Global Noodles Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Dried, Instant, Frozen), Raw Material, Others, Form , End User , Nature, Packaging Type, And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Industry Analysis (2025 To 2033)

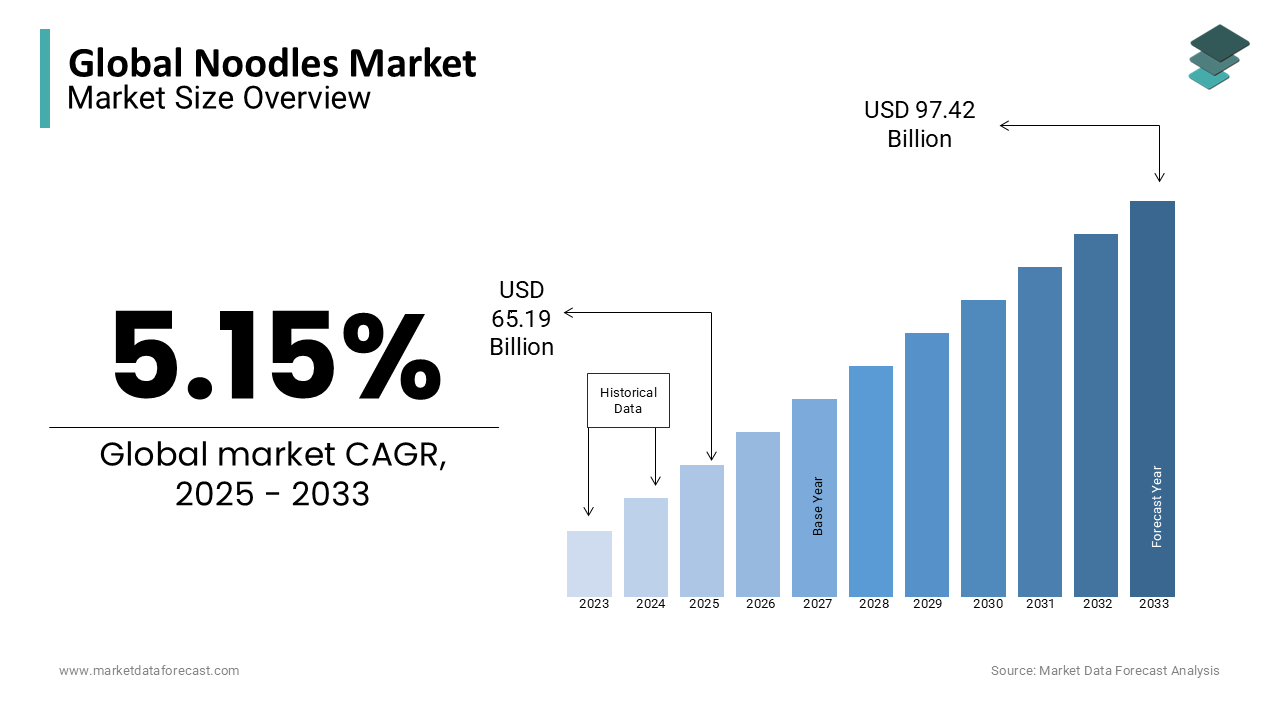

Global Noodles Market Size (2025 To 2033)

The global noodles market size was calculated to be USD 62 billion in 2024 and is anticipated to be worth USD 97.42 billion by 2033 from USD 65.19 billion In 2025, growing at a CAGR of 5.15% during the forecast period.

Current Scenario of the Global Noodles Market

The noodles market is growing consistently year-on-year. Currently, organic or plant-based food is gaining popularity. The increasing consumption is encouraged by the rising concern about health and fitness among customers who strive to integrate more natural and less processed or ready-made foods into their diets. Also, in the present industry scenario, the noodles market has experienced noteworthy demand for gluten-free and organic types that support lowering the danger of chronic diseases and enhancing comprehensive well-being. Hence, adding natural supplements has provided new opportunities for diversifying product ranges and increasing sales for industry players like Foodle Noodle, Lotus Foods, etc.

Apart from this, the development of wholesome, healthy noodles has integrated soy-based operational food ingredients. The SPI, FFSF, and DFSF are the alternatives for wheat flour. Hence, changing customer's preference for artisanal soy-fortified noodles in their regular diet is directly proportionate to its sales, further fuelling the expansion of the market in the coming years. Brands like Nestle, Nissan, etc, responded to this by launching a wide range of homemade noodles blended with standard flavors of species for swift and gut-friendly appetizers.

MARKET DRIVERS

The noodles market is propelled by increasing ethnic and regional tastes and choices among customers.

People like the millennial population base look for varied culinary seasoning, herbs, or spices reflecting various cultures and cuisines. Most of the public depends on cuisine versions such as Italian, Asian, Chinese, Vietnamese, and Korean cuisines for local and cultural flavors in food offerings like noodles. This transition in customer behavior is influencing the demand and sales of noodles, spaghetti, and pasta around the world. Consequently, industry players innovate and diversify their menus to satisfy evolving consumer priorities.

Furthermore, the progressive rise in the health-conscious public, particularly young demographics results in a considerable change towards craft and artisanal noodle ingredients. The artisanal ones are gaining popularity with an emphasis on nourishing and operational advantages. They are packed in LDPE/PET-MET and MET-MET/LDPE are not impacted by moisture and are extremely acceptable due to their prolonged shelf life. These noodles comprise healthier ingredients such as atta instead of white flour and are enriched with important nutrients.

MARKET RESTRAINTS

The competition and price sensitivity are restricting the growth of the noodle market.

The industry is extremely dynamic and fierce, presenting substantial challenges for brands to remain in their position among competitive and cost-sensitive customers. The progress of the market with the latest entrants creates an opportunity for strong price competition that endangers even prominent player's revenues. Making a balance between offering cheap prices while maintaining profits remains a major constraint. This deliberate act becomes tougher as consumer behavior changes, along with newcomer concerns, which will reduce costs in an attempt to enter the industry.

Market Opportunities

The concept of premiumization in the F&B industry is expected to give potential opportunities for the noodles market.

Another component taking the market forward globally is the increased demand for natural additives. The application of organic additives in noodles and pasta will achieve sustained market growth as some of the players have started to add these to their products in the recent past. For instance, Kraft Foods offers a premium-quality company selling boxes of colored noodles. These are organically flavored with spices such as annatto, turmeric, and paprika. Consumers are not very much attracted to this feature. So, the noodles market is expected to expand rapidly during the estimation period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.15% |

|

Segments Covered |

By Type, Raw Material, Form, End-User, Nature, Packaging Type, & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nissin Foods Holdings Co. Ltd., Capital Foods Pvt. Ltd., Mandarin Noodle, Thai President Foods Public Co. Ltd., Sun Noodle, Sanyo Foods Corp. of America, Yau Kee Noodles Factory Ltd., Nestle SA, Sakura Noodle Inc., Ottogi Co. Ltd., Acecook Vietnam Joint Stock Co., House Foods Group Inc. Samyang Foods Co., Ltd., Nongshim Co., Ltd. Lotus Foods, and Ebro Ingredients (Ebro Foods) |

SEGMENTAL ANALYSIS

By Type Insights

The instant segment accounts for a significant portion of the noodles market share. The growing demand for convenience food choices among customers is propelled by the elevated need for easy-to-prepare and ready-to-eat meals such as noodles. Moreover, busy routine lifestyles or hectic work timetables drive a large portion of the population towards convenience food items because they provide various advantages, such as quick appetizers with prolonged shelf life. Further, this shift is the reflection of the fast-moving way of living and the growing volume of working professionals with limited to no time for food preparation. Hence, these are the causes of this tendency.

By Raw Material Insights

White flour is the biggest subsegment in the noodles market. It is the main ingredient utilized in dried noodle-making. This can be attributed to the flavor, texture, versatility, gluten content, availability, and cost. Apart from this, prolonged consumption of white flour-based noodles has made their taste and flavor adjust to this. Also, the lack of availability and potential alternatives have strengthened its market share. But wheat options are quickly gaining popularity.

By Form Insights

The narrow strip is the most prevalent form in the noodles market and holds the maximum share. Narrow strip wheat-based noodles are significantly famous in Asian economies like China and Japan for udon and ramen cuisine. Also, their adaptability in soups, stir-fries, etc. are the main ingredient in several cuisines.

By End User Insights

Restaurants and food services are the leading segment in this category of the noodles market. It involves fine dining, casual dining establishments, and fast-food chains. Restaurants are major contributors to the market growth. The industry progressed rapidly due to the versatility of noodles, which can be added to various dishes and gain traction as affordable food for gourmet experiences. This flexibility enables restaurants to serve a wider consumer base and boosts revenues. Moreover, the proliferation of food culture has elevated the popularity of international cuisines involving APAC noodle dishes. This has influenced the market share of restaurants and food services.

Additionally, the growth of food delivery services or platforms and the rising demand for takeaway meals have fuelled consumption via restaurants. Furthermore, trains and airplanes also participated in the industry's development through premium costs for onboard foods.

By Nature Insights

The organic or vegan segment has been gaining traction over the market share in the past few years with the rising consumer preferences towards eating healthy food options in a regular diet. People nowadays are more aware of selecting food options to focus on health and wellness, which is probably a major factor in the market's growth rate. Conventional segment is likely to have the prominent growth rate by the end of 2029.

By Packaging Type Insights

The packets segment is leading with the largest size of the noodles market, whereas the cups segment is likely to have potential growth opportunities throughout the forecast period. The rising prominence of eating ready-to-cook meals, especially in urban areas, is anticipated to fuel the growth rate of the market. The launch of innovative technologies in making ready-to-eat meals, which are mostly preferred by the working class people, is absolutely to propel the growth rate of the market.

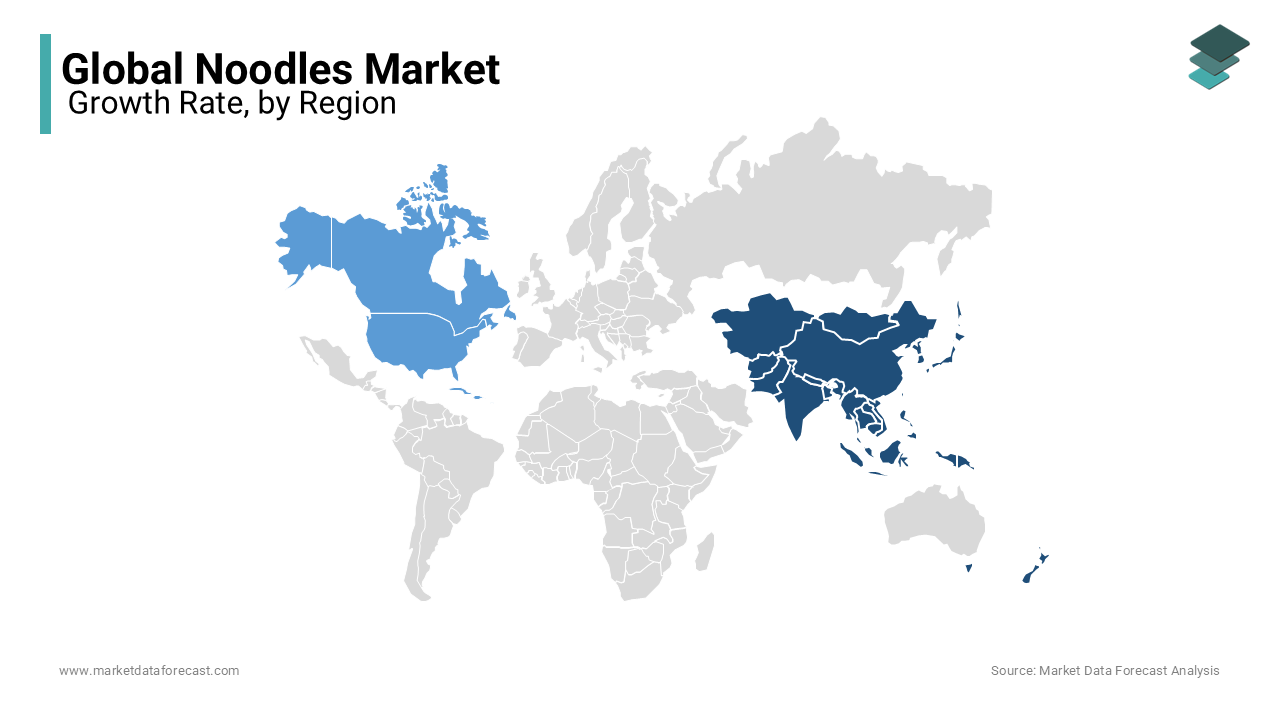

REGIONAL ANALYSIS

Asia Pacific continues to be the dominant noodles market, with the largest industry shares. India, Indonesia, and China are among the biggest noodle-consuming nations in the world. With 42.2 billion instant noodle servings eaten, China and Hong Kong are in the top position, Indonesia with 14.5 billion, India with 8.7 billion, Vietnam with 8.1 billion, and Japan with 5.8 billion are driving the regional market size. In addition, product differentiation is considerably fuelled by several factors like cost-effectiveness, accessibility, and cultural taste. Moreover, year-on-year demand is consistently surging, with around 100 billion servings eaten annually. Instant noodle consumption in the area is mainly pushed forward by key contributors, including China, India, Indonesia, South Korea, and Japan. Roughly 40 billion packages of instant noodles are eaten annually in China, accounting for approximately 39 percent of world consumption.

The North American noodle market is another major player, and this is improved by a customer base that shows an inclination for premium and healthier noodle choices. This industry is identified by a notable transition to premiumization with a special focus on artisanal and gourmet noodles. The retail sector in the region has adopted this pattern by broadening its noodle items, thus improving their availability to customers. Therefore, this development presents new opportunities for the industry players to explore the niche noodles market.

KEY PLAYERS IN THE GLOBAL NOODLES MARKET

Major players in the global noodles market include Nissin Foods Holdings Co. Ltd., Capital Foods Pvt. Ltd., Mandarin Noodle, Thai President Foods Public Co. Ltd., Sun Noodle, Sanyo Foods Corp. of America, Yau Kee Noodles Factory Ltd., Nestle SA, Sakura Noodle Inc., Ottogi Co. Ltd., Acecook Vietnam Joint Stock Co., House Foods Group Inc. Samyang Foods Co., Ltd., Nongshim Co., Ltd. Lotus Foods, and Ebro Ingredients (Ebro Foods)

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Lotun Foods launched two fresh and enhanced traditional and brown pad thai rice noodles. This is the expansion of their organic Asian rice noodle line.

- In December 2023, Nissin introduced the Manchurian and Schezwan products, which are all-new fusion flavours of noodles. Moreover, in the same year, Nissin Geki, the latest brand of Korean noodles, was launched.

DETAILED SEGMENTATION OF THE GLOBAL NOODLES MARKET INCLUDED IN THIS REPORT

This research report on the global noodles market has been segmented and sub-segmented based on type, raw material, form, end-user, nature, packaging type, and region.

By Type

- Dried

- Instant

- Frozen

By Raw Material

- Oats

- Rice

- Wheat

- White Flour

- Others (Corn, Millet, etc.)

By Form

- Wide Stripe

- Narrow Strip

- Wave Strip

By End User

- Households

- Travel and Hospitality

- Restaurants and Food Services

- Others

By Nature

- Organic or Vegan

- Conventional

By Packaging Type

- Packets

- Cups

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. Which countries have the highest demand for noodles?

China, Japan, South Korea, Indonesia, and India are leading markets for noodles, with strong demand also growing in North America and Europe.

2. How has the noodles market evolved over the years?

The market has shifted from traditional and instant noodles to healthier, high-protein, gluten-free, and plant-based alternatives to meet changing consumer preferences.

3. Who are the major consumers of noodles?

Noodles are widely consumed by people of all age groups, particularly students, working professionals, and families looking for quick and convenient meal options.

4. What factors are driving the growth of the noodles market?

Increasing urbanization, busy lifestyles, product innovation, and the rising popularity of instant and ready-to-eat meals are key growth drivers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]