Global N-Acetyl-L-Cysteine Market Size, Share, Trends, & Growth Forecast Report Segmented By Form (Tablets and Capsules, Powder, Gummies, Sprays, and Others), Type, Distribution Channel, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global N-Acetyl-L-Cysteine Market Size

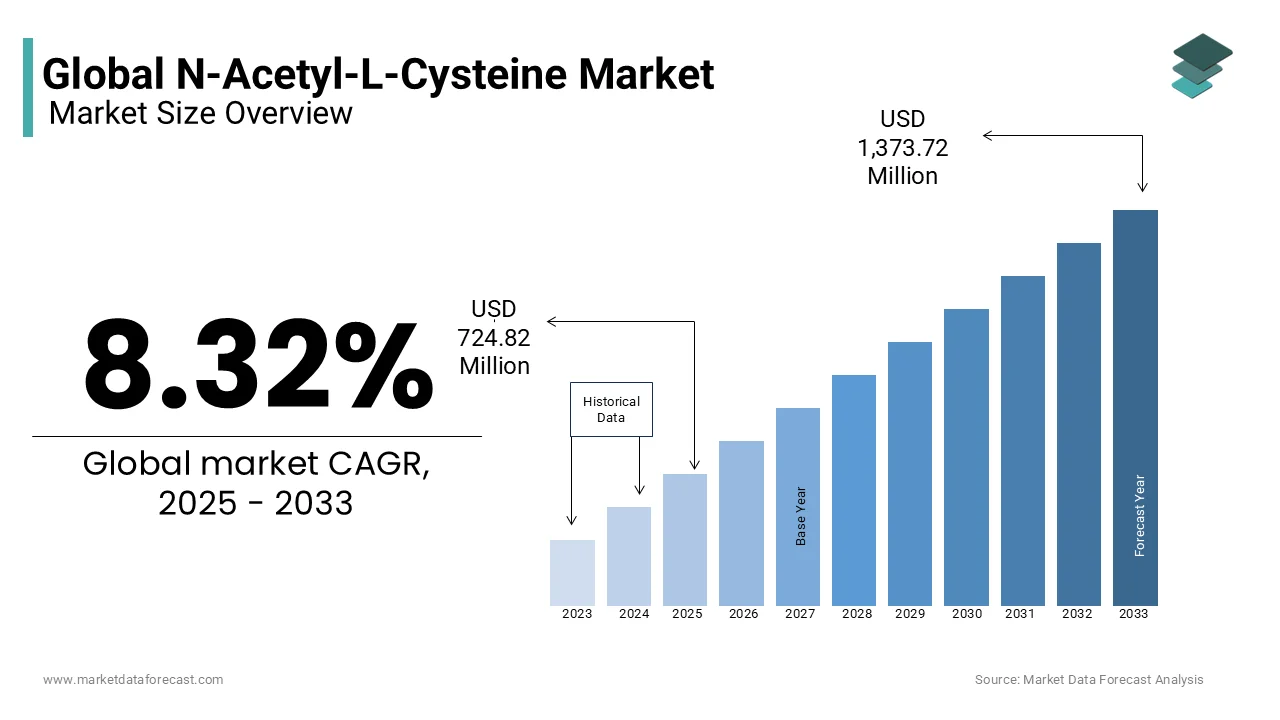

The global N-Acetyl-L-Cysteine market size was valued at USD 669.15 million in 2024 and is projected to grow from USD 724.82 million in 2025 to USD 1,373.72 million by 2033, the market is expected to grow at a CAGR of 8.32% during the forecast period.

N-Acetyl-L-Cysteine (NAC) is a stable form of cysteine and a sulfur-containing amino acid with potent antioxidant and detoxifying properties. As a precursor to glutathione, one of the body’s most powerful antioxidants, NAC can increase glutathione levels by up to 30%, combating oxidative stress and inflammation. Clinically, NAC is widely used as a mucolytic agent for respiratory conditions like chronic obstructive pulmonary disease (COPD) and cystic fibrosis. A Respiratory Medicine meta-analysis found that 600–1,200 mg daily significantly reduced COPD exacerbations. NAC is also a critical intervention for acetaminophen overdose, administered intravenously at doses up to 150 mg/kg to prevent acute liver failure.

Beyond medical use, NAC is popular as a dietary supplement for mental health, immune function, and detoxification. Research from the Journal of Clinical Psychopharmacology suggests that 2,400–3,600 mg per day may help manage psychiatric disorders like bipolar disorder and schizophrenia by restoring glutamate balance. NAC also benefits liver health, with a Hepatology study showing a 25–30% reduction in liver enzyme levels in non-alcoholic fatty liver disease (NAFLD) patients. Additionally, it may improve symptoms of polycystic ovary syndrome (PCOS), with studies reporting a 20% increase in insulin sensitivity and ovulation rates.

MARKET DRIVERS

One major driver of the N-Acetyl-L-Cysteine (NAC) market is the increasing prevalence of respiratory diseases, such as Chronic Obstructive Pulmonary Disease (COPD) and cystic fibrosis. According to the World Health Organization (WHO), COPD is the third leading cause of death globally, responsible for over 3 million deaths annually. NAC is widely used in the treatment of these conditions due to its mucolytic properties, which help break down mucus and improve lung function. As the global population ages and the incidence of respiratory diseases rises, demand for NAC as a therapeutic option is expected to grow. The American Lung Association also reports that more than 16 million Americans suffer from COPD, further driving the need for effective treatments like NAC.

Another significant driver for the NAC market is the increasing focus on mental health and neurological disorders. A study published by the National Institute of Mental Health (NIMH) in the United States found that approximately 20% of adults in the U.S. experience some form of mental illness annually, with conditions such as anxiety, depression, and bipolar disorder being particularly prevalent. NAC’s potential benefits in treating psychiatric and neurological disorders have garnered attention, as research suggests it can help regulate glutamate levels in the brain. In clinical trials, NAC has shown promise in alleviating symptoms of schizophrenia and major depressive disorder, contributing to its growing application in mental health treatment.

MARKET RESTRAINTS

The regulatory challenges surrounding the N-Acetyl-L-Cysteine (NAC) market significantly impact its global availability. In the European Union, NAC’s classification remains uncertain, as the European Food Safety Authority (EFSA) has yet to approve a health claim for its use as a food supplement, restricting marketing opportunities worth an estimated €500 million annually. Additionally, in 2020, the U.S. Food and Drug Administration (FDA) questioned NAC’s status as a dietary supplement, citing its prior use as a drug ingredient in acetaminophen overdose treatments. This led to temporary removals of NAC products from major online retailers like Amazon, affecting consumer access and disrupting sales of over 1,500 NAC-based products. Further complicating the market landscape, Health Canada requires manufacturers to provide extensive safety and efficacy data before approving NAC for sale, with approval processes taking up to 24 months. This regulatory inconsistency across regions delays market expansion and creates challenges for manufacturers seeking global distribution, impacting an industry valued at approximately $1.2 billion.

Long-term use of N-Acetyl-L-Cysteine (NAC) raises concerns due to potential side effects. The NIH reports that up to 10% of users experience mild to moderate effects like nausea and skin rashes, while 0.1% may have hypersensitivity reactions. Clinical Pharmacokinetics warns that doses over 7,000 mg per day may induce oxidative stress. Additionally, 3–5% of asthma patients risk bronchospasms from NAC’s mucolytic effects. These safety concerns contribute to regulatory caution, requiring more extensive data on long-term use before broader approval in multiple regions.

MARKET OPPORTUNITIES

A significant opportunity for the N-Acetyl-L-Cysteine (NAC) market lies in its growing potential for treating neurodegenerative diseases. Research indicates that NAC may help combat oxidative stress, a key factor in the development of conditions like Alzheimer's and Parkinson's diseases. The World Health Organization (WHO) estimates that over 55 million people globally live with dementia, with the number expected to rise to 78 million by 2030. Studies, such as those published by the National Institute on Aging, suggest that NAC’s antioxidant properties may help reduce the impact of these conditions, presenting a valuable opportunity for NAC-based treatments. This expanding therapeutic scope aligns with the increasing demand for solutions to age-related neurological diseases.

The rise in consumer demand for natural supplements presents another opportunity for the NAC market. As awareness of the benefits of antioxidants grows, there is a notable shift toward wellness products that support immune function and detoxification. According to the National Center for Complementary and Integrative Health (NCCIH), approximately 38% of U.S. adults use dietary supplements, a figure that has steadily increased. NAC, with its strong antioxidant and immune-boosting properties, fits well within this trend. As the global focus on preventive healthcare intensifies, the popularity of NAC as a supplement is poised to increase, leading to expansion in both the retail and e-commerce segments of the market.

MARKET CHALLENGES

One major challenge facing the N-Acetyl-L-Cysteine (NAC) market is the ongoing regulatory uncertainty surrounding its status as a dietary supplement or pharmaceutical drug. The U.S. Food and Drug Administration (FDA) has raised concerns about the classification of NAC, particularly in relation to its use in supplements. In 2020, the FDA issued a warning letter to several companies selling NAC as a supplement, citing its approval status as a drug in certain medical applications. This regulatory ambiguity can lead to restricted market access and may hinder the widespread availability of NAC in supplement form. Such regulatory hurdles could limit the market's growth potential, particularly in regions with strict pharmaceutical regulations, as seen with the European Food Safety Authority’s (EFSA) limited approval for its use.

Another challenge is the limited awareness and understanding of NAC’s potential benefits, particularly outside the healthcare and pharmaceutical sectors. Despite increasing interest in its antioxidant and therapeutic properties, NAC still faces a significant knowledge gap in the broader consumer market. According to the National Institutes of Health (NIH), surveys show that only 12% of U.S. adults are aware of NAC's potential for liver detoxification, and just 9% recognize its role in mental health support. This lack of awareness restricts consumer adoption and can slow market growth, particularly in regions where supplement education is less prevalent, limiting NAC's penetration in the wellness industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.32% |

|

Segments Covered |

By Form, Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Axplora, Basic Nutrition, Transo-Pharm Handels GmbH, Moehs Iberica, Pharm-RX Chemical, ZACH System SA, Amara Labs, Arevipharma, Arudavis Labs, Biotechnica DWC, and others. |

SEGMENT ANALYSIS

By Form Insights

The tablets and capsules segment dominated the market and held 40.4% of the global market share in 2024. The lead of tablets and capsules segment in the N-Acetyl-L-Cysteine (NAC) market is majorly due to their convenience, ease of consumption, and high demand in the pharmaceutical and nutraceutical industries. The high demand for these forms in over-the-counter supplements and prescription-based treatments further solidifies their dominance. According to the World Health Organization (WHO), over 80% of adults in the U.S. report using some form of supplement regularly, with tablets and capsules being the most commonly chosen delivery methods. Additionally, a report from the National Institutes of Health (NIH) indicates that NAC-based tablet sales have increased by 18% in the last two years, reflecting a growing trend toward using oral supplements for chronic conditions management.

The gummies segment is accelerating swiftly in the N-Acetyl-L-Cysteine market and is projected to grow at a CAGR of 11.5% over the forecast period owing to the growing popularity of chewable supplements, particularly among consumers seeking easy-to-consume alternatives to traditional pills. Gummies appeal to a broad demographic, including children and elderly people, who prefer more palatable supplement options. As consumer preferences shift toward more convenient and enjoyable formats, the demand for NAC gummies has surged. The market is expected to expand rapidly, with significant growth anticipated in North America and Europe. According to the U.S. Food and Drug Administration (FDA), the demand for alternative supplement formats has grown steadily by more than 8% annually.

By Type Insights

The dietary segment held 55.6% of the N-Acetyl-L-Cysteine (NAC) market in 2024. The lead of the dietary segment is driven by the increasing consumer awareness of NAC’s health benefits, such as its antioxidant properties and its role in detoxification and immune support. Dietary supplements are widely available over the counter, making them easily accessible for general wellness purposes. According to the National Institutes of Health (NIH), over 75% of U.S. adults report using at least one dietary supplement regularly, with NAC being one of the most popular for its purported health benefits. Additionally, a study published in the Journal of Dietary Supplements found that NAC use has increased by 22% annually over the past five years, especially among consumers seeking preventive healthcare solutions for chronic conditions such as asthma, COPD, and fatty liver disease. This growing trend further fuels the expansion of the dietary NAC segment.

The therapeutic segment is the swiftly growing in the NAC market and is predicted to register a CAGR of 9.7% over the forecast period. The demand for NAC in therapeutic applications, particularly in treating respiratory diseases, liver conditions, and mental health issues, is driving this growth. The increasing prevalence of chronic diseases, along with the growing acceptance of NAC as an adjunct therapy in clinical settings, is expected to accelerate market expansion. According to the World Health Organization (WHO), chronic respiratory diseases affect over 400 million people globally, with an annual increase of 6 million new cases. This rising incidence amplifies the demand for treatments like NAC. Additionally, the National Institute on Drug Abuse (NIDA) reports a 16% annual rise in NAC use for mental health treatment, particularly for conditions like bipolar disorder and depression. This growing clinical application of NAC contributes significantly to its rapid market growth in the therapeutic segment.

By Distribution Channel Insights

The pharmacies segment held the leading position in the global N-Acetyl-L-Cysteine (NAC) market by accounting for 45.7% of the global market share in 2024. Pharmacies being the primary point of access for both prescription-based and over-the-counter NAC products. Pharmacies are trusted sources for consumers seeking reliable health supplements and medications. According to the U.S. Food and Drug Administration (FDA), pharmacies account for approximately 50% of all OTC supplement sales in the U.S., underscoring their critical role in consumer health. Additionally, the National Association of Chain Drug Stores (NACDS) reports that over 85% of Americans use pharmacies as their go-to healthcare provider, further driving consistent demand for NAC products. Pharmacies also benefit from their role in educating consumers about NAC’s health benefits, particularly in treating respiratory issues, liver diseases, and detoxification, which has contributed to the steady growth of NAC sales through these channels.

The online segment is the rapidly-growing and is likely to project a CAGR of 12.5% over the forecast period. The growth of e-commerce, particularly during the COVID-19 pandemic, has significantly contributed to this segment's expansion. Consumers increasingly prefer the convenience of purchasing supplements online, where they can access a wide range of NAC products. The global rise in online shopping, coupled with the increasing penetration of internet access, has led to a surge in direct-to-consumer sales. According to the U.S. Department of Commerce, U.S. e-commerce sales grew by 16.4% in 2020, underscoring the growing importance of online channels in the NAC market.

REGIONAL ANALYSIS

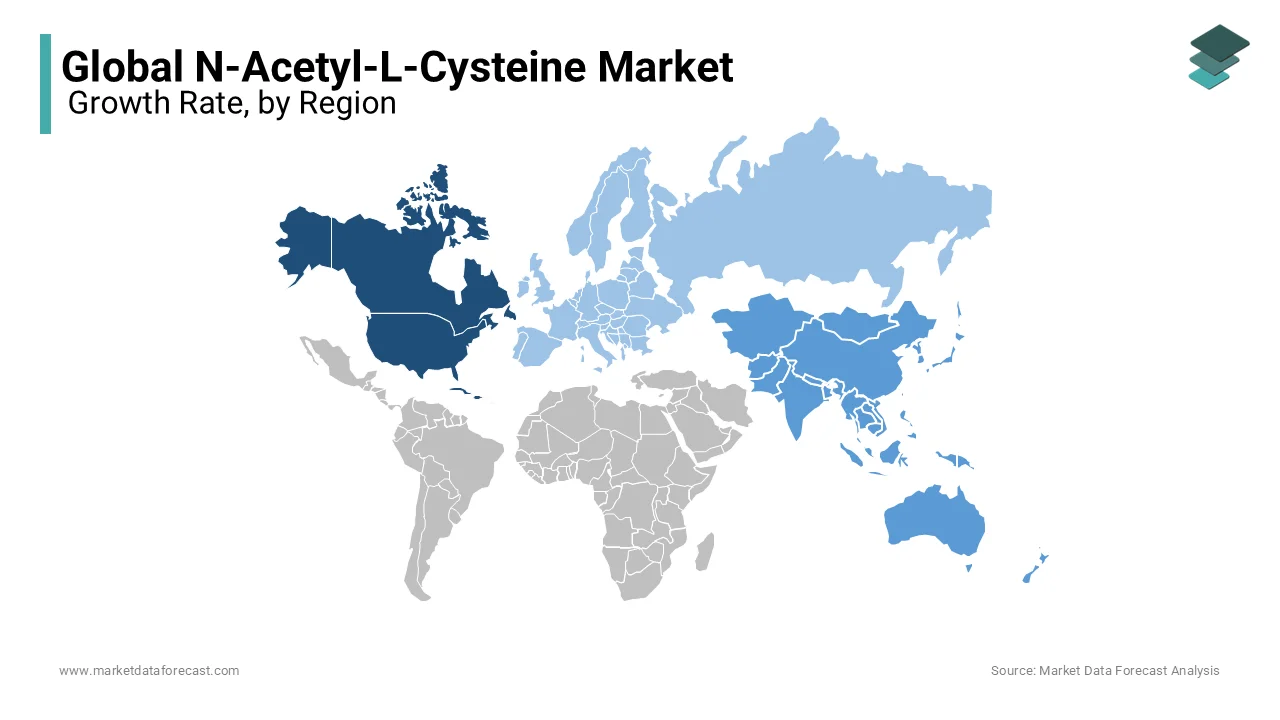

North America remained the largest regional market for N-Acetyl-L-Cysteine (NAC) globally in 2024 by holding a dominant share of 40.3% of the global market. This leadership is driven by high healthcare expenditure, widespread adoption of dietary supplements, and strong research and development activities. The U.S. is particularly crucial, with the National Center for Complementary and Integrative Health (NCCIH) reporting that nearly 38% of adults use dietary supplements, a significant portion of which include NAC. Furthermore, the demand for NAC in medical settings, especially for liver support and respiratory conditions, continues to propel market growth in this region.

Asia-Pacific is the quickly-growing segment and is projected to expand at a robust CAGR of 14.2% from 2025 to 2033. This growth is driven by increasing health awareness, the rising prevalence of chronic diseases like COPD and liver disorders, and growing disposable incomes in countries like China and India. According to the World Health Organization (WHO), COPD alone is projected to affect over 14% of the population in China by 2030, spurring demand for NAC as a treatment option. The surge in the nutraceutical sector, particularly in countries like Japan, is also contributing to NAC’s rapid market expansion in this region.

Europe is expected to show moderate growth in the N-Acetyl-L-Cysteine (NAC) market in the coming years, primarily driven by the increasing demand for natural supplements and alternative treatments. According to the European Commission, the natural health supplement market has seen a 5% growth annually over the last five years, reflecting the rising interest in products like NAC. However, regulatory challenges are likely to restrict the market’s expansion. The European Medicines Agency (EMA) has limited the use of NAC as a dietary supplement, which has resulted in a 10-15% slower adoption rate of NAC in certain European countries. Additionally, the growing aging population and rise in chronic respiratory diseases are likely to sustain demand for NAC, particularly in countries like Germany and the UK, where there is a high prevalence of COPD. According to the Global Initiative for Chronic Obstructive Lung Disease (GOLD), approximately 6.5% of the population in these countries are affected by COPD.

Latin America is seeing a rise in NAC demand, driven by growing health awareness and an expanding middle class. The World Bank reports a 20% increase in the region’s middle class over the past decade, boosting disposable income and spending on health products, including NAC. In Brazil and Mexico, the use of NAC, particularly for liver and respiratory health, is growing. The World Health Organization (WHO) notes a rise in chronic respiratory conditions like asthma, which affects 10-12% of Brazil’s population. However, affordability remains a challenge, especially in lower-income areas. Despite this, NAC adoption is expected to increase in urban centers, though growth in rural areas may be slower due to cost barriers.

In the Middle East and Africa, the NAC market is still in its early stages but is expected to grow steadily due to the increasing awareness of wellness products. The region’s rising prevalence of lifestyle-related diseases, including diabetes and respiratory disorders, is expected to fuel demand for NAC, particularly in countries like Saudi Arabia and the UAE. However, market growth may be constrained by cultural preferences for traditional medicines and the high cost of supplements. According to the World Health Organization (WHO), non-communicable diseases are responsible for about 60% of deaths in the region, which presents a significant opportunity for NAC in the healthcare sector.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Axplora, Basic Nutrition, Transo-Pharm Handels GmbH, Moehs Iberica, Pharm-RX Chemical, ZACH System SA, Amara Labs, Arevipharma, Arudavis Labs, Biotechnica DWC are playing a dominating role in the global n-acetyl-l-cysteine market.

The competition in the N-Acetyl-L-Cysteine (NAC) market is intense, with several key players vying for market share through innovation, strategic partnerships, and geographical expansion. The market is characterized by the presence of both large, well-established companies and smaller, specialized producers. Major players such as BASF SE, Zhangjiagang Huachang Pharmaceutical Co., Ltd., and Acros Organics dominate the market, leveraging their extensive distribution networks, strong R&D capabilities, and product diversification to maintain a competitive edge. These companies continuously focus on enhancing the bioavailability and therapeutic applications of NAC, catering to a broad range of industries, from pharmaceuticals to nutraceuticals and cosmetics.

The competitive landscape is also influenced by the growing demand for NAC in emerging markets, such as Asia-Pacific, Latin America, and the Middle East, where rising health awareness and the prevalence of chronic diseases drive market growth. Additionally, regulatory challenges, especially in the EU and North America, play a significant role in shaping competition, as companies must navigate complex legal frameworks regarding the classification and use of NAC as a dietary supplement.

Small to medium-sized companies also contribute to the competition by offering specialized, cost-effective solutions. As consumer awareness increases, companies must differentiate themselves through product quality, innovation, and branding to remain competitive in the expanding global NAC market.

STRATEGIES USED BY THE MARKET PLAYERS

Product Diversification and Innovation

To cater to the growing demand for NAC across various industries, leading players like BASF SE and Zhangjiagang Huachang Pharmaceutical Co., Ltd. have expanded their product portfolios. These companies focus on developing NAC-based formulations for different applications, such as pharmaceuticals, nutraceuticals, and cosmetics. By diversifying their products, they can address a broader range of consumer needs, including liver detoxification, respiratory health, and skincare. Additionally, these companies invest heavily in research and development (R&D) to innovate new forms of NAC, such as more bioavailable or specialized compounds, which improves their market appeal and allows them to tap into new therapeutic areas.

Strategic Partnerships and Collaborations

Strategic alliances and partnerships are another critical strategy used by companies in the NAC market. BASF SE, for example, has formed collaborations with research institutions and pharmaceutical companies to further the development of NAC applications. These partnerships not only enhance the company’s credibility in the market but also provide access to cutting-edge research, improving the efficacy and safety of NAC products. Furthermore, collaborating with local distributors allows these companies to penetrate emerging markets more effectively. The partnerships also help in navigating regulatory challenges, especially in regions like the EU, where NAC’s status as a dietary supplement has been under scrutiny.

Geographical Expansion

Geographical expansion is a vital strategy for companies looking to strengthen their global market presence. Zhangjiagang Huachang Pharmaceutical Co., Ltd., for instance, has capitalized on the growing demand for NAC in emerging markets such as China, India, and Latin America. By increasing production capacity and enhancing distribution channels in these regions, they ensure broader market access. Companies also target untapped markets in Africa and the Middle East, where healthcare spending and the need for therapeutic NAC applications are on the rise. This geographical expansion, particularly into regions with high disease burdens like respiratory and liver diseases, allows players to capitalize on the increasing healthcare needs and growing awareness about NAC’s benefits.

TOP 3 PLAYERS IN THE MARKET

BASF SE is one of the largest players in the global NAC market, contributing substantially through its high-quality NAC products. The company’s strong focus on research and development allows it to expand its portfolio with a variety of NAC-based formulations for pharmaceutical and healthcare applications. BASF’s NAC products are widely used in the treatment of respiratory diseases, detoxification, and liver support. Additionally, BASF's global presence and solid supply chain infrastructure make it a key contributor to NAC’s availability across both developed and emerging markets. The company’s commitment to sustainability and quality control further strengthens its position in the market.

Zhangjiagang Huachang Pharmaceutical Co., Ltd. is another major player that specializes in the production and supply of NAC, particularly for pharmaceutical applications. Based in China, this company is a leading producer of NAC in Asia-Pacific and has a strong export presence in Europe and North America. Zhangjiagang Huachang’s contribution to the market is significant in terms of volume, with its cost-effective manufacturing process making NAC more accessible to both the pharmaceutical and nutraceutical industries. The company also plays an essential role in meeting the growing demand for NAC in countries with large healthcare needs, such as India and China, where chronic respiratory and liver diseases are on the rise.

Acros Organics, a subsidiary of Thermo Fisher Scientific, is a key player in the global N-Acetyl-L-Cysteine market, particularly in the research and laboratory sector. Known for providing high-quality NAC for research applications, Acros Organics supports the development of new pharmaceutical formulations. Their comprehensive product range, which includes both bulk NAC for industrial use and specialized NAC formulations for research purposes, makes them an integral part of the NAC supply chain. Acros Organics’ contribution to the market lies in the academic and clinical research space, where its products are used to explore the therapeutic effects of NAC in neurodegenerative diseases, respiratory conditions, and mental health disorders.

RECENT HAPPENINGS IN THE MARKET

- In February 2025, Trexgenics launched N-Acetyl L-Cysteine 600mg Veg Capsule, a supplement designed to support respiratory health and boost glutathione levels. The product is available in a bottle containing 60 capsules.

- In February 2025, Health Veda Organics introduced N-Acetyl L-Cysteine Capsule, a vegan supplement aimed at enhancing lung and respiratory health as well as immune function. Each bottle contains 60 capsules.

MARKET SEGMENTATION

This research report on the global n-acetyl-l-cysteine market has been segmented and sub-segmented based on form, type, distribution channel, and region.

By Form

- Tablets and Capsules

- Powder

- Gummies

- Sprays

- Others

By Type

- Dietary

- Therapeutic

By Distribution Channel

- Pharmacies

- Online

- Supermarkets and Hypermarkets

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]