North America Caustic Potash Market Research Report – Segmented By Form ( Solid Caustic Potash, Liquid Caustic Potash ) Grade( Industrial-Grade Caustic Potash , Pharma-Grade Caustic Potash ) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

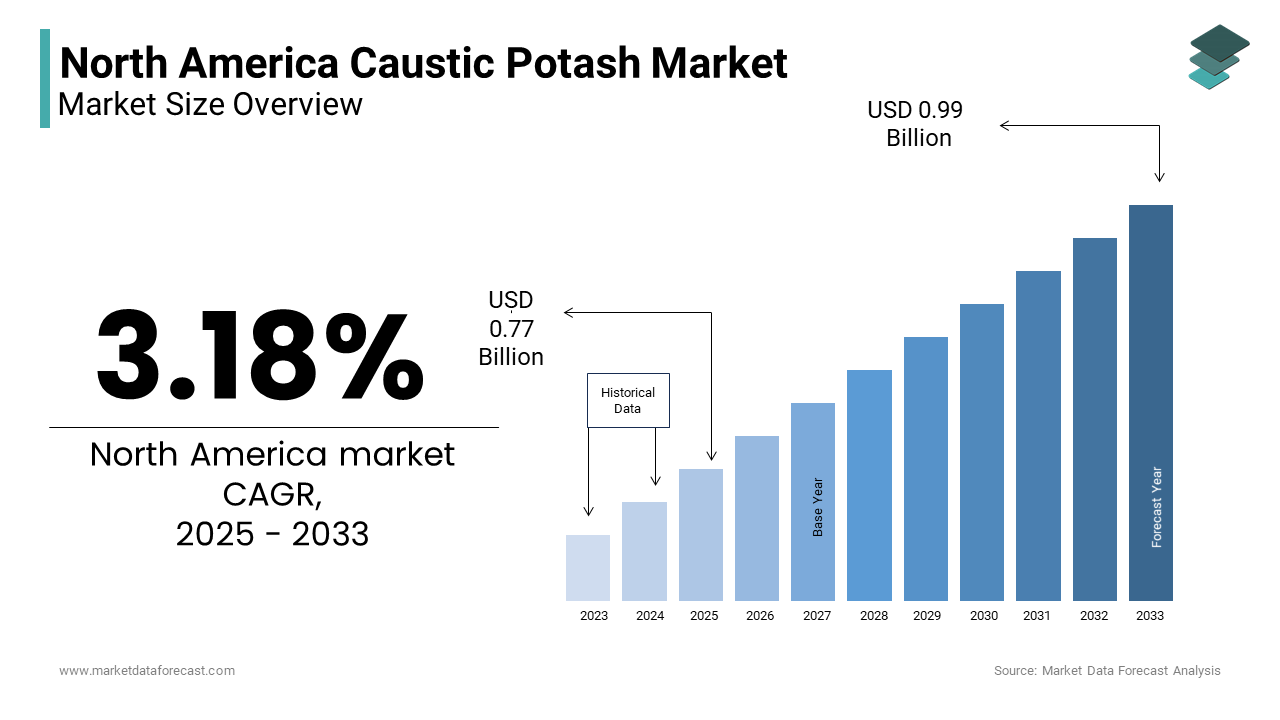

North America Caustic Potash Market Size

The North America Caustic Potash Market Size was valued at USD 0.75 billion in 2024. The North America Caustic Potash Market size is expected to have 3.18 % CAGR from 2025 to 2033 and be worth USD 0.99 billion by 2033 from USD 0.77 billion in 2025.

The North America caustic potash market is a significant contributor to the global chemical industry, with its robust demand driven by industrial and agricultural applications. The region accounts for a significant portion of the global caustic potash market. Moreover, the United States leads the regional market. This dominance is attributed to the country's well-established chemical manufacturing sector and high consumption rates in industries such as detergents, fertilizers, and pharmaceuticals. Canada follows closely by leveraging its abundant natural resources and favorable regulatory environment for chemical production.

The market conditions are shaped by steady growth in end-use sectors, particularly agriculture, where caustic potash serves as a key ingredient in potassium-based fertilizers. Also, the consumption of potash in the U.S. agricultural sector grew notably in 2022 compared to the previous year. Additionally, the rise in demand for potassium soaps and detergents has further bolstered the market. However, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations, which have slightly tempered growth.

MARKET DRIVERS

Rising Demand in the Fertilizer Industry

The fertilizer industry stands as a primary driver for the caustic potash market in North America. Potash, a critical component of potassium-based fertilizers, plays an indispensable role in enhancing crop yields and soil fertility. According to the International Fertilizer Association, the global demand for potash exceeded 70 million metric tons in 2022, with North America accounting for a key portion of this consumption. This demand is fueled by the increasing need for sustainable farming practices to meet the food requirements of a growing population.

Moreover, government initiatives promoting the use of balanced fertilizers have further propelled the market. For instance, the U.S. Department of Agriculture’s Conservation Stewardship Program incentivizes farmers to adopt nutrient management practices that include potassium-rich fertilizers. These factors collectively ensure a consistent demand for caustic potash, driving its market growth.

Expanding Usage in Industrial Applications

The industrial applications of caustic potash, particularly in the production of potassium soaps, detergents, and specialty chemicals, significantly contribute to market expansion. Caustic potash is preferred in liquid soaps and detergents due to its superior solubility and cleaning properties.

Furthermore, the pharmaceutical industry’s reliance on caustic potash for synthesizing active pharmaceutical ingredients (APIs) adds to its demand. These applications, coupled with advancements in industrial technologies, create a strong pull factor for the market, ensuring sustained growth.

MARKET RESTRAINTS

Volatility in Raw Material Prices

Among the most pressing challenges for the caustic potash market is the volatility in raw material prices, particularly potassium chloride. Like, the price of potassium chloride surged considerablyin 2022 due to geopolitical tensions and supply chain disruptions. Such fluctuations directly impact the cost of producing caustic potash, leading to increased operational expenses for manufacturers.

This price instability creates uncertainty in the market, affecting profit margins and investment decisions. Smaller players, in particular, struggle to absorb these costs, often resulting in reduced production capacities. Additionally, end-users, especially small-scale farmers and detergent manufacturers, face higher input costs, which can dampen overall demand. While larger companies may mitigate these risks through long-term supplier contracts, smaller enterprises remain vulnerable to these economic pressures.

Stringent Environmental Regulations

Environmental regulations pose another significant restraint for the caustic potash market in North America. The production process involves energy-intensive methods, contributing to greenhouse gas emissions and water pollution. Similarly, the chemical manufacturing sector contributed a key share to the industrial emissions in the U.S. in the recent years.

To comply with regulations such as the Clean Air Act and the Resource Conservation and Recovery Act, manufacturers must invest in advanced technologies and waste management systems. These compliance costs can be substantial, especially for small and medium-sized enterprises. Furthermore, public scrutiny and environmental activism have pushed governments to enforce stricter norms, creating additional barriers.

MARKET OPPORTUNITIES

Growth in Bio-Based Products

The rising demand for bio-based products presents a lucrative opportunity for the caustic potash market in North America. Consumers are increasingly shifting toward eco-friendly alternatives, including biodegradable soaps, detergents, and fertilizers. Also, caustic potash is a key ingredient in formulating bio-based cleaning agents and personal care products due to its non-toxic and biodegradable nature.

In North America, the trend toward sustainability is supported by government policies such as the U.S. BioPreferred Program, which promotes the use of renewable chemicals. This initiative has encouraged manufacturers to incorporate caustic potash into their formulations, creating new revenue streams. Besides, the growing popularity of organic farming has spurred the demand for bio-based potassium fertilizers, further expanding the market's scope.

Technological Advancements in Production

Technological advancements in production processes offer another promising opportunity for the caustic potash market. Innovations such as membrane cell technology and energy-efficient electrolysis have significantly improved production efficiency while reducing environmental impacts. These advancements enable manufacturers to produce high-purity caustic potash at lower costs are making it more competitive in price-sensitive markets. Furthermore, automation and digitalization in manufacturing facilities enhance productivity and reduce human error is ensuring consistent quality. Companies investing in R&D and adopting cutting-edge technologies can gain a competitive edge by meeting the evolving needs of end-users. For instance, the pharmaceutical sector demands ultra-high-purity grades, which can only be achieved through advanced production techniques.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the caustic potash market in North America. The pandemic-induced logistical bottlenecks, coupled with geopolitical tensions, have severely impacted the availability of raw materials. Like, The chemical industry did experience disruptions, particularly in late 2022 which is leading to production slowdowns and inventory shortages.

These disruptions not only affect the timely delivery of products but also inflate transportation and storage costs. For instance, the reliance on imported potassium chloride from regions like Russia and Belarus has been hampered by trade restrictions, forcing manufacturers to seek alternative suppliers at higher prices. Besides, port congestions and labor shortages exacerbate the problem, creating a ripple effect across the value chain. Companies must invest in diversifying their supplier base and developing resilient logistics networks to mitigate these risks.

Intense Market Competition

The North America caustic potash market faces intense competition from both domestic and international players, posing a significant challenge. This competition drives down prices, eroding profit margins and making it difficult for smaller companies to sustain themselves.

Moreover, established players often engage in aggressive pricing strategies and mergers to consolidate their positions. For example, large multinational corporations leverage economies of scale to offer competitive pricing, leaving smaller firms at a disadvantage. Additionally, the influx of low-cost imports from countries like China and India intensifies the pressure on local manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.18 % |

|

Segments Covered |

By Form,Grade and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Occidental Chemical Corporation (OxyChem),FMC Corporation,Tessenderlo Group,The Mosaic Company |

SEGMENTAL ANALYSIS

By Form Insights

The segment of solid caustic potash spearheaded the North America market by possessing a market share of approximately 65.4%. This dominance is primarily driven by its widespread use in the fertilizer industry, where solid forms are preferred for their ease of handling and storage. Solid caustic potash is integral to the production of potassium-based fertilizers, which are essential for improving crop yields and soil health.

The agricultural sector's reliance on solid caustic potash is further supported by government initiatives promoting sustainable farming practices. For instance, the U.S. Department of Agriculture’s Environmental Quality Incentives Program encourages the use of potassium-rich fertilizers, boosting demand. Additionally, the industrial sector's preference for solid forms in soap and detergent manufacturing contributes to its market leadership. The stability and longer shelf life of solid caustic potash make it a reliable choice for end-users, ensuring its continued dominance in the market.

The liquid caustic potash segment is the fastest-growing, with a projected CAGR of 6.2% from 2025 to 2033. This growth is fueled by its increasing adoption in specialized applications such as pharmaceuticals and water treatment. Liquid forms offer superior solubility and ease of integration into formulations, making them ideal for high-purity applications.

The pharmaceutical industry, in particular, is a major driver of this growth. Apart from these, the rising emphasis on water treatment solutions has expanded its use in municipal and industrial applications. Investments in R&D and technological advancements further support the segment's rapid expansion, positioning it as a key growth area in the market.

By Grade Insights

The industrial-grade caustic potash segment held the largest market share by accounting for 55.9% of the North America market. This segment's growth is propelled by its extensive use in the production of potassium soaps, detergents, and specialty chemicals. The surging demand for cleaning agents and personal care products has significantly boosted the consumption of industrial-grade caustic potash.

Government initiatives promoting hygiene and sanitation, particularly post-pandemic, have further accelerated this demand. For instance, the U.S. Environmental Protection Agency’s Safer Choice Program encourages the use of eco-friendly cleaning products, many of which rely on industrial-grade caustic potash. Additionally, the segment benefits from its cost-effectiveness and versatility, making it a preferred choice for large-scale industrial applications.

Pharma-grade caustic potash is the fastest-growing segment, with a projected CAGR of 7.5% in the coming years. This development is fueled by the pharmaceutical industry's increasing demand for high-purity chemicals used in drug synthesis. The U.S. pharmaceutical sector relies heavily on pharma-grade caustic potash for producing APIs and other critical components.

Advancements in drug development and the rising prevalence of chronic diseases have further amplified this demand. Additionally, stringent regulatory standards necessitate the use of ultra-high-purity materials, driving the adoption of pharma-grade caustic potash. Investments in R&D and technological innovations in production processes also support this segment's rapid expansion, positioning it as a key growth driver in the market.

COUNTRY LEVEL ANALYSIS

The United States became the largest and most influential player in the North America caustic potash market by commanding 70% of the regional market share in 2024. The country's dominance is influenced by its advanced chemical manufacturing infrastructure, robust agricultural sector, and high industrial demand. Like, the nation consumed a substantial metric tons of potash in recent years, primarily for fertilizer production. The U.S. Department of Agriculture’s Conservation Stewardship Program (CSP) has further accelerated demand by incentivizing farmers to adopt nutrient management practices that include potassium-based fertilizers. Additionally, the growing popularity of eco-friendly detergents and cleaning products has expanded the use of caustic potash in household applications. The U.S. also benefits from its technological prowess, enabling efficient production processes and innovative product formulations, ensuring its continued leadership in the market.

Canada is trailing in the North America caustic potash market by leveraging its vast natural resources and favorable regulatory environment. The country holds some of the world’s largest potash reserves giving it a competitive edge in cost-effective production. Also, Canada’s agricultural sector is a key driver of demand, with government initiatives like the Agricultural Climate Solutions program promoting sustainable farming practices. These programs encourage the use of potassium-rich fertilizers, thereby boosting consumption. Furthermore, Canada’s strategic geographic location facilitates seamless exports to the U.S. and other global markets, enhancing its market presence. The country’s commitment to environmental sustainability and innovation in production technologies further supports its growth trajectory.

Mexico is an emerging player in the North America caustic potash market, driven by its expanding agricultural and industrial sectors. Government programs promoting rural development and precision agriculture have further increased demand for potassium-based fertilizers. Mexico’s proximity to the U.S., one of the largest markets for caustic potash, provides a significant advantage for exports. Investments in infrastructure and manufacturing capabilities are expected to bolster the country’s growth potential in the coming years.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Caustic Potash Market are Occidental Chemical Corporation (OxyChem),FMC Corporation,Tessenderlo Group,The Mosaic Company,Armand Products Company,Cogent Chemical Inc.,Intercontinental Chemical Corporation (ICC), Tessenderlo Kerley International (TKI),Solvay SA,Evonik Industries AG

The North America caustic potash market is characterized by intense competition, with a mix of multinational corporations and regional players vying for market share. The market is moderately consolidated, with Nutrien Ltd., The Mosaic Company, and Compass Minerals International collectively holding considerable portion of the market share. These companies leverage their extensive distribution networks, technological expertise, and economies of scale to dominate the landscape.

Smaller players, however, face challenges such as limited resources and price pressures. To compete, they often focus on niche markets and product differentiation. The entry of low-cost imports from Asia further intensifies competition, compelling companies to adopt innovative strategies and form strategic alliances to sustain growth. Despite these challenges, the market remains dynamic, with opportunities for growth driven by emerging applications and technological advancements.

Top Players in the Market

Nutrien Ltd.

Nutrien Ltd., headquartered in Saskatchewan, Canada, is the largest producer of caustic potash globally. The company operates some of the world’s largest potash mines and leverages its extensive distribution network to cater to both domestic and international markets. Nutrien’s focus on sustainability and innovation has enabled it to develop premium-grade caustic potash tailored to diverse end-use applications, including fertilizers, detergents, and pharmaceuticals.

The Mosaic Company

The Mosaic Company, based in Minnesota, U.S., is a leading player in the industrial-grade caustic potash segment. The company specializes in producing high-quality potassium-based fertilizers and specialty chemicals, serving major agricultural and detergent industries. Mosaic’s strategic investments in advanced production technologies and eco-friendly formulations have strengthened its market position.

Compass Minerals International

Compass Minerals International focuses on niche markets such as pharmaceuticals and water treatment, offering ultra-high-purity caustic potash. The company’s expertise in developing customized solutions for specific applications has enabled it to carve out a unique position in the market. Compass Minerals’ commitment to R&D and sustainability further enhances its competitive edge.

Top Strategies Used by Key Players

Mergers and Acquisitions

Companies like Nutrien Ltd. have actively pursued acquisitions to expand their global footprint. For instance, Nutrien acquired a stake in a Brazilian fertilizer distributor to strengthen its presence in Latin America, ensuring access to new markets and customer bases.

Capacity Expansions

The Mosaic Company invested heavily in upgrading its Florida facilities to enhance production efficiency and reduce environmental impacts. Such expansions enable companies to meet rising demand while adhering to sustainability goals.

R&D Investments

Compass Minerals International focuses on developing innovative formulations tailored to niche applications, such as high-purity caustic potash for pharmaceuticals. This strategy allows the company to differentiate itself in a crowded market.

Strategic Partnerships

Collaborations with research institutions and industry players have enabled companies to co-develop cutting-edge technologies and improve product quality.

Sustainability Initiatives

All three top players emphasize sustainability by adopting eco-friendly production methods and promoting the use of bio-based products. These efforts align with consumer preferences and regulatory requirements, enhancing brand reputation.

RECENT HAPPENINGS IN THE MARKET

- In March 2023 , Nutrien Ltd. expanded its production capacity in Saskatchewan, Canada, to meet rising global demand for potash. This move ensures the company can cater to increasing agricultural needs worldwide.

- In June 2023 , The Mosaic Company launched a new line of eco-friendly potassium fertilizers designed to align with sustainability goals. This initiative targets environmentally conscious consumers and regulatory compliance.

- In August 2023 , Compass Minerals International partnered with a U.S.-based pharmaceutical firm to develop high-purity caustic potash for drug synthesis. This collaboration strengthens its position in the pharmaceutical sector.

- In October 2023 , Nutrien Ltd. signed a long-term supply agreement with a Brazilian agribusiness to secure its market presence in Latin America. This deal ensures consistent revenue streams and expands its customer base.

- In December 2023 , The Mosaic Company invested $500 million in upgrading its Florida facilities to enhance production efficiency and reduce emissions. This investment underscores its commitment to sustainability and operational excellence.

MARKET SEGMENTATION

This research report on the north america caustic potash market has been segmented and sub-segmented into the following.

By Form

- Solid Caustic Potash

- Liquid Caustic Potash

By Grade

- Industrial-Grade Caustic Potash

- Pharma-Grade Caustic Potash

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What factors are driving the growth of the caustic potash market in North America?

Key growth drivers include rising demand in the agricultural sector, increased usage in chemical and pharmaceutical industries, and the shift toward environmentally friendly cleaning products.

Which countries in North America contribute most to the caustic potash market?

The United States holds the largest share, followed by Canada and Mexico, due to their advanced industrial sectors and agricultural demand.

What are the recent trends in the North American caustic potash market?

Recent trends are Growing use in battery electrolytes (especially for electric vehicles), Increasing demand for organic and sustainable fertilizers,Technological advancements in production methods

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]