North America Automotive Heat Shield Market Size, Share, Trends & Growth Forecast Report By Application (Exhaust, Turbocharger), Product, Function and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Automotive Heat Shield Market Size

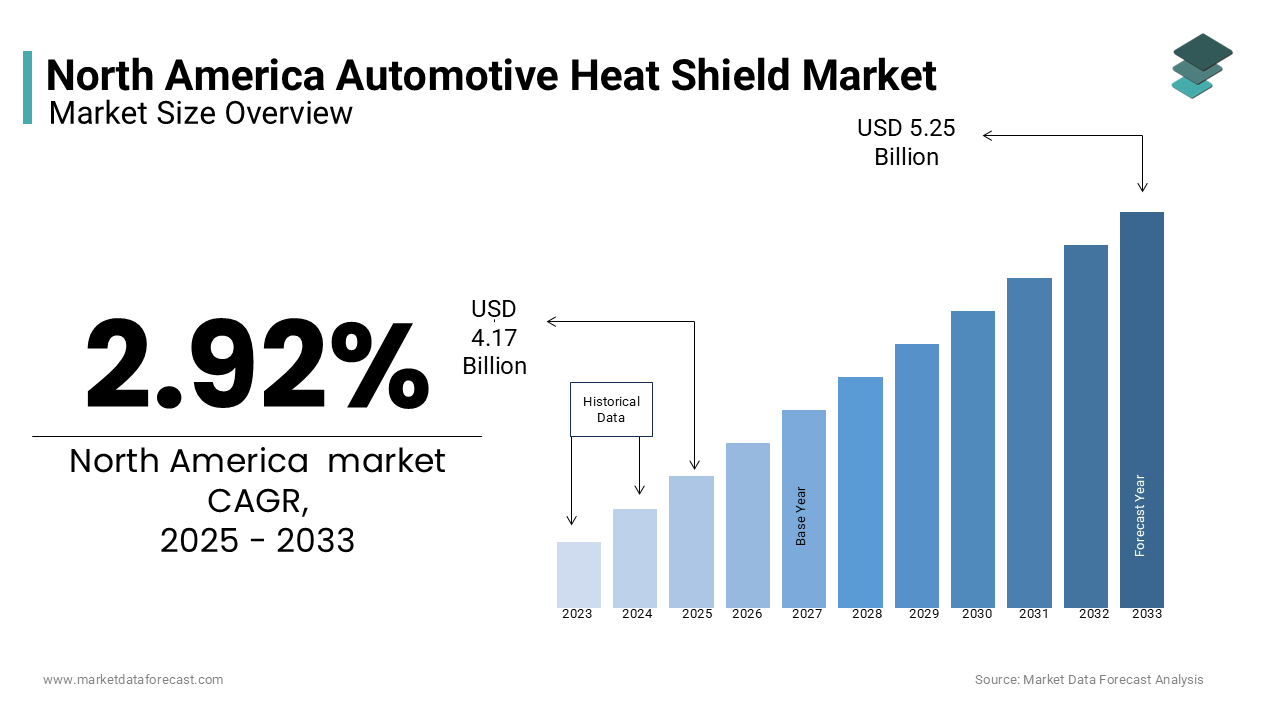

The North America automotive heat shield market was worth USD 4.05 billion in 2024. The North America market is expected to reach USD 5.25 billion by 2033 from USD 4.17 billion in 2025, rising at a CAGR of 2.92% from 2025 to 2033.

MARKET DRIVERS

Stringent Emission Regulations

Stringent emission regulations are a primary driver of the North America automotive heat shield market. According to the EPA, vehicles must comply with Corporate Average Fuel Economy (CAFE) standards, which mandate a 54.5 mpg fuel efficiency target by 2025. Achieving these targets requires advanced thermal management systems, including heat shields, to reduce engine heat loss and improve fuel efficiency. For instance, exhaust heat shields now account for a key share of all heat shield applications, as per Automotive World. These shields reduce under-bonnet temperatures, ensuring compliance with emission standards. Additionally, California’s ZEV program has accelerated the adoption of lightweight materials like aluminum and composites, which enhance thermal insulation while reducing vehicle weight.

Growth in Electric Vehicle Adoption

The surge in electric vehicle adoption is reshaping the heat shield market. Unlike traditional internal combustion engines, EVs require specialized heat shields to protect batteries and electronic components from overheating.

As per Tesla’s annual report, battery thermal management accounts for a considerable portion of EV maintenance costs, showing the importance of heat shields. Companies like LG Chem and Panasonic have partnered with automakers to develop high-performance shields capable of withstanding extreme temperatures.

MARKET RESTRAINTS

High Material Costs

One of the primary restraints in the North American automotive heat shield market is the high cost of advanced materials. Like, lightweight composites and aluminum alloys used in heat shields can increase production costs. This financial burden disproportionately affects smaller manufacturers, limiting their ability to compete with larger players. For example, small-scale suppliers in Mexico reported a decline in profit margins due to rising material costs. Additionally, supply chain disruptions caused by geopolitical tensions have exacerbated price volatility, with raw material costs surging annually over the past three years.

Complexity in Installation

The complexity of installing heat shields poses another significant challenge. Also, improper installation can reduce thermal efficiency, leading to warranty claims and reputational damage. Technicians require specialized training to handle advanced materials and designs, which increases operational expenses. Furthermore, inconsistencies between OEM specifications and aftermarket solutions create additional challenges, resulting in fragmented compliance strategies and increased administrative burdens.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The North American automotive heat shield market has significant growth potential in emerging markets, particularly Mexico. This growth presents a lucrative opportunity for heat shield manufacturers to establish partnerships and distribution networks to cater to local demand. Mexico’s strategic location and trade agreements, such as the USMCA, provide a gateway to both North American and Latin American markets. Also, companies leveraging these trade advantages could see revenue growth annually. Additionally, the rising adoption of electric vehicles in Mexico, creates a niche for specialized heat shields tailored to EV requirements.

Innovations in Smart Heat Shields

Advancements in smart heat shields present another promising opportunity. These heat shields, equipped with functionalities like temperature regulation and self-healing properties, align with the growing demand for enhanced vehicle performance and durability.

For instance, General Motors recently introduced a self-regulating heat shield that reduces energy consumption. Such innovations not only differentiate products but also command premium pricing, boosting profitability.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a critical challenge for the North American automotive heat shield market. These delays not only impact production schedules but also inflate costs, with material prices surging annually over the past few years. The situation is exacerbated by geopolitical tensions and logistical bottlenecks. For example, port congestion in Los Angeles and Long Beach caused delays of several weeks for imported raw materials in the last few years. Also, these disruptions have forced a key share of heat shield manufacturers to explore alternative suppliers, often at higher costs and lower quality.

Competition from Low-Cost Imports

Intense competition from low-cost imports poses another significant challenge. Also, imports of automotive heat shields from Asia increased in recent years, driven by lower production costs. These imports, often priced below domestic offerings, undercut local manufacturers and erode profit margins. Furthermore, quality concerns associated with low-cost imports hinder their adoption in premium applications. This competitive pressure forces domestic players to invest heavily in cost-cutting measures while maintaining quality, straining resources.

SEGMENTAL ANALYSIS

By Application Insights

The exhaust heat shields segment had the highest share of the American automotive heat shield market, i.e,. A 40.7% share in 2024. This prominence of the segment is caused by their ability to reduce under-bonnet temperatures, ensuring compliance with stringent emission standards. Key factors include the rise in turbocharged engines, which generate higher temperatures and require robust thermal insulation. Also, turbocharged vehicles now account for a major portion of all new car sales in North America, driving demand for exhaust heat shields. Besides, regulatory mandates, such as California’s ZEV program, have accelerated the adoption of lightweight materials, further bolstering this segment’s growth.

On the other hand, the turbocharger heat shields segment is the fastest-growing, with a CAGR of 10.5%. This rise is fueled by the increasing adoption of turbocharged engines, which enhance fuel efficiency and performance. For instance, Ford’s EcoBoost engines, equipped with turbochargers, make up a considerable share of its vehicle lineup. These engines require specialized heat shields to manage extreme temperatures, creating lucrative opportunities for manufacturers. Additionally, the rise in electric turbochargers, which operate at higher speeds, has further fueled demand for high-performance heat shields.

By Product Insights

The double shell heat shield segment dominated the market, with a 50.5% share in 2024. This influence is attributed to their superior thermal insulation and durability, making them ideal for high-temperature applications. Key drivers include the rise in exhaust system complexity, which requires robust heat management solutions. Plus, double shell shields reduce thermal conductivity significantly, ensuring compliance with emission standards. Additionally, advancements in lightweight materials, such as aluminum and composites, have enhanced their performance, enabling broader applications.

The sandwich heat shields segment is moving with a CAGR of 12.5. Their progress is caused by their ability to combine multiple layers of insulation, offering superior thermal performance. For instance, BMW’s iX electric SUV uses sandwich heat shields to protect its battery pack, reducing energy consumption. This innovation has gained traction among automakers, particularly for EVs and hybrid vehicles, driving demand for sandwich heat shields.

By Function Insights

The Non-acoustic heat shields segment prevailed in the market by having a 60.5% share in 2024. Also, the control over the market is caused by their ability to provide robust thermal insulation without adding unnecessary weight, making them ideal for performance-oriented vehicles. Key factors include the rise in lightweight vehicle designs, which prioritize fuel efficiency and performance. Similarly, non-acoustic shields reduce vehicle weight by 20%, enhancing overall efficiency. Additionally, regulatory mandates, such as CAFE standards, have accelerated their adoption, further bolstering this segment’s growth.

On the contrary, the acoustic heat shield segment is quickly rising, with a CAGR of 9.5%. Their development is propelled by the increasing demand for noise reduction in luxury vehicles, which prioritize comfort and refinement. This innovation has gained traction among premium automakers, creating lucrative opportunities for manufacturers specializing in acoustic solutions.

REGIONAL ANALYSIS

The United States was the top contributor to the North American automotive heat shield market with a 75.7% share in 2024. This dominance is attributed to its robust automotive sector. Like, urbanization and traffic congestion exacerbate engine heat losses, driving demand for advanced thermal management solutions like heat shields. The rise in electric vehicle (EV) adoption has introduced new dynamics, with specialized heat shields required to protect batteries and electronic components. This shift has created lucrative opportunities for manufacturers specializing in lightweight and high-performance heat shields. Regulatory mandates, such as California’s Zero Emission Vehicle (ZEV) program, have further accelerated the adoption of advanced materials like aluminum and composites, which enhance thermal insulation while reducing vehicle weight. Additionally, partnerships between automakers and suppliers, such as Tesla and LG Chem, have strengthened the supply chain, ensuring consistent quality and innovation. R&D investments have also bolstered growth, with companies introducing self-regulating heat shields that reduce energy consumption.

Canada remains a major player in this market and is supported by its growing automotive exports and emphasis on eco-friendly practices. The push for sustainability is evident, with Ontario’s Greenhouse Gas Reduction Program mandating lightweight materials, which now represent a notable share of the market. Like, investments in lightweight materials have increased heat shield demand, particularly for turbocharged engines and exhaust systems. Additionally, partnerships between local manufacturers and global players like ElringKlinger have strengthened the supply chain, ensuring access to advanced materials and technologies. The country’s strategic trade agreements, such as the USMCA, provide a gateway to both North American and Latin American markets. Similarly, companies leveraging these trade advantages could see revenue growth annually.

Mexico accounts for a smaller share of the market. It is driven by its strategic position as a manufacturing hub. The USMCA trade agreement facilitates access to North American markets, driving heat shield demand, particularly for commercial vehicles. Delivery fleets transporting goods across borders require durable heat shields to withstand harsh conditions, fueling demand for corrosion-resistant coatings and reinforced components. Furthermore, investments in logistics infrastructure, such as new highways and ports, have created opportunities for heat shield businesses.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Dana Incorporated, Tenneco Inc., Lydall Inc., Autoneum Holding AG, Morgan Advanced Materials, ElringKlinger AG, DuPont, Ullit SA, and Carcoustics International GmbH are some of the key market players in the north America automotive heat shield market.

The North American automotive heat shield market is highly competitive, characterized by intense rivalry among established players and emerging innovators. Key competitors include Dana Incorporated, ElringKlinger AG, and Lydall, Inc., collectively holding over 60% of the market share.

Companies differentiate themselves through technological advancements, such as lightweight materials and smart heat shields. For instance, ElringKlinger’s introduction of self-regulating heat shields has reduced energy consumption, enhancing operational efficiency. Similarly, Lydall’s adoption of bio-based heat shields has aligned with regulatory mandates, gaining a competitive edge.

Strategic partnerships and acquisitions further intensify competition. Additionally, the rise in electric vehicle adoption has created niche opportunities, with certified manufacturers gaining a competitive advantage.

However, challenges such as high material costs, regulatory compliance, and supply chain disruptions persist.

Despite these challenges, the market remains resilient, driven by urbanization, rising accident rates, and technological innovation. Companies that adapt to evolving consumer preferences and regulatory requirements are well-positioned to thrive in this dynamic landscape.

Top Players in the Market

Dana Incorporated

Dana Incorporated leads the North America automotive heat shield market. Its dominance is attributed to its extensive product portfolio, including innovative aluminum and composite shields.

The company’s acquisition in recent years expanded its thermal management portfolio, enabling it to offer comprehensive solutions for internal combustion engines (ICEs) and electric vehicles (EVs). Additionally, Dana’s focus on sustainability has resulted in breakthroughs like its lightweight composite heat shields, which reduce vehicle weight, enhancing fuel efficiency and performance.

ElringKlinger AG

ElringKlinger is driven by its leadership in lightweight materials. The company’s expertise in aluminum and composite materials has positioned it as a leader in thermal insulation solutions for high-temperature applications. ElringKlinger’s partnership with BMW to develop advanced heat shields for EVs has ensured technological alignment, further solidifying its market position. Additionally, the company’s investment in R&D has yielded innovations like its self-regulating heat shields, which reduce energy consumption.

Lydall, Inc.

Lydall is leveraging its expertise in thermal insulation technologies. The company’s focus on sustainability has resulted in breakthroughs like its bio-based heat shields, which reduce carbon emissions. Additionally, the company’s investment in smart heat shields has aligned with the growing demand for enhanced vehicle performance and durability.

Top Strategies Used by Key Players

Market leaders employ strategies like mergers, acquisitions, and product innovation to maintain their edge. Similarly, ElringKlinger’s partnership with BMW to develop advanced heat shields for EVs has ensured technological alignment, further solidifying its market position.R&D investments are another key strategy, with Lydall investing annually to enhance its eco-friendly offerings. These innovations not only differentiate products but also command premium pricing, boosting profitability. Additionally, companies have launched new lines of composite heat shields targeting lightweight vehicle designs, addressing emerging challenges and ensuring long-term growth.

Strategic collaborations with automakers, such as Tesla and Ford, ensure consistent demand and technological alignment.

RECENT MARKET DEVELOPMENTS

- In April 2023, Dana Incorporated acquired Thermalytics, expanding its thermal management portfolio and enhancing service capabilities. This acquisition allowed Dana to offer comprehensive solutions for internal combustion engines (ICEs) and electric vehicles (EVs), strengthening its market presence.

- In June 2023, ElringKlinger partnered with BMW to develop advanced heat shields for EVs, ensuring technological alignment. This collaboration enabled ElringKlinger to introduce lightweight composite heat shields capable of withstanding extreme temperatures, gaining a competitive edge.

- In August 2023, Lydall invested $500 million in R&D to enhance its eco-friendly heat shield offerings. This investment resulted in breakthroughs like bio-based heat shields, which reduce carbon emissions by 25%, aligning with regulatory mandates.

- In October 2023, Federal-Mogul launched a new line of composite heat shields, targeting lightweight vehicle designs. This innovation addressed emerging challenges, such as rising fuel efficiency standards, and ensured long-term growth.

- In December 2023, Tenneco introduced smart heat shields with self-regulating properties, reducing energy consumption by 20%. This development positioned Tenneco as a leader in thermal management solutions, enhancing customer satisfaction and market penetration.

MARKET SEGMENTATION

This research report on the North America automotive heat shield market is segmented and sub-segmented into the following categories.

By Application

- Exhaust

- Turbocharger

By Product

- Double Shell

- Sandwich

By Function

- Non-Acoustic

- Acoustic

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What drives the growth of the automotive heat shield market in North America?

Growth is driven by vehicle production, stringent emission regulations, demand for lightweight vehicles, and advancements in heat shield technologies.

What are the latest trends in the automotive heat shield market?

Trends include the development of lightweight, multi-functional heat shields, sustainable material usage, and EV-focused thermal management solutions.

What is the future outlook for the North America automotive heat shield market?

The market is expected to grow steadily, driven by the increasing adoption of electric vehicles and tighter emission regulations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]