North America Ablation Devices Market Size, Share, Trends & Growth Forecast Report By Device Technology (Radiofrequency Devices, Laser/Light Ablation, Ultrasound Devices, Cryoablation Devices, Other Devices), Application (Cancer Treatment, Cardiovascular Disease Treatment, Ophthalmologic Treatment, Gynecological Treatment, Urological Treatment, Cosmetic Surgery, Other Applications), End-Users (Hospitals, Ambulatory Surgical Centers, Other End-Users) and Country (United States, Canada, Mexico) Industry Analysis From 2025 to 2033.

North America Ablation Devices Market Size

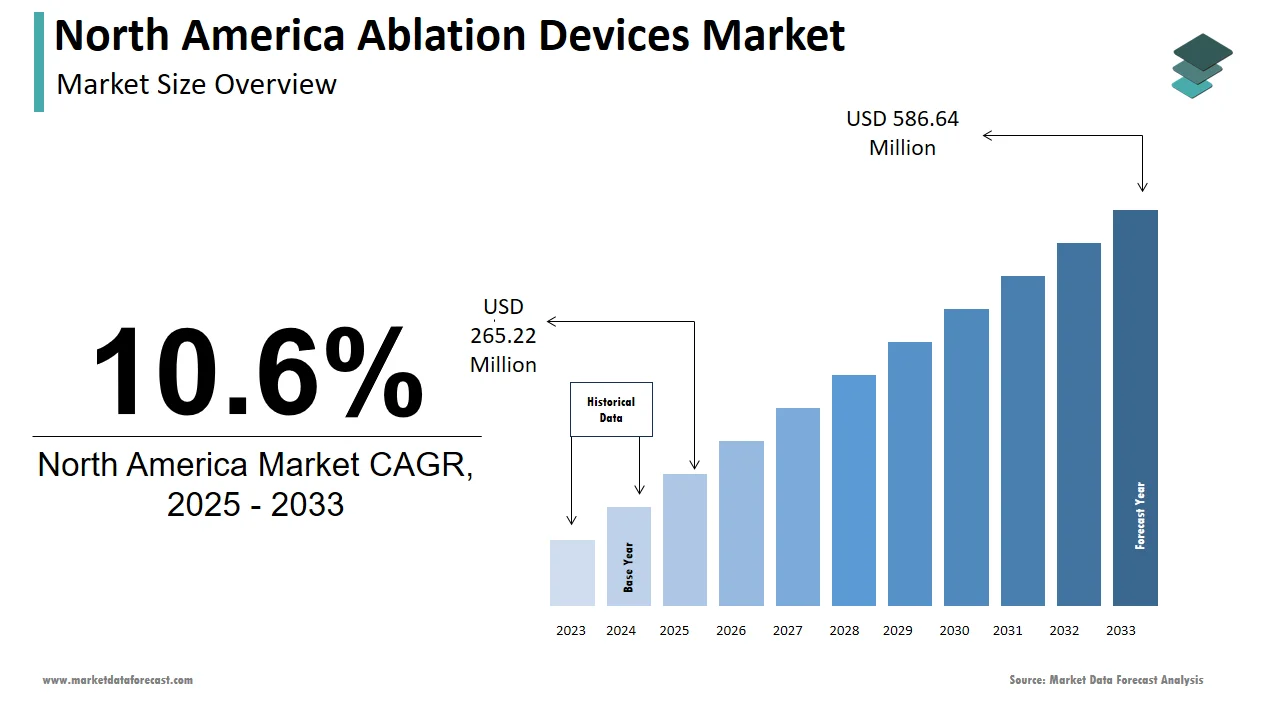

The size of the ablation devices market in North America was valued at USD 239.59 million in 2024. This market is expected to grow at a CAGR of 10.6% from 2025 to 2033 and be worth USD 586.64 million by 2033 from USD 265.22 million in 2025.

The North America ablation devices market has been witnessing steady growth from the last few years due to the advancements in minimally invasive surgical technologies and increasing prevalence of chronic diseases. According to the American Heart Association, cardiovascular diseases account for over 800,000 deaths annually in the U.S., creating a robust demand for ablation devices used in cardiac treatments. Radiofrequency ablation devices dominate the landscape, accounting for approximately 45% of the market share in 2023, as per data from the National Institutes of Health. Canada has also embraced these technologies, with provincial healthcare systems investing in advanced ablation solutions to address rising cases of cancer and cardiac disorders. A study published by the Canadian Medical Association highlights that ablation procedures reduce hospital readmissions by 30%, underscoring their critical role in modern healthcare. Additionally, innovations such as cryoablation and ultrasound-based devices are gaining traction, ensuring sustained market momentum despite challenges like high costs and regulatory hurdles.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases in North America

The increasing prevalence of chronic diseases, particularly cardiovascular disorders and cancer is a primary driver of the North American ablation devices market. According to the Centers for Disease Control and Prevention, heart disease remains the leading cause of death in the U.S., with over 650,000 fatalities annually, while cancer accounts for nearly 600,000 deaths. These conditions necessitate advanced treatment options such as ablation, which offers minimally invasive solutions with faster recovery times. A study published by the American Cancer Society highlights that ablation therapies achieve a success rate of 85% in treating small tumors, appealing to oncologists seeking effective alternatives to traditional surgery. Canada has also witnessed significant adoption, with provincial governments prioritizing investments in cancer care infrastructure. As per Statistics Canada, the number of ablation procedures performed annually has increased by 20% over the past five years, reflecting the growing reliance on these technologies.

Technological Advancements in Minimally Invasive Procedures

Technological innovations in minimally invasive procedures have revolutionized the ablation devices market, contributing to the expansion of the North American ablation devices market. According to the National Institutes of Health, advancements such as real-time imaging integration and precision-guided ablation systems have improved treatment accuracy by 40%, reducing complications and enhancing patient outcomes. For instance, cryoablation devices, which use extreme cold to destroy abnormal tissues, have demonstrated a 90% success rate in treating atrial fibrillation, as noted by the American Heart Association. Canada has embraced these advancements, with research institutions collaborating with manufacturers to develop next-generation devices tailored to specific applications. A study published by the Canadian Institute for Health Research highlights that minimally invasive ablation procedures reduce recovery times by 50%, appealing to both patients and healthcare providers. These innovations not only address unmet clinical needs but also position North America as a global leader in ablation technology.

MARKET RESTRAINTS

High Costs of Advanced Ablation Technologies

The high cost of advanced ablation technologies is one of the major restraints to the North American ablation devices market. According to the Healthcare Cost and Utilization Project, a single radiofrequency ablation procedure can cost huge, making it inaccessible for uninsured or underinsured patients. Even with insurance coverage, out-of-pocket expenses deter many individuals from pursuing these treatments. This financial burden is further compounded by the rising costs of cutting-edge components, which are often passed on to consumers. For instance, a report by the American Medical Association reveals that only 60% of eligible patients undergo ablation procedures due to affordability issues. In Canada, provincial healthcare systems face similar challenges, as budgetary constraints limit access to advanced ablation devices. As per Statistics Canada, wait times for subsidized procedures have increased by 15% annually over the past three years, hindering market growth and patient accessibility.

Regulatory Hurdles and Compliance Challenges

Regulatory hurdles and compliance challenges are further hampering the growth of the North American ablation devices market. According to the Food and Drug Administration, only 50% of ablation devices submitted for approval meet the required safety and efficacy standards on the first attempt, necessitating costly revisions and additional testing. This lengthy process discourages smaller companies from entering the market, reducing competition and innovation. In Canada, provincial healthcare systems impose additional restrictions on the use of certain ablation technologies, further complicating market entry. A study published by the Biotechnology Innovation Organization notes that regulatory and compliance issues have slowed the adoption of ablation devices, limiting their market penetration despite their potential benefits.

MARKET OPPORTUNITIES

Growing Adoption of Personalized Medicine

The increasing adoption of personalized medicine is one of the major opportunities for the ablation devices market. According to the National Institutes of Health, personalized ablation therapies tailored to individual patient profiles achieve a 30% higher success rate compared to conventional approaches. This trend is particularly pronounced in cancer treatment, where tumor-specific ablation techniques are gaining traction. Canada has positioned itself as a leader in this space, with startups developing AI-driven ablation devices capable of mapping lesion boundaries with sub-millimeter precision. A study published by the Canadian Oncology Society highlights that personalized ablation reduces recurrence rates by 25%, appealing to healthcare providers seeking targeted solutions. Additionally, advancements in biomarker identification have enabled the development of patient-specific protocols, ensuring broader adoption of ablation technologies.

Expansion into Emerging Applications

The expansion of ablation devices into emerging applications is another lucrative opportunity for the regional market growth. According to the American Society for Gastrointestinal Endoscopy, ablation therapies are increasingly being used to treat gastrointestinal disorders such as Barrett’s esophagus, with success rates exceeding 90%. Canada has also embraced this trend, with provincial healthcare systems investing in pilot programs to explore the use of ablation in neurology and dermatology. A study published by the Canadian Dermatology Association highlights that cryoablation devices reduce scarring by 40% in cosmetic procedures, appealing to aesthetic clinics seeking non-invasive solutions. These untapped applications position ablation devices as a transformative force in the market, ensuring sustained growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Device Technology, Application, End-Users, and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson (Biosense Webster, Inc.), Medtronic PLC, AngioDynamics, Inc., and others. |

SEGMENTAL ANALYSIS

By Device Technology Insights

The radiofrequency ablation devices segment had 44.1% of the North America ablation devices market share in 2024. The leading position of radiofrequency ablation devices segment is driven by their widespread use in treating cardiovascular diseases and cancer, where they offer precise and minimally invasive solutions. According to the American Heart Association, radiofrequency ablation achieves a success rate of 85% in treating atrial fibrillation, making it the preferred choice for cardiologists. The affordability and versatility of these devices make them particularly appealing to hospitals and ambulatory surgical centers, which account for over 70% of all ablation procedures, as per data from the National Institutes of Health. Canada has also embraced this technology, with provincial healthcare systems integrating radiofrequency ablation into standard treatment protocols. A study published by the Canadian Cardiovascular Society highlights that these devices reduce procedural risks by 30%, reinforcing their dominance in the market.

The cryoablation devices segment is anticipated to register a CAGR of 12.8% over the forecast period owing to their effectiveness in treating conditions such as atrial fibrillation and small tumors, where extreme cold is used to destroy abnormal tissues. According to the American Cancer Society, cryoablation achieves a success rate of 90% in treating small renal tumors, appealing to oncologists seeking minimally invasive alternatives. Canada has also witnessed significant adoption, with research institutions collaborating with manufacturers to develop next-generation cryoablation systems. A study published by the Canadian Urological Association highlights that cryoablation reduces recovery times by 50%, appealing to patients and healthcare providers alike.

By Application Insights

The cancer treatment segment dominated the North America ablation devices market by occupying 36.1% of the regional market share in 2024. The prominent position of cancer treatment segment in the North American market is attributed to the rising incidence of cancer and the increasing adoption of minimally invasive therapies such as radiofrequency and cryoablation. According to the American Cancer Society, cancer accounts for nearly 600,000 deaths annually in the U.S., with ablation therapies emerging as a critical tool for treating small tumors and metastatic lesions. The versatility of ablation devices allows for precise targeting of cancerous tissues while preserving surrounding healthy structures, reducing recovery times by 40%, as noted by the National Cancer Institute. Canada has also embraced this trend, with provincial healthcare systems investing in advanced ablation technologies to improve patient outcomes. A study published by the Canadian Oncology Society highlights that ablation procedures reduce hospital readmissions by 25%, underscoring their importance in modern oncology. These factors solidify cancer treatment as the largest application segment in the market.

The cardiovascular disease segment is predicted to grow at a promising CAGR of 12.7% over the forecast period owing to the increasing prevalence of heart diseases, particularly atrial fibrillation, which affects over 6 million Americans, according to the Centers for Disease Control and Prevention. Radiofrequency and cryoablation devices are gaining traction due to their ability to achieve success rates exceeding 85% in treating arrhythmias. Canada has also witnessed significant adoption, with research institutions collaborating with manufacturers to develop next-generation ablation systems tailored to cardiovascular applications. A study published by the Canadian Cardiovascular Society highlights that ablation procedures reduce procedural risks by 30%, appealing to cardiologists seeking safer alternatives to traditional surgery. These advancements position cardiovascular disease treatment as the most dynamic application segment in the market.

By End-Users Insights

The hospitals segment had the leading share of 61.1% of the North America ablation devices market share in 2024. The dominating position of hospitals segment in the North American market is attributed to their role as primary providers of advanced medical treatments, including cancer therapy and cardiovascular interventions. According to the American Hospital Association, hospitals account for over 70% of all ablation procedures performed annually, reflecting their critical role in delivering specialized care. The availability of skilled healthcare professionals and advanced infrastructure ensures timely administration of ablation therapies, improving patient outcomes. Additionally, government programs such as Medicare and Medicaid provide financial assistance for hospital-based treatments, enhancing accessibility for low-income patients. Canada has also embraced this trend, with provincial healthcare systems prioritizing investments in hospital-based ablation technologies. A study published by the Canadian Medical Association highlights that hospital-based ablation reduces mortality rates by 20%, reinforcing their dominance in the market.

The ambulatory surgical centers segment is projected to exhibit a CAGR of 14.04% over the forecast period owing to the growing demand for cost-effective and minimally invasive procedures, which can be performed on an outpatient basis. According to the Centers for Medicare & Medicaid Services, ambulatory surgical centers perform over 30% of all ablation procedures in the U.S., driven by their ability to reduce costs by 25% compared to traditional hospital settings. Canada has also witnessed significant adoption, with provincial governments encouraging the use of ambulatory centers to alleviate hospital congestion. A study published by the Canadian Healthcare Facilities Association highlights that these centers reduce wait times by 40%, appealing to patients seeking timely access to care. These factors position ambulatory surgical centers as the most dynamic end-user segment in the market.

REGIONAL ANALYSIS

The United States captured 80.7% of the North America ablation devices market share in 2024. The domination of the U.S. in the North American region is driven by the country’s high prevalence of chronic diseases, advanced healthcare infrastructure, and robust investments in medical technology. According to the Centers for Disease Control and Prevention, over 650,000 Americans die annually from heart disease, creating a robust demand for ablation devices used in cardiac treatments. Additionally, the presence of leading manufacturers and research institutions ensures continuous innovation, solidifying the U.S.’s dominance in the regional market. Government initiatives such as Medicare and Medicaid provide coverage for ablation procedures, ensuring affordability for low-income patients. Collaborations between academia and industry foster innovation, with startups developing next-generation ablation solutions tailored to specific applications.

Canada is the second-largest contributor to the North America ablation devices market and is estimated to grow at a healthy CAGR over the forecast period. The rising cases of cancer and cardiovascular diseases that increase the demand for advanced ablation therapies are propelling the growth of the Canadian market. According to Statistics Canada, provincial healthcare systems have allocated $1 billion annually to support cancer care infrastructure, many of which rely on ablation devices for minimally invasive treatments. Cryoablation and radiofrequency devices are gaining traction, supported by Canada’s focus on improving patient outcomes. Additionally, partnerships between academia and industry foster innovation, with collaborative efforts driving the development of next-generation ablation technologies. While smaller in scale compared to the U.S., Canada’s strategic emphasis on accessibility and quality healthcare positions it as a key player in the regional market.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America ablation devices market profiled in this report are Abbott Laboratories, Boston Scientific Corporation, Johnson & Johnson (Biosense Webster, Inc.), Medtronic PLC, AngioDynamics, Inc., and Others.

TOP MARKET PLAYERS

The North America ablation devices market is led by three key players: Medtronic, Boston Scientific Corporation, and Johnson & Johnson (through its subsidiary Biosense Webster). Medtronic dominates with its flagship radiofrequency ablation systems, which are widely regarded as the gold standard in the industry. Boston Scientific follows closely, offering innovative cryoablation devices tailored to cardiovascular applications. Johnson & Johnson rounds out the top three, with a strong presence in cancer treatment solutions. Its commitment to research and development has enabled the launch of AI-driven ablation systems, reinforcing its global standing.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America ablation devices market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Medtronic has partnered with leading research institutions to develop AI-driven ablation systems capable of real-time lesion mapping. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Boston Scientific, for example, acquired a startup specializing in cryoablation technologies, enhancing its capabilities in cardiovascular applications. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Johnson & Johnson has invested heavily in establishing distribution networks across Canada, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving patient needs.

COMPETITION OVERVIEW

The North America ablation devices market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Medtronic, Boston Scientific Corporation, and Johnson & Johnson dominating the landscape. These companies compete on the basis of product innovation, technological superiority, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as AI-driven diagnostics and personalized ablation solutions. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for minimally invasive procedures and advancements in ablation technologies.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In February 2024, Medtronic launched a next-generation radiofrequency ablation system designed for real-time imaging integration. This initiative aimed to address unmet clinical needs and expand its product portfolio.

- In April 2024, Boston Scientific acquired a startup specializing in cryoablation technologies. This acquisition was anticipated to enhance its capabilities in cardiovascular applications.

- In June 2024, Johnson & Johnson partnered with a Canadian research institute to develop AI-driven ablation systems. This collaboration sought to address regional disparities in treatment accessibility.

- In August 2024, Abbott Laboratories introduced an advanced ultrasound ablation device with enhanced precision. This innovation aimed to reduce procedural risks and improve patient outcomes.

- In October 2024, Stryker expanded its production facilities in the U.S. to meet the growing demand for ablation devices in cancer treatment. This investment was intended to enhance production capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the North America ablation devices market is segmented and sub-segmented into the following categories.

By Device Technology

- Radiofrequency Devices

- Laser/Light Ablation

- Ultrasound Devices

- Cryoablation Devices

- Other Devices

By Application

- Cancer Treatment

- Cardiovascular Disease Treatment

- Ophthalmologic Treatment

- Gynecological Treatment

- Urological Treatment

- Cosmetic Surgery

- Other Applications

By End-Users

- Hospitals

- Ambulatory Surgical Centers

- Other End-Users

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the expected CAGR of the North America ablation devices market?

The North America ablation devices market is expected to grow at a CAGR of 10.6% from 2025 to 2033.

2. Which technology holds the largest share in the North America ablation devices market?

Radiofrequency ablation devices dominate the North America ablation devices market, holding approximately 45% of the market share.

3. What factors are driving the growth of the North America ablation devices market?

The growth of the North America ablation devices market is driven by advancements in minimally invasive procedures and the increasing prevalence of chronic diseases.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]