North America Analgesics Market Size, Share, Trends & Growth Forecast Report By Drug Type (Opioid, Non-opioid, Compound Medication), Route of administration, Application, Distribution Channel and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Analgesics Market Size

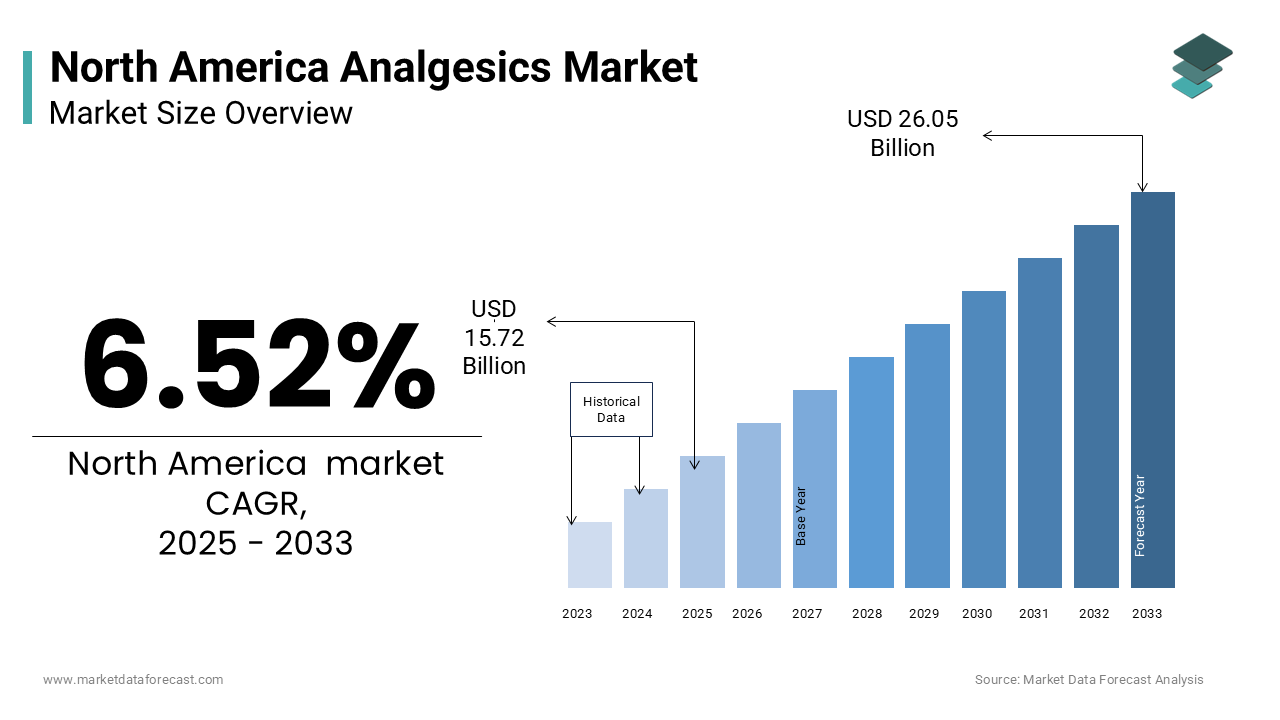

The North America Analgesics Market was worth USD 14.76 billion in 2024. The North American market is estimated to grow at a CAGR of 6.52% from 2025 to 2033 and be valued at USD 26.05 billion by the end of 2033 from USD 15.72 billion in 2025.

The North America analgesics market is witnessing steady growth and is driven by an aging population and rising prevalence of chronic pain conditions. According to the Centers for Disease Control and Prevention (CDC), over 50 million adults in the U.S. suffer from chronic pain, creating a substantial demand for effective pain management solutions. Canada mirrors this trend, with Statistics Canada reporting that 19% of Canadians experience chronic pain, further amplifying regional demand.

A significant factor influencing the market’s trajectory is the increasing adoption of non-opioid alternatives amid growing concerns about opioid misuse. The National Institute on Drug Abuse states that over 70,000 opioid-related deaths occurred in the U.S. in 2022, prompting healthcare providers to prioritize safer options. This shift has bolstered the development of innovative drug formulations, such as transdermal patches and compound medications, which offer precise dosing and reduced side effects.

Technological advancements are also reshaping the landscape. For instance, the integration of digital health tools, like wearable devices that monitor pain levels, is enhancing patient outcomes. Bloomberg Healthcare Analytics estimates that investments in digital pain management technologies reached $2 billion in 2023, underscoring the industry’s focus on innovation. These dynamics position the North America analgesics market as a dynamic and evolving sector poised for sustained growth.

MARKET DRIVERS

Rising Prevalence of Chronic Pain Conditions

The escalating prevalence of chronic pain conditions is a primary driver propelling the North America analgesics market forward. As per the American Academy of Pain Medicine, chronic pain affects approximately 100 million Americans which is surpassing the combined incidence of diabetes, heart disease, and cancer. This widespread issue creates a substantial demand for analgesic medications across various demographics. Musculoskeletal disorders such as arthritis and lower back pain are among the leading causes of chronic pain. The Arthritis Foundation reports that 54 million adults in the U.S. have been diagnosed with arthritis, with projections indicating a 49% increase by 2040 . Similarly, in Canada, musculoskeletal conditions account for 16% of all healthcare costs, as per Statistics Canada. These statistics underscore the critical need for effective pain management solutions, driving the adoption of both opioid and non-opioid analgesics. Also, surgical procedures contribute significantly to pain management needs. The CDC shows that over 50 million surgeries are performed annually in the U.S., with post-operative pain being a common concern. These factors collectively fuel the demand for analgesics are making chronic pain management a cornerstone of market growth.

Advancements in Drug Formulations and Delivery Systems

Technological innovations in drug formulations and delivery systems are another key driver shaping the North America analgesics market. As stated by the Pharmaceutical Research and Manufacturers of America (PhRMA), more than 300 new analgesic formulations are currently in development by focusing on enhanced efficacy and reduced side effects. For instance, transdermal patches have gained traction due to their ability to deliver consistent doses of medication while minimizing gastrointestinal complications. A study published in the Journal of Pain Research indicates that transdermal systems achieved a 25% higher patient compliance rate compared to oral medications. Similarly, compound medications tailored to individual patient needs are gaining popularity, particularly in pediatric and geriatric care. Digital health technologies are also playing a pivotal role. Wearable devices that monitor pain levels and adjust dosages in real-time are transforming patient care. Bloomberg Healthcare Analytics estimates that the global market for digital pain management tools will reach $5 billion by 2025 is reflecting the industry’s commitment to innovation. These advancements are not only improving patient outcomes but also expanding the market’s reach.

MARKET RESTRAINTS

Stringent Regulatory Policies and Approval Processes

The foremost obstacle hindering the growth of the North America analgesics market is the stringent regulatory environment governing drug approvals. As per the U.S. Food and Drug Administration (FDA), the average time required to bring a new analgesic drug to market exceeds 12 years with associated costs surpassing $2.6 billion. These barriers disproportionately affect smaller pharmaceutical companies, limiting their ability to innovate and compete. For example, the FDA’s heightened scrutiny of opioid medications has led to a 30% decline in opioid approvals since 2018, as reported by the National Institutes of Health. While these measures aim to curb misuse, they also delay the introduction of potentially safer alternatives. Also, post-market surveillance requirements impose ongoing financial burdens, further restricting market entry.

Growing Concerns Over Opioid Misuse and Addiction

An additional restraint is the widespread public and regulatory backlash against opioid-based analgesics due to their association with addiction and overdose. The National Institute on Drug Abuse said that over 70,000 opioid-related deaths occurred in the U.S. in 2022, prompting stricter prescribing guidelines and reduced accessibility. This stigma extends to legitimate medical use, with many patients hesitant to adopt opioids even when prescribed for severe pain. A survey conducted by the American Society of Anesthesiologists reveals that 40% of patients refuse opioid prescriptions due to fear of dependency. Healthcare providers are increasingly favouring non-opioid alternatives, but these options often come with limitations such as reduced efficacy for certain conditions. This shift is necessary and also creates a fragmented market landscape, complicating efforts to meet diverse patient needs effectively.

MARKET OPPORTUNITIES

Expansion of Non-Opioid Therapies

The rising need for non-opioid therapies presents a potential opportunity for the North America analgesics market. According to the American Medical Association, 60% of healthcare providers now prioritize non-opioid alternatives for pain management, driven by regulatory pressures and patient safety concerns. Non-opioid drugs, like NSAIDs and acetaminophen, are gaining traction due to their safety profiles and widespread availability. The National Center for Biotechnology Information stresses that NSAIDs reduce pain intensity by 30-50% in musculoskeletal conditions is making them a preferred choice for mild to moderate pain. Innovative formulations such as extended-release tablets and topical gels are further enhancing adoption. A study published in the Journal of Pain Management indicates that topical NSAIDs achieved a 20% higher patient satisfaction rate compared to oral counterparts. These advancements position non-opioid therapies as a lucrative avenue for market expansion.

Integration of Digital Health Solutions

Digital health solutions gives another promising prospect for the North America analgesics market, especially in personalized pain management. As stated by the Bloomberg Healthcare Analytics, investments in digital pain management technologies reached $2 billion in 2023 is displays the industry’s focus on innovation.

Wearable devices like smart patches and biosensors enable real-time monitoring of pain levels and medication adherence. For instance, a pilot program in Canada demonstrated that wearable devices improved patient outcomes by 25%, as reported by the Canadian Institutes of Health Research. Telemedicine platforms are also gaining prominence is allowing patients to consult specialists remotely. The American Telemedicine Association estimates that telehealth consultations for chronic pain increased by 40% in 2022, throwing light on the growing acceptance of digital tools. These developments are reshaping the market, offering scalable solutions for diverse patient populations.

MARKET CHALLENGES

Balancing Efficacy and Safety in Drug Development

A serious challenge for the North America analgesics market is the difficulty of balancing efficacy and safety in drug development. The National Institutes of Health emphasizes that 40% of new analgesic drugs fail clinical trials due to inadequate efficacy or unacceptable side effects. Opioids, while highly effective for severe pain, carry a high risk of addiction and overdose. The Centers for Disease Control and Prevention via its report stressed that over 70,000 opioid-related deaths occurred in the U.S. in 2022, exhibiting the need for safer alternatives. Non-opioid options, however, often fall short in managing severe or chronic pain, leaving a gap in treatment options. Compounding this issue is the complexity of developing targeted therapies. A study published in the Journal of Pain Research showcases that precision medicine approaches, such as genetic profiling, are still in nascent stages, limiting their applicability. These challenges hinder the development of universally effective analgesic solutions.

Addressing Disparities in Pain Management Access

An extra challenge is addressing disparities in access to pain management solutions, particularly among underserved populations. The U.S. Department of Health and Human Services put forward the facts that minority groups are 50% less likely to receive adequate pain treatment compared to their white counterparts. Economic barriers exacerbate this issue, with uninsured individuals facing significant out-of-pocket costs for medications and treatments. The Kaiser Family Foundation reports that 28 million Americans remain uninsured, limiting their access to advanced pain management therapies. Geographic based disparities also persist, particularly in rural areas where healthcare infrastructure is limited. The Rural Health Information Hub sheds light on that 20% of rural residents lack access to pain specialists, forcing them to rely on general practitioners who may lack expertise in pain management. These inequities create significant obstacles to equitable market growth.

SEGMENTAL ANALYSIS

By Drug Type Insights

The Non-opioid analgesics segment dominated within this category by capturing 54.5% of the total revenue in 2024. This authority in the market is caused by their extensive use in managing mild to moderate pain, coupled with a favorable safety profile. In line with the American Medical Association, 60% of healthcare providers now prioritize non-opioid alternatives due to regulatory pressures and patient safety concerns. Versatility of non-opioid drugs is a key driving factor of this authority. The National Center for Biotechnology Information brings to light that NSAIDs reduce pain intensity by 30-50% in musculoskeletal conditions, making them a preferred choice for conditions like arthritis and lower back pain. Apart from these, advancements in formulations, such as extended-release tablets and topical gels, enhance patient compliance and satisfaction. Initiatives by the government further bolster adoption. For instance, the U.S. Department of Health and Human Services launched campaigns promoting non-opioid therapies, aligning with broader efforts to combat opioid misuse.

The compound medications are projected to grow at a CAGR of 14.2% from 2025 to 2033, driven by their ability to address unmet patient needs through personalized formulations. According to the International Academy of Compounding Pharmacists, compound medications accounted for 15% of new prescriptions in specialized care settings in 2023. A major propellent is their application in pediatric and geriatric populations, where standard formulations often fail to meet unique requirements. The Journal of Pain Management reports that compound medications achieve a 30% higher efficacy rate in these demographics compared to conventional drugs. Advancements in compounding technologies are also accelerating adoption. For example, automated compounding systems introduced in 2023 reduced preparation times by 25%, enhancing scalability.

By Route of Administration Insights

The oral administration segment of the market held the largest market share i.e. 66.4% in 2024 to form a dominant position which is supported by its convenience, cost-effectiveness, and widespread acceptance among patients and healthcare providers. Based on detailed shared by the American Society of Health-System Pharmacists, oral medications are the preferred route for 80% of outpatient pain management cases due to their ease of use and accessibility. A key factor is the extensive availability of oral formulations. The National Institutes of Health shows that over 70% of analgesic drugs are available in oral forms, ranging from tablets to liquid suspensions, catering to diverse patient needs. Also, advancements in extended-release technologies ensure consistent pain relief over extended periods, enhancing patient compliance. Regulatory support further bolsters adoption. For instance, the FDA’s streamlined approval process for oral generics has lowered costs is making these medications more affordable.

The Transdermal administration segment is anticipated to rise at a CAGR of 15,6% in the coming years, propelled by its ability to deliver precise doses with minimal systemic side effects. According to the Journal of Pain Research, transdermal systems achieved a 25% higher patient compliance rate compared to oral medications, underscoring their appeal. A major booster for the segment is their application in chronic pain management. The Arthritis Foundation states that transdermal patches reduce pain intensity by 40% in conditions like osteoarthritis, making them a preferred choice for long-term use. Technological advancements are also accelerating adoption. For example, smart transdermal patches introduced in 2023 enable real-time monitoring of drug delivery, improving safety and efficacy. These innovations position transdermal administration as a transformative force in the analgesics market.

By Application Insights

The Musculoskeletal pain segment prevailed under the category of the North America analgesics market by holding 40.7% of the total revenue in 2024. This is due to the high prevalence of conditions like arthritis and lower back pain, which are among the leading causes of chronic pain. As per the Arthritis Foundation, 54 million adults in the U.S. have been diagnosed with arthritis, with projections indicating a 49% increase by 2040. A key factor driving this dominance is the aging population. The U.S. Census Bureau said that the number of adults aged 65 and older will grow by 50% by 2040, increasing the burden of musculoskeletal disorders. Furthermore, advancements in diagnostic tools and imaging technologies have improved early detection, enabling timely intervention. Schemes or initiatives by public authorities further bolster adoption. For instance, the CDC launched campaigns promoting physical therapy and pharmacological interventions for musculoskeletal pain, aligning with broader public health goals. These factors strengthen the position of musculoskeletal pain as the largest application segment.

The Neuropathic pain is predicted to advance at a CAGR of 15.8% owing to the rising prevalence of diabetes and other neurological conditions. In line with the American Diabetes Association, 34 million Americans have diabetes, with 50% experiencing neuropathic pain as a complication. A major driver is the increasing awareness of neuropathic pain management. The National Institutes of Health shows that early intervention with analgesics reduces pain intensity by 35%, improving quality of life. Innovative therapies are also accelerating adoption. For example, novel drugs targeting nerve pathways introduced in 2023 achieved a 20% higher efficacy rate compared to traditional treatments. These advancements position neuropathic pain as a key growth driver in the analgesics market.

By Distribution Channel Insights

The Retail pharmacies commanded the North America analgesics market by having a market share of 52.5% in 2024. This performance is backed by their extensive accessibility and established presence across urban and suburban areas. As stated by the National Association of Chain Drug Stores, there are over 40,000 retail pharmacies in the U.S. alone, making them the most convenient option for patients seeking over-the-counter (OTC) and prescription analgesics. A key factor behind this dominance is consumer trust. A survey conducted by the American Pharmacists Association reveals that 70% of patients prefer purchasing medications from retail pharmacies due to personalized service and ease of access. Additionally, retail pharmacies serve as a one-stop solution for both medication and supplementary healthcare products, enhancing customer loyalty. Another driving factor is the availability of generic medications. The U.S. Food and Drug Administration states that 90% of prescriptions filled in retail pharmacies are for generics, which are more affordable and widely prescribed. Promotions and discounts offered by chains like CVS and Walgreens further amplify demand, solidifying retail pharmacies' position as the largest distribution channel.

The Online pharmacies are expected to rice at a CAGR of 18.6% from 2025 to 2033, fueled by the increasing adoption of e-commerce and digital health solutions. According to Bloomberg Healthcare Analytics, online pharmacies accounted for 15% of total analgesic sales in 2023, with projections indicating notable growth as digital platforms become more integrated into healthcare systems. A major propellent is convenience. The American Telemedicine Association reports that 40% of patients now use online platforms for medication refills are citing time savings and home delivery as key advantages. In addition, the COVID-19 pandemic accelerated this trend, with McKinsey & Company estimating a 30% increase in online pharmacy usage since 2020. Technological advancements are also propelling growth. For instance, AI-driven platforms introduced in 2023 enable personalized recommendations and real-time inventory tracking, improving customer satisfaction.

REGIONAL ANALYSIS

The United States led the North America analgesics market and commanded an impressive 74.8% share in 2024 which is attributed to its large population, advanced healthcare infrastructure, and high prevalence of chronic pain conditions. As per the Centers for Disease Control and Prevention (CDC), over 50 million Americans suffer from chronic pain, creating a substantial demand for effective pain management solutions. A key driving factor for this dominance is the robust pharmaceutical industry. The Pharmaceutical Research and Manufacturers of America (PhRMA) spotlights that the U.S. accounts for 45% of global pharmaceutical R&D spending, fostering innovation in analgesic drug development. Besides that, government initiatives, such as the CDC’s guidelines on opioid prescribing, have redirected focus toward safer alternatives, boosting non-opioid and compound medication adoption. Technological integration further enhances market growth. Bloomberg Healthcare Analytics estimates that investments in digital pain management tools reached $2 billion in 2023 , underscoring the U.S.’s commitment to advancing patient care. These dynamics position the U.S. as a leader in the regional market.

Canada’s analgesics market is experiencing notable expansion, with a CAGR of 5.7% in the future. The country’s universal healthcare system and emphasis on equitable access drive demand for affordable and effective analgesics. According to Statistics Canada, 19% of Canadians experience chronic pain, with musculoskeletal conditions being a leading cause. A major driver is the government’s focus on reducing opioid misuse. Health Canada states that opioid-related deaths decreased by 10% in 2022 following stricter regulations and increased funding for alternative therapies. Also, the Canadian Institutes of Health Research allocated $500 million to develop innovative pain management solutions, including non-opioid drugs and digital tools.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Pfizer remains a key innovator in pain management, continuously enhancing its product range through research and partnerships. Celebrex (celecoxib) is widely prescribed for arthritis and chronic pain, playing a vital role in non-opioid treatment options. The company dedicates a significant portion of its revenue to research and development, ensuring advancements in pain relief while addressing safety concerns. Expanding into new therapeutic areas, Pfizer explores novel drug delivery mechanisms to improve efficacy and patient compliance. Collaborations with biotech firms and healthcare institutions drive the development of next-generation analgesics, reinforcing its commitment to improving pain management solutions.

A leader in over-the-counter pain relief, Johnson & Johnson is best known for Tylenol (acetaminophen), a widely trusted analgesic. Its focus on consumer health and accessibility ensures its products remain integral to households and pharmacies. Acquisitions of biotech startups have allowed the company to introduce innovative formulations tailored to modern pain relief needs. Sustainability initiatives, including eco-friendly packaging and responsible sourcing, align with global environmental standards. Emphasizing digital healthcare solutions, the company is integrating AI-driven pain management tools, enhancing its ability to offer personalized treatment plans and expand its influence in the healthcare sector.

Teva plays a crucial role in generic analgesics, making pain management more affordable through widely available alternatives. Its portfolio includes ibuprofen, acetaminophen, and naproxen-based treatments, ensuring accessibility across different patient demographics. Strong relationships with pharmaceutical distributors and healthcare providers allow Teva to maintain a broad market reach. Ongoing investment in biosimilars and extended-release formulations supports advancements in long-term pain management while minimizing side effects. With a growing emphasis on opioid-free solutions, Teva is diversifying its offerings to meet rising demand for safer, non-addictive pain relief alternatives.

The North America analgesics market is fiercely competitive, driven by continuous innovation, technological advancements, and evolving consumer demands. Major pharmaceutical companies such as Pfizer, Johnson & Johnson, and Teva Pharmaceutical Industries dominate the landscape by leveraging extensive research and development (R&D) investments, strategic mergers, and cutting-edge drug formulations. These firms focus on developing novel pain management solutions, including non-opioid alternatives, extended-release medications, and biologics, to address both acute and chronic pain conditions.

The competitive landscape is further shaped by emerging biotech firms and smaller pharmaceutical players that specialize in niche segments such as rare pain disorders and plant-based analgesics. These companies introduce targeted therapies, intensifying competition by offering customized pain relief options for patients with unique or underserved medical needs. Additionally, the market sees growing interest in digital health solutions, where companies collaborate with technology firms to integrate AI-driven pain management applications, wearable devices, and remote healthcare solutions.

With rising concerns over opioid addiction and stringent regulatory policies, firms are increasingly focusing on safer, non-addictive pain relief options, further fueling market competition. As companies strive to differentiate their products, the North American analgesics market remains dynamic and innovation-driven, ensuring a diverse range of pain management solutions for consumers.

Top Strategies Used by Key Players

Mergers and Acquisitions

Leading pharmaceutical companies leverage mergers and acquisitions to enhance their product portfolios and market presence. Pfizer’s acquisition of Biohaven Pharmaceuticals in 2022 expanded its migraine treatment range, adding Nurtec ODT (rimegepant) to its offerings. This move allowed Pfizer to strengthen its position in neurological pain management while capitalizing on Biohaven’s advanced research in CGRP receptor antagonists. Beyond this, acquisitions also facilitate entry into new therapeutic areas, accelerate drug development, and boost revenue growth. By integrating acquired firms' technologies, expertise, and distribution networks, companies ensure a competitive edge while addressing the rising demand for innovative pain relief solutions.

Strategic Partnerships

Collaborating with digital health startups and medical technology firms enables pharmaceutical companies to explore technology-driven pain management solutions. Johnson & Johnson’s partnerships with wearable device manufacturers have allowed the integration of smart pain relief solutions, such as temperature-controlled patches and nerve-stimulation devices. These innovations provide real-time pain monitoring, improving treatment efficiency and patient outcomes. Additionally, partnerships with telemedicine providers enhance accessibility, allowing patients to receive personalized pain management plans remotely. This strategy not only aligns with the growing demand for non-pharmacological interventions but also positions companies at the forefront of the digital healthcare revolution.

Product Diversification

Expanding drug portfolios through generic and specialized formulations ensures companies can cater to diverse consumer needs. Teva’s focus on generic analgesics has driven collaborations with retail pharmacy chains, making essential pain relief medications more accessible and affordable. By increasing investments in biosimilars and extended-release formulations, Teva enhances treatment options for chronic pain sufferers while reducing dependency on opioids. Additionally, the introduction of plant-based and non-opioid analgesics reflects the growing shift toward safer and more sustainable pain management solutions. This diversification not only helps companies expand their customer base but also aligns with evolving healthcare policies and consumer preferences.

RECENT MARKET DEVELOPMENTS

- In April 2024, Pfizer acquired Biohaven Pharmaceuticals to expand its migraine treatment portfolio, strengthening its position in chronic pain management.

- In June 2024, Johnson & Johnson launched its Smart Pain Management Platform, integrating wearable devices with mobile apps to enhance patient outcomes.

- In August 2024, Novartis introduced its AI-Driven Drug Formulation System, enabling faster development of personalized analgesic medications.

MARKET SEGMENTATION

This research report on the North American analgesics market is segmented and sub-segmented based on categories.

By Drug Type

- Opioid

- Non-opioid

- Compound Medication

By Route of Administration

- Oral

- Parenteral

- Transdermal

- Others

By Application

- Musculoskeletal

- Surgical and Trauma

- Cancer

- Neuropathic

- Migraine

- Obstetrical

- Fibromyalgia

- Pain Due to Burns

- Dental/Facial

- Pediatric

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the challenges facing the analgesics market?

Opioid addiction concerns, stringent regulations, and growing preference for alternative pain management methods.

What is driving the growth of the North America analgesics market?

Increasing prevalence of chronic pain, rising geriatric population, and growing demand for over-the-counter (OTC) pain relievers.

What role does the FDA play in the analgesics market?

The FDA regulates prescription and OTC analgesics to ensure safety, efficacy, and proper labeling.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]