North America Vascular Stent Market Research Report – Segmented By Product (Peripheral Stents, Coronary Stents, EVAR Stent Grafts), Type, Mode of Delivery, Material, End-user, Country (the United States, Canada and Rest of North America) - Industry Analysis From 2025 to 2033

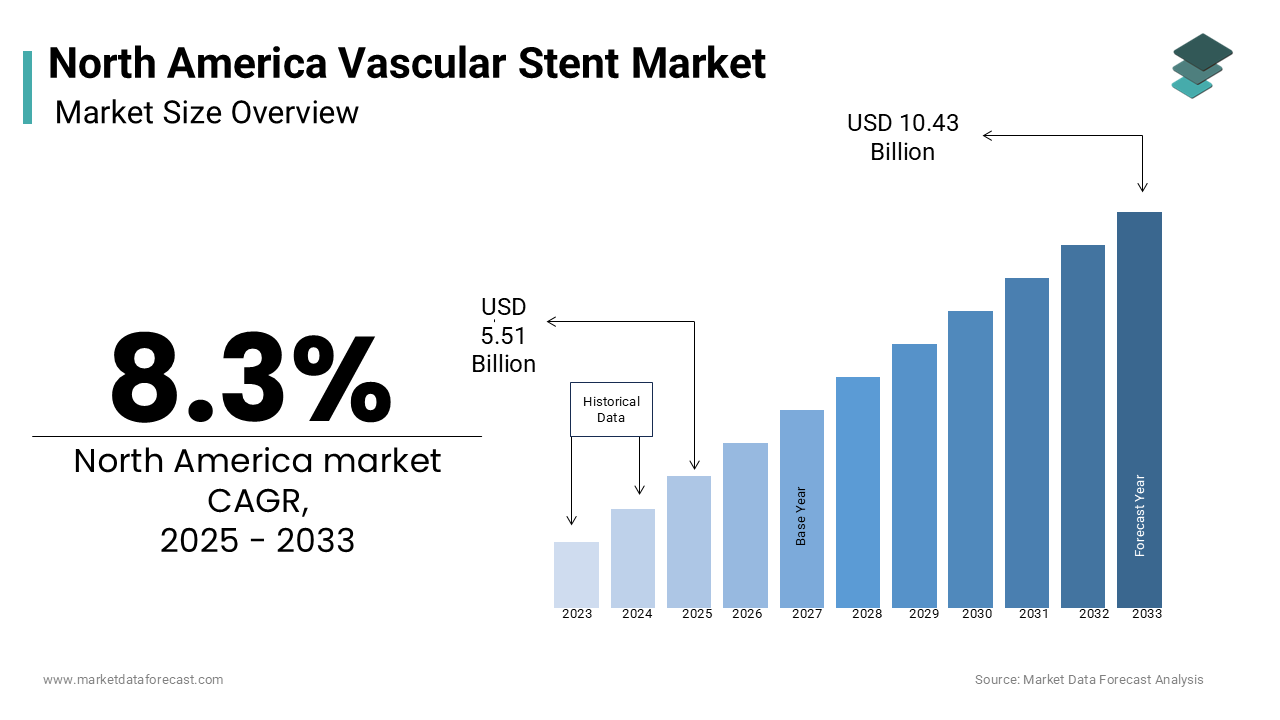

North America Vascular Stent Market Size

The size of the vascular stent market in North America is valued at USD 5.09 billion in 2024 and is expected to grow at a CAGR of 8.3%, to reach USD 10.43 billion by 2033 from USD 5.51 billion in 2025.

The North America vascular stents market is a vital segment within the broader cardiovascular devices industry, driven by advancements in interventional cardiology and rising prevalence of vascular diseases. According to data from the American Heart Association, cardiovascular diseases account for nearly 870,000 deaths annually in the U.S., creating substantial demand for minimally invasive treatments like stenting procedures. The region holds over 45% of the global vascular stents market, with the United States being the largest contributor due to its robust healthcare infrastructure and high adoption rates of advanced medical technologies.

A significant factor shaping the market landscape is the increasing incidence of peripheral artery disease (PAD) and coronary artery disease (CAD). As per the Centers for Disease Control and Prevention (CDC), approximately 18 million adults in the U.S. suffer from PAD, while CAD affects over 18 million individuals. These conditions necessitate the use of stents to restore blood flow, driving market growth. Additionally, an aging population further amplifies demand; projections indicate that by 2030, one-fifth of Americans will be aged 65 or older, as stated by the U.S. Census Bureau. This demographic shift underscores the growing need for vascular interventions is reinforcing the market's upward trajectory.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases remain the leading cause of mortality in North America is significantly influencing the demand for vascular stents. According to the American College of Cardiology, coronary artery disease alone accounts for over 650,000 deaths annually in the U.S. with the need for effective treatment options. Vascular stents are indispensable in managing these conditions, particularly through percutaneous coronary interventions (PCIs). Data from the National Cardiovascular Data Registry reveals that over 900,000 PCIs were performed in the U.S. in 2021, underscoring their widespread adoption.

The precision and reliability of drug-eluting stents (DES) have revolutionized patient outcomes, reducing restenosis rates compared to bare-metal stents. For instance, studies published in the Journal of the American Medical Association indicate that DES lowers restenosis risks by up to 50%, making them the preferred choice among cardiologists. Furthermore, the growing prevalence of risk factors such as hypertension, diabetes, and obesity is escalating the burden of cardiovascular diseases that is directly fueling the demand for vascular stents.

Technological Advancements Enhancing Efficacy

Technological innovations are transforming the vascular stents market is driving higher adoption rates across North America. Bioabsorbable stents, for instance, represent a breakthrough in stent technology by offering temporary scaffolding that dissolves after healing. According to a report by the Cleveland Clinic, bioabsorbable stents reduce long-term complications such as thrombosis is appealing to both patients and practitioners.

Additionally, advancements in stent materials, such as cobalt-chromium alloys, enhance durability and biocompatibility. A study by the Society for Cardiovascular Angiography and Interventions highlights that these materials improve procedural success rates by 20%. Self-expanding stents is designed for complex anatomies, are gaining traction in peripheral vascular interventions. These innovations align with the growing emphasis on personalized medicine by fostering trust among healthcare providers and propelling market growth.

MARKET RESTRAINTS

High Costs and Budget Constraints

One of the most significant barriers to the growth of the North America vascular stents market is the high cost associated with these devices. Advanced stents, particularly drug-eluting and bioabsorbable variants, come with steep price tags due to their sophisticated engineering and clinical benefits. According to a publication by the Healthcare Supply Chain Association, hospitals spend billions annually on cardiovascular devices, with stents being one of the costliest categories. Such expenditures strain hospital budgets in smaller facilities or rural areas where financial resources are limited. Reimbursement policies for stent procedures also vary widely, often failing to cover the full cost of treatment. A study referenced by the American Medical Association indicates that inconsistent insurance coverage discourages healthcare providers from adopting premium-priced stents. For example, Medicare reimbursement rates for certain PCI procedures using DES are often insufficient to offset procurement costs is leading to reluctance among providers to invest in newer models. These economic factors hinder the widespread adoption of advanced stents despite their clinical advantages is creating a restraint on market growth.

Stringent Regulatory Standards

Stringent regulatory requirements imposed by agencies like the U.S. Food and Drug Administration (FDA) pose another challenge to the vascular stents market. Manufacturers must comply with rigorous testing protocols and obtain premarket approvals before launching new products. The Food and Drug Administration reports that approval timelines for Class III medical devices, including vascular stents, can extend up to three years is delaying market entry and increasing development costs. Furthermore, recent recalls of defective stents have heightened scrutiny. For example, in 2021, the FDA issued warnings about malfunctions in certain bioabsorbable stents by citing instances of scaffold fractures and adverse reactions. Such incidents not only tarnish brand reputations but also intensify regulatory oversight is compelling manufacturers to allocate additional resources toward compliance. These stringent measures act as a deterrent to innovation and slow down the introduction of next-generation stents is impeding overall market progress.

MARKET OPPORTUNITIES

Expanding Applications in Emerging Therapies

The expanding scope of vascular stents beyond traditional applications presents a lucrative opportunity for market growth. The stent grafts are increasingly utilized to treat abdominal aortic aneurysms (AAA) with the rise of endovascular aneurysm repair (EVAR) procedures. The Society for Vascular Surgery estimates that over 200,000 AAA cases are diagnosed annually in the U.S. is escalating the need for EVAR stent grafts.

Stent grafts offer minimally invasive alternatives to open surgeries by reducing recovery times and improving patient outcomes. For instance, according to a study published in the Journal of Vascular Surgery, EVAR reduces postoperative complications by 30% compared to traditional methods. Moreover, advancements in modular designs enable customization for diverse anatomical structures, enhancing usability.

Growing Emphasis on Preventive Healthcare

The growing emphasis on preventive healthcare and early diagnosis of vascular diseases creates significant opportunities for the vascular stents market. Public health initiatives, such as the Million Hearts® program led by the CDC, aim to prevent one million heart attacks and strokes by 2027. Early detection of conditions like PAD and CAD enables timely interventions is increasing the demand for stents.

Additionally, awareness campaigns targeting lifestyle modifications have bolstered screening rates, particularly among high-risk populations. Data from the American Heart Association reveals that cardiovascular screenings have increased by 15% over the past decade, driving demand for interventional devices. These trends align with the broader shift toward value-based care is presenting opportunities for manufacturers to innovate and meet evolving healthcare needs.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The North America vascular stents market faces stiff competition among key players that is leading to aggressive pricing strategies that impact profitability. Major companies like Abbott Laboratories, Boston Scientific, and Medtronic dominate the landscape, but smaller firms are increasingly entering the fray, intensifying rivalry. According to a competitive analysis by Deloitte, price wars have become commonplace, with discounts ranging from 10% to 20% offered to secure contracts with large hospital networks. This environment creates challenges for manufacturers striving to balance affordability with innovation. Smaller players often struggle to compete with established brands, limiting their ability to scale operations. Furthermore, consolidation among healthcare providers has resulted in bulk purchasing agreements favoring low-cost suppliers, squeezing profit margins. These dynamics hinder long-term investments in research and development by posing a challenge to sustained market growth.

Resistance to Change Among Practitioners

Another obstacle is the resistance to adopting new technologies among some healthcare practitioners. Despite the availability of advanced stents, many cardiologists prefer traditional bare-metal stents due to familiarity and perceived reliability. A survey conducted by the American College of Cardiology found that nearly 35% of respondents expressed hesitation in switching to newer stent models without extensive training.

Training programs for innovative devices are often inadequate or underfunded, exacerbating this issue. Moreover, concerns about device malfunctions persist, as per the FDA's recall database, which documents user-reported errors. Overcoming practitioner requires targeted educational initiatives and robust post-market support, which remains a persistent challenge for market players aiming to drive adoption of cutting-edge solutions.

SEGMENTAL ANALYSIS

By Product Insights

The coronary stents segment held 55.4% of the North America vascular stents market share in 2024. The growth of the segment is attributed to driven by the rising prevalence of coronary artery disease (CAD), which necessitates frequent use of stents during PCIs. According to the American Heart Association, CAD affects over 18 million individuals in the U.S., creating substantial demand for these devices.

Drug-eluting stents (DES) are favored for their ability to reduce restenosis rates by enhancing patient outcomes. According to a study published in the New England Journal of Medicine, DES lowers restenosis risks by up to 50% compared to bare-metal stents. Additionally, advancements in biocompatible coatings and delivery systems further bolster their appeal by encouraging wider adoption.

The peripheral stents segment is anticipated to achieve a CAGR of 9.2% from 2025 to 2033. This rapid expansion is fueled by the rising incidence of peripheral artery disease (PAD), which affects over 8.5 million adults in the U.S., as stated by the Centers for Disease Control and Prevention. Innovations such as self-expanding stents and nitinol-based designs contribute to their accelerated adoption. Moreover, partnerships between manufacturers and training institutions are equipping surgeons with skills to utilize peripheral stents effectively will propel the growth of the segment.

By Type Insights

The drug-eluting stents (DES) segment was the largest by capturing 55.8% of the North America vascular stents market share in 2024. The growth of the market is attributed to superior clinical outcomes in reducing restenosis rates. Studies published in the Journal of the American College of Cardiology indicate that DES lowers restenosis risks by up to 50% compared to bare-metal stents. Their efficacy in treating complex lesions and long-term patency makes them ideal for high-risk patients. Additionally, advancements in polymer coatings enhance biocompatibility by fostering trust among practitioners.

The bioabsorbable stents segment is likely to witness a significant CAGR of 10.5% during the forecast period. Their temporary scaffolding eliminates long-term complications, addressing concerns related to thrombosis. Increasing investments in biomaterials and nanotechnology are amplifying demand for bioabsorbable stents, as they align with the growing emphasis on personalized medicine by fostering rapid adoption.

By Mode of Delivery Insights

The balloon-expanding stents segment held the dominant share of the North America vascular stents market in 2024. Their prevalence is attributed to affordability and ease of deployment in coronary interventions. Hospitals prioritize balloon-expanding stents for their compatibility with standard catheter systems.

Advancements in delivery mechanisms and radiopaque markers further enhance usability. Additionally, the growing volume of PCI procedures favors balloon-expanding stents due to their reliability and cost-effectiveness.

The self-expanding stents are projected to grow at a CAGR of 9.8% in the next coming years. Their flexibility and adaptability make them ideal for peripheral vascular interventions. The surge in PAD cases is projected to grow by 7% annually by the Centers for Disease Control and Prevention, that directly boosts demand for self-expanding stents. Innovations such as nitinol-based designs contribute to their accelerated adoption, as they ensure optimal radial strength and conformability, fostering rapid market penetration.

By Material Insights

The metal stents dominated the North America vascular stents market by holding prominen share in 2024. The growth of the segment was driven by high tensile strength and durability by ensuring long-term patency. Cobalt-chromium alloys, in particular, are widely adopted for their biocompatibility and thin struts that is enhancing procedural success rates. The growing prevalence of CAD and PAD further amplifies demand was supported by advancements in surface treatments to reduce thrombogenicity, solidifying their position as the backbone of the market.

The polymer stents segment is poised to hit a highest CAGR of 11.2% in the foreseen years. Their biodegradable nature eliminates long-term complications by aligning with sustainability trends in healthcare. Manufacturers are investing in novel polymers and additive manufacturing techniques to extend lifespans, accelerating market penetration.

By End User Insights

The hospitals segment led the North America vascular stents market share in 2024. This dominance is primarily driven by the high volume of cardiovascular procedures performed in hospital settings, particularly percutaneous coronary interventions (PCIs). According to the National Cardiovascular Data Registry, over 900,000 PCIs were conducted in U.S. hospitals in 2021. The availability of advanced catheterization labs and skilled interventional cardiologists further amplifies hospital-based demand. Additionally, hospitals benefit from structured reimbursement policies for stent procedures, ensuring financial feasibility. For instance, Medicare covers approximately 70% of PCI costs, as stated by the Centers for Medicare & Medicaid Services (CMS) by encouraging hospitals to invest in cutting-edge stent technologies.

The research institutes segment is projected to exhibit a CAGR of 10.3% from 2025 to 2033. This rapid expansion is fueled by increasing investments in clinical trials and R&D activities aimed at developing next-generation stents. According to a report by the Pharmaceutical Research and Manufacturers of America (PhRMA), over $90 billion was allocated to cardiovascular research in North America in 2022 by fostering innovation in stent design and materials. Advancements in bioabsorbable stents and nanotechnology have intensified collaboration between research institutes and manufacturers. For example, partnerships with academic institutions enable the testing of novel polymer coatings is accelerating the introduction of safer and more effective stents.

REGIONAL ANALYSIS

The United States was the top performer in the North America vascular stents market by capturing 80.9% of share in 2024. The country's dominance stems from its advanced healthcare infrastructure and high adoption rates of minimally invasive treatments. The prevalence of cardiovascular diseases, which account for nearly 870,000 deaths annually, drives significant demand for vascular stents, as per the American Heart Association. Government initiatives promoting preventive healthcare, such as the Million Hearts® program, have bolstered early diagnosis and intervention by increasing stent usage. Additionally, favorable reimbursement policies ensure affordability that is encouraging hospitals to adopt premium stent technologies.

Canada is likely to gain huge traction with an expected CAGR of 20.1% throughout the forecast period. The country's robust public healthcare system and growing emphasis on patient safety drive demand for advanced medical devices. The rising incidence of peripheral artery disease (PAD), affecting over 1.5 million Canadians, as reported by the Heart and Stroke Foundation. Government-funded research initiatives and collaborations with international firms ensure access to innovative products by enhancing market growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Notable companies leading the North American Vascular Stent Market profiled in this report are Medtronic, plc (Ireland), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), BIOTRONIK SE & Co. KG (Germany), B. Braun Melsungen AG (Germany), Terumo Corporation (Japan), STENTYS SA (France), MicroPort Scientific Corporation (China), Meril Life Sciences Pvt. Ltd. (India), Vascular Concepts (India), W. L. Gore and Associates (U.S.), C. R. Bard (U.S.), Endologix, Inc. (U.S.), Lombard Medical Technologies (U.K.), Translumina GmbH (Germany), and JOTEC GmbH (Germany).

The North America vascular stents market is characterized by intense competition among established players striving to innovate and capture greater market share. Leading firms like Abbott Laboratories, Boston Scientific, and Medtronic continuously invest in R&D to introduce cutting-edge products that address unmet clinical needs. This competitive landscape is further shaped by collaborations between manufacturers and healthcare providers to develop customized solutions.

Technological advancements, such as AI-enabled stents and compatibility with robotic platforms, serve as key differentiators. Smaller players also contribute to market dynamism by targeting underserved segments with affordable alternatives. Regulatory compliance and stringent quality controls add layers of complexity, compelling companies to prioritize safety alongside innovation.

Top Players in the North America Vascular Stents Market

Abbott Laboratories

Abbott Laboratories stands as a pioneer in the vascular stents market, renowned for its innovative product portfolio tailored to meet diverse clinical needs. The company’s Xience family of drug-eluting stents is widely regarded for its superior efficacy in reducing restenosis rates. Abbott’s strong distribution network ensures widespread accessibility across North America, catering to both urban hospitals and rural clinics.

Boston Scientific

Boston Scientific excels in offering cost-effective yet high-performing vascular stents, making it a preferred choice for budget-conscious facilities. The company’s focus on ergonomic design and modular reloadable cartridges enhances operational efficiency during surgeries. Strategic acquisitions have expanded its product line, enabling it to cater to niche applications such as thoracic surgeries. Boston Scientific continues to reinforce its competitive edge in the market with a robust pipeline of innovations.

Medtronic

Medtronic commands a formidable presence in the vascular stents market through its focus on quality and usability. Specializing in coronary and peripheral stents, Medtronic’s commitment to sustainability is evident in its biocompatible materials, which enhance patient outcomes. Collaborations with academic institutions for training programs have strengthened surgeon confidence in adopting their products with Medtronic’s reputation as a trusted brand.

Major Strategies Used by Key Players in the North America Vascular Stents Market

Key players in the North America vascular stents market employ a mix of organic and inorganic strategies to maintain their dominant position in the marketplace. These include product innovation, strategic partnerships, and mergers and acquisitions. For instance, Abbott focuses heavily on R&D, launching technologically advanced stents equipped with IoT capabilities to enhance precision. Boston Scientific leverages collaborations with training institutions to promote awareness about its products among surgeons. Meanwhile, Medtronic prioritizes cost optimization by streamlining manufacturing processes while maintaining high-quality standards.

Penetration pricing strategies are another common tactic, particularly in emerging markets within North America, ensuring affordability without compromising performance. Joint ventures with robotics firms also enable companies to integrate stents into automated surgical systems by fostering synergies across technologies.

RECENT MARKET DEVELOPMENTS

- In April 2023, Abbott launched the latest version of its Xience stent, featuring enhanced biocompatible coatings to reduce thrombogenicity is strengthening its dominance in drug-eluting stents.

- In June 2023, Boston Scientific acquired a startup specializing in bioabsorbable stents by expanding its portfolio and addressing sustainability trends in healthcare.

- In September 2023, Medtronic partnered with Intuitive Surgical to integrate its stents with robotic-assisted platforms is boosting compatibility and market reach.

- In November 2023, Abbott collaborated with Mayo Clinic to conduct training workshops on advanced stenting techniques by increasing surgeon confidence and adoption rates.

- In February 2024, Boston Scientific introduced a self-expanding nitinol stent designed for complex peripheral interventions by enhancing its presence in the peripheral stents segment.

MARKET SEGMENTATION

This research report on the North America vascular stent market has been segmented and sub-segmented into the following categories.

By Product

- Peripheral Stents

- Coronary Stents

- EVAR Stent Grafts.

By Type

- Bare-Metal Stents

- Drug-Eluting Stents

- Bioabsorbable Stents

By Mode of Delivery

- Self-Expanding Stents

- Balloon Expanding Stents.

By Material

- Metal

- Polymer

By End User

- Hospitals

- Research Institutes

By Country

- U.S

- Canadathe

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]