North America Battery Separator Market Size, Share, Trends & Growth Forecast Report Segmented By Type, Battery, Material, Technology, End-user, And By Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Battery Separator Market Size

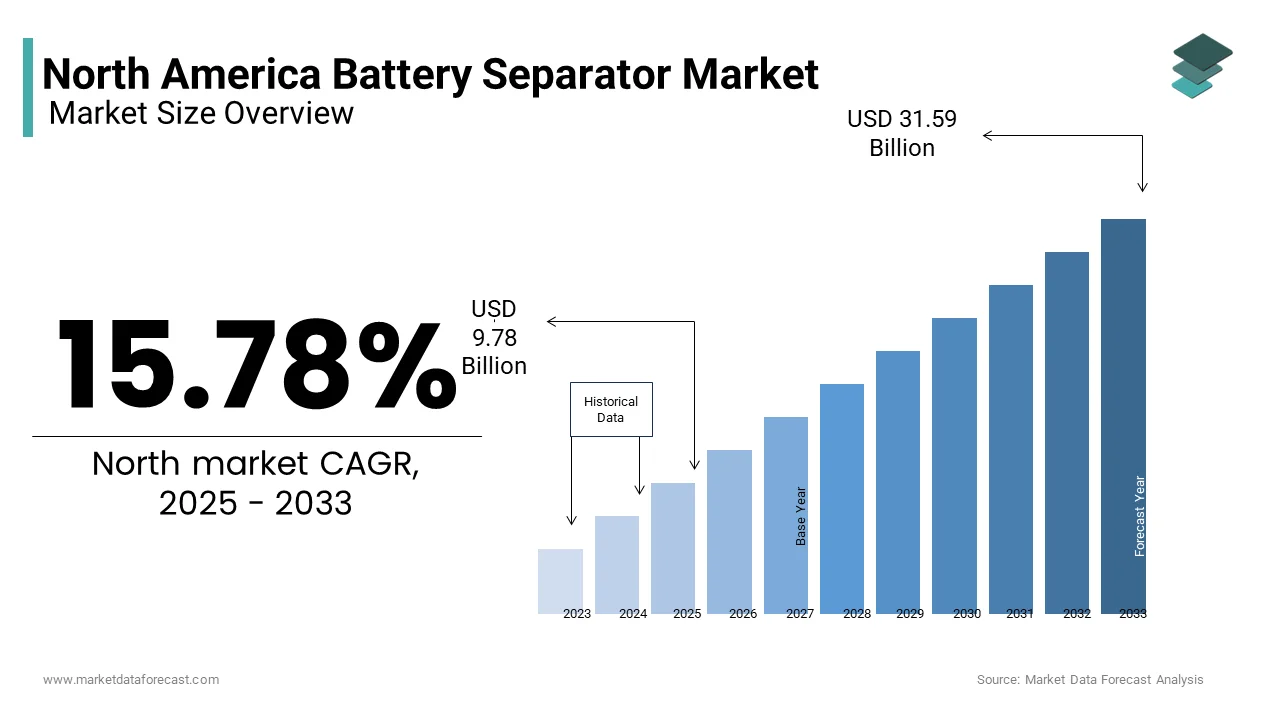

The North America battery separator market size was valued at USD 8.45 billion in 2024 and is anticipated to reach USD 9.78 billion in 2025 from USD 31.59 billion by 2033, growing at a CAGR of 15.78% during the forecast period from 2025 to 2033.

The North America battery separator market is predicted to have significant growth over the forecast period owing to the increasing adoption of electric vehicles (EVs) and advancements in energy storage systems. According to the Edison Electric Institute, the EV market in the U.S. is rapidly growing and creating a robust demand for high-performance battery separators. Lithium-ion batteries, which require advanced separators to enhance thermal stability and safety, dominate this landscape. As per data from the National Renewable Energy Laboratory, over 60% of all EVs sold in North America in 2023 were powered by lithium-ion batteries, underscoring the critical role of separators in this segment. Canada is also emerging as a key player, with provincial governments investing in renewable energy projects that rely on efficient energy storage solutions. Polyethylene (PE) and polypropylene (PP) separators account for approximately 70% of the market share, as noted by the American Chemistry Council, due to their cost-effectiveness and superior performance. However, challenges such as supply chain disruptions and rising raw material costs are impacting production timelines, particularly for coated separators, which are gaining traction for their enhanced durability.

MARKET DRIVERS

Surge in Electric Vehicle Adoption in North America

The rapid adoption of electric vehicles (EVs) is primarily driving the growth of the North American battery separator market. According to the International Energy Agency, EV sales in North America increased by 40% in 2023, accounting for nearly 10% of total vehicle sales. This surge is driven by government incentives, such as tax credits and subsidies, which aim to reduce carbon emissions and promote sustainable transportation. For instance, the U.S. Inflation Reduction Act provides up to $7,500 in tax credits for EV purchases, accelerating consumer adoption. Lithium-ion batteries, which power over 90% of EVs, require advanced separators to ensure thermal stability and prevent short circuits. A study published by the National Renewable Energy Laboratory highlights that separators contribute to 20% of the overall battery cost, making them a critical component in EV manufacturing. Additionally, partnerships between automakers and battery manufacturers, such as Tesla’s collaboration with Panasonic, have further amplified demand for high-performance separators, ensuring sustained market growth.

Expansion of Renewable Energy Storage Systems

The growing deployment of renewable energy storage systems is further boosting the expansion of the North American battery separator market. According to the U.S. Energy Information Administration, solar and wind energy accounted for 15% of total electricity generation in 2023, with projections indicating a 50% increase by 2030. These intermittent energy sources require efficient storage solutions, such as lithium-ion batteries, to ensure grid stability. As per data from the American Council on Renewable Energy, the U.S. installed over 5 gigawatts of energy storage capacity in 2023, with separators playing a pivotal role in enhancing battery efficiency and lifespan. Canada has also embraced this trend, with provinces like Ontario investing in large-scale energy storage projects to support renewable integration. Advanced separators, such as ceramic-coated options, are gaining traction due to their ability to improve thermal resistance and reduce degradation rates, as noted by the Canadian Renewable Energy Association.

MARKET RESTRAINTS

High Production Costs of Advanced Separators

The high production costs associated with advanced battery separators is majorly hindering the growth of the North American battery separator market. According to the American Chemistry Council, ceramic-coated separators, which offer superior thermal stability, are priced 30% higher than traditional polyethylene (PE) or polypropylene (PP) separators. This cost disparity limits their adoption, particularly among small- and medium-sized battery manufacturers operating on tight budgets. Additionally, the rising prices of raw materials, such as lithium and cobalt, have further exacerbated production expenses, as noted by the National Mining Association. In Canada, provincial governments face challenges in subsidizing advanced separator technologies, leaving many renewable energy projects reliant on less efficient alternatives. Furthermore, the complexity of manufacturing processes, such as multi-layer coating and precision cutting, increases operational costs, deterring widespread adoption. These financial barriers hinder market growth and limit accessibility to cutting-edge separator technologies.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages are also hampering the growth of the battery separator market in North America. The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to delays in the procurement of critical materials such as polyethylene and polypropylene. According to the U.S. Department of Commerce, imports of these polymers declined by 15% in 2023, impacting production timelines for separators. Canada faces similar challenges, with logistical bottlenecks delaying the delivery of raw materials to manufacturing facilities. Additionally, geopolitical tensions, particularly between the U.S. and China, have disrupted access to advanced separator technologies, as highlighted by the Canadian Chamber of Commerce. A study by the International Trade Administration reveals that over 60% of North American battery manufacturers experienced production delays due to supply chain issues in 2023.

MARKET OPPORTUNITIES

Growing Demand for Solid-State Battery Separators

The emergence of solid-state batteries is a notable opportunity for the battery separator market in North America. Unlike traditional lithium-ion batteries, solid-state designs eliminate liquid electrolytes, relying instead on advanced separators to facilitate ion transport. According to the U.S. Department of Energy, solid-state batteries are projected to capture 10% of the global battery market by 2030, driven by their superior energy density and safety features. Polyvinyl chloride (PVC) and nylon-based separators, which offer enhanced mechanical strength and thermal stability, are gaining traction for use in these applications. Canada has positioned itself as a leader in this space, with research institutions collaborating with industry players to develop next-generation separators. A study published by the Canadian Advanced Materials Consortium highlights that solid-state separators can reduce charging times by 50%, appealing to EV manufacturers seeking faster performance. These advancements position solid-state separators as a transformative force in the market.

Expansion into Non-Automotive Applications

The expansion of battery separators into non-automotive applications is another prominent opportunity for growth. According to the Consumer Technology Association, the demand for portable electronics, such as smartphones and laptops, is projected to grow at a CAGR of 8% through 2030. These devices rely on compact, high-performance batteries, driving the need for advanced separators that enhance efficiency and longevity. Additionally, the rise of smart home technologies, such as IoT-enabled devices, has created new avenues for separator manufacturers. As per data from the National Electrical Manufacturers Association, the U.S. smart home market is expected to reach $40 billion by 2025, with separators playing a critical role in powering interconnected devices. Canada has also embraced this trend, with startups developing specialized separators for wearable technology. These factors highlight the untapped potential of non-automotive applications in driving market expansion.

MARKET CHALLENGES

Technological Barriers in Developing High-Performance Separators

The development of high-performance separators capable of meeting the demands of next-generation batteries, which is one of the significant challenges for the regional market. According to the U.S. Department of Energy, advanced separators must exhibit superior thermal stability, mechanical strength, and ionic conductivity to support innovations such as solid-state and ultra-fast charging batteries. However, achieving these properties often requires complex manufacturing processes, such as multi-layer coating and nanoparticle integration, which are both costly and technically challenging. A study published by the American Chemical Society highlights that only 40% of experimental separator designs successfully transition from laboratory testing to commercial production due to scalability issues. Canada faces similar hurdles, with research institutions struggling to bridge the gap between theoretical advancements and practical applications. Additionally, the lack of standardized testing protocols for new materials further complicates the development process, as noted by the Canadian Standards Association. These technological barriers hinder market growth and limit the adoption of cutting-edge solutions.

Environmental Concerns and Sustainability Issues

Environmental concerns surrounding the production and disposal of battery separators are further challenging the expansion of the North American market. According to the Environmental Protection Agency, the manufacturing of polyethylene (PE) and polypropylene (PP) separators generates significant greenhouse gas emissions, contributing to the industry's carbon footprint. Additionally, the disposal of used separators, particularly those coated with ceramic or other non-biodegradable materials, exacerbates waste management challenges. A report by the National Recycling Coalition reveals that less than 5% of battery separators are currently recycled in North America, highlighting the urgent need for sustainable alternatives. Canada has taken steps to address these issues, with provincial governments investing in research initiatives focused on biodegradable and recyclable separator materials. However, the high costs and limited availability of eco-friendly options remain significant obstacles, as noted by the Canadian Environmental Technology Advancement Council. These challenges underscore the importance of developing sustainable solutions to ensure long-term market viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.26% |

|

Segments Covered |

By Type, Battery Type, Material, Technology, End-Use By Country |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

U.S, Canada, Mexico Rest of North America |

|

Market Leaders Profiled |

Asahi Kasei Corporation (Japan), Shanghai Energy New Materials Technology Co., Ltd. (China), SK ie technology (South Korea), Toray Industries, Inc. (Japan), Ahlstrom (Finland), Sinoma Science & Technology Co., Ltd. (China), Bernard Dumas (France), Cangzhou Mingzhu Plastic Co., Ltd. (China), Delfortgroup AG (Asutria), Eaton (Europe), ENTEK (US), Freudenberg (Germany), Hebei Gellec New Energy Science & Technology Co., Ltd. (China), Mitsubishi Paper Mills Limited (Japan), Hollingsworth & Vose (US), Nanografi Nano Technology (Turkey), Solvay (Belgium), Sumitomo Chemical Co., Ltd. (Japan), Teijin Limited (Japan), UBE Corporation (Japan), W-Scope Corporation (Japan) |

SEGMENTAL ANALYSIS

By Type Insights

The non-coated separators segment accounted for 60.9% of the North America battery separator market share in 2024. The prominent position of non-coated separators segment in the North American market is driven by their cost-effectiveness and widespread use in conventional lead-acid and lithium-ion batteries. According to the American Chemistry Council, non-coated separators account for over 70% of all separators used in automotive starter batteries, which remain a staple in the region’s transportation sector. Their simplicity in design and lower production costs make them an attractive choice for manufacturers operating under tight budgets. Additionally, advancements in polymer technologies have improved the durability and performance of non-coated separators, extending their lifespan and reducing maintenance requirements. Government incentives promoting the adoption of affordable energy storage solutions have further solidified their leadership in the market. For instance, Canada’s Clean Energy Initiative prioritizes the use of cost-effective separators in renewable energy projects, ensuring broader accessibility.

The coated separators segment is predicted to register the highest CAGR of 12.8% over the forecast period due to their ability to enhance thermal stability and prevent internal short circuits, making them ideal for high-performance applications such as electric vehicles (EVs) and renewable energy storage systems. According to the National Renewable Energy Laboratory, coated separators reduce the risk of thermal runaway by 40%, significantly improving battery safety. The increasing adoption of ceramic-coated options, which offer superior mechanical strength and resistance to degradation, has further accelerated demand. Canada has embraced this trend, with provincial governments investing in research initiatives to develop advanced coatings tailored to extreme weather conditions. A study published by the Canadian Advanced Materials Consortium highlights that coated separators can extend battery life by up to 30%, enhancing their appeal among manufacturers.

By Battery Type Insights

The lithium-ion batteries segment occupied the leading share of 71.7% of the regional market share in 2024. The leading position of lithium-ion batteries segment in the North American market is driven by their widespread use in electric vehicles (EVs), consumer electronics, and renewable energy storage systems. According to the Edison Electric Institute, EV sales in the U.S. increased by 40% in 2023, with lithium-ion batteries powering over 90% of these vehicles. The growing demand for high-energy-density solutions has further amplified the need for advanced separators that enhance battery efficiency and safety. Canada has also witnessed significant adoption, with provinces like Ontario investing in large-scale lithium-ion battery projects to support renewable energy integration. Additionally, government incentives, such as tax credits for EV purchases, have reinforced the dominance of lithium-ion batteries in the market.

The lead-acid batteries segment is another major segment and is anticipated to grow at a promising CAGR in the European market over the forecast period owing to their affordability and reliability, making them a preferred choice for automotive starter batteries and backup power systems. According to the Battery Council International, lead-acid batteries account for over 60% of all automotive batteries sold in North America, underscoring their enduring relevance. Advances in separator technologies, such as enhanced microporous designs, have improved the performance and lifespan of lead-acid batteries, driving renewed interest in this segment. Canada has embraced these innovations, with provincial governments promoting the use of lead-acid batteries in off-grid renewable energy projects. A study published by the Canadian Renewable Energy Association highlights that modern lead-acid batteries can achieve a 20% increase in energy efficiency, appealing to cost-conscious consumers.

By Material Insights

The polyethylene (PE) segment held the leading share of the European battery separator market in 2024. The domination of PE segment in the North American market is attributed to its excellent thermal stability and cost-effectiveness, making it the material of choice for both lead-acid and lithium-ion batteries. According to the American Chemistry Council, PE separators account for over 70% of all separators used in automotive starter batteries, which remain a staple in the region’s transportation sector. Their microporous structure ensures efficient ion transport while maintaining mechanical strength, reducing the risk of short circuits. Additionally, advancements in polymer technologies have improved the durability of PE separators, extending their lifespan and reducing maintenance costs. Government incentives promoting affordable energy storage solutions have further solidified their dominance. For instance, Canada’s Clean Energy Initiative prioritizes the use of cost-effective materials like PE in renewable energy projects, ensuring broader accessibility.

The nylon segment is projected to witness the fastest CAGR of 14.2% over the forecast period due to its superior mechanical strength and resistance to high temperatures, making it ideal for advanced applications such as electric vehicles (EVs) and industrial energy storage systems. According to the National Renewable Energy Laboratory, nylon separators reduce degradation rates by 25%, significantly enhancing battery longevity. Canada has embraced this trend, with provincial governments investing in research initiatives to develop nylon-based separators tailored to extreme weather conditions. A study published by the Canadian Advanced Materials Consortium highlights that nylon separators can improve battery efficiency by 15%, appealing to manufacturers seeking high-performance solutions.

By Technology Insights

The wet process segment accounted for 61.2% of the North America battery separator market share in 2024. The promising position of wet process segment in the North American market is driven by its ability to produce separators with uniform microporous structures, ensuring consistent performance in both lead-acid and lithium-ion batteries. According to the Battery Council International, wet-processed separators are used in over 80% of automotive starter batteries sold in North America, underscoring their widespread adoption. The affordability and scalability of the wet process make it an attractive choice for manufacturers operating under tight budgets. Additionally, advancements in solvent recovery technologies have reduced environmental impacts, aligning with sustainability goals. Canada has also embraced this technology, with provincial governments promoting its use in renewable energy projects to support grid stability.

The dry process segment is projected to witness a healthy CAGR over the forecast period due to its cost-effectiveness and reduced environmental footprint, making it ideal for large-scale production of separators for electric vehicles (EVs) and consumer electronics. According to the U.S. Department of Energy, dry-processed separators reduce manufacturing costs by 20% compared to the wet process, appealing to cost-conscious manufacturers. Canada has witnessed significant adoption, particularly in provinces like Ontario, where startups are developing dry-process technologies tailored to local needs. A study published by the Canadian Environmental Technology Advancement Council highlights that dry-processed separators generate 30% fewer greenhouse gas emissions, aligning with regional sustainability initiatives.

By End-Use Insights

The automotive segment occupied 51.4% of the regional market share in 2024 due to the growing adoption of electric vehicles (EVs) and hybrid vehicles, which rely on advanced separators to enhance battery performance and safety. According to the Edison Electric Institute, EV sales in the U.S. increased by 40% in 2023, with lithium-ion batteries powering over 90% of these vehicles. The demand for separators that prevent thermal runaway and ensure long-term durability has further amplified the sector’s dominance. Canada has also embraced this trend, with provincial governments investing in EV infrastructure to support sustainable transportation. Additionally, government incentives, such as tax credits for EV purchases, have reinforced the automotive sector’s leadership in the market.

The industrial segment is expected to grow at a significant CAGR over the forecast period in the European market owing to the increasing deployment of energy storage systems in manufacturing facilities, data centers, and renewable energy projects. According to the U.S. Energy Information Administration, industrial energy storage capacity is expected to grow by 50% through 2030, driving demand for high-performance separators. Canada has positioned itself as a leader in this space, with provinces like Alberta investing in large-scale industrial projects to support oil and gas operations. A study published by the Canadian Renewable Energy Association highlights that separators used in industrial applications can reduce downtime by 25%, appealing to manufacturers seeking reliable solutions. These factors position the industrial sector as the most dynamic segment in the market.

REGIONAL ANALYSIS

The United States occupied the largest share of 80.9% of the North American battery separator market in 2024. The dominating position of the U.S. in the North American market is driven by the country’s advanced manufacturing capabilities, robust R&D infrastructure, and strong demand for electric vehicles (EVs). According to the Edison Electric Institute, EV sales in the U.S. increased by 40% in 2023, creating a surge in demand for high-performance separators. Lithium-ion batteries, which require advanced separators to ensure thermal stability and safety, dominate this landscape. Additionally, government initiatives such as the Inflation Reduction Act provide up to $7,500 in tax credits for EV purchases, accelerating consumer adoption. The presence of leading manufacturers and research institutions ensures continuous innovation, solidifying the U.S.’s dominance in the regional market.

Canada is predicted to account for a notable share of the North American battery separator market over the forecast period. The focus of Canada on renewable energy integration and sustainable transportation are propelling the Canadian market growth. According to Natural Resources Canada, the country aims to achieve net-zero emissions by 2050, with energy storage systems playing a critical role in this transition. Provinces like Ontario and Quebec have invested heavily in lithium-ion battery projects to support renewable energy initiatives. Additionally, Canada’s abundant natural resources, such as lithium and nickel, provide a competitive advantage in producing cost-effective separators. Collaborations between academia and industry foster innovation, with startups developing advanced materials tailored to extreme weather conditions. While smaller in scale compared to the U.S., Canada’s strategic emphasis on sustainability positions it as a key player in the regional market.

Top Players In the North America Battery Separator Market

Asahi Kasei dominates with its innovative polyethylene (PE) separators, which are widely regarded as the gold standard in the industry. Celgard follows closely, offering advanced wet-process separators that cater to diverse applications, including EVs and consumer electronics. Toray Industries rounds out the top three, with a strong presence in high-performance nylon-based separators. Its commitment to sustainability has enabled the launch of eco-friendly solutions, reinforcing its global standing.

Top Strategies Used By Key Market Participants

Key players in the North America battery separator market employ a variety of strategies to strengthen their positions. Strategic partnerships and collaborations are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Asahi Kasei has partnered with leading EV manufacturers to develop next-generation separators tailored to high-energy-density batteries. Capacity expansions are another critical strategy, allowing firms to meet rising demand. Celgard, for example, announced plans to increase its production capacity by 30% in 2024, ensuring timely delivery of products. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Toray Industries has invested heavily in establishing manufacturing facilities in Canada, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer demands.

Competition Overview In The North America Battery Separator Market

The North America battery separator market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Asahi Kasei, Celgard, and Toray Industries dominating the landscape. These companies compete on the basis of product innovation, technological superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as eco-friendly materials and solid-state battery separators. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for advanced separators in EVs, renewable energy storage, and consumer electronics.

KEY MARKET PLAYERS

Asahi Kasei Corporation (Japan), Shanghai Energy New Materials Technology Co., Ltd. (China), SK ie technology (South Korea), Toray Industries, Inc. (Japan), Ahlstrom (Finland), Sinoma Science & Technology Co., Ltd. (China), Bernard Dumas (France), Cangzhou Mingzhu Plastic Co., Ltd. (China), Delfortgroup AG (Asutria), Eaton (Europe), ENTEK (US), Freudenberg (Germany), Hebei Gellec New Energy Science & Technology Co., Ltd. (China), Mitsubishi Paper Mills Limited (Japan), Hollingsworth & Vose (US), Nanografi Nano Technology (Turkey), Solvay (Belgium), Sumitomo Chemical Co., Ltd. (Japan), Teijin Limited (Japan), UBE Corporation (Japan), W-Scope Corporation (Japan) are the market players that are dominating the North America battery separator market.

RECENT HAPPENINGS IN THIS MARKET

- In January 2024, Asahi Kasei launched a next-generation polyethylene separator designed for high-energy-density lithium-ion batteries. This initiative aimed to address unmet consumer needs and expand its product portfolio.

- In March 2024, Celgard acquired a startup specializing in eco-friendly separator materials. This acquisition was anticipated to enhance its capabilities in sustainable manufacturing.

- In May 2024, Toray Industries partnered with a Canadian research institution to develop nylon-based separators for extreme weather conditions. This collaboration sought to address regional challenges in battery performance.

- In July 2024, SK Innovation introduced a dry-process separator with enhanced thermal stability. This innovation aimed to reduce manufacturing costs and improve environmental sustainability.

- In September 2024, LG Chem expanded its production facilities in the U.S. to meet the growing demand for EV battery separators. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the North America battery separator market is segmented and sub-segmented into the following categories.

By Type

- Non-Coated Separators

- Coated Separators

By Battery Type

- Lithium-Ion Batteries

- Lead-Acid Batteries

By Material

- Polyethylene (PE)

- Nylon

By Technology

- Wet Process

- Dry Process

By End-Use

- Automotive

- Industrial

By Country

- U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

Why are battery separators important?

They prevent short circuits while allowing ion flow, improving battery safety, efficiency, and lifespan, especially in lithium-ion and lead-acid batteries.

How does EV growth impact the battery separator market?

Rising EV demand, driven by government incentives and stricter emissions rules, is increasing the need for high-performance separators.

What materials are used in battery separators?

Common materials include polyethylene (PE), polypropylene (PP), ceramic coatings, and advanced composite membranes.

What challenges does the market face?

Issues include raw material costs, supply chain disruptions, safety concerns, and recycling limitations.

Who are the top players in the industry?

Key companies include Asahi Kasei, Toray Industries, SK Innovation, Entek International, and Freudenberg.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]