North American CBCT Dental Imaging Market Size, Share, Trends & Growth Forecast Report By Type of Detector (Flat Panel Detectors, Image Intensifier, Endodontic), Application, End-User, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North American CBCT Dental Imaging Market Size

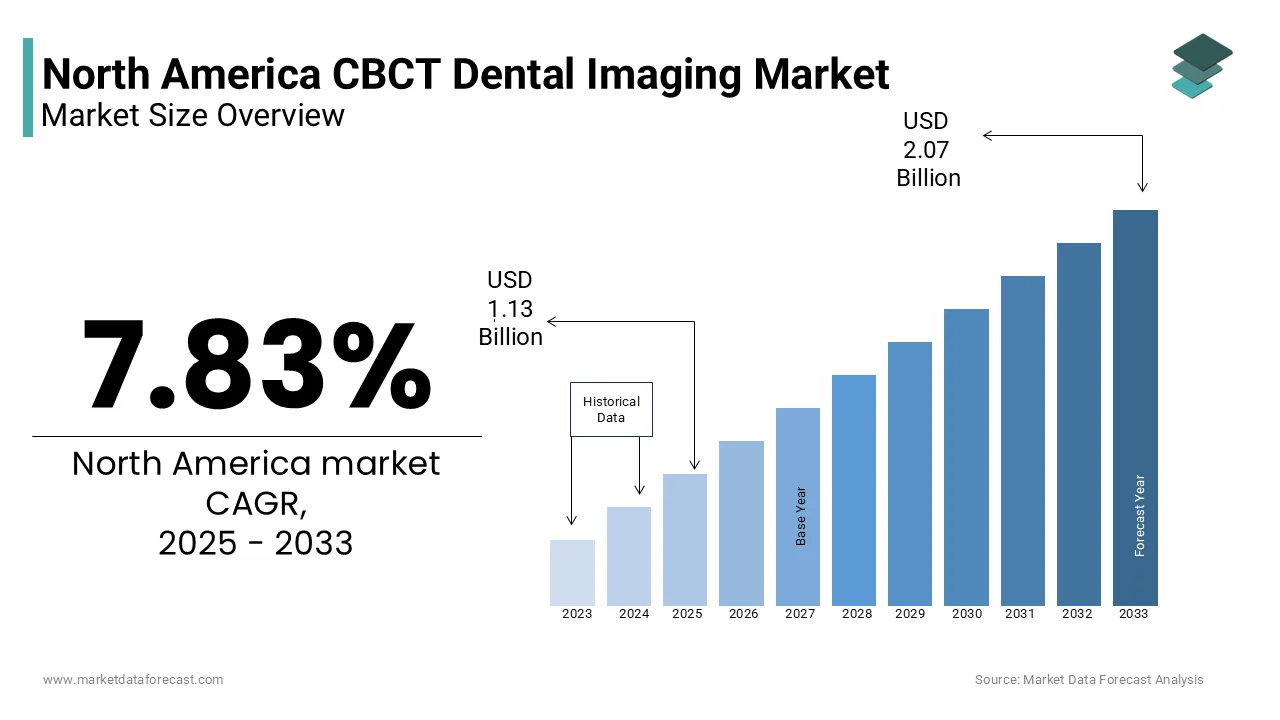

The North American CBCT Dental Imaging market size was valued at USD 1.05 billion in 2024. The European market size is estimated to be worth USD 2.07 billion by 2033 from USD 1.13 billion in 2025, growing at a CAGR of 7.83% from 2025 to 2033.

The North American cone-beam computed tomography (CBCT) dental imaging market is a rapidly evolving segment within the broader healthcare diagnostics industry. According to the American Dental Association, approximately 120 million Americans are missing at least one tooth is driving demand for advanced imaging solutions like CBCT, which are critical for procedures such as dental implants and orthodontics. The region’s robust healthcare infrastructure, coupled with increasing awareness of oral health, has propelled the adoption of CBCT systems. For instance, Canada’s Public Health Agency reports that oral health issues affect nearly 60% of adults is creating a significant need for precise diagnostic tools.

MARKET DRIVERS

Rising Demand for Dental Implants

The growing demand for dental implants is a primary driver of the CBCT dental imaging market in North America. According to the American Academy of Implant Dentistry, over 3 million Americans have dental implants, with this number increasing by 500,000 annually. CBCT imaging plays a pivotal role in pre-surgical planning by offering high-resolution 3D images that ensure precise implant placement. This technology minimizes risks such as nerve damage and enhances patient outcomes, making it indispensable for dental practitioners. Additionally, the aging population contributes significantly to this trend, with the U.S. Census Bureau projecting that seniors will account for 21% of the population by 2030. Older adults are more prone to tooth loss, thereby increasing the need for implants and associated imaging technologies. A study by the Journal of Prosthetic Dentistry found that CBCT-guided implant surgeries result in a success rate exceeding 97%, further underscoring its value.

Advancements in Imaging Technology

Technological advancements represent another major driver shaping the CBCT dental imaging market. Innovations such as AI-powered image processing and cloud-based data storage have revolutionized how dental professionals utilize imaging data. For instance, Carestream Dental introduced SmartPad, a software solution that integrates AI algorithms to enhance image clarity and reduce diagnostic errors. Moreover, the integration of CBCT systems with electronic health records (EHRs) enables seamless data sharing between specialists, improving collaborative care. Data from HIMSS Analytics reveals that over 90% of U.S. hospitals now use EHR systems, facilitating better integration. These advancements not only improve diagnostic accuracy but also enhance workflow efficiency by making CBCT systems a cornerstone of modern dental practices.

MARKET RESTRAINTS

High Costs of CBCT Systems

One of the primary restraints hindering the adoption of CBCT systems is their high cost, which limits accessibility for smaller dental practices. A fully equipped CBCT machine can cost between USD 80,000 and USD 150,000 is making it unaffordable for many clinics, especially those in rural areas. According to the National Rural Health Association, rural communities face significant disparities in access to advanced dental technologies, exacerbating existing healthcare inequities. Even insured patients encounter challenges, as some insurance providers do not cover CBCT imaging or impose strict eligibility criteria. According to a report by the Kaiser Family Foundation, only 45% of dental procedures involving advanced imaging are reimbursed by private insurers. These financial barriers impede widespread adoption, slowing market penetration and limiting the potential benefits of CBCT technology.

Concerns Over Radiation Exposure

Another restraint is the concern over radiation exposure associated with CBCT imaging, despite its relatively lower dosage compared to traditional CT scans. Patients and practitioners alike remain cautious about the long-term effects of repeated imaging, particularly for children and adolescents. According to the American Association of Physicists in Medicine, while CBCT emits less radiation than conventional CT, it still poses risks if used excessively or improperly. Regulatory bodies like the FDA mandate strict guidelines for usage, requiring manufacturers to provide detailed safety information. However, misinterpretation of guidelines or lack of training can lead to misuse, undermining trust in the technology. For instance, a study published in Pediatric Dentistry revealed that improper positioning during CBCT scans increased radiation exposure by up to 30%.

MARKET OPPORTUNITIES

Growing Adoption of Teledentistry

The increasing popularity of teledentistry presents a significant opportunity for the CBCT dental imaging market. With remote consultations becoming mainstream, CBCT systems enable dentists to share high-resolution 3D images with specialists by enhancing collaborative care. According to McKinsey & Company, teledentistry utilization stabilized at levels 38 times higher than pre-pandemic rates, reflecting its growing acceptance. CBCT’s ability to capture detailed anatomical structures makes it ideal for virtual consultations for complex cases like orthodontics and endodontics. For instance, Dentsply Sirona’s Sidexis Cloud platform allows practitioners to securely store and share CBCT images, improving accessibility and reducing travel costs for patients. Data from the American Telemedicine Association indicates that over 75% of patients prefer remote options for routine dental check-ups, further amplifying demand.

Expansion of Dental Tourism

The rise of dental tourism represents another promising avenue for market growth. North America, particularly the U.S., is witnessing an influx of patients traveling from neighboring countries for affordable yet high-quality dental care. According to the Medical Tourism Association, dental tourism is projected to grow at a CAGR of 15% from 2023 to 2030. CBCT imaging plays a crucial role in attracting international patients, as it ensures accurate diagnostics and treatment planning, enhancing the reputation of destination clinics. For example, Mexican dental clinics equipped with CBCT systems have reported a 20% increase in foreign patients seeking implants and orthodontic treatments. Additionally, partnerships between local clinics and global firms facilitate the adoption of advanced technologies by ensuring compliance with international standards.

MARKET CHALLENGES

Limited Reimbursement Coverage

A significant challenge facing the CBCT dental imaging market is the limited reimbursement coverage provided by insurance companies. Many insurers classify CBCT imaging as an elective procedure, excluding it from standard dental benefits. According to the National Association of Dental Plans, only 20% of dental insurance policies cover advanced imaging technologies is leaving patients to bear the full cost. This financial burden disproportionately affects low-income populations, who may forego necessary diagnostics due to affordability concerns. For instance, a study by the Journal of Dental Hygiene found that uninsured patients are 40% less likely to undergo CBCT scans compared to their insured counterparts. The lack of universal coverage undermines efforts to promote preventive care, as early detection of conditions like oral cancer or impacted teeth relies heavily on advanced imaging. Addressing these gaps requires policy reforms and increased advocacy to ensure equitable access to CBCT technology.

Stringent Regulatory Standards

Another pressing challenge is the stringent regulatory standards governing medical imaging devices, which delay product launches and increase development costs. In the U.S., the Food and Drug Administration (FDA) mandates rigorous clinical trials and safety evaluations before approving new CBCT systems. According to Deloitte Insights, it takes an average of five years and over USD 94 million to bring a Class II medical device to market. This lengthy and costly process often discourages smaller companies from entering the market, thereby limiting innovation. Moreover, post-market surveillance requirements add to the complexity, as manufacturers must continuously demonstrate device efficacy and safety. For instance, Planmeca faced delays in launching its ProMax 3D system due to additional testing requests from regulators. Such regulatory hurdles create uncertainty and stifle market growth is impacting the pace of technological advancements and adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.83% |

|

Segments Covered |

By Type of Detector, Application, End-User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Dentsply Sirona, Koninklijke Philips N.V., ., Hefei Meyer Optoelectronic Technology INC, Xoran Technologies LLC, Vatech Co., Ltd, Envista Holdings, Planmeca OY, J. Morita Mfg. Corp., Cefla S.CActeon Group, Hitachi Ltd., Genoray Co Ltd, Asahi RoEntgen Ind. Co. Ltd, and others |

SEGMENT ANALYSIS

By Type of Detector Insights

The flat panel detectors segment was the largest and held 60.1% of the North American CBCT dental imaging market share in 2024. The growth of the segment is attributed with the ability to deliver superior image quality with reduced radiation exposure by making them the preferred choice for dental practitioners. The aging population plays a pivotal role in driving this segment’s dominance, with the U.S. Census Bureau projecting that seniors will account for 21% of the population by 2030. Additionally, hospitals and clinics prefer flat panel detectors due to their compatibility with electronic health records (EHRs). According to HIMSS Analytics, over 90% of U.S. hospitals now use EHR systems is facilitating seamless integration of imaging data. Another contributing factor is the growing emphasis on preventive care, encouraged by insurance providers offering incentives for early diagnosis.

By Application Insights

The endodontic applications segment is anticipated to pose a fastest CAGR of 8.5% from 2025 to 2033. This surge is fueled by the increasing prevalence of root canal treatments and the need for precise imaging to diagnose complex cases. CBCT systems excel in capturing detailed anatomical structures by surpassing traditional 2D radiographs in functionality. According to a report by Frost & Sullivan, CBCT imaging reduces diagnostic errors by 30% by appealing to endodontists aiming to optimize treatment outcomes. Technological advancements, such as AI-driven analytics, further enhance diagnostic accuracy is making CBCT a preferred choice for clinicians. Moreover, favorable reimbursement policies, including expanded coverage for endodontic procedures, incentivize adoption.

By End-User Insights

The hospitals and dental clinics segment was accounted in capturing a dominant share of the North American CBCT dental imaging market in 2024. The growth of the segment is driven with the widespread presence and role as primary providers of advanced dental care services. According to the American Hospital Association, there are over 6,000 hospitals in the U.S., many of which house specialized dental departments equipped with CBCT systems. These institutions prioritize precision in diagnostics is making CBCT imaging indispensable for procedures such as dental implants and orthodontics. The rise in dental tourism has further amplified demand, with clinics investing in state-of-the-art CBCT systems to attract international patients. For instance, Canadian dental clinics have reported a 25% increase in foreign patients seeking CBCT-guided treatments, according to the Canadian Dental Association. Additionally, partnerships between hospitals and device manufacturers have strengthened this segment’s position is ensuring widespread availability of cutting-edge technologies.

The academic and research institutes segment is likely to gain huge traction with a CAGR of 9.3% from 2025 to 2033. This growth is driven by the increasing emphasis on research and innovation in dental imaging technologies. CBCT systems are widely used in academic settings for training dental students and conducting clinical studies on oral health conditions. A study published in the Journal of Dental Education revealed that 85% of dental schools in North America now incorporate CBCT imaging into their curricula. Furthermore, government funding for dental research has bolstered adoption.

REGIONAL ANALYSIS

The United States was the top performer in the North American CBCT dental imaging market by accounting for 80% of share in 2024. The growth of the segment is attributed due to its robust healthcare infrastructure, high prevalence of oral health issues, and strong adoption of advanced medical technologies. According to the Centers for Disease Control and Prevention (CDC), nearly half of all Americans aged 30 and above suffer from periodontal disease is driving demand for precise diagnostic tools like CBCT. The country’s emphasis on preventive care, supported by favorable insurance policies, further accelerates adoption. For example, private insurers like Delta Dental cover CBCT imaging for specific procedures by reducing barriers to access. Additionally, the U.S. government’s investment in digital health initiatives, such as the FDA’s Digital Health Innovation Action Plan.

Canada CBCT dental imaging market is likely to exhibit a CAGR of 11.2% in the next coming years. The country’s universal healthcare system, funded through the Canada Health Act that ensures equitable access to advanced diagnostic tools, including CBCT systems. According to Statistics Canada, oral health issues affect nearly 60% of adults is escalating the critical need for effective imaging solutions. The Canadian government’s focus on teledentistry expansion, particularly post-pandemic, has bolstered remote monitoring adoption. For instance, Ontario’s Digital First for Health strategy aims to integrate digital tools into routine care by benefiting patients requiring CBCT imaging. Furthermore, collaborations between local manufacturers and international firms have enhanced product accessibility.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Dentsply Sirona, Koninklijke Philips N.V., ., Hefei Meyer Optoelectronic Technology INC, Xoran Technologies LLC, Vatech Co., Ltd, Envista Holdings, Planmeca OY, J. Morita Mfg. Corp., Cefla S.CActeon Group, Hitachi Ltd., Genoray Co Ltd, Asahi RoEntgen Ind. Co. Ltd. are playing dominating role in North America CBCT dental imaging market

The North American CBCT dental imaging market is characterized by intense competition, driven by technological advancements and growing demand for innovative solutions. Key players like Carestream Dental, Planmeca, and Dentsply Sirona dominate the market, leveraging their extensive R&D capabilities and global presence. Smaller firms, however, are gaining traction by focusing on niche segments and cost-effective solutions. The competitive landscape is further shaped by collaborations with tech companies, enabling the integration of AI and cloud technologies. Regulatory compliance and quality standards remain critical differentiators, with companies striving to meet stringent requirements.

TOP PLAYERS IN THIS MARKET

Carestream Dental LLC

Carestream Dental stands as a global leader in the CBCT dental imaging market, renowned for its innovative product portfolio and commitment to advancing dental diagnostics. The company offers cutting-edge solutions like the CS 9600 CBCT system, which combines exceptional image quality with AI-driven analytics. Carestream Dental’s strengths lie in its extensive R&D capabilities and strategic collaborations with dental professionals that is enabling it to address unmet clinical needs effectively. Its robust distribution network ensures widespread availability, while its focus on training practitioners enhances user adoption. Carestream Dental’s dominance is further reinforced by its proactive approach to integrating cloud-based platforms is positioning it at the forefront of the industry.

Planmeca Oy

Planmeca Oy is another dominant player, leveraging its expertise in dental imaging technologies to drive market innovation. The company’s ProMax 3D family of CBCT systems exemplifies its commitment to precision and versatility, offering customizable imaging options tailored to diverse clinical needs. Planmeca’s strengths include its diversified product portfolio, spanning imaging systems and CAD/CAM solutions are catering to varied practitioner requirements. Its emphasis on sustainability and ethical practices further enhances its reputation.

Dentsply Sirona Inc.

Dentsply Sirona Inc. is a key contributor to the market, distinguished by its focus on patient-centric design and seamless integration of imaging technologies. The company’s offerings, such as the Orthophos SL series, enable efficient diagnostics and treatment planning, setting new standards for accuracy and usability. Dentsply Sirona’s strengths lie in its collaborative approach, working closely with clinicians to develop tailored solutions.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Leading companies in the North American CBCT dental imaging market employ diverse strategies to strengthen their positions and drive growth. Strategic partnerships and collaborations are a cornerstone, enabling firms to leverage complementary expertise and expand their reach. For instance, Carestream Dental partnered with Google Cloud to enhance data storage and sharing capabilities for its CBCT systems, improving accessibility and workflow efficiency. Another prominent strategy is mergers and acquisitions, allowing companies to consolidate resources and enter new markets. Planmeca’s acquisition of a leading AI software developer exemplifies this approach, broadening its technological capabilities. Additionally, firms prioritize R&D investments to innovate and stay ahead of competitors.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Carestream Dental launched its AI-powered CS 9600 CBCT system, featuring enhanced image clarity and reduced radiation exposure that is elevating the importance of precision diagnostics.

- In June 2023, Planmeca introduced the ProMax 3D Classic, a compact CBCT system designed for small clinics, expanding its reach in underserved markets.

- In February 2023, Dentsply Sirona acquired a leading teledentistry platform, integrating remote consultation capabilities with its CBCT systems to improve accessibility.

- In October 2022, Carestream Dental partnered with Microsoft Azure to enhance cloud-based data storage for its imaging systems is boosting scalability and security.

- In August 2022, Planmeca collaborated with the University of Michigan to develop AI-driven predictive models for early detection of oral diseases, setting a new benchmark for innovation.

MARKET SEGMENTATION

This research report on the North American CBCT Dental Imaging market is segmented and sub-segmented into the following categories.

By Type of Detector

- Flat Panel Detectors

- Image Intensifier

By Application

- Dental Implants

- Endodontic

- Orthodontics

- Others

By End-User

- Hospitals & Dental Clinics

- Academic & Research Institutes

- Others

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the CAGR of the European CBCT dental imaging market?

The European market is expected to grow at a compound annual growth rate (CAGR) of 7.83% from 2025 to 2033.

2. What factors are driving growth in the CBCT dental imaging market?

Key drivers include advancements in imaging technology, increasing prevalence of oral health issues, and rising adoption of CBCT systems for accurate diagnosis and treatment planning.

3. What are the emerging trends in CBCT dental imaging market ?

Trends include integration with CAD/CAM technology, reduced radiation doses, applications in orthodontics and endodontics, and advancements in image reconstruction software.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]