North America Aesthetic Medicine Market Size, Share, Trends & Growth Forecast Report By Product Type (Aesthetic Laser Devices, Energy Devices, Body Contouring Devices, Facial Aesthetic Devices, Aesthetic Implants, Skin Aesthetic Devices), Application (Anti-Aging and Wrinkles, Facial and Skin Rejuvenation, Breast Enhancement, Body Shaping and Cellulite, Tattoo Removal, Vascular Lesions, Scars, Pigment Lesions, Reconstructive, Psoriasis and Vitiligo), End User (Cosmetic Centers, Dermatology Clinics, Hospitals, Medical Spas and Beauty Centers), Distribution Channel (Direct, Retail), and Country (United States, Canada, Mexico, Rest of North America) Industry Analysis From 2025 to 2033.

North America Aesthetic Medicine Market Size

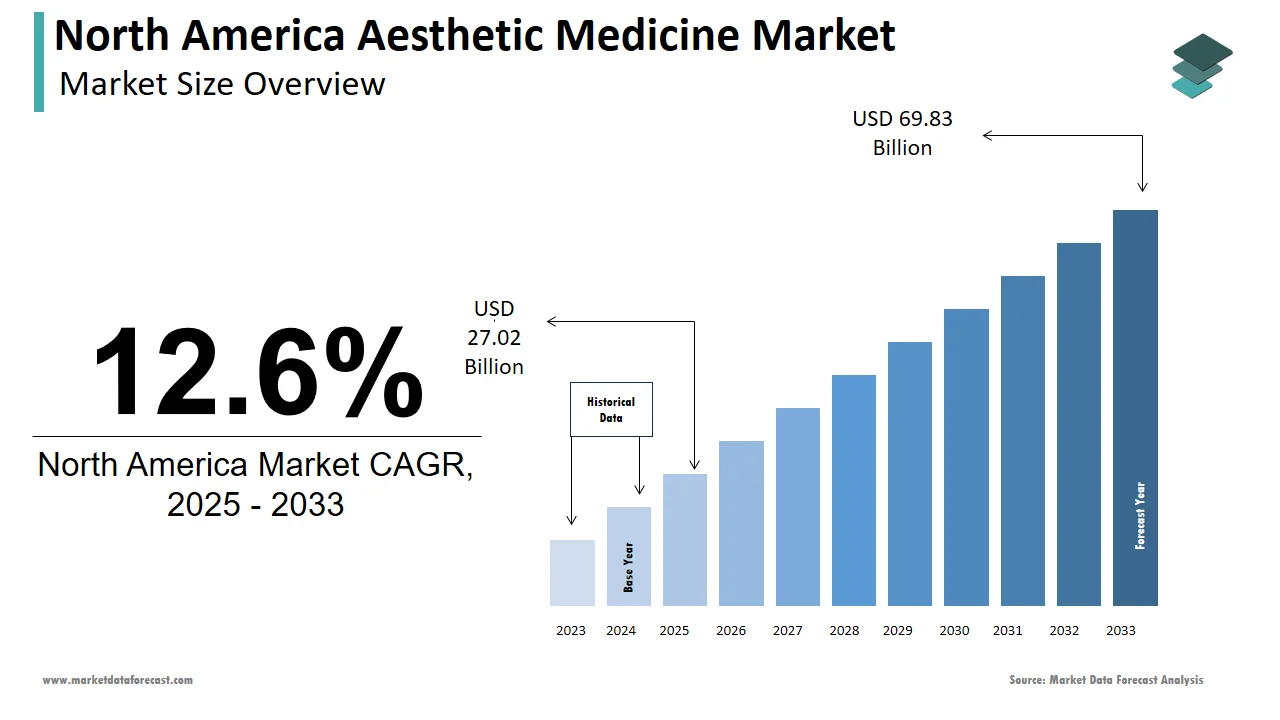

The size of the aesthetic medicine market in North America was valued at USD 24 billion in 2024. This market is expected to grow at a CAGR of 12.6 % from 2025 to 2033 and be worth USD 69.83 billion by 2033 from USD 27.02 billion in 2025.

Aesthetic medicine is a wide array of treatments, including injectables such as botulinum toxin and dermal fillers, laser therapies, body contouring, and skin rejuvenation techniques. This field has gained significant traction due to a cultural shift toward self-care, wellness, and the normalization of cosmetic enhancements in mainstream society. The region's robust infrastructure, high disposable incomes, and accessibility to advanced medical technologies have positioned North America as a global leader in aesthetic innovation.

A notable trend driving this market is the growing demand among younger demographics, particularly millennials and Generation Z, who are increasingly investing in preventive and subtle aesthetic treatments. According to the American Society for Aesthetic Plastic Surgery, non-surgical procedures accounted for over 70% of all aesthetic interventions performed in the United States in recent years. Furthermore, a report by the International Society of Aesthetic Plastic Surgery have revealed that the U.S. ranks first globally in total aesthetic procedures per capita, reflecting its dominant role in the sector. Additionally, societal factors such as the influence of social media platforms like Instagram and TikTok have amplified awareness and acceptance of aesthetic treatments, with a survey by the American Academy of Facial Plastic and Reconstructive Surgery revealing that over 55% of practitioners observed an increase in requests for procedures directly influenced by social media trends.

MARKET DRIVERS

Rising Prevalence of Skin Disorders and Aging Population

The increasing prevalence of chronic skin conditions, coupled with the aging population in North America, is a significant driver of the North America aesthetic medicine market growth. According to the Centers for Disease Control and Prevention, approximately 50 million Americans are affected by acne annually, making it one of the most common dermatological concerns that prompt individuals to seek aesthetic treatments. Additionally, the U.S. Census Bureau projects that by 2034, adults aged 65 and older will outnumber children under 18 for the first time in history. This demographic shift has led to a surge in demand for anti-aging solutions such as Botox, chemical peels, and laser therapies.

Growing Influence of Social Media and Celebrity Culture

Social media platforms and celebrity culture have profoundly influenced consumer behavior by propelling the growth of the aesthetic medicine market in North America. A survey conducted by the Pew Research Center indicates that 72% of American adults use social media, where influencers and celebrities frequently showcase cosmetic enhancements, normalizing these procedures among the general public. Platforms like Instagram and TikTok have become hubs for sharing "before-and-after" content, driving awareness and acceptance of aesthetic treatments. According to the American Society of Plastic Surgeons, nearly 40% of their members reported an increase in consultations directly attributed to social media trends. Furthermore, the Federal Trade Commission has observed a rise in advertisements promoting aesthetic procedures by reflecting the commercialization of beauty standards.

MARKET RESTRAINTS

High Cost of Aesthetic Procedures and Limited Insurance Coverage

The high cost of aesthetic procedures poses a significant restraint to the North American aesthetic medicine market, as many treatments are considered elective and are not covered by health insurance. According to the U.S. Bureau of Labor Statistics, the average annual expenditure on healthcare per consumer unit in the United States was approximately $5,000 in 2022 by leaving limited room for out-of-pocket spending on non-essential procedures. As per the Centers for Medicare & Medicaid Services, only medically necessary treatments are eligible for reimbursement, excluding cosmetic interventions such as Botox or liposuction. For instance, the American Society of Plastic Surgeons estimates that a single session of botulinum toxin injections can cost between $300 and $1,000 by making it inaccessible for a significant portion of the population. This financial barrier restricts market growth, particularly among middle- and lower-income groups who cannot afford these discretionary expenses.

Increasing Regulatory Scrutiny and Safety Concerns

Stringent regulatory scrutiny and growing safety concerns surrounding aesthetic treatments act as notable restraints in the North American market. The U.S. Food and Drug Administration consistently updates guidelines to ensure the safety and efficacy of medical devices and injectables used in aesthetic procedures. According to the National Center for Health Statistics, adverse events from cosmetic treatments have risen by 24% over the past decade by raising public apprehension about their safety. Additionally, the Federal Trade Commission has issued warnings about misleading advertising practices, which erode consumer trust. A study published by the Journal of the American Medical Association reveals that nearly 15% of individuals who undergo minimally invasive procedures experience complications, such as infections or allergic reactions. These factors contribute to hesitancy among potential patients by impeding broader adoption and limiting the expansion of the aesthetic medicine market in the region.

MARKET OPPORTUNITIES

Expansion of Telemedicine in Aesthetic Consultations

The integration of telemedicine into aesthetic medicine presents a significant opportunity for market growth in North America. According to the U.S. Department of Health and Human Services, telehealth adoption surged by over 63% during the COVID-19 pandemic, with many patients embracing virtual consultations for non-emergency healthcare needs. This trend has extended to aesthetic medicine, where practitioners now offer virtual assessments for treatments like skincare regimens or injectables, enhancing accessibility for individuals in rural or underserved areas. According to the American Telemedicine Association, over 75% of patients express satisfaction with telehealth services, citing convenience and time savings as key benefits. As per the National Center for Health Statistics, nearly 30% of adults in the U.S. live in areas with a shortage of dermatologists by making telemedicine a viable solution to bridge this gap. This technological advancement is expected to drive patient engagement and expand the market’s reach.

Rising Demand for Non-Invasive Anti-Aging Solutions

The growing preference for non-invasive anti-aging solutions offers a lucrative opportunity for the North American aesthetic medicine market. The Administration on Aging estimates that the number of Americans aged 65 and older will reach 95 million by 2060 by creating a vast consumer base seeking minimally invasive procedures. Non-surgical treatments such as laser therapies, chemical peels, and dermal fillers are gaining traction due to their lower risk profiles and shorter recovery times compared to traditional surgeries. As per National Institute on Aging, over 60% of older adults prioritize maintaining a youthful appearance, driving demand for these procedures. Additionally, the American Academy of Dermatology notes that non-invasive treatments have seen a year-over-year growth rate of approximately 15%, reflecting their increasing popularity. This shift toward safer, accessible options positions the market for sustained expansion in the coming years.

MARKET CHALLENGES

Ethical Concerns and Unrealistic Expectations Among Patients

Ethical concerns and unrealistic expectations among patients pose a significant challenge to the North American aesthetic medicine market. According to the U.S. National Library of Medicine, nearly 30% of individuals seeking cosmetic procedures have underlying psychological conditions, such as body dysmorphic disorder, which can lead to dissatisfaction even after successful treatments. The American Psychological Association notes that the pervasive influence of filtered images on social media has heightened unrealistic beauty standards, with 60% of patients reporting that their decisions were influenced by digitally altered content. This disconnect between patient expectations and achievable outcomes increases the risk of post-procedure complaints and legal disputes. Furthermore, the Federal Trade Commission has identified a rise in unethical marketing practices, where exaggerated claims about results are made, further complicating patient education and trust-building efforts. Addressing these ethical dilemmas remains a pressing challenge for practitioners.

Environmental and Health Risks Associated with Medical Waste

The environmental and health risks associated with medical waste generated by aesthetic procedures present another critical challenge for the market. The U.S. Environmental Protection Agency estimates that healthcare facilities produce approximately 2.5 million tons of medical waste annually, with aesthetic clinics contributing significantly due to single-use devices, needles, and chemical peels. Improper disposal of this waste poses environmental hazards, including contamination of water sources and soil degradation. According to the Occupational Safety and Health Administration, healthcare workers face a 25% higher risk of exposure to hazardous materials during waste handling by raising safety concerns within clinics. As per the National Institute of Environmental Health Sciences, improper incineration of medical waste releases toxic pollutants, such as dioxins, into the atmosphere. These environmental and occupational risks necessitate stricter compliance with waste management protocols by adding operational complexity for aesthetic medicine providers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application, End User, Distribution Channel, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.), Cutera, Inc. (U.S.), Densply Sirona (U.S.), Institut Straumann AG (U.S.), Candela Corporation (U.S.), BioHorizons(U.S.), Cynosure, LLC (U.S.), Alma Lasers (U.S.), 3M (U.S), Sciton (California), and Others. |

SEGMENT ANALYSIS

By Product Type Insights

The aesthetic laser devices dominated the North American aesthetic medicine market by accounting for 28.4% of share in 2024 owing to their versatility in addressing various dermatological concerns, including hair removal, pigmentation disorders, and skin rejuvenation. The National Institute of Arthritis and Musculoskeletal and Skin Diseases reports that over 40% of adults seek treatments for chronic skin conditions, driving demand for laser-based solutions. Additionally, advancements in laser technology have improved safety and efficacy by making these devices a preferred choice among practitioners. Their widespread adoption elevates their importance in delivering precise, minimally invasive treatments due to their position as the largest segment in the market.

The body contouring devices segment is anticipated to register a CAGR of 14.5% during the forecast period. This rapid growth is fueled by rising obesity rates, with over 42% of U.S. adults classified as obese by creating demand for non-invasive fat reduction solutions like cryolipolysis and radiofrequency treatments. According to the National Center for Health Statistics, a 30% increase in individuals seeking body contouring procedures over the past five years that is driven by growing health consciousness and societal emphasis on physical appearance. Technological innovations enabling quicker recovery times and enhanced outcomes further propel this segment's expansion. Its importance lies in addressing both cosmetic and health-related concerns by positioning it as a key driver of future market growth.

By Application Insights

The anti-aging and wrinkles segment was the largest and held 40.2% of the North American aesthetic medicine market share in 2024. This dominance is driven by several factors, including the region's aging population and shifting societal attitudes toward maintaining a youthful appearance. The U.S. Census Bureau projects that adults aged 55 and above will constitute over 25% of the population by 2030 by creating a robust demand for treatments targeting age-related concerns. Minimally invasive procedures like botulinum toxin injections (Botox) and hyaluronic acid-based dermal fillers have become increasingly popular due to their quick results, minimal downtime, and relatively low risk compared to surgical alternatives. According to the National Institute on Aging, over 70% of older adults express a desire to maintain a youthful appearance, with many seeking non-surgical solutions to address fine lines, wrinkles, and sagging skin. Additionally, advancements in injectable technologies and the growing availability of skilled practitioners have made these treatments more accessible than ever. The anti-aging and wrinkles category not only addresses cosmetic concerns but also plays a crucial role in boosting self-esteem and overall well-being by making it a cornerstone of the aesthetic medicine industry.

The body shaping and cellulite segment is likely to experience a fastest CAGR of 16.5% in the next coming years. This rapid expansion can be attributed to rising obesity rates and an increasing emphasis on physical appearance. According to the Centers for Disease Control and Prevention, 41.9% of American adults were obese in 2020 owing to the widespread need for effective body contouring solutions. Non-invasive fat reduction technologies, such as cryolipolysis (CoolSculpting), laser-assisted lipolysis, and radiofrequency treatments, have gained significant traction due to their ability to target stubborn fat deposits without surgery or prolonged recovery periods. According to the American Academy of Dermatology, over 60% of women and 40% of men express dissatisfaction with their body shape, particularly in areas prone to cellulite, such as the thighs and buttocks. This dissatisfaction has fueled demand for innovative treatments that deliver visible and lasting results. Furthermore, technological advancements have improved the safety, efficacy, and affordability of these procedures, making them accessible to a broader demographic. For instance, the introduction of at-home devices for cellulite reduction has expanded consumer options is driving market growth.

By End User Insights

The medical spas and beauty centers segment was the largest by capturing a 45.6% of the North American aesthetic medicine market share in 2024 owing to the offering affordable, non-invasive treatments like facials, laser hair removal, and injectables in a relaxed, spa-like environment. According to the U.S. Bureau of Labor Statistics, over 60% of consumers prefer these facilities due to their convenience and focus on wellness. Medical spas also benefit from a growing millennial demographic that prioritizes aesthetic treatments. Their ability to blend medical professionalism with luxury experiences makes them pivotal in expanding accessiblity to aesthetic care.

The cosmetic centers segment is ascribed to achieve a prominent CAGR of 12.8% throughout the forecast period. This rapid expansion is driven by advancements in minimally invasive technologies, such as radiofrequency and ultrasound devices, which reduce recovery time and attract a broader audience. According to the Centers for Disease Control and Prevention, the demand for quick, effective solutions is rising, particularly among working professionals aged 25-45. Additionally, the Federal Trade Commission have shown that the increased consumer trust in cosmetic centers due to transparent pricing models and specialized services.

By Distribution Channel Insights

The direct distribution channel dominated the North America aesthetic medicine market by occupying a significant share in 2024. This dominance is attributed to the inherent trust and reliability associated with direct interactions between patients and certified practitioners. According to the National Center for Health Statistics, over 70% of patients prefer receiving treatments directly from licensed professionals due to the assurance of quality, safety, and personalized care. Procedures such as injectables, laser therapies, and body contouring are typically administered in clinical settings, where practitioners can tailor solutions to individual needs. This segment's importance lies in its ability to address complex aesthetic concerns while ensuring regulatory compliance and minimizing risks. Furthermore, the direct channel fosters long-term patient-practitioner relationships by enhancing customer loyalty and repeat visits, which are critical for sustaining revenue streams in this highly competitive market.

The retail distribution channel is projected to witness a fastest CAGR of 12.3% in the future period. This rapid expansion is fueled by the increasing accessibility of FDA-approved over-the-counter products and at-home aesthetic devices, which cater to the growing demand for affordable and convenient self-care solutions. According to the Pew Research Center, over 80% of consumers now engage in online shopping for health and beauty products that is driven by the proliferation of e-commerce platforms and targeted digital marketing campaigns. Also, the National Retail Federation, younger demographics, particularly millennials and Gen Z, are propelling this trend, as they prioritize accessible and non-invasive options for maintaining their appearance. These consumers are drawn to retail channels due to their cost-effectiveness and ease of use by enabling them to experiment with aesthetic treatments without committing to clinical procedures. The retail distribution channel is poised to play a transformative role in democratizing access to aesthetic medicine by making it a focal point for innovation and investment in the coming years.

COUNTRY LEVEL ANALYSIS

The United States aesthetic medicine market was accounted in holding a dominant share of 85.4% in 2024. This dominance is underpinned by a combination of factors, including the country’s advanced healthcare infrastructure, high per capita income, and a deeply ingrained cultural emphasis on personal appearance and wellness. According to the Centers for Disease Control and Prevention (CDC), over 50 million Americans seek dermatological treatments annually, with a significant portion opting for aesthetic procedures such as injectables, laser therapies, and body contouring. The regulatory oversight provided by the Food and Drug Administration (FDA) ensures that treatments are safe, effective, and innovative, further bolstering consumer confidence. Additionally, the U.S. serves as a global hub for technological advancements in aesthetic medicine by attracting investments and fostering innovation.

Canada is poised to achieve a significant CAGR of 9.7% during the forecast period. This impressive growth is fueled by a confluence of demographic, economic, and societal factors. Health Canada reports that over 60% of Canadians aged 40 and above are increasingly investing in aesthetic treatments, particularly non-invasive procedures like injectables, laser skin resurfacing, and body sculpting. According to the Canadian Dermatology Association, the aging population, coupled with rising disposable incomes, has significantly contributed to this trend. Moreover, the growing acceptance of aesthetic procedures among younger demographics, influenced by social media platforms and celebrity culture, has expanded the consumer base. Canada’s focus on adopting cutting-edge technologies and offering patient-centric care has positioned it as a key player in the aesthetic medicine landscape. Canada is expected to maintain its rapid pace of expansion by making it a critical contributor to the North American market’s overall growth trajectory.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America aesthetic medicine market profiled in this report are Mentor WorldWide LLC (a subsidiary of Johnsons & Johnsons) (U.S.), Cutera, Inc. (U.S.), Densply Sirona (U.S.), Institut Straumann AG (U.S.), Candela Corporation (U.S.), BioHorizons(U.S.), Cynosure, LLC (U.S.), Alma Lasers (U.S.), 3M (U.S), Sciton (California), and Others.

TOP 3 PLAYERS IN THE MARKET

Mentor Worldwide LLC (a subsidiary of Johnson & Johnson)

Mentor Worldwide LLC is a prominent player in the North American aesthetic medicine market, renowned for its innovative solutions in breast aesthetics and body contouring. As a subsidiary of Johnson & Johnson, one of the largest healthcare conglomerates globally, Mentor leverages extensive research and development capabilities to deliver cutting-edge products. Its flagship offerings include silicone gel-filled and saline breast implants, which are widely used in cosmetic and reconstructive surgeries. Mentor’s contribution lies in its commitment to safety, quality, and patient satisfaction, setting benchmarks for regulatory compliance and clinical efficacy. Mentor has established itself as a trusted brand among surgeons and patients alike by significantly influencing global standards in aesthetic medicine.

Cutera, Inc.

Cutera, Inc. is a leading innovator in the field of laser and energy-based aesthetic systems by catering to both medical professionals and consumers. The company specializes in non-invasive and minimally invasive treatments for skin rejuvenation, hair removal, and body contouring. Cutera’s diverse portfolio includes platforms like the "TruSculpt" series for fat reduction and the "excel V" system for vascular and pigmented lesion treatments. Its contributions to the global market are marked by a focus on versatility and precision, enabling practitioners to address a wide range of aesthetic concerns with customizable solutions. Cutera’s emphasis on technological advancements and user-friendly designs has positioned it as a key driver of innovation by helping expand the accessibility and adoption of aesthetic procedures worldwide.

Candela Corporation

Candela Corporation is a trailblazer in the aesthetic medicine industry, particularly in the realm of laser and light-based technologies. Known for its state-of-the-art devices, Candela offers solutions for skin resurfacing, tattoo removal, scar treatment, and vascular lesions. The company’s flagship products, such as the "GentleMax Pro" and "PicoWay," are celebrated for their efficacy and safety by making them popular choices among dermatologists and plastic surgeons. Candela’s global impact stems from its dedication to advancing aesthetic science while prioritizing patient outcomes. By continuously pushing the boundaries of innovation, Candela has played a pivotal role in shaping the evolution of non-surgical aesthetic treatments by contributing significantly to the growth and credibility of the global aesthetic medicine market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the North American aesthetic medicine market frequently engage in collaborations and partnerships to enhance their product portfolios and expand their reach. For instance, companies like Candela Corporation and Cutera, Inc. often partner with research institutions, dermatology clinics, and technology firms to co-develop innovative solutions. These alliances enable them to integrate cutting-edge technologies, such as artificial intelligence and advanced imaging, into their devices, ensuring they remain at the forefront of innovation. Additionally, partnerships with training academies and professional associations help these companies educate practitioners on the safe and effective use of their products by fostering trust and loyalty among healthcare providers.

Focus on Research and Development

Investment in research and development (R&D) is a cornerstone strategy for leaders like Mentor Worldwide LLC and Dentsply Sirona. By prioritizing R&D, these companies continuously refine existing products and introduce novel solutions that address unmet needs in the aesthetic medicine space. For example, advancements in biocompatible materials for implants or energy-based platforms for non-invasive treatments are direct outcomes of sustained R&D efforts. This focus not only strengthens their competitive edge but also reinforces their reputation as pioneers in the industry that is capable of delivering safe, effective, and innovative solutions.

Expansion of Product Portfolios and Market Penetration

The key players actively diversify their product offerings and explore new applications for their technologies to occupy their market position. Companies like Alma Lasers and Sciton have successfully introduced multi-functional devices that cater to a wide range of aesthetic concerns, from skin rejuvenation to body contouring. This versatility appeals to a broader customer base, including both established practitioners and emerging clinics. Furthermore, these companies emphasize geographic expansion by targeting underserved regions within North America by ensuring their products are accessible to a wider audience and strengthening their brand presence.

Marketing and Branding Initiatives

Effective marketing and branding strategies are critical for companies like BioHorizons and 3M to differentiate themselves in a highly competitive market. These players invest in digital marketing campaigns, social media engagement, and participation in industry conferences to increase visibility and build credibility. They also leverage patient testimonials and case studies to demonstrate the efficacy of their products, appealing to both practitioners and end consumers.

Emphasis on Regulatory Compliance and Safety

Regulatory compliance is a key focus for companies such as Institut Straumann AG and Cynosure, LLC. By adhering to stringent regulatory standards set by bodies like the FDA, these players ensure their products meet the highest safety and efficacy benchmarks. This commitment not only builds trust among healthcare providers and patients but also mitigates risks associated with product recalls or legal challenges. Additionally, proactive engagement with regulatory agencies allows these companies to stay ahead of evolving guidelines by reinforcing their reputation as responsible and reliable contributors to the aesthetic medicine industry.

COMPETITIVE LANDSCAPE

The North American aesthetic medicine market is characterized by intense competition, driven by the presence of established multinational corporations, innovative startups, and specialized firms vying for market share. Key players such as Mentor Worldwide LLC (a subsidiary of Johnson & Johnson), Cutera, Inc., and Candela Corporation dominate the landscape, leveraging their extensive research and development capabilities, robust distribution networks, and brand recognition to maintain its dominance. These companies focus on technological advancements, introducing state-of-the-art devices and solutions like laser systems, injectables, and non-invasive body contouring tools to cater to evolving consumer demands.

The competitive environment is further intensified by the growing emphasis on non-surgical procedures, which has led to increased innovation and product diversification. Companies are also adopting strategic collaborations, mergers, and acquisitions to expand their portfolios and geographic reach. For instance, partnerships with dermatology clinics and training academies help enhance practitioner adoption, while acquisitions of emerging firms enable access to novel technologies. Additionally, regulatory compliance plays a critical role in shaping competition, as adherence to strict FDA guidelines ensures product safety and efficacy, fostering trust among consumers and practitioners.

Smaller firms and regional players contribute to the competitive dynamics by offering cost-effective and niche solutions, particularly in underserved areas. This fragmented yet dynamic ecosystem fosters innovation but also requires companies to continuously adapt to shifting consumer preferences, technological disruptions, and pricing pressures by ensuring that the market remains highly vibrant and challenging for all participants.

RECENT MARKET DEVELOPMENTS

- In February 2025, L'Oréal acquired stakes in clinics located in China and North America. This strategic move aims to gain deeper insights into the medical aesthetics market, enhancing L'Oréal's understanding and presence in the sector.

- In December 2024, Revance Therapeutics agreed to a revised buyout offer from Crown Laboratories. The agreement, set at $3.10 per share, reflects adjustments following a breach in Revance's distribution agreement for Teoxane's dermal fillers. This acquisition is expected to finalize in the first quarter of 2025, potentially impacting the competitive landscape of aesthetic injectables.

- In November 2024, the FDA reprimanded Merz Aesthetics for a misleading Instagram advertisement. The ad, featuring Nate Berkus promoting Xeomin, was criticized for overstating the drug’s benefits and providing inadequate risk disclosures.

- In August 2024, L'Oréal acquired a 10% stake in the Swiss skincare firm Galderma. This investment signifies L'Oréal's commitment to expanding its footprint in the medical aesthetics and dermatology sectors, leveraging Galderma's established market presence.

- In July 2024, Merz Therapeutics acquired Inbrija and Ampyra from Acorda Therapeutics for $185 million. These medications, targeting Parkinson’s disease and multiple sclerosis respectively, bolster Merz's therapeutic portfolio, potentially influencing its offerings in the aesthetic medicine market.

- In March 2024, McKinsey & Company reported on the growth projections for the medical-aesthetics market. The analysis promoted an expected compound annual growth rate (CAGR) of 11.9% for neuromodulators like Botox in the United States and Canada by 2025, indicating a robust expansion in this segment.

- In January 2024, Allergan Aesthetics identified key trends shaping the aesthetic medicine industry. These include a rising demand for non-surgical treatments targeting the lower face, neck, and jawline, and the growing influence of GLP-1 medications on aesthetic choices, reflecting evolving consumer preferences.

- In December 2023, Galderma reported a significant increase in demand for its aesthetic injectable products. This surge was particularly notable among baby boomers and individuals using weight-loss medications like Ozempic by shifting demographics in the aesthetic injectables market.

- In December 2023, plastic surgeons predicted a rise in chin implants and facelifts for 2025. This trend reflects a growing interest in procedures that enhance facial contours and address signs of aging, indicating evolving patient preferences in aesthetic treatments.

- In December 2023, the U.S. aesthetic medicine market was projected to exceed a valuation of $71.49 billion by 2033. This forecast is anticipated to expand opportunities within the sector over the coming years.

MARKET SEGMENTATION

This research report on the North America aesthetic medicine market is segmented and sub-segmented into the following categories.

By Product Type

- Aesthetic Laser Devices

- Ablative Skin Resurfacing Devices

- CO2 Laser

- Erbium Laser

- Others

- Non-Ablative fractional Laser Resurfacing Devices

- Radiofrequency

- Intense Pulsed Light

- Fractional Laser

- The Q-switched ND:YAG Laser

- Others

- Energy Devices

- Laser Surgery Devices

- Electrocautery devices

- Electrosurgery Devices

- Cryosurgery Devices

- Harmonic Scalpel

- Microwave Devices

- Body Contouring Devices

- Liposuction

- Nonsurgical Skin Tightening

- Cellulite Treatment

- Facial Aesthetic Devices

- Botox Injection

- Dermal Filler

- Natural Dermal Fillers

- Synthetic Dermal Fillers

- Collagen injections

- Chemical peel

- Facial Toning

- Fraxel

- Cosmetic Acupuncture

- Electrotherapy

- Microdermabrasion

- Permanent Makeup

- Aesthetic Implants

- Breast Augmentation

- Saline Implants

- Silicon Implants

- Buttock Augmentation

- Aesthetic Dental Implants

- Dental Titanium Implants

- Dental Zerconium Implants

- Facial Implants

- Soft Tissue Implants

- Transdermal Implant

- Others

- Skin Aesthetic Devices

- Laser Skin Resurfacing Devices

- Non Surgical Skin Tightening Devices

- Light Therapy Devices

- Tattoo Removal Devices

- Micro-Needling Products

- Thread Lift Products

- Nail Treatment Laser Devices

- Others

By Application

- Anti-Aging and Wrinkles

- Facial and Skin Rejuvenation

- Breast Enhancement

- Body Shaping and Cellulite

- Tattoo Removal

- Vascular Lesions

- Sears

- Pigment Lesions

- Reconstructive

- Psoriasis and Vitiligo

- Others

By End User

- Cosmetic Centers

- Dermatology Clinics

- Hospitals

- Medical Spas and Beauty Centers

By Distribution Channel:

- Direct

- Retail

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected market size of the North America aesthetic medicine market by 2033?

The North America aesthetic medicine market is expected to reach USD 69.83 billion by 2033.

2. What factors are driving the growth of the North America aesthetic medicine market?

The market's growth is driven by the increasing prevalence of skin disorders, an aging population, and the growing influence of social media and celebrity culture.

3. Which demographic is increasingly contributing to the demand in the North America aesthetic medicine market?

Younger demographics, particularly millennials and Generation Z, are increasingly investing in preventive and subtle aesthetic treatments, contributing significantly to market demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]