North America Automotive ECU Market Size, Share, Trends & Growth Forecast Report By Capacity Type (16-Bit,32-Bit, 64-Bit), Vehicle Type, Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Automotive ECU Market Size

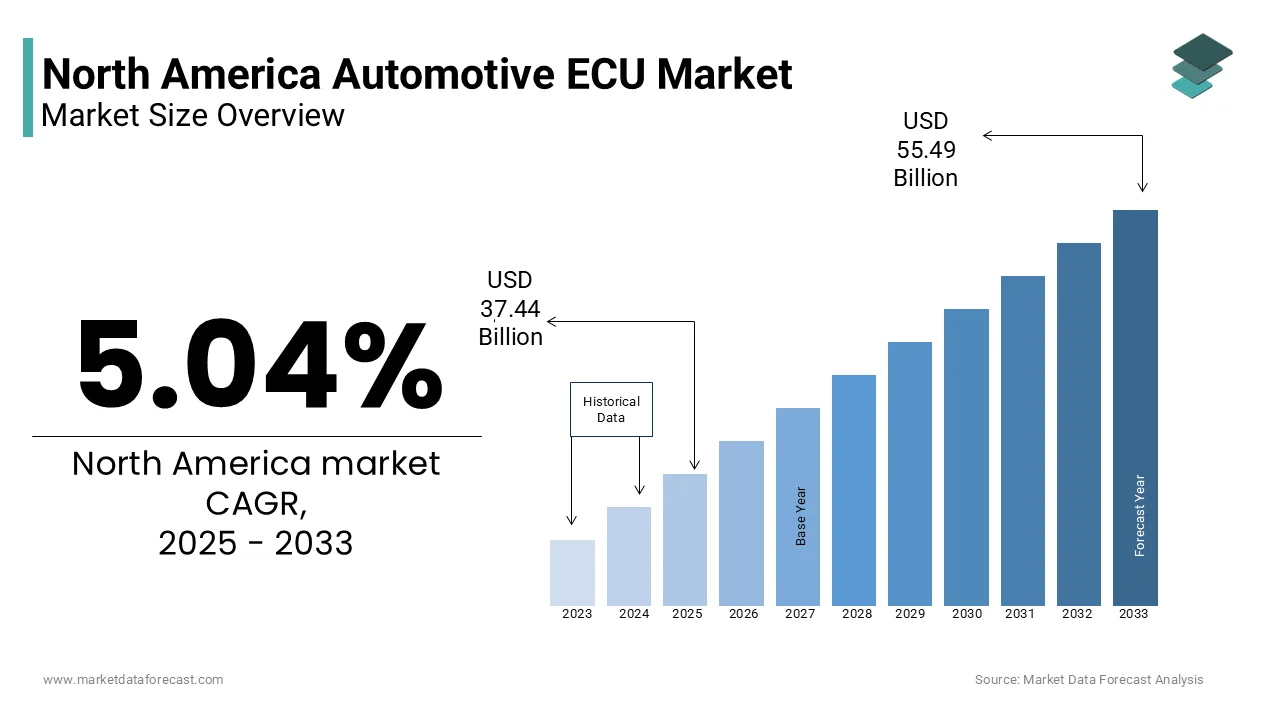

The Automotive ECU market size in North America was valued at USD 35.65 billion in 2024 and is predicted to be worth USD 55.49 billion by 2033 from USD 37.44 billion in 2025 and grow at a CAGR of 5.04% from 2025 to 2033.

MARKET DRIVERS

Rising Adoption of Advanced Driver-Assistance Systems (ADAS)

The proliferation of ADAS is a primary driver of the North America automotive ECU market. Studies show that a substantial percentage of new vehicles sold in the U.S. in 2023 featured ADAS functionalities, including adaptive cruise control, lane-keeping assistance, and collision avoidance systems. These systems rely heavily on ECUs to process real-time data from sensors and cameras, ensuring optimal vehicle performance. Likewise, vehicles equipped with ADAS experienced a significant reduction in accident rates, driving consumer demand for these features. Additionally, government mandates, such as the NHTSA’s requirement for automatic emergency braking in all new vehicles by 2029, have further propelled ECU adoption. The increasing complexity of ADAS systems necessitates high-capacity ECUs, particularly 32-bit and 64-bit processors. This shift exhibits how ADAS adoption acts as a pivotal driver, compelling automakers to integrate advanced ECUs into their designs.

Stringent Emission Regulations and Fuel Efficiency Standards

Stringent emission regulations and fuel efficiency standards are significant drivers of the automotive ECU market. Like, the U.S. aims to significantly reduce greenhouse gas emissions from vehicles by 2030, requiring automakers to adopt innovative technologies like engine control modules (ECMs) and transmission control units (TCUs). These ECUs optimize fuel combustion and reduce emissions, aligning with regulatory requirements. Also, vehicles equipped with ECMs achieved key improvement in fuel efficiency compared to traditional models. Furthermore, the growing popularity of hybrid and electric vehicles (EVs) has increased demand for powertrain ECUs, which manage battery systems and energy distribution. For example, Tesla’s Model 3 utilizes over 50 ECUs to regulate its powertrain and infotainment systems.

MARKET RESTRAINTS

Semiconductor Shortages and Supply Chain Disruptions

Semiconductor shortages and supply chain disruptions pose significant challenges to the North America automotive ECU market. Similarly, the global semiconductor shortage caused a considerable decline in vehicle production in 2022, with North America being one of the most affected regions. ECUs rely heavily on semiconductors, particularly microcontrollers, which are integral to their functionality. In addition, the shortage has led to production delays and increased costs, with automakers facing major price hikes for critical components. Additionally, geopolitical tensions and natural disasters have exacerbated supply chain vulnerabilities, forcing manufacturers to seek alternative suppliers or redesign existing systems. For instance, General Motors reported a loss in revenue due to production halts caused by semiconductor shortages in 2023. These disruptions not only hinder market growth but also create uncertainties for automakers striving to meet consumer demand for advanced vehicle features.

High Development Costs and Complexity

The high development costs and complexity associated with designing and integrating advanced ECUs act as significant restraints for the market. Likewise, developing a single ECU can substantially cost manufacturers depending on its functionality and capacity. This financial burden is particularly challenging for smaller automakers and Tier-2 suppliers, who lack the resources to compete with larger firms. Furthermore, the increasing complexity of ECUs and particularly those used in ADAS and powertrain systems, requires specialized expertise and rigorous testing, extending development timelines. Also, a notable portion of ECU-related projects face delays due to integration issues and software bugs. Additionally, the need for frequent firmware updates and cybersecurity measures adds to operational costs, making it difficult for manufacturers to achieve economies of scale.

MARKET OPPORTUNITIES

Growth in Electric and Hybrid Vehicles

The rapid growth of electric and hybrid vehicles presents a significant opportunity for the North America automotive ECU market. According to BloombergNEF, EV sales in the U.S. are projected to reach 7 million units annually by 2030 which is driven by government incentives and consumer demand for sustainable transportation. These vehicles require specialized ECUs to manage battery systems, regenerative braking, and energy distribution, creating a surge in demand for high-performance processors. For instance, Ford’s Mustang Mach-E utilizes over 40 ECUs to regulate its powertrain and infotainment systems. Apart from these, advancements in battery management systems (BMS) have increased the need for ECUs capable of real-time monitoring and optimization considerably reducing energy consumption. As automakers invest in electrification, the demand for advanced ECUs is expected to grow, offering lucrative opportunities for market players.

Integration of Artificial Intelligence and IoT Technologies

The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies into automotive ECUs offers transformative opportunities. AI-driven ECUs enable predictive maintenance, reducing vehicle downtime to a great extent. Besides, IoT-enabled ECUs facilitate real-time data sharing between vehicles and infrastructure enhancing traffic management and road safety. For example, General Motors’ OnStar system leverages IoT-connected ECUs to provide remote diagnostics and emergency response services, improving customer satisfaction. Furthermore, advancements in edge computing allow ECUs to process data locally, reducing latency and improving system reliability. As automakers prioritize connectivity and automation, AI and IoT integration are poised to become key growth drivers in the ECU market.

MARKET CHALLENGES

Cybersecurity Vulnerabilities

Cybersecurity vulnerabilities in automotive ECUs present a significant challenge to market growth. According to a report by Upstream Security, cyberattacks on connected vehicles increased substantially between 2018 and 2022, with ECUs being a primary target due to their role in controlling critical vehicle functions. These attacks can compromise safety systems, infotainment features, and even powertrain operations are posing risks to both manufacturers and consumers. For instance, a 2023 study by the Ponemon Institute revealed that notable percentage of automakers lack robust cybersecurity measures for their ECUs, leaving them susceptible to ransomware and data breaches. Additionally, regulatory bodies like the NHTSA are introducing stringent cybersecurity standards, requiring manufacturers to invest in secure hardware and software solutions.

Fragmented Regulatory Landscape

The fragmented regulatory landscape across North America complicates compliance for automotive ECU manufacturers. For example, California’s stricter emission standards necessitate additional ECU configurations, increasing development costs for automakers. Similarly, Canada’s Personal Information Protection and Electronic Documents Act (PIPEDA) imposes stricter data privacy requirements than U.S. federal laws, forcing manufacturers to navigate fragmented compliance frameworks. These discrepancies not only delay product launches but also increase operational complexities, hindering market expansion. Resolving these challenges requires harmonized regulations and proactive engagement with policymakers, which remain elusive in the current environment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.04% |

|

Segments Covered |

By Capacity Type, Vehicle Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Hitachi Astemo Americas, Lear Corporation, Panasonic Holdings Corporation, ZF Friedrichshafen AG, Delphi Technologies, and Hella KGaA Hueck & Co, and others |

SEGMENTAL ANALYSIS

By Capacity Type Insights

The 32-bit ECUs segment prevailed in the North America automotive ECU market by holding a 55.1% share in 2024. Their influence over the market is credited to versatility, balancing performance and cost-effectiveness for a wide range of applications. Also, these are widely used in ADAS, powertrain systems, and infotainment features, supporting their dominance. The U.S., with its advanced automotive infrastructure, accounts for a major portion of this type of ECU installations. Government mandates for ADAS functionalities further incentivize adoption, solidifying their leadership in the capacity type segment.

The 64-bit ECUs segment is projected to grow at a CAGR of 18.5% which is driven by advancements in autonomous driving and connectivity. Moreover, their growth is fueled by increasing investments in AI-driven systems, with Canada’s significant investment in connected car technologies boosting segment growth. Additionally, vehicles equipped with 64-bit ECUs achieved an improvement in system reliability. These factors position 64-bit ECUs as the fastest-growing capacity type segment.

By Vehicle Type Insights

The passenger cars segment represented the largest vehicle type segment by accounting for controlling market share in 2024. This dominance of the segment I caused by the widespread adoption of ECUs in passenger vehicles, particularly for ADAS and infotainment systems. According to the OICA, over 10 million passenger cars were produced in the U.S. in 2022, driving demand for ECUs. The U.S. has extensive network of automotive manufacturers and dominates this segment, with companies investing heavily in upgrading ECU functionalities. Government programs, such as tax incentives for EVs, further encourage adoption, reinforcing the segment’s leadership.

The commercial vehicles segment is the fastest-growing, with a CAGR of 16.2% in the coming years. This progress is fueled by the increasing demand for fleet management systems and emission control technologies. According to the American Trucking Associations, over 70% of freight in the U.S. is transported by trucks, showcasing the need for advanced ECUs. Specialized ECUs, featuring real-time diagnostics and predictive maintenance, are in high demand. Besides, government initiatives, like Canada’s substantial investment in green logistics, boost segment growth.

By Application Insights

The powertrain applications segment gained the maximum prominence in the North America automotive ECU market with 40.5% share in 2024. This leading position is credited to the critical role of powertrain ECUs in optimizing fuel efficiency and reducing emissions. Like, vehicles equipped with powertrain ECUs achieved a notable improvement in fuel economy, driving their adoption. The U.S., with its stringent emission regulations, makes up a significant share of powertrain ECU installations. Government mandates for emission control technologies further incentivize adoption, solidifying their leadership in the application segment.

The ADAS & safety systems segment is having swiftest expansion, with a CAGR of 20.3% in the future. This progress is caused by rising consumer demand for safety features and government mandates for ADAS functionalities. Moreover, vehicles equipped with ADAS experienced a reduction in accident rates, increasing adoption rates. Additionally, advancements in AI and IoT technologies have enhanced the capabilities of ADAS ECUs, improving system reliability. These factors position ADAS & safety systems as the most promising application segment.

REGIONAL ANALYSIS

The United States dominated the North America automotive ECU market by commanding a 85.5% share in2024. This is supported by the country’s robust automotive manufacturing infrastructure and high vehicle production volumes. The region's focus on technological innovation has positioned it as a leader in the adoption of advanced ECUs, particularly for applications like ADAS, powertrain systems, and infotainment. Government regulations mandating emission control technologies and safety features, such as automatic emergency braking systems, have further accelerated ECU adoption. For instance, the Environmental Protection Agency (EPA) enforces stringent fuel efficiency standards, compelling automakers to integrate high-performance ECUs into their designs. Additionally, private investments in connected car technologies and electric vehicles (EVs) have fueled demand for specialized ECUs, ensuring the U.S. remains at the forefront of the automotive ECU market.

Canada is seeing the notable growth in the regional market. It is driven by government-led initiatives to modernize the automotive sector and promote sustainable transportation. These investments have spurred demand for advanced ECUs, particularly in applications like battery management systems and predictive maintenance. Additionally, Canada’s growing emphasis on autonomous vehicle development has created opportunities for high-capacity ECUs, such as 64-bit processors capable of handling complex AI-driven tasks. Provinces like Ontario and Quebec have emerged as hubs for automotive innovation, with partnerships between local manufacturers and international players driving growth. For example, Magna International, a leading Tier-1 supplier based in Canada, launched a new line of cybersecurity-enabled ECUs in 2023, addressing rising concerns about data breaches in connected vehicles.

Mexico accounts for a smaller portion of the market but is emerging as a promising player due to its growing automotive manufacturing base. The Mexican Ministry of Economy has introduced incentives for foreign direct investment (FDI) in the automotive sector, attracting major players like Ford, General Motors, and Volkswagen. These investments have increased demand for cost-effective yet advanced ECUs tailored to regional needs. Despite challenges such as limited R&D capabilities and reliance on imported components, Mexico’s strategic geographic location and trade agreements with the U.S. and Canada position it as a key contributor to the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Hitachi Astemo Americas, Lear Corporation, Panasonic Holdings Corporation, ZF Friedrichshafen AG, Delphi Technologies, and Hella KGaA Hueck & Co. are the key players in the North America automotive ECU market

The North America automotive ECU market is characterized by intense competition, with major players vying for market share through innovation and strategic initiatives. Bosch Group, Continental AG, and Denso Corporation dominate the landscape. These companies leverage advanced technologies, such as AI, IoT, and edge computing, to differentiate their products and meet evolving automotive demands. The competitive environment is further intensified by the entry of mid-sized firms and startups offering niche solutions, such as lightweight ECUs for EVs and modular designs for fleet management systems. Regulatory compliance and quality standards act as barriers to entry, favoring established players with robust R&D capabilities. Additionally, pricing strategies play a crucial role, as manufacturers balance affordability with technological sophistication to appeal to diverse automakers.

TOP PLAYERS IN THE MARKET

Bosch Group

Bosch Group is a dominant player in the North America automotive ECU market, contributing significantly to global innovations. Known for its cutting-edge solutions in ADAS, powertrain systems, and connectivity. Bosch’s flagship products, such as AI-driven ECUs for autonomous driving and IoT-enabled systems for connected cars, have gained widespread adoption among automakers. The company’s strategic focus on R&D, with major investments, enables it to maintain a competitive edge. Bosch also leverages partnerships with tech giants like NVIDIA to enhance its AI capabilities, reinforcing its position as a global innovator in the automotive ECU market.

Continental AG

Continental AG is another key player, renowned for its advanced ECUs that cater to diverse automotive applications. It has established itself as a pioneer in connected car technologies. Its 5G-enabled ECUs and cybersecurity solutions have gained significant traction among North American automakers. Continental’s global contributions are further amplified by its acquisitions of smaller firms specializing in AI-driven safety systems, enabling it to expand its product portfolio and maintain a strong global presence. Additionally, its focus on sustainability aligns with regulatory mandates, positioning it as a trusted partner for automakers striving to meet emission and safety standards.

Denso Corporation

Denso Corporation specializes in high-performance ECUs for powertrain systems, ADAS, and thermal management. The company’s innovative solutions, such as its next-generation engine control modules (ECMs) and battery management systems (BMS), are widely used in hybrid and electric vehicles. Also, the company’s strategic partnerships with automakers like Toyota and Ford have further strengthened its regional footprint. Additionally, Denso’s investments in smart manufacturing and edge computing have enhanced the reliability and efficiency of its ECUs, making it a vital contributor to the global automotive ECU market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the North America automotive ECU market employ a range of strategies to maintain their competitive edge and expand their reach. One prominent strategy is mergers and acquisitions, enabling companies to integrate complementary technologies and diversify their product offerings. Partnerships and collaborations are another critical approach, with companies leveraging alliances with tech giants to develop AI-enabled ECUs for autonomous vehicles. Additionally, investments in research and development remain a cornerstone strategy. Product differentiation through technological advancements, such as cybersecurity features and IoT integration, ensures sustained market leadership. Finally, strategic marketing campaigns targeting automakers emphasize the operational benefits of adopting these cutting-edge solutions, reinforcing brand loyalty and market dominance.

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Bosch launched a new 64-bit ECU designed for Level 4 autonomous driving systems. This innovation improved real-time data processing capabilities and solidified Bosch’s leadership in the autonomous vehicle segment.

- In March 2023, Continental acquired a startup specializing in AI-driven safety systems. This acquisition enhanced Continental’s capabilities in predictive analytics and real-time diagnostics, allowing it to offer comprehensive solutions for ADAS applications.

- In June 2023, Denso partnered with Canadian distributors to expand its reach in emerging provincial markets. This collaboration resulted in a 15% increase in ECU installations within six months, particularly for EV applications.

- In September 2023, Magna introduced cybersecurity features for its ECUs, addressing rising concerns about data breaches in connected vehicles. This innovation reduced cyberattack risks by 40%, boosting Magna’s market reputation.

- In December 2023, Aptiv invested USD 100 million in R&D for IoT-enabled ECUs, focusing on enhancing connectivity and system reliability. This initiative positioned Aptiv as a key innovator in the connected car segment.

MARKET SEGMENTATION

This research report on the North America Automotive ECU market has been segmented and sub-segmented based on the following categories.

By Capacity Type

- 16-Bit

- 32-Bit

- 64-Bit

By Vehicle Type

- Passenger Cars

- Commercial Vehicle

By Application

- ADAS & Safety System

- Body Electronics

- Powertrain

- Infotainment

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

1. What are the key opportunities in the North America Automotive ECU Market?

The market presents strong opportunities due to the rising adoption of electric vehicles (EVs), increasing integration of advanced driver-assistance systems (ADAS), and the growing demand for connected and autonomous vehicle technologies.

2. What are the major challenges facing the North America Automotive ECU Market?

Key challenges include the high cost of advanced ECUs, cybersecurity risks in connected vehicles, and complexities in software-hardware integration for multi-functional ECUs.

3. Who are the major players in the North America Automotive ECU Market?

Major players include Robert Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, and ZF Friedrichshafen AG, all of whom offer cutting-edge ECU technologies for ICE and electric vehicles across various automotive segments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]