North America Automotive Coatings Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Resin, Technology, Layer, Application, And By Region (The USA, Canada, Mexico And Rest of North America), Industry Analysis, From (2025 to 2033)

North America Automotive Coatings Market Size

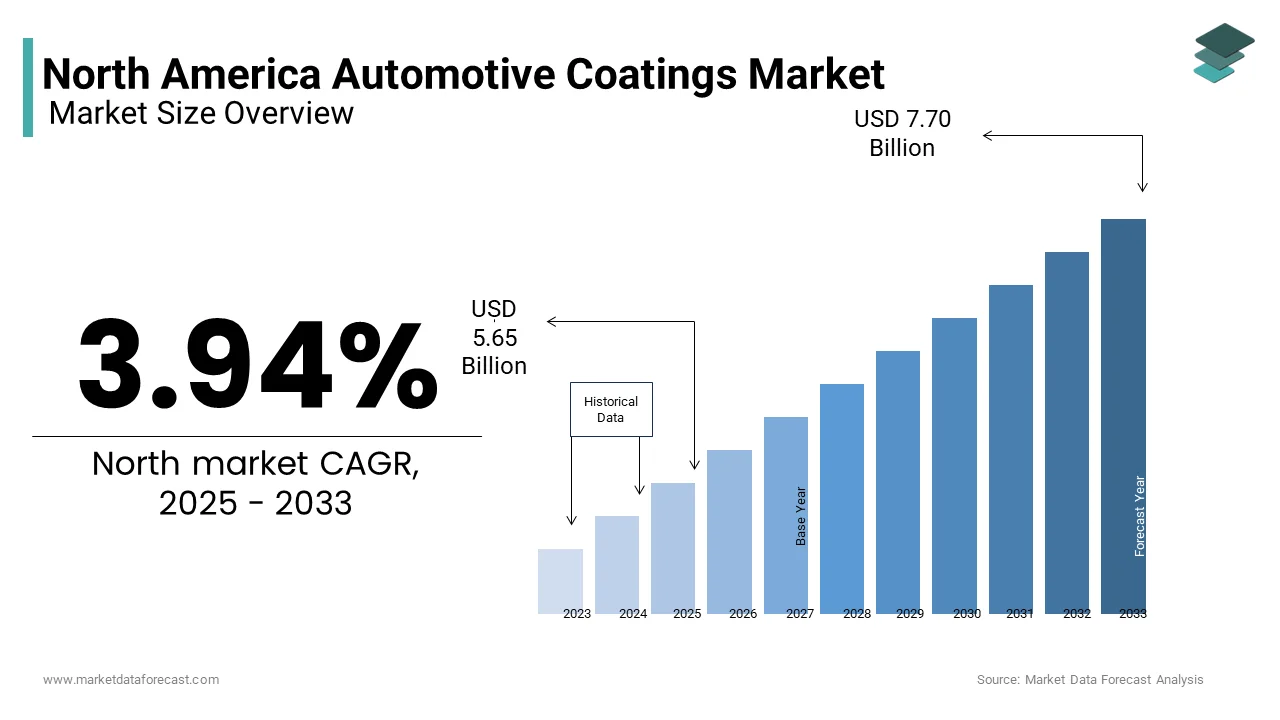

The North American automotive coatings market was valued at USD 5.44 billion in 2024 and is anticipated to reach USD 5.65 billion in 2025 from USD 7.70 billion by 2033, growing at a CAGR of 3.94% during the forecast period from 2025 to 2033.

MARKET DRIVERS

Rising Demand for Electric Vehicles

The surge in electric vehicle adoption is a pivotal driver for the North American automotive coatings market. As per Bloomberg NEF, EV sales in the region grew by 85% in 2022, reaching nearly 1 million units. This exponential growth has created a heightened demand for advanced coatings tailored to EV requirements. Unlike traditional vehicles, EVs prioritize lightweight materials and corrosion-resistant coatings to extend battery life and improve efficiency. For instance, polyurethane-based coatings, which offer superior protection against environmental factors, have seen an annual increase in demand specifically for EV applications.

Moreover, aesthetic customization plays a crucial role, with consumers favoring glossy finishes and unique color palettes. Automakers are increasingly investing in high-performance coatings to meet consumer expectations and regulatory standards, further propelling market growth.

Stringent Environmental Regulations

Environmental regulations are another key driver reshaping the market. The U.S. Environmental Protection Agency mandates a reduction in volatile organic compound (VOC) emissions, compelling manufacturers to transition from solvent-based to water-based coatings. This shift not only aligns with sustainability goals but also attracts incentives for eco-friendly practices.

Furthermore, California’s Zero Emission Vehicle (ZEV) program, adopted by several states, has accelerated the adoption of low-VOC coatings. As per industry estimates, automakers adhering to these regulations have reduced their carbon footprint significantly over the past decade. This regulatory push ensures steady demand for innovative coatings that balance performance and environmental compliance.

MAJOR RESTRAINTS

High Costs of Advanced Coatings

One of the primary restraints in the North American automotive coatings market is the high cost associated with advanced formulations. According to McKinsey & Company, premium coatings such as nano-coatings and self-healing variants can increase production costs. These coatings, while offering superior performance, are often unaffordable for small and medium-sized automakers, limiting their widespread adoption.

Additionally, the raw material costs for resins like polyurethane and epoxy have surged over the past three years due to supply chain disruptions. Like, these price fluctuations disproportionately affect smaller players, creating a barrier to entry. The economic burden is further exacerbated by the need for specialized equipment and skilled labor to apply these advanced coatings, adding to operational expenses.

Complex Regulatory Compliance

Navigating the complex web of environmental regulations poses another significant restraint. The transition to low-VOC coatings, while beneficial for the environment, requires substantial investment in R&D and infrastructure upgrades.

Furthermore, inconsistencies between state and federal regulations create additional challenges. Also, these discrepancies result in fragmented compliance strategies, increasing administrative and operational burdens for manufacturers.

MAJOR OPPORTUNITIES

Expansion into Emerging Markets

The North American automotive coatings market has a significant opportunity to expand into emerging markets within the region, particularly Mexico. This growth presents a lucrative opportunity for coatings manufacturers to establish partnerships and distribution networks to cater to local demand.

Mexico’s strategic location and trade agreements, such as the USMCA, provide a gateway to both North American and Latin American markets. Additionally, the rising adoption of electric vehicles in Mexico, with projections of 500,000 EVs on the road by 2025, creates a niche for specialized coatings tailored to EV requirements.

Innovations in Smart Coatings

Advancements in smart coatings present another promising opportunity. These coatings, equipped with functionalities like temperature regulation and self-healing properties, align with the growing demand for enhanced vehicle performance and aesthetics. Such innovations not only differentiate products but also command premium pricing, boosting profitability.

MAJOR CHALLENGES

Supply Chain Disruptions

Supply chain disruptions remain a critical challenge for the North American automotive coatings market. Also, global shortages of key raw materials like titanium dioxide and acrylic resins have increased lead times since 2020. These delays not only impact production schedules but also inflate costs, with resin prices surging annually.

The situation is exacerbated by geopolitical tensions and logistical bottlenecks. For example, port congestion in Los Angeles and Long Beach caused delays of up to six weeks for imported raw materials in recent years. So, these disruptions have forced a notable share of coatings manufacturers to explore alternative suppliers, often at higher costs and lower quality.

Competition from Low-Cost Imports

Intense competition from low-cost imports poses another significant challenge. Also, imports of automotive coatings from Asia increased significantly in recent years, driven by lower production costs. These imports, often priced below domestic offerings, undercut local manufacturers and erode profit margins.

Furthermore, quality concerns associated with low-cost imports hinder their adoption in premium applications. This competitive pressure forces domestic players to invest heavily in cost-cutting measures while maintaining quality, straining resources.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.73% |

|

Segments Covered |

By Resin, Technology, Layer, Application and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

The Sherwin-Williams Company, Jotun, RPM International Inc, PPG Industries Inc, Beckers Group, BASF SE, Axalta Coating Systems, Teknos Group, Akzo Nobel N V, Kansai Paints Co Ltd, National Paints Factories Co Ltd, SIKA AG, TIGER Coatings GmbH & Co KG. |

SEGMENTAL ANALYSIS

By Resin Type Insights

The segment of Polyurethane dominated the North American automotive coatings market by holding a 40.3% share in 2024. This dominance is due to its exceptional durability and resistance to abrasion, making it ideal for exterior applications. Like, polyurethane coatings reduce maintenance costs compared to traditional options, driving their adoption. Key factors include the growing demand for UV-resistant coatings, especially in sunbelt states like Arizona and Texas. Additionally, polyurethane’s versatility supports customization, catering to consumer preferences for glossy finishes.

The acrylic coatings segment is the fastest-growing, with a projected CAGR of 7.8% through 2033. Their rapid growth is fueled by their eco-friendly properties and compatibility with water-based formulations. The shift toward sustainable practices has bolstered demand, with acrylic coatings reducing VOC emissions compared to solvent-based alternatives. Also, R&D investments have enhanced acrylic formulations, improving adhesion and weather resistance. This technological advancement positions acrylic coatings as a preferred choice for next-generation vehicles.

By Vehicle Type Insights

The passenger cars segment had the largest share of the North American automotive coatings market, i.e., 65.6% in 2024. This control is driven by the region’s high vehicle ownership rates. Consumer preferences for aesthetic customization play a pivotal role. In support of this, the majority of passenger car buyers opt for metallic or pearlescent finishes, driving demand for basecoats and clearcoats. Additionally, the rise in ride-sharing services has increased fleet purchases, further boosting coatings consumption.

The segment of commercial vehicles is merging quickly in the landscape, with a CAGR of 8.2%. This rise is attributed to the booming e-commerce sector, with online retail sales in North America surging as the years pass. Delivery fleets require durable coatings to withstand harsh conditions, driving demand for epoxy-based solutions. Also, commercial vehicle registrations increased in recent years, showing the segment’s potential. Investments in logistics infrastructure further support this upward trajectory.

By Technology Type Insights

The solvent-based coatings segment commanded the market by holding a 50.1% share in 2024. This widespread use is attributed to their superior adhesion and quick drying properties, making them ideal for mass production. Similarly, solvent-based coatings reduce production time, enhancing operational efficiency. Despite environmental concerns, their cost-effectiveness and reliability ensure continued demand, particularly in high-volume manufacturing hubs like Michigan and Ontario.

The water-based coatings segment is moving ahead quickly, with a CAGR of 9.5%. Their growth is fueled by stringent environmental regulations and the push for sustainable practices. Plus, water-based coatings reduce VOC emissions, aligning with regulatory mandates. Technological advancements have improved their performance, enabling broader applications.

By Coat Type Insights

The clearcoats segment was the top performer in the North American automotive coatings market, with a 60.1% share in 2024. This leading position is driven by their ability to enhance gloss and protect underlying layers from UV damage. Like, clearcoats extend the lifespan of vehicle finishes by a notable period, making them indispensable for premium vehicles. Consumer demand for high-gloss finishes has further bolstered their adoption, particularly in luxury segments.

The basecoats segment is witnessing a rapid development, with a CAGR of 8.7%. This is backed by advancements in pigmentation technology, enabling vibrant and durable color options. Also, metallic and pearlescent basecoats now account for a major share of new vehicle sales, reflecting shifting consumer preferences. Besides, the rise in customization trends has created opportunities for niche applications, driving innovation in this segment.

COUNTRY LEVEL ANALYSIS

The United States was the biggest contributor to the North American automotive coatings market by commanding a 75.6% share in 2024. It is prevailing due to its robust automotive manufacturing sector. Key drivers include the rise in electric vehicle (EV) production, with Tesla alone representing a substantial percentage of EV sales in recent times. This surge has fueled demand for advanced coatings tailored to EV requirements. Additionally, California’s stringent environmental regulations have accelerated the adoption of water-based coatings. R&D investments have also bolstered innovation, with companies like PPG Industries introducing self-healing clearcoats that reduce maintenance costs. Furthermore, the U.S. Department of Energy’s funding for EV infrastructure has created opportunities for specialized coatings, positioning the country as a leader in sustainable automotive solutions.

Canada holds a considerable market share, which is driven by its growing automotive exports and emphasis on eco-friendly practices. The push for sustainability is evident, with Ontario’s Greenhouse Gas Reduction Program mandating low-VOC coatings, which now represent a key portion of the market. Plus, investments in lightweight materials have increased coatings demand, particularly for corrosion-resistant formulations. Additionally, partnerships between local manufacturers and global players like BASF have strengthened the supply chain, ensuring consistent quality and innovation.The

Mexican market is supported by its strategic position as a manufacturing hub. The USMCA trade agreement has facilitated access to North American markets, driving coatings consumption. Furthermore, the rise in EV production, with Nissan and Volkswagen investing in local facilities, has created demand for specialized coatings.

KEY MARKET PLAYERS

The Sherwin-Williams Company, Jotun, RPM International Inc, PPG Industries Inc, Beckers Group, BASF SE, Axalta Coating Systems, Teknos Group, Akzo Nobel N V, Kansai Paints Co Ltd, National Paints Factories Co Ltd, SIKA AG, TIGER Coatings GmbH & Co KG. are the market players that are dominating the North America automotive coatings market.

Top Players in the Market

PPG Industries

PPG Industries leads the North American automotive coatings market. Its dominance is attributed to its extensive product portfolio, including innovative polyurethane and water-based coatings.

The company’s focus on sustainability has resulted in breakthroughs like its Aquaclear line, which reduces VOC emissions. Additionally, PPG’s partnerships with automakers ensure consistent demand and technological alignment.

Axalta Coating Systems

Axalta is driven by its leadership in color technology. Its Color Matching System services a wide number of body shops globally, underscoring its reach.

Axalta’s Spies Hecker and Cromax brands dominate the premium segment, with a key share in high-performance coatings. The company’s investment in R&D has yielded innovations like its 2K waterborne basecoat, which reduces application time.

BASF SE

BASF is leveraging its expertise in resin technologies. According to BASF’s financial report, its coatings division reported revenues.

The company’s CathoGuard series for corrosion protection is widely adopted. BASF’s commitment to sustainability is evident in its biomass-balanced coatings, which reduce carbon emissions.

Top Strategies Used By Key Players

Market leaders employ strategies like mergers, acquisitions, and product innovation to maintain their edge. For instance, PPG Industries acquired Tikkurila Oyj, expanding its presence in Europe and strengthening its coatings portfolio. Similarly, Axalta partnered with Hyundai to develop advanced color technologies, enabling customization for luxury vehicles.

IR&D investments are another key strategy, with BASF investing to enhance its eco-friendly offerings. These strategies not only bolster market share but also align with regulatory mandates, ensuring long-term growth.

COMPETITION OVERVIEW

The North American automotive coatings market is highly competitive, characterized by intense rivalry among established players and emerging innovators. Key competitors include PPG Industries, Axalta Coating Systems, and BASF SE.

Companies differentiate themselves through innovation, with a focus on eco-friendly formulations and smart coatings. Strategic collaborations, such as Axalta’s partnership with Toyota, highlight efforts to capture niche segments. Additionally, price wars and regional expansions intensify competition, particularly in Mexico, where low-cost imports challenge domestic players.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, PPG Industries launched its Enviro-Prime coating system, designed to reduce VOC emissions by 40%, enhancing its sustainability credentials.

- In June 2023, Axalta Coating Systems introduced its next-generation ChromaDyne basecoat, offering faster drying times and improved color accuracy.

- In August 2023, BASF SE partnered with Ford to develop bio-based coatings, reducing carbon emissions by 30%.

- In October 2023, Sherwin-Williams acquired Valspar’s automotive division, expanding its product range and market reach.

- In December 2023, AkzoNobel invested $500 million in a new R&D facility to develop advanced waterborne coatings, targeting North American markets.

MARKET SEGMENTATION

This research report on the North American automotive coatings market is segmented and sub-segmented into the following categories.

By Resin Type

- Polyurethane

- Epoxy

- Acrylic

- Other Resin Types

By Technology

- Solvent-Borne

- Water-Borne

- Powder

- Other Technologies

By Layer

- E-Coat

- Primer

- Base Coat

- Clear Coat

By Application

- Automotive OEM

- Automotive Refinish

By Country

- The USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What are automotive coatings, and why are they essential in the North American market?

Automotive coatings are specialized layers applied to vehicles for protection against corrosion, UV damage, scratches, and to enhance visual appeal, playing a crucial role in durability, brand identity, and resale value.

What factors are driving the growth of the automotive coatings market in North America?

Growth is fueled by increasing vehicle production, rising demand for electric vehicles (EVs), greater consumer focus on premium finishes, and technological advances in eco-friendly, low-VOC, and waterborne coatings.

What types of automotive coatings are commonly used in North America?

The main types include primers (for adhesion and corrosion protection), basecoats (color application), clearcoats (gloss and scratch resistance), and electrocoats (for uniform rust protection in mass production).

What challenges are impacting the North American automotive coatings industry?

Major challenges include fluctuating raw material prices, stricter environmental regulations around solvent emissions, and the complexity of balancing sustainability goals with the performance expectations of modern coatings.

What are the future trends shaping the North America automotive coatings market?

Key trends include the rise of self-healing paints, nanotechnology-based coatings, personalized color innovations, and a strong shift toward greener technologies like powder coatings and water-based systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]