North America Automotive Lead Acid Battery Market Size, Share, Trends & Growth Forecast Report by Vehicle Type (Passenger Cars, Commercial Vehicles, Two Wheelers, HEV Cars), Product (SLI Batteries, Micro Hybrid Batteries), Type (Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries), Customer Segment (OEM, Replacement), and Country (United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033.

North America Automotive Lead Acid Battery Market Size

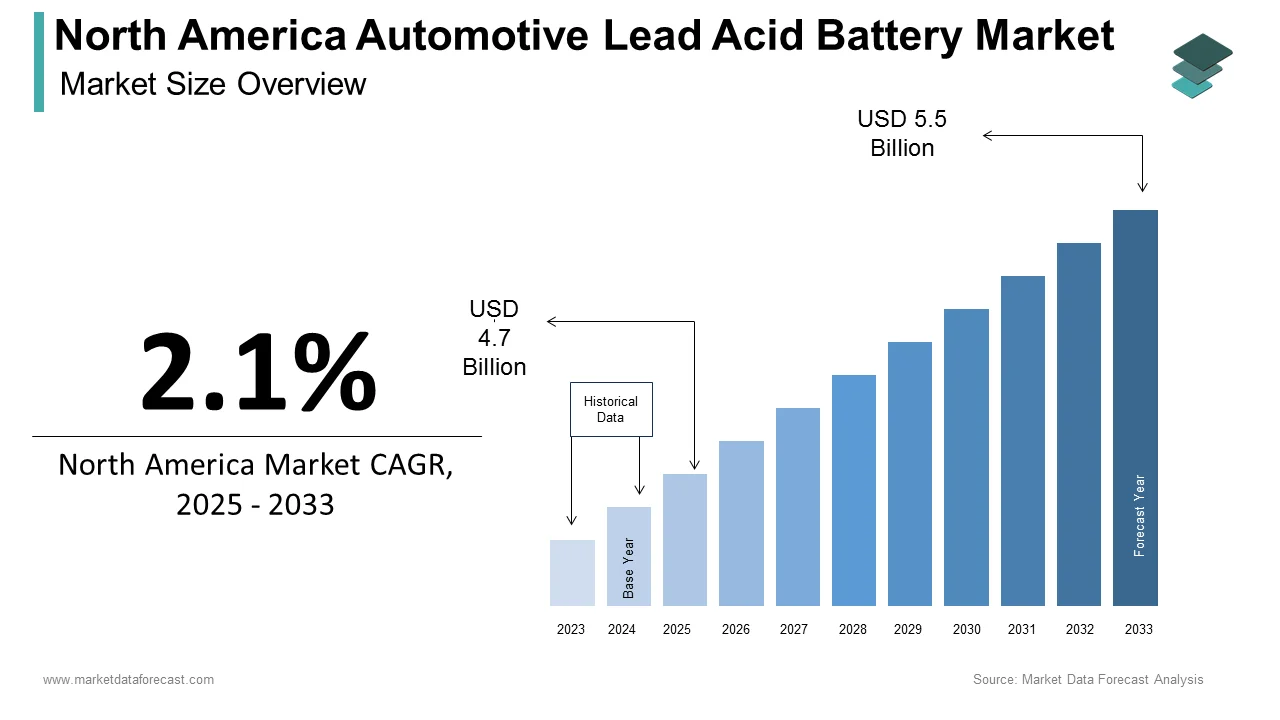

The size of the North American automotive lead acid battery market was valued at USD 4.6 billion in 2024. This market is expected to grow at a CAGR of 2.1% from 2025 to 2033 and be worth USD 5.55 billion by 2033 from USD 4.7 billion in 2025.

The North America automotive lead acid battery market is defined by the extensive utilization of lead acid batteries across various vehicle types, including passenger cars, commercial vehicles, and motorcycles. Renowned for their reliability, cost-effectiveness, and ability to deliver high surge currents, lead acid batteries are particularly well-suited for starting, lighting, and ignition (SLI) applications. This growth trajectory is primarily driven by the increasing production and sales of vehicles, alongside the rising demand for electric and hybrid vehicles that utilize lead acid batteries for auxiliary power. As per market insights, the North America automotive lead acid battery market is poised for continued expansion, with manufacturers focusing on technological advancements, such as enhanced battery performance and recycling initiatives, to meet evolving consumer and regulatory demands. The market is also benefiting from the growing trend of sustainability, as lead acid batteries are highly recyclable, contributing to a circular economy within the automotive sector.

MARKET DRIVERS

Increasing Vehicle Production and Sales

The North America automotive lead acid battery market is largely driven by the increasing vehicle production and sales across the region. As the automotive industry continues to recover from the impacts of the COVID-19 pandemic, vehicle manufacturers are ramping up production to meet the growing consumer demand for personal and commercial vehicles. According to the Automotive Industry Association, U.S. light vehicle sales are projected to reach approximately 17 million units by 2025 is illustrating a steady growth trajectory. This surge in vehicle production directly correlates with the demand for lead acid batteries, which are essential for starting, lighting, and ignition (SLI) functions in conventional vehicles. Besides, the rising popularity of electric and hybrid vehicles, which often utilize lead acid batteries for auxiliary power, further contributes to the demand for lead acid batteries in the automotive sector. The reliability and cost-effectiveness of lead acid batteries make them a preferred choice for manufacturers, ensuring their continued relevance in the evolving automotive landscape.

Growth of Electric and Hybrid Vehicles

The growth of electric and hybrid vehicles also drives the growth of the North America automotive lead acid battery market. As consumers increasingly seek environmentally friendly transportation options, the demand for electric and hybrid vehicles has surged. As per the International Energy Agency, the number of electric vehicles on the road in the United States is expected to reach 18 million by 2030 is indicating a robust growth trajectory. Lead acid batteries play a crucial role in these vehicles, providing reliable power for auxiliary functions such as lighting, infotainment systems, and climate control. Additionally, lead acid batteries are often used in hybrid vehicles to support the main battery system, enhancing overall vehicle performance and efficiency. The versatility and affordability of lead acid batteries make them an attractive option for manufacturers looking to balance performance and cost in electric and hybrid vehicle applications.

MARKET RESTRAINTS

Competition from Alternative Battery Technologies

Increasing competition from alternative battery technologies, particularly lithium-ion batteries is among the primary restraints affecting the North America automotive lead acid battery market.As the automotive industry shifts towards electrification, lithium-ion batteries have gained prominence due to their higher energy density, lighter weight, and longer lifespan compared to lead acid batteries. In line with a report by BloombergNEF, the cost of lithium-ion batteries has decreased by approximately 89% since 2010 is making them more accessible for electric vehicle manufacturers. This trend poses a challenge for lead acid battery manufacturers, as automakers increasingly opt for lithium-ion solutions for their electric and hybrid vehicles. Additionally, the growing interest in advanced battery technologies, such as solid-state batteries and fuel cells, further intensifies competition in the market. As a result, lead acid battery manufacturers must innovate and adapt to maintain their market share, which may require significant investment in research and development.

Regulatory Challenges and Environmental Concerns

Regulatory challenges and environmental concerns associated with lead acid battery production and disposal is another significant restraint in the North America automotive lead acid battery market. The presence of lead, a toxic heavy metal, in lead acid batteries raises environmental and health concerns, leading to stringent regulations governing their manufacturing, recycling, and disposal. The U.S. Environmental Protection Agency states that improper disposal of lead acid batteries can result in soil and water contamination, prompting regulatory bodies to enforce strict guidelines to mitigate these risks. Compliance with these regulations can impose additional costs on manufacturers, potentially impacting profitability. Furthermore, the increasing focus on sustainability and the transition towards greener technologies may lead to further scrutiny of lead acid batteries, as consumers and regulators seek safer and more environmentally friendly alternatives.

MARKET OPPORTUNITIES

Expansion of Recycling Initiatives

The North America automotive lead acid battery market presents significant opportunities for growth through the expansion of recycling initiatives. Lead acid batteries are highly recyclable, with approximately 97% of their components being recoverable, making them one of the most recycled consumer products in the world. According to the Battery Council International, over 90% of lead acid batteries are recycled in the United States, highlighting the industry's commitment to sustainability. As consumers and regulatory bodies increasingly prioritize environmental responsibility, the demand for recycling programs and sustainable practices is on the rise. This trend is driving manufacturers to invest in advanced recycling technologies and processes that enhance the efficiency of lead recovery and minimize environmental impact.

Growth in Aftermarket Services

A major opportunity in the North America automotive lead acid battery market lies in the expansion of aftermarket services. As the automotive industry evolves, there is an increasing demand for maintenance and replacement services for lead acid batteries, particularly as vehicles age and require battery replacements. The industry estimates indicate that the aftermarket for automotive batteries is projected to reach $10 billion by 2025 is reflecting a growing trend in vehicle maintenance and care. This trend presents an opportunity for lead acid battery manufacturers and distributors to expand their service offerings, including installation, recycling, and warranty programs. Also, the rise of e-commerce and online retail has facilitated the growth of aftermarket services, allowing consumers to easily access replacement batteries and related services.

MARKET CHALLENGES

Supply Chain Disruptions

Potential for supply chain disruptions is a grave challenge for the North America automotive lead acid battery market. The production of lead acid batteries relies on key materials such as lead and sulfuric acid, which can be affected by fluctuations in supply and demand. According to industry reports, disruptions in the supply chain, particularly during adverse weather conditions or global events like the COVID-19 pandemic, have led to increased prices and shortages of essential materials. This situation poses a challenge for manufacturers who must ensure a consistent supply of high-quality materials to meet consumer demand. Moreover, the sourcing of materials can be impacted by ethical and sustainability concerns, leading some consumers to seek alternatives. As the market shifts towards sustainable and health-conscious options, manufacturers may face challenges in sourcing suitable substitutes that meet consumer expectations for quality and performance.

Competition from Alternative Battery Technologies

Another challenge in the North America automotive lead acid battery market is the increasing competition from alternative battery technologies. The rise of health-conscious consumers has led to a surge in demand for various natural and plant-based alternatives, which can pose a challenge to the adoption of lead acid batteries. This trend is particularly pronounced among consumers who are increasingly seeking energy storage solutions that align with their values of sustainability and efficiency. As a result, lead acid battery manufacturers must compete not only with other lead acid brands but also with a wide array of alternative battery technologies that cater to evolving consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Vehicle Type, Product, Type, Customer Segment, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Johnson Controls, Exide Technologies, East Penn Manufacturing, EnerSys, GS Yuasa Corporation, and Others. |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The passenger car segment in 2024 emerged as the largest category by commanding a market share of 55.2%. This rule can be supported by the extensive use of lead acid batteries in passenger vehicles for starting, lighting, and ignition (SLI) applications. The reliability and cost-effectiveness of lead acid batteries make them a preferred choice for automakers, ensuring their continued relevance in the automotive landscape. Additionally, the growing trend of electric and hybrid vehicles, which often utilize lead acid batteries for auxiliary power, further contributes to the demand for lead acid batteries in passenger cars.

Conversely, the commercial vehicle segment is experiencing rapid growth, with a projected CAGR of 5.5% over the forecast years. This segment's growth can be attributed to the increasing demand for commercial vehicles in various industries, including logistics, construction, and transportation. As per the American Trucking Association, the U.S. trucking industry is projected to grow significantly, with freight volumes expected to increase by 3.4% annually through 2025. Lead acid batteries play a crucial role in commercial vehicles, providing reliable power for starting engines and supporting various electrical systems. The durability and robustness of lead acid batteries make them well-suited for the demanding conditions faced by commercial vehicles. Besides, the rise of e-commerce and the increasing need for efficient logistics solutions have further propelled the demand for commercial vehicles and thereby driving the need for lead acid batteries.

By Product Insights

The starting, lighting, and ignition (SLI) batteries represented the dominant portion of the North America automotive lead acid battery market and captured 70.8% of the market share in 2024. This influence is mainly due to the extensive use of SLI batteries in conventional vehicles for starting engines and powering electrical systems. The reliability and performance of SLI batteries make them a preferred choice for automakers, ensuring their continued relevance in the automotive landscape. Further, the growing trend of electric and hybrid vehicles, which often utilize SLI batteries for auxiliary power, further contributes to the demand for lead acid batteries in this segment.

On the other hand, the micro hybrid battery segment is witnessing swift growth, with a calculated CAGR of 6.1% in the future. This segment's growth can be attributed to the increasing adoption of micro hybrid vehicles, which utilize lead acid batteries for start-stop systems that enhance fuel efficiency and reduce emissions. The market insights reveal that the demand for micro hybrid vehicles is on the rise, driven by the growing focus on sustainability and regulatory pressures to reduce carbon emissions. Micro hybrid batteries are designed to support the start-stop functionality, allowing the engine to turn off when the vehicle is stationary and restart when the driver accelerates, thereby improving fuel efficiency by up to 10%. This technology is becoming increasingly popular among automakers as they seek to meet stringent emissions regulations while providing consumers with cost-effective solutions. Apart from this, the versatility of lead acid batteries makes them suitable for micro hybrid applications, as they can deliver the necessary power for engine restarts and support various electrical systems.

By Type Insights

The flooded batteries segment of the North America automotive lead acid battery market secured the largest position by contributing a market share of 65.7% in 2024. This can be attached to the widespread use of flooded batteries in various automotive applications, particularly in conventional vehicles. Flooded batteries are favored for their robust performance, ease of maintenance, and affordability, making them a popular choice among consumers and manufacturers alike. Also, the growing trend of vehicle electrification and the increasing focus on battery recycling have further propelled the demand for flooded batteries, as they are easily recyclable and have an well-established infrastructure for disposal.

Conversely, the enhanced flooded battery (EFB) segment is having rapid rise, with a estimated CAGR of 6.5% in the coming years owing to the increasing adoption of EFB technology in vehicles equipped with start-stop systems, which require batteries that can withstand frequent cycling and provide reliable performance. According to market insights, the demand for EFBs is on the rise, driven by the growing trend of micro hybrid vehicles and the need for improved fuel efficiency. Enhanced flooded batteries are designed to deliver higher power output and greater durability compared to traditional flooded batteries, making them well-suited for modern automotive applications. Moreover, the rise of electric and hybrid vehicles has further propelled the demand for EFBs, as they provide a cost-effective solution for auxiliary power needs.

By Customer Segment Insights

The original equipment manufacturer (OEM) segment prevailed in the North America automotive lead acid battery market by possessing a market share of 75.1% in 2024. This is because of the extensive use of lead acid batteries in new vehicle production, where manufacturers rely on these batteries for SLI applications. The reliability and cost-effectiveness of lead acid batteries make them a preferred choice for automakers, ensuring their continued relevance in the automotive landscape. Also, the growing trend of electric and hybrid vehicles, which often utilize lead acid batteries for auxiliary power, further contributes to the demand for lead acid batteries in the OEM segment.

Whereas, the replacement segment is developing quickly, with a projected CAGR of 5.7% over the forecast years. This progression can be linked to the increasing need for battery replacements as vehicles age and require maintenance. Based on the industry estimates, the average lifespan of a lead acid battery is approximately three to five years, leading to a consistent demand for replacement batteries in the automotive market. The rise of e-commerce and online retail has further facilitated the growth of the replacement segment, allowing consumers to easily access replacement batteries and related services. Besides, the increasing focus on vehicle maintenance and care has prompted consumers to invest in high-quality replacement batteries that ensure optimal performance.

REGIONAL ANALYSIS

The United States stood out as the leading country by accounting a market share of 73.8% in 2024. The U.S. market is characterized by a robust demand for lead acid batteries, driven by the increasing vehicle production and sales across the region. According to the Automotive Industry Association, U.S. light vehicle sales are projected to reach approximately 17 million units by 2025 is signifying a steady growth trajectory. This surge in vehicle production directly correlates with the demand for lead acid batteries, which are essential for starting, lighting, and ignition functions in conventional vehicles. Additionally, the rising popularity of electric and hybrid vehicles, which often utilize lead acid batteries for auxiliary power, further contributes to the demand for lead acid batteries in the U.S. market. The reliability and cost-effectiveness of lead acid batteries make them a preferred choice for manufacturers, ensuring their continued relevance in the evolving automotive landscape.

Canada demonstrates the most accelerated progression in the market for automotive lead acid batteries in North America, with a projected CAGR of 5.9% over the assessment period. The Canadian market is experiencing a similar trend to that of the U.S., with an increasing number of consumers seeking reliable battery solutions for their vehicles. The Canadian market is also witnessing a growing interest in sustainable battery solutions, reflecting the broader trend towards environmentally friendly practices in the automotive sector. As consumers become more aware of the importance of battery quality and performance, manufacturers are responding by introducing innovative products that cater to these demands. The expansion of retail channels including online shopping is further enhancing the accessibility of automotive lead acid batteries across Canada.

The Rest of North America shows steady rise in the North American automotive lead acid battery market. While this segment is smaller compared to the U.S. and Canada, it presents unique growth opportunities. In Mexico, the awareness of lead acid battery products is gradually increasing, particularly among consumers who are influenced by trends from the U.S. The growing trend of vehicle ownership and the incorporation of lead acid batteries into traditional vehicles are contributing to the market's expansion. Moreover, the increasing availability of imported lead acid battery products from the U.S. is enhancing consumer access to a wider variety of options. As the market matures, manufacturers have the opportunity to introduce localized products that resonate with regional needs, further driving growth in the Rest of North America. The increasing focus on vehicle maintenance and care among consumers in these regions is also expected to bolster the demand for automotive lead acid batteries.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America automotive lead acid battery market profiled in this report are Johnson Controls, Exide Technologies, East Penn Manufacturing, EnerSys, GS Yuasa Corporation, and Others.

The North America automotive lead acid battery market is characterized by the presence of several key players who dominate the landscape. Notable companies include Johnson Controls, which is recognized for its extensive range of automotive batteries, and Exide Technologies, a leading provider of stored energy solutions that has established a strong foothold in the lead acid battery segment. These companies leverage their extensive distribution networks and brand recognition to capture a significant share of the market. Additionally, smaller, niche players are emerging, focusing on innovative formulations and technology-driven products, such as enhanced flooded batteries and micro hybrid batteries. The competitive landscape is further intensified by the growing trend of e-commerce, as brands increasingly adopt online sales strategies to reach a broader audience. As consumer preferences continue to evolve, key players are investing in product innovation, marketing strategies, and sustainability initiatives to strengthen their market position and appeal to environmentally conscious consumers.

MAJOR STRATEGIES USED BY KEY PLAYERS

Key players in the North America automotive lead acid battery market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is product innovation, where companies continuously develop new formulations and applications for lead acid batteries to cater to changing consumer preferences. For instance, introducing enhanced flooded batteries and micro hybrid batteries has become a popular tactic to attract automakers looking for efficient power solutions. Additionally, many manufacturers are focusing on sustainability initiatives, such as reducing lead waste and improving recycling processes, to appeal to environmentally aware consumers.

Another strategy involves expanding distribution channels, particularly through e-commerce platforms, to enhance product accessibility. Companies are increasingly partnering with online retailers to reach a wider audience and capitalize on the growing trend of online shopping. Furthermore, marketing campaigns that emphasize the reliability and performance of lead acid batteries in various automotive applications are being utilized to engage consumers and drive brand loyalty. Collaborations with automotive manufacturers and industry influencers are also becoming common practices to create buzz around new product launches.

COMPETITION OVERVIEW

The North America automotive lead acid battery market is characterized by a competitive landscape that includes both established brands and emerging players. Major companies such as Johnson Controls, Exide Technologies, and East Penn Manufacturing dominate the market, leveraging their extensive distribution networks and brand recognition to capture significant market shares. These companies invest heavily in product innovation, focusing on new formulations and applications to meet the evolving preferences of consumers and automakers. Additionally, the rise of niche brands specializing in enhanced and micro hybrid batteries has intensified competition, as these companies cater to a growing demographic seeking advanced battery solutions. The increasing trend of e-commerce has further transformed the competitive landscape, with brands adopting online sales strategies to reach a broader audience. As consumer preferences continue to shift towards unique and efficient products, competition is expected to intensify, prompting manufacturers to differentiate themselves through quality, performance, and innovative marketing strategies

RECENT ACTIONS BY KEY PLAYERS

- In January 2023, Johnson Controls launched a new line of enhanced flooded batteries, expanding its product portfolio to cater to the growing demand for efficient power solutions. This initiative aims to enhance consumer accessibility to advanced battery technologies.

- In March 2023, Exide Technologies introduced a fortified lead acid battery product line, targeting the increasing interest in high-performance batteries among consumers.

- In May 2023, East Penn Manufacturing announced a partnership with a popular automotive influencer to promote its lead acid battery products through social media campaigns, aimed at increasing brand awareness and consumer engagement.

- In July 2023, Johnson Controls expanded its distribution network by partnering with major automotive retailers across North America, enhancing the availability of its lead acid battery products to a wider audience.

- In September 2023, Exide Technologies launched a marketing campaign focused on educating consumers about the benefits of lead acid batteries in various automotive applications, aiming to increase brand loyalty and consumer engagement.

- In November 2023, East Penn Manufacturing participated in a major automotive expo, showcasing its lead acid battery products and engaging with industry professionals to promote brand awareness.

- In January 2024, Johnson Controls introduced a new line of eco-friendly lead acid batteries, capitalizing on the growing trend of sustainability among consumers.

- In March 2024, Exide Technologies announced the launch of a lead acid battery subscription service, allowing consumers to receive regular shipments of their favorite products, thereby enhancing customer convenience and loyalty.

- In April 2024, East Penn Manufacturing collaborated with a renowned automotive expert to create a series of educational materials on the importance of battery maintenance, leveraging social media to reach a broader audience.

- In June 2024, Johnson Controls launched a limited-edition seasonal promotion for lead acid batteries, aiming to attract consumers looking for unique and value-driven options during the summer driving season.

MARKET SEGMENTATION

This research report on the North American automotive lead acid battery market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two Wheelers

- HEV Cars

By Product

- SLI Batteries

- Micro Hybrid Batteries

By Type

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

By Customer Segment

- OEM

- Replacement

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth of the North America Automotive Lead Acid Battery Market?

The North America Automotive Lead Acid Battery Market is expected to grow steadily, driven by increasing vehicle production and demand for reliable energy storage solutions.

2. Which factors are influencing the North America Automotive Lead Acid Battery Market?

The North America Automotive Lead Acid Battery Market is influenced by rising vehicle sales, advancements in battery technology, and government regulations promoting energy-efficient solutions.

3. What are the key challenges in the North America Automotive Lead Acid Battery Market?

The North America Automotive Lead Acid Battery Market faces challenges such as competition from lithium-ion batteries, environmental concerns, and fluctuating raw material prices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]