North America Additive Manufacturing with Metal Powders Market Research Report – Segmented By Manufacturing Technique ( powder bed fusion , blown powder deposition ) Material , Application and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Additive Manufacturing with Metal Powders Market Size

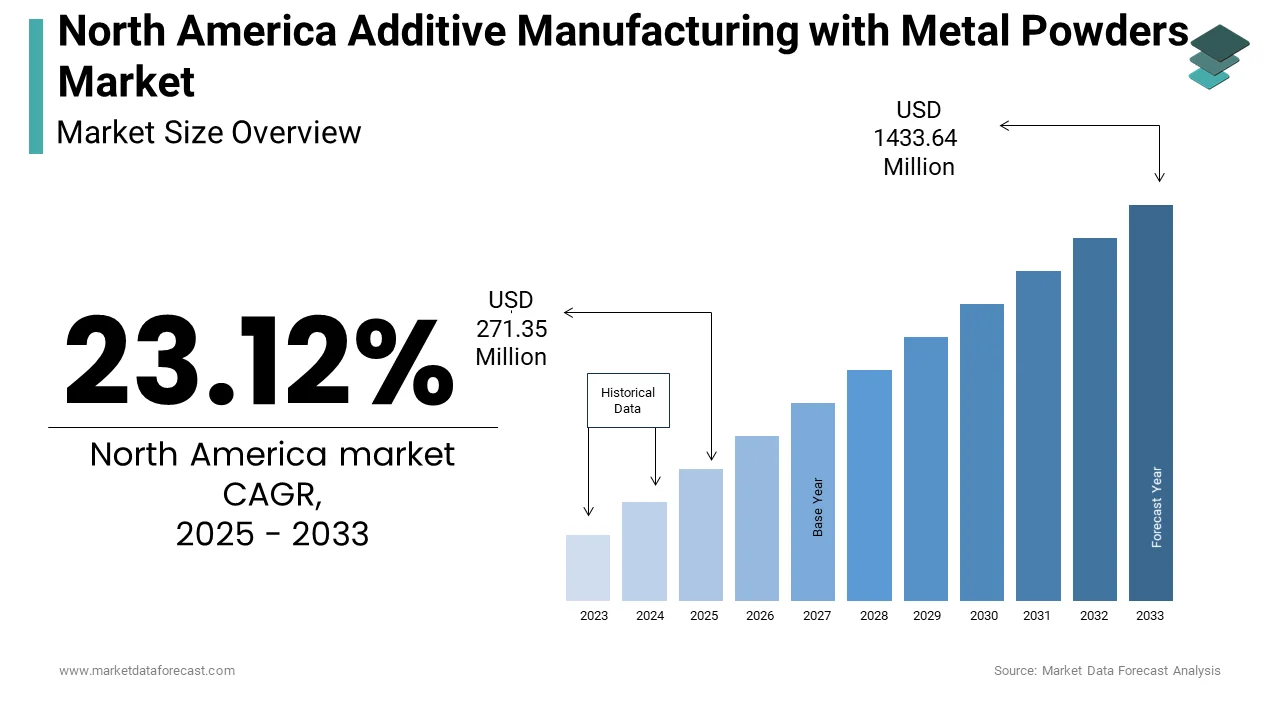

The North America Additive Manufacturing with Metal Powders Market Size was valued at USD 220.37 million in 2024. The North America Additive Manufacturing with Metal Powders Market size is expected to have 23.12 % CAGR from 2025 to 2033 and be worth USD 1433.64 million by 2033 from USD 271.35 million in 2025.

The North American additive manufacturing with metal powders market has emerged as a cornerstone of industrial innovation, driven by its transformative applications across aerospace, medical, and automotive sectors. As per the National Institute of Standards and Technology, additive manufacturing is pivotal in reshaping supply chains, enabling on-demand production and reducing material waste. Furthermore, regulatory support for sustainable manufacturing practices has bolstered demand. For instance, the U.S. Department of Energy’s initiatives promote energy-efficient technologies by aligning perfectly with additive manufacturing's capabilities.

MARKET DRIVERS

Growing Demand for Lightweight Components in Aerospace

The aerospace industry serves as a major driver for the North America additive manufacturing with metal powders market with the need for lightweight yet high-strength components. Titanium and aluminum alloys, widely used in aerospace will enable manufacturers to reduce aircraft weight by up to 40%. As per a report by Boeing, additive manufacturing has reduced lead times for complex parts with its operational benefits. Additionally, the Federal Aviation Administration's stringent safety standards necessitate advanced materials will further drive the growth of the market.

Advancements in Medical Implants and Devices

The medical sector is another key driver by leveraging additive manufacturing with metal powders for producing customized implants and surgical instruments. Biocompatible metals like titanium and stainless steel are extensively used in 3D-printed hip and knee replacements is offering superior strength and compatibility. Furthermore, an aging population, with individuals aged 65 and above expected to constitute 22% of the U.S. population by 2030 that drives demand for personalized medical solutions.

MARKET RESTRAINTS

High Initial Investment Costs

A significant restraint impacting the additive manufacturing with metal powders market is the high initial investment required for equipment and infrastructure. Industrial-grade 3D printers capable of processing metal powders often cost upwards of $500,000, according to the Manufacturing Institute. This financial barrier limits accessibility for small and medium enterprises (SMEs), which account for nearly 45% of the manufacturing sector in North America. Additionally, ancillary costs such as maintenance, software licensing, and skilled labor training further inflate expenses. According to a report by Deloitte, only 25% of SMEs in the region have adopted advanced manufacturing technologies due to cost concerns. The larger companies can absorb these expenses through economies of scale while smaller firms struggle to justify the return on investment. This disparity restricts widespread adoption in cost-sensitive industries like consumer goods and construction that is ultimately constraining market growth.

Limited Availability of Standardized Materials

Another pressing challenge is the limited availability of standardized metal powders, which hinders scalability and consistency in production. Variability in powder particle size, morphology, and composition affects print quality and mechanical properties are leading to inconsistent outputs. A study by the American Society for Testing and Materials notes that non-standardized materials increase defect rates by up to 20%. Moreover, the lack of universal certification processes complicates procurement by forcing manufacturers to rely on niche suppliers. This fragmentation not only raises costs but also delays project timelines by limiting the technology's appeal. Addressing these material standardization issues remains a formidable challenge for stakeholders aiming to scale operations efficiently.

MARKET OPPORTUNITIES

Expansion into Renewable Energy Applications

The renewable energy sector presents a lucrative opportunity for the additive manufacturing with metal powders market owing to its ability to produce complex components for wind turbines and solar panels. For instance, 3D-printed turbine blades made from titanium alloys reduce weight by 25% while enhancing aerodynamic efficiency, as per General Electric. Additionally, the solar energy sector utilizes additive manufacturing for heat exchangers and thermal storage systems by improving energy conversion rates. A report by BloombergNEF projects a 40% increase in solar capacity installations in North America by 2030. These innovations amplifies the material's transformative potential in advancing sustainable energy solutions by unlocking significant growth opportunities.

Customization in Automotive Manufacturing

The automotive industry offers another promising avenue by leveraging additive manufacturing for customized parts and prototypes. According to a study by McKinsey & Company, additive manufacturing reduces prototyping costs by up to 50% is accelerating product development cycles. Furthermore, the rise of electric vehicles (EVs) creates demand for intricate battery housings and cooling systems, where metal powders excel. The trend positions additive manufacturing as a key enabler in reshaping automotive manufacturing that will enhance the growth of the market.

MARKET CHALLENGES

Limited Awareness Among End-Users

A significant challenge facing the additive manufacturing with metal powders market is the limited awareness among end-users regarding its multifaceted applications. Despite its proven efficacy in industries like aerospace and healthcare, many small and medium enterprises remain unaware of its benefits. According to a survey conducted by the Manufacturing Institute, only 35% of SMEs in the U.S. are familiar with additive manufacturing's capabilities beyond prototyping. This knowledge gap restricts broader adoption in emerging sectors like renewable energy and consumer goods. Additionally, misconceptions about high costs deter potential users even though long-term savings outweigh initial investments. According to a study by PwC, lack of technical expertise and training further compounds the issue by leaving businesses unprepared to integrate advanced materials into their processes. Bridging this awareness deficit requires targeted educational campaigns and industry collaborations is posing a significant hurdle for market players aiming to expand their customer base.

Intense Competition from Traditional Manufacturing Methods

Another pressing challenge is the intense competition from traditional manufacturing methods, which threaten market share for additive manufacturing with metal powders. Conventional techniques like casting and forging offer similar functionalities at lower costs is creating a fragmented competitive landscape. These methods are often perceived as more cost-effective in high-volume applications like construction and heavy machinery. Moreover, advancements in hybrid manufacturing is combining additive and subtractive processes, are further intensifying rivalry. A report by the National Institute of Standards and Technology notes that hybrid technologies exhibit superior performance in specific applications, such as large-scale industrial components. This growing preference for alternatives erodes additive manufacturing's market dominance is forcing manufacturers to innovate and differentiate their offerings to maintain relevance. Navigating this competitive environment remains a formidable challenge for industry participants.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

23.12 % |

|

Segments Covered |

By Manufacturing Technique, Material , Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

EOS,Arcam,Concept Laser,3D systems,Trumpf,Renishaw,Optomec,Matsuura Machinery. |

SEGMENTAL ANALYSIS

By Manufacturing Technique Insights

The powder bed fusion segment dominated the North American additive manufacturing with metal powders market by holding a share of 50.6% in 2024 due to its unparalleled precision and ability to produce complex geometries with minimal material waste. According to the National Institute of Standards and Technology, powder bed fusion is widely used in aerospace and medical applications, where accuracy and repeatability are paramount. For instance, GE Aviation utilizes this technique to produce fuel nozzles for jet engines by reducing weight by 25% and improving fuel efficiency. Additionally, the segment benefits from advancements in laser and electron beam technologies, which enhance print speed and resolution. As per a report by ASTM International, powder bed fusion reduces production costs by up to 30% compared to traditional methods.

The blown powder deposition segment is projected to witness a CAGR of 25.5% from 2025 to 2033. This growth is propelled by its versatility in repairing and coating large components in the oil and gas and energy sectors. Additionally, the technique's ability to process a wide range of materials, including tungsten carbide and nickel-based alloys that enhances its appeal. A study published in the Journal of Materials Processing Technology notes a 40% increase in R&D funding for blown powder technologies in 2022.

By Material Insights

The stainless steel segment was the largest and accounted in capturing 30.2% of the North American additive manufacturing with metal powders market share in 2024 due to its corrosion resistance, durability, and versatility across industries. According to the National Institute of Standards and Technology, stainless steel is extensively used in medical implants and surgical instruments by offering biocompatibility and strength. For instance, Zimmer Biomet leverages 3D-printed stainless steel components to produce custom orthopedic implants that can easily reduce production costs by 20%. Additionally, the automotive sector utilizes stainless steel for lightweighting and structural reinforcement, as per the Center for Automotive Research.

The titanium alloys segment is projected to register a CAGR of 28.8% from 2025 to 2033. This growth is fueled by its exceptional strength-to-weight ratio and biocompatibility by making it ideal for aerospace and medical applications. For example, Boeing uses titanium alloys in aircraft structures, reducing weight by 35% while maintaining structural integrity. As per a study published in the Journal of Aerospace Engineering, a 40% increase in titanium alloy usage in aerospace between 2020 and 2022. Additionally, advancements in powder production technologies have lowered costs by enhancing accessibility. These trends position titanium alloys as a transformative material in additive manufacturing that is driving rapid market expansion.

By Application Insights

The aerospace segment was the largest by occupying 40.5% of the North American additive manufacturing with metal powders market share in 2024. The growth of the segment is due to the material's ability to produce lightweight, high-strength components essential for modern aircraft. According to Boeing, additive manufacturing reduces lead times for complex parts by 75% by enhancing operational efficiency. Additionally, the Federal Aviation Administration's stringent safety standards necessitate advanced materials.

The medical segment is esteemed to showcase a CAGR of 27.7% from 2025 to 2033. The growth of the segment is driven by its applications in producing customized implants and surgical instruments. As per a study in the Journal of Medical Engineering, a 30% reduction in production costs by amplifying its appeal. These innovations position the segment as a key growth driver in the market.

COUNTRY LEVEL ANALYSIS

The United States was the top performer in the North American additive manufacturing with metal powders market by capturing 75.7% of share in 2024 with its advanced industrial infrastructure, robust R&D ecosystem, and strong demand across key sectors such as aerospace, automotive, and healthcare. For instance, companies like Boeing and Lockheed Martin utilize titanium and aluminum alloys to create complex parts that are both durable and cost−effective. Additionally, the medical sector’s rapid adoption of 3D−printed implants and surgical instruments has further amplified demand. Government initiatives, such as the Department of Energy’s funding for clean energy technologies, have also bolstered the market by promoting sustainable manufacturing practices.

Canada additive manufacturing with metal powders market held 15.3% of share in 2024 owing to its focus on renewable energy, aerospace, and advanced manufacturing. According to Natural Resources Canada, the country’s abundant natural resources, including nickel and titanium, provide a competitive advantage in producing high-quality metal powders. The aerospace sector, concentrated in regions like Quebec and Ontario, leverages additive manufacturing for producing lightweight components used in aircraft and satellites. Bombardier Aerospace, for example, utilizes 3D-printed titanium parts to reduce weight and improve fuel efficiency. Additionally, Canada’s commitment to sustainability aligns with the growing use of additive manufacturing in renewable energy applications. Furthermore, government programs like the Strategic Innovation Fund provide financial support for advanced manufacturing technologies by fostering innovation and market growth.

Mexico was accounted in holding 10.2% of the North American additive manufacturing with metal powders market share in 2024 owing to its burgeoning automotive manufacturing industry and increasing industrialization. According to the International Trade Administration, Mexico is the seventh-largest vehicle producer globally, with automotive exports exceeding $100 billion annually. Additive manufacturing is increasingly utilized in this sector for prototyping, lightweighting, and producing custom components.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North American additive manufacturing with metal powders market are EOS,Arcam,Concept Laser,3D systems,Trumpf,Renishaw,Optomec,Matsuura Machinery,ExOne, Ping, Phenix Systems, Plunkett Associates, Pratt & Whitney, Progold MTU, Metalysis, GE, and Puris.

The North American additive manufacturing with metal powders market is characterized by intense competition, driven by the presence of established giants and emerging players striving to carve out their niche. EOS GmbH, 3D Systems, and SLM Solutions dominate the landscape by leveraging their extensive R&D capabilities, global supply chains, and brand recognition. However, the market is also witnessing fragmentation, with smaller firms introducing cost-effective alternatives and niche products. This has intensified rivalry in segments like medical implants and aerospace components, where polymer-based substitutes pose a significant threat. Regulatory compliance and environmental standards further add complexity, compelling manufacturers to invest in cleaner technologies. Additionally, the rise of e-commerce platforms has lowered barriers to entry, enabling smaller firms to compete effectively. This dynamic interplay of factors creates a fiercely competitive environment by pushing companies to continuously innovate and adapt to changing market conditions.

Top Players in the Market

The North American additive manufacturing with metal powders market is dominated by three major players: EOS GmbH, 3D Systems, and SLM Solutions, each contributing significantly to global innovation and market expansion. EOS GmbH, headquartered in Germany but with a strong presence in North America. The company specializes in industrial-grade 3D printers and metal powders, offering solutions tailored for aerospace, medical, and automotive applications. Its flagship product, the EOS M 400-4, is widely used for producing large-scale components with exceptional precision. 3D Systems, based in Rock Hill, South Carolina and focuses on end-to-end solutions, from design software to advanced printing technologies. The company’s ProX series is renowned for its ability to process a wide range of materials, including titanium and stainless steel, making it a preferred choice for medical implants and aerospace components. SLM Solutions, another key player and excels in selective laser melting technology. Its machines are widely adopted for producing high-strength parts used in demanding environments, such as gas turbines and orthopedic devices.

Top strategies used by the key market participants

Key players in the North American additive manufacturing with metal powders market employ a range of strategies to maintain their competitive edge and drive growth. Research and development (R&D) is a cornerstone strategy by enabling companies to innovate and expand their product portfolios. For instance, EOS GmbH invests heavily in developing advanced metal powders and laser technologies by ensuring its offerings remain at the forefront of industrial applications. Strategic partnerships and collaborations are another critical approach, with 3D Systems forging alliances with healthcare firms to develop customized implants and surgical instruments. These partnerships not only broaden their market reach but also align with evolving customer demands. SLM Solutions, for example, acquired a startup specializing in hybrid manufacturing technologies, enhancing its capabilities in repairing and coating large components. Another prominent strategy is expanding distribution networks, with companies like Renishaw establishing partnerships with local distributors to strengthen accessibility across North America.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, EOS GmbH launched a new line of titanium powders specifically designed for aerospace applications by enhancing its portfolio for lightweight component production.

- In June 2024, 3D Systems partnered with Zimmer Biomet, a leading medical device manufacturer, to develop customized orthopedic implants using 3D-printed stainless steel components by reducing production costs by 20%.

- In August 2024, SLM Solutions invested $50 million in a state-of-the-art production facility in Michigan to meet rising demand for high-strength parts used in gas turbines and orthopedic devices.

- In October 2024, Renishaw expanded its distribution network across North America by establishing partnerships with local distributors by strengthening its market presence and accessibility.

- In December 2024, Desktop Metal acquired Hybrid Manufacturing Technologies, a startup specializing in hybrid additive and subtractive processes by enhancing its capabilities in repairing and coating large industrial components.

MARKET SEGMENTATION

This research report on the north america additive manufacturing with metal powders market has been segmented and sub-segmented into the following.

By Manufacturing Technique

- powder bed fusion

- blown powder deposition

By Material

- stainless steel

- titanium alloys

By Application

- aerospace

- medical

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

Which industries are the primary adopters of metal powder AM in North America?

Key industries include aerospace & defense, automotive, healthcare (especially dental and orthopedic implants), energy, and industrial tooling.

What are the key drivers for the North American metal AM market?

Major drivers include increasing demand for lightweight components in aerospace and automotive industries, advancements in metal powder materials, and the growing adoption of Industry 4.0 technologies.

What are the challenges facing the metal AM industry in North America?

Challenges include high equipment and material costs, limited material availability, post-processing requirements, and a shortage of skilled workforce.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]