Global Neobanking Market Size, Share, Trends, & Growth Forecast Report, Segmented by Organization Size (Large Enterprises and SMEs), Service Type (Loans, Mobile Banking, Checking & Bank Account, Payment & Money Transfer, and Others), Application (Personal, Enterprise, and Others), Account Type (Business Account and Bank Account), & Region, Industry Forecast From 2024 to 2033

Global Neobanking Market Size

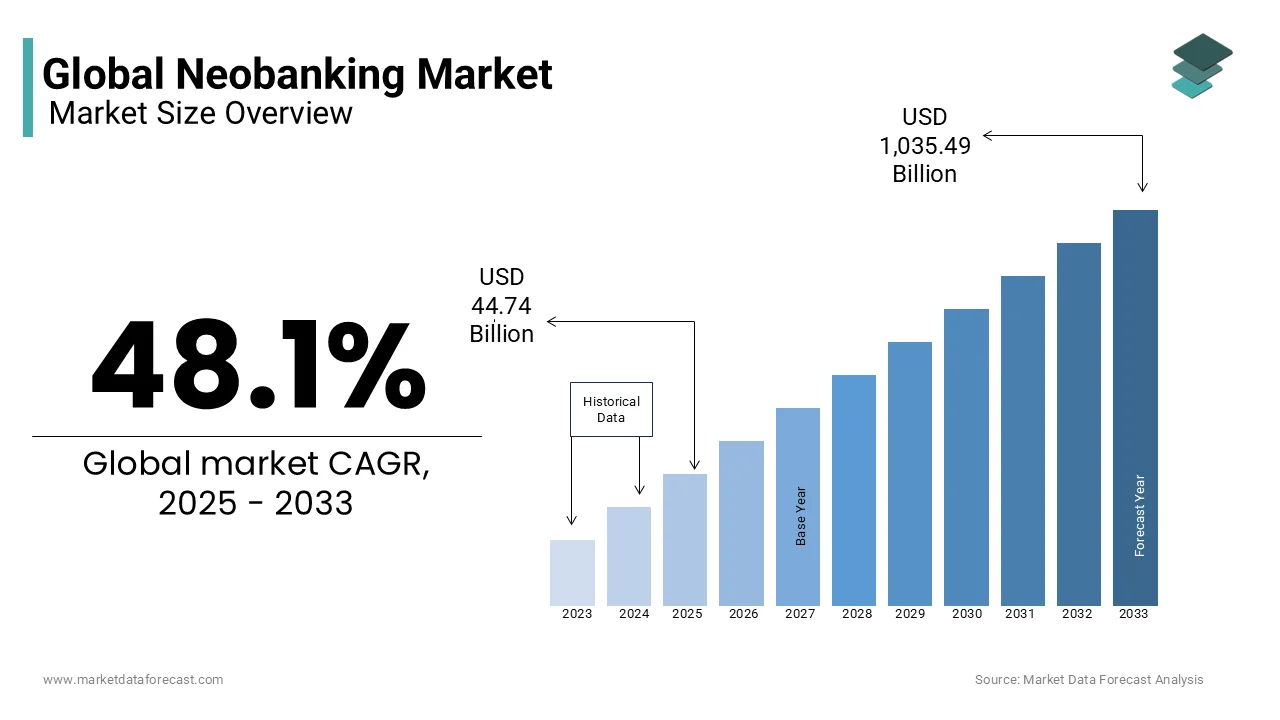

The global neobanking market was valued at USD 30.21 billion in 2024. The global market is predicted to reach USD 44.74 billion in 2025 and USD 1,035.49 billion by 2033, growing at a CAGR of 48.1% during the forecast period 2025 to 2033.

Neobanking is a novel banking technology with complete online banking solutions for its customers. These banks differ from traditional ones as they need no physical offices or branches. Neobanking allows everything from opening an account to other services without needing to travel to a bank. GoBank and Moven are a number of the first-ever Neobanking organizations. However, with rising demand for these banks, rivalry is certain to occur in this market. The neobanking market has experienced rapid growth in recent years and this trend is expected to fuel further during the forecast period. These banks have given a fresh approach to managing money and have positioned themselves as a major competitor to traditional players. By this year, they have secured a substantial market share, particularly among the younger population and tech-savvy customers who prefer transparency, convenience, and new features.

- For instance, as per research published in the International Journal of Case Studies in Business, IT, and Education (IJCSBE), the neobanking sector has approximately 1.1 billion clients worldwide as of October 2023, depicting a massive growth of over 30% in the last 18 months.

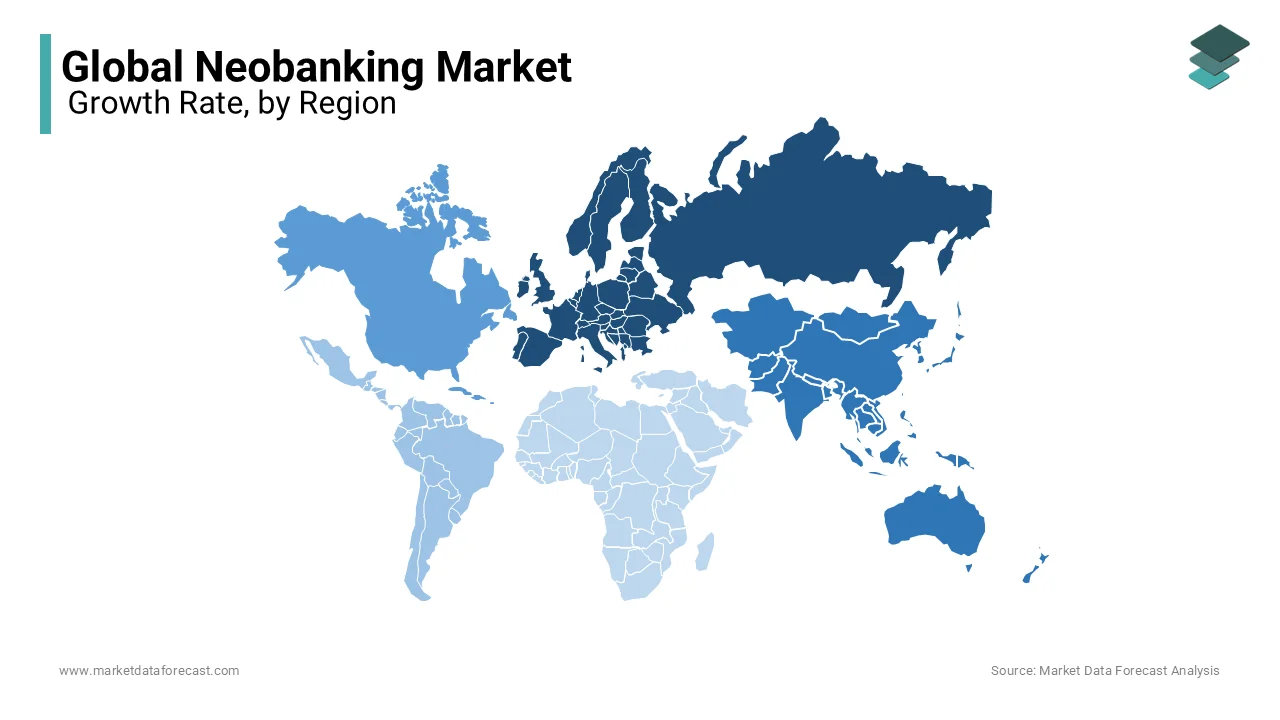

Moreover, the interface of these banks' websites gives them superiority, along with easy account opening and transaction processes. Till March 2023, there are 278 neobanks worldwide. Europe is dominating this market, followed by Asia Pacific, which is rapidly rising in this field and has become the fastest-growing region. However, the European market barely escaped the recession and is regaining its stability. This was made possible due to the mix of resilient financial districts and the region's most innovative technological minds. Now, these banks are surpassing legacy banks in app adoption rate in the continent. All these signs look positive, but some European countries are still in the process of fully realizing the digital banking opportunity. In addition, big tech companies mostly back the "challenger banks" in Asia but are almost non-existent within the Asian market. Asia still needs a proper regulatory framework to accommodate challenger banks, so, unsurprisingly, many challenger banks are an offshoot of a bank. Despite this, the market is quickly expanding, especially in India, and other key Asian economies are exhibiting a prospective environment for neobanks and the development of the open banking paradigm.

- It is expected that there will be 50+ neo-banks in APAC, which will serve more than 22 million customers. China, for example, is anticipated to become one of the largest markets for neobanking by 2025.

MARKET DRIVERS

The growing user demand for convenience within the banking sector fuels the market growth.

Benefits like transactions and automatic products provided by these banking platforms have substantially differentiated them from standard institutions. Also, rising smartphone penetration with increasing internet accessibility facilitates easy and quick services and transactions. The widespread availability of 4G networks and the subsequent roll-out of 5G networks in several countries worldwide have accelerated internet penetration, and consumers can access banking services and products from their mobile devices. So, neobanking is a perfect finance technology because it offers complete solutions to customers for online banking.

- According to Exploding Topics, nearly 90 per cent of mobile phones worldwide and most of the global population presently possess one. More than 7.2 billion smartphones are currently present in the world. In Q1 2024, the smartphone market expanded significantly at 7.8 per cent alone.

Growing demand for customer convenience within the banking sector is accelerating and the emergence of multiple technology startups & early adoption technology, these factors are likely to contribute to the market expansion significantly. Low Interest Rates and favourable regulations from the governments are several countries further boost the global market growth. The growth of the global neobanking market is also being fuelled by the exponential use of technology by people and growing access to online content within the banking sector. The neobanks offer various features like cost-effectiveness, higher interest rates, and customer convenience for opening accounts much faster and easier. This led to a significant increase in its customer base and revenue.

- For instance, the average revenue generated by neo banks per customer rose to 75 US dollars from 69 US dollars in the last 18 months, depicting a close to 50 per cent surge.

MARKET RESTRAINTS

However, financial security factors and authenticity are a number of factors expected to restrain this market expansion. The majority of security problems in most of the applications identified were repetitive. Phishing/pharming, malware, and social engineering are the 3 primary cybersecurity threats these types of banks and other digital banks encounter. These dangers are targeted at gaining entry to a customer's personal data, bank account cash, or other possible harmful actions. The most frightening aspect is that neo-banks can only do a little because the main solution is to make the user base aware of hazards. The higher application of technology results in a surge in technical risks, which are ample.

- As per a survey, in the neobank market, the rate of fintech fraud, i.e. 0.30 per cent, is three times debit cards and two times credit cards.

MARKET OPPORTUNITIES

Offering a more individualized digital experience presents potential opportunities for the growth of the neobanking market. Users nowadays expect fintech bank services to be personalized, omnichannel, and live. Neo banks that take advantage of data analytics to offer customized suggestions and future-oriented services will delight their users. Moreover, offerings, like interactive in-chat with bankers and location-based and customized budget alerts, will propel engagement. These banks that have expert digital customer experience will gain market share.

- For instance, about 71 per cent of the users expect personalization from the companies and brands they select.

MARKET CHALLENGES

Building trust is one of the major challenges for the growth of the neobanking market. These banks are comparatively new in the finance industry, they are required to establish customer trust. These banks need more extensive operational experience than traditional banks possess. The absence of impersonal assistance for complicated financial processes or transactions can irritate most customers. Particular groups like elderly or older adults and non-tech-savvy consumers could find it challenging to use neo-banking for specific transactions. Additionally, the need for a regulatory structure and well-defined protocols are limiting the growth of the market. This is because these banks cannot offer lending products or accept deposits in their own books because of the incapability to operate independently. They are generally less regulated than conventional banks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

48.1% |

|

Segments Covered |

By Organization Size, Service Type, Account Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

MYBANK, Deutsche Bank, Citigroup, Fidor Bank, CBC, Starling Bank, Movencorp Inc., Toscana, Agricultural Bank of China; Inc., HSBC Group, and Webank, Inc and Others. |

SEGMENTAL ANALYSIS

By Account Type Insights

The market is divided into business accounts and bank accounts. The business account segment held the most significant market share because it provides various business-related services like credit, investment, asset, and transaction management. This segment's rise in this market shows a more comprehensive transition into digital banking solutions that emphasize technological incorporation, cost-effectiveness, and convenience. Further, the potential of these banking applications to provide ease of processes and simplicity in disbursement to dealers, sellers, and other associated parties by lowering human interaction is projected to push forward the segment's market share.

By Application Insights

The global neobanking market is segmented into personal, enterprise, and other applications. Businesses favor neobanking platforms as they facilitate payments, better management of enterprise collections, and reconciliation on a seamless interface. The growth of neobanks is a key trend in the banking industry because they provide affordable, faster, and more hassle-free financial services than standard banks. They employ fintech, which is the technology that enhances and automates finance. They compete with traditional banks to refine their user experience and facilitate financial inclusion and authorization to millions of people.

By Service Type Insights

The checking & bank account segment is the most prevailing category in the neobanking market. This is due to their focus on opening and managing a bank or checking account since they are important for customers. It offers a base for earning interest, executing transactions, and handling money. Whereas, the payment & money transfer segment has rapidly grown in the last few years. These banks usually aim for digital nomads, millennials, and those underserviced by standard banking networks. Technological developments and shifts in consumer preferences have made approachable, digital-first a reality, and the volume of their customers globally is estimated to surpass 386 million by 2028.

By Organization Size Insights

The small enterprise segment had the leading share of the global market in 2024. As per the study, about 80 per cent of small and medium enterprises that accepted neo-banking solutions and services reported better operational effectiveness and improved management of cash flow. In developing countries in the Asia Pacific, these SMEs hold around 40 per cent market share of neobanking.

REGIONAL ANALYSIS

Europe dominates the neobanking market. Among these regions, Europe held the biggest market share because of the establishment of multiple technology startups and early technology adoption. The congestion faced in central commercial banks and a rapid increase in technological banking startups have created growth opportunities for non-conventional banking institutions. Moreover, Ireland is a crucial player in the region, which is elevating the region's market size.

- According to the study, in 2023, Ireland is in the third position in neobanking usage by nation, with about 22 per cent of Irish citizens utilising digital-only banks. This amounts to 1.1 million individuals.

Furthermore, Portugal, Spain, and Germany are believed to have escalated the region's market growth because they are quickly adopting this banking system and are estimated to have experienced steep increases in acceptance rates. For instance, about 14 per cent of the Portuguese people in 2023 utilized a neobank, and this has been anticipated to increase to about 33 per cent by 2027, equivalent to 3.35 million people. This shows a 133 per cent rise in the country's adoption between 2024 and 2033.

The Asia Pacific is predicted to emerge as the fastest-growing regional market over the forecast period because of the increasing investments within the FinTech sector. FinTech companies are now developing neobanks as these banks don't demand cumbersome organizational structures and legacy structures. This market dynamics may increase the number of new banks in countries like India and China.

- As per Seon, in 2023, India has around 26 per cent of its citizens utilizing a digital-only bank. This shows that India had the majority of neo-bank consumers by volume, with about 371.2 million account holders.

The achievement of these banks in India depends on catering to the underbanked and unbanked populations and incorporating substitute credit scoring. It is also recognized for its client-friendly features, lower costs, and 24-hour assistance. Besides this, the APAC market expansion is likely to be supported by the Philippines whose approximately 13 per cent were engaging with neo-banks in 2023 and it is expected that this number will reach around 39.8 million people (i.e. 32 per cent) which is a 161 per cent surge from the previous acceptance rate in the same year.

North America is a key regional segment for neobanking in the worldwide market. The United States and Canada have a broadly similar traditional financial system, with 4577 banks and 28 domestic banks, respectively. However, many Canadian banks' loans are the fundamental difference between the two financial systems. Such proportion is one of the major factors that make American banks safer. Apart from this, the market in Canada is witnessing healthy growth, with the volume of customers estimated to climb to 5 million by 2028, signifying a 12.22 per cent user penetration. In the meantime, the customer base in the United States is projected to touch 80 million by 2025, having a 24 per cent penetration rate. This development is driven by the inclination of 72 per cent of millennials and Generation Z to mainly bank online. Moreover, larger neo-banks in Canada are Neo Financial, Wingocard, Stack, Mogo, and Koho, and in the US, popular ones are Current, Aspiration, Varo, and Chime.

Latin America holds considerable growth potential for the neobanking market. Brazil is leading the regional market owing to the boost driven by COVID-19 limitations. It has moved ahead with the digital transformation of its economy, and, as a consequence, prominent neo-banks have experienced their consumer base rise tremendously.

- According to Seon, about 43 per cent of the Brazilian population has an account in neo-bank, positioning it as the nation with the biggest neobanking community.

Another country slated to expand Latin America's market size is Mexico. Forty-one per cent of Mexican people (i.e. 54.1 million citizens) will employ neobanking by 2027. That number represents a 148 per cent rise from 17 per cent of individuals who possess a digital-only bank account in 2023.

KEY PLAYERS IN THE MARKET

The major companies operating in the global neobanking market include MYBANK, Deutsche Bank, Citigroup, Fidor Bank, CBC, Starling Bank, Movencorp Inc., Toscana, Agricultural Bank of China, Inc., HSBC Group, and Webank, Inc.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Bunq reported that it is exposing financial frauds and money laundering by collaborating with the support of NVIDIA accelerated computing and artificial intelligence (AI). NVIDIA GPUs significantly increase the training speed of its automatic transaction-monitoring system accelerated computing.

- In April 2024, the Reserve Bank of India (RBI) gave a non-banking financial company (NBFC) to the Bengaluru-based neobank Fi. It is supported by the Temasek and Peak XV. Moreover, Jupiter, Bright, Niyo, and Freo are India's main competitors.

- In April 2024, Keytom, which is a digital asset-centric neobank, was introduced in the United Arab Emirates (UAE) with the main objective of assisting consumers to manage their digital assets from a comfortable location efficiently.

MARKET SEGMENTATION

This report on global neobanking market is segmented on the premise of organization size, service type, account type, application, and region.

By Organization Size

- Large Enterprises

- small

By Service Type

- Loans

- Mobile Banking

- Checking & Bank Account

- Payment & Money Transfer

By Account Type

- Business Account

- Bank Account

By Application

- Personal

- Enterprise

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How are traditional banks responding to the emergence of neobanks?

Traditional banks are responding to the emergence of neobanks by enhancing their digital capabilities, investing in fintech partnerships, and launching their own digital banking platforms. Some traditional banks are also acquiring neobanks to gain access to their technology and customer base.

What role does artificial intelligence (AI) play in the operations of neobanks?

AI plays a significant role in the operations of neobanks by enabling personalized customer experiences, fraud detection and prevention, risk assessment, credit scoring, chatbot-based customer support, and data analytics for decision-making.

What opportunities does open banking present for neobanks in expanding their service offerings?

Open banking presents opportunities for neobanks to expand their service offerings by leveraging APIs to integrate with third-party financial services, offering customers access to a wider range of products such as insurance, investment, and lending services.

hat are the key technological trends shaping the future of the neobanking market globally?

Key technological trends shaping the future of the neobanking market include the adoption of blockchain for secure and transparent transactions, the use of biometrics for identity verification, the rise of decentralized finance (DeFi) solutions, and the integration of Internet of Things (IoT) devices for seamless banking experiences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]