Global Nitrogenous Fertilizers Market Size, Share, Trends, & Growth Forecast Report, Segmented By Ingredient (Urea, Ammonium Nitrate, Ammonium Chloride, Sodium Nitrate, Ammonium Sulphate, Calcium Nitrate, Calcium Ammonium Nitrate (CAN), Other Nitrogenous Fertilizers), Application (Crop Based-Oil Seeds, Fruits & Vegetables, Grains & Cereals, Non-Crop Based-Turf & Ornamental Grass And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Nitrogenous Fertilizers Market Size

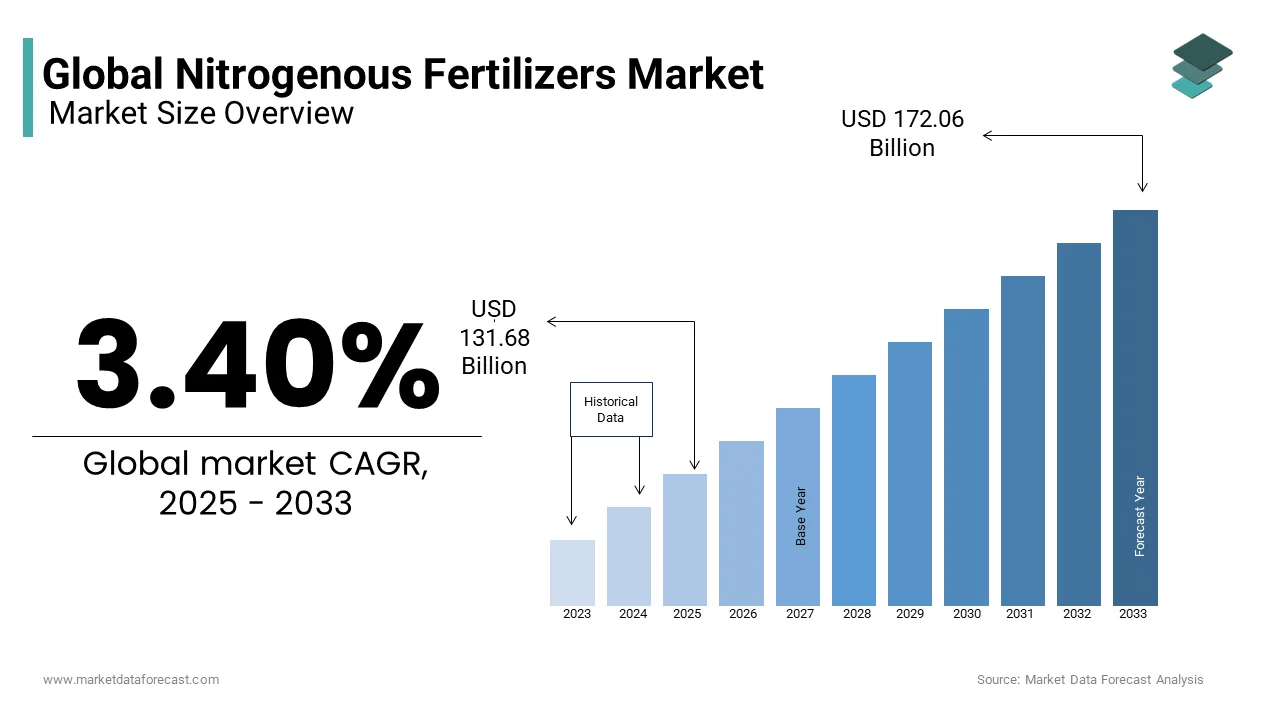

The global nitrogenous fertilizers market was valued at USD 127.35 billion in 2024 and is anticipated to be USD 131.68 billion in 2025 from USD 172.06 billion by 2033, growing at a CAGR of 3.40% from 2025 to 2033.

Nitrogen is the most essential nutrient for plants to grow and develop. Though available in abundance in the environment, it is only promptly taken by some plants. Nitrogenous fertilizers are inorganic and are typically utilized in the agriculture industry. It consists of nitrous complexes such as ammonium sulfate, calcium nitrate, and other compounds in minute amounts. The soil fertility and the type of crop used are the factors that decide the number of nitrogenous fertilizers required.

Nitrogenous fertilizers are mineral and organic components applied to plants to provide nitrogen nutrition. The plants do not fully utilize the nitrogenous fertilizers applied to the plants; only half percent is taken by the plants, and the remaining portion is either washed out or reacted with other organic components in the soil or groundwater. Nitrogenous fertilizers include various synthetic compounds such as synthetic ammonia, nitric acid, ammonium nitrate, and urea, where the synthetic ammonia and nitric acid play a crucial role as intermediates in the production of ammonium nitrate and urea fertilizers. Various nitrogenous fertilizers are ammonia liquor, ammonium nitrate, ammonium sulfate, aqua ammonia, nitric acid, urea, and others.

- In 2022, Nitrogenous fertilizers were the most traded product, which was 76th worldwide, contributing 0.25% of the world trade.

MARKET DRIVERS

The growth of the global nitrogenous fertilizers market is majorly driven by factors such as globally increasing population, rising disposable income, and high efficiency of nitrogenous fertilizers. The expansion of the agriculture sector, rapid adoption of modern farming techniques, increasing number of subsidies and incentives from the governments of various countries in favor of nitrogenous fertilizers, and increasing adoption of precision agriculture practices are boosting the growth of the global market.

Furthermore, factors such as rising demand for high-yield crops, growth of commercial farming operations, technological developments in the manufacturing of fertilizers, increasing awareness of soil degradation and nutrient depletion, and changing weather patterns that impact crop yields are promoting the global nitrogenous fertilizers market. An increase in the demand for bio-based fertilizers, the rapid shift towards organic farming, growth of the horticulture industry, rising adoption of nitrogen-efficient crop varieties, increasing efforts from the market participants to develop nitrogen stabilizers to reduce environmental impact, and growing demand for nitrogenous fertilizers in Asia-Pacific region are favoring the growth of the nitrogenous fertilizers market worldwide.

- Nitrogen is the primary fertilizer that is adopted in field crops, which accounts for approximately 45.57% of the total consumption.

The escalation in technological advancements and the rising adoption of advanced farming techniques create growth opportunities for the market. The growing global population is enhancing the demand for food products in larger quantities and is fueling market growth. For Instance, the United Nations predicts that the requirement for food production should be increased to 70% by 2050 to meet the global population.

MARKET RESTRAINTS

The excess utilization of nitrogen fertilizers leads to oxidation, which releases nitrous oxide, one of the primary components contributing to global warming, as it is around 300 times more potent than carbon dioxide. This is the significant factor hampering the adoption of nitrogenous fertilizers among the farmers, leading to limited market growth. Various other environmental effects are caused by nitrogen, such as water and air pollution, as the soil bacteria convert the nitrogen into nitrate, contaminating the groundwater, streams, and other local waterbodies, enhancing the environmental concerns and leading to restricted market growth. The increased use of nitrogen fertilizers will make the soil more acidic, making it less fertile and hindering global market growth. The higher costs associated with nitrogenous fertilizers and the longer wait period to see the effect impede market growth, as urea fertilizers must be used in advance for efficient impact. The negative impact of nitrogenous fertilizers on human health is that they affect the skin, eyes, and respiratory system, which may limit their adoption among farmers, leading to restricted market expansion.

- According to information provided by the IFA, global ammonia production declined by an estimated 1% in 2022 due to lower fertilizer affordability.

MARKET OPPORTUNITIES

Commercial agriculture practices worldwide are a significant factor in the global nitrogenous fertilizers market opportunities. Expanding commercial agricultural practices is revolutionizing the agricultural industry with progressive change and advanced technologies, which are positively influencing with. The increasing global population, technological escalation, and improved farming techniques are all demanding high-quality fertilizers, which boosts the adoption of nitrogenous fertilizers, leading to an enhanced market growth rate.

- For Instance, the demand for the N, P, and K fertilizers and yeast-coated fertilizers has increased in the past years due to their high ability to boost soil fertility.

- According to the data provided by the United Nations, the world population is estimated to exceed nine billion by 2050.

The increased advancements in the agricultural industry, such as vertical farming, which involves soil sensors and other advanced equipment supporting the adoption of various effective fertilizers, drive market growth opportunities.

MARKET CHALLENGES

An increase in the cost of raw materials is a significant challenge for manufacturers, which limits market expansion. The rising shift towards organic farming practices is estimated to have a negative impact on the global market growth rate. The growing demand from consumers for organic food is influencing farmers to adopt these methods, which may hinder the expansion of the nitrogenous fertilizers market. This factor is majorly implemented across developed nations with high organic farming movements. The presence of stringent regulations regarding the approval and usage of nitrogen fertilizers, which comprises complexity and a longer wait period for product launches, will act as a significant challenge for the market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.40% |

|

Segments Covered |

By Ingredients, Application, Non-Crop, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yara International ASA, Agrium In, Coromandel International Ltd, Potash Corp, KOCH Industries Inc, CF Industries Holdings Inc, CVR Partners, Lp, Bunge Ltd, Sinofert Holdings Ltd and Eurochem |

SEGMENTAL ANALYSIS

By ingredients Insights

The urea segment is projected to register steady growth during the forecast period. Urea-based nitrogenous fertilizers are leading the ingredient segment in terms of consumption. Urea has more nitrogen content than other nitrogenous fertilizers, and its cost-effective affordability is majorly escalating segment growth. The production of urea is highly cost-effective and more energy efficient than other fertilizers as the manufacturing involves lower greenhouse gas emissions, contributing to segmental growth.

- Domestic urea production has experienced an increase of 13.4%, which is 31.11 million tonnes in 2023, compared to 2022, which is 27.43 million tonnes.

The ammonium nitrate segment is projected to be the fastest-growing segment during the forecast period. Nitrogenous fertilizers widely rely on ammonia owing to their higher nitrogen content, leaching loss resistance, and good solubility, which is estimated to escalate segment growth opportunities. Ammonium nitrate is gaining traction over urea due to its stability and the fact that there is no rapid nitrogen loss to the atmosphere, which fuels the segment expansion.

By Application Insights

The grains and cereals sub-segment held the largest market share owing to the growing demand for cereals and grains, which enhanced the requirement for larger yields. The growing awareness among the people regarding the health benefits of grains and cereals and the increased demand for these globally is primarily accelerating the segment revenue. According to a statement mentioned by the FAO, cereals only contribute to half of the world's harvested land. Nitrogenous fertilizers such as urea, ammonium nitrate, and anhydrous ammonia are extensively used for cereals and grains due to their high effectiveness, as these plants require adequate nitrogen supply for healthy growth.

On the other hand, the oilseeds segment is expected to grow prominently in the coming years with a considerable CAGR. Oilseeds are the most essential crops that play a crucial role in consumer food's daily requirements, boosting the segment growth. The need for escalation in seed germination, which provides healthy plant growth, is fueling the adoption rate of effective fertilizers, which positively influence segment growth. The wide application of nitrogenous fertilizers to oilseed crops provides successful results where an improvement in the crop yield is observed.

REGIONAL ANALYSIS

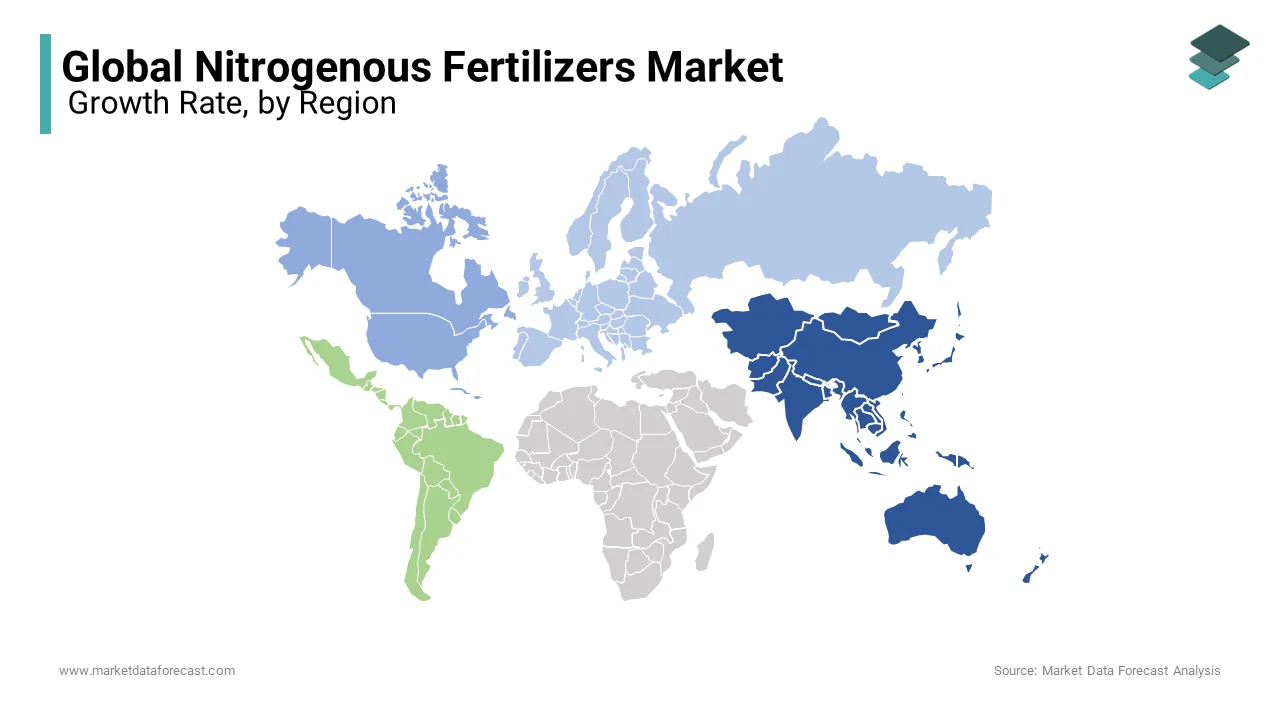

The Asia Pacific region held the dominating position in the worldwide market in 2023.

The Asia Pacific region is the largest producer of agricultural products, and the availability of the most extensive arable land for cultivation and the growing demand for food to meet the requirements of the rising population are a few primary factors contributing to the expansion of the regional market share. The increasing requirement for effective and affordable fertilizers for plants is enhancing the adoption of nitrogenous fertilizers across the region, escalating regional market revenue. These fertilizers play a crucial role in maintaining food security, especially in countries like China and India, by allowing significant yield increases and positively influencing market growth.

- According to the data provided by the OEC, the top importers of nitrogenous fertilizers are India, Brazil, and the United States in 2022

North America is another notable regional segment in the global market.

The North American region holds the second-largest global market share and is estimated to record prominent market growth during the forecast period. The presence of well-established infrastructure, advanced agricultural industry, increased demand for sustainable agricultural practices, and rise in the production of various types of crops across the region are driving regional market share growth.

- The United States dominated the regional market, holding around 155.09 million hectares of total area for crop cultivation by 2022.

The European region is expected to register a steady CAGR in the global market.

The increasing agricultural practices across the region and the enlarging consumer demand for veganism are raising the demand for plants, contributing to regional market growth. The increased imports of nitrogenous fertilizers from the regional countries are escalating the regional market revenue.

- In 2022, Russia held the most significant revenue of around USD 6.27 billion in exporting nitrogenous fertilizers.

LIST OF KEY COMPANIES IN THE GLOBAL MARKET

Yara International ASA, Agrium In, Coromandel International Ltd, Potash Corp, KOCH Industries Inc, CF Industries Holdings Inc, CVR Partners, Lp, Bunge Ltd, Sinofert Holdings Ltd and Eurochem are a few of the notable companies in the global nitrogenous fertilizers market.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Nitricity Inc., a start-up company, announced the successful results of its locally produced liquid calcium nitrate, which significantly enhanced the scale. The Nitricity made the announcement with various collaborations, including Elemental Excelerator, Olam Food Ingredients (OFI), and Madera Resource Conservation District.

- In January 2024, Orlen Group subsidiary Anwil announced the completion of its third nitrogen fertilizer plant building. This is estimated to enhance Poland's food security by lowering the import of fertilizers.

- In April 2023, Sabic Agri-Nutrients Company announced the acquisition of ETC Group for a transaction value of USD 320 million. The major aim of the acquisition is to enlarge the supply chain and distribution network of Agri-nutrients.

MARKET SEGMENTATION

This research report on the global nitrogenous fertilizers market has been segmented and sub-segmented by ingredients, application, and region.

By Ingredients

- Urea

- Ammonium Nitrate

- Ammonium Chloride

- Sodium Nitrate

- Ammonium Sulphate

- Calcium Nitrate

- Calcium Ammonium Nitrate (CAN)

- Other Nitrogenous Fertilizers

By Application

- Crop Based

- Oilseeds

- Fruits & Vegetables

- Grains & Cereals

- By Non-Crop

- Turf & Ornamental Grass

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What are the benefits of using nitrogenous fertilizers?

Nitrogenous fertilizers help improve crop yields, promote healthy plant growth, enhance plant protein synthesis, and increase soil nitrogen levels, among other benefits.

2. What are some key factors influencing the prices of nitrogenous fertilizers?

Key factors influencing nitrogenous fertilizer prices include the cost of raw materials (such as natural gas for ammonia production), energy prices, global supply and demand dynamics, weather conditions affecting crop production, currency exchange rates, and government subsidies or regulations affecting fertilizer markets.

3. How is the nitrogenous fertilizers market expected to grow in the coming years?

Growth projections for the nitrogenous fertilizers market depend on various factors such as global population growth, increasing demand for food, technological advancements in agriculture, and government policies regarding fertilizer use and environmental protection. Market research reports and industry analyses can provide insights into future trends and growth prospects.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]