North America Artificial Disc Market Research Report – Segmented By Material Type ( Metal + Plastic, Advanced Polymers) ,Indication, End-Use and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Artificial Disc Market Size

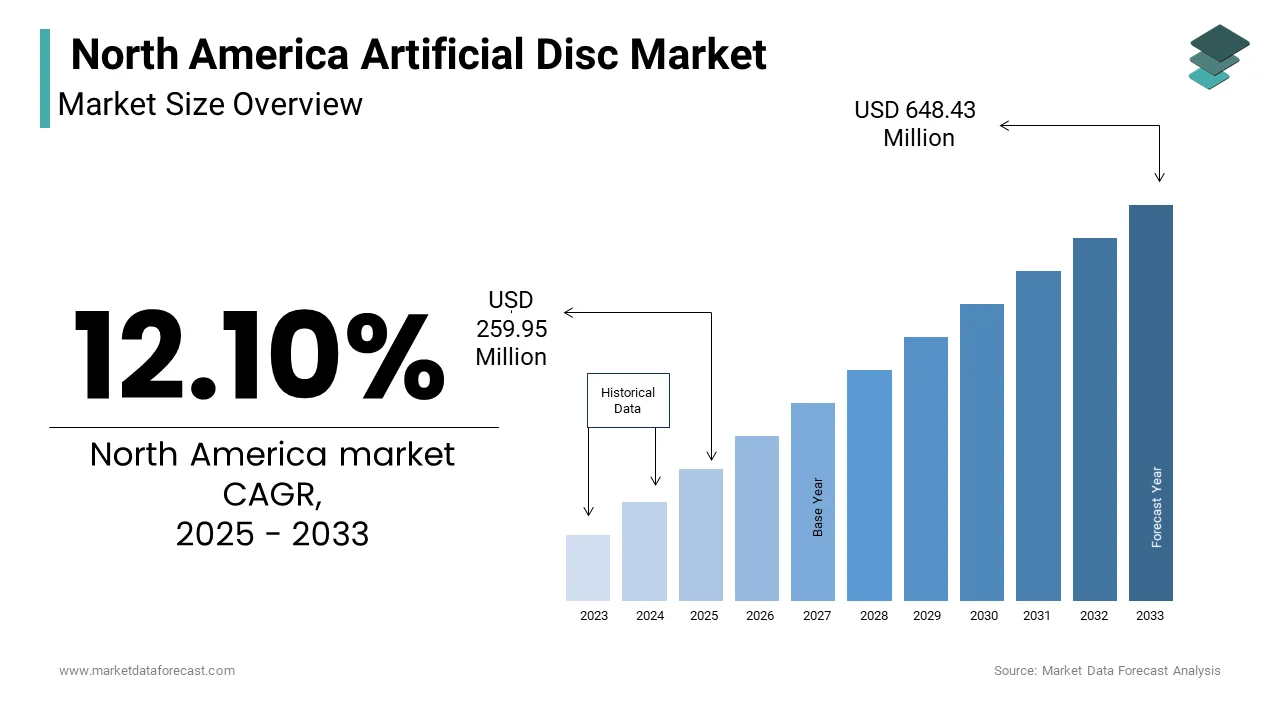

The North America Artificial Disc Market Size was valued at USD 231.88 million in 2024. The North America Artificial Disc Market size is expected to have 12.10 % CAGR from 2025 to 2033 and be worth USD 648.43 million by 2033 from USD 259.95 million in 2025.

The North America artificial disc market has established itself as a significant segment within the broader medical device industry which is driven by advancements in spinal care technologies. Moreover, the region accounts for a substantial share of the global market, with the United States alone contributing highest in the regional revenue. Canada follows as the second-largest contributor, albeit with a smaller footprint. The market is characterized by a high prevalence of degenerative disc diseases, with a large percentage of Americans suffering from chronic back pain annually. This has fueled demand for minimally invasive solutions like artificial discs. Furthermore, the region's robust healthcare infrastructure and favorable reimbursement policies have bolstered adoption rates. However, stringent regulatory frameworks and high costs associated with procedures remain pivotal challenges. The presence of key players such as Medtronic and DePuy Synthes has further reinforced the market's dominance in the region.

MARKET DRIVERS

Rising Prevalence of Degenerative Disc Diseases

A primary driver of the North America artificial disc market is the escalating incidence of degenerative disc diseases, which are increasingly affecting younger populations. Like, nearly 40% of individuals aged 40 and above exhibit signs of disc degeneration, while this figure rises to over 80% for those above 60. Such alarming statistics underscore the growing demand for effective treatment options like artificial discs. Additionally, sedentary lifestyles and obesity both of which are prevalent in North America are exacerbating spinal disorders. For instance, the Centers for Disease Control and Prevention reports that 42.4% of U.S. adults are obese, contributing to increased pressure on spinal structures. Moreover, advancements in disc replacement technology have improved outcomes, making them a preferred alternative to traditional spinal fusion surgeries. With clinical studies indicating high success rates for certain artificial disc models, patient confidence in these procedures continues to rise, further propelling market growth.

Technological Advancements in Minimally Invasive Procedures

Technological innovations in minimally invasive surgical techniques represent another major driver for the artificial disc market. The development of advanced materials such as biocompatible metals and polymers has significantly enhanced the durability and functionality of artificial discs. These innovations have reduced recovery times and minimized postoperative complications, making disc replacement surgeries more appealing to both patients and surgeons. Furthermore, robotic-assisted surgeries are gaining traction, with systems like the Mazor X Stealth Edition enabling unparalleled precision during implantation. Similarly, robotic assistance has majorly improved surgical accuracy, thereby boosting adoption rates. The integration of AI and machine learning in preoperative planning is another breakthrough, allowing for personalized treatment strategies.

MARKET RESTRAINTS

High Costs Associated with Artificial Disc Replacement Procedures

A most significant restraint in the North America artificial disc market is the exorbitant cost of artificial disc replacement procedures. These costs encompass surgeon fees, hospital charges, and the price of the artificial disc itself. Such financial burdens deter many patients, particularly those without adequate insurance coverage, from opting for these procedures. Additionally, disparities in reimbursement policies across states further complicate access to affordable care. For instance, while Medicare provides partial coverage for artificial disc replacements, private insurers often impose stringent eligibility criteria or outright deny claims. This financial barrier limits the market's reach, especially among low-income populations.

Stringent Regulatory Approval Processes

Another major restraint is the rigorous regulatory approval processes required for artificial disc devices, which can delay market entry and increase development costs. The U.S. Food and Drug Administration mandates extensive clinical trials to ensure the safety and efficacy of these devices, a process that can span several years and cost millions of dollars, as outlined by the FDA's official guidelines. For example, obtaining a Premarket Approval (PMA) for a new artificial disc can take up to five years, during which manufacturers must conduct multi-phase trials involving hundreds of patients. These prolonged timelines and high expenses discourage smaller companies from entering the market, consolidating power among established players. Furthermore, even after approval, devices are subject to post-market surveillance, which adds to operational costs.

MARKET OPPORTUNITIES

Increasing Investments in Research and Development

A burgeoning opportunity in the North America artificial disc market lies in the heightened focus on research and development initiatives aimed at enhancing product efficacy and expanding applications. Companies are channeling significant resources into developing next-generation artificial discs that incorporate smart materials capable of self-healing or adapting to biomechanical stresses. For instance, investments in biomaterials research have led to the creation of discs with improved wear resistance and biocompatibility. Additionally, collaborations between academia and industry are fostering innovation; universities such as Stanford and MIT are partnering with firms to explore novel designs and functionalities. Financial backing from venture capitalists and government grants is further fueling these efforts. Likewise, funding for biomedical engineering projects has increased notably over the past three years.

Growing Adoption of Telemedicine for Preoperative Consultations

The integration of telemedicine into preoperative consultations presents another promising opportunity for the artificial disc market. With the COVID-19 pandemic accelerating the adoption of virtual healthcare services, telemedicine platforms are now widely used to facilitate remote evaluations and patient education. A significant percentage of patients prefer virtual consultations for non-emergency conditions, including spinal disorders. This trend reduces logistical barriers for patients residing in rural areas, who previously faced challenges accessing specialized care. Moreover, telemedicine allows surgeons to efficiently screen candidates for artificial disc replacement, optimizing resource allocation.

MARKET CHALLENGES

Limited Awareness Among Patients and Healthcare Providers

A persistent challenge in the North America artificial disc market is the limited awareness among patients and healthcare providers regarding the benefits of artificial disc replacement compared to traditional spinal fusion. Despite offering superior outcomes, such as preserving spinal mobility and reducing adjacent segment degeneration, many patients remain uninformed about these advantages. Only a small portion of surveyed patients were aware of artificial disc replacement as a viable treatment option. Similarly, misconceptions among healthcare professionals about the complexity of the procedure hinder its adoption. For instance, some surgeons perceive artificial disc surgeries as technically demanding, dissuading them from recommending it to patients. This lack of awareness stifles demand, preventing the market from reaching its full potential.

Ethical Concerns Surrounding Long-Term Safety Data

Ethical concerns surrounding the long-term safety and efficacy of artificial discs pose another challenge to market growth. While short-term outcomes are well-documented, data on performance beyond ten years remains scarce, raising questions about durability and potential complications. These uncertainties are compounded by ethical debates over the use of experimental materials in disc designs, which may not withstand extended use. Besides, the absence of standardized protocols for long-term monitoring complicates efforts to gather comprehensive evidence.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.10 % |

|

Segments Covered |

By Material Type, Indication,End-Use and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Medtronic PLC, Orthofix Medical Inc, Globus Medical Inc Class A, NuVasive, AxioMed Spine |

SEGMENTAL ANALYSIS

By Material Type Insights

The "Metal + Plastic" segment was at the forefront the North America artificial disc market with a share of 65.5% in 2024. This is primarily attributed to the superior mechanical properties of these materials, which provide durability and flexibility, mimicking natural disc behavior. Metals like titanium and cobalt-chrome alloys are favored for their strength, while ultra-high-molecular-weight polyethylene (UHMWPE) offers excellent wear resistance. Also, the combination ensures longevity and reduces the risk of revision surgeries, a critical factor given the rising demand for durable solutions. Another driving factor is the extensive clinical validation of these materials, with decades of successful usage in other orthopedic implants. Like, metal-plastic combinations have demonstrated lower failure rates over a decade, reinforcing their reliability. Apart from these, economies of scale achieved through mass production lower manufacturing costs, making these discs more accessible.

The advanced polymer segment represented the fastest-growing in the artificial disc market, with a projected CAGR of 9.2% through 2033. This rapid growth is due to the ongoing innovations in polymer science, enabling the development of discs with enhanced biocompatibility and adaptability. For instance, shape-memory polymers allow discs to adjust to varying spinal loads, improving functionality. Another driving factor is the increasing focus on reducing metal ion release, which has raised safety concerns. Polymers eliminate this risk, appealing to both patients and regulators. Furthermore, advancements in additive manufacturing enable precise fabrication of complex polymer-based designs. These innovations align with the growing demand for personalized healthcare solutions, positioning advanced polymers as a transformative force in the market.

By Indication Insights

The cervical segment led the North America artificial disc market by accounting for 60.6% of the total market share in 2024. This dominance is caused by the higher prevalence of cervical disc degeneration. Cervical discs are subjected to significant stress due to neck movements, making them more prone to damage. Different contributing aspect is the relatively straightforward surgical approach for cervical disc replacements, which reduces operative risks and recovery times. Additionally, the availability of multiple FDA-approved devices for cervical applications expands treatment options, further solidifying the segment's leadership.

The lumbar segment is the rapidly advancing, with a CAGR of 8.5%. This development is fueled by the rising incidence of lumbar disc herniation, affecting an eye-catching portion of the population annually. Advances in surgical techniques, such as minimally invasive approaches, have made lumbar disc replacements safer and more effective. Furthermore, the development of motion-preserving implants addresses the limitations of traditional fusion surgeries, appealing to younger patients seeking active lifestyles. Also, lumbar disc replacements reduce adjacent segment degeneration, driving adoption.

By End-Use Insights

The hospital segment prevailed in the North America artificial disc market by capturing a 70.8% of the market share in 2024. This progress of the segment is due to the centralized nature of hospitals, which house state-of-the-art surgical facilities and multidisciplinary teams required for complex procedures. Additionally, hospitals serve as referral centers for severe spinal conditions, ensuring a steady patient inflow. The availability of advanced imaging technologies, such as MRI and CT scans, further enhances diagnostic accuracy, facilitating timely interventions. In addition, hospitals conducted a large portion of all spinal surgeries in in the past few years, exhibiting their pivotal role. Furthermore, partnerships with academic institutions enable hospitals to stay at the forefront of innovation, attracting patients seeking cutting-edge treatments.

The outpatient facilities segment is accelerating a quick pace, with a CAGR of 10.3%. This advancement is propelled by the shift toward outpatient care, motivated by cost savings and convenience. Procedures performed in ambulatory surgery centers (ASCs) are typically cheaper than those in hospitals. Additionally, shorter wait times and personalized care enhance patient satisfaction. In addition, the advent of minimally invasive techniques has made artificial disc replacements feasible in outpatient settings, reducing recovery periods. Further, ASCs handled more spinal surgeries in recent years.

COUNTRY LEVEL ANALYSIS

The United States led the North America artificial disc market by commanding a 85.8% of the regional revenue share in 2024. This dominance is fueled by several interwoven factors, including the country's advanced healthcare infrastructure, high prevalence of spinal disorders, and robust reimbursement policies. The U.S. healthcare system is highly equipped to handle complex procedures such as artificial disc replacements, with hospitals and specialized clinics housing cutting-edge surgical technologies. Similarly, a large percentage of Americans suffer from chronic back pain annually, creating a vast patient pool for innovative treatments. Moreover, favorable reimbursement frameworks, particularly from Medicare and private insurance providers, have significantly reduced financial barriers for patients seeking these procedures. For instance, the Centers for Medicare & Medicaid Services (CMS) covers artificial disc replacements under specific conditions, which has encouraged adoption rates. Additionally, the presence of key players like Medtronic, DePuy Synthes, and NuVasive ensures that the U.S. remains at the forefront of technological advancements. These companies invest heavily in R&D, contributing to breakthroughs in materials science and minimally invasive techniques. According to the American Academy of Orthopedic Surgeons, over 200,000 spinal surgeries are performed annually in the U.S., with artificial discs gaining traction due to their superior outcomes compared to traditional fusion surgeries. Furthermore, increasing awareness campaigns led by professional medical associations have educated both patients and surgeons about the benefits of artificial discs, driving demand even further. The U.S. market is also characterized by a strong regulatory framework enforced by the FDA ensuring the safety and efficacy of devices. This rigorous oversight not only protects patients but also enhances trust in artificial disc technologies, strengthen the U.S.'s position as the largest and most influential player in the North America artificial disc market.

Canada is contributing a notable portion to the regional revenue. While its market size is smaller compared to the U.S., Canada's universal healthcare system plays a critical role in shaping the adoption of artificial disc technologies. However, budgetary constraints within the public healthcare system often limit access to advanced procedures like artificial disc replacements, particularly in rural areas. Despite these challenges, Canada's market is steadily growing, driven by increasing investments in healthcare infrastructure and rising awareness among patients and surgeons. Collaborations between Canadian universities and international firms are accelerating innovation, with research focusing on biocompatible materials and motion-preserving implants. Additionally, the Canadian government's initiatives to modernize healthcare facilities and adopt digital health solutions, such as telemedicine, are improving accessibility to spinal care. Like, outpatient spinal surgeries have increased over the past three years, reflecting a shift toward minimally invasive procedures. This trend aligns with the growing popularity of artificial discs, which offer shorter recovery times and better long-term outcomes compared to traditional fusion surgeries. Furthermore, favorable reimbursement policies from provincial health authorities are gradually reducing financial barriers, encouraging more patients to opt for artificial disc replacements.

Mexico represents a nascent yet rapidly evolving segment of the North America artificial disc market. However, the country's market is poised for significant expansion, driven by demographic shifts and increasing healthcare investments. Also, the aging population is a key driver of spinal disorders, with degenerative disc diseases becoming more prevalent among adults aged 40 and above. This demographic trend is expected to fuel demand for advanced treatments, including artificial disc replacements. Besides, the Mexican government has prioritized healthcare modernization, investing in state-of-the-art facilities and training programs for surgeons. These efforts aim to bridge the gap between urban and rural healthcare access, ensuring that more patients can benefit from cutting-edge technologies. Partnerships with U.S.-based firms are also playing a pivotal role in introducing innovative solutions to the Mexican market. For example, collaborations with Medtronic and DePuy Synthes have enabled the introduction of FDA-approved artificial discs, enhancing treatment options for patients. According to the Mexican Association of Orthopedic Surgery, the number of spinal surgeries performed annually has increased substantially over the past five years, reflecting growing acceptance of artificial discs. Despite these positive developments, challenges such as limited awareness and high procedure costs remain barriers to widespread adoption. Educational campaigns targeting both healthcare providers and patients are essential to overcoming these hurdles.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America artificial disc market are Medtronic PLC, Orthofix Medical Inc, Globus Medical Inc Class A, NuVasive, AxioMed Spine, Zimmer Biomet Holdings Inc, Centinel Spine, Aesculap, spineart, Synergy Spine and Pain Center.

The North America artificial disc market is characterized by intense competition, with established players and emerging innovators vying for market share. Companies like Medtronic, DePuy Synthes, and NuVasive dominate the landscape, leveraging their expertise, resources, and extensive distribution networks to maintain leadership. Meanwhile, NuVasive's focus on minimally invasive techniques and personalized care sets it apart, appealing to surgeons and patients seeking advanced yet less invasive options. Despite their dominance, these players face stiff competition from smaller firms entering the market with disruptive technologies. For instance, startups specializing in biomaterials and AI-driven surgical tools are challenging traditional incumbents, forcing them to adapt or risk obsolescence. Regulatory frameworks, particularly those enforced by the FDA, add another layer of complexity, requiring companies to demonstrate the safety and efficacy of their devices through rigorous clinical trials. High costs associated with artificial disc replacements also create barriers to entry, favoring larger firms with deeper pockets. However, the competitive environment fosters innovation, benefiting patients and healthcare providers alike.

Top Players in the Market

Medtronic

Medtronic is the undisputed leader in the North America artificial disc market, leveraging its extensive portfolio of innovative products to maintain its dominance. The company's flagship product, the Prestige LP Cervical Disc, is widely regarded as a gold standard in cervical disc replacement, offering unparalleled durability and biomechanical performance. Also, the company's success is driven by a relentless focus on R&D, with notable investments . This commitment to innovation has enabled Medtronic to introduce groundbreaking technologies, such as smart implants equipped with sensors to monitor postoperative outcomes. Additionally, Medtronic's expansive distribution network ensures that its products are accessible to healthcare providers across North America. Strategic partnerships with academic institutions and hospitals further enhance its ability to address unmet clinical needs, reinforcing its leadership position in the market.

DePuy Synthes

DePuy Synthes, a subsidiary of Johnson & Johnson, is another dominant player in the North America artificial disc market, renowned for its ProDisc line of artificial discs. It distinguishes itself through its commitment to patient-centric designs and motion-preserving technologies. DePuy Synthes' strategic acquisitions and collaborations further strengthen its market position. For example, the acquisition of Emerging Implant Technologies (EIT) expanded its portfolio of 3D-printed implants, enabling personalized solutions for patients. Additionally, the company's global reach and robust supply chain ensure consistent availability of its products, even in remote regions.

NuVasive

NuVasive specializes in minimally invasive spinal solutions, making it a key player in the North America artificial disc market. The company's Mobi-C Cervical Disc is one of its standout products, designed to mimic natural disc movement while minimizing tissue disruption during implantation. This focus on innovation has resulted in breakthroughs such as the Pulse platform, which integrates navigation, imaging, and robotics into a single system for enhanced surgical precision. NuVasive's emphasis on patient education and advocacy further differentiates it from competitors. The company collaborates with patient organizations to raise awareness about the benefits of artificial discs, driving adoption rates. Additionally, NuVasive's strategic partnerships with hospitals and outpatient facilities ensure widespread accessibility to its products.

Top Strategies Used by Key Players

Key players in the North America artificial disc market employ a diverse array of strategies to maintain their competitive edge and expand their market presence. Product innovation remains a cornerstone of their approach, with companies investing heavily in R&D to develop next-generation artificial discs.

Strategic partnerships and collaborations are another critical tactic, fostering innovation and expanding market reach. NuVasive's collaboration with Mayo Clinic exemplifies this approach, combining expertise to advance minimally invasive spinal technologies. Mergers and acquisitions are also prevalent, allowing firms to diversify their portfolios and enter new markets. Additionally, educational campaigns targeting healthcare providers and patients play a pivotal role in driving adoption. Companies like NuVasive partner with patient advocacy groups to raise awareness about the benefits of artificial discs, addressing misconceptions and building trust. Expanding geographical reach through distribution agreements further bolsters market presence, ensuring that cutting-edge technologies are accessible to underserved regions.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Medtronic acquired Axonics, a neurostimulation company, to enhance its spinal care portfolio and integrate advanced neuromodulation technologies.

- In June 2023, DePuy Synthes launched the ProDisc L Revision System, addressing unmet needs in lumbar revisions and expanding its product offerings for complex cases.

- In March 2023, NuVasive partnered with Mayo Clinic to co-develop minimally invasive spinal technologies, combining clinical expertise with innovative engineering.

- In January 2023, Globus Medical introduced the SECURE-C Artificial Disc, marking its entry into the cervical disc replacement segment and diversifying its spinal portfolio.

- In September 2022, Zimmer Biomet invested $50 million in a new R&D facility focused on spinal innovations, signaling its commitment to advancing artificial disc technologies.

MARKET SEGMENTATION

This research report on the north america artificial disc market has been segmented and sub-segmented into the following.

By Material Type

- Metal + Plastic

- Advanced Polymers

By Indication

- Cervical

- Lumbar

By End-Use

- Hospitals

- Outpatient Facilities

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What is the North America Artificial Disc Market?

The North America Artificial Disc Market refers to the segment of the medical device industry that focuses on the development, manufacturing, and sale of artificial discs used in spinal disc replacement surgeries across the U.S., Canada, and Mexico.

What is driving the growth of the artificial disc market in North America?

Key drivers include an aging population, rising prevalence of degenerative disc diseases, increased demand for minimally invasive surgeries, advancements in implant materials and design, and favorable reimbursement policies.

What are the current trends in the North America artificial disc market?

Some trends are Increased adoption of 3D printing for customization, Development of next-gen materials like biocompatible polymers, Rise in outpatient surgical centers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]