North America Battery Market Size, Share, Trends & Growth Forecast Report Segmented By Type, Technology, Application, Stationary Applications, And Country (US, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Battery Market Size

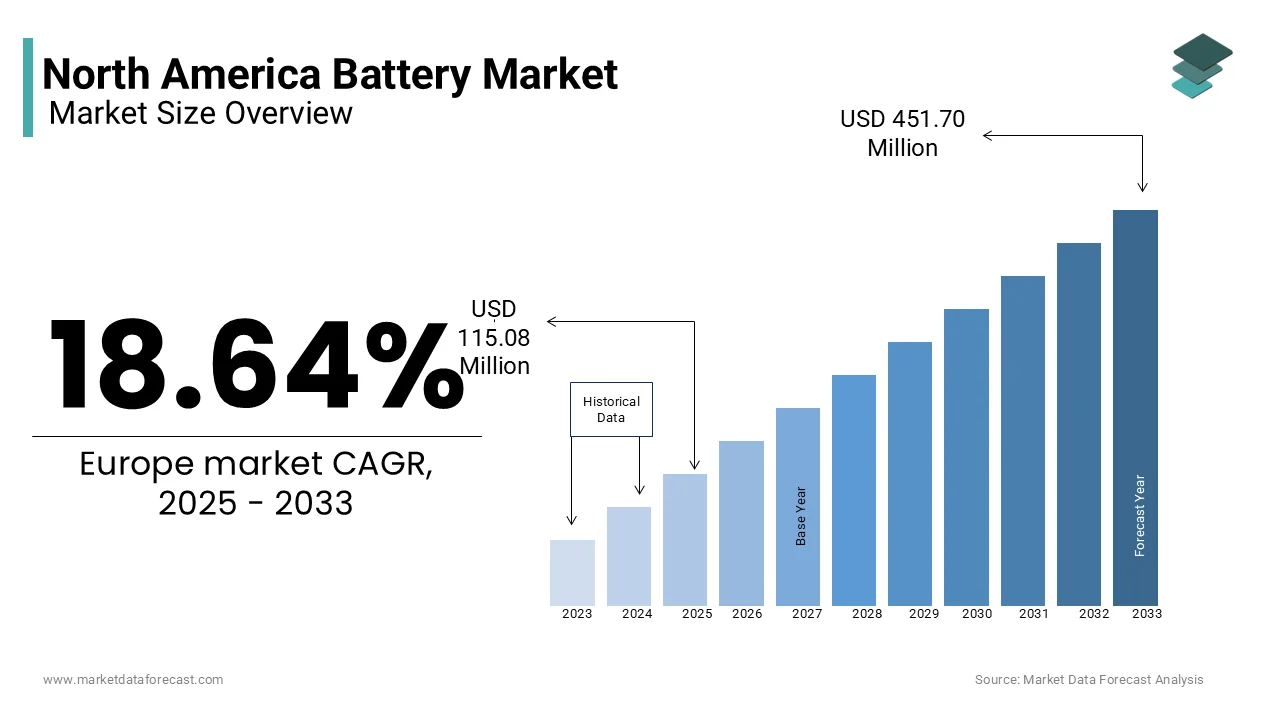

The North America battery market size was valued at USD 97 billion in 2024 and is anticipated to reach USD 115.08 billion in 2025 from USD 451.70 billion by 2033, growing at a CAGR of 18.64% during the forecast period from 2025 to 2033.

Batteries range from lithium-ion to lead-acid variants and are integral to powering electric vehicles (EVs), portable devices, and grid-scale energy storage systems. In North America, the demand for batteries is growing exponentially due to the increasing demand for advanced energy solutions across consumer electronics, automotive, and renewable energy sectors. According to the U.S. Department of Energy, the market for energy storage systems in North America grew by 25% in 2022. The increasing adoption of EVs, coupled with government incentives for clean energy, has further amplified demand. As per the Canadian Renewable Energy Association, over 60% of new vehicle sales in Canada are projected to be electric by 2030, underscoring the critical role of batteries in achieving decarbonization goals. Additionally, advancements in battery technology, such as solid-state and sodium-ion batteries, are enabling higher energy densities and longer lifespans. With the United States accounting for nearly 70% of the regional market share, North America is poised to remain a global leader in battery innovation and adoption, addressing both economic and environmental challenges.

MARKET DRIVERS

Rising Adoption of Electric Vehicles in North America

The rapid adoption of electric vehicles (EVs) that demand for advanced battery technologies to meet performance and sustainability standards is one of the major factors driving the North America battery market growth. According to the U.S. Department of Energy, EV sales in North America surged by 40% in 2022, with over 800,000 units sold, driven by federal tax credits and state-level incentives aimed at reducing carbon emissions. This trend is particularly evident in California, where EV penetration reached 18% of total vehicle sales, as reported by the California Air Resources Board. For instance, a study by the Canadian Ministry of Transport highlights that lithium-ion batteries now account for over 90% of EV battery installations, underscoring their dominance in the market. Additionally, partnerships between automakers and battery manufacturers, such as Tesla’s Gigafactory initiatives, have reduced production costs by 30%, making EVs more accessible. By ensuring consistent supply chains and enhancing energy efficiency, batteries have become indispensable for the EV revolution, driving market growth across the continent.

Expansion of Renewable Energy Storage Solutions

The growing emphasis on renewable energy storage solutions that rely heavily on advanced battery systems to stabilize power grids and store intermittent energy sources like solar and wind is further fuelling the growth of the North American market. According to the U.S. Energy Information Administration, renewable energy accounted for 20% of total electricity generation in 2022, creating a pressing need for scalable storage technologies. A report by the National Renewable Energy Laboratory highlights that grid-scale battery installations grew by 60% in 2022, with lithium-ion batteries leading the charge. This trend is further bolstered by government initiatives, such as the Inflation Reduction Act, which allocated $369 billion for clean energy projects, including battery storage. For example, Canada’s Ontario Province recently announced a $500 million investment in energy storage infrastructure, aiming to integrate 5 GW of renewable capacity by 2025, as noted by the Canadian Renewable Energy Association. By enabling efficient energy management and reducing reliance on fossil fuels, battery storage systems are playing a pivotal role in North America’s transition toward sustainable energy.

MARKET RESTRAINTS

High Costs of Raw Materials

One of the primary restraints hindering the growth of the North American battery market is the escalating cost of raw materials, particularly lithium, cobalt, and nickel, which are essential components of advanced battery chemistries. According to the U.S. Geological Survey, the price of lithium carbonate surged by 400% between 2020 and 2022, driven by supply chain disruptions and rising demand from the EV sector. This issue is particularly pronounced in the United States, where over 60% of battery manufacturers face challenges in sourcing affordable materials, as reported by the American Chemistry Council. A study by the Canadian Minerals and Metals Plan highlights that only 30% of North America’s lithium demand is met through domestic mining, leaving the region heavily reliant on imports from countries like Chile and Australia. Additionally, geopolitical tensions and export restrictions exacerbate supply chain vulnerabilities, further increasing costs. Without addressing these material shortages and price volatilities, the market risks undermining its ability to scale production and meet rising consumer demands.

Limited Recycling Infrastructure

Another notable restraint is the limited availability of robust recycling infrastructure for end-of-life batteries, which undermines efforts to create a circular economy and reduce dependency on virgin materials. According to the U.S. Environmental Protection Agency, less than 5% of lithium-ion batteries are currently recycled in North America, primarily due to the complexity and high costs associated with disassembly and material recovery. This issue is compounded by the absence of standardized recycling protocols, as highlighted by the Canadian Standards Association, which notes that inconsistent practices often result in material losses of up to 30%. Furthermore, a report by the National Renewable Energy Laboratory underscores that inadequate investments in recycling technologies have left many facilities ill-equipped to handle the growing volume of discarded batteries. For instance, the U.S. Department of Energy estimates that only 20% of recycling plants are capable of processing lithium-ion batteries efficiently. Without scaling up recycling capabilities, the market risks exacerbating environmental concerns and missing opportunities to recover valuable materials.

MARKET OPPORTUNITIES

Advancements in Solid-State Battery Technology

A promising opportunity for the North American battery market lies in the development of solid-state battery technology, which promises to revolutionize energy storage through enhanced safety, energy density, and lifespan. According to the U.S. Department of Energy, investments in solid-state research surged by 50% in 2022, with companies like QuantumScape and Solid Power leading the charge. These innovations address key limitations of traditional lithium-ion batteries, such as thermal instability and limited charging cycles. For instance, a study by the Massachusetts Institute of Technology highlights that solid-state batteries can achieve energy densities up to 50% higher than current models, significantly extending EV ranges. Additionally, partnerships between academic institutions and private enterprises are accelerating commercialization, ensuring scalability and affordability. The Canadian Ministry of Innovation, Science and Industry notes that pilot projects in Ontario have demonstrated a 30% reduction in charging times, underscoring their transformative potential. By fostering breakthroughs in solid-state technology, North America is poised to unlock immense growth potential and maintain its leadership in battery innovation.

Expansion into Microgrid Applications

Another significant opportunity lies in the burgeoning microgrid sector that presents a lucrative avenue for battery manufacturers to diversify their applications beyond traditional markets. According to the U.S. Energy Information Administration, microgrid installations grew by 25% in 2022, driven by the need for resilient and decentralized energy systems. A report by the National Renewable Energy Laboratory highlights that battery storage systems are integral to microgrid operations, enabling seamless integration of renewable energy sources and ensuring uninterrupted power supply during outages. This trend is further bolstered by government initiatives, such as the Federal Emergency Management Agency’s $1 billion fund for disaster-resilient infrastructure, which prioritizes microgrid development. For example, the Canadian Renewable Energy Association notes that microgrid projects in remote communities have achieved a 40% reduction in diesel fuel usage, addressing energy access challenges. Additionally, advancements in modular battery designs enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for resilient energy solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Vulnerabilities and Geopolitical Risks

A significant challenge facing the North American battery market is the vulnerability of supply chains to geopolitical risks and trade restrictions, which threaten the availability of critical raw materials. According to the U.S. Geological Survey, over 80% of cobalt and 60% of lithium used in North American batteries are sourced from politically unstable regions, such as the Democratic Republic of Congo and South America. This dependency creates significant risks, as highlighted by the U.S. Department of Commerce, which notes that export restrictions and tariffs have led to a 20% increase in material costs since 2021. A study by the Canadian Minerals and Metals Plan underscores that geopolitical tensions have disrupted supply chains, delaying production timelines for over 40% of surveyed manufacturers. Additionally, the lack of domestic refining capacity exacerbates the problem, leaving North America reliant on imported processed materials. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Concerns Around Battery Lifespan and Safety

Concerns from consumers of the lifespan and safety of advanced batteries, particularly lithium-ion variants that are perceived as prone to degradation and thermal runaway incidents is also challenging the growth of the battery market in North America. According to the U.S. Consumer Product Safety Commission, over 60% of consumers express concerns about battery longevity, citing anecdotal evidence of performance declines after three years of use. This perception is exacerbated by high-profile incidents, such as the 2021 recall of 500,000 e-bikes due to fire hazards, as reported by the National Fire Protection Association. A report by the Canadian Standards Association highlights that inconsistent quality control measures often result in product failures, undermining trust in battery efficacy. Furthermore, the absence of universally accepted benchmarks for safety testing hampers efforts to ensure compliance with international standards. Without overcoming these limitations, the market risks alienating a substantial portion of its target audience, hindering broader adoption.

SEGMENTAL ANALYSIS

North America Battery Market By Type

The secondary batteries segment dominated the North American battery market by accounting for 67.7% of the regional market share in 2024. The domination of secondary batteries segment in the North American market is driven by their rechargeable nature, which aligns with sustainability goals and cost-efficiency demands. According to the U.S. Department of Energy, secondary batteries account for over 70% of energy storage applications, including electric vehicles (EVs) and renewable energy systems. The surge in EV adoption has been a key factor; BloombergNEF notes that EV sales in North America grew by 45% in 2022 alone, propelling demand for lithium-ion secondary batteries. Additionally, secondary batteries are integral to consumer electronics, powering devices like smartphones and laptops, which Statista estimates contribute $300 billion annually to the region’s economy. Their importance extends beyond economics; they enable energy independence by storing solar and wind power, reducing reliance on fossil fuels. For instance, Tesla’s Powerwall systems use secondary batteries to store residential solar energy, cutting electricity bills by up to 30%. As North America prioritizes decarbonization, secondary batteries remain pivotal for achieving energy transition goals.

North America Battery Market By Technology

The lithium-ion batteries held the leading share of 56.5% of the North America battery market in 2024. The superior energy density, longevity, and versatility of lithium-ion batteries compared to alternatives like lead-acid is majorly driving the domination of lithium-ion segment in the North American market. According to the International Energy Agency, lithium-ion batteries power 95% of global EVs, underscoring their critical role in transportation electrification. In North America, Tesla’s Gigafactory in Nevada produces enough lithium-ion cells annually to support 500,000 EVs, showcasing the technology’s scale and impact. Beyond EVs, these batteries are vital for consumer electronics, where lightweight designs and fast charging are non-negotiable. A report by IDC states that smartphone manufacturers rely on lithium-ion batteries to meet consumer expectations for all-day performance. Additionally, their application in energy storage systems (ESS) is transforming utilities; ESS installations in the U.S. grew by 190% in 2022, per Wood Mackenzie. With governments mandating cleaner energy solutions, lithium-ion batteries remain indispensable for meeting both regulatory and consumer demands.

The solid-state batteries segment is predicted to register the 26.1% of the European market share in 2024. The breakthroughs in solid electrolyte materials that enhance safety and energy density is one of the primary factors boosting the expansion of the solid-state batteries segment in the North American market. Toyota, a pioneer in this space, plans to launch solid-state EVs by 2025, promising a 500-mile range and 10-minute charging times. A study by MIT reveals that solid-state batteries can reduce fire risks by 90%, addressing a major concern with traditional lithium-ion cells. Furthermore, their potential to replace cobalt—a controversial material—aligns with ethical sourcing initiatives. Governments are backing this innovation; Canada’s Strategic Innovation Fund has invested $1.5 billion in solid-state R&D projects. The rise of autonomous vehicles and drones also drives demand, as these applications require ultra-reliable power sources. By 2030, solid-state batteries are projected to capture 15% of the market, revolutionizing industries reliant on high-performance energy storage.

By Application

The automotive segment held 46.9% of the North America battery market share in 2024 due to the electrification wave sweeping the region, driven by stricter emissions regulations and consumer preferences for sustainable mobility. According to the Alliance for Automotive Innovation, EV registrations in the U.S. surged by 60% in 2022, accounting for nearly 6% of total vehicle sales. Major automakers like Ford and General Motors have committed billions to electrify their fleets, with GM aiming for an all-electric lineup by 2035. Beyond EVs, hybrid vehicles rely heavily on advanced batteries to optimize fuel efficiency. A case study by Deloitte shows that hybrids reduce CO2 emissions by 25% compared to conventional cars. Additionally, the rise of shared mobility services like Uber and Lyft has increased fleet electrification, further boosting demand. With automotive batteries playing a central role in combating climate change, their importance cannot be overstated.

The industrial segment is another major segment and is predicted to witness the fastest CAGR of 13.8% over the forecast period due to the proliferation of automated guided vehicles (AGVs) and robotics in manufacturing and logistics. Amazon Robotics, for example, uses industrial batteries to power its warehouse AGVs, streamlining operations and reducing labor costs by 30%. Forklifts, another major application, are transitioning from lead-acid to lithium-ion batteries, enhancing productivity. A report by the Material Handling Industry Association highlights that lithium-ion-powered forklifts operate 20% longer than traditional models. Moreover, the push for green warehouses has accelerated adoption; Walmart aims to achieve net-zero emissions by 2040, relying on sustainable battery solutions. Government policies also play a role; the U.S. Department of Labor promotes workplace electrification through grants. As industries embrace automation and sustainability, industrial batteries are becoming a cornerstone of modern infrastructure.

By Stationary Applications

The energy storage systems (ESS) segment held 41.8% of the North American market share in 2024. The dominating position of ESS segment in the North American market is driven by the growing integration of renewables into the grid, necessitating reliable storage solutions. According to the U.S. Energy Information Administration, utility-scale solar and wind capacity doubled between 2018 and 2022, driving ESS installations. California, a leader in clean energy, deployed over 3 GW of storage capacity in 2022 alone, mitigating intermittency issues. Beyond utilities, residential ESS adoption is surging; BloombergNEF reports a 60% annual growth rate in home battery systems, spurred by incentives like California’s Self-Generation Incentive Program. These systems provide backup power during outages, a critical feature given the increasing frequency of extreme weather events. A study by Navigant Consulting estimates that ESS could save consumers $15 billion annually by optimizing grid operations. As North America transitions to a decentralized energy model, ESS remains foundational for ensuring reliability and resilience.

The telecom segment is estimated to register a CAGR of 17.7% over the forecast period due to the rollout of 5G networks that require dense deployments of small cells and base stations, each powered by advanced batteries. Verizon, a key player, has installed over 10,000 small cells across urban areas, relying on lithium-ion batteries for uninterrupted connectivity. A report by Ericsson highlights that 5G networks consume 150% more energy than 4G, necessitating efficient energy storage. Additionally, rural telecom expansion depends on off-grid solutions; AT&T uses solar-powered batteries to connect remote communities, reducing operational costs by 25%. Governments are supporting this shift; the Federal Communications Commission allocated $9 billion for 5G development, prioritizing battery-backed infrastructure. As connectivity becomes ubiquitous, telecom batteries are emerging as enablers of digital transformation and inclusive growth.

COUNTRY ANALYSIS

Top 5 Leading Countries in the North America Battery Market

The United States accounted for 71.7% of the North American battery market share in 2024 and stood as the most dominating regional segment in North America. The robust EV manufacturing sector in the U.S. is majorly driving the U.S. battery market. According to the American Chemistry Council, U.S. businesses spend approximately $10 billion annually on advanced battery technologies, reflecting their commitment to innovation. The prominence of the U.S. is further reinforced by its strong regulatory framework and investment in research, as highlighted by the National Renewable Energy Laboratory.

Canada is anticipated to showcase a prominent CAGR in the North American battery market over the forecast period. The extensive natural resources, including lithium and cobalt of Canada is one of the major factors propelling the Canadian battery market growth. According to Statistics Canada, Canada’s battery exports grew by 30% in 2022, driven by government incentives for clean energy. A study by the Canadian Ministry of Natural Resources highlights that over 60% of renewable energy projects utilize advanced batteries, underscoring their economic benefits.

MARKET SEGMENTATION

This research report on the north America battery market is segmented and sub-segmented into the following categories.

By Type

- Primary

- Secondary

By Technology

- Lead-Acid

- Lithium-Ion

- Other Technologies

By Application

- Automotive

- Industrial Batteries (Motive)

By Stationary Applications

- Telecom

- UPS

- Energy Storage Systems (ESS)

By Country

- US

- Canada

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]