Global Mycotoxin Testing Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Aflatoxins, Ochratoxin A, Patulin, Fusarium Toxins), Technology (HPLC-Based, LC-MS/MS-Based, Immunoassay-Based), Food And Feed, Tested (nuts, Spices, Grains, Seed, Processed Foods, Dairy Products, Meat, And Pulses) And Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Mycotoxin Testing Market Size

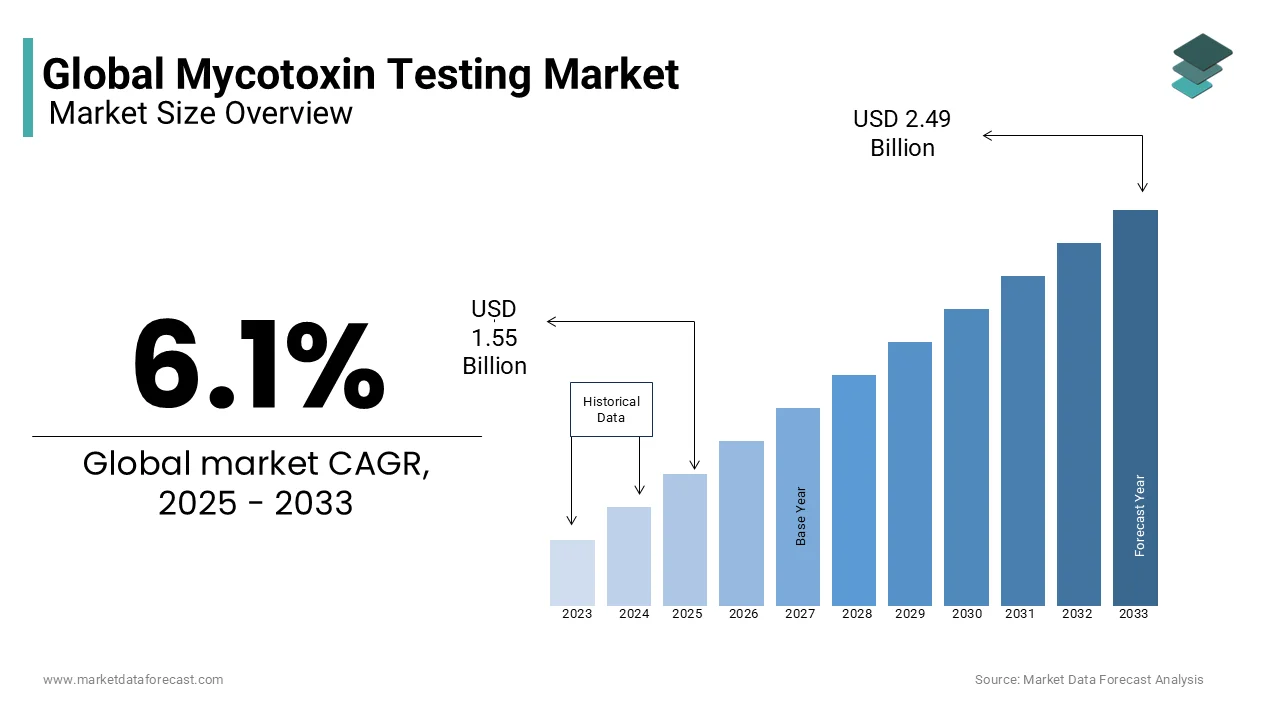

The global mycotoxin testing market was valued at USD 1.46 billion in 2024 and is anticipated to reach USD 1.55 billion in 2025 from USD 2.49 billion by 2033, growing at a CAGR of 6.1% during the forecast period from 2025 to 2033.

Mycotoxins, toxic secondary metabolites produced by fungi, pose significant risks to human and animal health, as well as economic stability in the agricultural and food industries. According to the World Health Organization, mycotoxin contamination affects approximately 25% of global food crops, leading to annual losses exceeding $1 billion. These toxins, which include aflatoxins, ochratoxins, and fusarium toxins, can cause severe health issues such as cancer, immune suppression, and neurological disorders when ingested through contaminated food or feed. According to the Food and Agriculture Organization, mycotoxin-related diseases affect over 4.5 billion people globally with the important need for robust testing mechanisms. Europe and North America are at the forefront of adopting advanced mycotoxin testing technologies, which is driven by stringent regulatory frameworks and consumer demand for safe food products.

MARKET DRIVERS

Stringent Regulatory Frameworks and Compliance Requirements

Stringent regulatory frameworks and compliance requirements are propelling the growth of the mycotoxin testing market. The European Food Safety Authority mandates rigorous testing protocols for food and feed products, with maximum permissible limits set for various mycotoxins, such as 2 parts per billion (ppb) for aflatoxins in cereals. Similarly, the U.S. Food and Drug Administration enforces strict guidelines by requiring regular testing of commodities like grains and dairy products. According to the International Trade Centre, non-compliance with these regulations can result in trade bans, costing exporters up to $500 million annually. This has led to increased adoption of mycotoxin testing solutions in regions with high export volumes like Southeast Asia and Latin America. For instance, India’s Ministry of Commerce reports that mycotoxin testing has reduced rejection rates of agricultural exports by 30% with its importance in maintaining global trade standards. These regulatory pressures are driving innovation and investment in testing technologies, ensuring safer food supplies worldwide.

Rising Consumer Awareness and Demand for Safe Food

The rising awareness among consumers about food safety and quality is another significant driver fueling the mycotoxin testing market. A survey conducted by the International Food Information Council reveals that 70% of consumers in developed countries prioritize purchasing food products tested for contaminants, including mycotoxins. This trend is particularly evident in urbanized regions like North America and Europe, where health-conscious consumers are willing to pay a premium for certified safe products. Additionally, the Global Food Safety Initiative reports that retailers are increasingly demanding mycotoxin-free certifications for their supply chains, further boosting testing demand. For example, Walmart’s stringent supplier requirements have led to a 20% increase in mycotoxin testing among its vendors. As awareness spreads to emerging markets, driven by social media and educational campaigns, the demand for comprehensive testing solutions is expected to surge, positioning mycotoxin testing as a cornerstone of modern food safety practices.

MARKET RESTRAINTS

High Costs Associated with Advanced Testing Technologies

The high costs associated with advanced mycotoxin testing technologies act as a significant barrier to market growth for small-scale producers and developing regions. The International Finance Corporation estimates that setting up a state-of-the-art mycotoxin testing laboratory can cost between $500,000 and $1 million, excluding ongoing operational expenses. For instance, liquid chromatography-mass spectrometry (LC-MS/MS), a gold standard in mycotoxin detection, requires expensive equipment and skilled personnel by making it inaccessible for many stakeholders. In Sub-Saharan Africa, where access to affordable testing solutions is limited, only 10% of agricultural cooperatives utilize advanced testing methods, according to the African Development Bank. While government subsidies and financing programs aim to alleviate these challenges, their reach remains insufficient to meet the growing demand for scalable and cost-effective testing solutions by hindering broader market penetration.

Limited Awareness Among Small-Scale Farmers

Limited awareness among small-scale farmers about the risks of mycotoxin contamination and the importance of testing poses another major restraint. A study by the Consultative Group on International Agricultural Research found that only 25% of farmers in South Asia are aware of mycotoxins and their impact on crop quality and human health. This knowledge gap often results in inadequate testing and improper storage practices, exacerbating contamination risks. For example, improper drying of maize and peanuts in humid climates can lead to aflatoxin levels exceeding 100 ppb, far above safe consumption limits. According to the African Soil Health Consortium services, which aim to educate farmers on best practices to remain underfunded in many rural areas. Additionally, misinformation spread through unverified sources exacerbates the problem, deterring potential adopters. The full potential of mycotoxin testing cannot be realized is limiting its adoption in underserved agricultural communities.

MARKET OPPORTUNITIES

Growing Adoption of Portable Testing Devices

The growing adoption of portable mycotoxin testing devices presents a lucrative opportunity for market players seeking to democratize access to testing solutions. The Organisation for Economic Co-operation and Development forecasts that handheld immunoassay-based devices will capture 30% of the global testing market by 2030 due to their affordability and ease of use. For instance, portable kits developed by companies like Neogen Corporation enable on-site testing with results available within minutes, reducing reliance on centralized laboratories. According to the European AgriTech Association, these devices have gained traction in remote farming communities, where access to advanced infrastructure is limited. Additionally, advancements in sensor technology have improved the accuracy of portable solutions by making them competitive alternatives to traditional methods.

Expansion into Emerging Markets

The emerging markets offer untapped potential for the mycotoxin testing market is driven by increasing agricultural investments and supportive government policies. The Asian Development Bank reports that agricultural output in South Asia and Southeast Asia is projected to grow by 4% annually over the next decade by creating robust demand for testing solutions. For example, India’s Ministry of Agriculture has launched initiatives to promote mycotoxin testing, aiming to combat crop losses caused by fungal contamination. Similarly, Brazil’s agrochemical sector, valued at $12 billion in 2022, offers significant opportunities for market expansion. According to the International Trade Centre, trade agreements and reduced tariffs are facilitating the entry of foreign suppliers into these regions. By capitalizing on these developments, stakeholders can establish a strong foothold in burgeoning economies by unlocking substantial revenue streams and fostering sustainable agricultural growth.

MARKET CHALLENGES

Complexity of Multi-Toxin Detection

The complexity of detecting multiple mycotoxins simultaneously poses a significant challenge to the effectiveness of testing solutions by threatening their widespread adoption. The International Union of Pure and Applied Chemistry reports that over 300 mycotoxins have been identified, each requiring specific detection methods and calibration standards. For instance, LC-MS/MS, while highly accurate, often struggles to detect low-concentration toxins without extensive sample preparation, increasing testing times and costs. According to the European AgriTech Association, even immunoassay-based methods face diminishing efficacy when targeting multiple toxins simultaneously. Addressing this issue requires continuous innovation and diversification of testing strategies, which can be costly and time-consuming. Without proactive measures, the inability to efficiently detect multi-toxin contamination could undermine the progress achieved through advanced technologies by necessitating urgent action to preserve their impact.

Fragmented Regulatory Standards Across Regions

Fragmented regulatory standards across regions complicate the implementation and standardization of mycotoxin testing practices, creating additional hurdles for market players. The European Chemicals Agency mandates rigorous testing of all food and feed products, ensuring minimal contamination levels. However, inconsistencies in regulatory standards across countries create additional barriers. For example, while the European Union enforces strict guidelines, some developing nations lack clear frameworks, leading to fragmented market dynamics. According to the Pesticide Action Network, approximately 40% of new testing products face delays during the regulatory approval phase by impacting their commercial viability. Furthermore, disparities in labeling and certification requirements hinder cross-border trade by limiting the scalability of mycotoxin testing solutions. Streamlining processes and harmonizing regulations are essential to facilitate faster adoption and market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Technology, Food Tested, Feed Tested and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bureau Veritas S.A, Symbio Laboratories, Romer Labs Diagnostic GmbH, Eurofins Scientific SE, Asurequality Ltd., ALS Ltd, Microbac Laboratories, Intertek Group PLC, Silliker, Inc, SGS S.A. |

SEGMENTAL ANALYSIS

By Type Insights

The aflatoxins segment dominated the mycotoxin testing market by holding a 45.3% of share in 2024 due to their prevalence in staple crops like maize, peanuts, and tree nuts, as well as their potent carcinogenic properties. The U.S. Department of Agriculture reports that aflatoxin contamination causes annual losses exceeding $200 million in the United States alone by intensifying demand for effective testing solutions. Additionally, their strict regulatory limits, such as 2 ppb in the EU, make them a priority for food safety authorities. Addressing public health risks while ensuring compliance with international trade standards is making it indispensable for modern food safety practices.

The fusarium toxins segment is lucratively growing with a CAGR of 9.5% from 2025 to 2033. This growth is fueled by their increasing prevalence in cereals and grains due to climate change and changing agricultural practices. According to the Germany’s Federal Ministry of Agriculture, fusarium toxins, such as deoxynivalenol that have gained attention due to their impact on livestock health and productivity. Their ability to contaminate large volumes of crops aligns with the growing emphasis on food and feed safety by making them a focal point for testing innovations.

By Technology Insights

The HPLC-based testing segment dominated the mycotoxin testing market with a dominant share of 40.4% in 2024. Its prominence stems from its high sensitivity and ability to detect multiple toxins simultaneously by ensuring comprehensive analysis. According to the U.S. Food and Drug Administration, HPLC-based methods have reduced false-negative results by 30% by enhancing testing reliability. Additionally, their compatibility with regulatory standards makes them a preferred choice for laboratories worldwide.

The Immunoassay-based testing is likely to witness a fastest CAGR of 10.5% from 2025 to 2033. This growth is driven by its affordability and ease of use, particularly in remote and resource-limited settings. According to the India’s Ministry of Agriculture, immunoassay kits have gained traction in rural areas, where access to advanced infrastructure is limited. Their ability to provide rapid results aligns with the growing emphasis on on-site testing by making them indispensable for decentralized applications.

By Food Tested Insights

The Cereals, grains, and pulses segment dominated the mycotoxin testing market by capturing 50.4% of share in 2024 due to their susceptibility to fungal contamination and their role as staple foods globally. According to the Canadian Grain Commission, mycotoxin testing has reduced rejection rates of grain exports by 25% due to its importance in maintaining food safety and trade standards.

The processed food segment is anticipated to register a CAGR of 8.5% during the forecast period. This growth is driven by the rising demand for safe and certified processed products in urbanized regions. As per Germany’s Federal Ministry of Agriculture, mycotoxin testing in processed food has gained traction due to stricter retailer requirements by improving consumer trust and brand reputation.

By Feed Tested Insights

Cereals and cereal by-products dominate the mycotoxin testing market for feed, holding a share of approximately 55%, according to the Food and Agriculture Organization. Their leadership arises from their widespread use as primary ingredients in animal feed formulations, making them highly susceptible to mycotoxin contamination. The European Food Safety Authority highlights that cereals like maize and barley are particularly vulnerable to Fusarium toxins, which pose significant health risks to livestock. For instance, U.S. poultry farmers using HPLC-based testing have reported a 35% reduction in feed-related health issues, underscoring the critical role of testing in ensuring animal welfare. Additionally, advancements in rapid detection technologies have enhanced their compatibility with diverse feed matrices, further solidifying their dominance. The International Food Safety Network notes that the affordability and adaptability of testing solutions for cereals make them indispensable for both commercial feed producers and small-scale farmers, ensuring their continued importance in the market. As global demand for safer animal feed grows, the prominence of cereals and cereal by-products in mycotoxin testing is expected to persist.

Oil meals and cakes represent the fastest-growing segment, with a compound annual growth rate (CAGR) of 22%, as per the Organisation for Economic Co-operation and Development. This rapid expansion is fuelled by their increasing use in livestock feed formulations and the rising awareness about the impact of mycotoxins on animal health. The International Centre for Agricultural Research in the Dry Areas emphasizes that oil meals, such as soybean meal, are gaining traction in regions like Asia Pacific and Latin America, where protein-rich feeds are in high demand. For example, Indian dairy farmers using LC-MS/MS-based testing have achieved a 50% improvement in feed safety while enhancing milk quality. Additionally, government initiatives promoting sustainable livestock farming have accelerated the adoption of advanced testing technologies, particularly in emerging markets. The African Development Bank projects that investments in oil meal testing will surge by 30% annually in sub-Saharan Africa, driven by the need for safer feed options. This segment's rapid growth underscores its potential to revolutionize livestock nutrition, positioning it as a transformative force in the mycotoxin testing market.

REGIONAL ANALYSIS

North America led the global mycotoxin testing market with a 35.4% of share in 2024. The region's dominance is attributed to its advanced agricultural infrastructure and stringent food safety regulations. For instance, California’s agricultural sector, valued at $50 billion in 2022, prioritizes mycotoxin testing to ensure compliance with export standards.

Asia Pacific is registering a fastest growth rate with an estimated CAGR of 11.2% in the foreseen years. The rapid urbanization, population growth, and increasing agricultural output are driving demand for mycotoxin testing solutions. China and India collectively account for 60% of regional consumption, as stated by the International Trade Centre. For instance, China’s Ministry of Agriculture has implemented mandatory testing protocols for staple crops like rice and wheat, boosting market growth. Government initiatives promoting safe food production and export quality standards further accelerate adoption by positioning Asia Pacific as a key growth hub for the mycotoxin testing market.

Europe mycotoxin testing market is anticipated to grow at steady pace throughput the forecast period. The growth is driven by its rigorous regulatory framework and high consumer awareness regarding food safety. Germany is holding largest share in the market by rapidly adopting new technologies and growing investment. According to the European Commission, mycotoxin testing has reduced contamination-related trade disputes by 40% with its importance in maintaining international trade standards. Additionally, the EU’s emphasis on sustainable agriculture and organic farming has further accelerated the adoption of advanced testing technologies by ensuring compliance with both domestic and global safety norms.

Latin America’s tropical climate and reliance on export-oriented agriculture necessitate robust mycotoxin testing solutions are ascribed to propel the growth of the mycotoxin testing market. For example, Brazil’s coffee and soybean industries have adopted advanced testing methods to comply with EU import regulations by reducing rejection rates by 25%. Investments in agricultural infrastructure and partnerships with international testing companies are expected to further drive market expansion in the coming years.

The Middle East and Africa’s arid conditions and limited access to advanced testing technologies amplify the need for scalable and cost-effective solutions. South Africa leads adoption, leveraging its relatively developed agricultural sector to implement testing protocols for maize and peanuts, which are highly susceptible to aflatoxin contamination. International aid programs and government investments in food safety initiatives are expected to unlock untapped potential by fostering market growth and improving public health outcomes.

KEY MARKET PLAYERS

Bureau Veritas S.A, Symbio Laboratories, Romer Labs Diagnostic GmbH, Eurofins Scientific SE, Asurequality Ltd., ALS Ltd, Microbac Laboratories, Intertek Group PLC, Silliker, Inc, SGS S.A. these are the market players dominate the global mycotoxin testing market.

MARKET SEGMENTATION

This research report on the global mycotoxin testing market is segmented and sub-segmented into the following categories.

By Type

- Ochratoxins

- Aflatoxins

- Patulin

- Fusarium

- Fumonisin

- Trichothecenes

- Zearalenone

- Other Toxins

By Technology

- HPLC

- LC-MS/GC-MS

- Immunoassay Based/Elisa

- Other Tests

By Food Tested

- Cereals, Grains & Pulses

- Dairy Products

- Processed Food

- Meat & Poultry

- Nuts, Seeds & Spices

- Others

By Feed Tested

- Cereals & Cereal By-Products

- Oil Meals & Cakes

- Forage & Silage

- Others

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

- Rest of the World

Frequently Asked Questions

Why is mycotoxin testing important for food and feed safety?

Mycotoxins are toxic compounds produced by fungi that can contaminate food and feed, posing serious health risks to humans and animals. Testing ensures compliance with safety standards.

What factors are fueling the demand for mycotoxin testing worldwide?

Strict food safety regulations, rising awareness about mycotoxin-related health hazards, increased global trade in food products, and advancements in testing technologies.

Which industries require mycotoxin testing the most?

The food & beverage, animal feed, agriculture, and pharmaceutical industries rely on mycotoxin testing to maintain product safety and regulatory compliance.

What are the most commonly tested mycotoxins?

Aflatoxins, ochratoxins, fumonisins, deoxynivalenol (DON), zearalenone, and patulin are among the most frequently tested mycotoxins in food and feed products.

Who are the major players in the global mycotoxin testing market?

Leading companies include SGS, Eurofins Scientific, Bureau Veritas, Intertek Group, and Neogen Corporation, offering advanced testing solutions worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]