North America Cold Pressed Juices Market Size, Share, Trends & Growth Forecast Report By Type, , Category, Packaging, Distribution Channel and Country (the U.S., Canada, Mexico and Rest of North America) - Analysis on Size, Share, Trends, & Growth Forecast (2025 to 2033)

North America Cold Pressed Juices Market Size

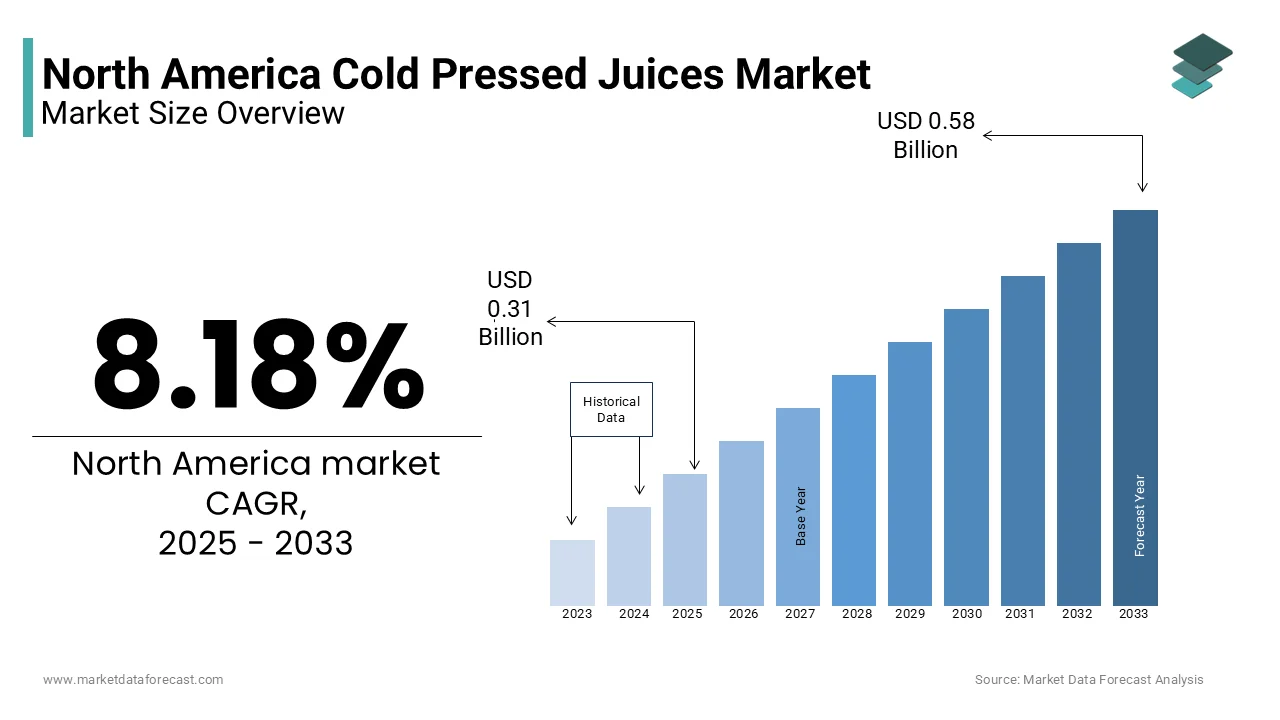

The North America cold pressed juices market size was valued at USD 0.29 billion in 2024. The European market is estimated to be worth USD 0.58 billion by 2033 from USD 0.31 billion in 2025, growing at a CAGR of 8.18% from 2025 to 2033.

The North America cold pressed juices market specializes in the production and distribution of juices extracted from fruits and vegetables using a cold pressing technique. This method involves crushing and pressing the produce without the application of heat which helps retain essential nutrients, enzymes, and flavours. The cold pressed juices are often perceived as healthier alternatives to traditional juices as they are generally free from additives and preservatives. This market development is supported by increasing consumer awareness of health and wellness, the rising demand for natural and organic products, and the growing trend of incorporating functional beverages into daily diets. As consumers become more health-conscious and seek convenient ways to enhance their nutrition, the cold pressed juices market in North America is poised for significant expansion, offering innovative products that cater to evolving consumer preferences.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

The rising health consciousness among consumers is a significant driver of the North America cold pressed juices market. As individuals become more aware of the importance of nutrition and its impact on overall health, there is a growing demand for products that promote wellness. A survey conducted by the International Food Information Council reports that 77% of consumers reported that they are trying to eat healthier, with many seeking out natural and organic food and beverage options. Cold pressed juices are known for their high nutrient content and absence of artificial additives and is align perfectly with this trend. Moreover, the increasing prevalence of lifestyle-related health issues such as obesity and diabetes has prompted consumers to seek healthier alternatives to sugary beverages. The convenience of cold pressed juices, which can be easily consumed on-the-go, further enhances their appeal.

Growth of the Organic Food and Beverage Sector

The growth of the organic food and beverage sector is another key driver propelling the North America cold pressed juices market. As consumers increasingly prioritize organic products due to their perceived health benefits and environmental sustainability, the demand for organic cold pressed juices has surged. In line with the Organic Trade Association, organic food sales in the United States reached $62 billion in 2020 is showing a 12.4% increase from the previous year. This pattern is particularly evident among younger consumers who are more likely to seek out organic options. Cold pressed juices made from organic fruits and vegetables not only appeal to health-conscious consumers but also align with the growing demand for sustainable and ethically sourced products. The increasing availability of organic produce and the expansion of distribution channels for organic products further support this trend.

MARKET RESTRAINTS

High Production Costs

A primary restraint affecting the North America cold pressed juices market is the skyrocketing production expenditure associated with cold pressing technology. The process of cold pressing requires specialized equipment and machinery which can be expensive to purchase and maintain. The industry estimates indicate that the cost of cold press juicers can range from $5,000 to $20,000 that is depending on the scale of production. Also, the sourcing of high-quality as well as fresh produce for cold pressed juices can lead to increased costs, particularly when organic ingredients are used. These high production costs can result in elevated retail prices for cold pressed juices, potentially limiting their accessibility to price-sensitive consumers. In the end, smaller producers may struggle to compete with larger brands that can leverage economies of scale to reduce costs. To tackle this problem, companies in the cold pressed juices market must focus on optimizing their production processes and exploring cost-effective sourcing strategies.

Short Shelf Life and Storage Challenges

Another significant restraint impacting the North America cold pressed juices market is the short shelf life of cold pressed juices compared to traditional juices. Due to the absence of preservatives and the natural degradation of nutrients, cold pressed juices typically have a shelf life of only 3 to 5 days when stored under refrigeration. Based on a study by the Food and Drug Administration, the rapid spoilage of cold pressed juices can lead to significant food waste and inventory management challenges for retailers. This limited shelf life can deter retailers from stocking cold pressed juices, as they may face challenges in selling products before they expire. Furthermore, the need for cold storage and transportation can increase operational costs for producers and retailers alike. To address these challenges, companies in the cold pressed juices market are exploring innovative preservation techniques, such as high-pressure processing (HPP), which can extend shelf life while maintaining product quality. By adopting such technologies, producers can enhance the marketability of their cold pressed juices, reduce waste, and improve overall profitability. However, the initial investment in advanced preservation methods can be substantial, posing a barrier for smaller companies.

MARKET OPPORTUNITIES

Expansion of Distribution Channels

The expansion of distribution channels presents a significant opportunity for growth in the North America cold pressed juices market. As consumer demand for cold pressed juices continues to rise, companies are increasingly exploring diverse distribution strategies to reach a broader audience. As stated by a study, e-commerce sales of beverages including cold pressed juices grew by 40% in 2020 that is spotlighting the potential of online sales channels. Retailers are also expanding their offerings of cold pressed juices in supermarkets, health food stores, and convenience stores are making these products more accessible to consumers. The rise of subscription services and direct-to-consumer models further enhances the distribution landscape by allowing consumers to receive fresh juices delivered to their doorsteps. As companies invest in expanding their distribution networks and leveraging digital platforms, the cold pressed juices market is expected to experience significant growth, catering to the evolving preferences of health-conscious consumers.

Increasing Consumer Interest in Functional Beverages

The increasing consumer interest in functional beverages represents another major opportunity for growth in the North America cold pressed juices market. As consumers become more health-conscious, they are seeking beverages that offer additional health benefits beyond basic nutrition. Cold pressed juices can be formulated with added ingredients such as superfoods, probiotics, and adaptogens, enhancing their appeal as functional beverages. The growing awareness of the health benefits associated with specific ingredients, such as turmeric for inflammation or ginger for digestion, is driving consumer interest in cold pressed juices that incorporate these elements. Because companies innovate and develop new formulations that cater to the demand for functional beverages, the cold pressed juices market is poised for significant growth, attracting a wider range of health-conscious consumers.

MARKET CHALLENGES

Competition from Traditional Juices and Beverages

A major challenge facing the North America cold pressed juices market is the intense competition from traditional juices and other beverage options. The landscape of fruit and vegetable juices is highly saturated, with numerous established brands offering a wide variety of products at competitive prices. Many consumers may opt for traditional juices due to their lower price points and longer shelf life, which can pose a challenge for cold pressed juice producers. Besides, the marketing and branding efforts of established juice companies can overshadow newer entrants in the cold pressed segment. To solve this challenge, cold pressed juice brands must focus on differentiating their products through unique flavors, health benefits, and sustainable sourcing practices.

Regulatory Compliance and Quality Standards

The regulatory compliance and quality standards associated with food and beverage production present another significant challenge for the North America cold pressed juices market. Cold pressed juices must adhere to stringent food safety regulations set forth by agencies such as the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA). According to a report by the FDA, foodborne illnesses can result in significant public health concerns, leading to increased scrutiny of juice production processes. Compliance with these regulations can require substantial investments in quality control measures, testing, and documentation, which can be particularly burdensome for smaller producers. Additionally, the need for transparency in labeling and ingredient sourcing can create challenges for companies seeking to differentiate their products in a crowded market. To navigate these challenges, cold pressed juice producers must prioritize compliance with regulatory standards and invest in robust quality assurance programs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.18% |

|

Segments Covered |

By Type, Category, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Pressed Juicery, Suja Life, PepsiCo Inc., Liquiteria, Evolution Fresh, Evergreen Juices Inc., Hain BluePrint, Inc., LLC, JustPressed, Juice Generation, Organic Avenue, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The fruit juices segment was at the forefront by capturing 63.1% of the total market share in 2024. This authority can be attached to the widespread popularity of fruit-based beverages among consumers, who often seek refreshing and flavourful options. Cold pressed fruit juices are particularly appealing to health-conscious consumers since they are typically free from additives and preservatives are retaining the natural flavors and nutrients of the fruits. The escalating trend of incorporating fruits into daily diets further propels the demand for cold pressed fruit juices.

The fastest-growing segment in the North America cold pressed juices market is the vegetable juices segment that is projected to see a CAGR of 24.6% in the coming years. This surge can be influenced by the rising customer understanding of the health benefits associated with vegetable consumption, particularly in the context of preventive health and wellness. The findings of a study by the World Health Organization states that the increasing vegetable intake is linked to a reduced risk of chronic diseases, which has led to a surge in demand for vegetable-based beverages. Cold pressed vegetable juices offer a convenient way for consumers to incorporate more vegetables into their diets are appealing to those seeking nutrient-dense options. Also, the rise of health trends such as detoxification and cleansing diets has further ignited the popularity of vegetable juices.

By Category Insights

The organic category spearheaded the North America cold pressed juices market by contributing 55.4% of the total market share in 2024. This position in the market can be credited to the soaring consumer preference for organic products driven by growing awareness of health and environmental issues. As stated in the Organic Trade Association, organic food sales in the United States reached $62 billion in 2020 is showing a 12.4% increase from the previous year. These cold pressed juices are perceived as healthier alternatives because they are made from fruits and vegetables grown without synthetic pesticides or fertilizers. The rising demand for clean-label products further propels the popularity of organic cold pressed juices since consumers seek transparency in their food choices.

The conventional category is predicted to witness the highest CAGR of 22.1% from 2025 to 2033 owing to the increasing availability and affordability of conventional cold pressed juices are making them accessible to a broader audience. Conventional cold pressed juices offer a convenient way for consumers to enjoy the benefits of fresh juices without the premium price associated with organic options. Moreover, the surging pattern of incorporating cold pressed juices into daily diets for their nutritional benefits is further fueling demand.

By Packaging Insights

The bottles segment prevailed in the North America cold pressed juices market by holding 72.9% of the total market share in 2023. This prominence can be linked to the widespread consumer preference for bottled beverages, which offer convenience and portability. Based on a report by Beverage Marketing Corporation, bottled juice sales in the United States reached $4 billion in 2021 is showing the popularity of ready-to-drink options among consumers. Bottles are also favored for their ability to preserve the freshness and quality of cold pressed juices, making them an ideal choice for both retailers and consumers. The developing trend of on-the-go consumption further propels the demand for bottled cold pressed juices, as busy consumers seek convenient and healthy beverage options.

The pouches segment is the fastest-growing and is forecasted to have a CAGR of 26.5% in the coming years because of the amplified demand for convenient and eco-friendly packaging solutions among consumers. The Smithers Pira through its report revealed that the flexible packaging business is expected to grow at a rate of 4% annually with pouches gaining popularity due to their lightweight and space-saving characteristics. Pouches are particularly appealing to health-conscious consumers seeking portable options for cold pressed juices, as they are easy to carry and consume on-the-go. Apart from these, the rising awareness of environmental sustainability is driving the demand for pouches as they often use less material than traditional bottles and can be made from recyclable materials.

By Distribution Channel Insights

The hypermarkets and supermarkets segment was the largest by accounting for 61.7% of the total market share in 2024. The extensive reach and convenience offered by these retail formats which provide consumers with a wide variety of cold pressed juice options under one roof is driving the segment forward. These often feature dedicated sections for health and wellness products, including cold pressed juices that is making it easier for consumers to find and purchase these items. The growing trend of health-conscious shopping further propels the demand for cold pressed juices in these retail environments, as consumers increasingly seek nutritious options while grocery shopping.

The Rapidly expanding segment in the North America cold pressed juices market is the online distribution channel that is projected to experience a CAGR of 29.7% from 2025 to 2033. This progress can be attached to the rising consumer preference for online shopping and particularly in the wake of the COVID-19 pandemic which has accelerated the shift towards e-commerce. Online platforms offer consumers the convenience of purchasing cold pressed juices from the comfort of their homes, often with the added benefit of home delivery. Also, the expansion of subscription services for health and wellness products is further driving the demand for online sales of cold pressed juices.

REGIONAL ANALYSIS

The United States dominates the North America cold pressed juices market by accounting for 68.7% of the overall market share in 2024. This is supported by the country's advanced retail infrastructure and the presence of major juice brands driving innovation in the cold pressed segment. According to the U.S. Department of Agriculture, the organic food market in the U.S. reached $62 billion in 2020 is signifying a growing consumer preference for natural and organic products, including cold pressed juices. The U.S. market is described by significant investments in marketing and distribution, leading to the introduction of a wide variety of cold pressed juice options that cater to diverse consumer preferences. Also, the increasing focus on health and wellness among American consumers further propels the demand for cold pressed juices.

Canada is projected to be the fastest-growing market in North America and is expected to grow at a CAGR of 10.5% during the forecast period. The surge is driven by the heightening demand for cold pressed juices driven by the expansion of the health and wellness sector and the rising adoption of organic products. Based on a study by Statistics Canada, the value of Canadian organic food is likely to rise by 7% annually and is creating opportunities for cold pressed juice producers. The Canadian market is defined by a powerful emphasis on quality and sustainability, with consumers increasingly recognizing the importance of cold pressed juices in enhancing their nutrition. Besides, government initiatives aimed at promoting healthy eating and local sourcing further support this trend.

The Rest of America region is experiencing moderate growth which includes countries such as Mexico in the cold pressed juices market. This is witnessing growth backed by the increasing demand for healthy beverage options and the expansion of the retail sector in the region. The market showcases a focus on affordability and accessibility, with organizations seeking cost-effective cold pressed juice solutions that enhance consumer health. Furthermore, the rising awareness of the importance of nutrition and wellness is driving the adoption of cold pressed juices among Mexican consumers.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Pressed Juicery, Suja Life, PepsiCo Inc., Liquiteria, Evolution Fresh, Evergreen Juices Inc., Hain BluePrint, Inc., LLC, JustPressed, Juice Generation, Organic Avenue are some major players dominating the North American Cold Pressed Juices Market.

Suja Juice is a leading player in the North America cold pressed juices market, known for its organic and non-GMO cold pressed juices. The company offers a wide range of flavors and functional beverages, catering to health-conscious consumers. Suja's commitment to quality and sustainability has positioned it as a dominant force in the cold pressed juice market, with a significant share of the North American landscape.

Blueprint is another major player in the North America cold pressed juices market, recognized for its innovative juice blends and cleanse programs. The company focuses on using high-quality, organic ingredients to create nutrient-dense cold pressed juices that appeal to health-conscious consumers. Blueprint's emphasis on transparency and sustainability has made it a trusted brand in the cold pressed juice sector.

Naked Juice, a subsidiary of PepsiCo, is a prominent player in the North America cold pressed juices market, offering a variety of cold pressed juice products. The brand is known for its commitment to using real fruits and vegetables, with no added sugars or preservatives. Naked Juice's extensive distribution network and strong brand recognition have contributed to its success in the cold pressed juice market.

The competition in the North America cold pressed juices market is defined by a dynamic landscape where innovation, quality, and consumer engagement are paramount. Major players are continuously striving to differentiate themselves through unique product offerings and effective marketing strategies. The market is witnessing a surge in the adoption of cold pressed juices, driven by increasing consumer demand for healthy and natural beverage options. As organizations prioritize health and wellness, companies that provide high-quality, flavorful, and functional cold pressed juices are gaining a competitive edge.

Furthermore, the presence of both established brands and emerging startups fosters a competitive environment that encourages rapid product development and innovation. The ongoing trend of health-conscious consumption is further intensifying competition, as consumers seek out new and exciting flavors and formulations. Therefore, companies must remain agile and responsive to market trends to maintain their competitive advantage in the North America cold pressed juices market.

STRATEGIES USED BY THE MARKET PLAYERS

Key players in the North America cold pressed juices market employ various strategies to strengthen their market position and enhance competitiveness. One prominent strategy is the focus on innovation and product development, enabling companies to introduce new flavors and formulations that cater to evolving consumer preferences. For instance, Suja Juice continuously expands its product line to include functional beverages that address specific health needs.

Additionally, strategic partnerships and collaborations play a crucial role in expanding market reach and enhancing product offerings. Blueprint, for example, has formed alliances with health and wellness retailers to ensure a diverse range of high-quality cold pressed juices for its customers, allowing the brand to differentiate itself in a competitive landscape.

Furthermore, companies are increasingly prioritizing sustainability and transparency in their sourcing and production processes. Naked Juice emphasizes its commitment to using non-GMO ingredients and environmentally friendly packaging, which resonates with health-conscious consumers.

Moreover, many key players are actively pursuing marketing initiatives to raise awareness of their products and educate consumers about the benefits of cold pressed juices. By leveraging social media and influencer partnerships, these companies can effectively engage with their target audience and drive sales. By employing these strategies, key players in the North America cold pressed juices market are positioning themselves to capitalize on emerging opportunities and navigate the challenges of a rapidly evolving industry landscape.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Suja Juice announced the launch of a new line of functional cold pressed juices designed to support immune health.

- In February 2024, Blueprint introduced a new cleanse program that combines cold pressed juices with plant-based snacks for a holistic health approach.

- In March 2024, Naked Juice expanded its product offerings to include a new range of cold pressed smoothies aimed at health-conscious consumers.

- In April 2024, Pressed Juicery announced a partnership with a major grocery chain to increase the availability of its cold pressed juices in retail locations.

- In May 2024, Organic Avenue launched a new subscription service for its cold pressed juices, allowing customers to receive fresh juices delivered to their homes weekly.

- In June 2024, HPP (High Pressure Processing) announced enhancements to its production capabilities to improve the shelf life of cold pressed juices while maintaining quality.

- In July 2024, Juice Press introduced a new line of cold pressed juices infused with adaptogens to cater to the growing demand for functional beverages.

- In August 2024, Daily Harvest expanded its product line to include cold pressed juices, focusing on organic and sustainably sourced ingredients.

- In September 2024, Tickle Water announced a collaboration with a health-focused influencer to promote its line of cold pressed juices and wellness products.

- In October 2024, Clean Juice launched a new marketing campaign aimed at educating consumers about the benefits of cold pressed juices and organic ingredients.

MARKET SEGMENTATION

This research report on the North America cold pressed juices market is segmented and sub-segmented into the following categories.

By Type

- Fruit Concentrates

- Citrus Fruits

- Orange

- Lemon

- Grapefruit

- Berries

- Strawberry

- Others

- Tropical Fruits

- Mango

- Pineapple

- Banana

- Passion Fruit

- Others

- Citrus Fruits

- Vegetable Concentrates

- Carrot

- Tomato

- Beetroot

- Cucumber

- Others

By Category

- Conventional

- Organic

By Packaging

- Bottles

- Cartons

- Pouches

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

By Country

- The United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth rate for the North America cold pressed juices market?

The market is expected to grow at a compound annual growth rate (CAGR) of 8.18% from 2025 to 2033.

2. What factors are driving the growth of the North America cold pressed juices market?

Key drivers include increasing health awareness among consumers, rising disposable incomes, a growing preference for natural and nutritious beverages, and the detoxifying benefits associated with cold pressed juices.

3. Who are the major players in the North America cold pressed juices market?

Major companies include Pressed Juicery, Suja Life, PepsiCo Inc., Liquiteria, Evolution Fresh, Evergreen Juices Inc., Hain BluePrint, JustPressed, Juice Generation, and Organic Avenue.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]