North America Bottled Water Market Research Report - Segmented By Product Type (Still water, Carbonated water, Flavored water, Functional water), Packaging , Distribution Channel, and By Region(United States, Canada And Rest Of North America) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

North America Bottled Water Market Size

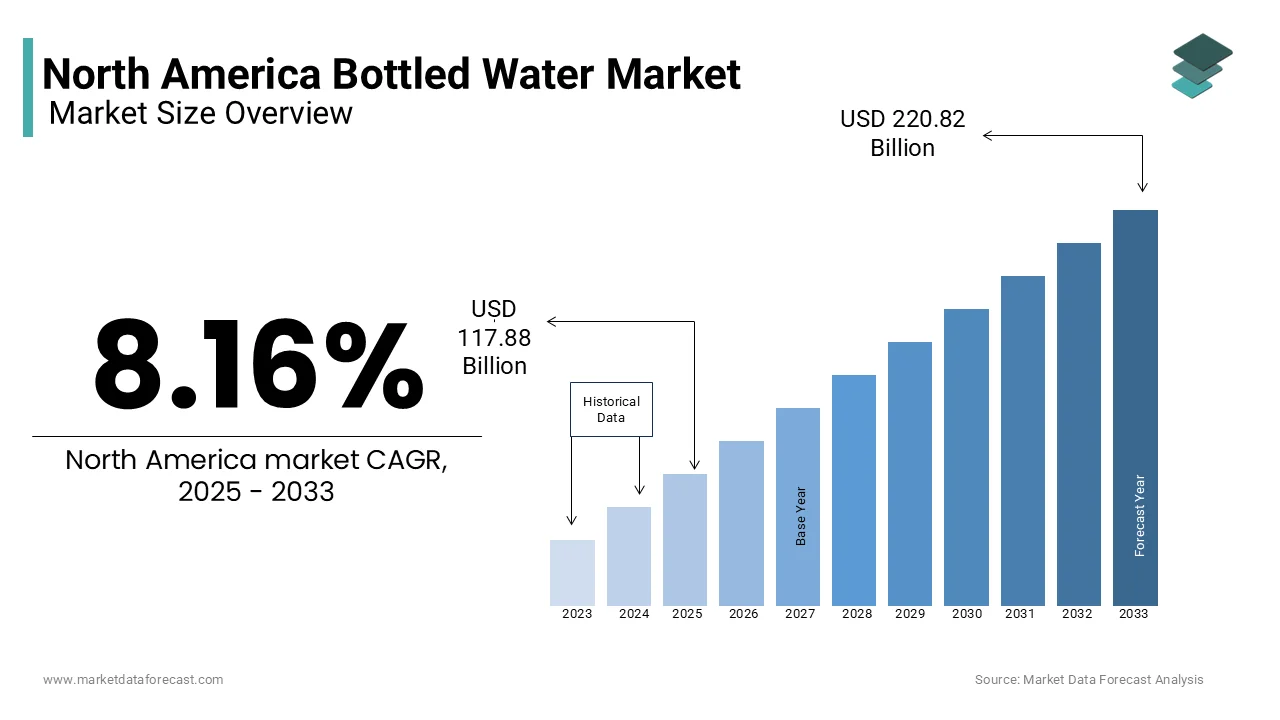

The North American Bottled Water Market size was valued at USD 108.98 billion in 2024 and the market size is expected to reach USD 220.82 billion by 2033 from USD 117.88 billion in 2025. The market's promising CAGR for the predicted period is 8.16%.

The North America Bottled Water Market includes the production, distribution, and consumption of packaged drinking water which is sourced from springs, wells, or purified municipal supplies are available in plastic, glass, or alternative eco-friendly packaging. It includes still, sparkling, and functional varieties, catering to diverse tastes and wellness demands across the United States, Canada, and Mexico. The current scenario highlights a strong growth trajectory and is fuelled by a shift away from sugary beverages toward healthier hydration options, with bottled water solidifying its position as a staple in daily consumption. In the U.S., it has emerged as the leading packaged beverage category, driven by perceptions of purity, portability, and accessibility, despite ongoing debates over environmental impacts tied to plastic waste.

The U.S. Census Bureau estimates North America’s population at approximately 370 million in 2025, providing a vast consumer base. Meanwhile, the World Health Organization notes that 99% of U.S. tap water meets safety standards, yet consumer trust in bottled alternatives persists. The Environmental Protection Agency reports that Americans generate about 4.9 pounds of waste per person daily, with plastic bottles contributing significantly, underscoring sustainability challenges. These factors frame the market’s evolution, balancing convenience with ecological considerations.

MARKET DRIVERS

People Want Healthier Drinks

One big reason the North America Bottled Water Market is growing is that people care more about staying healthy. They’re picking bottled water instead of sugary drinks like soda. The Beverage Marketing Corporation said that in 2022, people in the U.S. drank 15.9 billion gallons of bottled water, more than soda for seven years straight. This is because folks worry about health problems like gaining weight or getting sick from sugar. The International Bottled Water Association found that 63% of Americans choose water to stay hydrated and feel good, thanks to ads showing it’s clean and has no calories, making the market bigger.

Easy to Carry and Fits Busy Lives

Another reason is that bottled water is super easy to take anywhere, perfect for busy people. It comes in small bottles you can grab and go, great for city folks or travelers. The U.S. Census Bureau says 80% of Americans live in cities in 2025, where quick water options matter. The Beverage Marketing Corporation shared that 91% of bottled water sales in 2024 came from stores like gas stations, showing how handy it is. People use it at work, the gym, or events, and sales hit $46 billion in 2022, proving it’s a must-have for fast-moving North Americans.

MARKET RESTRAINTS

Plastic Bottles Hurt the Planet

A grave problem holding back the bottled water market is that plastic bottles harm the environment. Most bottles are plastic, and people don’t like the trash they make. The Environmental Protection Agency says Americans made 35.7 million tons of plastic waste in 2018, and bottles were a big part likely even more by 2025. The National Oceanic and Atmospheric Administration found only 9% of plastic gets recycled worldwide, so most ends up in landfills or the ocean. People complain, and some places in Canada ban plastic bottles, pushing companies to use expensive eco-friendly options, which can shrink their profits and growth.

Tap Water Is Cheaper and Trusted

Another issue is that tap water competes with bottled water because it’s good and cheap. The U.S. Environmental Protection Agency says 92% of public water systems were safe in 2023, so people trust tap water more. The American Water Works Association did a survey in 2022 showing 64% of Americans like tap water better since it saves money and doesn’t hurt the planet. Big cities like New York push tap water as clean and free, making bottled water seem less needed.

MARKET OPPORTUNITIES

Tapping Into Rural and Underserved Markets

A new opportunity is reaching rural areas where tap water quality lags. The U.S. Environmental Protection Agency says 15% of rural U.S. households lack reliable drinking water access in 2024, creating demand for bottled options. With 19% of Americans—about 70 million people—living rurally per the U.S. Census Bureau, this untapped market is huge. Companies can offer affordable bulk packs or local sourcing to win trust. The Rural Community Assistance Partnership notes 30% of rural residents buy bottled water regularly. Expanding here could grow sales, especially in Mexico and Canada’s remote regions, where similar gaps exist.

Leveraging Smart Packaging Technology

Smart packaging like QR codes or hydration-tracking caps offers a fresh edge. The Packaging Association reports smart packaging grew 12% in food and drink use by 2023, hinting at bottled water potential. A 2024 Mintel survey shows 55% of U.S. consumers like interactive products. Brands could use this to share water source stories or health tips, appealing to tech-savvy buyers. The Consumer Technology Association predicts smart packaging sales will hit $5 billion in North America by 2026. This innovation could boost brand loyalty and stand out in a crowded market.

MARKET CHALLENGES

Extreme Weather Disrupting Supply Chains

Climate change brings a new challenge with storms and droughts hitting water supply. The National Oceanic and Atmospheric Administration says U.S. extreme weather events rose 20% from 2020 to 2024, delaying bottling or sourcing. In 2023, California droughts cut spring water output by 15%, per the U.S. Geological Survey, raising costs. Floods in Canada also slowed distribution, with Statistics Canada noting a 10% logistics cost hike. Companies must adapt with backup sources or storage but this squeezes profits in a price-sensitive market, threatening steady growth.

Growing Skepticism About Water Purity Claims

Consumers are doubting bottled water’s “pure” image is posing a challenge. A 2023 Consumer Reports study found 40% of tested U.S. bottled waters had trace contaminants, sparking distrust. The Pew Research Center says 52% of Americans now question bottled water safety versus tap in 2024, up from 45% in 2021. Misleading labels like “mountain spring” from municipal sources fuel this. The Food and Drug Administration tightened labeling rules in 2024 but compliance costs hit smaller brands hard. Losing trust could shrink sales unless companies prove quality clearly.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.16% |

|

Segments Covered |

By Product Type, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Nestle Waters, Hangzhou Wahaha Group Co., Ltd, The Coca-Cola Company, Danone, PepsiCo Inc., Natural Waters of Viti Ltd, Icelandic Glacial Inc, Mountain Valley Spring Company, Dasani, and others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The still water segment was the top performing category and held a dominant market share in 2024. People see it as the simplest and the purest way to stay hydrated without extras like bubbles or flavors which is driving this segment forward. The U.S. Centers for Disease Control and Prevention says 66% of Americans drink three or more glasses daily, showing how much people rely on it. Its importance comes from being a trusted, everyday choice for families and kids.

On the other hand, functional water is the fastest-growing segment, with a CAGR of 8.5% from 2025 to 2033. It’s booming because people want water with health boosts like vitamins or energy helpers, especially gym-goers and busy workers. The U.S. Department of Agriculture notes 33% of adults now pick drinks with added nutrients and are driving this trend. The National Institutes of Health says 25% of Americans feel tired daily, so energy-boosting water matters. Its importance lies in meeting new lifestyle needs, making hydration fun and useful.

By Packaging Insights

The PET bottles segment rose up as the biggest category and capture a substantial market share in 2024. It prevailed as they’re cheap, light, and easy to carry which is fitting busy lives. The U.S. Environmental Protection Agency says PET production uses 30% less energy than glass, making it cost-effective for companies. Its importance is huge since most people grab PET bottles from stores daily is keeping sales strong.

The “others” segment and mainly aluminum cans are the rapidly expanding, with a CAGR of 7.0% during the forecast period. It’s growing fast owing to the fact that people want planet-friendly options over plastic. The U.S. Department of Energy states aluminum cans recycle at 54%, way more than PET’s 9%. The National Institutes of Health says 68% of young adults prefer sustainable products are boosting demand. This segment matters as it helps companies meet green goals and attract eco-smart buyers which is shaping the future of bottled water.

By Distribution Channel Insights

The Supermarkets segment emerged as the prominent channel by contributing a 61.9% market share in 2024 since they’re one-stop shops where families buy in bulk, trusting the variety and brands. The U.S. Census Bureau says 87% of U.S. households shop at supermarkets weekly making it a key spot for water sales. Its significance lies in offering big packs and deals, keeping bottled water a household must-have.

The “others” segment and especially online sales is rising swiftly with a CAGR of 9.3% from 2025 to 2033. It’s expanding because consumerd love ordering water delivered to their door, skipping store trips. The U.S. Department of Commerce reports e-commerce sales jumped 14% in 2023 and that is showing online shopping’s rise. The Pew Research Center says 41% of Americans now shop online weekly, boosting this trend. Its importance is in making water easy to get, particularly for busy or rural folks, changing how companies reach buyers.

REGIONAL ANALYSIS

The USA spearheaded the North America Bottled Water Market and held a substantial market share in 2024 due to its massive population and unique reliance on bottled water in disaster-prone areas like hurricane zones. The U.S. Federal Emergency Management Agency reports 45 million Americans faced water disruptions from natural disasters in 2023, boosting demand. Its importance lies in driving regional trends, with 15.9 billion gallons consumed in 2022, per the International Bottled Water Association, shaping innovation and sustainability efforts across North America.

Canada is the fastest-growing market, with a CAGR of 7.6% from 2025 to 2033. This growth caused by a surge in outdoor recreation like camping needing portable hydration. Statistics Canada says 22% of Canadians camped in 2023, up 5% from 2020, fueling bottled water sales. The U.S. Environmental Protection Agency notes Canada’s recycling rate hit 42% in 2022, supporting eco-friendly packaging shifts. This matters because Canada’s focus on sustainability and active lifestyles sets a model for green innovation, influencing North American market evolution.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Nestle Waters, Hangzhou Wahaha Group Co., Ltd, The Coca-Cola Company, Danone, PepsiCo Inc., Natural Waters of Viti Ltd, Icelandic Glacial Inc, Mountain Valley Spring Company, Dasani are playing dominating role in the North America bottled water market.

The competition in the North America Bottled Water Market is intense, with companies finding new and creative ways to stand out. One fresh approach is how brands are focusing on personalized hydration . Some companies are introducing bottled water with added customization, like letting customers choose flavors, add vitamins, or adjust carbonation levels. This makes their products more appealing to people who want unique experiences. By offering tailored options, these brands attract health-conscious buyers who see bottled water as more than just a drink—it’s part of their lifestyle.

Another interesting trend is the rise of regional pride in branding . Big players like Nestlé Waters highlight the local sources of their water, such as Poland Spring or Deer Park, to connect emotionally with consumers. People love supporting local businesses, and this strategy helps build trust and loyalty. It also sets these brands apart from competitors that focus only on global appeal.

Innovation in smart packaging is another game-changer. Some companies are testing bottles with QR codes that tell consumers about the water’s source, purity, and environmental impact. Others use temperature-sensitive labels to show when the water is perfectly chilled. These tech-savvy ideas make bottled water feel modern and convenient.

Finally, brands are tying themselves to social causes , like clean water projects or reducing plastic waste. By doing this, they create emotional connections with buyers who care about the planet. Together, these strategies make the market more dynamic and competitive, giving consumers exciting new choices while pushing companies to think creatively to stay ahead.

TOP PLAYERS IN THE MARKET

Nestlé Waters

Nestlé Waters is one of the leading players in the North America Bottled Water Market, known for its wide range of popular brands like Poland Spring, Perrier, and Deer Park. The company has built a strong reputation by offering high-quality products that cater to diverse consumer preferences, from purified water to sparkling varieties. Nestlé Waters focuses on sustainability by adopting eco-friendly packaging and reducing plastic waste, which has helped it appeal to environmentally conscious buyers. Its strong distribution network ensures that its products are available in stores, online platforms, and vending machines across the region. Through these efforts, Nestlé Waters has significantly contributed to the growth of the bottled water market by promoting healthier hydration habits and encouraging the adoption of sustainable practices, making it a key driver of innovation and consumer trust.

PepsiCo (Aquafina)

PepsiCo, through its Aquafina brand, holds a prominent position in the North America Bottled Water Market. Aquafina is widely recognized as a trusted and affordable option, making it a household name. PepsiCo’s strength lies in its ability to leverage its existing infrastructure and partnerships to ensure widespread availability of Aquafina in supermarkets, convenience stores, and foodservice outlets. The company emphasizes innovation by introducing new product formats, such as flavored and functional bottled waters, to meet changing consumer tastes. Additionally, PepsiCo’s commitment to promoting recycling and reducing its environmental footprint has strengthened its reputation as a responsible player in the industry. By combining affordability, accessibility, and sustainability, PepsiCo has played a pivotal role in expanding the bottled water market and positioning it as a convenient and healthy beverage choice for millions of consumers.

Coca-Cola (Dasani)

Coca-Cola’s Dasani brand is another major player in the North America Bottled Water Market, known for its focus on purity and quality. Dasani has successfully positioned itself as a premium yet accessible option, appealing to a broad audience. Coca-Cola’s extensive distribution network and marketing expertise have allowed Dasani to maintain a strong presence in both urban and rural areas. The company is committed to sustainability, working to reduce plastic use and promote recyclable packaging. Additionally, Coca-Cola has introduced innovations like flavored and enhanced waters to attract health-conscious consumers who seek variety. Through these initiatives, Coca-Cola has significantly contributed to the bottled water market’s growth by driving consumer awareness about hydration and sustainability while meeting evolving demands for healthier and more diverse beverage options.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Collaborative Partnerships with Health and Wellness Platforms

A new and innovative strategy gaining traction is the collaboration between bottled water companies and health and wellness platforms. Key players like Nestlé Waters and Coca-Cola (Dasani) are partnering with fitness apps, gyms, and wellness influencers to position their products as essential components of a healthy lifestyle. These partnerships often include co-branded content, such as hydration tips, workout guides, or challenges that encourage consumers to drink more water. By aligning themselves with the growing wellness movement, these companies not only enhance their brand image but also tap into niche communities that prioritize health and self-care. This approach helps them build deeper connections with health-conscious consumers who view bottled water as more than just a beverage—it’s part of their daily wellness routine.

Localized and Regional Branding

Another emerging strategy is the focus on localized and regional branding to appeal to specific communities. Companies like Nestlé Waters have successfully capitalized on this by emphasizing the regional sourcing of their water brands, such as Poland Spring in the Northeast or Deer Park in the Mid-Atlantic. By highlighting the local origins of their products, these brands create a sense of authenticity and trust among consumers who prefer to support regional businesses. Additionally, localized branding allows companies to tailor their messaging and packaging to reflect cultural preferences or regional pride, making their products more relatable. This strategy not only strengthens consumer loyalty but also differentiates these brands from larger, more generic competitors.

Introduction of Smart Packaging and Technology Integration

To stay ahead in the competitive market, some players are experimenting with smart packaging and technology integration. For instance, companies are exploring the use of QR codes on labels that provide information about the water’s source, purity, and environmental impact. Others are testing temperature-sensitive labels that change color to indicate when the water is optimally cool for consumption. These technological innovations not only enhance the consumer experience but also address growing concerns about transparency and product safety. By adopting cutting-edge solutions, these players position themselves as forward-thinking and modern, appealing to tech-savvy buyers who value convenience and innovation in their purchases.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, regulators in the United States and the United Kingdom tightened restrictions on per- and polyfluoroalkyl substances (PFAS), commonly known as "forever chemicals," due to their widespread presence in the environment and associated health risks. These substances have been linked to various health issues, prompting authorities to set some of the lowest acceptable concentration levels for PFAS in drinking water. This regulatory step aims to enhance public health by reducing exposure to these harmful chemicals.

- In March 2025, the city of Midland initiated its fifth bottled water distribution event in response to ongoing water pressure problems caused by a broken valve at T-Bar Ranch, which supplies approximately 30% of the city's water. Residents were advised to conserve water, particularly by reducing lawn watering and pool filling, to mitigate the issue.

MARKET SEGMENTATION

This research report on the North America bottled water market is segmented and sub-segmented into the following categories.

By Product Type

- Still water

- Carbonated water

- Flavored water

- Functional water

By Packaging

- PET bottles

- Glass Bottles

- Others

By Distribution Channel

- Supermarket

- Convenience/drug stores

- Grocery stores

- Others

By Region

- U.S

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the expected growth rate for the North American bottled water market?

The market is anticipated to grow at a compound annual growth rate (CAGR) of 8.16% from 2025 to 2033.

2.What Are the Environmental Impacts of Bottled Water?

While bottled water offers convenience, its production, transportation, and disposal can have environmental impacts, including plastic pollution and carbon emissions. Many consumers are opting for eco-friendly alternatives such as reusable water bottles and filtered tap water.

3.Are There Any Health Benefits Associated with Bottled Water?

Bottled water provides hydration and is an essential component of a healthy lifestyle. Some varieties, such as mineral water, may contain trace minerals beneficial to health, although the overall health benefits depend on individual preferences and needs.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]