North America Industrial Vegetation Management Market Size, Share, Trends, COVID-19 Impact and Growth Forecast Report, Segmented By Product Type, End User and Country (The U.S., Canada and Rest of North America), Industry Analysis From (2025 to 2033)

North America Industrial Vegetation Management Market Size

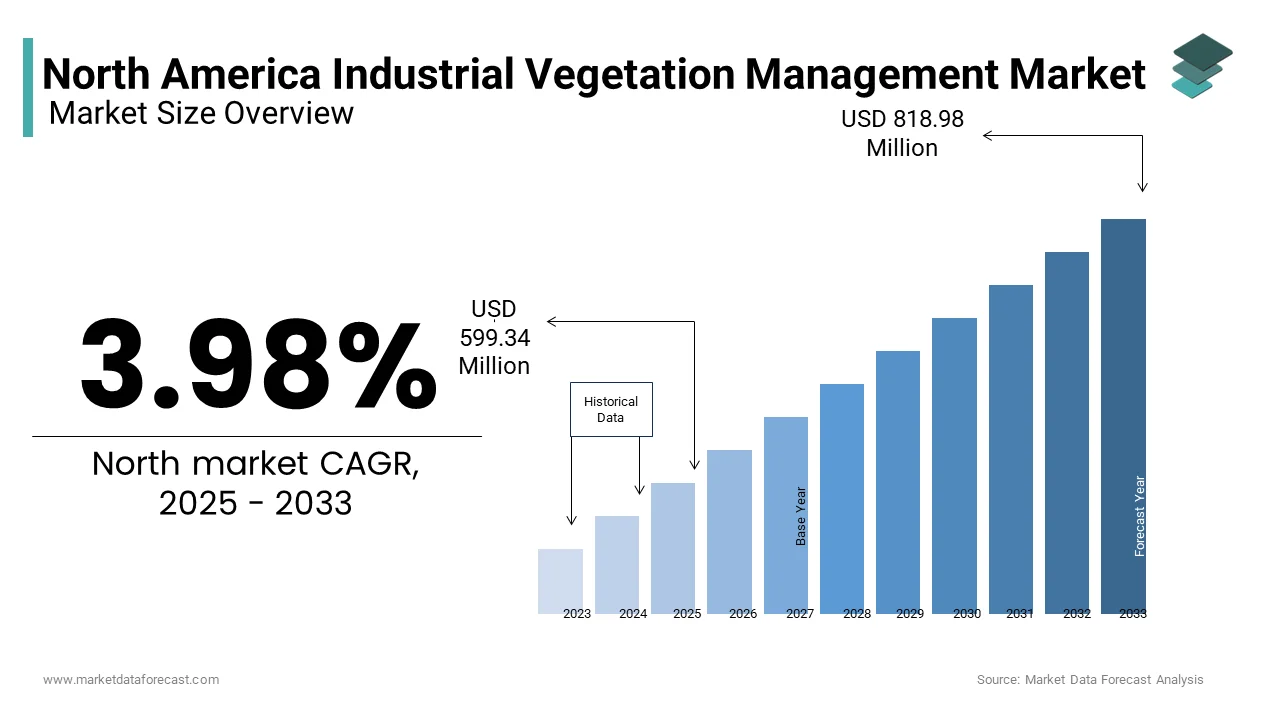

The North American industrial vegetation management market was valued at USD 576.4 million in 2024 and is anticipated to reach USD 599.34 million in 2025, from USD 818.98 million by 2033, growing at a compound annual growth rate (CAGR) of 3.98% during the forecast period from 2025 to 2033.

Industrial vegetation management (IVM) is a process of removing unwanted vegetation, such as weeds, grass, and other unused plants, during the setup of infrastructure, transport lines, and industries.

Current Scenario Of The North America Industrial Vegetation Management Market

The North America industrial vegetation management market is experiencing the swift adoption of digital solutions and technologies to address climate change.

A survey published by Aidash of senior executives of vegetation management discloses that 82 per cent of utilities acknowledge the requirement to utilise digital tools and are either upgrading their operations or seeking to do so. This addresses the rising severity of wildfires and storms because of extreme weather events, total financial losses amounting to billions, legal changes, and increased outages due to vegetation.

With utilities broadening their activities and the need for sustainable energy solutions surging, the utility vegetation management industry has witnessed notable growth and transformation in the last few years. Moreover, one of the most significant trends in the market is the acceptance of modern technologies to improve management approaches. Innovations like remote sensing tools, drones, satellite mapping, and LiDAR have transformed how UTM experts evaluate vegetation dangers, schedule maintenance operations, and oversee intrusions around power lines. These technologies allow more accuracy and productive vegetation control, resulting in enhanced dependability and affordability for utilities. In addition, utilities are progressively improving their focus on ecological stewardship, which is a central value of this market, and the Utility Arborist Association (UAA) by seeking to lower their environmental footprint and conserve natural resources.

Furthermore, in this market, utilities are actively looking into green substitutes or options for standard vegetation management practices. Integrated vegetation management (IVM), biodiversity monitoring, and bio-based selective herbicide methods are gaining popularity.

MARKET DRIVERS

The increasing urbanization and development of utility infrastructures are the primary factors driving the North American industrial vegetation management market. The emphasis on safety by the local government in the implementation of electricity lines, railway routes, and highways is also fuelling the regional market growth. The rising need for proper vegetation to avoid infrastructure-related accidents or fires, along with the offered environmental benefits, is further promoting the IVM market in this region. The latest trend in drone technologies, remote sensing, GPS systems, and geographical information systems is favoring the growth of the North American IVM market. The modern research and development activities, along with supporting government initiatives to promote vegetation management, are boosting regional market growth. The need to control invasive plant varieties and reduce infrastructure maintenance costs is predicted to create more opportunities for the North American industrial vegetation management market in the future.

The adoption of the modern approach also propels the market. The broader application of light detection and ranging (LIDAR), satellite imagery, and land survey techniques, which utilize pulsed laser light emitting from fixed-wing airplanes and helicopters for a 3D depiction, can be implemented. Drones outfitted with LIDAR may simply the process. Presently, vegetation management needs endless hours to inspect and collect data before much more time are spent removing all the problematic areas. This will help in reducing the costs.

According to a study by General Electric, data-driven visual intelligence can substantially lower vegetation management expenditure by up to 20 per cent, and to 30 per cent for unscheduled power cuts or disruptions caused by trees.

MARKET RESTRAINTS

The major limitation of the North American industrial vegetation management market is the resistance from people to use chemical herbicides and pesticides that can harm the atmosphere. Also, the lack of experienced workers and high expenses associated with the implementation of vegetation management practices are negatively impacting local businesses. In addition, the concerns related to invasive species management, harsh climatic conditions, and consumer misunderstanding are affecting the profitability of players in this business. Besides, the long-term impact of vegetation management processes and the challenges with data privacy due to the applications of GIS and remote sensing are supposed to limit the North American industrial vegetation management market.

MARKET OPPORTUNITIES

Technological breakthroughs, legal requirements, and consumer expectations will thrive the adoption of new methods to industrial vegetation management, needing utilities to do innovations and adjustments in the current setup. The rising emphasis on climate resilience and sustainability will define the future of this market, with utilities looking for unique solutions to reduce vegetation-linked dangers while encouraging environmental stewardship. By supporting emerging technologies, raising partnerships across the industry sectors, and focusing on safety and environmental responsibility. The industrial vegetation management market can effectively address the obstacles and future opportunities, maintaining a dependable and robust electricity supply for upcoming generations.

Moreover, the growing demand for electrification in the US and Canada for industries looking to lower reliance on natural gas, oil, and coal provides potential prospects for market expansion.

A 2024 report by the U.S. Energy Information Administration (EIA) estimates a 2.4 per cent surge in electricity usage this year. Also, the region’s demand is anticipated to grow 68 per cent by 2050, in contrast to the average of 57 per cent in the US.

From the upcoming removal of small gas-powered engines in California to the steady rise of electric vehicles and the equipment and systems that assist them, the need for power is escalating. So, this vegetation management will have a crucial role in helping utilities to enhance their capacity to fulfill this demand.

MARKET CHALLENGES

The growth of the North America industrial vegetation management market is impeded by various challenges that need unique solutions. One of the key difficulties is adherence to legal requirements, with the utilities obliged to comply with strict vegetation management criteria established by state and federal authorities. Directing through complicated legal frameworks and assuring adherence to ecological rules can be discouraging tasks for UVM experts, necessitating current investment and training in specialized resources.

Discovering or identifying vegetation situated at vital distances from infrastructure presents a significant problem that Utilities must solve to maintain consistency and protection of electricity supply and, enhance the resilience of the distribution network, minimize expenditure, and prevent regulatory penalties. This is another major challenge derailing the growth trajectory of the market.

According to the 2022 research by The College of Nature Resources (CNUC) conducted with over 60 utilities in the United States of America, 23 per cent of energy outages in the US are associated with vegetation, and such disruptions have a severe social, environmental, and economic effects.

This situation is further worsened by extreme climatic conditions, which are growing more common due to climate change, and their connection with vegetation. Throughout storms with powerful winds or snowfall in the northeast region of the United States, trees or forests were responsible for an especially large proportion of power cuts, going as far as 90 per cent in densely forested areas like New England and Connecticut. Also, previously, in 2020, energy customers in the country faced on average over 8 hours of power cuts, the maximum number of levels ever registered since 2013 when the agency started collecting grid electricity data. The primary reason for disruption was because of the vegetation and weather.

Impact Of COVID-19 On The North American Industrial Vegetation Management Market

The COVID-19 pandemic had an initial negative impact on the North American industrial vegetation management market. The lockdown restrictions resulted in supply chain disruptions, transportation limitations, and the cancellation of infrastructure projects. The shutdown of several companies led to a pause in research and development activities and improvements in the vegetation management process. Also, the temporary closures and contactless conditions led to labor shortages for the removal of unwanted plant species. The lockdown also halted new highways and industrial constructions, which hampered the growth of the North American industrial vegetation management market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.98% |

|

Segments Covered |

By Product, End Use and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

USA, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

BASF, DuPont, Dow Agro Sciences, Monsanto, Nufarm, Helena, Boultbee Vegetation Management, DBI Services, Ferrosafe, Lewis Services, Corteva Canada, VegClear, and Aquatic Vegetation Control Inc |

SEGMENTAL ANALYSIS

By Product Type Insights

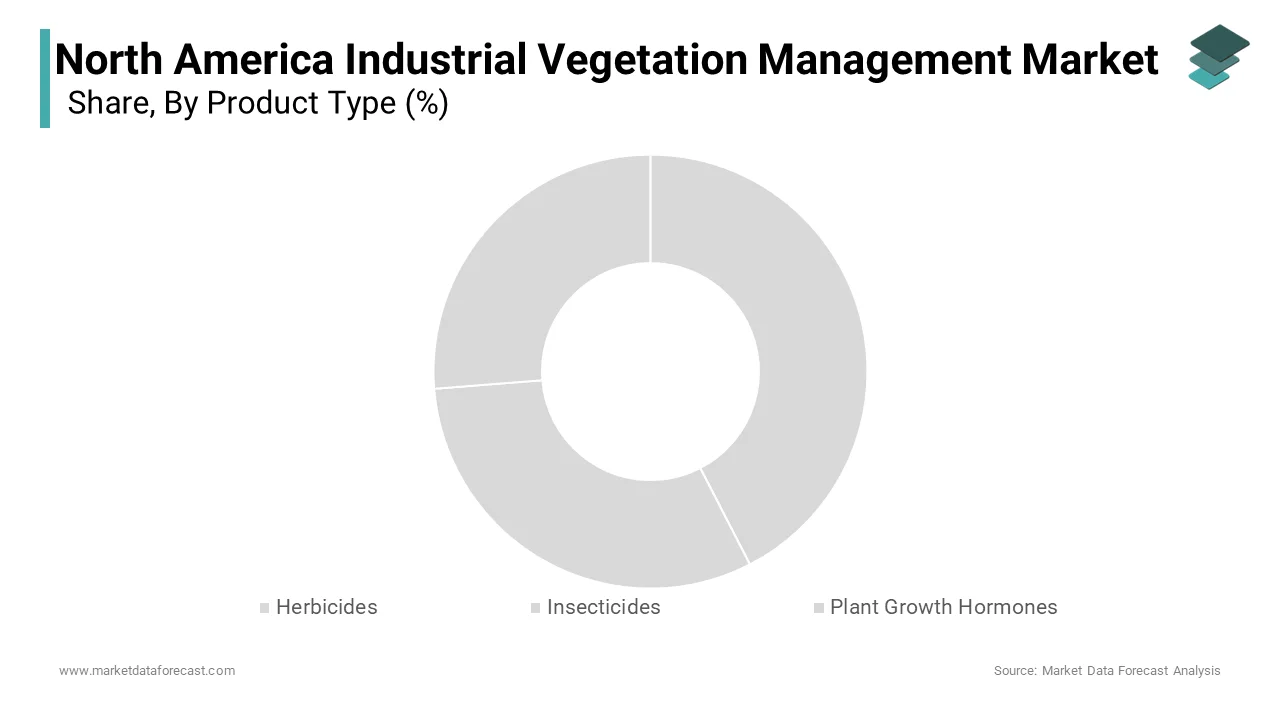

The herbicides segment accounted for a significant share of the North American industrial vegetation management market in 2024 and is expected to grow at a promising CAGR during the forecast period. The availability of effective and affordable herbicides to control the growth of weeds along with the rise in utility, roadways, and railways projects, are promoting the demand in this segment.

By End Use Insights

The utilities segment recorded a notable share of the regional industrial vegetation management market in 2023, and the lead of the segment is estimated to continue throughout the forecast period owing to the modifications to the traditional power lines and utility infrastructure. In addition, the transportation segment is likely to register significant growth in the coming years owing to the expanding transportation and logistics sector that requires roadways and railways for the movement of goods.

COUNTRY ANALYSIS

The USA dominated the regional industrial vegetation management market in 2024 and will continue to lead the market in North America during the forecast period due to the rising demand for advanced transportation and utility infrastructure within the area. California is a prominent state in the USA that spends huge amounts on vegetation management. In addition, the supportive government initiatives coupled with the adoption of the latest technologies are contributing to the US industrial vegetation management market. Moreover, the country's market share is also increasing because of the swift implementation of digital solutions.

As per a report by Aidash, about 11 per cent of utilities have already done significant changes, and 41 per cent have done few adjustments or modifications to vegetation management tactics. 48 per cent are still waiting to perform any upgrades but most do intend to accept solutions based on digital technologies by 2050 or later.

Similarly, Canada is also an emerging market in North America, and with harsh climatic conditions, there is a huge need for continuous maintenance of industrial sites, transportation, and utilities, which will benefit the industrial vegetation management business in this locale.

According to Statistics Canada, around 74.1 per cent, i.e. just less than three-quarters, of the territory of 1016 population centers all over Canada was categorized as green in summer 2023, increasing little from 72.1 per cent in summer 2022.

KEY MARKET PLAYERS

BASF, DuPont, Dow Agro Sciences, Monsanto, Nufarm, Helena, Boultbee Vegetation Management, DBI Services, Ferrosafe, Lewis Services, Corteva Canada, VegClear, and Aquatic Vegetation Control Inc. Are some major key players involved in the industrial vegetation management market.

RECENT HAPPENINGS IN THE NORTH AMERICA INDUSTRIAL VEGETATION MANAGEMENT MARKET

- In September 2024, Eversource was acknowledged as a Tree Line USA utility by the Arbor Day Foundation for its consistent dedication to ecological stewardship and maintaining reliable electricity service for consumers. In partnership with the National Association of State Foresters, the Tree Line USA initiative identifies private and public utilities that exhibit superior tree care standards, encouraging the dual objectives of protective and dependable electric service for consumers and, at the same time, promoting tree plantation that aligns with utility requirements and fostering the growth of healthy trees.

- In August 2024, Pacific Gas & Electric Company (PG&E) announced that it is extending its agreement with Planet Labs, a San Francisco-located supplier of satellite-generated data, within its program for utility’s vegetation management. PG&E makes use of the planet’s satellite-based information on vegetation involving canopy proximity, cover, and height for electric system infrastructure to emphasize the reduction of risks related to vegetation.

MARKET SEGMENTATION

This market research report on the North American industrial vegetation management market is segmented and sub-segmented into the following categories.

By Product Type

- Herbicides

- Insecticides

- Plant Growth Hormones

By End Use

- Utilities

- Transportation

- Oil & Gas

- Industrial Areas

By Country

- The U.S.

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What Is The Current Size Of North America Industrial Vegetation Management System Market ?

The North American industrial vegetation management system's current market size is at USD 599.34 million in 2025.

What Is The Dominating Factor In North America Industrial Vegetation Management System Market ?

The USA dominated the regional industrial vegetation management system market due to the rising demand for advanced transportation and utility infrastructure within the area.

What Are The Key Market Players Involved In North America Industrial Vegetation Management System Market ?

BASF, DuPont, Dow Agro Sciences, Monsanto, Nufarm, Helena, Boultbee Vegetation Management, DBI Services, Ferrosafe, Lewis Services, Corteva Canada, VegClear, and Aquatic Vegetation Control Inc. are some major players involved in the North American industrial vegetation management market system market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com