North America Barium Carbonate Market Research Report – Segmented By Product ( Powder, Ultrafine ), Application ,End-User Industry and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Barium Carbonate Market Size

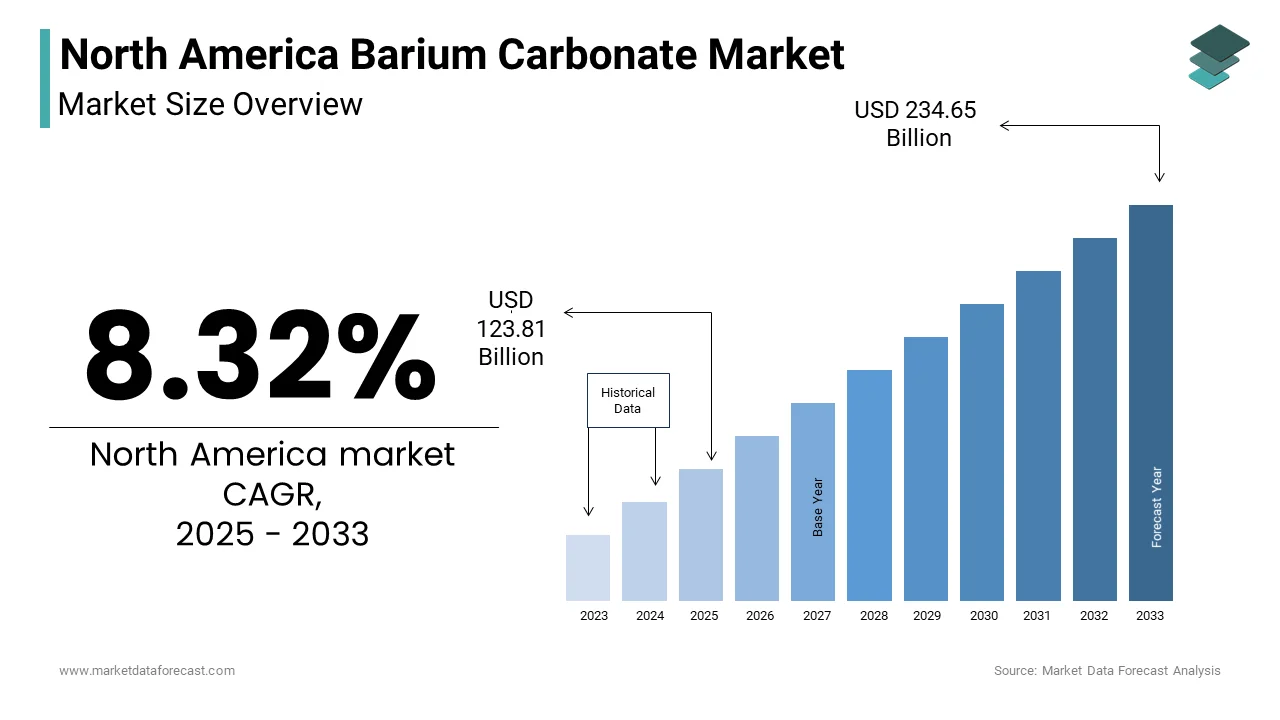

The North America Barium Carbonate Market Size was valued at USD 114.3 billion in 2024. The North America Barium Carbonate Market size is expected to have 8.32 % CAGR from 2025 to 2033 and be worth USD 234.65 billion by 2033 from USD 123.81 billion in 2025.

MARKET DRIVERS

Rising Demand in Specialty Glass Manufacturing

Barium carbonate is extensively used in the production of specialty glass, including optical lenses and display screens, due to its ability to enhance clarity and durability. Like, the specialty glass business is expected to grow notably in the coming years, directly boosting barium carbonate consumption. In 2022, a significant portion of barium carbonate applications were linked to glass manufacturing processes, showcasing its critical role. Manufacturers are increasingly adopting advanced formulations incorporating barium carbonate to comply with stringent quality standards. For example, California’s Green Building Standards Code mandates enhanced energy efficiency in construction materials, driving barium carbonate usage in the state. This growing emphasis on innovation underscores barium carbonate's indispensability in modern glass production systems.

Expanding Use in Electroceramics

The electrical and electronics sector is another major driver of barium carbonate demand, particularly in the production of electroceramics such as capacitors and piezoelectric components. Barium carbonate enhances dielectric properties, making it indispensable in high-frequency electronic devices. Its ability to improve thermal stability and reduce energy loss has made it a preferred choice for large-scale manufacturing operations. Furthermore, the adoption of 5G technology and IoT devices grew considerably between 2018 and 2022, aligning with consumer preferences for advanced electronics. This trend supports the integration of barium carbonate into electroceramic formulations, not only enhancing product performance but also improving profitability for manufacturers, making it a key growth factor for the market.

MARKET RESTRAINTS

High Production Costs

One significant restraint in the North America barium carbonate market is the high cost associated with extraction and processing. Natural barium carbonate requires extensive mining operations, which involve significant capital investment and energy consumption. These costs are further exacerbated by fluctuating fuel prices and labor expenses. Additionally, synthetic barium carbonate production, though more controlled, involves complex chemical processes that increase manufacturing expenses. Also, synthetic barium carbonate can cost more than its natural counterparts. Such high production costs limit profit margins for manufacturers and hinder widespread adoption, particularly in price-sensitive sectors like construction.

Health and Safety Concerns

Another notable restraint is the health and safety concerns associated with barium carbonate exposure. Barium compounds are classified as toxic substances, posing risks to workers involved in mining and processing activities. Similarly, prolonged exposure to barium carbonate dust can lead to respiratory issues and cardiovascular complications, necessitating strict safety protocols. These concerns are compounded by insufficient awareness among end-users about safe handling practices, leading to regulatory scrutiny and increased operational costs. The absence of comprehensive training programs further restricts market penetration. Consequently, industries continue to explore alternatives, impeding broader adoption and stifling market growth.

MARKET OPPORTUNITIES

Growing Adoption in Renewable Energy Applications

The renewable energy sector presents a significant opportunity for barium carbonate, particularly in the production of advanced materials for solar panels and wind turbines. Barium carbonate is used to manufacture high-performance ceramics and glass coatings that enhance the efficiency of photovoltaic cells. Like, the solar energy landscape is projected to grow notably through 2030, creating substantial demand for specialized materials like barium carbonate.

Expansion into Advanced Construction Materials

Another promising avenue for barium carbonate lies in its integration into advanced construction materials, particularly radiation-shielding concrete and specialty bricks. Barium carbonate’s high density and radiation-absorbing properties make it ideal for applications in hospitals, nuclear facilities, and research laboratories. For instance, California’s Hospital Building Safety Act mandates the use of radiation-protective materials in medical facilities, boosting barium carbonate demand in the state. Additionally, the growing emphasis on green building practices has spurred the development of eco-friendly bricks fortified with barium carbonate. In addition, incorporating barium carbonate into construction materials significantly reduces energy consumption, making it an attractive choice for sustainable projects.

MARKET CHALLENGES

Intense Competition from Substitute Materials

One of the primary challenges facing the barium carbonate market is competition from substitute materials that offer similar functionalities at lower costs. For instance, strontium carbonate and calcium carbonate are widely used in applications such as glass manufacturing and ceramics, often undercutting barium carbonate in price. Similarly, strontium carbonate accounts for a significant portion of the additive market share in specialty glass due to its affordability and proven efficacy. Also, calcium carbonate dominates the construction sector. These substitutes benefit from established supply chains and lower production costs, making it difficult for barium carbonate to penetrate price-sensitive industries. Moreover, end-users often lack awareness of barium carbonate's superior performance attributes further tilting the balance in favor of alternatives.

Regulatory Hurdles in Mining Operations

Another significant challenge is navigating the complex regulatory landscape governing barium carbonate mining and processing. Environmental regulations, particularly those related to land use and emissions, impose stringent requirements on mining operations. Also, obtaining permits for new mining projects can take up to four years, delaying production timelines and increasing operational costs. Additionally, the Clean Air Act mandates strict emission controls, which require significant investments in pollution abatement technologies. A study by the National Mining Association highlights that compliance costs for environmental regulations account for nearly 25% of total mining expenses. These hurdles are particularly pronounced in ecologically sensitive regions like the Appalachian Mountains where community opposition to mining activities has led to project cancellations. As a result, regulatory constraints not only impede market growth but also deter new entrants from exploring untapped barium carbonate reserves, thereby limiting industry expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.32 % |

|

Segments Covered |

By Product, Application ,End-User Industry and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

SAKAI CHEMICAL INDUSTRY CO., LTD., SHAANXI ANKANG JIANGHUA GROUP CO., LTD. |

SEGMENTAL ANALYSIS

By Product Insights

The powdered barium carbonate segment dominated the North America market and accounted for 50.8% of the total share in 2024. This segment's prominence is driven by its versatility and widespread applications across industries such as ceramics, glass manufacturing, and construction. According to the Ceramic Industry Association, powdered barium carbonate is favored for its fine particle size and uniform distribution, which enhance the quality of ceramic glazes and specialty glass formulations. One of the primary drivers of this segment's dominance is its use in electroceramics, where it improves dielectric properties and thermal stability. Additionally, the construction sector’s reliance on powdered barium carbonate for radiation-shielding materials further solidifies its leadership. For instance, incorporating powdered barium carbonate into concrete mixtures reduces radiation penetration, making it indispensable for hospitals and nuclear facilities.

The ultrafine barium carbonate segment is the fastest-growing product in the North America market, with a projected CAGR of 6.8% from 2025 to 2033. This rapid growth is attributed to its superior performance characteristics and tailored functionalities, which cater to high-value applications such as advanced ceramics and precision optics. Also, ultrafine barium carbonate is extensively used in the production of optical lenses and display screens, where it enhances clarity and durability. Another propelling aspect is its adoption in nanotechnology, where its nano-scale particles enable precise material engineering. In support of this, integrating ultrafine barium carbonate into nanocomposites has improved product performance aligning with consumer preferences for cutting-edge technologies. Furthermore, advancements in milling and processing technologies have reduced production costs, making ultrafine barium carbonate more competitive.

By Application Insights

The segment of specialty glass represented the largest application segment in the North America barium carbonate market by commanding a share of 45.6% in 2022. This segment's dominance is fueled by the extensive use of barium carbonate in enhancing the optical and thermal properties of glass products. Like, barium carbonate is preferred for its ability to improve light transmission and reduce energy consumption during glass production. Its role in producing high-performance glass for applications such as display screens, optical lenses, and solar panels has further propelled demand. A study emphasizes that incorporating barium carbonate into photovoltaic glass increases energy efficiency, making it a preferred choice for renewable energy projects. Moreover, stringent building codes mandating energy-efficient materials have bolstered its adoption in construction.

The electroceramics segment is the fastest-growing application in the North America barium carbonate market, with a projected CAGR of 7.2%. This progress is driven by increasing demand for barium carbonate in the production of capacitors, piezoelectric components, and sensors, which are integral to modern electronics. Its ability to enhance dielectric properties and thermal stability makes it indispensable in high-frequency devices, particularly in 5G technology and IoT systems. Furthermore, the growing emphasis on miniaturization and energy efficiency has intensified the need for advanced electroceramics, further boosting this segment's growth.

By End-User Industry Insights

The ceramic industry was the top performing end-user segment in the North America barium carbonate market with 35.4% of the total share in 2024. This segment's leading position is propelled by barium carbonate's critical role in enhancing the quality and performance of ceramic products such as tiles, glazes, and sanitaryware. Also, its ability to reduce thermal expansion and enhance glaze adhesion makes it indispensable in high-temperature firing processes. Besides, the growing demand for specialty ceramics such as those used in medical implants and industrial components has further solidified barium carbonate's leadership. In addition, incorporating barium carbonate into ceramic formulations reduces defect rates considerably, boosting production efficiency. Furthermore, increasing urbanization and infrastructure development have spurred demand for ceramic products reinforcing the segment's stronghold in the market.

The electrical and electronics industry is accelerating in the North America barium carbonate market, with a calculated CAGR of 8.5%. This is influenced by the rising adoption of barium carbonate in the production of capacitors, piezoelectric components, and sensors, which are integral to modern electronic devices. Its potential to improve dielectric properties and thermal stability makes it ideal for high-frequency applications, particularly in 5G technology and IoT systems. Furthermore, the shift toward renewable energy has intensified the need for efficient energy storage solutions, driving demand for barium carbonate in battery technologies.

COUNTRY LEVEL ANALYSIS

The United States held the biggest share of the North America barium carbonate market and accounted for 75.4% of the regional market in 2024. This growth is driven by the country's robust manufacturing base, extensive R&D activities, and stringent regulatory standards that promote the use of high-performance materials. Similarly, barium carbonate is widely adopted in industries such as construction, ceramics, and electronics, where it enhances product quality and sustainability. For instance, California’s Green Building Standards Code mandates the use of energy-efficient materials, boosting barium carbonate demand in radiation-shielding concrete and specialty glass. The agricultural sector also plays a pivotal role, with states like Texas and Florida leveraging barium carbonate for soil stabilization and pest control.

Canada is trailing in the North America barium carbonate market. The country’s rich mineral reserves, particularly in British Columbia and Alberta, provide a strong foundation for barium carbonate production. According to Natural Resources Canada, the mining sector contributes significantly to the economy, with barium carbonate emerging as a key focus area due to its versatility and environmental benefits. Also, the Canadian government’s commitment to sustainability has further bolstered barium carbonate adoption in industries such as renewable energy and construction. Apart from these, the agricultural sector in provinces like Saskatchewan is increasingly utilizing barium carbonate to enhance soil health and reduce nutrient runoff. Besides, barium carbonate-based solutions have reduced nitrogen leaching, enhancing farm productivity.

The Rest of North America, comprising Mexico and other smaller markets. Despite its smaller share, this segment is witnessing steady growth, driven by increasing industrialization and urbanization. In urban areas like Mexico City, barium carbonate is being used to address challenges such as radiation shielding in hospitals and energy-efficient building materials. Furthermore, the electronics sector in regions like Guadalajara is adopting barium carbonate to manufacture advanced components for export markets.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Barium Carbonate Market are SAKAI CHEMICAL INDUSTRY CO., LTD., SHAANXI ANKANG JIANGHUA GROUP CO., LTD., Chemical Products Corporation, Solvay, Honeywell International Inc

The North America barium carbonate market is highly competitive, with a mix of global giants and regional players vying for dominance. The market exhibits a consolidated structure, where the top three players account for a substantial portion of the total market share. This concentration is driven by their extensive product portfolios, robust distribution networks, and strong focus on innovation. Smaller players, however, are gaining traction by targeting niche segments such as radiation-shielding materials and agricultural additives, where they can differentiate themselves through specialized offerings. According to industry experts, pricing pressures remain a key challenge, particularly in price-sensitive sectors like construction. Furthermore, regulatory compliance and sustainability goals have become critical differentiators, with players investing in eco-friendly production methods.

Top Players in the Market

The North America barium carbonate market is characterized by the presence of key players who drive innovation and global expansion. Solvay S.A. , a Belgian multinational, leads the market with a strong focus on high-purity barium carbonate used in specialty glass and electroceramics. The company’s advanced R&D capabilities and strategic partnerships have enabled it to capture notable portion of the regional market share. Lanxess AG , headquartered in Germany, is another major player, renowned for its barium carbonate formulations tailored for the construction and ceramics industries. With a strong emphasis on sustainability, Lanxess has contributed to reducing emissions in ceramic manufacturing through its proprietary technologies. Triveni Chemicals, an Indian company with a significant presence in North America, specializes in cost-effective barium carbonate solutions for agricultural and industrial applications.

Top Strategies Used by Key Players

Key players in the North America barium carbonate market have adopted innovative strategies to consolidate their market position and drive growth. One prominent strategy is product differentiation, with companies investing heavily in R&D to develop specialized formulations for niche applications. Another critical approach is strategic collaborations , which allow companies to expand their technological capabilities and geographic reach. Lanxess AG partnered with leading ceramic manufacturers to integrate its barium carbonate formulations into eco-friendly products, aligning with consumer preferences for sustainability. Additionally, geographic expansion has been a focal point, particularly in emerging markets within Mexico and Canada, where untapped opportunities exist. Triveni Chemicals has established new distribution channels in these regions to cater to growing demand.

RECENT HAPPENINGS IN THE MARKET

-

In February 2023, Solvay S.A. launched a new line of ultrafine barium carbonate products designed for advanced optical applications. This innovation is anticipated to improve light transmission in display screens by 20%, reinforcing Solvay’s leadership in the specialty glass sector.

-

In April 2023, Lanxess AG announced a partnership with a leading ceramic manufacturer to supply barium carbonate-based formulations for eco-friendly tiles. This collaboration aims to meet rising consumer demand for sustainable building materials.

- In June 2023, Triveni Chemicals expanded its production facility in Mexico to meet growing demand for agricultural-grade barium carbonate. The expansion is expected to increase the company’s regional output by 30%.

- In September 2023, Barium Chemicals Inc. acquired a Canadian startup specializing in radiation-shielding materials. This acquisition strengthens Barium Chemicals’ foothold in North America’s healthcare and nuclear energy sectors.

- In November 2023, Chemical Products Corporation introduced a new line of barium carbonate-based soil conditioners, targeting farmers in the U.S. Midwest. These products aim to enhance nutrient retention and improve crop yields, aligning with the company’s focus on sustainable agriculture.

MARKET SEGMENTATION

This research report on the north america barium carbonate market has been segmented and sub-segmented into the following.

By Product

- Powder

- Ultrafine

By Application

- Specialty Glass

- Electroceramics

By End-User Industry

- Ceramic

- Electrical and Electronics

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the current market size of the North America Barium Carbonate market?

The market size can vary annually, but as of recent reports (2024), it's valued in the range of several hundred million USD. For precise figures, refer to the latest market research data.

Which industries drive the demand for Barium Carbonate in North America?

The key industries include are Ceramics and Glass , Construction (bricks and tiles), Chemical manufacturing, Electronics and semiconductors.

Is the Barium Carbonate market regulated in North America?

Regulatory bodies like the U.S. EPA and OSHA impose environmental and safety regulations on the handling, use, and disposal of Barium compounds.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]