North America Corn Seeds Market Size, Share, Trends & Growth Forecast Report Segmented By Type, End-User and Country (The United States, Canada and Rest of North America) - Industry Analysis From 2024 to 2032

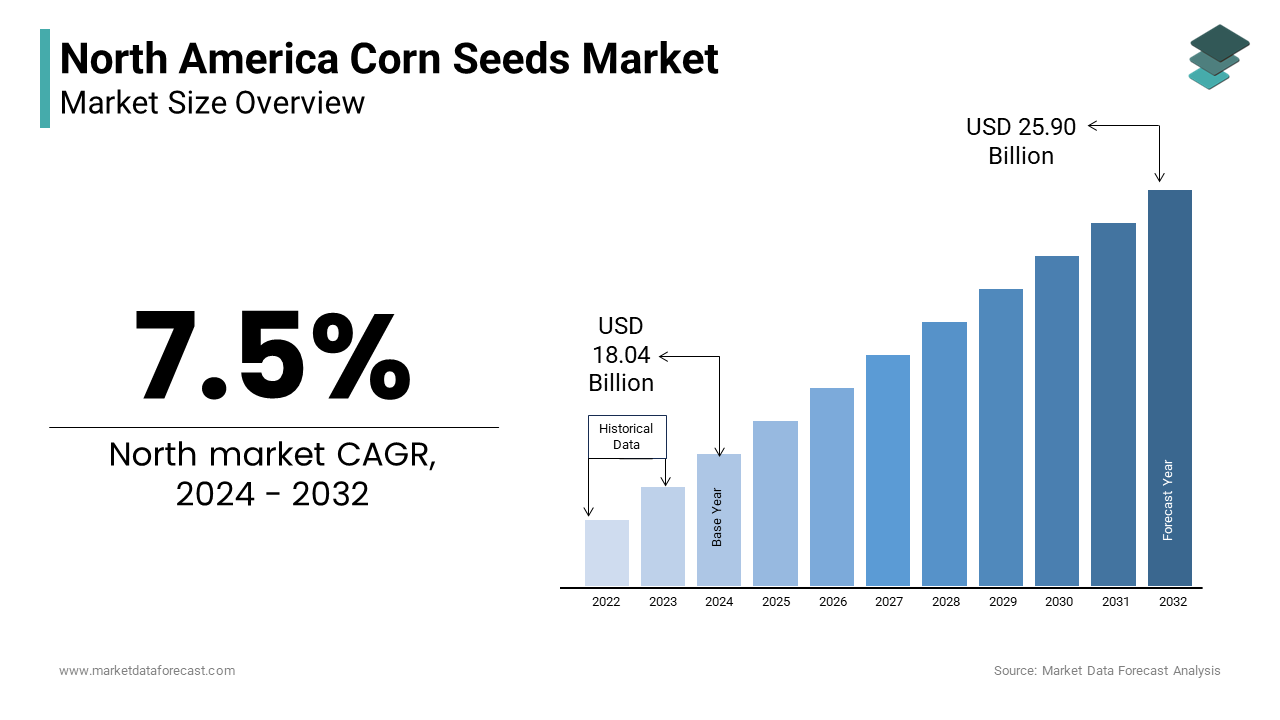

North America Corn Seeds Market Size (2024 to 2032)

The North American corn seeds market was expected to ba valued at USD 16.78 billion in 2023 and is anticipated to reach USD 18.04 billion in 2024 from USD 32.17 billion by 2032, growing at a CAGR of 7.5% from 2024 to 2032. It captures 45% of the global market.

Corn is the third most widely planted crop globally, following wheat and rice, and serves as a critical commodity in both food and feed industries. In North America, corn plays an integral role in agricultural production, with significant contributions to food consumption, animal feed, and ethanol production. North America's leadership in global corn production is underpinned by advanced farming technologies, robust government support, and a strong export market, positioning the region as a pivotal player in the global corn seeds industry.

The demand for corn seeds is being driven by the increasing need for genetically modified (GM) and hybrid varieties that enhance yields, resist diseases, and tolerate drought. Technological innovations within the seed industry are rising to meet the challenges posed by climate change and unpredictable weather patterns. Simultaneously, government policies such as the US Farm Bill provide critical subsidies, ensuring farmers can continue to produce competitively despite price volatility. Moreover, the growing consumer demand for sustainable agriculture is fueling interest in organic and non-GMO seeds, signaling a shift towards cleaner, eco-friendly farming practices.

Key players in the market, including Bayer, Corteva Agriscience, and Syngenta, are continually innovating through research and development to offer high-performance seed varieties. However, environmental concerns, operational costs, and climate change present notable challenges. The adoption of precision agriculture and expansion into emerging markets offer promising avenues for growth, as North America remains at the forefront of global corn production and seed development.

MARKET DRIVERS

Growing Demand for Ethanol Production In North America

The demand for corn seeds in North America has seen substantial growth due to the increasing use of ethanol as a biofuel. Ethanol, derived from corn, has become a crucial component of gasoline in the United States, driven by renewable energy mandates and environmental regulations. As the global shift toward cleaner energy sources accelerates, the demand for high-yield, drought-resistant corn seed varieties is expected to grow. This trend is projected to continue as nations worldwide adopt biofuels to reduce carbon emissions, positioning ethanol production as a key growth driver in the corn seeds market.

Increased Demand for Animal Feed

Corn is an essential ingredient in animal feed, especially within the expanding livestock sector in North America. As meat and dairy consumption rises due to population growth and changing dietary preferences, the demand for corn as a staple feed grain remains robust. Corn seed sales are driven by the need for high-yielding varieties that support feed efficiency and enhance the livestock supply chain. This growing demand for feed grains is expected to further propel the North American corn seeds market, particularly in regions such as the Midwest, where livestock farming plays a critical role in agricultural productivity.

Technological Advancements in Seed Varieties

Advances in biotechnology have revolutionized the corn seeds market in North America, particularly through the development of genetically modified organisms (GMOs) that offer superior yield, pest resistance, and drought tolerance. These innovations have significantly improved crop resilience against climate change while reducing reliance on chemical pesticides. Emerging technologies, such as CRISPR gene editing, are further enhancing seed traits to increase adaptability and sustainability, fueling demand for advanced seed varieties. This trend towards innovation is expected to drive long-term growth in the corn seeds market as farmers seek greater efficiency and sustainability in their operations.

Government Support and Subsidies

Government policies in the United States and Canada, particularly the US Farm Bill, play a vital role in supporting corn seed production by offering subsidies and incentives that promote the adoption of advanced technologies. These programs help mitigate the risks associated with market fluctuations and ensure that farmers can access the latest seed varieties. Subsidies also encourage the cultivation of genetically modified (GM) and drought-tolerant seeds, which are crucial in maintaining the competitiveness of North American corn farmers in global markets. As a result, government support remains a key driver of growth in the corn seeds market in the North American region.

MARKET RESTRAINTS

Environmental Concerns

The environmental impact of intensive corn farming is a significant restraint on the North American corn seeds market. Corn cultivation can lead to soil degradation, depletion of water resources, and reduced biodiversity due to monocropping practices. Heavy reliance on irrigation, particularly in drought-prone areas, exacerbates water scarcity, while nutrient runoff from fertilizers contributes to ecosystem imbalances. These environmental concerns are increasingly drawing attention from regulators and consumers alike, compelling the corn seed industry to adopt more sustainable farming practices and develop eco-friendly seed varieties that reduce the ecological footprint of corn production.

Volatility in Corn Prices

Corn seed demand in North America is highly sensitive to price volatility caused by fluctuating global market conditions and trade policies. Changes in international trade agreements, tariffs, and export restrictions can disrupt the balance of supply and demand, directly influencing seed purchasing decisions. Additionally, external factors such as oil prices—impacting ethanol production—and global food shortages can lead to sharp fluctuations in corn prices. This unpredictability makes it challenging for farmers to project profits, limiting consistent seed adoption and posing a constraint on market growth.

Climate Change and Unpredictable Weather

The increasing frequency of extreme weather events due to climate change has created significant challenges for the North American corn industry. Unpredictable patterns such as prolonged droughts, heatwaves, and heavy rainfall have reduced yield stability, making it difficult for farmers to maintain consistent production. Although advancements in drought-tolerant and heat-resistant seed varieties offer some relief, climate variability continues to affect the timing and outcome of planting cycles. The resulting uncertainty impacts seed demand and poses a considerable challenge for the corn seed industry, which must adapt to these changing environmental conditions.

MARKET OPPORTUNITIES

Adoption of Precision Agriculture

The adoption of precision agriculture offers significant growth opportunities for the North American corn seeds market. Precision farming utilizes cutting-edge technologies like GPS, drones, and data analytics to optimize key farming processes such as planting, irrigation, and crop management. By improving resource efficiency and reducing waste, precision agriculture enhances crop yields while lowering input costs. As farmers increasingly adopt these technologies, the demand for premium corn seed varieties that align with precision agriculture is expected to rise. This integration boosts both productivity and sustainability in the corn farming industry, positioning precision agriculture as a key driver of market expansion.

Organic and Non-GMO Corn Seed Market

The growing consumer demand for organic and non-GMO products presents a lucrative opportunity for the North American corn seeds market. As awareness around food safety, environmental sustainability, and health consciousness increases, more farmers are shifting to organic and non-GMO farming practices. Organic corn seeds, which are cultivated without synthetic chemicals, are particularly appealing to consumers who prioritize natural and sustainable food products. This rising demand for cleaner agriculture opens up new market avenues for seed companies to develop and promote organic and non-GMO seed varieties, catering to both niche and mainstream agricultural sectors.

Expansion into Emerging Markets

Emerging markets, particularly in Latin America, represent a promising growth avenue for North American corn seed producers. Countries such as Mexico and Brazil have experienced a surge in agricultural activity, spurring demand for high-yield, climate-resilient seed varieties. Trade agreements like the US-Mexico-Canada Agreement (USMCA) streamline the export process, enabling North American seed companies to tap into these fast-growing markets. The expanding agricultural sectors in Latin America, coupled with the need for advanced seed technology to combat changing climate conditions, present significant opportunities to diversify revenue streams and strengthen North America’s presence in the global corn seed market.

MARKET CHALLENGES

Pest and Disease Resistance

The corn seed industry faces an ongoing challenge in combating pests and diseases that threaten crop yields. Pests like corn rootworms and diseases such as corn leaf blight can severely damage crops, creating a constant need for innovative seed development. As pests develop resistance to current pesticides, seed companies must invest in research to create more resilient seed varieties that can withstand these evolving threats. This continuous need for R&D can be costly and time-consuming, and failure to stay ahead of pest and disease resistance could lead to significant reductions in crop productivity and farmer profitability.

Trade and Tariff Issues

Trade disputes, particularly between the United States and China, pose a significant challenge for the North American corn seed market. Tariffs on US agricultural products have reduced demand for American corn seeds in key export markets, such as China, disrupting global supply chains and decreasing revenue potential. These trade tensions also make it difficult for farmers to sell their surplus, leading to reduced demand for seed replenishment. The uncertainty surrounding protectionist policies and fluctuating trade agreements creates instability for seed producers who rely heavily on international markets. Resolving these trade issues is crucial for ensuring steady growth in corn seed exports and maintaining the market’s long-term stability.

This research report on the North American corn seeds market is segmented and sub-segmented into the following categories.

By Type

- Baby Corn

- Field Corn

- Sweet Corn

- Pop Corn

By End Products

- Animal Feed

- Corn Flour or meal

- Corn Starch

- Corn Syrup

COUNTRY ANALYSIS

- The United States

- Canada

- Rest of North America

THE U.S. IS THE LEADING CORN-PRODUCING NATION

The U.S. holds a dominant position as the largest corn-producing nation in the world, accounting for 40% of the global corn harvest. North America, collectively with Latin America, controls approximately 65% of the global corn seed market. In terms of value, the U.S. remains the largest market for corn seeds worldwide, driven by high production levels, advanced farming practices, and the adoption of genetically modified (GM) and hybrid seed varieties. In 2010, the U.S. cultivated around 35 million hectares of maize, reinforcing its position as the top corn producer. The country also consumes the most corn, and its corn seed trade reaches key importers like Italy, Mexico, Canada, France, and Spain.

The U.S. corn seeds market commands 35-40% of the global market, making it the largest globally. Corn is the most widely grown crop in the U.S., with a compound annual growth rate (CAGR) of approximately 3% in recent years. This growth is propelled by the rising demand for corn across biofuel, animal feed, and industrial sectors. The U.S. is also a leader in seed innovation, particularly in GM seeds, which offer enhanced productivity and resilience against pests, diseases, and varying climate conditions. This market dominance is supported by the country's adoption of advanced seed varieties and farming technologies that optimize crop yields.

Major Corn-Producing States in the U.S.

Four states—Iowa, Illinois, Nebraska, and Minnesota—lead corn production in the U.S., contributing over 50% of the nation’s total output. Iowa alone accounts for 20% of the country's corn production, followed closely by Illinois at 15%. Nebraska and Minnesota also play significant roles in U.S. corn farming. These states heavily depend on GM and hybrid seed varieties, enabling farmers to maximize crop yields and withstand environmental challenges. This high level of production drives strong demand for advanced corn seeds, particularly those engineered for pest resistance, drought tolerance, and overall higher productivity.

Seed Innovation and Development in the U.S.

The U.S. is at the forefront of seed innovation, with collaborations between universities, research centers, and industry leaders. Research institutions like Iowa State University and the University of Illinois, along with companies like Bayer CropScience (formerly Monsanto) and Corteva Agriscience, are continuously developing high-yield, drought-resistant, and pest-resistant seed varieties. These innovations help address climate-related challenges while promoting sustainable farming practices. Such advancements ensure that U.S. farmers remain competitive by improving productivity and farm profitability through the use of cutting-edge seed technology.

Impact of the U.S. Farm Bill

The U.S. Farm Bill plays a pivotal role in shaping the corn seeds market. The bill provides critical subsidies, crop insurance, and research funding that support corn seed production. By stabilizing corn prices and incentivizing sustainable practices, the Farm Bill helps U.S. farmers adopt the latest seed technologies, including GM seeds and precision agriculture. Additionally, the bill promotes biofuel production, particularly ethanol, increasing demand for corn and, subsequently, corn seeds. The Farm Bill’s influence on the U.S. corn industry ensures steady market growth and maintains the country’s competitive edge in global agriculture.

CORN SEED MARKET IN CANADA

Though smaller than the U.S. market, Canada’s corn seed market has experienced steady growth, driven by rising demand in Ontario and Quebec, which together produce over 80% of the country’s corn. With a strong emphasis on high-quality feed corn, biofuels, and food processing applications, Canada’s corn seed market continues to expand. Modern seed technologies, particularly GM seeds, play a vital role in boosting crop yields and improving sustainability in Canada's relatively short growing seasons. The adoption of advanced seed varieties has enabled Canadian farmers to increase efficiency and meet growing domestic and international demands.

Corn Seed Market Growth in Canada

Ontario is the leading corn-producing province in Canada, responsible for nearly 60% of the country’s corn output, followed by Quebec, which contributes around 20%. These provinces rely heavily on GM seeds and precision farming techniques to enhance productivity. The increasing demand for high-yield seed varieties, especially for livestock feed and biofuel production, is expected to drive continued growth in Canada’s corn seeds market. As farmers seek to improve yields and minimize environmental impact, the use of innovative seed technologies will remain crucial in Canada’s agricultural development.

Adoption of GM Seeds in Canada

Canada has widely adopted genetically modified (GM) seeds, particularly for corn, with more than 80% of the country’s corn crop being genetically modified. Health Canada and the Canadian Food Inspection Agency (CFIA) regulate the use of GM seeds to ensure they meet strict safety and environmental standards. The adoption of GM seeds has allowed Canadian farmers to mitigate pest infestations, boost yields, and adapt to fluctuating weather conditions, making GM technology a cornerstone of Canadian corn production. This reliance on GM seeds continues to enhance productivity and supports Canada’s competitiveness in global agricultural markets.

Weather Challenges in Canada

Canada’s colder climate and shorter growing seasons present significant challenges for corn production, especially in northern regions. Late springs and harsh winters shorten the planting window, necessitating the development of faster-maturing, cold-resistant seed varieties. Canadian research institutions and seed companies have responded by developing corn seeds specifically designed to thrive under these conditions. These innovations allow farmers to maximize crop yields despite the country’s environmental constraints, ensuring that corn production remains viable even in challenging weather conditions.

KEY MARKET PLAYERS

The North American corn seeds market is dominated by major players, including Monsanto (Bayer CropScience), DuPont Pioneer (Corteva Agriscience), and Syngenta. These companies hold substantial market share through their extensive portfolios of GM and hybrid seeds, advanced seed treatments, and well-established distribution networks. Competition in the market is intense, with key players focusing on research and development (R&D), strategic partnerships, and mergers to maintain and expand their market positions. Investment in R&D for pest-resistant and high-yield seeds, as well as collaborations with research institutions, keeps these companies at the forefront of agricultural biotechnology.

RECENT MARKET DEVELOPMENTS

Partnerships and Collaborations

- In 2023, Bayer partnered with the University of Nebraska to develop drought-resistant corn seeds specifically suited to the Great Plains. This collaboration focuses on enhancing water-use efficiency to address climate challenges in key corn-growing regions.

- Corteva Agriscience has collaborated with CIMMYT (International Maize and Wheat Improvement Center) to create disease-resistant and high-yielding corn varieties aimed at enhancing food security in North America and developing countries.

- Syngenta partnered with The Nature Conservancy in 2022 to promote sustainable farming practices, focusing on developing eco-friendly seed varieties that align with environmental conservation goals.

Product Launches

- In 2022, Corteva introduced PowerCore Enlist corn, offering enhanced insect resistance and herbicide tolerance. This product targets farmers dealing with pest infestations and herbicide-resistant weeds.

- In 2023, Bayer launched its short-stature corn variety designed to withstand high winds and variable climate conditions, improving crop resilience and yield.

- Syngenta released Agrisure Viptera in 2021, a GM corn seed providing comprehensive protection against pests, reducing the need for chemical pesticides and offering a more sustainable farming solution.

Mergers & Acquisitions

- In 2018, Bayer completed its $63 billion acquisition of Monsanto, gaining access to Monsanto’s extensive GM corn seed portfolio.

- In 2019, Corteva became an independent company following the DowDuPont merger, assuming control of DuPont’s seed technologies and crop protection assets.

- In 2018, Syngenta acquired Nidera Seeds, strengthening its presence in Latin America and expanding its global corn seed portfolio.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]