Global Non-Alcoholic Beverage Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Soft Drinks, Bottled Water, Tea & Coffee, Juice and Dairy Drinks), Distribution Channel (Specialty Stores, Online Store, Super Markets/ Hyper Markets, Convenience Stores, Departmental Stores and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis (2025 to 2033)

Global Non-Alcoholic Beverage Market Size

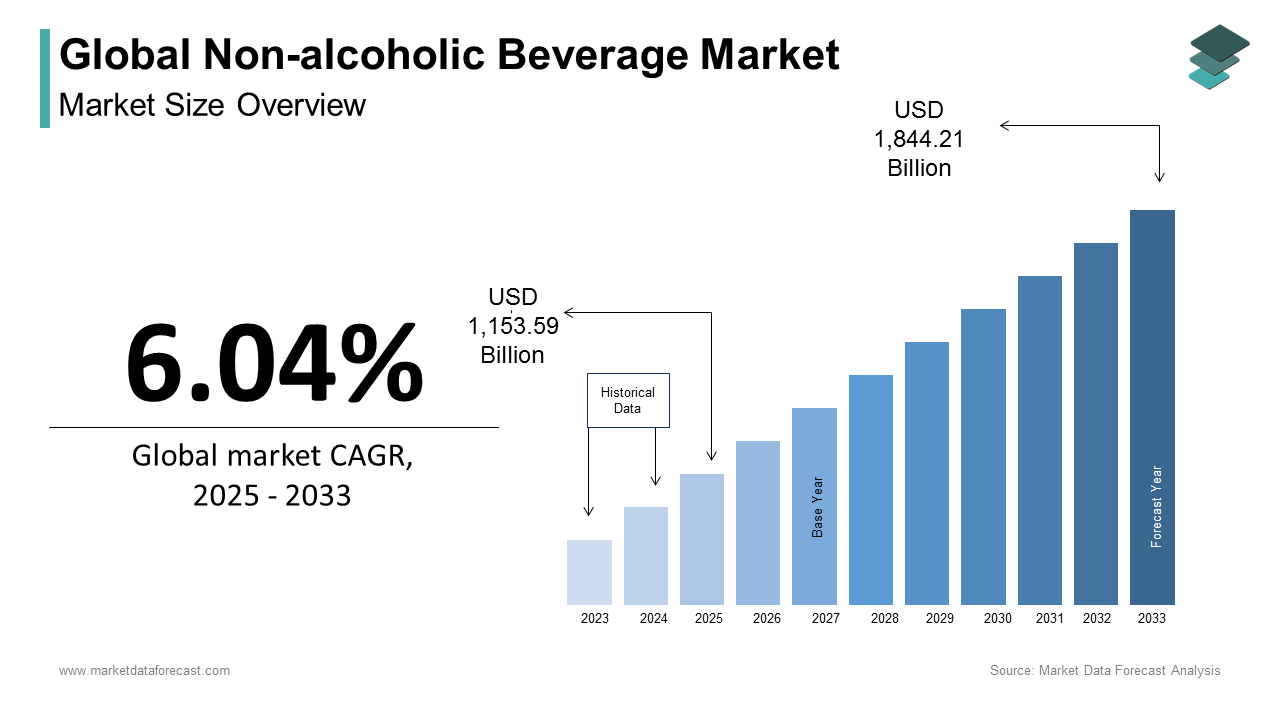

The global non-alcoholic beverage market size was worth USD 1,087.88 billion in 2024. The global market size is estimated to grow at a CAGR of 6.04% from 2025 to 2033 and be valued at USD 1,844.21 billion by 2033 from USD 1,153.59 billion in 2025.

Several foreign and domestic regulatory agencies govern these non-alcoholic beverages. Non-alcoholic beverages are a kind of alcoholic drink in the non-alcoholic version. They include beverages that contain less than 0.5% alcohol. These drinks are popular in countries that enforce alcohol prohibition laws like Kuwait, Saudi Arabia, and Iran. Non-alcoholic beverages have grown significantly in recent years under the influence of drunken driving laws. People are now aware of their moral, social and legal responsibilities and prefer not to drink and drive. Some people have a health condition where they cannot drink, and others want to lead a healthy life.

The drinks that contain zero percent of alcohol are familiarly known as non-alcoholic beverages. These beverages are made especially without using any kind of alcohol, especially for those who are health conscious. In a few countries where alcoholic beverages are not permitted, these drinks come in the favor of people who want to have beverages. Non-alcoholic beverages have specific health benefits where they can reduce the various risks of chronic diseases. Nowadays, consumers are seeking to drink non-alcoholic beverages due to their interest in the maintenance of health and wellness. Around 43% of the world's population chooses to drink only non-alcoholic drinks, even at occasional events. Bars and restaurants are attracting consumers by launching various beverages with different flavors with almost zero alcohol percentage substantially to leverage the growth rate of the market.

MARKET DRIVERS

YoY Growth in the Demand for Functional Beverages Worldwide

The growing demand for functional beverages to complement health without changing taste is driving the global non-alcoholic beverages market. Changes in consumer tastes and preferences and the propensity to consume convenience foods and beverages have led to increased demand for non-alcoholic drinks in recent years. Manufacturers are focusing on developing new products to meet the changing tastes and preferences of consumers. Ethanol distillation is a notable process that separates non-alcoholic beverages from alcoholic beverages. As concerns about obesity and health awareness grow, the growth of the functional beverage and bottled water products sector will be promoted. In contrast, at the same time, demand for carbonated beverages is expected to be limited. The global Non-Alcoholic Beverage market has witnessed rapid changes due to factors such as increased purchasing power, improved living standards at the population level, and rapid urbanization.

Rising Health Awareness Among Public

Lifestyle changes and increased consumer awareness of adequate health and wellness are further fuelling the non-alcoholic beverages market. As the popularity of convenience foods and beverages increases, the global market demand for non-alcoholic beverages increases. Additionally, continued product innovation among major players, such as the introduction of zero-calorie or low-calorie drinks, is assumed to create opportunities in the global Non-Alcoholic Beverage market during the outlook period. As interest in obesity and other health problems increases, the Non-Alcoholic Beverage industry worldwide is reorganizing. The demand for relaxing drinks, energy drinks and functional drinks ready for coffee and tea is gaining popularity due to its low-calorie content. In addition to changing the pattern of the diet to consume nutrient-dense products, shifting the customer's focus toward a healthy lifestyle is expected to be one of the industry's primary drivers.

Additionally, the utility of alternative beverages, including functional soft drinks, is assumed to increase as concerns about the ill effects associated with drinking alcoholic beverages. The adult consumer group is presumed to remain the top buyer during the forecast period. The increasing workforce, athletes and athletes encourages the demand for nutritional drinks to improve performance and increase energy levels throughout the day. This is supposed to boost the demand for non-alcoholic drinks like functional beverages, energy drinks and juices in the foreseen years. Additionally, consumers are switching to more delicious, healthy, and nutritious natural and organic foods. This consumer trend is gaining popularity among young people around the world.

MARKET RESTRAINTS

Increasing Awareness of Side Effects with the Consumption of Non-Alcoholic Beverages

Consumers' perceptions of the health effects, such as diabetes, created by the consumption of soft drinks are a deterrent to the global Non-Alcoholic Beverage market. In addition, strict government rules and regulations on the use of ingredients in non-alcoholic beverages limit the global market for non-alcoholic drinks. Though non-alcoholic beverages are labeled as having zero percent alcohol content, few beverages are made with very little amount of alcohol in them, which should be avoided by pregnant ladies, which is a restraining factor for the growth rate of the non-alcoholic beverages market. Even smaller amounts of alcoholic beverages can show adverse results when a pregnant woman drinks these non-alcoholic beverages, which is why it is important to check the label information before drinking these drinks.

High Costs of Non-Alcoholic Beverages

The growing costs of the beverages due to the disruptions in the supply chain of the raw materials is another factor that is hindering the growth rate of the non-alcoholic beverages market. In addition, the availability of local brand products is a challenging factor for key market players. The local brand products do not follow the rules and regulations by the government officials where people go for these drinks due to their cost-effective, but few of them report various health-related issues, which are likely to hinder the demand for the branded non-alcoholic beverages that hamper the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.04% |

|

Segments Covered |

By Product Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The Coco-Cola Company, PepsiCo, Inc., Nestle S.A., Danone, Calcol, Inc., Livewire Energy, Attitude Drinks, Co., Dydo Drinco, Dr. Pepper Snapple Group, A.G. Barr and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

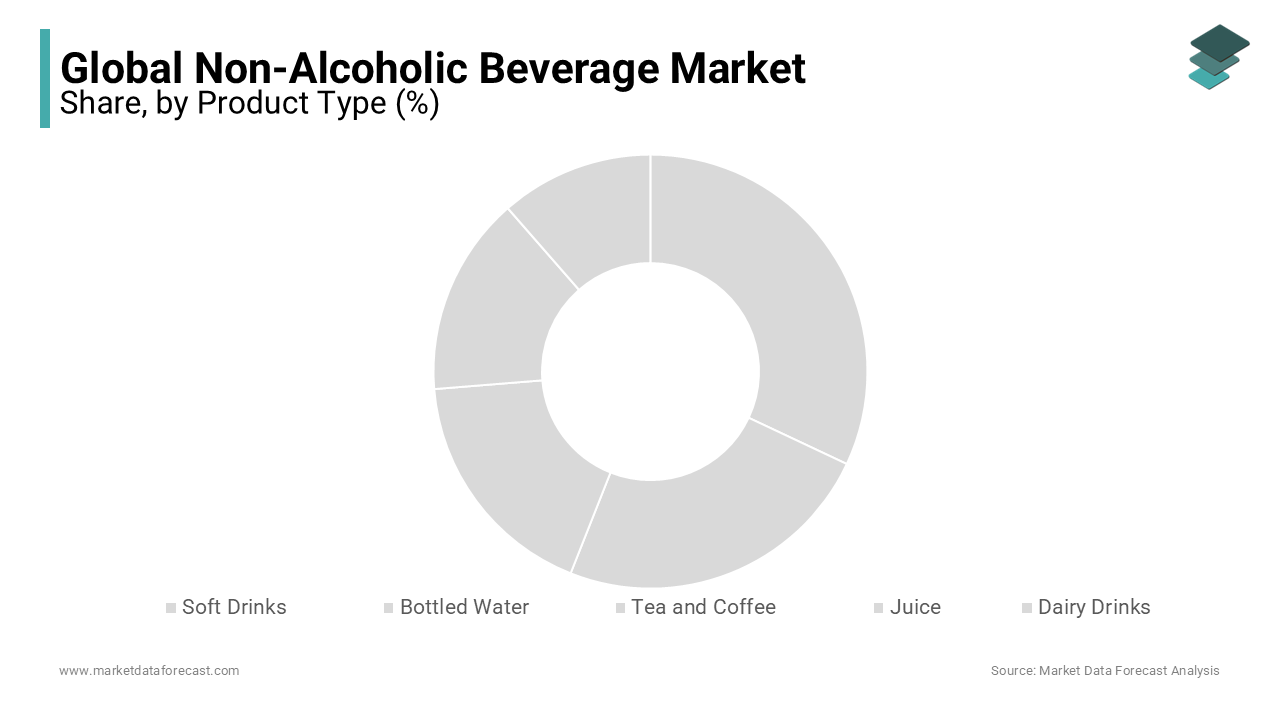

The soft drinks segment is leading with the largest share of the non-alcoholic beverages market. According to some research studies, around 1.25 billion people in India drink 5.9 billion liters of soft drinks in a year, which is an absolute growth factor for the non-alcoholic beverages market. Rapid urbanization and growing prominence for the launch of modern beverages with no alcohol in the beverages are leveling up the market’s growth. The tea and coffee segment has a prominent growth rate throughout the forecast period. Most people across the world prefer tea or coffee as part of their routine lifestyle. More than 12.6% of people around the earth drink coffee daily, which is ascribed to gearing up the growth rate of the market in the coming years.

By Distribution Channel Insights

The supermarket/hypermarkets segment is leading with the dominant share of the non-alcoholic beverages market. The feasibility of purchasing beverages in the nearest stores like supermarkets/hypermarkets is accounted for in amplifying the growth rate of the market. The rising focus on adopting modern technologies is also increasing the market’s growth rate in the forecast period. The online store segment is gaining huge popularity these days, with the latest various applications available on smartphones that can deliver the ordered products directly to the doorstep. Nowadays, people are more inclined to order specific beverages online due to the various discount offers available in different applications. Smartphones are now everywhere, and people are more aware of the use of these applications, which is likely to elevate the growth rate of the market.

REGIONAL ANALYSIS

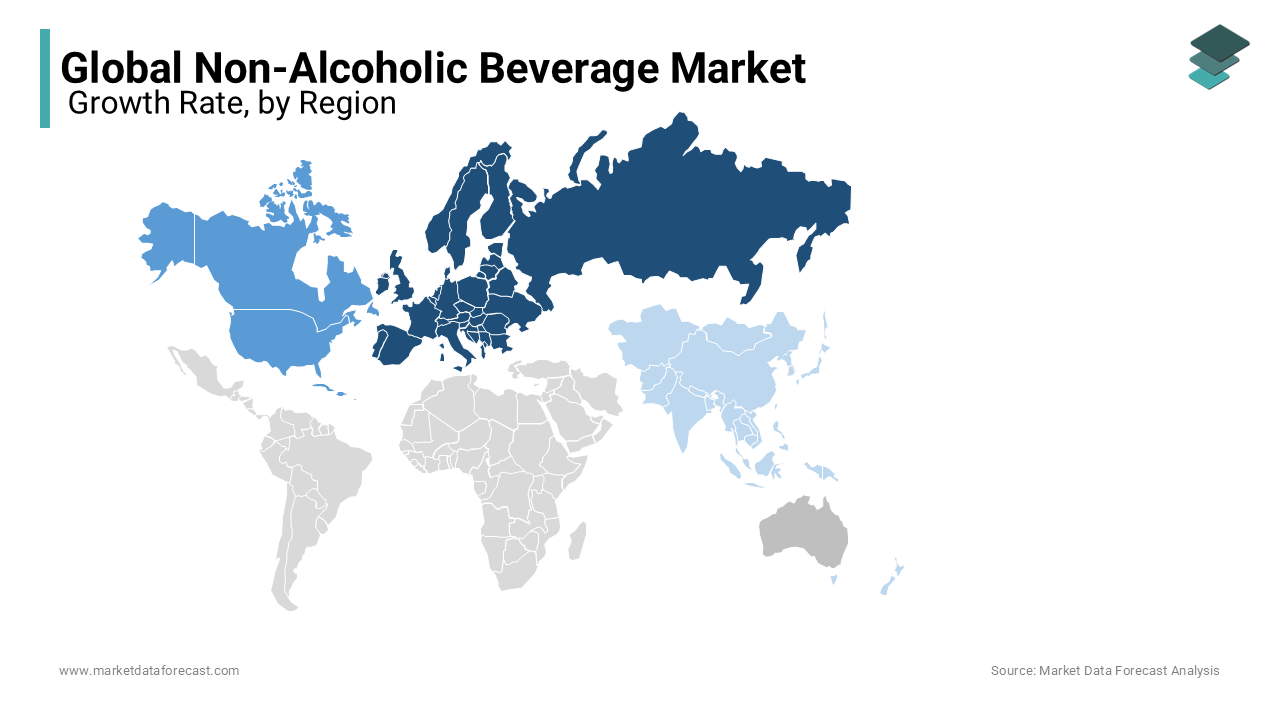

Europe is likely to have the most prominent growth rate by the end of 2025. European countries are more likely to launch different types of beverages according to customers' preferences. The trend towards the adoption of no-alcohol drinks due to the rising number of health-conscious people will eventually spur the market’s growth rate in Europe. The UK is the leading country in manufacturing high-quality non-alcoholic beverages, and the prominence of these drinks has huge potential across the world due to their special characteristics. Top companies follow high standards while manufacturing non-alcoholic beverages and get easy approvals from the Food and Drug Administration due to its standards, which shall propel the market’s growth rate to an extent.

The North American non-alcoholic beverages market had the largest share of 35.4% in 2023, with key players in the region adopting marketing strategies, including innovative product launches and mergers and acquisitions, to meet the growing demand for low-sugar, natural beverages and low calories. North America occupied the largest market for this industry due to the presence of developed countries and the early adoption of soda products. Rising obesity problems in the United States and Mexico and government-imposed taxes on sugar products are pushing the limits of CSD and low-calorie, non-nutritive sweetener products.

The Asia-Pacific non-alcoholic beverages market is likely to expand at a promising CAGR during the forecast period. Asia-Pacific has become the fastest-growing region in the non-alcoholic beverage market due to a variety of unexplored markets and populations and increased disposable income. There is a growing awareness of the health benefits associated with non-alcoholic beverages in the market, such as improved cholesterol and the level of saturated fat in the body. Major manufacturers are launching new products to meet the growing demands of their customers. The need for these drinks is increasing due to various strict government policies and regulations for alcohol. Powered by emerging economies such as China, India, Thailand and Malaysia, the region has a competitive advantage over other parts due to low-cost labor and the availability of raw materials. As the demand for various non-alcoholic beverages increases in these regions, the global market for non-alcoholic drinks is likely to expand.

KEY MARKET PARTICIPANTS

Companies playing a key role in the global non-alcoholic beverage market include Coco-Cola Company, PepsiCo, Inc., Nestle S.A., Danone, Calcol, Inc., Livewire Energy, Attitude Drinks, Co., Dydo Drinco, Dr. Pepper Snapple Group and A.G. Barr. The main players in the market are PepsiCo and The Coca-Cola Company, which are promoted by e-commerce channels through the development of technology and the adoption of smartphones. Direct selling and e-commerce channels are estimated to bring more stability to the business by providing an alternative way to market its products.

RECENT HAPPENINGS IN THE MARKET

- In October 2018, United Breweries Ltd. launched a lemon drink under the 'Kingfisher Radler' brand and entered the non-alcoholic beverages sector. This strategic move is supposed to ensure a significant demand for products during the projection period.

- Indian Food, 100% FDI Food and One Belt One Road Initiative are attracting new participants to establish production and distribution facilities in the Asia Pacific region.

- Coca-Cola introduced special sparking cocktails in 2019, named as Bar None in the United States. This brand is available at Bellini Spritz, Sangria, Ginger Mule and Dry-Aged Cider.

MARKET SEGMENTATION

This research report on the global non-alcoholic beverage market includes product type, distribution channel, and region.

By Product Type

- Soft Drinks

- Bottled Water

- Tea and Coffee

- Juice

- Dairy Drinks

By Distribution Channel

- Speciality Stores

- Online Store

- Super Markets/ Hyper Markets

- Convenience Stores

- Departmental Stores

- Others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

1. Name three key vendors of the Global Non-Alcoholic Beverage Market?

The Coco-Cola Company, PepsiCo, Inc. and Nestle S.A. are three key market vendors.

2. What is the acceptable percentage of alcohol in non-alcoholic beverage?

The Non-Alcoholic Beverage Market is expected to reach a valuation of US$ 1.60 trillion by the end 2028.

3. What is the expected growth rate of the Non-Alcoholic Beverage Market in the Asia-Pacific region?

Non-Alcoholic beverages can contain less than 0.5% alcohol.

4. What are the different types of non-alcoholic beverage?

The Asia-Pacific market is expected to grow with a CAGR of 6% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]