North America Air Barrier Market Size, Share, Trends & Growth Forecast Report By Category (Coating, Membrane), Phase (Three-Phase, Single-Phase), Voltage Rating (Up to 15 kV, 16 to 27 kV), Insulation Medium (Epoxy Insulation, Air Insulation) and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Air Barrier Market

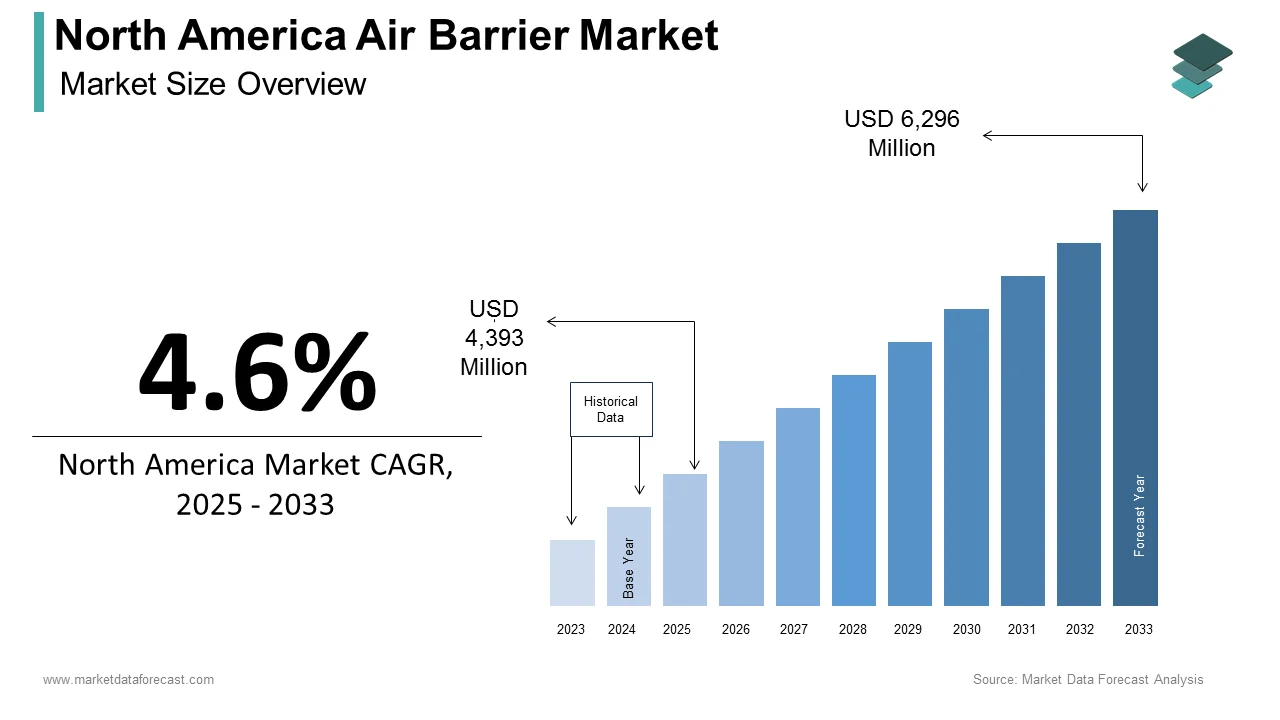

The size of the North America air barrier market was valued at USD 4,200 million in 2024. This market is expected to grow at a CAGR of 4.6% from 2025 to 2033 and be worth USD 6,296 million by 2033 from USD 4,393 million in 2025.

Air barriers are essential for enhancing energy efficiency, improving indoor air quality, and ensuring the overall performance of building envelopes. These barriers are typically made from materials such as membranes, coatings, or rigid panels that are strategically installed to create a continuous barrier against air movement. This growth is driven by the increasing emphasis on energy-efficient building practices, stringent building codes, and the rising awareness of the importance of indoor environmental quality. As per market insights, the North America air barrier market is poised for continued expansion, with manufacturers focusing on innovations in material technology and installation methods. The market is also benefiting from the growing trend of sustainable construction practices, as air barriers play a vital role in reducing energy consumption and enhancing the durability of buildings.

MARKET DRIVERS

Growing Emphasis on Energy Efficiency

The North America air barrier market is greatly driven by the growing emphasis on energy efficiency in building construction and renovation. As energy costs continue to rise and concerns about climate change intensify, both consumers and regulatory bodies are increasingly prioritizing energy-efficient building practices. According to the U.S. Department of Energy, buildings account for approximately 40% of total energy consumption in the United States, showcasing the critical need for improvements in energy efficiency. Air barriers play a vital role in reducing energy loss by preventing air leakage, which can account for a significant portion of heating and cooling costs. The implementation of stringent building codes and standards, such as the International Energy Conservation Code, is further propelling the demand for air barrier systems as builders and architects seek to comply with these regulations. Additionally, the growing trend of green building certifications, such as LEED (Leadership in Energy and Environmental Design), is encouraging the adoption of air barriers as part of comprehensive energy-efficient design strategies.

Increasing Awareness of Indoor Air Quality

Increasing awareness of indoor air quality (IAQ) and its impact on occupant health and comfort is another major driver of the North America air barrier market. Poor indoor air quality can lead to a range of health issues, including respiratory problems, allergies, and decreased productivity. As per the Environmental Protection Agency, indoor air pollution can be two to five times higher than outdoor levels, making it essential for building owners and managers to implement effective strategies to improve IAQ. Air barriers contribute to better indoor air quality by minimizing the infiltration of outdoor pollutants, allergens, and moisture, which can lead to mold growth and other issues. The growing emphasis on creating healthier indoor environments is prompting architects, builders, and facility managers to prioritize the installation of air barrier systems in both new construction and renovation projects. Moreover, the rise of health-conscious consumers and the increasing demand for sustainable building practices are further driving the adoption of air barriers as a means to enhance indoor air quality.

MARKET RESTRAINTS

High Installation Costs

High installation costs associated with air barrier systems is one of primary restraints affecting the North America air barrier market. The upfront investment required for high-quality air barrier materials and the labor involved in proper installation can be significant. The industry estimates states that the cost of installing air barrier systems can range from $1.50 to $3.00 per square foot, depending on the complexity of the project and the materials used. This financial barrier can deter potential adopters, particularly smaller construction companies or those operating on tight budgets. Additionally, the ongoing costs associated with maintenance and potential retrofitting can further strain budgets, particularly for companies that may not have the resources to support such investments. The need for specialized training and expertise to ensure proper installation and performance of air barrier systems can also add to the overall costs. As a result, companies may be hesitant to invest in air barriers, particularly if they are uncertain about the return on investment.

Regulatory Compliance Challenges

Regulatory compliance challenges associated with the installation and performance of air barrier systems is a serious restraint in the North America air barrier market. The construction industry is subject to various regulations regarding building codes, energy efficiency standards, and environmental impact, which can vary significantly across different jurisdictions. In line with the International Code Council, compliance with these regulations can be complex and time-consuming, often requiring extensive documentation and testing to demonstrate adherence to performance standards. This regulatory landscape can pose challenges for manufacturers and contractors, particularly smaller companies that may lack the resources to navigate complex compliance requirements. Also, the increasing focus on sustainability and the transition towards greener technologies may lead to further scrutiny of air barrier systems, as consumers and regulators seek safer and more environmentally friendly alternatives.

MARKET OPPORTUNITIES

Expansion of Green Building Initiatives

The North America air barrier market presents potential opportunities for growth through the expansion of green building initiatives. As the focus on sustainability and energy efficiency intensifies, more builders and developers are seeking to incorporate environmentally friendly practices into their projects. Air barriers play a crucial role in achieving green building certifications, such as LEED (Leadership in Energy and Environmental Design), by enhancing energy efficiency and indoor air quality. The integration of air barrier systems into green building designs not only helps meet regulatory requirements but also provides a competitive advantage in the marketplace. Besides, the growing trend of retrofitting existing buildings to improve energy performance is further driving the demand for air barriers, as building owners seek to reduce energy consumption and operational costs.

Technological Advancements in Air Barrier Materials

A major opportunity in the North America air barrier market lies in the technological advancements in air barrier materials and systems. Innovations in material science are leading to the development of more effective and efficient air barrier solutions that enhance performance while reducing costs. Experts say advancements in polymer technology and the introduction of breathable membranes are expected to drive the market forward, providing better moisture control and air permeability. These new materials not only improve the overall performance of air barriers but also contribute to the durability and longevity of building envelopes. The increasing focus on energy efficiency and sustainability is prompting manufacturers to invest in research and development of advanced air barrier technologies that cater to these demands. This focus on technological advancements is expected to significantly contribute to the growth of the air barrier market in North America, providing opportunities for innovation and development in the coming years.

MARKET CHALLENGES

Supply Chain Disruptions

Among the significant challenges facing the North America air barrier market is the potential for supply chain disruptions. The production of air barrier systems relies on key materials and components, which can be affected by fluctuations in supply and demand. According to industry reports, disruptions in the supply chain, particularly during adverse weather conditions or global events like the COVID-19 pandemic, have led to increased prices and shortages of essential materials. This situation poses a challenge for manufacturers who must ensure a consistent supply of high-quality components to meet consumer demand. Furthermore, the sourcing of materials can be impacted by geopolitical factors, leading to uncertainties in the availability of critical components. As the market shifts towards sustainable and health-conscious options, manufacturers may face challenges in sourcing suitable substitutes that meet consumer expectations for quality and performance.

Competition from Alternative Building Solutions

A grave challenge in the North America air barrier market is the increasing competition from alternative building solutions.

The rise of health-conscious consumers has led to a surge in demand for various energy-efficient building materials and technologies, such as insulated panels and advanced window systems, which can pose a challenge to the adoption of traditional air barrier systems. This trend is particularly pronounced among builders and architects who are increasingly seeking solutions that align with their goals of improving energy efficiency and sustainability. Hence, air barrier manufacturers must compete not only with other air barrier brands but also with a wide array of alternative building technologies that cater to evolving consumer preferences.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Category, Phase, Voltage Rating, Insulation Medium, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

3M Co, BASF SE, Carlisle Companies Inc, Dow Inc, GCP Applied Technologies Inc, General Electric Co, Henry Co, TK Products Construction Coating, VaproShield LLC, W. R. Meadows Inc., and Others., and Others. |

SEGMENTAL ANALYSIS

By Category Insights

The coating category represented the largest segment by commanding a market share of 54.4% in 2024. This rule can be attributed to the extensive use of air barrier coatings in various applications, particularly in commercial and residential construction. As per the industry statistics, the coating segment is projected to grow at a notable pace over the next five years and is driven by the increasing demand for energy-efficient building practices and the need for effective air sealing solutions. Air barrier coatings are favored for their ability to create a continuous barrier against air leakage while allowing for moisture control, making them ideal for a wide range of building materials. Besides, the growing trend of retrofitting existing buildings to improve energy performance is further propelling the demand for air barrier coatings, as building owners seek to reduce energy consumption and operational costs.

Conversely, the membrane segment is experiencing rapid growth, with a projected CAGR of 8.2% over the forecast years. This segment's growth can be attached to the increasing adoption of air barrier membranes in both new construction and renovation projects, where they provide effective air sealing and moisture control. According to market insights, the demand for air barrier membranes is on the rise, driven by the growing trend of sustainable building practices and the need for improved indoor air quality. Membranes are particularly advantageous for their lightweight design and ease of installation, making them an attractive option for builders and contractors. In addition, the rise of government incentives and regulations promoting the use of energy-efficient building materials is making air barrier membranes more accessible to consumers and businesses.

By Phase Insights

The three-phase segment emerged as the biggest category of the North America air barrier market by having a substantial market share in 2024. This control over the market can be linked to the extensive use of three-phase systems in electrical distribution networks, where they are favoured for their ability to provide balanced power and improved efficiency. In a report published by the industry statistics, the three-phase segment is projected to grow at a CAGR of 6.5% over the next five years, driven by the increasing demand for reliable power supply in industrial and commercial applications. Three-phase air barriers are essential for managing the complexities of modern electrical grids, as they can quickly detect and isolate faults, minimizing downtime and enhancing system reliability. Apart from this, the growing trend of integrating renewable energy sources into the grid is further propelling the demand for three-phase air barriers, as they play a crucial role in managing distributed energy resources.

On the other hand, the single-phase segment is experiencing rapid growth, with a calculated CAGR of 8.5% during the forecast period. This progress of the segment can be caused by the surging adoption of single-phase air barriers in residential and small commercial applications where simplicity and cost-effectiveness are paramount. According to market insights, the demand for single-phase air barriers is on the rise, driven by the growing trend of maximizing energy efficiency and improving system performance. Single-phase air barriers are particularly advantageous in settings where the electrical load is lower, making them an ideal choice for utilities looking to enhance service reliability without incurring the higher costs associated with three-phase systems. Additionally, the increasing focus on improving grid resilience and reducing outage times is prompting utilities to invest in single-phase air barriers as part of their modernization efforts.

By Voltage Rating Insights

The voltage rating segment of up to 15 kV secured the highest position in the North America air barrier market and held a market share of 60.4% in 2024. This influence can be due to the extensive use of low-voltage air barriers in distribution networks, particularly in residential and light commercial applications. Air barriers in this voltage range are essential for utilities to quickly detect and isolate faults, minimizing service interruptions and enhancing overall system reliability. Further, the growing trend of integrating renewable energy sources into low-voltage distribution networks is further propelling the demand for air barriers rated up to 15 kV.

Whereas, the voltage rating segment of 16 to 27 kV is seeing swift expansion, with an estimated CAGR of 8.1% in the coming years owing to the rising acceptance of medium-voltage air barriers in urban and industrial applications where higher reliability and performance are required. The market insights reveals that the demand for air barriers in this voltage range is on the rise, driven by the growing need for reliable power supply in areas with higher electrical loads and more complex distribution networks. Medium-voltage air barriers are particularly advantageous for utilities looking to improve service reliability in areas with higher electrical loads and more complex distribution networks. Also, the rise of government incentives and regulations promoting the use of advanced electrical distribution technologies is making air barriers rated between 16 to 27 kV more accessible to utilities and energy providers.

By Insulation Medium Insights

The epoxy insulation segment retained the top spot in the North America air barrier market by commanding a market share of 65.2% in 2024. This prominence can be fuelled by the widespread use of epoxy-based materials in various applications, particularly in commercial and industrial construction. Epoxy insulation is favored for its excellent adhesion properties, chemical resistance, and ability to create a seamless barrier against air and moisture infiltration. Further, the growing trend of energy-efficient building practices and the need for improved indoor air quality are further propelling the demand for epoxy-based air barriers, as they contribute to enhanced energy performance and occupant comfort.

Conversely, the air insulation segment is experiencing rapid growth, with a projected CAGR of 9.1%. This segment's growth can be attributed to the increasing adoption of air-based insulation solutions in both new construction and renovation projects, where they provide effective air sealing and moisture control. According to market insights, the demand for air insulation is on the rise, driven by the growing trend of sustainable building practices and the need for improved indoor air quality. Air insulation systems are particularly advantageous for their lightweight design and ease of installation, making them an attractive option for builders and contractors. Besides, the rise of government incentives and regulations promoting the use of energy-efficient building materials is making air insulation more accessible to consumers and businesses.

REGIONAL ANALYSIS

USA led the space in the North America air barrier market and held a dominant market share of 70.3% in 2024. It is benefiting from stringent energy-efficiency codes, widespread commercial and residential construction, and increasing demand for moisture control solutions. The adoption of high-performance building envelopes has further amplified its influence. As per a 2023 report by the U.S. Census Bureau, the country hosts over 140 million housing units many of which are aging and require retrofitting, fueling demand for modern air sealing solutions. Besides, with climate zones ranging from arid deserts to humid coastal areas, there is a significant focus on enhancing building performance against diverse environmental stresses such as wind-driven rain and thermal loss.

Canada experiences rapid growth in air barrier adoption largely due to its cold and variable climate. It is set to rise at a CAGR of 9.7% over the forecast period. With average winter temperatures in several provinces regularly dipping below -20°C, airtight building design is critical for reducing heating loads and preventing condensation issues. The Canadian government actively promotes net-zero energy-ready buildings, and provinces like British Columbia have adopted the BC Energy Step Code, which mandates progressively stricter airtightness standards. Apart from this, Canada has one of the world’s highest urbanization rates, with approximately 82% of its population living in cities are leading to dense construction activity in metropolitan hubs like Toronto, Vancouver, and Montreal.

Rest of America including Mexico, the Caribbean, and parts of Central America demonstrates gradual development shaped by differing climate conditions and varying levels of infrastructure modernization. Countries in this segment face a mix of tropical, arid, and temperate climates with humidity control and wind resistance being key concerns, particularly in coastal and hurricane-prone regions. Moreover, urbanization across Latin American countries continues to rise, with cities like Mexico City, Bogotá, and Lima experiencing population booms that place pressure on residential and commercial infrastructure. For example, Mexico’s urban population now exceeds 80 million, creating a steady need for modernized building techniques.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America air barrier market profiled in this report are 3M Co, BASF SE, Carlisle Companies Inc, Dow Inc, GCP Applied Technologies Inc, General Electric Co, Henry Co, TK Products Construction Coating, VaproShield LLC, W. R. Meadows Inc., and Others.

RECENT MARKET DEVELOPMENTS

- In January 2025, Heidelberg Materials, one of the world's largest cement producers, announced plans to expand its presence in the U.S. market. The company aims to capitalize on favorable conditions under the current administration, focusing on creating industrial jobs and improving infrastructure. Heidelberg Materials plans to invest up to 1 billion euros in the U.S., including the acquisition of Giant Cement Holding to strengthen its position in the southeastern U.S.

MARKET SEGMENTATION

This research report on the North America air barrier market is segmented and sub-segmented into the following categories.

By Category

- Coating

- Membrane

By Phase

- Three-Phase

- Single-Phase

By Voltage Rating

- Up to 15 kV

- 16 to 27 kV

By Insulation Medium

- Epoxy Insulation

- Air Insulation

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is driving the growth of the North America air barrier market?

The North America air barrier market is growing due to rising energy efficiency standards, stricter building codes, and increasing awareness of indoor air quality.

2. What challenges does the North America air barrier market face?

High installation costs, regulatory compliance complexities, and competition from alternative building solutions hinder market growth.

3. What opportunities exist in the North America air barrier market?

Technological advancements in air barrier materials and the expansion of green building initiatives present significant growth opportunities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com