North America Refrigerant Market Size, Share, Trends & Growth Forecast Report By Type (Hydrofluorocarbons (HFCs), Hydrochlorofluorocarbons (HCFCs), Hydrocarbons (HC), Inorganic Refrigerants), Application (Air Conditioning, Refrigeration, Heat Pumps), By End-use (Residential, Commercial, Industrial) & Country (The U.S., Canada & Rest of North America), Industry Analysis From 2024 to 2032

North America Refrigerant Market Size

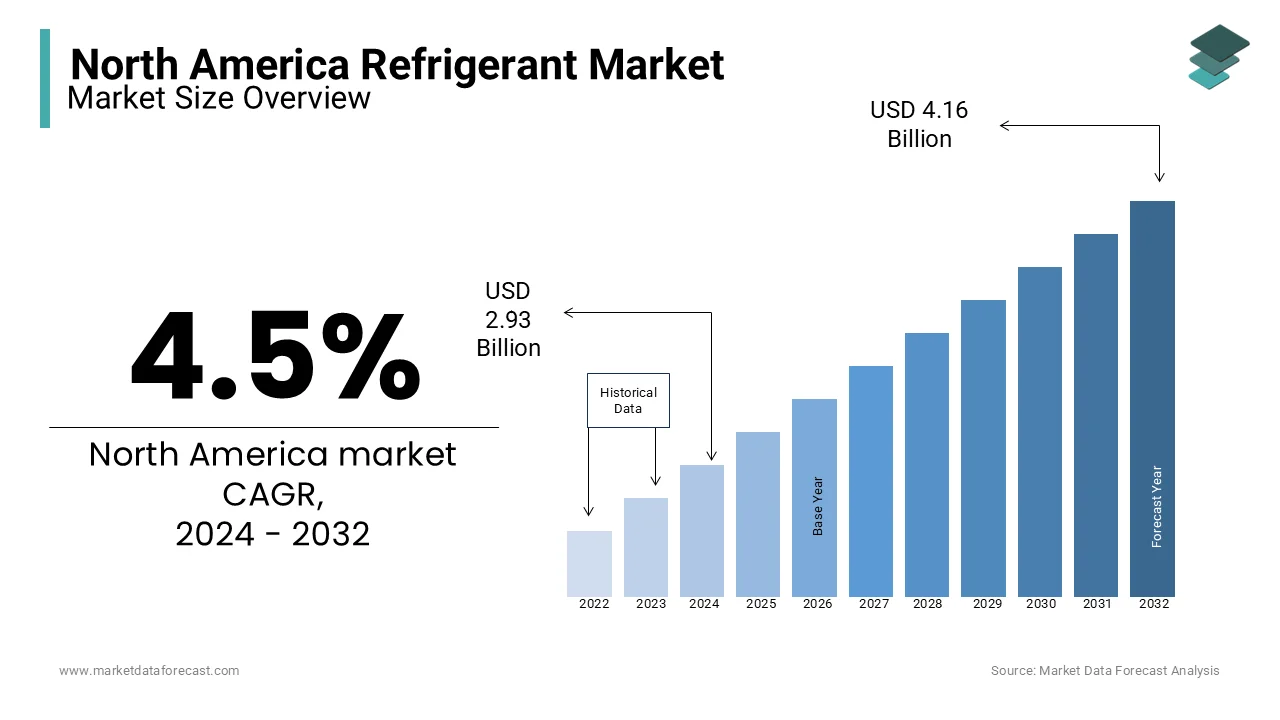

The refrigerant market size in North America was worth USD 2.8 billion in 2023. The market in North America is anticipated to grow at a CAGR of 4.5% from 2024 to 2032 and be worth USD 4.16 billion by 2032 from USD 2.93 billion in 2024.

Refrigerants are substances used in cooling systems, including air conditioners, refrigerators, and heat pumps, to absorb and release heat efficiently. The refrigerants market in North America is undergoing a significant transformation as traditional refrigerants, such as chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), are being phased out due to their high ozone depletion potential (ODP) and global warming potential (GWP). The U.S. Environmental Protection Agency (EPA) has implemented the Significant New Alternatives Policy (SNAP) to promote the adoption of low-GWP refrigerants, aligning with international frameworks like the Kigali Amendment to the Montreal Protocol. This has spurred the development and usage of hydrofluorocarbons (HFCs), hydrofluoroolefins (HFOs), and natural refrigerants such as ammonia, CO₂, and hydrocarbons. According to the reports of the U.S. Department of Energy, residential and commercial cooling systems account for approximately 10% of total energy consumption, which shows the importance of energy-efficient refrigerants.

MARKET DRIVERS

Stringent Environmental Regulations

Strict environmental policies in North America are a significant driver for the regional refrigerant market. The U.S. Environmental Protection Agency (EPA) enforces the Significant New Alternatives Policy (SNAP) to promote low-global-warming-potential (GWP) refrigerants to phase out ozone-depleting substances such as HCFCs. Additionally, Canada adheres to the Kigali Amendment as a commitment to reduce HFC consumption by 85% by 2036. According to the United Nations Environment Programme, such measures are expected to prevent a temperature rise of up to 0.4°C by 2100. These regulatory frameworks are incentivizing manufacturers and end-users to transition to eco-friendly refrigerants and spurring innovation in natural alternatives like CO₂ and hydrocarbons.

Rising Demand for Cold Chain Infrastructure

The increasing need for cold storage and transportation, particularly in the food and pharmaceutical sectors is driving demand for refrigerants in North America. As per the reports of the U.S. Department of Agriculture, food imports requiring refrigeration grew by 8% annually over the last decade. Additionally, the COVID-19 pandemic highlighted the critical role of cold storage in vaccine distribution, which is further boosting infrastructure development. According to the estimations of the International Institute of Refrigeration, nearly 15% of food production requires refrigeration globally and North America is a major contributor. This expanding cold chain network is creating substantial demand for advanced refrigerants to ensure efficiency and sustainability.

MARKET RESTRAINTS

High Transition Costs for Eco-Friendly Refrigerants

The transition to low-GWP and natural refrigerants presents significant financial challenges for industries in North America. Retrofitting or replacing existing equipment to accommodate newer refrigerants can be costly. As per the estimations of the U.S. Department of Energy, upgrading commercial refrigeration systems to comply with eco-friendly standards can cost businesses up to 30% more than traditional systems. Additionally, the limited availability of skilled technicians trained to handle newer refrigerants increases operational costs. Small and medium-sized enterprises, particularly in the food service and retail sectors are facing difficulties in adopting these changes and slowing the overall pace of the market transition toward sustainable refrigerant solutions.

Operational Challenges with Natural Refrigerants

Natural refrigerants such as ammonia, hydrocarbons, and CO₂ are gaining traction due to their low GWP and these pose operational challenges that hinder widespread adoption. For instance, ammonia is highly toxic and requires stringent safety measures, and hydrocarbons are flammable, raising concerns in residential and commercial settings. CO₂-based systems are eco-friendly but these operate at high pressures and increase system complexity and maintenance costs. The U.S. Occupational Safety and Health Administration (OSHA) has highlighted safety risks associated with handling toxic and flammable refrigerants, which require specialized training and equipment. These technical challenges make it difficult for some sectors to fully embrace natural refrigerants and impacting the market penetration in North America.

MARKET OPPORTUNITIES

Technological Advancements in Refrigerant Systems

Technological innovation in refrigeration and air conditioning systems is creating significant opportunities in the North American refrigerant market. The development of energy-efficient systems compatible with low-GWP refrigerants is a key focus area. As per the reports of the U.S. Department of Energy, the adoption of advanced technologies such as variable-speed compressors and enhanced heat exchanger designs can improve energy efficiency by up to 30%. Additionally, smart refrigeration systems with IoT integration enable precise monitoring and control and optimize refrigerant usage. These advancements not only reduce operational costs but also align with environmental regulations and encourage manufacturers to develop innovative refrigerant solutions for various industrial and commercial applications.

Expansion of the Cold Chain Industry

The cold chain sector is growing rapidly owing to the increasing demand for frozen food and biopharmaceuticals, which presents a lucrative opportunity for refrigerant manufacturers in North America. According to the U.S. Food and Drug Administration, nearly 70% of vaccines require temperature-controlled logistics, this highlights the importance of efficient refrigeration systems. Similarly, as per the reports of the United States Department of Agriculture (USDA), the frozen food market in the U.S. is expanding at an annual rate of 7%. This expansion needs advanced refrigerants that meet both performance and environmental standards, which is expected to fuel the regional market growth in the coming years.

MARKET OPPORTUNITIES

Limited Infrastructure for Natural Refrigerants

The adoption of natural refrigerants in North America faces challenges due to inadequate infrastructure and logistical constraints. Many industrial and commercial facilities lack the necessary systems and pipelines to handle ammonia, CO₂, or hydrocarbons safely. According to the U.S. Department of Energy, retrofitting facilities to accommodate natural refrigerants can increase costs by 20%-40% and create a significant barrier for businesses. Furthermore, the availability of specialized storage and transportation systems for these refrigerants remains limited, especially in rural areas. This lack of supportive infrastructure slows the transition to sustainable refrigerants, particularly for small and medium enterprises that face financial and technical hurdles in upgrading their systems.

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages pose ongoing challenges for the North American refrigerant market. The COVID-19 pandemic highlighted vulnerabilities in global supply chains and led to delays in the availability of refrigerant components and systems. According to the reports of the U.S. Census Bureau, a 25% increase was noticed in raw material costs for refrigeration equipment in 2021 due to supply chain bottlenecks. Additionally, geopolitical tensions and trade restrictions have further strained the supply of critical components, including compressors and heat exchangers. These disruptions not only affect manufacturing timelines but also increase the cost of end-user products and making it challenging for businesses to adopt modern refrigerant technologies on a large scale.

MARKET CHALLENGES

High Costs of Regulatory Compliance

Meeting stringent environmental regulations poses a significant financial challenge for the North American refrigerant market. Compliance with policies such as the U.S. Environmental Protection Agency’s Significant New Alternatives Policy (SNAP) and the Kigali Amendment requires industries to transition to low-GWP refrigerants. As per the projections of the U.S. Department of Energy, transitioning to eco-friendly refrigerants could increase system costs by 15–30%, depending on the complexity of the required modifications. These costs disproportionately impact small businesses and industries with aging infrastructure and limit their ability to upgrade systems promptly. The financial burden of compliance continues to hinder the widespread adoption of environmentally friendly refrigerants.

Limited Workforce Expertise

The shortage of skilled technicians trained in handling modern refrigerants presents a major challenge in the North America refrigerant market. Newer refrigerants like CO₂ and hydrocarbons require specialized knowledge for safe handling, system retrofitting, and maintenance. According to the U.S. Bureau of Labor Statistics, the demand for HVAC and refrigeration technicians is projected to grow by 5% from 2020 to 2030 but the workforce is struggling to meet this demand. Moreover, certifications for handling alternative refrigerants, such as those mandated by the EPA under Section 608, are not uniformly accessible across regions. This challenge delays the transition to advanced refrigerants and impacts the market growth in North America.

SEGMENTAL ANALYSIS

By Type Insights

The Hydrofluorocarbons segment had the leading share of the North American market in 2023. Hydrofluorocarbons have been widely used in North America as synthetic refrigerants in various applications due to their non-ozone-depleting nature. It has also gained the largest prominence as an alternative to ozone-depleting substances, particularly after the phase-out of chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs). However, concerns about HFCs' high global warming potential (GWP) led to regulatory initiatives aiming for their gradual phase-down.

By Application Insights

The air conditioning segment is likely to continue dominating the market in North America over the forecast period. Air conditioning applications historically dominated the North American refrigerant market growth due to the widespread use of air conditioning systems in residential, commercial, and industrial settings. The demand for air conditioning in homes, offices, malls, and other spaces remains consistently high. The dominance of air conditioning is fueled by the region's warm climate, urbanization, and a growing emphasis on indoor comfort. The type of refrigerant used in air conditioning systems is influenced by regulatory shifts, with a transition towards low-GWP alternatives.

By End User Insights

The residential segment accounted for the major share of the North American market in 2023. Residential applications play a significant role and hold the largest share in the market growth, driven by the widespread use of refrigerants in home air conditioning and refrigeration units. The demand for residential air conditioning and refrigeration systems is consistently high, particularly during warmer seasons. Energy efficiency, safety considerations, and compliance with environmental regulations influence the dominant refrigerants in residential applications.

Commercial applications cover a broad range, including refrigeration in supermarkets, restaurants, and other commercial spaces and air conditioning in offices and retail establishments. The commercial sector demands efficient and reliable refrigeration and air conditioning systems.

REGIONAL ANALYSIS

The United States dominated the refrigerant market in North America in 2023 and is likely to continue to dominate throughout the forecast period due to its advanced industrial infrastructure and strict regulatory framework promoting sustainable refrigerants. The Significant New Alternatives Policy (SNAP) U.S. Environmental Protection Agency has accelerated the adoption of low-GWP refrigerants and is supported by federal and state-level incentives. According to the U.S. Department of Energy, the HVAC industry accounts for nearly 12% of national energy consumption and these drive innovations in energy-efficient refrigerants. As per the data of the U.S. Census Bureau, the U.S. cold chain logistics network is valued at $6.7 billion and this further supports the demand for advanced refrigeration systems, which is likely to contribute to the domination of the U.S. in the North American market.

Canada is one of the top performers in the North American refrigerant market. Canada is a signatory to the Kigali Amendment and targets an 85% reduction in HFC consumption by 2036. According to Environment and Climate Change Canada, refrigeration accounts for 30% of the country’s greenhouse gas emissions, which is spurring investments in low-GWP refrigerants such as CO₂ and hydrocarbons. Additionally, the robust cold storage industry of Canada that is driven by food exports and vaccine distribution is generating significant demand for advanced refrigerants. These factors make Canada a key market for sustainable refrigerant adoption in North America.

Mexico is emerging as an important player in the North American refrigerant market due to industrial growth and increasing demand for refrigeration. Mexico is expanding its manufacturing and export sectors, which rely heavily on cooling systems. As per the reports of the Ministry of Environment and Natural Resources of Mexico, ongoing efforts to phase out HCFCs under the Montreal Protocol. The hot climate and growing urbanization of Mexico also increase the demand for air conditioning and provide opportunities for eco-friendly refrigerants.

KEY PLAYERS IN THE MARKET

Chemours Company, Honeywell International Inc., Arkema S.A., The Linde Group, Daikin Industries, Ltd., Mexichem S.A.B. de C.V. (now Orbia), Arkema Inc., A-Gas Americas, National Refrigerants, Inc., Airgas, Inc. (Part of Air Liquide), Harp International Ltd., Hudson Technologies, Inc., Refrigerant Solutions Ltd., Tazzetti S.p.A., General Gas, Puyang Zhongwei Fine Chemical Co., Ltd., Star Refrigeration, Eastman Chemical Company, DuPont de Nemours, Inc., and others.

MARKET SEGMENTATION

This research report on the North American refrigerant market is segmented and sub-segmented based on the following categories.

By Type

- Hydrofluorocarbons

- Hydrochlorofluorocarbons

- Hydrocarbons

- Inorganic Refrigerants

By Application

- Air Conditioning

- Refrigeration

- Heat Pumps

By End-user

- Residential

- Commercial

- Industrial

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

1. What is the North America Refrigerant Market growth rate during the projection period?

The North America Refrigerant Market is expected to grow with a CAGR of 4.5% between 2024-2029.

2. What can be the total North America Refrigerant Market value?

The North America Refrigerant Market size is expected to reach a revised size of US$ 3.65 billion by 2029.

3, Name any three North America Refrigerant Market key players?

Arkema Inc., A-Gas Americas, and National Refrigerants, Inc. are the three North America Refrigerant Market key players.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]