North America Biodefense Market Research Report – Segmented By Product (Anthrax, Smallpox, Botulism, Radiation/Nuclear) and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Biodefense Market Size

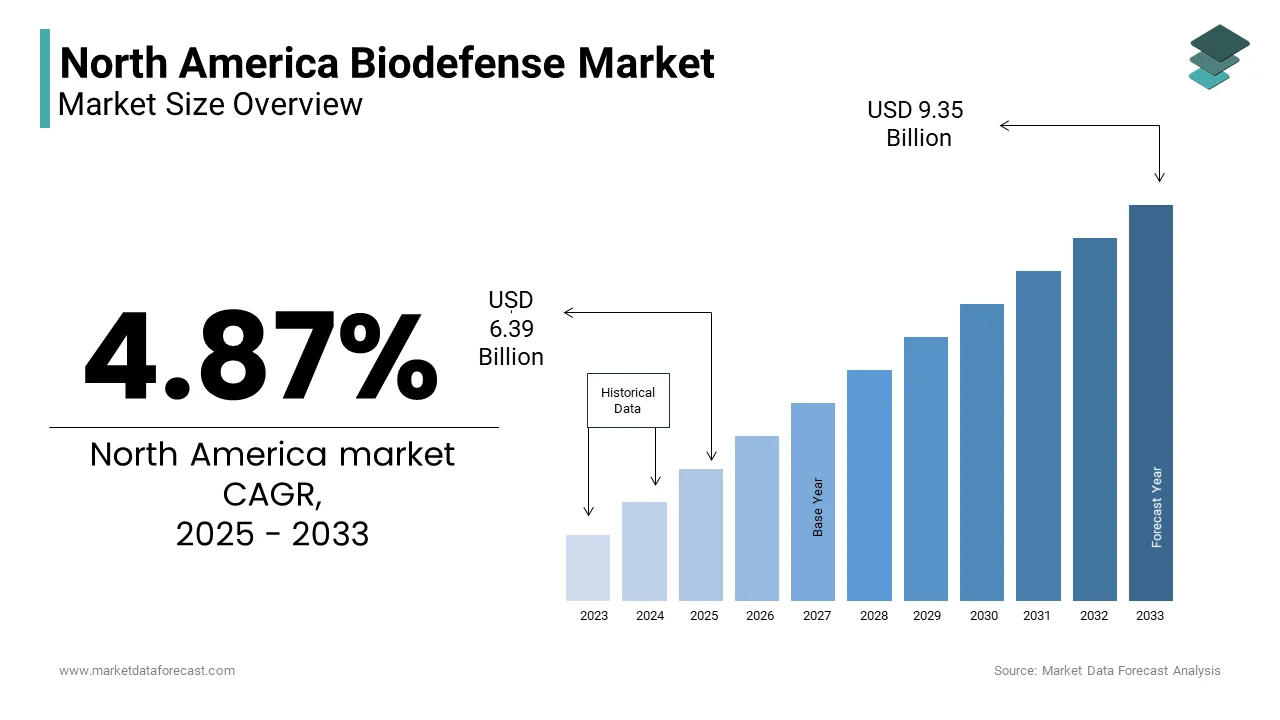

The North America Biodefense Market Size was valued at USD 6.09 billion in 2024. The North America Biodefense Market size is expected to have 4.87% CAGR from 2025 to 2033 and be worth USD 9.35 billion by 2033 from USD 6.39 billion in 2025.

The North America biodefense market growth is driven by the region’s proactive stance on biosecurity threats. Canada follows with a smaller but growing share, supported by initiatives like the Canadian Safety and Security Program (CSSP), which emphasizes biothreat preparedness. Market conditions reflect robust government funding and private sector collaboration, with increasing emphasis on innovation in biotechnology. The rise of synthetic biology and advanced manufacturing technologies has further bolstered the market’s growth trajectory.

MARKET DRIVERS

Rising Threat of Bioterrorism

The escalating threat of bioterrorism serves as a primary driver for the biodefense market. Anthrax remains a significant concern, with the U.S. Centers for Disease Control and Prevention (CDC) estimating that a large-scale bioterror attack could result in economic losses exceeding $1 trillion. Additionally, advancements in diagnostic tools, such as rapid antigen tests, have reduced detection times. These initiatives not only mitigate risks but also drive demand for biodefense solutions across North America.

Pandemic Preparedness Initiatives

Pandemic preparedness initiatives are another key driver, fueled by lessons learned from the COVID-19 pandemic. In2022, the U.S. allocated 10 billion under the American Rescue Plan Act to strengthen pandemic response capabilities, including vaccine development and supply chain resilience. Smallpox, although eradicated, remains a focus due to its potential use in bioterrorism. According to the Centers for Disease control and Prevention (CDC), the U.S. maintains a stockpile of 300 million doses of smallpox vaccine. Furthermore, collaborations between public and private entities, such as Operation Warp Speed, have accelerated the development of countermeasures by fostering innovation and driving market growth.

MARKET RESTRAINTS

High Development Costs

High development costs pose a significant challenge to the biodefense market. According to the Biomedical Advanced Research and Development Authority (BARDA), developing a single vaccine can cost upwards of 1 billion, deterring smaller companies from entering the market. These financial barriers limit innovation and slow the introduction of new countermeasures. Additionally, the low incidence of bioterrorism events reduces the commercial viability of certain products is making it difficult for manufacturers to recover R&D expenses.

Regulatory Hurdles

Stringent regulatory requirements further impede the market growth. The U.S. Food and Drug Administration (FDA) mandates rigorous testing and validation processes for biodefense products, which can extend timelines by 3–5 years, according to the FDA’s Center for Biologics Evaluation and Research (CBER). For example, obtaining approval for a radiation countermeasure involves complex animal efficacy studies due to ethical limitations on human trials. Delays in regulatory clearance not only increase costs but also create uncertainty for manufacturers. Furthermore, discrepancies between U.S. and Canadian regulations complicate cross-border trade is limiting market access for smaller players.

MARKET OPPORTUNITIES

Advancements in Synthetic Biology

Advancements in synthetic biology is a promising opportunity for the biodefense market. Researchers have developed a CRISPR−based diagnostic tool capable of detecting bio threat agents within minutes, which reduces response times significantly in synthetic biology research with its strategic importance. Such type of developments are likely to position synthetic biology as an important tool in the future biodefense strategies.

Expansion of Public-Private Partnerships

Public-private partnerships (PPPs) offer a significant growth avenue by fostering collaboration between governments and market players. According to the Biomedical Advanced Research and Development Authority (BARDA), PPPs have facilitated the development medical counter measures from past many years. For instance, BARDA’s partnership with Emergent BioSolutions led to the production of millions of anthrax vaccine doses is likely to ensure the demand of biodefense in the next coming years. In 2022, Canada launched the Pandemic Preparedness Challenge, allocating $500 million to incentivize private sector participation. These initiatives not only reduce development costs but also enhance innovation, and also create new opportunities for the market expansion in the future period.

MARKET CHALLENGES

Limited Shelf Life of Countermeasures

The limited shelf life of biodefense countermeasures presents a significant challenge. The Strategic National Stockpile (SNS) must replace expired smallpox vaccines annually by costing approximately $200 million. This logistical burden strains budgets and complicates inventory management. Moreover, storage requirements, such as cold chain logistics, add complexity and expense, particularly for rural areas. These challenges hinder the scalability of biodefense solutions which is limiting their availability during emergencies and increasing operational costs.

Ethical Concerns in Testing

Ethical concerns surrounding the testing of biodefense products pose another challenge. The U.S. Food and Drug Administration (FDA) requires rigorous safety and efficacy data, but ethical limitations often restrict human trials for bioterrorism countermeasures. The alternative methods such as animal efficacy studies are less reliable with low success rate. For instance, radiation countermeasures face significant hurdles due to the inability to conduct controlled human exposure studies. These ethical constraints delay product approvals and increase development costs are creating barriers to innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.87 % |

|

Segments Covered |

By Product and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

XOMA corporation, Altimmune Inc. Emergent Biosolutions Inc., Dynavax Technologies Corporation |

SEGMENTAL ANALYSIS

By Product Insights

The Anthrax segment dominated the North America biodefense market with an estimated share of 40.3% in 2024. The growth of the segment is driven with the rising priority in national security agendas due to the lethal nature of anthrax spores as a bioterroris magent. The Strategic National Stockpile(SNS) holds over 30 million doses of anthrax vaccines, underscoring its critical role in preparedness. Advancements in recombinant DNA technology have improved vaccine efficacy annually for anthrax countermeasures that is driving innovation and production capacity.

The radiation/nuclear segment is lucratively growing with an anticipated CAGR of 8.2% throughout the forecast period. This growth is fueled by rising concerns over nuclear accidents and radiological terrorism. According to the Biomedical Advanced Research and Development Authority (BARDA), advancements in small-molecule therapeutics have increased survival rates by 30% in animal models exposed to high radiation levels. Additionally, collaborations between academic institutions and pharmaceutical companies have accelerated the development of novel treatments. Canada’s emphasis on nuclear safety in regions near power plants, has further amplified demand by positioning radiation/nuclear countermeasures as a pivotal growth driver.

COUNTRY LEVEL ANALYSIS

The United States was the largest contributor in the North America biodefense market by accounting for 85.7% of share in 2024. Programs like Project BioShield and the Strategic National Stockpile ensure preparedness against anthrax, smallpox, and other biothreats. The U.S. also leads in innovation, with private firms collaborating with federal agencies to develop cutting-edge solutions. For instance, Operation Warp Speed demonstrated the U.S.’s ability to rapidly deploy vaccines during pandemics.

Canada held 10% of the North America biodefense market share in 2024. According to Public Safety Canada, the country’s proximity to major U.S. cities necessitates coordinated efforts to address cross-border biothreats. Additionally, Canada’s investments in synthetic biology and advanced diagnostics have bolstered its capacity to respond to emergencies. Partnerships with international organizations, such as the World Health Organization (WHO) will amplify its role in global biosecurity initiatives.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America biodefense market are XOMA corporation, Altimmune Inc. Emergent Biosolutions Inc., Dynavax Technologies Corporation, SIGA Technologies, Elusys Therapeutics Inc, Ichor Medical Systems, Dynport Vaccine Company,Cleveland Biolabs, Bavarian Nordic ,Ology Bioservices , Alnylam Pharmaceuticals Inc.

The North America biodefense market is highly competitive, characterized by the dominance of established players like Emergent BioSolutions, Bavarian Nordic, and SIGA Technologies. These companies leverage government contracts, advanced R&D capabilities, and proprietary technologies to maintain its dominance. The market also witnesses participation from mid-sized firms specializing in niche areas such as radiation countermeasures by creating a fragmented yet dynamic landscape. Innovation remains a key differentiator, with companies investing heavily in synthetic biology and advanced manufacturing to address evolving biothreats. Smaller players face challenges such as limited access to capital and stringent regulatory requirements, but collaborations with larger entities provide opportunities for growth. This competitive environment ensures continuous advancements in biodefense solutions.

Top Players in the Market

Emergent BioSolutions

Emergent BioSolutions is a leading player in the North America biodefense market. Headquartered in Maryland, the company specializes in developing vaccines and therapeutics for anthrax, smallpox, and botulism. Its flagship product, BioThrax, is the only FDA-approved anthrax vaccine, with in the Strategic National Stockpile. Emergent’s state-of-the-art manufacturing facilities and partnerships with federal agencies ensure a steady supply of critical countermeasures are anticipated to leverage the position of the company in the marketplace.

Bavarian Nordic

Bavarian Nordic, a Denmark-based company with a strong presence in North America. The company leads in smallpox vaccines, including its FDA-approved JYNNEOS vaccine. Bavarian Nordic’s collaboration with the U.S. government has resulted in the delivery of millions of doses to the Strategic National Stockpile. The company’s innovative MVA-BN platform enables the development of versatile vaccines targeting multiple biothreats is reinforcing its competitive edge.

SIGA Technologies

SIGA Technologies is to have lucrative position in the North America biodefense market due to its focus on adopting new technologis at faster rate. The company’s TPOXX(tecovirimat) is the only FDA approved oral treatment for smallpox that address a unmet needs in medical countermeasures. SIGA’s partnerships with government agencies, including BARDA, have secured long−term contracts. Investments in R&D and clinical trials have enhanced the drug’s efficacy thereby positioning SIGA as a key player in the biodefense landscape.

Top strategies used by the key market participants

Key players in the North America biodefense market employ diverse strategies to maintain competitiveness. Government contracts are a cornerstone, with companies like Emergent BioSolutions and SIGA Technologies securing multi-year agreements under Project BioShield. Innovation is another focal point as Bavarian Nordic’s investment in MVA-BN technology exemplifies the push for versatile platforms capable of addressing multiple threats. Collaborations with academic institutions and federal agencies drive R&D efforts, ensuring timely development of countermeasures. Additionally, companies are expanding manufacturing capacities to meet surge demands during emergencies.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Emergent BioSolutions expanded its manufacturing facility in Baltimore that is increasing production capacity for anthrax vaccines by 30%.

- In May 2023, Bavarian Nordic received FDA approval for an enhanced version of its JYNNEOS vaccine that will improve storage stability by 25%.

- In July 2023, SIGA Technologies signed a $200 million contract with the U.S. government to supply additional doses of TPOXX for smallpox preparedness.

- In September 2023, Altimmune launched a Phase II clinical trial for its intranasal anthrax vaccine that aimed to reduce administration complexity.

- In November 2023, Soligenix partnered with the National Institutes of Health (NIH) to develop a heat-stable Ebola vaccine by addressing logistical challenges in storage and transport.

MARKET SEGMENTATION

This research report on the North America Biodefense Market has been segmented and sub-segmented into the following.

By Product

- Anthrax

- Smallpox

- Botulism

- Radiation/Nuclear

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the North America Biodefense Market?

The North America biodefense market refers to the industry involved in the development, production, and distribution of medical countermeasures and defense mechanisms against biological threats

What is the market outlook or forecast for the North America biodefense industry?

The market is expected to grow steadily, driven by persistent biological threats and increasing investments in advanced biodefense solutions.

Which countries dominate the North America biodefense market?

The United States is the dominant player, owing to High defense budget allocations, Strong presence of biotech and pharmaceutical companies

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]