitchen and bathroom upgrades accounting for a substantial share. Ceramic tiles are a preferred choice for these projects due to their versatility, durability, and aesthetic appeal. Furthermore, the Canada Mortgage and Housing Corporation notes that Canadian homeowners spent over CAD 80 billion on renovations in 2021. This ongoing focus on enhancing living spaces is expected to drive sustained demand for ceramic tiles in the residential segment.

MARKET CHALLENGES

Economic Uncertainty

One of the primary challenges facing the North America ceramic tiles market is economic uncertainty, which can significantly impact consumer spending and investment in construction projects. Fluctuations in economic conditions, such as inflation rates, employment levels, and consumer confidence that can lead to reduced demand for ceramic tiles. According to a report by the National Association of Home Builders, economic uncertainty can result in a slowdown in new construction and renovation projects by directly affecting the sales of ceramic tiles.

Moreover, during periods of economic downturn, consumers may prioritize essential expenditures over home improvement projects are leading to decreased demand for non-essential items like ceramic tiles. This challenge necessitates that manufacturers and retailers remain agile and responsive to changing economic conditions by adapting their strategies to maintain market share.

Supply Chain Disruptions

Another significant challenge is the potential for supply chain disruptions, which can impact the availability and pricing of ceramic tiles. The COVID-19 pandemic has showcased many vulnerabilities in global supply chains by leading to shortages and delays in the procurement of raw materials and finished products. According to a survey conducted by the American Ceramic Society, nearly 50% of manufacturers reported disruptions in their supply chains due to the pandemic by affecting their ability to meet production demands.

Additionally, geopolitical tensions and trade disputes can further exacerbate supply chain challenges by leading to increased costs and uncertainty in the market. They must implement effective supply chain management strategies to mitigate the impact of these disruptions as manufacturers strive to maintain consistent production levels. Ensuring a reliable supply of raw materials and finished products is crucial for the long-term sustainability and competitiveness of the North America ceramic tiles market.

SEGMENTAL ANALYSIS

By Product Insights

The glazed ceramic tiles segment was the largest by capturing 55.4% of the North America ceramic tiles market share in 2024. This dominance is primarily driven by the widespread use of glazed tiles in residential and commercial applications due to their aesthetic appeal and durability. The importance of the glazed ceramic tiles segment lies in their ability to provide a protective layer that enhances the tile's resistance to stains, moisture, and wear. This makes them particularly suitable for high-traffic areas, kitchens, and bathrooms. Additionally, the variety of designs, colors, and finishes available in glazed tiles allows consumers to achieve their desired aesthetic while benefiting from the practical advantages of ceramic materials. The glazed ceramic tiles segment is expected to maintain its leading position in the North America ceramic tiles market as the demand for stylish and functional flooring solutions continues to rise.

The porcelain tiles segment is likely to experience a fastest CAGR of 7.4% during the forecast period. This growth can be attributed to the increasing popularity of porcelain tiles for both residential and commercial applications, driven by their durability and versatility. The rising trend of incorporating porcelain tiles into various applications is a key driver of growth in this segment. Porcelain tiles are known for their low water absorption rates by making them suitable for wet areas and outdoor applications. Additionally, advancements in manufacturing technologies have enabled the production of porcelain tiles that mimic natural materials, such as wood and stone that further enhances their appeal. The porcelain tiles segment is well-positioned for robust growth in the North America ceramic tiles market as the demand for durable and aesthetically pleasing flooring solutions continues to rise.

By Application Insights

The wall tiles segment dominated the North America ceramic tiles market with 40.5% of share in 2024. This dominance is primarily driven by the extensive use of ceramic tiles in residential and commercial wall applications, where they are favored for their aesthetic appeal and ease of maintenance. Ceramic wall tiles are commonly used in kitchens, bathrooms, and other areas where aesthetics and functionality are essential. The wall tiles segment is expected to maintain its leading position in the North America ceramic tiles market as the demand for innovative and attractive wall solutions continues to rise by providing opportunities for product development and design innovation.

The floor tiles segment is projected to register a CAGR of 8.4% during the forecast period. This growth can be attributed to the increasing demand for durable and aesthetically pleasing flooring solutions in residential and commercial settings. The rising trend of incorporating ceramic floor tiles into various applications is a key driver of growth in this segment. Ceramic floor tiles are known for their durability, ease of maintenance, and resistance to wear by making them suitable for high-traffic areas. Additionally, advancements in design and manufacturing have led to the production of tiles that mimic natural materials, such as hardwood and stone that further enhances their appeal. The floor tiles segment is well-positioned for robust growth in the North America ceramic tiles market as the demand for stylish and functional flooring solutions continues to rise.

REGIONAL ANALYSIS

The United States dominated the North America ceramic tiles market with a dominant share of 70.3% in 2024. This dominance can be attributed to the robust construction and renovation activities across the country, which drive the demand for ceramic tiles in residential and commercial applications. Moreover, the U.S. market is characterized by a growing trend towards home improvement and renovation, with consumers increasingly investing in high-quality flooring and wall solutions. The demand for ceramic tiles is further supported by the increasing focus on sustainability and energy efficiency in construction practices.

Canada ceramic tiles market is likely to showcase a prominent CAGR of 4.5% during the forecast period. The Canadian market is characterized by a strong emphasis on quality and innovation in building materials. The country’s commitment to sustainability and environmental responsibility is ascribed to fuel the growth of the market. The country has implemented various initiatives aimed at promoting the use of eco-friendly building materials, which enhances the appeal of ceramic tiles. Canada is well-positioned to capitalize on the opportunities in the North America ceramic tiles market as the demand for high-quality and sustainable flooring solutions continues to rise.

MARKET SEGMENTATION

This research report on the north america ceramic tiles market is segmented and sub-segmented based on categories.

By Product

- Glazed Ceramic Tiles

- Porcelain Tiles

- Scratch-free Ceramic Tiles

- Other Products

By Application

- Wall Tiles

- Floor Tiles

- Other Applications

By End Use

- Residential

- Commercial

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What factors are driving the demand for ceramic tiles in North America?

Factors include increased construction activity, a preference for eco-friendly materials, and the growing trend of home renovations.

What are the challenges facing the ceramic tiles market in North America?

Challenges include raw material price fluctuations, competition from alternative flooring, and environmental concerns in manufacturing.

How is the North America Ceramic Tiles Market growing?

The market is growing due to increased demand for stylish, durable flooring and the trend of home renovation and remodeling.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]