Global Next-Generation Sequencing (NGS) Market Size, Share, Trends, Growth Analysis Report - Segmented By Product (Software and Services), Technology (Targeted Re-Sequencing, Whole Genome Sequencing, De Novo Sequencing, Exome Sequencing, RNA-Seq, ChIP-Seq and Methyl-Seq), Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Next-Generation Sequencing Market Size

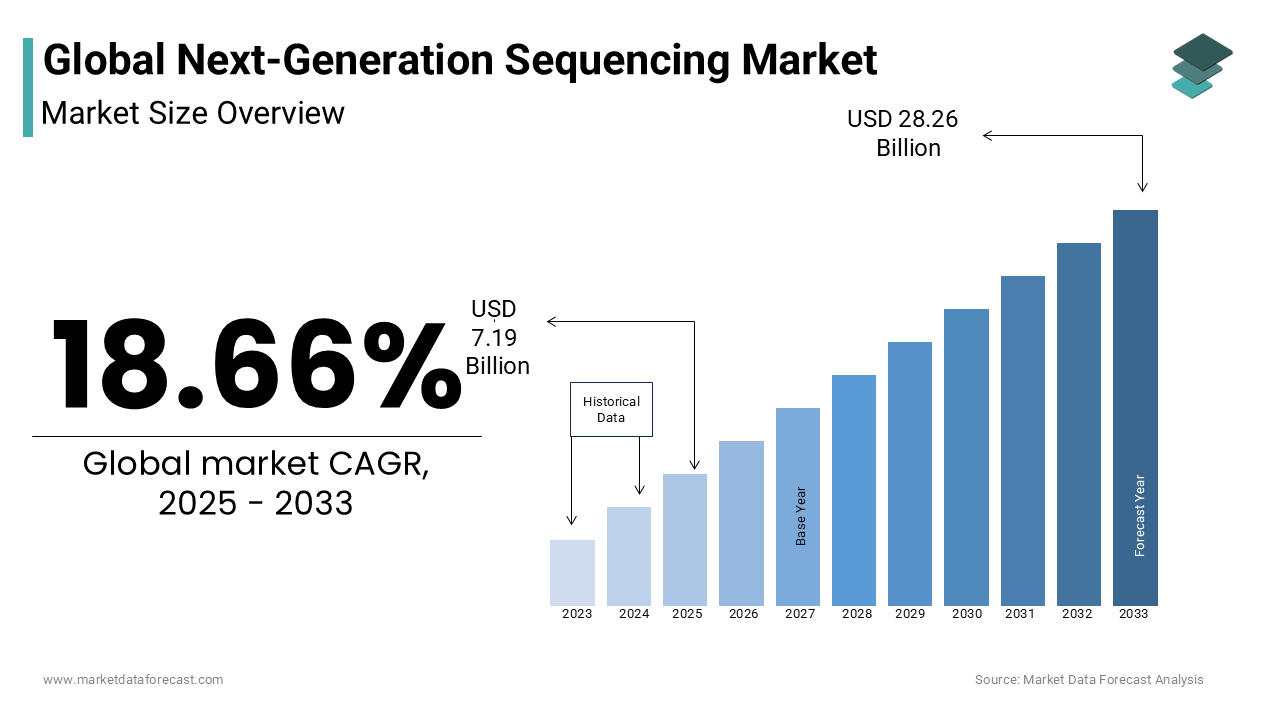

The global next-generation sequencing (NGS) market was valued at USD 6.06 billion in 2024. The global NGS market size is estimated to grow to USD 28.26 billion by 2033 from USD 7.19 billion in 2025, growing at a CAGR of 18.66% during the forecast period.

The next-generation sequencing (NGS) approach uses massively parallel processing to form DNA sequencing. There are two methods to prepare the templates: amplified templates originating from single molecules and single DNA molecule templates. NGS plays a pivotal role in clinical practice by improving diagnosis procedures. This technique is mainly used in discovering disease-causing genes. This technique takes a single day to complete the entire human genome.

Current Scenario of the Next-Generation Sequencing Market

Generation sequencing (NGS) is a DNA sequencing technology that has revolutionized genomic research. The NGS is the most widely considered method for determining the part of the nucleotide genome of an individual's genome. The NGS utilizes DNA sequencing technologies as these are capable of processing multiple DNA sequences in parallel. The NGS involves the integration of hundreds to thousands of genes at the same time in multiple samples, and it also helps in the discovery and analysis of various types of genomic features in a single sequencing run from single nucleotide variants. The NGS has multiple benefits, such as pathogen identification, outbreak tracking, and the study of antimicrobial resistance through the sequence of genomes like bacteria, viruses, and other microbes. The global next-generation sequencing market is accounted for with significant growth and is anticipated to witness notable growth during the forecast period. The NGS plays a vital role in understanding complex genetic structures and evaluating the genetic information of the diseases. The NGS is known for its higher level of data resolution. It allows researchers to detect genetic variations, structural rearrangements, and mutations, creating growth opportunities for the next-generation sequencing market. According to data stated in Taylor & Francis, the success rate of the NGS is increasing for both DNA and RNA. The percentage of increase is estimated to be 58.3% to 95.5% for DNA analysis and from 56.7% to 78.9% for RNA analysis.

MARKET DRIVERS

An increasing number of advancements in genomics research is propelling the NGS market growth.

Genomics research has experienced numerous significant developments, and NGS has played a vital role in facilitating this progress. The speed and accuracy of sequencing entire genomes have been improved dramatically through next-generation sequencing. Next-generation sequencing technology plays a significant role in analyzing vast amounts of genetic data and identifying the causes of various diseases. In addition, the involvement of next-generation sequencing in developing personalized medicine is on the rise. Researchers and healthcare providers have been using next-generation sequencing to analyze genetic mutations to understand the risk of genetic diseases and develop personalized therapies accordingly.

The growing patient population suffering from genetic diseases fuels the growth rate of the NGS market.

In recent years, next-generation sequencing technology has been increasingly used to identify the genetic variations associated with genetic diseases. In addition, NGS technology has been playing a pivotal role in diagnosing and treating genetic diseases. The population suffering from genetic disorders is growing continuously, and WHO says millions of people are affected by genetic diseases worldwide. An estimated 400 million people worldwide were affected by rare diseases in 2019, most of them because of genetic mutations. In the U.S., an estimated 30 million people suffer from genetic diseases. The National Institute of Health (NIH) says an estimated more than 6000 rare genetic diseases have been identified to date, and the number is increasing. Likewise, the growing number of genetic diseases and the increasing population suffering from these diseases is expected to result in the growing use of next-generation sequencing technology in diagnosis and treatment procedures and boost the market's growth rate.

The decreasing sequencing costs drive the NGS market growth.

The sequencing cost has continuously decreased over the last few years, making NGS affordable and accessible to researchers and clinicians. This has resulted in the rising adoption of NGS technology in clinical settings. This trend is expected to fuel in the coming years and result in the market's growth rate. In addition, factors such as increasing demand for personalized medicine, rapid adoption of technological developments in NGS platforms and software tools, and rising usage of NGS in agricultural and animal genomics accelerate market growth. Furthermore, the growing adoption of NGS in clinical diagnostics, increasing usage of NIPT, rising usage of NGS in microbiology for pathogen detection and identification, and studying microbial communities propel the NGS market growth. Furthermore, factors such as the growing cancer patient population, increasing investments for the R&D of advanced and innovative NGS solutions by the market participants and research institutes, the growing need to improve diagnostic procedures and to ensure quality treatment, an increasing number of studies on genomes are leveling up the growth rate of this next-generation sequencing market.

MARKET RESTRAINTS

High costs associated with installing and maintaining the equipment required for NGS in laboratories are hampering the market growth.

Lack of standardization is another significant attribute limiting the demand for the NGS and the market's growth rate. The interpretation of the data's DNA sequence, acceleration of the data analysis, and shortage in the data storage generated in the bottleneck are some other key factors inhibiting the growth rate of the next-generation sequencing market. In addition, there are serious issues, such as data originating from the usage of various datasets, which must be addressed. Some DNA, like short fragments, should be analyzed and compared with the reference databases, which is against but efficient and fast. Commercial software companies and industries have proposed many solutions to these challenges, but many hardships still exist. Updating the data to the central or disturbed data storage and analysis services by the clients' computers and the data parallelization using the grid or cloud solutions further hinder the NGS market growth. Another factor restraining market growth is the unexpected results produced by the NGS, which evaluates various genes that may produce unexpected risk factors that lead to other diseases or unidentified variants. Various other factors, such as ethical challenges as it generates large amounts of data, which results in variations of clinical relevance, and the NGS process is the most time-consuming procedure, are hindering the global market growth rate. The presence of issues with the sequencing quality due to its limitations is estimated to impede the market growth opportunities. Stringent regulations for approval of the procedures from the regulatory authorities involve complexity and take longer, which will be challenging to the market players in expanding the market revenue.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Illumina, Thermo Fisher Scientific, Pacific Biosciences, Macrogen Inc., Partek Inc., Genomatix Software GmbH, Perkin Elmer Inc., GATC Biotech Ag, Agilent Technologies Inc., Biomatters Ltd., BGI (Beijing Genomics Institute), Oxford Nanopore Technologies Ltd., DNASTAR Inc., Knome Inc., and Qiagen N.V. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the services segment is predicted to occupy the major share of the worldwide NGS market during the forecast period by growing fastest. Factors such as the growing patient population suffering from genetic diseases, increasing demand for sequence-based products, rising need for data management services to store large amounts of data, and favorable government policies majorly drive segmental growth. In addition, the growing demand for personalized medicine, the increasing need for NGS-based diagnostics, and the rising number of NGS service providers propels the segment's growth rate. Furthermore, the declining cost of NGS services and increasing awareness among end-users about the advantages of NGS accelerate the growth rate of the segment.

On the other hand, the software segment is predicted to register a promising CAGR during the forecast period. Factors such as the growing need for efficient data analysis and interpretation, rising adoption of NGS technology in research and clinical applications, and an increasing number of advancements in NGS data analysis software boost the segment's growth rate. The segmental growth is further driven by the rising integration of artificial intelligence (A.I.) and machine learning (ML) technologies in NGS data analysis software.

By Technology Insights

Based on the technology, the targeted re-sequencing segment is predicted to account for the largest share of the worldwide NGS market during the forecast period. It is expected to show the highest CAGR. The growing usage of targeted re-sequencing in oncology research is one of the key factors driving segmental growth. Targeted re-sequencing has been increasingly used to study the cancer genome as it can help researchers analyze the cancer genome efficiently and effectively. This trend is predicted to continue in the coming years and boost segmental growth. In addition, the growing number of advancements in targeted re-sequencing technologies and increasing adoption of targeted re-sequencing in clinical applications accelerate the segment's growth rate.

On the other hand, the whole genome sequencing segment is projected to showcase a healthy growth rate over the forthcoming years. The growing usage of WGS in research and clinical applications, increasing technological developments in WGS, and the benefits of WGS, such as improved accuracy, speed, and cost-effectiveness, drive segmental growth. In addition, the rising usage of WGS in the development of personalized medicine favors the segment's growth rate.

By Application Insights

Based on the application, the diagnostics segment accounted for the largest share of the global NGS market in 2024 and is estimated to repeat the same trend throughout the forecast period. The growing cancer patient population and favorable reimbursement policies from the government towards NGS-based tests in the U.S. contribute to the segmental growth.

On the other hand, the personalized medicine segment is predicted to witness a prominent CAGR during the forecast period. The growing awareness regarding the benefits of NGS, increasing demand for personalized therapies, and early detection of disorders enhance segmental growth.

REGIONAL ANALYSIS

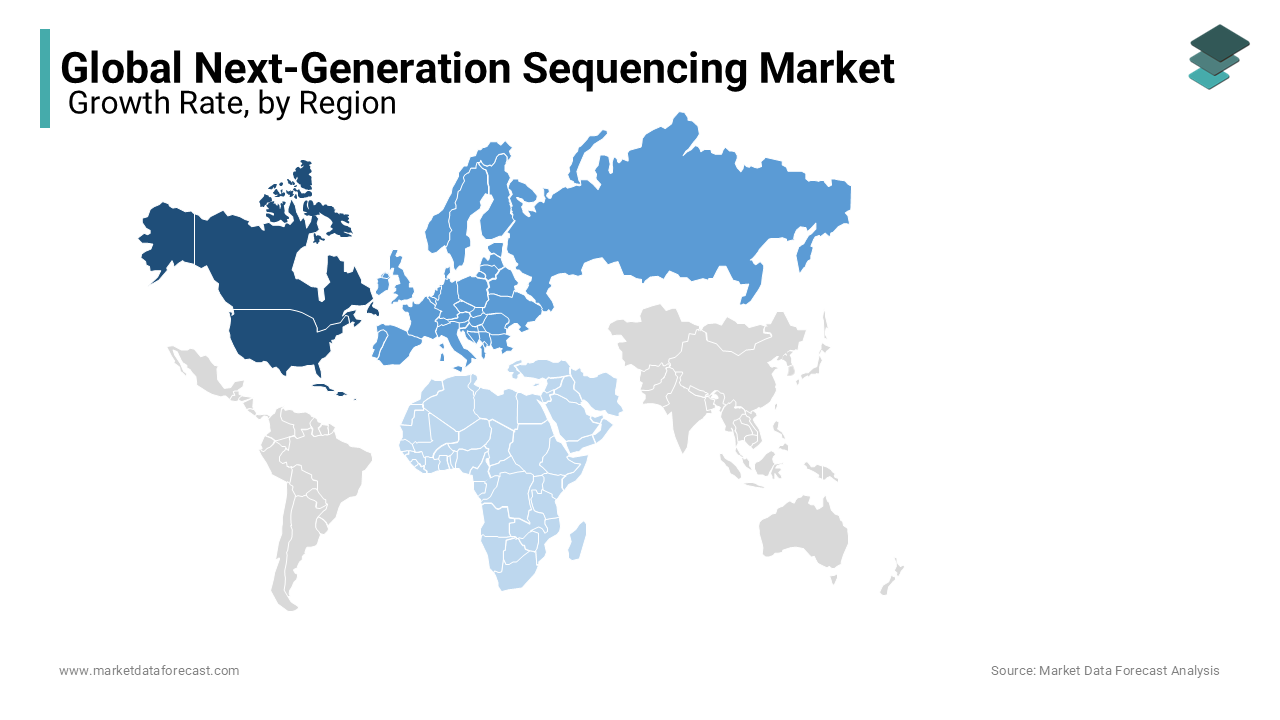

Geographically, the North American region accounted for the largest share of the worldwide market in 2024 and is expected to continue to dominate North America in the global market throughout the forecast period. The growth of the North American NGS market is majorly driven by the increasing patient population suffering from chronic diseases, rising demand for personalized medicine and personalized diagnostics, favorable government initiatives, and funding for genomics R&D. In addition, the presence of notable NGS companies and research institutions, the presence of skilled professionals and advanced medical infrastructure further fuels the growth rate of the North American market. As a result, the U.S. NGS market held the largest share of the North American market, followed by Canada in 2024.

Europe held the second-largest worldwide market share in 2024 and is expected to register a notable CAGR during the forecast period. Factors such as the presence of several biotech and pharmaceutical companies, growing adoption of personalized medicine, and rising demand for NGS-based diagnostics propel the European next-generation sequencing market growth. In addition, the growing investments from the European governments for the research and developmental activities of genomics are key factors that boost the European NGS market growth. As a result, the UK NGS market had a significant share of the European market, followed by France and Germany, and the same trend is expected to continue during the forecast period.

Asia-Pacific is projected to showcase the fastest CAGR during the forecast period. The growth of the APAC market is attributed to the rising adoption of NGS technologies in research and clinical settings, increasing investments by governmental and non-governmental organizations in favor of genomics, and the growing patient population in developing countries promoting the NGS market growth in APAC. China is expected to grow at the highest CAGR during the forecast period in the APAC region. In addition, the presence of noteworthy developments in China and Japan to integrate new technologies and the development of healthcare, R&D, and clinical development frameworks of developing economies such as India and Australia have led the Asia Pacific market to witness rewarding growth throughout the forecast period.

Latin America accounted for a considerable share of the worldwide market in 2024 and is expected to grow steadily in the coming years. The growing number of investments by governmental organizations in the healthcare infrastructure and increasing adoption of advanced sequencing technologies primarily drive the NGS market in Latin America. As a result, Brazil and Mexico are predicted to occupy the leading share of the Latin American NGS market during the forecast period.

The NGS market in the Middle East and Africa is predicted to capture a moderate global market share during the forecast period.

KEY PLAYERS IN THE GLOBAL NGS MARKET

Illumina, Thermo Fisher Scientific, Pacific Biosciences, Macrogen Inc., Partek Inc., Genomatix Software GmbH, Perkin Elmer Inc., GATC Biotech Ag, Agilent Technologies Inc., Biomatters Ltd., BGI (Beijing Genomics Institute), Oxford Nanopore Technologies Ltd., DNASTAR Inc., Knome Inc., and Qiagen N.V. are some of the notable players in the global next-generation sequencing market.

RECENT DEVELOPMENTS IN THE NGS MARKET

- In April 2024, Merck KGaA introduced the first all-in-one, validated genetic stability assay, the Aptegra CHO genetic stability assay. The assay uses whole genome sequencing and bioinformatics to accelerate biosafety testing for commercial production clients.

- In January 2024, QIAGEN enhanced its QIAGEN CLC Genomics Workbench Premium with speed technology, which supports next-generation sequencing (NGS) in somatic cancer secondary analysis.

- In February 2024, Integrated DNA Technologies announced its collaboration with Element Biosciences, Inc. to develop more streamlined next-generation sequencing workflows.

- In November 2023, Elemental Biosciences, Inc. and QIAGEN collaborated and made a legal agreement to provide complete next-generation sequencing workflows for the AVITI System.

- In October 2023, GenDx announced the introduction of NGS-Turbo, which is used for HLA typing by using Oxford Nanopore Technologies sequencing instruments.

MARKET SEGMENTATION

This research report on the global next-generation sequencing market has been segmented and sub-segmented based on the product, technology, application, and region.

By Product

- Software

- Services

By Technology

- Targeted Re-Sequencing

- Whole Genome Sequencing

- De Novo Sequencing

- Exome Sequencing

- RNA-Seq

- ChIP-Seq

- Methyl-Seq

By Application

- Diagnostics

- Drug Discovery

- Biomarker Discovery

- Personalized Medicine

- Agriculture and Animals Research

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Does this report include the impact of COVID-19 on the Next Generation Sequencing Market?

Yes, we have studied and included the COVID-19 impact on the global Next Generation Sequencing Market in this report.

Which are the major players operating in the Next Generation Sequencing Market?

Illumina, Thermo Fisher Scientific, Pacific Biosciences, Macrogen Inc., Partek Inc., Genomatix Software GmbH, Perkin Elmer Inc., GATC Biotech Ag, Agilent Technologies Inc., Biomatters Ltd.,

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]