North America Car Care Products Market Research Report – Segmented By Product Type ( (Cleaning & Washing, Polishing & Waxing, Sealing Glaze & Coating) ), Application, Solvent and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Car Care Products Market Size

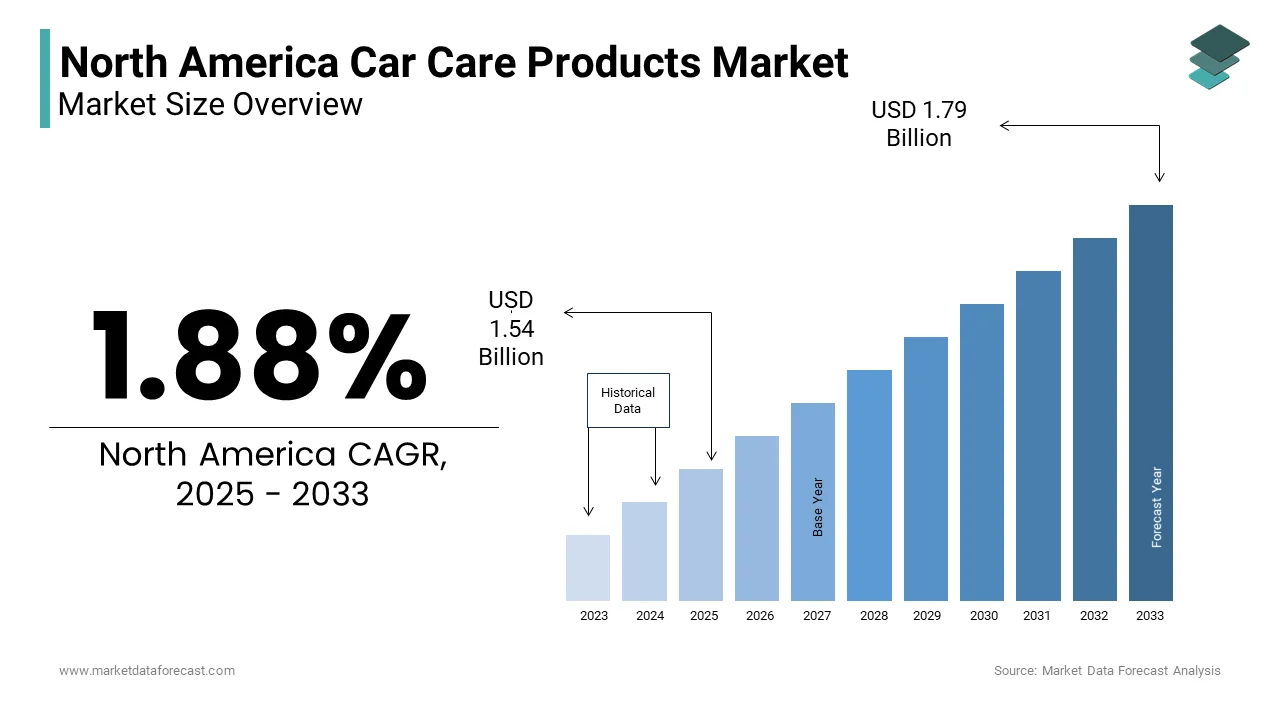

The North America Car Care Products Market Size was valued at USD 1.51 billion in 2024. The North America Car Care Products Market size is expected to have 1.88 % CAGR from 2025 to 2033 and be worth USD 1.79 billion by 2033 from USD 1.54 billion in 2025.

The North America car care products market is a thriving segment, driven by a robust automotive culture and a growing emphasis on vehicle aesthetics and maintenance. According to the U.S. Department of Transportation, there were over 284 million registered vehicles in the United States alone in 2022, underscoring the vast consumer base for car care solutions. As per data from the Bureau of Economic Analysis, personal consumption expenditures on vehicles and related services grew by 6% annually between 2020 and 2022, which is prompting the demand for premium car care products. Furthermore, the proliferation of DIY (do-it-yourself) car maintenance trends has fueled retail sales of these products among younger demographics.

MARKET DRIVERS

Growing Automotive Aesthetics Culture

The increasing focus on maintaining vehicle aesthetics serves as a primary driver for the North America car care products market. Consumers view their vehicles as extensions of personal identity, prompting investment in high-quality cleaning and polishing solutions. According to the Specialty Equipment Market Association (SEMA), the automotive appearance products segment accounted for $4.5 billion in revenue in 2022, reflecting strong consumer interest. Premiumization trends further amplify demand, with luxury car owners seeking specialized products such as ceramic coatings and paint sealants. Moreover, social media platforms like Instagram and YouTube have amplified the visibility of car detailing by inspiring enthusiasts to adopt professional-grade techniques at home. A study by GlobalWebIndex reveals that over 40% of Gen Z and millennial car owners engage with online content related to vehicle customization and care.

Rising Adoption of Electric Vehicles (EVs)

The rapid adoption of electric vehicles (EVs) represents another key driver for the car care products market. EVs require unique maintenance practices due to their advanced materials and finishes, creating niche demand for specialized cleaning agents and coatings. According to the International Energy Agency (IEA), EV sales in North America surged by 65% in 2022, with projections indicating continued growth. Manufacturers are capitalizing on this trend by developing non-abrasive formulas designed to protect sensitive surfaces without compromising performance. Additionally, partnerships with EV manufacturers to include car care kits as part of after-sales services have strengthened brand loyalty.

MARKET RESTRAINTS

Stringent Environmental Regulations

Stringent environmental regulations targeting harmful chemicals in car care products pose a significant restraint to the market. Volatile organic compounds (VOCs) commonly found in traditional cleaners and polishes contribute to air pollution, prompting regulatory agencies like the EPA to enforce stricter limits. As per the National Institute of Environmental Health Sciences, exposure to VOCs can lead to respiratory issues and long-term health risks, intensifying scrutiny on product formulations. Compliance with these regulations requires substantial investments in research and development, often increasing production costs. Smaller manufacturers face challenges in adapting to these standards by limiting their competitiveness. Furthermore, consumer skepticism toward "green" alternatives, perceived as less effective than conventional options, complicates efforts to transition to sustainable solutions.

Economic Uncertainty and Inflationary Pressures

Economic uncertainty and inflationary pressures represent another major restraint impacting the car care products market. Rising raw material costs, coupled with supply chain disruptions, have led to increased prices for essential components such as surfactants and solvents. Data from the U.S. Bureau of Labor Statistics indicates that the producer price index for chemical products rose by 12% in 2022, which is affecting manufacturing expenses. These cost escalations are often passed onto consumers by reducing affordability and dampening demand. Additionally, economic volatility influences discretionary spending, with households prioritizing necessities over luxury purchases like premium car care items.

MARKET OPPORTUNITIES

Expansion into E-Commerce Platforms

The rise of e-commerce presents a transformative opportunity for the North America car care products market. Online retail channels offer unparalleled accessibility and convenience, enabling manufacturers to reach a broader audience beyond traditional brick-and-mortar stores. Companies leveraging subscription models and personalized recommendations further enhance customer engagement. For instance, Amazon’s Subscribe & Save program allows users to automate replenishment of frequently used products, fostering brand loyalty. Additionally, virtual tutorials and influencer collaborations on platforms like YouTube and TikTok educate consumers about product usage, boosting sales.

Development of Smart Car Care Solutions

Advancements in smart technology create exciting opportunities for innovation within the car care products market. The integration of IoT-enabled devices and mobile applications allows users to monitor vehicle conditions and optimize maintenance schedules. Products equipped with sensors or QR codes provide real-time feedback on application effectiveness by enhancing user experience. For example, smart wax applicators track surface coverage and recommend optimal usage patterns. Such innovations not only differentiate brands but also appeal to tech-savvy consumers seeking convenience and precision.

MARKET CHALLENGES

Limited Awareness About Eco-Friendly Alternatives

One of the foremost challenges facing the North America car care products market is limited consumer awareness regarding eco-friendly alternatives. Despite growing environmental consciousness, many buyers remain uninformed about the availability and benefits of green car care solutions. This lack of awareness undermines efforts by manufacturers to promote biodegradable and non-toxic formulations. Misconceptions about reduced efficacy compared to conventional products further exacerbate the issue. Bridging this knowledge gap requires extensive marketing campaigns and educational initiatives, which can strain resources for smaller players. Until perceptions shift, widespread adoption of eco-friendly options will remain constrained.

Intense Competition Among Key Players

Another pressing challenge is the intense competition among established players vying for market dominance. Industry giants like 3M and Meguiar’s dominate the landscape by leveraging economies of scale and extensive distribution networks. These companies collectively control the market share by leaving limited room for emerging competitors. Smaller firms struggle to differentiate themselves amidst aggressive pricing strategies and aggressive promotional tactics employed by larger entities. Mergers and acquisitions further consolidate power, making it difficult for new entrants to gain traction.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

1.88 % |

|

Segments Covered |

By Product Type, Application, Solvent and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

3M Co, Sonax, Tetrosyl Limited, Chemical Guys, Wurth Group, MA-FRA, Cartec, Turtle Wax |

SEGMENTAL ANALYSIS

By Product Type Insights

The cleaning and washing segment dominated the North America car care products market by accounting for 45.6% of the total share in 2024 owing to the widespread adoption of vehicle cleaning solutions among consumers who prioritize maintaining their vehicles' appearance. According to the U.S. Department of Transportation, there are over 284 million registered vehicles in the United States alone, creating a vast consumer base for cleaning and washing products. A key factor propelling this segment's dominance is the growing trend of DIY car maintenance. Additionally, the proliferation of automated car wash facilities has further boosted demand for specialized cleaning agents. Furthermore, advancements in formulation technologies have led to the development of eco-friendly cleaning solutions by addressing environmental concerns while enhancing product appeal. These innovations ensure sustained growth and solidify the segment's position as the largest contributor to the market.

The sealing glaze and coating segment is projected to grow at the fastest CAGR of 8.2% throughout the forecast period. This rapid expansion is fueled by increasing consumer awareness about the benefits of protective coatings in preserving vehicle finishes. A pivotal driver is the rising adoption of electric vehicles (EVs), which require specialized coatings to safeguard sensitive surfaces. As per the International Energy Agency (IEA), EV sales in North America surged by 65% in 2022 by amplifying the need for advanced car care solutions. Additionally, partnerships with automotive manufacturers to include protective coatings as part of after-sales services have strengthened brand loyalty. Innovations such as self-healing and hydrophobic coatings also contribute to the segment's growth.

By Application Insights

The exterior application segment was accounted in holding a dominant share of the North America car care products market in 2024 with the consumers' heightened focus on vehicle aesthetics, particularly in maintaining paintwork and surface finishes. The National Highway Traffic Safety Administration estimates that over 70% of vehicle owners prioritize exterior cleaning and protection, which is driving demand for products like waxes, polishes, and coatings. A significant factor contributing to this segment's growth is the influence of social media platforms. Instagram and YouTube have popularized car detailing trends, inspiring enthusiasts to invest in premium exterior care solutions. Moreover, advancements in UV-resistant formulations address concerns about weather-induced damage, further boosting adoption rates.

The interior application segment is anticipated to register the highest CAGR of 7.8% in the next coming years. This growth is driven by increasing consumer attention to vehicle cabin hygiene and comfort. The rise of ride-sharing services and extended commute times has amplified demand for interior cleaning and sanitization products. Over 50% of drivers clean their vehicle interiors less frequently than exteriors by creating opportunities for specialized solutions. Another factor fueling this segment's expansion is the integration of advanced materials in modern vehicles. Leather, synthetic fabrics, and touch-sensitive panels require tailored care products to prevent damage. Additionally, the introduction of antimicrobial sprays and air purifiers for cabins aligns with post-pandemic health-conscious trends.

By Solvent Insights

The water-based solvents segment was the largest by accounting a dominant share of the North America car care products market in 2024 due to their versatility, cost-effectiveness, and compliance with environmental regulations. The Environmental Protection Agency (EPA) mandates restrictions on volatile organic compounds (VOCs), making water-based formulations a preferred choice for manufacturers. A key driver is the growing emphasis on sustainability. Consumers increasingly seek eco-friendly alternatives for cleaning and washing applications. Furthermore, advancements in surfactant technologies have enhanced the performance of these formulations by ensuring superior cleaning efficacy without compromising environmental safety.

The Foam-based solvents segment is gaining huge traction with a CAGR of 9.5% throughout the forecast period. This rapid expansion is driven by their convenience and ease of application in DIY car care scenarios. The rise of compact foam applicators and aerosol-based products has made them accessible to a broader audience. Another factor is the increasing adoption of professional-grade foam solutions in commercial car wash facilities. Additionally, innovations such as color-changing foams provide visual feedback during application by enhancing user experience.

COUNTRY LEVEL ANALYSIS

The United States was the largest contributor for the North America car care products market by occupying 80.1% of the share in 2024. The robust automotive culture and high disposable income levels is majorly escalating the growth of the market. Additionally, the proliferation of ride-sharing services like Uber and Lyft has amplified the need for frequent vehicle cleaning and detailing. A report by McKinsey & Company notes that shared mobility users spend more on car care products compared to private vehicle owners.

Canada led the North America car care products market with an estimated share of 15.4% in 2024. The country's harsh climate conditions necessitate frequent vehicle maintenance are boosting demand for protective coatings and anti-corrosion products. Moreover, the growing popularity of outdoor recreational activities has increased vehicle ownership, particularly SUVs and trucks. These vehicles require specialized care products are prompting the growth of the market to the next level. Canada's commitment to environmental sustainability also fosters demand for eco-friendly formulations is additionally to fuel the growth of the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America car care products market are 3M Co, Sonax, Tetrosyl Limited, Chemical Guys, Wurth Group, MA-FRA, Cartec, Turtle Wax, Inc, Liqui Moly, Autoglym, Mothers, Adam’s Polishes, Griot's Garage, Jopasu

The North America car care products market is characterized by intense competition, with global giants like 3M, Meguiar’s, and Turtle Wax dominating the landscape. These companies leverage their extensive distribution networks, cutting-edge technologies, and strong brand recognition to secure its position. Innovation remains a cornerstone of competitive strategy, with firms investing heavily in developing sustainable and high-performance products. Regulatory pressures have spurred the adoption of biodegradable variants by creating new battlegrounds for differentiation. Smaller players face significant barriers due to economies of scale enjoyed by larger entities, though niche markets offer some opportunities. Collaborations and joint ventures are common tactics to access untapped segments or enhance technological capabilities. For instance, partnerships with municipal authorities and industrial clients facilitate customized solutions tailored to specific needs. Furthermore, pricing strategies play a crucial role, as cost efficiency often determines supplier selection.

Top Players in the Market

3M

3M is a global leader in the car care products market, renowned for its innovative solutions and high-performance formulations. The company offers a diverse portfolio, including cleaning agents, waxes, and protective coatings tailored to both DIY enthusiasts and professional users. In recent years, 3M has prioritized sustainability by launching eco-friendly products that comply with stringent environmental regulations. For instance, in March 2023, the company introduced a line of biodegradable cleaning solutions designed to minimize ecological impact while maintaining efficacy.

Meguiar’s

Meguiar’s is a trusted name in the car care market, known for its premium-quality products catering to automotive enthusiasts. The brand emphasizes innovation, offering advanced solutions such as ceramic coatings and paint sealants. To expand its reach, Meguiar’s partnered with a major automotive retailer in Canada in May 2023 by enhancing distribution across North America. Additionally, the company has invested in digital marketing campaigns targeting younger demographics through platforms like Instagram and YouTube.

Turtle Wax

Turtle Wax specializes in affordable yet effective car care products by making it a household name among budget-conscious consumers. The company focuses on user-friendly solutions, such as spray-on waxes and foam applicators, to simplify vehicle maintenance. In July 2023, Turtle Wax introduced a smart foam applicator system featuring color-changing technology, providing real-time feedback during application. Furthermore, Turtle Wax actively collaborates with automotive dealerships to include its products in after-sales service packages by reinforcing its market position.

Top Strategies Used by Key Players

Key players in the North America car care products market employ strategies such as product innovation, strategic partnerships, and geographic expansion to maintain competitiveness. Companies focus on developing eco-friendly formulations to meet regulatory demands and consumer preferences. Partnerships with local distributors enhance market penetration, particularly in emerging regions like Mexico. Investment in R&D drives advancements in application-specific solutions by ensuring superior performance. Additionally, mergers and acquisitions enable firms to consolidate resources and broaden their service offerings. These strategies collectively strengthen market positions while addressing evolving industry challenges and opportunities.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, 3M launched a line of biodegradable car care products by aligning with environmental regulations and appealing to eco-conscious consumers.

- In May 2023, Meguiar’s partnered with a Canadian automotive retailer to expand its distribution network and enhance market reach across North America.

- In July 2023, Turtle Wax introduced a smart foam applicator system with color-changing technology, which is improving user experience for DIY enthusiasts.

- In September 2023, Chemical Guys acquired a regional distributor in Mexico by strengthening its supply chain capabilities and expanding into Central America.

- In January 2024, Armor All collaborated with an EV manufacturer to develop specialized interior care kits designed for electric vehicles, which is addressing unique maintenance needs.

MARKET SEGMENTATION

This research report on the north america car care products market has been segmented and sub-segmented into the following.

By Product Type

- Cleaning & Washing

- Polishing & Waxing

- Sealing Glaze & Coating

By Application

- Interior

- Exterior

By Solvent

- Water

- Foam-based

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

Which product segments dominate the north america car care products market?

The most prominent segments include are Cleaning and washing products (e.g., car shampoos, glass cleaners) Polishing and waxing products Interior care products Tire and wheel care

Who are the leading players in the North America car care products market?

Top companies include are 3M Company Turtle Wax, Inc. Meguiar’s Inc. Armor All (a division of Energizer Holdings) Mothers Polishes Chemical Guys

Which countries contribute most to the in North America car care products market?

The United States holds the largest market share, followed by Canada and Mexico, driven by higher car ownership rates and consumer spending.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]