North America Industrial Boilers Market Size, Share, Trends & Growth Forecast Report By Fuel (Natural Gas, Oil, Coal, and Others), Capacity, Technology, Product, Application, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Industrial Boilers Market Size

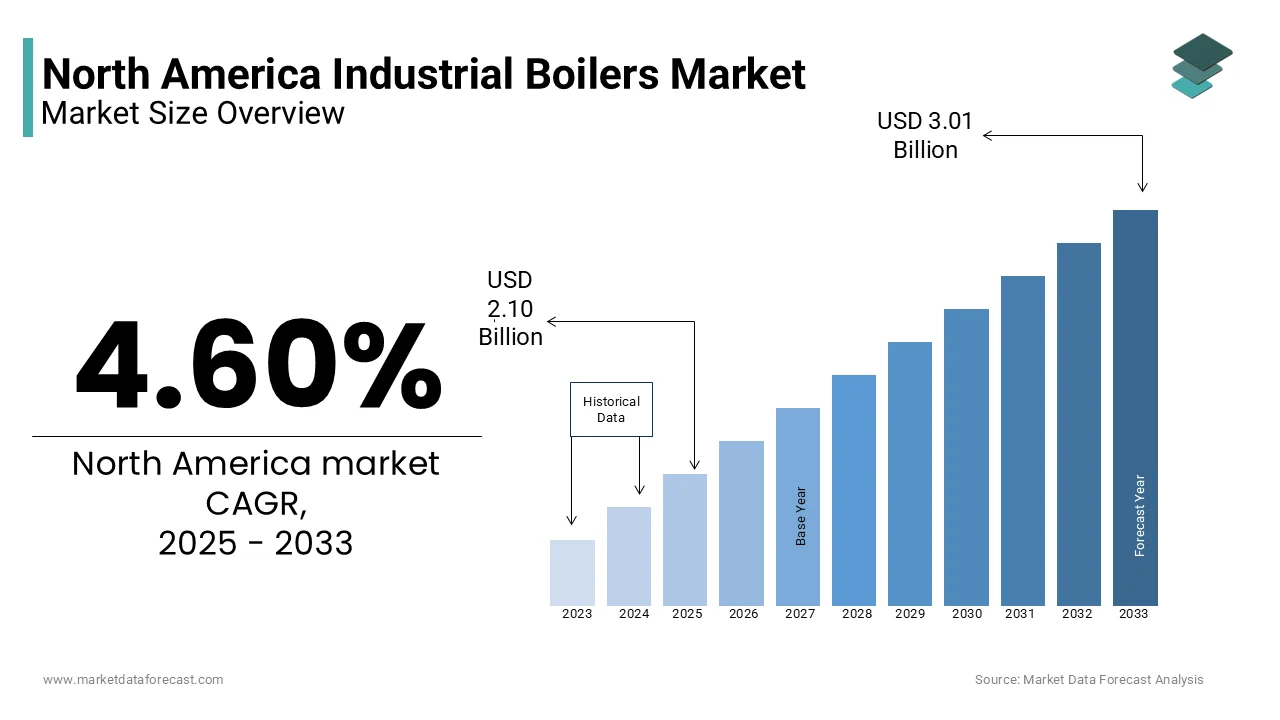

The North America industrial boilers market was worth USD 2.01 billion in 2024. The North American market is projected to reach USD 3.01 billion by 2033 from USD 2.10 billion in 2025, rising at a CAGR of 4.60% from 2025 to 2033.

Industrial boilers generate steam or hot water for various applications that are integral to industries such as chemicals, food processing, paper, and utilities. As per the Canadian Industrial Energy Association, over 60% of industrial boilers are utilized in the manufacturing sector, underscoring their importance in industrial operations. Additionally, advancements in boiler technologies, such as high-efficiency and low-emission systems, have improved energy efficiency by 20%, as highlighted by the National Boiler Manufacturers Association. With increasing emphasis on sustainable practices, such as carbon capture and renewable integration, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising demands of modern industries.

MARKET DRIVERS

Rising Demand from the Manufacturing Sector in North America

A significant driver propelling the North American industrial boilers market is the escalating demand from the manufacturing sector, which relies heavily on boilers for process heating and steam generation. According to the U.S. Manufacturing Institute, the manufacturing sector grew by 15% in 2022, with industrial boilers accounting for over 40% of energy-intensive processes. This trend is particularly evident in the United States, where government initiatives to boost domestic manufacturing have increased boiler installations by 25%, as reported by the U.S. Department of Commerce. For instance, a study by the Canadian Industrial Energy Association highlights that high-efficiency boilers achieved a 30% reduction in energy costs for manufacturers, making them an attractive option for large-scale operations. Additionally, partnerships between boiler manufacturers and industrial firms have reduced operational expenses by 18%, enhancing affordability. By ensuring consistent performance and reducing energy consumption, industrial boilers have become indispensable for modern manufacturing, driving market growth across the continent.

Stringent Environmental Regulations Driving Adoption of Low-Emission Boilers

The implementation of stringent environmental regulations targeting greenhouse gas emissions that have catalyzed the adoption of low-emission and energy-efficient boilers is further boosting the growth of the North American industrial boilers market. According to the U.S. Environmental Protection Agency, over 50% of industrial facilities have transitioned to low-NOx and ultra-low-NOx boilers, driven by compliance requirements. This trend is particularly pronounced in California, where state mandates have reduced emissions by 20%, as noted by the California Air Resources Board. According to a report by the Canadian Environmental Protection Agency, investments in advanced boiler technologies grew by 18% in 2022, driven by incentives for sustainable practices. Additionally, advancements in condensing and modular boilers have enhanced scalability, making them ideal for diverse applications. By addressing regulatory pressures and fostering ecological balance, low-emission boilers are unlocking immense growth potential in this sector.

MARKET RESTRAINTS

High Initial Costs of Advanced Boiler Systems

One of the primary restraints hindering the growth of the North American industrial boilers market is the high initial cost associated with advanced boiler systems, which often limits accessibility for small and medium-sized enterprises (SMEs). According to the U.S. Department of Energy, the average cost of installing a high-efficiency industrial boiler exceeds $500,000, creating financial barriers for rural manufacturers. This issue is particularly pronounced in Canada, where over 60% of SMEs lack access to financing options or subsidies, as reported by the Canadian Industrial Energy Association. A study by the National Boiler Manufacturers Association reveals that only 35% of surveyed businesses in rural areas have adopted advanced boiler technologies, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of these systems. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Limited Awareness Among Small-Scale Operators

Limited awareness among small-scale operators regarding the benefits and proper usage of advanced industrial boilers is another significant restraint for the North American industrial boilers market. According to the Canadian Federation of Independent Business, over 50% of small-scale manufacturers lack technical knowledge about boiler selection and maintenance, leading to suboptimal outcomes despite investing in premium systems. This issue is compounded by generational disparities, as highlighted by the U.S. Small Business Administration, which reports that operators aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Alberta demonstrates that improper usage and maintenance practices can reduce boiler efficiency by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Adoption of Renewable Energy Integration

The rapid adoption of renewable energy integration that offers innovative solutions for reducing carbon footprints and enhancing sustainability is one of the major opportunities for the North American industrial boilers market. According to the U.S. Department of Energy, over 60% of industrial facilities are exploring biomass and solar-powered boilers, driven by government incentives for clean energy. This trend is particularly evident in states like Texas and California, where renewable energy projects account for over 30% of total energy investments, as noted by the California Energy Commission. For instance, a study by the Canadian Renewable Energy Association highlights that biomass boilers achieved a 25% reduction in operational costs for food processors, making them an attractive option for large-scale adoption. Additionally, partnerships between renewable energy companies and boiler manufacturers are accelerating innovation, ensuring scalability and affordability. The Horizon North America program has allocated $1 billion for sustainable energy projects, including industrial boilers, as noted by the U.S. Environmental Protection Agency. By fostering breakthroughs in renewable integration, the market is poised to unlock immense growth potential.

Increasing Focus on Modular and Compact Boiler Systems

The growing focus on modular and compact boiler systems is another significant opportunity for the North American industrial boilers market. According to the National Boiler Manufacturers Association, modular boilers accounted for 20% of new installations in 2022, driven by their ability to reduce energy consumption and enhance flexibility. This trend is particularly pronounced in urban areas, where space constraints necessitate compact solutions, as highlighted by the U.S. Department of Housing and Urban Development. Additionally, advancements in smart boiler technologies have improved operational efficiency by 18%, enhancing consumer acceptance. For example, the Canadian Industrial Energy Association notes that 40% of surveyed facilities expressed a preference for modular systems, citing ease of installation and maintenance as key motivators. By leveraging these opportunities, companies can capitalize on the growing demand for innovative solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

The ongoing supply chain disruptions and raw material shortages is a major challenge to the North American industrial boilers market. According to the U.S. Department of Commerce, global shortages of key materials, such as steel and aluminum, led to a 15% decline in boiler production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in the United States, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the National Boiler Manufacturers Association. A study by the Canadian Industrial Energy Association highlights that 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as metals and alloys, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Aging Infrastructure and Retrofitting Challenges

The aging infrastructure of existing industrial boilers that require costly retrofitting and upgrades to meet modern efficiency and emission standards is another significant challenge to the North American market. According to the U.S. Environmental Protection Agency, over 50% of industrial boilers in North America are more than 20 years old, leading to inefficiencies and higher maintenance costs. This issue is compounded by inconsistent investment in infrastructure upgrades, as highlighted by the Canadian Federation of Independent Business, which notes that retrofitting costs can exceed $200,000 per facility. Furthermore, a report by the University of Alberta underscores that inadequate funding for retrofitting projects has left many facilities ill-equipped to handle large-scale operations. For instance, the U.S. Department of Energy estimates that only 25% of industrial boilers are currently compliant with modern emission standards. Without scaling up retrofitting capabilities, the market risks exacerbating environmental concerns and missing opportunities to recover valuable resources.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.60% |

|

Segments Covered |

By Fuel, Capacity, Technology, Product, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

AERCO, Babcock & Wilcox Enterprises, Inc., Burnham Commercial Boilers, Clayton Industries, Cleaver-Brooks, Doosan Corporation, Groupe Atlantic, Hurst Boiler & Welding Co, Inc., IHI Corporation, John Cockerill, John Wood Group PLC, Mitsubishi Heavy Industries, Ltd., Miura America Co., Ltd., Rentech Boiler Systems, Inc., Sofinter S.p.a, The Fulton Companies, Thermax Limited, and VIESSMANN. |

SEGMENTAL ANALYSIS

By Fuel Insights

The natural gas segment dominated the market by capturing 56.5% of the North American market share in 2024. The clean-burning properties and abundant availability of natural gas across the region is primarily driving the growth of the natural gas segment in the North American market. The U.S. Energy Information Administration (EIA) states that natural gas accounts for over 40% of the country’s energy consumption, making it the preferred fuel for industrial applications. A study published in Energy Policy highlights that natural gas-fired boilers reduce carbon emissions by up to 30% compared to coal, aligning with North America’s stringent environmental regulations. Additionally, the shale gas boom has lowered natural gas prices by 25% over the past decade, enhancing its affordability for industries. For instance, sectors like food processing and pharmaceuticals rely heavily on natural gas boilers for precise temperature control and energy efficiency. With the Biden administration committing $55 billion to renewable and low-carbon energy projects, natural gas remains pivotal in bridging the transition to cleaner energy systems while maintaining industrial productivity.

The electric boilers segment is another major segment in the North America industrial boilers market and is estimated to grow at a significant CAGR of 9.12% over the forecast period owing to the increasing adoption of renewable energy sources and electrification initiatives. A report by the National Renewable Energy Laboratory (NREL) states that electric boilers offer zero direct emissions, making them ideal for industries aiming to achieve net-zero targets. For example, companies like Tesla utilize electric boilers in their manufacturing facilities to align with sustainability goals. Additionally, advancements in grid infrastructure—backed by $7.5 billion in federal funding for clean energy projects—have improved the reliability and cost-effectiveness of electric boilers. A study in Applied Energy notes that electric boilers achieve energy efficiency rates of up to 99%, significantly higher than traditional fuel-based systems. As North America accelerates its shift toward decarbonization, electric boilers emerge as a transformative solution for eco-friendly industrial heating

By Capacity Insights

The > 10 - 50 MMBtu/hr capacity range segment occupied 41.8% of the North American market share in 2024. The domination of > 10 - 50 MMBtu/hr capacity range segment in the North American market is attributed to its versatility and suitability for medium-scale industrial operations, such as chemical processing, food production, and textiles. As per the American Chemistry Council, this capacity range supports processes requiring moderate heat loads while maintaining operational flexibility. For instance, food processing plants use boilers in this range to ensure consistent steam supply for sterilization and cooking, reducing downtime by up to 20%. Additionally, the growing trend of modular manufacturing has fuelled demand for scalable boiler systems. A study in Industrial Heating notes that > 10 - 50 MMBtu/hr boilers offer a balance between energy efficiency and capital investment, making them cost-effective for mid-sized enterprises. With industries prioritizing energy optimization under initiatives like the U.S. Department of Energy’s Better Plants Program, this capacity range remains central to industrial boiler applications.

The ≤ 0.3 - 2.5 MMBtu/hr capacity segment is predicted to exhibit the fastest CAGR of 9.8% over the forecast period in the North American industrial boilers market. The rising demand for compact and energy-efficient boilers in small-scale industries and commercial facilities is majorly boosting the expansion of the ≤ 0.3 - 2.5 MMBtu/hr capacity segment in the North American market. As per a report by the Small Business Administration (SBA), small businesses account for 44% of U.S. economic activity, creating significant opportunities for low-capacity boilers. For example, boutique breweries and artisanal bakeries increasingly adopt these systems for precise temperature control without excessive energy consumption. Additionally, the rise of decentralized energy systems—backed by $10 billion in federal incentives for microgrids—has boosted adoption in rural and remote areas. A study by the Journal of Cleaner Production highlights that ≤ 0.3 - 2.5 MMBtu/hr boilers reduce energy costs by up to 15% compared to larger systems, making them attractive for budget-conscious operators. As North America embraces localized and sustainable energy solutions, this segment emerges as a key driver of innovation.

By Technology Insights

The non-condensing boilers segment accounted for the leading share of 6.8% of the North American in 2024. The leading position of non-considering boilers is driven by their widespread use across legacy industrial systems, particularly in sectors like manufacturing and utilities. The U.S. Department of Energy reports that non-condensing boilers remain prevalent due to their compatibility with existing infrastructure, which reduces retrofitting costs by up to 30%. For instance, older facilities in the Midwest continue to rely on non-condensing systems for steam generation, ensuring uninterrupted operations. A study in Mechanical Engineering highlights that these boilers achieve thermal efficiencies of up to 85%, making them sufficient for many industrial applications. Additionally, their lower upfront costs make them accessible for budget-constrained industries. With the industrial sector accounting for 30% of North America’s energy consumption, non-condensing boilers remain critical in maintaining operational stability.

The condensing boilers segment is expected to witness the fastest CAGR of 11.4% over the forecast period in the North American industrial boilers market. The superior energy efficiency and alignment with sustainability goals of considerable boilers is one of the key factors propelling the growth of the considering boilers segment in the North American market. According to a report by the Environmental Protection Agency (EPA), condensing boilers achieve thermal efficiencies exceeding 95%, reducing fuel consumption by up to 20% compared to non-condensing systems. For example, hospitals and universities are increasingly adopting condensing boilers to meet regulatory standards and lower operating costs. Additionally, the push for green building certifications—such as LEED and ENERGY STAR—has amplified demand; a study by the Green Building Council reveals that certified buildings achieve a 15% premium in rental income. As North America intensifies efforts to combat climate change under initiatives like the Clean Energy Plan, condensing boilers emerge as a transformative solution for achieving energy efficiency and reducing carbon footprints.

By Product Insights

The steam boilers segment held 60.6% of the North American market share in 2024. The prominent position of steam boilers segment in North American market is driven by their critical role in industries requiring high-pressure steam for processes like power generation, chemical manufacturing, and sterilization. The American Society of Mechanical Engineers (ASME) highlights that steam boilers support over 70% of industrial heating applications, ensuring consistent performance and scalability. For instance, power plants rely on steam boilers to generate electricity, with thermal efficiency rates reaching up to 40%. Additionally, the versatility of steam boilers makes them indispensable for large-scale operations. A study in Thermal Engineering notes that steam boilers reduce operational downtime by 25%, enhancing productivity in energy-intensive sectors. With industries prioritizing process optimization under initiatives like the Industrial Assessment Centers Program, steam boilers remain central to North America’s industrial landscape.

The hot water boilers segment is estimated to grow at a CAGR of 8.8% over the forecast period in the North American market owing to their increasing use in commercial and institutional applications, such as offices, schools, and healthcare facilities. As per a report by the National Institute of Building Sciences, hot water boilers offer precise temperature control, which is making them ideal for space heating and domestic hot water systems. For example, universities like Harvard have adopted hot water boilers to achieve energy savings of up to 15% while meeting sustainability goals. Additionally, the rise of smart building technologies is accelerating the demand for efficient heating solutions. A study in Building Services Engineering highlights that hot water boilers integrate seamlessly with renewable energy systems, such as solar thermal panels, enhancing their appeal. As North America accelerates its transition to energy-efficient buildings, hot water boilers emerge as a key enabler of sustainable heating solutions.

By Application Insights

The healthcare facilities segment occupied the major share of 31.3% of the North America industrial boilers market in 2024. The rising need for reliable heating and sterilization systems in hospitals and clinics is majorly driving the domination of healthcare facilities segment in the North American market. According to the American Hospital Association, healthcare facilities consume 2.5 times more energy per square foot than other commercial buildings, with boilers playing a central role in meeting these demands. For instance, steam boilers are essential for sterilizing medical equipment and maintaining hygienic environments, reducing infection risks by up to 40%. Additionally, the aging population has increased demand for healthcare services, amplifying boiler usage. A study in Healthcare Engineering highlights that energy-efficient boilers reduce operating costs by 15%, enabling facilities to allocate resources toward patient care. With healthcare being a cornerstone of North America’s economy, boilers remain vital for ensuring safety and operational efficiency.

The educational institutions segment is fastest-growing application segment and is projected to witness a CAGR of 10.8% over the forecast period. The rising focus on sustainable campus infrastructure and energy-efficient heating systems are boosting the growth of the educational institutions segment in the North American market. As per a report by the U.S. Green Building Council, over 2,000 schools have achieved LEED certification, driving demand for eco-friendly boilers. For example, universities like Stanford have implemented advanced boiler systems to reduce energy consumption by 25% while meeting student housing needs. Additionally, government initiatives have created new opportunities for upgrading heating systems. A study in Education Facilities Management highlights that energy-efficient boilers improve indoor air quality by 20%, enhancing learning environments. As North America prioritizes education and sustainability, educational institutions emerge as a transformative segment driving innovation in industrial boiler applications.

REGIONAL ANALYSIS

The United States accounted for 86.4% of the North American industrial boilers market in 2024 due to the robust manufacturing and energy sectors of the U.S. According to the National Boiler Manufacturers Association, U.S. industries consume approximately 500,000 industrial boilers annually, reflecting their commitment to efficiency and sustainability.

Canada is another prominent market for industrial boilers in North America. The extensive natural resources and emphasis on sustainable practices in Canada are propelling the Canadian industrial boilers market growth. According to Statistics Canada, boiler sales grew by 10% in 2022, driven by government incentives for eco-friendly technologies. A study by the Canadian Environmental Protection Agency highlights that over 70% of industrial facilities utilize advanced boilers, underscoring their economic benefits.

KEY MARKET PLAYERS

The major players in the North America industrial boilers market include AERCO, Babcock & Wilcox Enterprises, Inc., Burnham Commercial Boilers, Clayton Industries, Cleaver-Brooks, Doosan Corporation, Groupe Atlantic, Hurst Boiler & Welding Co, Inc., IHI Corporation, John Cockerill, John Wood Group PLC, Mitsubishi Heavy Industries, Ltd., Miura America Co., Ltd., Rentech Boiler Systems, Inc., Sofinter S.p.a, The Fulton Companies, Thermax Limited, and VIESSMANN.

MARKET SEGMENTATION

This research report on the North America industrial boilers market is segmented and sub-segmented into the following categories.

By Fuel

- Natural Gas

- Oil

- Coal

- Others

By Capacity

- 10 MMBtu/hr

- 10 - 25 MMBtu/hr

- 25 - 50 MMBtu/hr

- 50 - 75 MMBtu/hr

- 75 - 100 MMBtu/hr

- 100 - 175 MMBtu/hr

- 175 - 250 MMBtu/hr

- > 250 MMBtu/hr

By Technology

- Condensing

- Non-Condensing

By Product

- Fire Tube

- Water Tube

By Application

- Food Processing

- Pulp & Paper

- Chemical

- Refinery

- Primary Metal

- Others

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the key factors driving the North America industrial boilers market?

The market is driven by increasing demand for energy-efficient heating solutions, growth in the food processing and chemical industries, and stricter environmental regulations promoting cleaner fuel alternatives.

Which industries are the primary users of industrial boilers in North America?

Major industries using industrial boilers include food processing, chemical, oil & gas, power generation, and manufacturing sectors.

What are the latest technological advancements in the North America industrial boilers market?

Advancements include high-efficiency condensing boilers, smart monitoring systems, and integration of automation for better control and performance optimization.

Which country in North America has the highest demand for industrial boilers?

The United States has the highest demand due to its large industrial base, especially in food processing, chemical, and power generation sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]