North America Kombucha Market Size, Share, Trends & Growth Forecast Report By Product Type (Original/Regular, Flavored), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of North America), Industry Analysis From 2025 to 2033

North America Kombucha Market Size

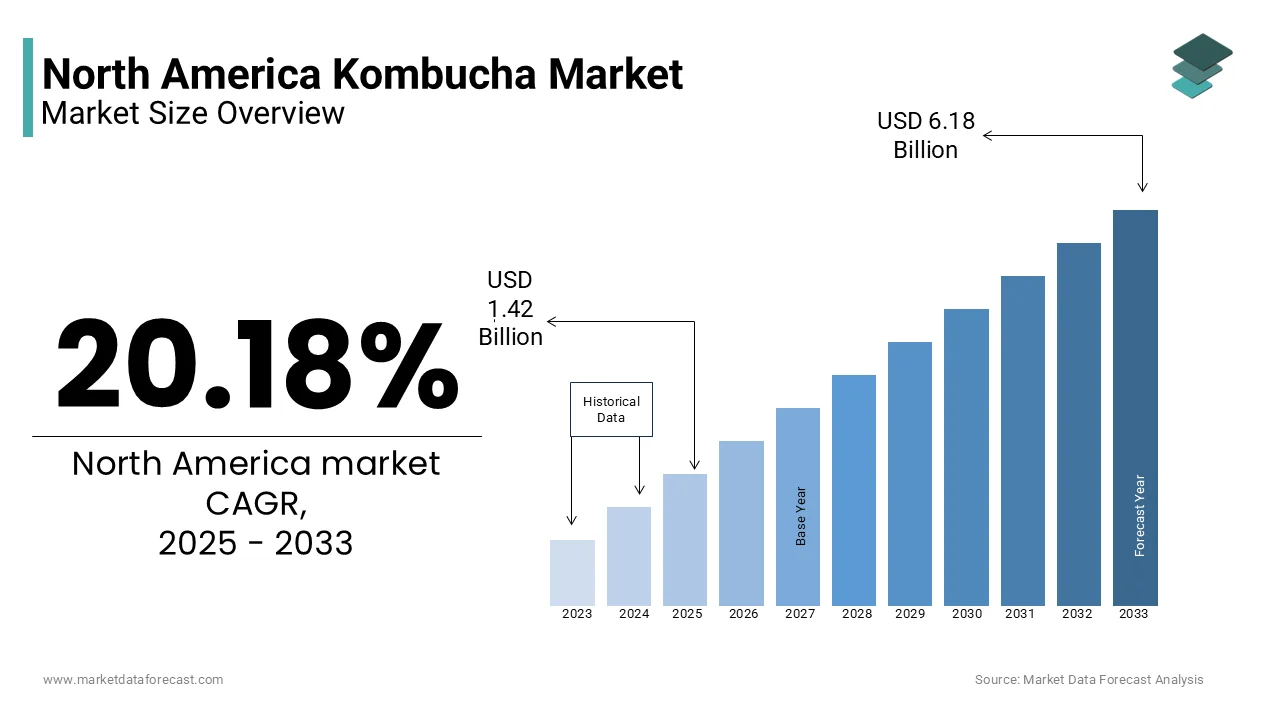

North America Kombucha Market size was valued at USD 1.18 billion in 2024, and the market size is expected to reach USD 6.18 billion by 2033 from USD 1.42 billion in 2025. The market's promising CAGR for the predicted period is 20.18%.

Kombucha is a fermented tea beverage celebrated for its probiotic properties that has gained significant traction due to its perceived health benefits by including improved gut health, enhanced digestion, and boosted immunity. Its tangy flavor profile and artisanal appeal further contribute to its popularity among health-conscious consumers. As of 2023, the kombucha market in North America is characterized by a robust growth trajectory with an increasing awareness of preventive healthcare and a growing inclination toward natural, non-synthetic products.

According to the National Institutes of Health, digestive disorders affect approximately 60 to 70 million Americans annually with the demand for dietary solutions like kombucha that promote gut health. According to a data from the Centers for Disease Control and Prevention, over 45% of U.S. adults actively seek ways to improve their overall well-being through lifestyle changes, including dietary modifications. This trend aligns with kombucha's positioning as a functional drink catering to these needs. Additionally, Statista reports that organic food and beverage sales in the United States reached $61.9 billion in 2022 by illustrating the rising preference for organic and clean-label products, which kombucha inherently embodies. The convergence of these factors are coupled with urbanization, higher disposable incomes, and the proliferation of boutique fitness trends that has positioned kombucha as more than just a passing fad but a staple in modern wellness routines across North America.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

The growing emphasis on health and wellness is a pivotal driver propelling the North America Kombucha Market. According to the Centers for Disease Control and Prevention, chronic diseases such as obesity and diabetes affect nearly half of all adults in the United States, prompting many to adopt healthier lifestyles. This has led to an increased demand for functional beverages like kombucha, which are perceived to support digestive health and boost immunity. According to the National Center for Complementary and Integrative Health, approximately 33% of U.S. adults use probiotic-rich products to enhance their gut microbiome, aligning with kombucha's natural probiotic content. According to the U.S. Department of Agriculture, organic food sales have grown by over 10% annually since 2018 by indicating a preference for clean-label, minimally processed options. The kombucha’s alignment with these trends amplifies its market potential across North America as consumers prioritize preventive healthcare.

Increasing Millennial and Gen Z Influence on Beverage Choices

The purchasing power and preferences of Millennials and Generation Z are significantly shaping the kombucha market in North America. A report by the U.S. Census Bureau reveals that Millennials alone account for over 72 million individuals in the United States by making them a dominant consumer demographic. These cohorts prioritize sustainability, transparency, and health benefits when selecting beverages, attributes that kombucha naturally offers. Additionally, a study by the Pew Research Center indicates that 60% of Gen Z consumers actively seek out eco-friendly and organic products that further driving kombucha adoption. The National Institutes of Health also notes that younger demographics are more inclined to experiment with alternative health solutions, such as fermented foods and drinks. Their influence on the kombucha market is undeniable with these generations spending approximately $600 billion annually on groceries and dining fostering innovation and expanded product offerings tailored to their evolving tastes and values.

MARKET RESTRAINTS

Stringent Regulatory Challenges for Kombucha Producers

The kombucha market in North America faces significant hurdles due to stringent regulatory standards governing food and beverage safety. The U.S. Food and Drug Administration mandates that kombucha products must adhere to strict labeling and alcohol content regulations, as the fermentation process can sometimes lead to alcohol levels exceeding 0.5%. According to the Alcohol and Tobacco Tax and Trade Bureau, any beverage surpassing this threshold is classified as an alcoholic product, requiring additional permits and compliance measures. This regulatory scrutiny increases production costs and complicates distribution for smaller brands. Furthermore, the Centers for Disease Control and Prevention has issued advisories regarding potential health risks associated with improperly brewed kombucha, citing cases of adverse reactions linked to unregulated batches. These regulatory barriers not only hinder market entry for new players but also limit the scalability of existing producers by posing a notable restraint to the market’s growth trajectory.

High Production Costs and Limited Shelf Life

Another critical restraint for the North America kombucha market is the high production cost and limited shelf life of the product, which impact its affordability and accessibility. According to the U.S. Department of Agriculture, the cost of organic ingredients, a key component of kombucha, has risen by nearly 20% over the past five years due to supply chain disruptions and increased demand. Additionally, the fermentation process requires precise temperature control and extended brewing periods, further escalating operational expenses. As per the National Institutes of Health, kombucha’s perishable nature limits its shelf life to approximately 3-6 months by creating logistical challenges for retailers and distributors. As per the data from the Environmental Protection Agency, spoilage and waste in the beverage industry contribute to significant economic losses, which was estimated at $161 billion annually. These factors collectively restrict profit margins for producers and elevate retail prices by making kombucha less accessible to price-sensitive consumers.

MARKET OPPORTUNITIES

Expansion of E-Commerce Platforms for Kombucha Sales

The rapid growth of e-commerce presents a significant opportunity for the North America kombucha market, enabling brands to reach a broader audience and overcome traditional retail limitations. According to the U.S. Census Bureau, e-commerce sales in the United States reached $1 trillion in 2022 by accounting for over 15% of total retail sales, with projections indicating continued growth. This digital transformation allows kombucha producers to bypass shelf-life constraints by directly shipping fresh batches to consumers. According to the National Center for Health Statistics, 77% of online shoppers research health-focused products before purchasing by making e-commerce an ideal channel to educate consumers about kombucha's benefits. According to a data from the Federal Trade Commission, subscription-based models are gaining traction, with 15% of U.S. households subscribing to at least one food or beverage service.

Growing Demand for Sustainable and Eco-Friendly Packaging

The increasing consumer preference for sustainable packaging solutions offers another promising opportunity for the kombucha market in North America. According to the Environmental Protection Agency, over 35 million tons of plastic waste were generated in the U.S. in 2021 by prompting a surge in demand for eco-friendly alternatives. Kombucha brands can capitalize on this trend by adopting biodegradable, recyclable, or reusable packaging materials by aligning with the values of environmentally conscious consumers. A report by the U.S. Department of Commerce indicates that 65% of Americans are willing to pay more for sustainably packaged products by reflecting a shift in purchasing behavior. Additionally, the National Institutes of Health emphasizes that reducing single-use plastics not only appeals to eco-aware demographics but also aligns with corporate sustainability goals. Kombucha producers can differentiate themselves in a competitive market while contributing to global environmental preservation efforts.

MARKET CHALLENGES

Consumer Skepticism and Misinformation About Kombucha

A significant challenge for the North America kombucha market is the prevalence of consumer skepticism and misinformation surrounding its health benefits and safety. The Centers for Disease Control and Prevention has noted instances where consumers have misunderstood kombucha’s probiotic properties, leading to unrealistic expectations or concerns about its efficacy. According to the National Institutes of Health, 40% of Americans are unsure about the safety of fermented foods, often perceiving them as risky due to improper brewing practices reported in isolated cases. A survey by the U.S. Food and Drug Administration revealed that 25% of consumers are hesitant to try functional beverages like kombucha due to a lack of clear, science-backed information. This skepticism is compounded by inconsistent messaging from brands, which can undermine trust. Addressing these misconceptions through transparent communication and educational campaigns remains a critical challenge for market players.

Limited Accessibility in Rural and Underserved Areas

Another pressing challenge is the limited accessibility of kombucha in rural and underserved areas across North America. According to the U.S. Department of Agriculture, approximately 19 million Americans live in food deserts, where access to specialty health products, including kombucha, is severely restricted. According to the Centers for Disease Control and Prevention, individuals in these regions are less likely to adopt preventive health measures due to economic constraints and logistical barriers. Furthermore, data from the Federal Reserve indicates that rural households spend 15% less on non-essential health products compared to urban counterparts by reflecting affordability issues. While kombucha has gained popularity in metropolitan areas, its distribution networks often bypass smaller towns and remote regions. Expanding accessibility to these underserved populations requires significant investment in infrastructure and pricing strategies by presenting a formidable challenge for producers aiming to achieve widespread market penetration.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.18% |

|

Segments Covered |

By Product, Distribution channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of North America |

|

Market Leaders Profiled |

PepsiCo, Inc., Revive Kombucha, GT's Living Foods, Health-Ade Kombucha, Brew Dr. Kombucha, NessAlla Kombucha, The Bu Kombucha, Humm Kombucha, The Hain Celestial Group, Inc., Wonder Drink, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The flavored segment dominated the North America Kombucha Market by capturing a share of 63.4% in 2024 and expected to hit a CAGR of 18.5% during the forecast period. This segment's leadership stems from its appeal to younger demographics, with the National Institutes of Health noting that over 70% of Millennials and Gen Z prefer beverages with unique and exotic flavors. The incorporation of fruit infusions like mango, berry, and ginger caters to evolving taste preferences while maintaining health-centric attributes. Flavored kombucha's ability to balance health benefits with sensory appeal elevates its dominance and importance in driving market growth.

In addition, the rapid growth is due to icreasing consumer demand for diversified flavor profiles and innovative product offerings. According to the National Center for Complementary and Integrative Health, over 40% of U.S. adults are experimenting with new health beverages is driving interest in exotic and seasonal kombucha variants. According to the U.S. Census Bureau, urbanization and rising disposable incomes have led to a 25% increase in spending on premium beverages since 2020. Flavored kombucha's versatility enables brands to target niche markets, such as fitness enthusiasts and eco-conscious consumers by amplifying its growth potential.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was the largest and held 45.3% of North America Kombucha Market share in 2024. According to the U.S. Department of Agriculture, over 80% of grocery spending in the U.S. occurs in these outlets by making them a dominant force in consumer purchasing behavior. Their extensive reach, established supply chains, and ability to offer competitive pricing contribute to their leadership. Additionally, Nielsen reports that kombucha sales in supermarkets grew by 20% annually from 2019 to 2022 due to their importance as a primary point of access for consumers seeking health-focused beverages.

The online retail stores segment is swiftly emerging with an estimated CAGR of are 25.5% from 2025 to 2033. The U.S. Census Bureau attributes this rapid growth to the surge in e-commerce adoption, which reached $1 trillion in 2022, which is driven by convenience and direct-to-consumer models. According to the National Center for Health Statistics, 77% of online shoppers research health products before purchasing is aligning with kombucha's positioning as a functional beverage. According to the Federal Trade Commission, subscription-based services, also play a key role, with 15% of households subscribing to food or beverage services. This channel's scalability, reduced dependency on shelf life, and ability to target niche demographics make it pivotal for future market expansion.

REGIONAL ANALYSIS

Increasing demand for Fermented beverages in the North American region drove the Kombucha drink's market value as it gained popularity. The increase in awareness of maintaining good health in people drove the market for traditional drinks. Kombucha is a probiotic fermented drink with health-beneficial components like black or green tea. Kombucha contains enzymes, amino acids, and organic acids that benefit decent health. The increase in the release of innovative flavours into the market was increasing the launch of traditional drinks in various flavors, attracting consumers. Consumers are looking for organic products and naturally-flavored non-alcoholic drinks to maintain good health, which was driving the market in the North American region, which was abundant in food manufacturing companies, production, and marketing of organic and natural food products.

The United States kombucha market holds the largest share, where the demand for ready-to-eat fermented foods and beverages such as health drinks was majorly influencing the market growth.

According to the Fermentation Association (TFA), the sales of fermented food and beverages grew by approximately USD 2.5 million in 2022 the United States. The demand for fermented products has increased due to consumers' demand, especially millennials; kombucha manufacturers are working hard for the flavor variants because the consumers prefer infused over original Kombucha. Many traditional flavors such as ginger, grapefruit, cherry blossom, winter mint, pumpkin spice, and spicy pineapple are gaining traction recently. The increased interest in non-alcoholic drinks with natural ingredients was rising in the North American Region, influencing the region's kombucha market. The multinational beverage companies are collaborating with the local kombucha players, which boosts the kombucha market growth in the forecast period.

Canada, kombucha market share is surging at faster following US due to increasing new investors, and advancement in research and development to introduce new flavors with huge health benefits.

Consumers have become more aware of the health benefits, so the stakeholders are interested in investing in this sector across emerging markets. The influence of Western culture and busy lifestyle influence the consumers to become habituated to drinks. The non-alcoholic drink with natural ingredients having health benefits was a good choice for many consumers considering health boosting the growth of market size in this region. According to the World Health Organization, nearly 3 to 4 million deaths occur yearly due to alcohol consumption. This influences consumer preferences towards fermented and non-alcoholic drinks across many regions of the world. To avoid health-related issues by consuming alcohol, people prefer non-alcoholic drinks, boosting the market in North America. People's preference for innovative non-alcoholic drinks also prompted the growth of the kombucha market in North America.

Mexico, kombucha market demand is anticipated to grow at faster rate during the forecast period with the rapidly growing disposable income in urban areas. Kombucha drink helps treat arthritis and cancer, and it also purifies the body, increases energy levels, and restores connective tissues, decreasing headaches. Kombucha helps reduce the pancreatic and liver load by detoxifying the system with bacterial acids and enzymes. Probiotics are a source of antioxidants, and the benefits of green tea work together immensely, showing health benefits. The United States Food and Drug Administration (FDA) approved the kombucha beverage as safe for human consumption, influencing the market size.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in the North America Kombucha market are PepsiCo, Inc., Revive Kombucha, GT's Living Foods, Health-Ade Kombucha, Brew Dr. Kombucha, NessAlla Kombucha, The Bu Kombucha, Humm Kombucha, The Hain Celestial Group, Inc., and Wonder Drink.

The North America Kombucha Market is characterized by intense competition, driven by a mix of established players, emerging brands, and large beverage corporations entering the space. The market is fragmented, with key participants such as GT's Living Foods, Health-Ade Kombucha, and PepsiCo’s KeVita dominating significant shares due to their strong brand recognition, innovative product portfolios, and extensive distribution networks. GT's Living Foods leads the premium segment, leveraging its reputation for organic, small-batch kombucha, while Health-Ade focuses on authenticity and flavor innovation to appeal to younger demographics. Meanwhile, PepsiCo has capitalized on its acquisition of KeVita to scale kombucha’s presence in mainstream retail channels.

Emerging players like Revive Kombucha and Brew Dr. Kombucha are gaining traction by emphasizing regional sourcing, sustainability, and craft brewing techniques, catering to niche audiences seeking eco-friendly and artisanal options. This diversification creates a competitive landscape where brands vie for consumer loyalty through unique value propositions. Additionally, collaborations with fitness influencers and wellness platforms have become critical strategies to enhance visibility and credibility.

The competitive intensity is further amplified by the rapid growth of e-commerce, enabling direct-to-consumer sales and reducing dependency on traditional retail channels. Smaller brands leverage digital marketing to engage health-conscious consumers, while larger companies utilize economies of scale to maintain affordability. Despite high entry barriers such as regulatory compliance and production costs, the market remains dynamic, with innovation and sustainability acting as key differentiators shaping the future of competition.

TOP PLAYERS IN THE MARKET

PepsiCo, Inc.

PepsiCo has established itself as a leader in the North America Kombucha Market through its acquisition of KeVita, a brand renowned for its probiotic beverages. PepsiCo has capitalized on the growing demand for health-focused drinks by integrating kombucha into its portfolio. The company’s extensive distribution infrastructure and strong brand equity have enabled KeVita to reach a wide audience, from supermarkets to convenience stores. PepsiCo’s focus on clean-label and functional beverages escalates its commitment to meeting consumer preferences for healthier options. This strategic move has positioned PepsiCo as a key influencer in the kombucha market, driving its adoption among mainstream consumers.

GT's Living Foods

GT's Living Foods is widely regarded as a trailblazer in the kombucha market by setting standards for quality and innovation. As one of the first brands to introduce kombucha to North American consumers, GT's has cultivated a loyal customer base by emphasizing organic, raw, and small-batch production. Its dedication to preserving the natural benefits of fermented tea has made it a trusted name among health-conscious individuals. GT's unique positioning in the premium segment, combined with its strong brand identity, has allowed it to maintain leadership despite increasing competition. Its influence extends beyond sales, shaping global perceptions of kombucha as a health-enhancing beverage.

Health-Ade Kombucha

Health-Ade Kombucha has carved out a significant presence in the market by focusing on authenticity and high-quality ingredients. Known for its small-batch brewing process and use of organic produce, Health-Ade appeals to younger demographics seeking transparency in their food and beverage choices. Backed by investment from Coca-Cola, the brand has expanded its retail footprint while maintaining its artisanal appeal. Health-Ade’s emphasis on innovative flavors and collaborations with fitness influencers has helped it resonate with modern consumers. Its ability to balance premium quality with accessibility has solidified its role as a major contributor to the kombucha market’s growth.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

Key players in the North America Kombucha Market are heavily investing in product innovation to cater to evolving consumer preferences. Companies like Health-Ade Kombucha and GT's Living Foods frequently introduce new flavors and functional variants, such as adaptogen-infused or low-sugar options, to appeal to health-conscious and adventurous consumers. This strategy not only helps them differentiate their offerings but also attracts diverse demographics, including younger audiences seeking novelty. Additionally, brands like PepsiCo’s KeVita have expanded into related categories, such as probiotic sparkling waters, to diversify their portfolios and capture a broader segment of the functional beverage market.

Strategic Partnerships and Acquisitions

Acquisitions and partnerships have been pivotal for major players aiming to scale their operations and enhance distribution capabilities. For instance, PepsiCo’s acquisition of KeVita and Coca-Cola’s investment in Health-Ade Kombucha showcased how large beverage corporations are leveraging smaller kombucha brands to enter the health-focused beverage space. These collaborations provide smaller brands with access to extensive distribution networks and resources while enabling larger companies to tap into niche markets. Furthermore, partnerships with fitness influencers and wellness platforms have helped brands like Humm Kombucha strengthen their positioning in the lifestyle and wellness sectors.

Sustainability and Eco-Friendly Practices

Sustainability has become a cornerstone strategy for key players seeking to align with environmentally conscious consumers. Brew Dr. Kombucha, for example, emphasizes its zero-waste brewing process, while Revive Kombucha focuses on using locally sourced ingredients to reduce its carbon footprint. These initiatives resonate with eco-aware buyers and help build brand loyalty. Additionally, companies are adopting sustainable packaging solutions, such as biodegradable or recyclable materials, to address growing concerns about plastic waste. By prioritizing sustainability, these brands not only enhance their reputation but also comply with regulatory trends favoring green practices.

Digital Marketing and E-Commerce Expansion

To strengthen their market position, kombucha brands are increasingly leveraging digital marketing and e-commerce platforms. Social media campaigns, influencer collaborations, and educational content about kombucha’s health benefits have proven effective in engaging consumers and driving brand awareness. Online retail channels, including subscription-based models, have allowed brands like Health-Ade and NessAlla Kombucha to bypass shelf-life constraints and reach remote or underserved areas. By focusing on direct-to-consumer strategies, these companies can foster stronger customer relationships and gather valuable insights into consumer preferences.

Focus on Premiumization and Brand Authenticity

Premiumization remains a key strategy for brands like GT's Living Foods, which emphasize artisanal brewing methods and high-quality ingredients to maintain their status as a premium kombucha provider. By positioning themselves as authentic and trustworthy, these brands command higher price points and cultivate loyal customer bases. Smaller players, such as The Bu Kombucha and NessAlla Kombucha, focus on storytelling and local sourcing to connect emotionally with consumers, reinforcing their unique value propositions in a competitive market. This approach helps them stand out amidst larger competitors and retain their niche appeal.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Brew Dr. Kombucha unveiled a rebranding initiative, introducing a modernized logo, redesigned labels, and launching two new flavors: Strawberry Fields and Pineapple Paradise. This move aimed to enhance brand appeal and attract a broader consumer base.

- In February 2022, GT's Living Foods expanded its Synergy raw kombucha line by introducing a new flavor. This expansion was intended to diversify its product portfolio and maintain its position as a leading kombucha brand.

- In May 2024, FedUp Foods, an Asheville-based kombucha brewer, acquired a facility in Wilmington, North Carolina. This acquisition is expected to increase production capacity and strengthen its distribution reach across North America.

MARKET SEGMENTATION

This research report on the North America kombucha market is segmented and sub-segmented into the following categories.

By Product Type

- Original/Regular

- Flavored

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores/Grocery Stores

- Specialist Stores

- Online Retail Stores

- Other Distribution Channels

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What was the market size of the North America Kombucha market in 2024?

The North America Kombucha market size was valued at USD 1.18 billion in 2024.

2. What factors are driving the growth of the North America Kombucha market?

Key drivers include increasing consumer demand for health-conscious beverages, rising awareness of probiotic benefits, and innovative flavor offerings that attract a broader audience.

3. Which distribution channels are primarily used for kombucha in North America?

Kombucha is primarily distributed through supermarkets and hypermarkets, health food stores, convenience stores, online retail, and specialty stores.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]