Global Neurovascular Devices Market Size, Share, Trends & Growth Forecast Report By Type (Embolization, Stenting systems, Support Devices, Neurovascular thrombectomy devices), Application, End-User and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Neurovascular Devices Market Size

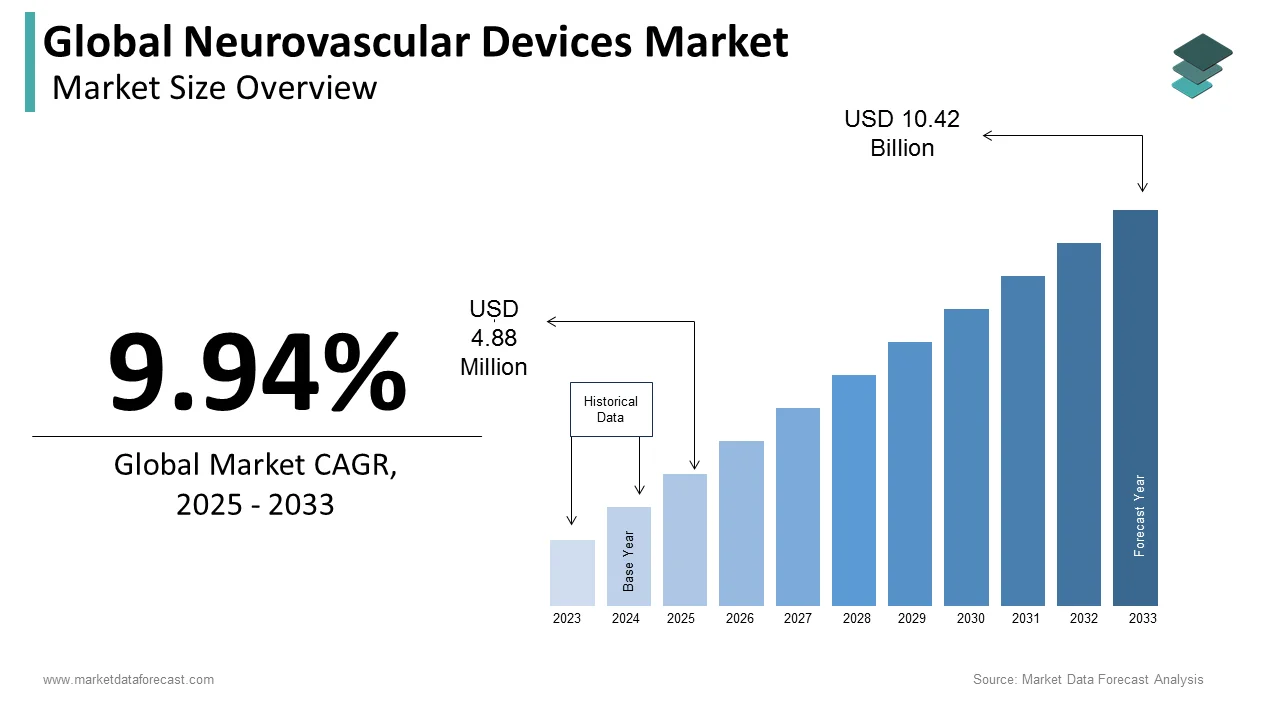

The size of the global neurovascular devices market was worth USD 4.44 billion in 2024. The global market is expected to grow at a CAGR of 9.94% from 2025 to 2033 and be valued at USD 10.42 billion by 2033 from USD 4.88 billion in 2025.

The global neurovascular devices market is predicted to have a promising future during the forecast period. The growing patient population suffering from neurovascular diseases, technological advancements in neurovascular devices and rising awareness and diagnosis of conditions like aneurysms and strokes among people are likely to fuel the demand for neurovascular devices in the coming years. The demand for neurovascular devices is particularly very high in the U.S. compared to other countries. Other than the U.S., Europe and Asia-Pacific regions are predicted to see a notable growth in the demand for these devices during the forecast period. China and India are looking for prominent and emerging markets for neurovascular devices. The global neurovascular devices market currently has intense competition with major companies such as Medtronic, Stryker, Johnson & Johnson, and Terumo Medical Corporation, which are at the top of the competition. These companies have been focussing on developing cutting-edge devices, minimally invasive stents and embolization products, strategic partnerships, mergers and acquisitions, and investments in R&D to further strengthen their position in the global market.

MARKET DRIVERS

YoY Growth in the Population Suffering from Neurological Diseases

The prevalence of neurovascular diseases such as stroke and aneurysms has been growing continuously worldwide. As per the World Health Organization (WHO), stroke is one of the major causes of death worldwide and is considered the third major reason for disability worldwide. An estimated 15 million people globally suffer a stroke every year, of which 5 million people die, and another 5 million people have been experiencing permanent disability. According to the projections of the American Heart Association, an estimated 4% of the U.S. population is likely to suffer a stroke by 2030. As these statistics define, the growing prevalence of neurovascular diseases is likely to fuel the demand for effective treatment options and result in the increasing demand for neurovascular devices.

Growing Aging Population Worldwide

The number of people turning the age of 60 and over is rapidly increasing worldwide. The aged people are more likely to suffer neurovascular diseases, such as stroke and aneurysms. As per the estimations of the United Nations (UN), the number of people aged 60 and above will reach 2.1 billion by 2050, which was 962 million in 2017. Japan is one of the countries with the highest aging population worldwide, and the number of neurovascular interventions in Japan is comparatively high. As per Eurostat, 21.1% of the European Union population is aged 65 years and over, and this percentage is anticipated to increase further in the coming years. The growth in the number of individuals aging beyond 60 fuels the risk of neurovascular conditions and boosts the demand for neurovascular devices.

Technological Advancements in Neurovascular Dvices

Technological developments such as stent retrievers, flow diverters, and embolization coils have brought several changes in the way the treatment has been provided for neurovascular diseases in recent years. For instance, the introduction of the Solitaire™ stent retriever device considerably improved the success rate of mechanical thrombectomy procedures in stroke patients. As per the study conducted by the Journal of NeuroInterventional Surgery, using stent retrievers promoted the rate of successful reperfusion to 88%. In addition, technological advancements in imaging, such as 3D angiography, improved the precision and effectiveness of neurovascular interventions. Companies that operate in the neurovascular devices market have been continuously investing in technology to update the capabilities of existing product lines and bring new products to the market, which is expected to continue to drive the global neurovascular devices market growth.

Furthermore, factors such as increasing demand for minimally invasive surgeries, rising awareness among people regarding the about stroke and aneurysm treatments, the expansion of healthcare infrastructure in emerging markets and y-o-y growth in the number of specialized neurosurgeons are supporting the growth of the neurovascular devices market. The growing population suffering from lifestyle-related disorders, rising adoption of advanced therapeutic procedures, increasing number of initiatives and funding from the governments for stroke prevention and continuous focus from the market participants on the development of innovative neurovascular devices are boosting the growth of the neurovascular devices market.

MARKET RESTRAINTS

High Costs

High costs associated with neurovascular devices are the biggest restraint to the global neurovascular devices market. In addition, factors such as strict regulatory requirements and approval processes for neurovascular devices, the shortage of skilled neurosurgeons in some countries, reimbursement challenges, and insurance coverage issues are hindering the growth of the neurovascular devices market. Furthermore, potential complications and risks associated with neurovascular procedures, lack of awareness of neurovascular devices in developing regions, high costs associated with the R&D of these devices, and intense competition from alternative treatments and technologies are hampering the growth of the global neurovascular devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.94% |

|

Segments Covered |

By Type, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

MicroPort Scientific Corporation, Terumo Corporation, Abbott, Acandis GmbH, Johnson & Johnson Services Inc., Gynesonics, Integer Holdings Corporation, Sensome, Stryker Corporation, Penumbra Inc., Rapid Medical, Medikit Co. Ltd., Codman Neuro (Integra Lifesciences), Perflow Medical Ltd., Medtronic plc, Evasc, Imperative Care Inc., Neuravi, Asahi Intecc Co. Ltd., Kaneka Corporation, Balt, OxfordEndovascular, Merit Medical Systems Inc., L. Gore & Associates Inc., MicroVention, Inc., Phenox GmbH, Blockade Medical LLC, WL. Gore & Associates Inc., Delaware Corporation, Secant Group LLC. |

SEGMENTAL ANALYSIS

By Type Insights

The embolization devices segment led the market and captured 34.7% of the global market share in 2023. Embolization devices play a vital role in treating conditions such as aneurysms and arteriovenous malformations. The growth of the embolization devices segment is majorly driven by the increasing number of embolization procedures, advancements in minimally invasive procedures, and growing awareness of embolization devices among patients and healthcare providers. For instance, as per the data of the American Journal of Neuroradiology, more than 50,000 embolization procedures are being performed in the U.S. alone every year.

The neurovascular thrombectomy devices segment is anticipated to be the fastest-growing segment in the global market. Neurovascular thrombectomy devices are majorly used in the treatment of acute ischemic stroke. Y-o-Y growth in the incidence of stroke, rising awareness about early intervention, and technological advancements in thrombectomy devices are propelling the growth of the neurovascular thrombectomy devices segment in the global market.

By Application Insights

The ischemic strokes segment occupied a share of 31.8% of the global market in 2023 and is expected to continue to be the dominating segment in the worldwide market during the forecast period. The dominance of the ischemic stroke segment is majorly credited to the rising incidence of stroke worldwide, technological advancements in thrombolytic therapies, and the rapid adoption of mechanical thrombectomy procedures. As per the American Stroke Association, Ischemic strokes account for 87% of the total number of strokes. According to the data of the World Stroke Organization, approximately 7.6 million new ischemic strokes are recorded every year. Furthermore, the rising emphasis on early stroke intervention and the development of advanced imaging and retrieval devices are boosting the expansion of the ischemic stroke segment in the global market.

The cerebral aneurysm segment is another major segment and accounted for 30.6% of the worldwide market share in 2023. Y-o-Y growth in the incidence of brain aneurysms, technological advancements in aneurysm coiling and flow diversion, and a rising number of awareness campaigns about early diagnosis and treatment are primarily driving the growth of the cerebral aneurysm segment in the global market. For instance, according to the Brain Aneurysm Foundation, an estimated 3-5% of the global population has cerebral aneurysms. The rapid adoption of minimally invasive procedures and improvements in imaging technologies are further contributing to the expansion of the cerebral aneurysm segment.

By End-User Insights

Hospitals are the largest end-users of neurovascular devices and accounted for 46.4% of the global market share in 2023. The domination of the hospital segment is likely to continue in the global market during the forecast period. Factors such as Y-o-Y growth in the prevalence of neurovascular disorders, the availability of advanced medical technologies, the presence of specialized neurovascular units within hospitals, and an increasing number of surgical procedures for treating aneurysms and strokes are propelling the growth of the hospital's segment in the global market. For instance, according to the World Health Organization (WHO), more than 80% of neurovascular surgeries were performed in hospitals in 2022.

The ambulatory centers segment is growing rapidly and is predicted to be the fastest-growing segment in the global market during the forecast period. The growing demand for outpatient services, the cost-effectiveness of ambulatory centers, and the increasing number of advancements in neurovascular device technologies that enable same-day procedures are contributing to the growth of the ambulatory centers segment in the worldwide market.

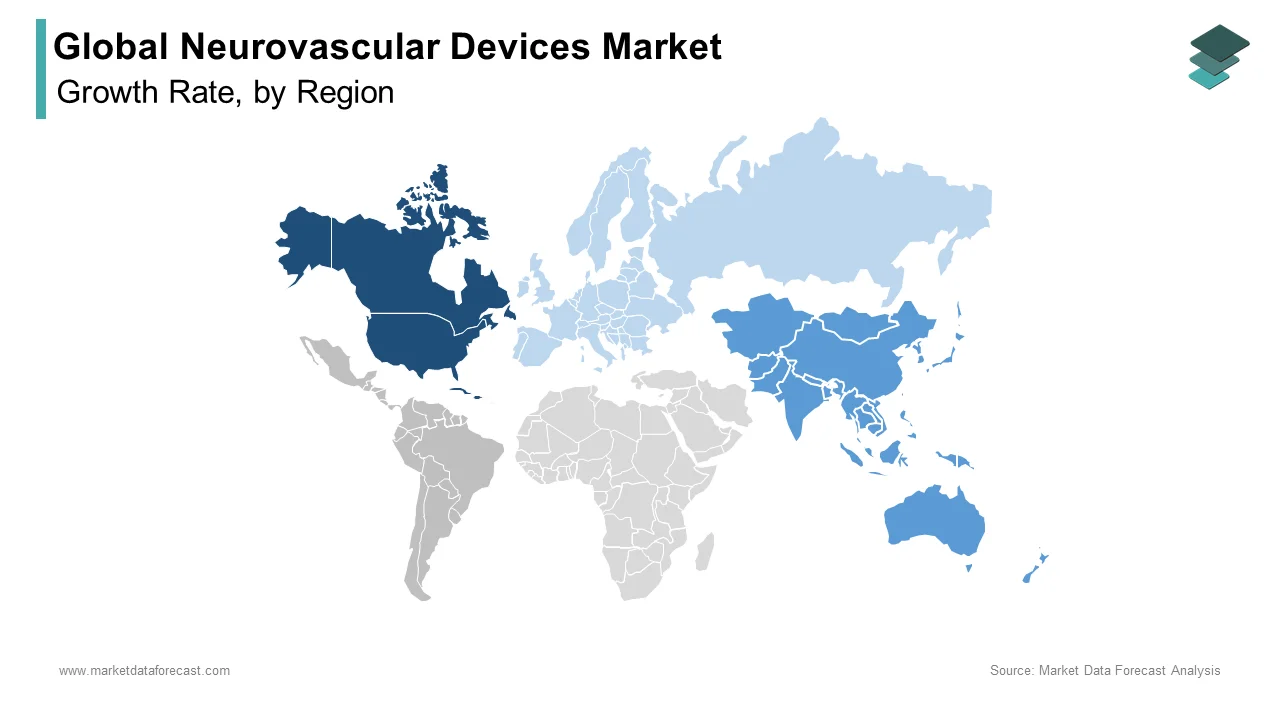

REGIONAL ANALYSIS

North America dominated the neurovascular devices market in 2023 by accounting for 34.8% of the global market share. The lead of the North American region in the global market is majorly due to the presence of advanced healthcare infrastructure and the high prevalence of neurovascular diseases. For instance, according to the data from the American Stroke Association, the U.S. has been experiencing 795,000 stroke cases in the U.S. The rapid adoption of minimally invasive neurovascular procedures and increasing investments in research and development are further propelling the expansion of the North American market.

The Asia-Pacific region is the fastest-growing regional segment in the worldwide market. The y-o-y rise in the prevalence of neurovascular diseases and an increasing number of improvements in the healthcare infrastructure across the region are fuelling the growth rate of the Asia-Pacific market. According to the World Health Organization (WHO), more than 5 million cases of stroke are reported from the Asia-Pacific region every year, with the majority of the cases from China and India. The growing healthcare expenditure and increasing number of neurointerventional procedures in Asia-Pacific are further contributing to the growth of the APAC market. As per the Asia-Pacific Stroke Organization (ASPO), the number of neurointerventional procedures in Asia-Pacific grew by 25% in the last 5 years.

Europe held a notable share of the worldwide market in 2023 and is expected to be a lucrative regional segment for neurovascular devices. The growing incidence of stroke in Europe is one of the factors supporting the European market expansion. For instance, as per the European Stroke Organisation, more than 1.1 million stroke cases are recorded in Europe every year, and stroke is the second major cause of death in Europe. The growing aging population, increasing incidence of neurovascular conditions, and favorable policies from the governments of European countries for healthcare innovation are boosting the European market growth.

KEY MARKET PLAYERS

Companies playing a promising role in the global neurovascular devices market include MicroPort Scientific Corporation, Terumo Corporation, Abbott, Acandis GmbH, Johnson & Johnson Services Inc., Gynesonics, Integer Holdings Corporation, Sensome, Stryker Corporation, Penumbra Inc., Rapid Medical, Medikit Co. Ltd., Codman Neuro (Integra Lifesciences), Perflow Medical Ltd., Medtronic plc, Evasc, Imperative Care Inc., Neuravi, Asahi Intecc Co. Ltd., Kaneka Corporation, Balt, OxfordEndovascular, Merit Medical Systems Inc., L. Gore & Associates Inc., MicroVention, Inc., Phenox GmbH, Blockade Medical LLC, WL. Gore & Associates Inc., Delaware Corporation, Secant Group LLC.

RECENT HAPPENINGS IN THE GLOBAL MARKET

- In April 2024, Route 92 Medical, Inc. received FDA 510(k) Clearance for their FreeClimb® 54 reperfusion system, which is believed to be a great addition to their portfolio of neurovascular devices.

- In February 2024, Philips launched the new Azurion neuro biplane system, which is designed to streamline neurovascular procedures with the intention to help healthcare professionals make the appropriate decisions quickly and treat patients effectively.

MARKET SEGMENTATION

This research report on the global neurovascular devices market has been segmented and sub-segmented based on type, application, end-user and region.

By Type

- Embolization

- Stenting systems

- Support Devices

- Neurovascular Microcatheters

- Neurovascular Guidewires

- Neurovascular thrombectomy devices

By Application

- Carotid Artery Stenosis

- Cerebral Aneurysm

- Arteriovenous Malformations and Fistulas

- Ischemic Strokes

By End-User

- Hospitals

- Specialty care centers

- Ambulatory centers

- Research laboratories

- Academic institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

At what CAGR, the global neurovascular devices market is growing?

The global neurovascular devices market is predicted to register a CAGR of 9.94% from 2025 to 2033.

Which segment by type dominated the neurovascular devices market in 2023?

The embolization devices segment accounted for 34.7% of the global neurovascular devices market share and emerged as the most dominating segment by type in the global market in 2023.

Which region is expected to grow at the fastest CAGR in the global neurovascular devices market during the forecast period?

The Asia-Pacific region is anticipated to witness the highest CAGR among all the regions in the global market during the forecast period.

Who are the key players in the global neurovascular devices market?

MicroPort Scientific Corporation, Terumo Corporation, Abbott, Acandis GmbH, Johnson & Johnson Services Inc., Gynesonics, Integer Holdings Corporation, Sensome, Stryker Corporation, Penumbra Inc., Rapid Medical, Medikit Co. Ltd., Codman Neuro (Integra Lifesciences), Perflow Medical Ltd., Medtronic plc, Evasc, Imperative Care Inc., Neuravi, Asahi Intecc Co. Ltd., Kaneka Corporation, Balt, OxfordEndovascular, Merit Medical Systems Inc., L. Gore & Associates Inc., MicroVention, Inc., Phenox GmbH, Blockade Medical LLC, WL. Gore & Associates Inc., Delaware Corporation, and Secant Group LLC are a few of the notable players in the global neurovascular devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]