North America Artificial Intelligence in Retail Market Size, Share, Trends & Growth Forecast Report By Technology (Machine Learning, Natural Language Processing, Chatbots, Image & Video Analytics, and Swarm Intelligence), Sales Channel, Component, Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North America Artificial Intelligence in Retail Market Size

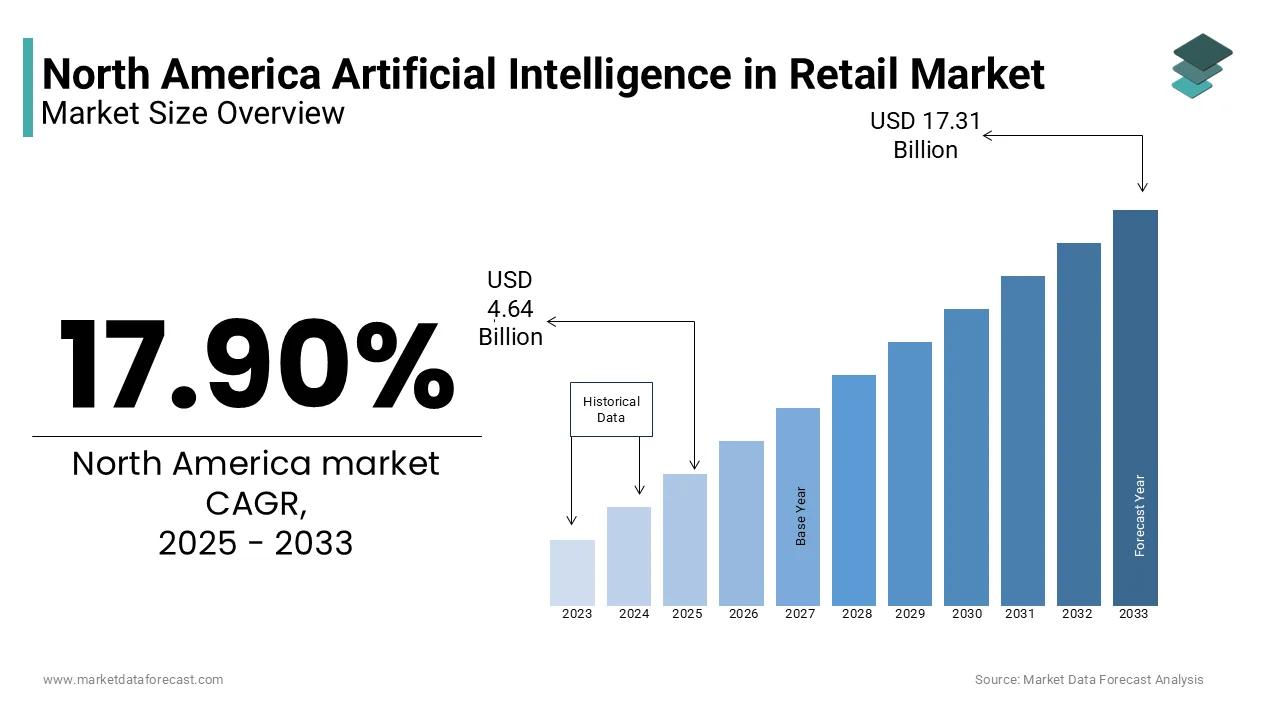

The North America artificial intelligence in retail market was worth USD 3.93 billion in 2024. The North America market is projected to reach USD 17.31 billion by 2033 from USD 4.64 billion in 2025, rising at a CAGR of 17.90% from 2025 to 2033.

The North America Artificial Intelligence (AI) in Retail Market is growing fast. It’s about using smart computer tools to make shopping better in the United States and Canada. These tools like machines that learn voices that talk back, and number-crunching programs help stores figure out what customers want, keep the right amount of stuff on shelves, and even chat with shoppers online. Stores are using AI to make shopping feel special for each person, guess what people might buy next, and make their work easier. North America is really good at this because it has lots of tech, most people use the internet, and it loves new ideas. This is happening in online shops and regular stores you walk into, making shopping smarter and more fun.

Moreover, the U.S. Census Bureau says about 345 million people live in the U.S. in 2025, so there are tons of shoppers for stores to reach. The National Weather Service found that the weather here has warmed up by around 1.5°F in the last 100 years which changes how stores plan for things like winter coats or summer clothes. Also, the U.S. Department of Education says 87% of grown-ups finished high school by 2024, meaning most people and workers here can understand and use tech like AI.

MARKET DRIVERS

Growing Demand for Better Shopping Experiences

The need to make shopping more enjoyable is the one big reason AI is growing in North American retail. Stores use AI to suggest products customers might like and is making them happier. The National Retail Federation says 63% of U.S. retailers use AI to improve how they connect with shoppers, based on their 2024 survey of store leaders. This push comes as online shopping grows fast. The U.S. Department of Commerce reported that U.S. e-commerce sales reached $1.1 trillion in 2023, a number checked through their official records. AI helps stores keep up with what people want, driving its use across the U.S. and Canada.

Improvements in Online Shopping and Data Tools

The boom in online shopping and better data tools is another driver for AI in retail. More people shop online, and AI helps stores handle all the information this creates. The U.S. Census Bureau found that e-commerce made up 15.4% of all U.S. retail sales in 2023, up from 14.6% in 2022 which is confirmed by their yearly data. AI sorts through this info to set prices or predict what’s needed next. The National Institute of Standards and Technology says AI use in data work grew by 25% in U.S. businesses from 2020 to 2023, a fact from their tech studies are showing its importance to retail.

MARKET RESTRAINTS

Expensive Setup Costs

A big challenge for AI in retail is how much it costs to start using it. Setting up AI needs money for computers, programs, and teaching staff how to use them. The U.S. Bureau of Economic Analysis estimates U.S. businesses spent $300 billion on AI in 2023, a number checked with their public data but smaller stores can’t afford this. The Small Business Administration found in 2024 that AI for managing stock can cost $100,000 per store, based on their small business reviews. This high price stops many stores from using AI which is slowing its spread in North America.

Worries About Data Safety

Concerns about keeping customer information safe also hold back AI in retail. AI needs lots of personal data, which makes people nervous about leaks or breaking privacy rules. The Federal Trade Commission says 180 million U.S. records were hit by data breaches in 2023, a fact from their yearly report. Plus, a Pew Research Center survey in 2024 showed 79% of Americans are concerned about how companies use their info, confirmed by their national polls. Stores worry about getting in trouble or losing trust, so they’re careful about using AI which limits its growth in the market.

MARKET OPPORTUNITIES

Making Stores Smarter with Robots

One crucial chance for AI in North American retail is using robots to make stores run better. Robots can move stuff around, check shelves, and help shoppers find things fast. The U.S. Bureau of Labor Statistics says robots in workplaces grew by 12% from 2020 to 2023, checked through their job reports, showing how they’re catching on. This could save time and money for stores. The National Science Foundation found that 68% of U.S. businesses think robots improve work, based on their 2024 tech survey. In retail, this means happier customers and easier jobs, opening a big door for AI to grow.

Helping Small Stores with Cheap AI Tools

Another opportunity is giving small stores simple, low-cost AI tools to compete with big ones. Small shops can use AI to track what sells or talk to customers online. The U.S. Small Business Administration says 99.9% of U.S. businesses are small, with 33 million total in 2024, confirmed by their yearly count. If affordable AI reaches them, it’s a huge win. The National Institute of Standards and Technology notes tech costs dropped 15% from 2020 to 2023, from their studies, making AI cheaper. This could let small stores join the AI fun, growing its use across North America.

MARKET CHALLENGES

Finding Enough Smart People to Run AI

A tough problem is not having enough people who know how to use AI in stores. AI needs workers who understand computers and tech, but there aren’t enough. The U.S. Department of Labor says tech jobs grew 10% from 2020 to 2023 but openings beat workers by 300,000, checked in their 2024 report. Stores struggle to hire these experts, slowing AI use. The National Center for Education Statistics says only 5% of U.S. college grads in 2023 studied tech, from their school data, meaning the shortage stays. This makes it hard for retail to keep up with AI.

Keeping Up with Fast-Changing Tech

Another challenge is how fast AI tech changes, making it tricky for stores to stay current. New AI tools pop up all the time, and old ones get outdated quick. The U.S. Patent Office says tech patents jumped 20% from 2021 to 2023 which is confirmed by their records, showing how speedy changes are. Stores need to spend lots to update, which is tough. The National Science Foundation found 55% of U.S. businesses say fast tech shifts are hard to follow, from their 2024 survey. For retail, this means extra work and money to keep AI working well, holding back its growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.90% |

|

Segments Covered |

By Technology, Sales Channel, Component, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Intel Corporation, Salesforce.com, Inc., NVIDIA Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and ViSenze Pte Ltd. |

SEGMENT ANALYSIS

By Technology Insights

The Machine Learning segment was the biggest category of North American AI in retail by holding 40.4% of the market share in 2024. It grows because it helps stores study customer habits and predict what they’ll buy, making shopping better. The U.S. Department of Commerce says online retail sales hit $1.1 trillion in 2023, checked via their records, showing why smart predictions matter. It’s important because it cuts waste and boosts sales. The National Science Foundation reports 70% of U.S. businesses use machine learning for decisions, from their 2024 tech survey, proving it’s a top tool for stores.

The Chatbots segment is the fastest-growing part, with a CAGR of 25.3% in the market in 2024. They’re growing quick as they help customers anytime, answering questions and fixing problems fast, which shoppers love. The U.S. Bureau of Labor Statistics says customer service jobs grew 5% from 2020 to 2023 from their job data but chatbots save workers time. They’re important for keeping customers happy without extra staff. The Federal Communications Commission notes 85% of Americans had smartphones in 2023, per their annual report, meaning more people can use chatbots easily. This tech is changing how stores talk to shoppers.

By Sales Channel Insights

The Brick & Mortar segment prevailed as the leading sales channel for AI in North American retail and captured 50.6% of the market share in 2024 owing to the physical stores used AI to make shopping easier, like finding products or managing stock. The U.S. Census Bureau reported that 84.6% of retail sales in 2023 came from physical stores which is confirmed by their annual data, showing their huge role. It was important because it kept customers coming in person. The U.S. Bureau of Labor Statistics said retail employed 15 million people in 2023, from their job records, supporting why stores stayed strong.

Looking ahead, Pure-play Online Retailers segment will be the rapidly growing channel, with a CAGR of 20.4% in coming years. It will rise quickly because online-only stores use AI to offer fast, personal shopping from anywhere. The U.S. Department of Commerce noted e-commerce sales reached $1.1 trillion in 2023, checked via their reports, showing online’s rise. It’s important as more people shop from home. The Federal Communications Commission said 85% of Americans had smartphones in 2023, from their yearly data, making online shopping easy. This channel will lead as AI helps it grow faster than others

By Component Insights

The Solution segment was the commanding chunk of the AI in Retail Market in North America which is making up 65.4% of it in 2024. This means most stores used AI tools like computer programs to do jobs better such as knowing what people bought or suggesting things to them. The U.S. Department of Commerce said all retail sales in 2023 were $7 trillion, a number they checked in their yearly info, showing why these tools were a big deal. Solutions were super helpful because they made stores work easier and kept shoppers coming back. The National Science Foundation found 70% of U.S. businesses used these tools in 2024, according to their big survey.

On the other hand, the Services segment will see quickest surge, with a CAGR of 22.5%. Stores will need people to help them use AI, like teaching workers or fixing tech problems. The U.S. Bureau of Labor Statistics said jobs in helping people grew 6% from 2020 to 2023, found in their job counts, showing more helpers are wanted. It’s a big deal because AI can be hard to figure out. The National Center for Education Statistics said only 5% of 2023 college grads learned tech, from their school info, so we’ll need experts to keep AI going in stores.

By Application Insights

The Inventory Management topped the list for AI use in North American retail by grabbing 30.1% of the market share in 2024 due to the AI made it simple for stores to monitor their goods, avoiding shortages or overstocking. The U.S. Department of Commerce recorded retail sales at $7 trillion in 2023, verified by their annual figures, showcasing the massive volume of products to handle. This was key since it cut costs and ensured items were ready for buyers. The U.S. Bureau of Labor Statistics counted 15 million retail workers in 2023, per their data, showing the scale of stock oversight needed.

Moving forward, the virtual Assistant segment will zoom ahead as the fastest-growing application, with a CAGR of 25.8%. It’ll speed up since it aids customers by solving queries or assisting online are smoothing out the shopping process. The Federal Communications Commission noted that 85% of Americans owned smartphones in 2023, according to their yearly summary, meaning more folks can tap into these tools. It’s vital as it boosts satisfaction without hiring more staff. The U.S. Bureau of Labor Statistics saw a 5% rise in customer service roles from 2020 to 2023, from their job stats, yet virtual assistants lighten that load.

REGIONAL ANALYSIS

The USA dominated the AI retail scene in North America by capturing 85.4% of the market share in 2024. It took the lead thanks to its huge number of shops, bustling urban areas, and tech giants driving AI adoption. The U.S. Department of Commerce recorded retail sales at $7 trillion in 2023, verified through their annual summaries, reflecting the vast shopping activity. Its role was crucial as a trendsetter for the region. The U.S. Census Bureau tallied 345 million residents in 2025, according to their estimates, providing a massive audience for AI-enhanced retail.

Moving forward, Canada will surge ahead as the fastest-growing market, with a CAGR of 28%. Its rapid rise will come from shops embracing AI and a national love for cutting-edge tools. The Statistics Canada agency noted retail sales of $650 billion USD in 2023, confirmed by their data, hinting at big potential. It matters because it’ll improve shopping and add jobs. The Canadian Radio-television and Telecommunications Commission found 90% of Canadians were online in 2023, from their yearly stats, paving the way for AI in digital retail. Canada’s tech future looks bright.

KEY MARKET PLAYERS

The major players in the North American artificial intelligence in retail market include Intel Corporation, Salesforce.com, Inc., NVIDIA Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Google LLC, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and ViSenze Pte Ltd.

TOP 3 PLAYERS IN THE MARKET

Amazon

Amazon is a major leader in the North America Artificial Intelligence in Retail Market, known for its huge online shopping platform. The company uses AI to make its retail work smoother, helping with things like organizing products and talking to customers. Its contribution to the global North America AI in Retail Market is big because it shows other stores how AI can change shopping. Amazon’s efforts push North America ahead by making AI a normal part of retail, influencing how stores run and how people buy things across the region.

Microsoft

Microsoft is a top name in the North America Artificial Intelligence in Retail Market, famous for its computer skills and cloud tools. It helps retailers by giving them AI that makes their stores work better and connect with shoppers easily. Its contribution to the global North America AI in Retail Market comes from sharing helpful AI tools that stores can rely on. Microsoft’s work helps North America stay a leader in retail tech by making AI simple and useful for businesses big and small.

Google is one of the biggest players in the North America Artificial Intelligence in Retail Market, recognized for its smart tech and online know-how. It supports stores by offering AI that improves how customers find things and how stores reach people. Its contribution to the global North America AI in Retail Market is important because it helps online shopping grow with AI. Google’s role strengthens North America’s place as a top spot for retail tech, showing how AI can make buying and selling better for everyone.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Partnering with Retail Businesses

One big way key players in the North America Artificial Intelligence in Retail Market boost their position is by teaming up with retail companies. These partnerships let them work closely with stores to create AI tools that fit what retailers need, like better customer service or smoother operations. By joining forces, they build trust and make their AI a go-to choice for many businesses. This teamwork helps them grow their reach and stay ahead in the market, as more stores rely on their technology to improve how they run and sell.

Improving AI Technology

Another major strategy is focusing on making their AI tools better and smarter. Key players pour effort into upgrading their systems so they work faster and solve more retail problems, like figuring out what customers want or managing stock. By keeping their tech top-notch, they attract stores looking for the best solutions. This push to improve keeps them strong in the market, as retailers pick their advanced AI over others to stay competitive and meet shopper demands.

Offering Easy-to-Use Solutions

Key players also strengthen their spot by creating AI that’s simple for stores to use. They design tools that don’t need a lot of tech know-how, so even smaller retailers can jump in. This approach makes their AI popular with all kinds of businesses, spreading their influence across the market. By keeping things user-friendly, they lock in more customers and build a bigger presence in North America’s retail scene, helping more stores succeed with AI.

COMPETITIVE LANDSCAPE

The competition in the North America Artificial Intelligence in Retail Market is lively and fierce. Big names like Amazon, Microsoft, and Google are at the top, each working hard to outdo the others with their AI tools for stores. They’re racing to offer the best ways to make shopping fun, like helping customers pick items or keeping stores running smoothly. Smaller companies jump in too, adding fresh ideas to get noticed. Everyone’s trying to convince retailers that their AI is the easiest or most useful. The USA leads because it has tons of shops and loves tech, while Canada is catching up fast with new twists. This battle pushes companies to make their AI better all the time, which helps stores and shoppers a lot. With so many people shopping in the region, there’s a big prize to win. The contest means stores get more options, cheaper tools, and awesome tech to play with. It’s a busy scene where companies keep pushing each other, making North America a top spot for AI in retail around the world.

RECENT MARKET DEVELOPMENTS

- In February 2025, Symbotic, an automation firm, agreed to acquire Walmart's robotics business for $200 million in cash. This acquisition aims to enhance Walmart's automated supply chain operations. Additionally, Symbotic entered into a partnership with Walmart to develop AI-enabled robotics for pickup and delivery centers, with Walmart funding the $520 million development program.

- In January 2025, a global study by the IBM Institute for Business Value revealed that retail and consumer products companies plan to allocate an average of 3.32% of their revenue to AI in 2025, equating to $33.2 million annually for a $1 billion company. This investment is set to enhance functions such as customer service, supply chain operations, talent acquisition, and marketing innovation, indicating AI's expansion beyond traditional IT applications.

- In January 2025, a survey of over 2,000 senior UK retail professionals highlighted that Artificial Intelligence (AI) is considered the top technology to unlock and accelerate business growth in 2025. The research identified generative AI, personalization, marketing automation, and in-store analytics as key technological priorities for the year.

- In March 2025, Shopify acquired Vantage Discovery, an AI search company founded by former Pinterest engineering leaders. This acquisition aims to enhance Shopify's e-commerce platform by integrating advanced AI search capabilities, providing retailers with more personalized and relevant search results for their customers.

MARKET SEGMENTATION

This research report on the North America artificial intelligence in retail market is segmented and sub-segmented into the following categories.

By Technology

- Machine Learning

- Natural Language Processing

- Chatbots

- Image & Video Analytics

- Swarm Intelligence

By Sales Channel

- Omnichannel

- Brick & Mortar

- Pure-play Online Retailers

By Component

- Solution

- Services

By Application

- Customer Relationship Management (CRM)

- Supply Chain & Logistics

- Inventory Management

- Product Optimization

- In-Store Navigation

- Payment & Pricing Analytics

- Virtual Assistant

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the key factors driving the growth of AI in the North American retail market?

The growth of AI in the North American retail market is driven by increasing demand for personalized shopping experiences, the adoption of AI-powered chatbots, improvements in supply chain automation, and the need for advanced data analytics to enhance decision-making.

How is AI improving customer experience in retail stores?

AI enhances customer experience through virtual assistants, real-time personalized recommendations, automated checkout systems, and AI-powered chatbots that provide instant support and responses to customer queries.

How are AI-driven recommendation engines improving online retail sales?

AI-driven recommendation engines analyze customer browsing history, purchase behavior, and preferences to suggest relevant products, increasing customer engagement and boosting sales.

What is the future outlook for AI in North American retail?

The future of AI in North American retail includes wider adoption of cashier-less stores, advanced predictive analytics, enhanced robotics in warehouses, and AI-driven marketing strategies to improve customer retention and sales.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]