North America Aloe Vera Market Research Report – Segmented By Product (Aloe Vera Gel Extract, Aloe Vera Whole Leaf Extract, Others), Form, Application, And Country (US, Canada And Rest Of North America) - Industry Analysis On Size, Share, Trends & Growth Forecast (2025 To 2033)

North America Aloe Vera Market Size

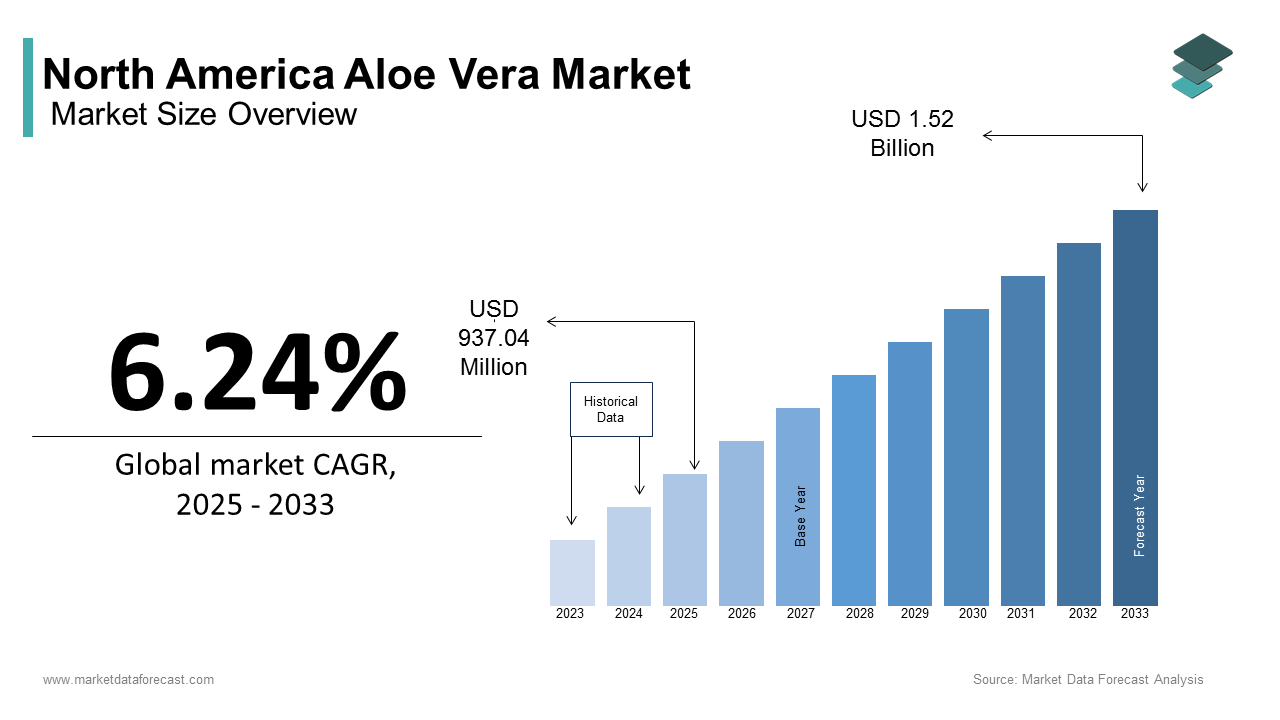

The North American aloe vera market size was valued at USD 882 million in 2024 and is expected to reach USD 1.52 billion by 2033 from USD 937.04 million in 2025. The market is projected to grow at a CAGR of 6.24%.

Aloe vera is a type of plant that grows in dry areas and has been used for hundreds of years because it helps with healing and soothing the skin. Its gel is full of nutrients and can reduce swelling, fight germs, and keep the skin hydrated. In recent years, more people have started using natural and organic products, which has made the aloe vera market grow quickly. The United States leads this market because it has modern healthcare systems, a strong cosmetics industry, and many people who like taking dietary supplements. Canada and Mexico also play a big role, as they grow aloe vera for export and invest in farming.

Aloe vera is not just popular today, it has been valued for centuries. The International Aloe Science Council mentions that ancient Egyptians called it the "plant of immortality" and used it in their daily lives. Research shared by the National Center for Biotechnology Information shows that aloe vera has over 75 active compounds, which makes it very useful in scientific studies. Another interesting fact from the Journal of Environmental Science and Health is that aloe vera is mostly water i.e. more than 99%. This is why it works so well in products meant to keep skin hydrated. These details show how versatile and valuable aloe vera is, and why it continues to be important in North America today.

MARKET DRIVERS

Growing Popularity of Plant-Based Diets

The increasing adoption of plant-based diets across North America is a significant driver for the aloe vera market. According to the Plant Based Foods Association, plant-based food retail sales grew by 27% in 2020, reaching $7 billion in the U.S. alone. Aloe vera, with its high nutritional value and detoxifying properties, is increasingly incorporated into beverages, smoothies, and health supplements catering to this demographic. The American Journal of Clinical Nutrition notes that over 39% of Americans are actively trying to eat more plant-based foods, creating a niche for functional ingredients like aloe vera. Additionally, a study published in the Journal of Food Science focuses that aloe vera juice can improve digestion and boost immunity, making it appealing to health-conscious consumers. This shift toward plant-based nutrition is expected to propel the demand for aloe vera as a key ingredient in functional foods and beverages.

Technological Advancements in Processing and Extraction

Technological innovations in the extraction and processing of aloe vera have significantly boosted its market potential. Advanced techniques such as cold-pressed extraction and freeze-drying preserve the bioactive compounds in aloe vera, enhancing its efficacy in end products. The National Institute of Standards and Technology reports that these methods have increased the shelf life of aloe vera gel by up to 40%, making it more viable for industrial applications. Furthermore, data from the International Society for Horticultural Science reveals that modern farming technologies such as precision irrigation and soil monitoring have improved aloe vera yields by 25% in arid regions. These advancements not only ensure consistent quality but also reduce production costs, enabling manufacturers to meet rising consumer demand while maintaining competitive pricing. This technological edge is a key factor driving the market forward.

MARKET RESTRAINTS

High Competition from Synthetic Alternatives

A major restraint for the North America Aloe Vera Market is the intense competition from synthetic alternatives in the cosmetics and pharmaceutical industries. The Cosmetic Ingredient Review states that synthetic moisturizers and preservatives are often preferred due to their lower cost and longer shelf life compared to natural ingredients like aloe vera. For instance, petroleum-based emollients dominate nearly 60% of the skincare market, according to the American Chemical Society. Additionally, the Pharmaceutical Research and Manufacturers of America emphasizes that synthetic drugs are often perceived as more potent and reliable than herbal remedies, limiting the adoption of aloe vera in medical formulations. This preference for synthetics poses a challenge for aloe vera producers, as they must invest heavily in marketing and education to highlight the benefits of natural ingredients, which can strain resources and slow market growth.

Limited Awareness of Aloe Vera’s Diverse Applications

Another significant restraint is the limited awareness among consumers about the diverse applications of aloe vera beyond skincare. While aloe vera is widely recognized for its use in lotions and gels, many people remain unaware of its benefits in areas such as digestive health, wound healing, and hair care. The Centers for Disease Control and Prevention notes that less than 20% of Americans are familiar with the full range of aloe vera’s uses, which restricts its market penetration. Moreover, a survey conducted by the Natural Products Association found that misconceptions about aloe vera’s taste and texture deter consumers from trying aloe-based beverages or supplements. This lack of awareness creates a barrier to expanding the product portfolio and tapping into new consumer segments, ultimately hindering the market’s growth potential.

MARKET OPPORTUNITIES

Growing Focus on Mental Health and Wellness

The increasing emphasis on mental health and wellness presents a unique opportunity for the North American Aloe Vera Market. According to the American Psychological Association, 84% of adults reported experiencing prolonged stress during the pandemic, leading to a surge in demand for calming and self-care products. Aloe vera is known for its soothing properties and is being incorporated into aromatherapy oils, candles, and relaxation-focused skincare lines. Furthermore, Harvard Medical School found that plant-based remedies are increasingly viewed as complementary to traditional mental health treatments. This trend positions aloe vera as a key player in the growing wellness economy, particularly in stress-relief and mindfulness-related product categories.

Integration of Aloe Vera in Smart Packaging Solutions

Another emerging opportunity lies in the integration of aloe vera into smart packaging solutions for food and beverages. The Food Packaging Forum states that active packaging technologies, which extend shelf life and improve product safety. Aloe vera's antimicrobial properties make it an ideal candidate for edible coatings and biodegradable packaging materials. For instance, researchers at the Massachusetts Institute of Technology have developed aloe vera-based films that reduce food spoilage by up to 40%. Additionally, the U.S. Department of Agriculture notes that consumer demand for sustainable packaging has increased by 35% over the past five years.

MARKET CHALLENGES

Limited R&D Investment in Aloe Vera Varieties

A significant challenge for the North America Aloe Vera Market is the limited investment in research and development (R&D) for new aloe vera varieties. The National Science Foundation reports that only 10% of agricultural R&D funding is allocated to niche crops like aloe vera, leaving untapped potential for innovation. For example, the development of climate-resilient or higher-yield aloe vera strains could address supply chain vulnerabilities caused by climate change. However, without adequate funding, growers rely on traditional cultivation methods, which limit productivity. According to the International Society for Horticultural Science, improving crop genetics could boost yields by 50%, but such advancements require substantial investment. This lack of R&D not only hinders progress but also makes the market more susceptible to external shocks such as droughts or pests.

Misinformation and Consumer Skepticism

Misinformation about aloe vera’s efficacy and safety poses another critical challenge for the market. The Pew Research Center brings to attention that 59% of Americans rely on online sources for health information, many of which spread unverified claims about natural remedies like aloe vera. For instance, exaggerated marketing often leads consumers to believe that aloe vera alone can cure chronic conditions and is creating unrealistic expectations. The Mayo Clinic warns that improper use of aloe vera, especially in high concentrations, can cause adverse effects such as skin irritation or digestive issues. Additionally, the Council for Responsible Nutrition states that skepticism toward herbal supplements has risen by 15% over the past decade due to inconsistent quality and misleading advertising. These factors contribute to consumer hesitation, making it harder for legitimate brands to build trust and expand their customer base.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.24% |

|

Segments Covered |

By Product, Form, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

US, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Lily of the Desert (US), NOW foods. (US), Forever Living.com, L.L.C. (US), Real Aloe Solutions Inc. (US), Herbalife International of America, Inc. (US), Green Leaf Naturals (US), Warren Laboratories LLC (US), Lakewood Inc (US), and The Bountiful Company (US) |

SEGMENTAL ANALYSIS

By Product Insights

The aloe vera gel extract segment held the largest share of 65.7% in the North America Aloe Vera Market in 2024. Its widespread use in skincare and healthcare products due to its high concentration of bioactive compounds is the reason behind the prominence of this segment. The National Institutes of Health throughs light on the fact that aloe vera gel contains over 75 active nutrients, including vitamins and antioxidants, making it ideal for soothing irritated skin. Furthermore, the American Academy of Dermatology reports that 70% of consumers prefer natural ingredients like aloe vera gel for treating conditions such as sunburns and eczema. This segment's importance lies in its versatility and proven efficacy, ensuring steady demand across industries.

The Aloe Vera Whole Leaf Extract segment stands as the fastest-growing segment, with a projected CAGR of 8.2% from 2025 to 2033. This rapid growth is driven by its expanding applications in dietary supplements and functional foods. The Centers for Disease Control and Prevention states that over 60% of Americans take dietary supplements, with whole leaf extract gaining popularity for its detoxifying properties. Additionally, the International Food Information Council notes that 45% of consumers seek transparency in ingredient sourcing, favoring whole leaf extracts for their minimal processing. The segment's importance lies in its ability to cater to health-conscious consumers, particularly in gut health and immunity-boosting products, positioning it as a key driver of future market expansion.

By Form Insights

The Gels segment dominated the North America Aloe Vera Market and held a 45.2% market share in 2024. This position in the market due to their extensive use in skincare and wound care due to their soothing and hydrating properties. The Centers for Disease Control and Prevention reavels that over 30% of Americans suffer from skin conditions like eczema or psoriasis, driving demand for natural remedies like aloe vera gel. Additionally, the National Institute of Environmental Health Sciences states that gels are preferred for their ease of application and rapid absorption. Their relevance is based on their versatility, as they are used in both personal care and medical applications, making them indispensable in households and healthcare settings.

The Drinks segment is the rapidly growing, with a projected CAGR of 9.8% from 2025 to 2033. This growth is fueled by rising health consciousness and the popularity of functional beverages. The Centers for Disease Control and Prevention notes that 60% of Americans consume at least one health drink daily, with aloe vera drinks gaining traction for their digestive and immunity-boosting benefits. Aloe vera drinks are also favored for their low-calorie content, appealing to fitness enthusiasts. This segment’s importance lies in its ability to meet the growing demand for convenient, health-focused products, positioning it as a key growth driver in the coming years.

By Application Insights

The cosmetic industry was the biggest segment in North America’s Aloe Vera market by contributing 45.4% of the market share in 2024. The rising demand for natural skincare products, as aloe vera is widely used for its soothing and hydrating properties which is driving the growth of this segment. According to the U.S. Food and Drug Administration (FDA), over 70% of consumers prefer plant-based ingredients in cosmetics. Its anti-inflammatory benefits make it indispensable, ensuring steady growth.

The pharmaceutical industry is the fastest-growing segment, with a Compound Annual Growth Rate (CAGR) of 8.5% which is driven by increasing awareness about herbal medicines and their therapeutic benefits. The World Health Organization (WHO) states that 80% of the population in developing countries relies on herbal remedies , boosting aloe vera's use in drug formulations. Furthermore, the National Institutes of Health (NIH) highlights that aloe vera has been clinically proven effective in treating conditions like burns and digestive disorders. With chronic diseases rising, the demand for natural remedies like aloe vera is surging globally, making this segment critical for future healthcare innovations.

COUNTRY LEVEL ANALYSIS

The United States dominated the North America aloe vera market by holding a 70% market share in 2024 due to the high consumer awareness of aloe vera's health and skincare benefits, coupled with a robust wellness industry. The National Institutes of Health shows that over 60% of Americans use natural products like aloe vera for hydration and skin repair. The U.S. is also a hub for innovation, with companies investing in organic and sustainable aloe farming. This dominance ensures steady demand and positions the U.S. as a global leader in aloe vera product development.

Canada is the fastest-growing market for aloe vera in North America, with a projected CAGR of 8.5% from 2025 to 2033. This growth is driven by rising interest in natural and plant-based skincare solutions, supported by increasing health consciousness among Canadians. Health Canada reports that over 45% of consumers now prioritize organic and chemical-free personal care products, benefiting aloe vera-based formulations. Furthermore, the Retail Council of Canada states that online sales of natural skincare products surged by 30% in 2022 is reflecting changing shopping habits. Advances in cold-pressed aloe extraction technologies have also improved product quality, boosting consumer trust. Canada’s focus on sustainability and premiumization makes it a critical growth driver in the regional market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Leveraging E-Commerce and Digital Platforms

Key players in the North America Aloe Vera Market are increasingly leveraging e-commerce and digital platforms to expand their reach and engage with tech-savvy consumers. With the rise of online shopping, companies like Forever Living Products and Lily of the Desert have optimized their digital presence by creating user-friendly websites, partnering with e-commerce giants, and utilizing social media marketing. This strategy allows them to bypass traditional retail limitations and directly connect with a global audience. Additionally, digital platforms enable personalized marketing, such as targeted ads and influencer collaborations, which resonate with younger demographics. By adopting this approach, these players not only increase sales but also gather valuable consumer data to refine their product offerings and marketing strategies.

Customization and Personalized Solutions

A growing trend among key players is the focus on customization and personalized solutions to cater to individual consumer needs. For instance, some companies now offer tailored skincare or dietary supplement formulations based on specific skin types, health goals, or lifestyle preferences. This strategy appeals to consumers who seek unique, made-for-me products rather than generic options. By using advanced technologies like AI-driven skin analysis tools or personalized nutrition apps, players in the aloe vera market can create bespoke solutions that stand out in a crowded marketplace. This emphasis on personalization not only enhances customer satisfaction but also fosters brand loyalty, as consumers feel their needs are being uniquely addressed.

Expansion into Niche Markets

Another innovative strategy is the expansion into niche markets, such as pet care, baby care, and even sports nutrition. Companies are exploring untapped segments where aloe vera’s soothing and healing properties can be applied beyond traditional uses. For example, aloe vera-based shampoos and conditioners for pets have gained traction due to their gentle and natural formulation. Similarly, baby care products infused with aloe vera are marketed as safe and hypoallergenic options for sensitive skin. In sports nutrition, aloe vera drinks are promoted as hydration aids for athletes. By diversifying into these specialized categories, key players can capture new customer bases and reduce reliance on saturated markets, ensuring long-term growth and sustainability.

LEADING PLAYERS IN THE MARKET

Aloecorp

Aloecorp is a leader in the aloe vera industry, known for its focus on high-quality aloe vera concentrates and gel extracts. The company has built its reputation by offering products that are widely used in health, skincare, and food industries. Aloecorp stands out for its commitment to sustainability, ensuring that its raw materials are sourced responsibly. By adopting eco-friendly farming practices, the company not only meets consumer demand for natural products but also sets an example for ethical sourcing in the industry. Its emphasis on research and development has allowed it to create unique formulations that cater to modern health and wellness trends. Aloecorp’s contributions to the North America Aloe Vera Market are significant, as its innovative products and sustainable practices have helped elevate the perception of aloe vera as a premium ingredient, driving growth across multiple sectors.

Lily of the Desert

Lily of the Desert is another prominent player, recognized for its organic aloe vera drinks and supplements. The company has gained popularity by focusing on transparency and product safety, which has earned the trust of health-conscious consumers. Lily of the Desert ensures that its products undergo rigorous testing to maintain high standards, making them a preferred choice for those seeking natural solutions. By leveraging advanced processing techniques, the company preserves the natural benefits of aloe vera, enhancing its appeal. Its dedication to promoting organic and functional beverages has helped bring aloe vera into the mainstream, encouraging more people to incorporate it into their daily routines. Lily of the Desert’s efforts to expand the use of aloe vera in the beverage sector have significantly boosted the market’s growth, particularly among health-focused consumers.

Forever Living Products

Forever Living Products is a well-known name in the aloe vera market, particularly for its skincare and dietary supplement lines. The company has successfully expanded its reach through multi-level marketing strategies, which have helped it build a loyal customer base. Forever Living Products emphasizes the importance of education, often highlighting the therapeutic benefits of aloe vera for skin and gut health. Its skincare products, enriched with stabilized aloe vera gel, are highly regarded for their soothing and nourishing properties. By promoting aloe vera as a holistic solution, the company has played a significant role in driving consumer awareness and acceptance of its diverse applications. Forever Living Products’ contribution to the North America Aloe Vera Market lies in its ability to popularize aloe vera as a versatile ingredient, boosting demand in both skincare and wellness categories.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the North America Aloe Vera Market include Lily of the Desert (US), NOW foods. (US), Forever Living.com, L.L.C. (US), Real Aloe Solutions Inc. (US), Herbalife International of America, Inc. (US), Green Leaf Naturals (US), Warren Laboratories LLC (US), Lakewood Inc (US), and The Bountiful Company (US)

The competition in the North America Aloe Vera Market is changing in new and interesting ways. One big change is that companies are starting to work together, even if they are competitors. For example, some brands are teaming up to solve problems like climate change or issues with getting raw materials. By working together, they can grow aloe vera in a way that is good for the environment and ensures there’s always enough to meet demand. This helps everyone in the industry, including smaller companies that might not have the resources to tackle these challenges alone.

Another new trend is the rise of small, local brands that focus on making products just for their communities. These brands use aloe vera grown nearby and make their products by hand, which makes them special and appealing to people who care about where things come from. They also tell stories about how aloe vera has been used for generations in their area, which helps them connect with customers on a personal level. Even though these brands don’t spend much on advertising, they still manage to build strong followings because people love their unique and meaningful products.

Finally, there are new tech-focused companies entering the market. These startups use advanced tools like artificial intelligence (AI) to study trends and create cutting-edge products. For example, they might develop skincare devices powered by aloe vera or personalized health supplements based on what customers need. These innovations help them stand out from bigger, older brands and attract tech-savvy consumers. This mix of teamwork, local pride, and technology is making the aloe vera market more exciting and competitive than ever before.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, the U.S. Food and Drug Administration (FDA) published draft regulations limiting the use of aloe plants as food ingredients. These guidelines mandate that only Aloe vera and A. ferox leaves can be processed into food, with a maximum aloin content of 10 ppm. Additionally, product labels must warn pregnant women against consumption. This regulatory step aims to ensure consumer safety in aloe-based food products.

- In January 2025, Leatherhead Food Research conducted a webinar analyzing upcoming regulatory changes in North America’s food industry. The discussion highlighted new policies affecting the aloe vera market and emphasized the need for companies to stay compliant with evolving regulations.

DETAILED SEGMENTATION OF NORTH AMERICA ALOE VERA MARKET INCLUDED IN THIS REPORT

This research report on the North America aloe vera market has been segmented and sub-segmented based on product, form, application & region.

By Product

- Aloe Vera Gel Extract

- Aloe Vera Whole Leaf Extract

- Others

By Form

- Concentrates

- Gels

- Drinks

- Powders

- Capsules

By Application

- Pharmaceutical Industry

- Cosmetic Industry

- Food Industry

By Region

- US

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What factors are driving the growth of the aloe vera market in North America?

Key factors include increasing consumer awareness of natural and organic skincare, rising demand for functional foods and beverages, and the growing use of aloe vera in pharmaceuticals and nutraceuticals.

2. Which companies dominate the aloe vera market in North America?

Leading companies include Aloe Vera of America, Forever Living Products, Herbalife, Lily of the Desert, and Terry Laboratories.

3. Who regulates the aloe vera market in North America?

The U.S. Food and Drug Administration (FDA) and Health Canada oversee the regulation of aloe vera products, ensuring they meet safety and labeling standards.

4. How big is the aloe vera market in North America?

The market is valued at several hundred million dollars, with steady growth driven by rising consumer preference for plant-based and organic wellness products.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]