North America Automation Testing Market Size, Share, Trends & Growth Forecast Report By Component (Testing Solutions - Functional Testing, API Testing, Security Testing, Compliance Testing, Usability Testing; Services - Professional Services, Managed Services), Endpoint Interface (Web, Mobile, Desktop, Embedded Software), Enterprise Size (Small and Medium-Sized Enterprises, Large Enterprises), End User (IT and Telecommunication, BFSI, Healthcare, Retail, Transportation and Logistics), and Country (The United States, Canada, Mexico, Rest of North America) Industry Analysis From 2025 to 2033.

North America Automation Testing Market Size

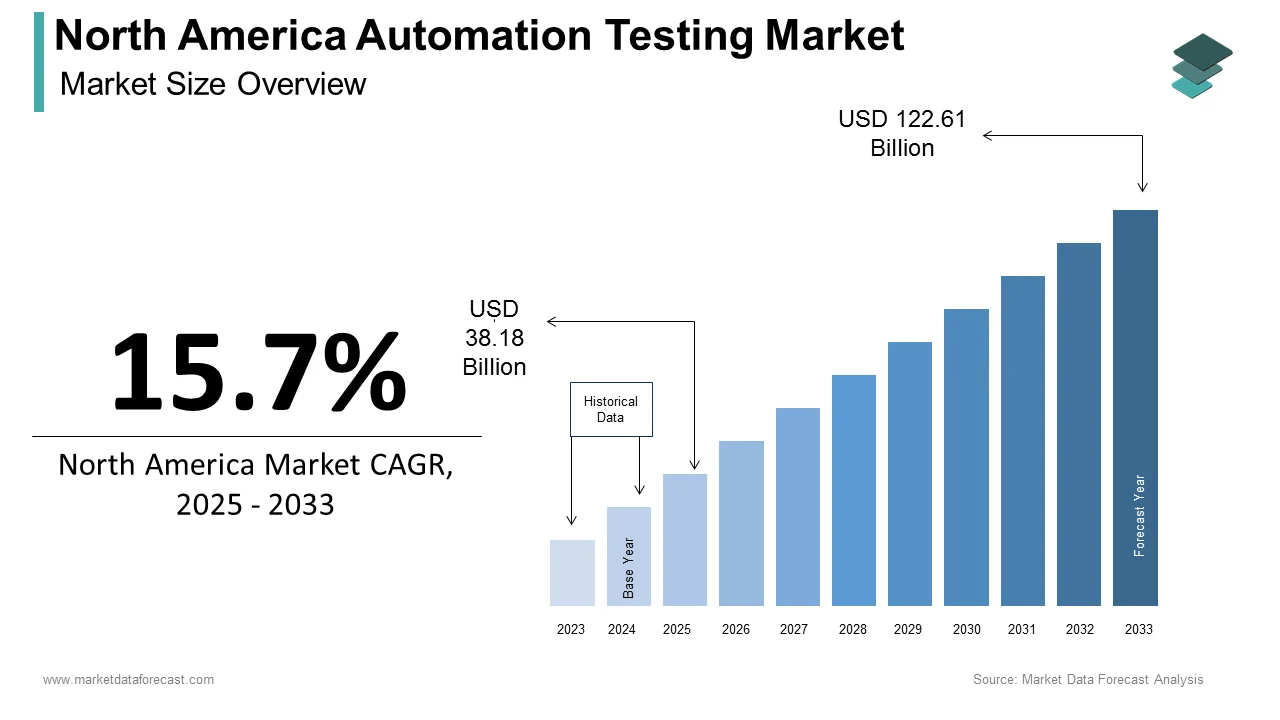

The size of the North America automation testing market was worth USD 33 billion in 2024. The North america market is anticipated to grow at a CAGR of 15.7% from 2025 to 2033 and be worth USD 122.61 billion by 2033 from USD 38.18 billion in 2025.

The North America automation testing market focuses on the use of automated tools and processes to conduct software testing. It enhances the efficiency, accuracy, and speed of the testing process by allowing organizations to deliver high-quality software products while reducing time-to-market. This market covers a variety of testing types, including functional testing, performance testing, regression testing, and security testing, among others. The advancing intricacy of software applications, along with the growing demand for faster release cycles, has propelled the adoption of automation testing solutions across various industries. This growth is driven by the rising need for continuous testing in agile and DevOps environments, as well as the increasing emphasis on quality assurance in software development. As organizations strive to enhance their software development processes, the automation testing market is poised for significant expansion, offering innovative solutions to meet the evolving demands of the digital landscape.

MARKET DRIVERS

Increasing Demand for Agile and DevOps Practices

The growing adoption of Agile and DevOps methodologies is a significant driver of the North America automation testing market. These practices emphasize collaboration, continuous integration, and rapid delivery of software, necessitating efficient testing processes to keep pace with accelerated development cycles. As per a survey conducted by the Project Management Institute, 71% of organizations reported using Agile methodologies in their projects, spotlighting the widespread shift towards Agile practices. Automation testing plays a crucial role in this context, enabling teams to execute tests quickly and reliably, thereby reducing the time required for quality assurance. Furthermore, the integration of automated testing into CI/CD (Continuous Integration/Continuous Deployment) pipelines allows for immediate feedback on code changes, facilitating faster iterations and improved software quality.

Rising Complexity of Software Applications

The increasing complexity of software applications is another key driver propelling the North America automation testing market. As companies develop more sophisticated applications that incorporate advanced technologies such as artificial intelligence, machine learning, and cloud computing, the need for comprehensive testing becomes paramount. In line with a study by the International Data Corporation (IDC), the global data sphere is expected to reach 175 zettabytes by 2025 draws attention to the growing volume of data that applications must handle. This complexity requires powerful testing strategies to ensure functionality, performance, and security. Automation testing provides a scalable solution to address these challenges, allowing organizations to conduct extensive testing across various scenarios and configurations. As the complexity of software applications continues to rise, the automation testing market is well-positioned for substantial growth.

MARKET RESTRAINTS

High Initial Investment Costs

Elevated initial investment costs associated with implementing automation testing solutions is one of the primary restraints affecting the North America automation testing market Organizations often face significant expenses related to purchasing automation tools, training personnel, and integrating these solutions into existing workflows. This financial barrier can deter smaller organizations or those with limited budgets from adopting automation testing is leading to a slower rate of market penetration. Additionally, the return on investment (ROI) for automation testing may not be immediately apparent, as organizations may need to invest time and resources before realizing the benefits of increased efficiency and reduced testing cycles.

Skill Shortages and Resistance to Change

A further significant restraint impacting the North America automation testing market is the shortage of skilled professionals with expertise in automation testing tools and methodologies. As players increasingly adopt automation testing, the demand for qualified testers who can design, implement, and maintain automated testing frameworks is growing. According to a survey by the World Economic Forum, 54% of employers reported difficulties in finding candidates with the necessary skills for automation testing roles. This skills gap can hinder organizations' ability to fully leverage automation testing solutions, limiting their effectiveness and potential benefits. Besides, resistance to change among existing testing teams can pose challenges to the successful implementation of automation testing. Many testers may be accustomed to traditional manual testing methods and may be hesitant to adopt new technologies.

MARKET OPPORTUNITIES

Growth of Artificial Intelligence in Testing

The integration of artificial intelligence (AI) into automation testing presents a significant opportunity for growth in the North America automation testing market. AI-driven testing solutions can enhance the efficiency and effectiveness of testing processes by enabling intelligent test automation, predictive analytics, and anomaly detection. According to a report by Gartner, AI in testing is expected to grow at a CAGR of 40% from 2021 to 2026 is driven by the increasing demand for faster and more accurate testing solutions. AI can automate complex testing tasks, such as test case generation and maintenance, reducing the time and effort required for manual intervention. Furthermore, AI-powered analytics can provide valuable insights into testing performance, helping organizations identify bottlenecks and optimize their testing strategies.

Expansion of Cloud-Based Testing Solutions

The expansion of cloud-based testing solutions represents another major opportunity for the North America automation testing market. Cloud-based testing platforms offer organizations the flexibility to scale their testing efforts, access a wide range of testing tools, and collaborate more effectively across distributed teams. Cloud-based testing solutions enable organizations to reduce infrastructure costs, streamline testing processes, and enhance collaboration among team members. Also, the ability to perform testing in real-time across various environments and devices allows organizations to ensure consistent quality across their applications.

MARKET CHALLENGES

Rapid Technological Advancements

The rapid pace of technological advancements in the software development landscape presents a challenge for the North America automation testing market. As new technologies and frameworks emerge, organizations must continuously adapt their testing strategies to keep up with the evolving landscape. Based on a report by Forrester, 60% of organizations struggle to keep their testing practices aligned with the latest technological trends. This challenge can lead to increased complexity in testing processes as organizations may need to invest in new tools and training to effectively test modern applications. Additionally, the constant introduction of new features and functionalities can make it difficult for testing teams to maintain comprehensive test coverage.

Integration with Legacy Systems

The integration of automation testing solutions with legacy systems poses a significant challenge for organizations in the North America automation testing market. Many organizations still rely on outdated systems and applications that may not be compatible with modern automation testing tools. According to a survey by Capgemini, 70% of organizations reported difficulties in integrating automation testing with their existing legacy systems. This challenge can hinder the effectiveness of automation testing efforts, as organizations may struggle to achieve seamless communication between new testing tools and legacy applications. Additionally, the complexity of legacy systems can make it difficult to implement automated testing processes, leading to increased testing cycles and potential quality issues.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Component, Endpoint Interface, Enterprise Size, End User, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Selenium, Accenture plc, Broadcom Inc., Capgemini SE, Cigniti Technologies, International Business Machines Corporation, Keysight Technologies Inc., Micro Focus Inc., Parasoft, Ranorex GmbH, Sauce Labs Inc., SmartBear Software Inc., Tricentis USA Corp., and Others. |

SEGMENTAL ANALYSIS

By Component Insights

The testing solutions segment of the North America automation testing market was at the commanding position by accounting for 60.7% of the total market share in 2024. This rule can be credited to the soaring desire for comprehensive testing tools that facilitate various types of testing including functional, performance, and security testing. The escalating sophistication of applications and the need for faster release cycles are propelling organizations to invest in advanced testing solutions that can automate repetitive tasks and enhance overall testing efficiency. Also, the integration of AI and machine learning capabilities into testing solutions is further driving their adoption as these technologies enable organizations to optimize their testing strategies and improve software quality.

The swiftest rising segment in the North America automation testing market is the services segment and is estimated to witness a CAGR of 22.1% from 2025 to 2033. This progress can be linked to the increasing demand for specialized testing services that complement automation testing solutions. Organizations are progressively seeking expert guidance and support to implement and optimize their automation testing strategies, leading to a surge in demand for consulting, training, and managed services. The mounting priority given to persistent testing and quality assurance in Agile and DevOps environments is further fuelling the demand for specialized testing services.

By Endpoint Interface Insights

The web segment remained the biggest endpoint in the North America automation testing market interface by contributing 50.6% of the total market share in 2024 . This dominance is driven by the increasing reliance on web applications for business operations and consumer interactions. The indication from a study reveals that the number of global internet users is expected to reach 5.6 billion by 2025 is showcasing the growing importance of web applications in various industries. The difficulties of web applications when coupled with the need for cross-browser compatibility and responsive design, necessitates comprehensive testing strategies to ensure optimal performance and user experience. Automation testing solutions for web applications enable organizations to conduct extensive testing across different browsers and devices are making sure of consistent functionality and performance.

The mobile segment is advancing quickly in this market and is predicted to see a CAGR of 25.3% in the future due to the heightening acceptance of mobile applications across various sectors, including retail, healthcare, and finance. As stated by a report from the App Annie, mobile app downloads are expected to reach 258 billion by 2025, underscoring the growing reliance on mobile applications for consumer engagement. The complications of mobile applications coupled with the need for compatibility across various devices and operating systems necessitates robust testing strategies to ensure optimal performance and user satisfaction. Automation testing solutions for mobile applications enable organizations to conduct extensive testing across different devices and platforms which is ensuring consistent functionality and performance.

By Enterprise Size Insights

The large enterprises represented the largest segment by holding for 70.6% of the total market share in 2024. The significant investments made by large organizations in automation testing solutions to enhance their software development processes are aiding the growth of this segment. As per a tudy by Gartner, large enterprises are increasingly adopting automation testing to improve efficiency, reduce time-to-market, and ensure high-quality software delivery. The complexity of large-scale applications and the need for comprehensive testing strategies necessitate robust automation solutions that can handle extensive testing requirements. Apart from these, large enterprises often have dedicated testing teams and resources, enabling them to implement and optimize automation testing effectively.

The small and medium-sized enterprises (SMEs) segment is projected to experience highest CAGR of 30.7% over the forecast period. This growth can be attributed to the surging recognition among SMEs of the importance of automation testing in enhancing software quality and accelerating development cycles. According to findings from the Small Business Administration, 60% of SMEs reported that they plan to invest in automation technologies to improve operational efficiency. The SMEs seek to compete in a rapidly evolving digital landscape, so, the adoption of automation testing solutions is becoming essential for ensuring the reliability and performance of their applications. Also, the availability of cost-effective automation testing tools and services is making it easier for SMEs to implement automation testing strategies.

By End User Insights

The IT and telecommunication segment continued to be the largest end user by accounting for 41.5% of the total market share in 2024. This authority is fuelled by the increasing complexity of software applications and the critical need for quality assurance in the IT and telecommunications sectors. In line with a data provided by the International Telecommunication Union, the global number of internet users is expected to reach 5.3 billion by 2023, highlighting the growing demand for reliable and high-performance applications. Automation testing solutions enable IT and telecommunications companies to conduct extensive testing across various platforms and devices are ensuring optimal performance and user satisfaction. The need for continuous testing in Agile and DevOps environments further propels the demand for automation testing in this sector.

The fastest expanding segment in the North America automation testing market is the healthcare which is projected to experience a CAGR of 28.3% from 2025 to 2033 owing to the growing digitization of healthcare services and the rising demand for reliable software applications in the sector. Based on a report by the American Hospital Association, nearly 96% of hospitals in the United States have adopted electronic health records (EHRs) is stressing the growing reliance on technology in healthcare. Automation testing solutions are essential for ensuring the accuracy, security, and compliance of healthcare applications that often handle sensitive patient data. The need for rigorous testing to meet regulatory requirements and ensure patient safety is driving the adoption of automation testing in the healthcare sector.

REGIONAL ANALYSIS

The United States remained a dominant position in the North America automation testing market and captured a market share of 80.3% in 2024. This control in the market can be attributed to the country's advanced technological infrastructure and the presence of major technology companies driving innovation in the automation testing sector. According to a report by the Bureau of Labor Statistics, the demand for software quality assurance analysts and testers is expected to grow by 22% from 2020 to 2030 which is signifying the rising attention on quality in software development. Moreover, the U.S. market is defined by major investments in research and development and is leading to the introduction of innovative automation testing solutions. Furthermore, the growing adoption of Agile and DevOps methodologies among U.S. organizations is propelling the demand for automation testing tools and services.

Canada is expected to witness the fastest growth in the North America automation testing market. It is projected to grow at a CAGR of 9.8% during the forecast period. The accelerating need for automation testing solutions driven by the expansion of the technology sector and the rising adoption of Agile methodologies are the prime reason behind this progress. The Statistics Canada via its study states that the Canadian technology sector is expected to grow by 5% annually is creating opportunities for automation testing providers. Also, the Canadian market is described by a powerful emphasis on quality assurance and compliance, with organizations increasingly recognizing the importance of automation testing in ensuring software reliability. Additionally, government initiatives aimed at promoting innovation and technology adoption further support this trend.

The Rest of America is also showing positive momentum but at a slower pace in the market. This region is witnessing development influenced by the increasing demand for automation testing solutions and the expansion of the technology sector in the region. As per a report, the number of software developers in Mexico is expected to reach 1.2 million by 2025 is reflecting the growing reliance on technology in various industries. The market is characterized by a focus on affordability and accessibility, with organizations seeking cost-effective automation testing solutions that enhance software quality. Besides, the rising awareness of the importance of quality assurance in software development is driving the adoption of automation testing in the region.

KEY MARKET PLAYERS

Some notable companies that dominate the North America automation testing market profiled in this report are Selenium, Accenture plc, Broadcom Inc., Capgemini SE, Cigniti Technologies, International Business Machines Corporation, Keysight Technologies Inc., Micro Focus Inc., Parasoft, Ranorex GmbH, Sauce Labs Inc., SmartBear Software Inc., Tricentis USA Corp., and Others.

Selenium

Selenium is a leading player in the North America automation testing market, known for its open-source testing framework that supports multiple programming languages and browsers. Selenium's flexibility and extensive community support have made it a popular choice among organizations seeking to implement automation testing solutions. The framework allows testers to create robust test scripts for web applications, enabling efficient testing across various platforms. Selenium's contribution to the automation testing market is significant, as it empowers organizations to enhance their testing capabilities while reducing costs associated with proprietary tools.

Micro Focus

Micro Focus is another major player in the North America automation testing market, offering a comprehensive suite of testing solutions that cater to various testing needs. The company's Unified Functional Testing (UFT) tool is widely recognized for its ability to automate functional and regression testing for web, mobile, and enterprise applications. Micro Focus's focus on innovation and customer-centric solutions has enabled it to capture a significant share of the automation testing market. The company's commitment to integrating AI and machine learning capabilities into its testing solutions further enhances its competitive position.

Tricentis

Tricentis is a prominent player in the North America automation testing market, known for its continuous testing platform that accelerates software delivery while ensuring quality. The company's Tosca testing solution leverages model-based testing and AI-driven analytics to optimize testing processes and improve test coverage. Tricentis's focus on enabling organizations to adopt Agile and DevOps practices has positioned it as a leader in the automation testing space. The company's innovative approach to testing, combined with its strong emphasis on user experience, has allowed it to capture a significant share of the North America automation testing market. Tricentis's solutions are designed to integrate seamlessly into CI/CD pipelines, facilitating continuous testing and rapid feedback loops, which are essential for modern software development practices. As organizations increasingly prioritize speed and quality in their software delivery processes, Tricentis's offerings are expected to play a crucial role in shaping the future of automation testing.

STRATEGIES EMPLOYED BY KEY PLAYERS

Key players in the North America automation testing market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and research and development, enabling companies to introduce cutting-edge automation testing tools that meet the evolving needs of organizations. For instance, Selenium continuously updates its framework to support the latest web technologies and programming languages, ensuring its relevance in a rapidly changing landscape.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Micro Focus, for example, has formed alliances with cloud service providers to integrate its testing solutions into cloud environments, allowing organizations to leverage the benefits of cloud computing in their testing processes.

Furthermore, companies are increasingly prioritizing customer-centric approaches, offering tailored solutions and support services to address specific requirements of their clients. This focus on customer engagement not only fosters loyalty but also enhances the overall value proposition of their offerings.

Moreover, many key players are actively pursuing mergers and acquisitions to expand their technological capabilities and market presence. Tricentis, for instance, has acquired several companies specializing in AI and machine learning to enhance its testing solutions. By leveraging these strategies, companies in the North America automation testing market are positioning themselves to capitalize on emerging opportunities and navigate the challenges of a rapidly evolving industry landscape.

COMPETITION OVERVIEW

The competition in the North America automation testing market is characterized by a dynamic landscape where innovation, efficiency, and user experience are paramount. Major players are continuously striving to differentiate themselves through advanced technologies and comprehensive solutions. The market is witnessing a surge in the adoption of automation testing tools, driven by increasing consumer demand for faster software delivery and higher quality. As organizations prioritize continuous testing and integration within Agile and DevOps frameworks, companies that offer robust, scalable, and user-friendly automation testing solutions are gaining a competitive edge.

Furthermore, the presence of both established players and emerging startups fosters a competitive environment that encourages rapid technological advancements. The ongoing digital transformation across various sectors is further intensifying competition, as organizations seek to optimize their software development processes with automation testing. In this context, companies must remain agile and responsive to market trends to maintain their competitive advantage in the North America automation testing market.

RECENT ACTIONS BY KEY PLAYERS

In recent months, several key players in the North America automation testing market have taken significant actions to strengthen their positions.

- In January 2024, Selenium announced the release of an updated version of its testing framework, enhancing support for the latest web technologies and improving user experience.

- In February 2024, Micro Focus launched a new version of its Unified Functional Testing tool, incorporating AI-driven capabilities to optimize test automation processes.

- In March 2024, Tricentis expanded its Tosca platform to include enhanced integration with popular CI/CD tools, facilitating seamless continuous testing for organizations.

- In April 2024, SmartBear introduced a new suite of testing tools designed specifically for mobile applications, addressing the growing demand for mobile testing solutions.

- In May 2024, Katalon announced a partnership with a leading cloud service provider to offer its automation testing solutions as a cloud-based service, enhancing accessibility for users.

- In June 2024, Ranorex unveiled a new version of its testing software, featuring improved support for cross-browser testing and enhanced reporting capabilities.

- In July 2024, Sauce Labs announced the acquisition of a startup specializing in AI-driven testing solutions, aiming to enhance its product offerings and market presence.

- In August 2024, TestComplete launched a new feature that allows users to automate testing for complex web applications with minimal coding required.

- In September 2024, Applitools introduced a new visual testing solution that leverages AI to improve the accuracy of visual regression testing.

- In October 2024, Cucumber announced a major update to its testing framework, enhancing support for behavior-driven development (BDD) practices and improving collaboration among teams.

These actions reflect the ongoing commitment of key players to innovate and adapt to the evolving demands of the North America automation testing market, ensuring they remain competitive in a rapidly changing landscape.

MARKET SEGMENTATION

This North America automation testing market research report is segmented and sub-segmented into the following categories.

By Component

-

Testing Solutions

-

Functional Testing

-

API Testing

-

Security Testing

-

Compliance Testing

-

Usability Testing

-

Others

-

-

Services

-

Professional Services

-

Managed Service

-

By Endpoint Interface

- Web

- Mobile

- Desktop

- Embedded Software

By Enterprise Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By End User

- IT and Telecommunication

- BFSI

- Healthcare

- Retail

- Transportation and Logistics

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the market size of the north america automation testing market?

The north america automation testing market was valued at USD 33 billion in 2024 and is projected to reach USD 122.61 billion by 2033, growing at a CAGR of 15.7%.

2. What factors drive the north america automation testing market?

The north america automation testing market is driven by rising adoption of Agile & DevOps, AI-powered testing, and increasing demand for cloud-based solutions.

3. What are the key challenges in the north america automation testing market?

The north america automation testing market faces challenges such as high initial costs, skill shortages, and integration complexities.

4. Which industries are driving demand in the north america automation testing market?

The north america automation testing market is seeing high demand from IT & telecom, BFSI, healthcare, and retail sectors.

5. What trends are shaping the north america automation testing market?

The north america automation testing market is witnessing trends like low-code/no-code testing tools, AI-driven test automation, and increased use of RPA.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]