Global Myasthenia Gravis Treatment Market Size, Share, Trends & Growth Forecast Report By Type (Generalized Myasthenia Gravis, Transient Neonatal Myasthenia Gravis and Ocular Myasthenia Gravis), Product (Monoclonal Antibodies, Cholinesterase Inhibitors, Intravenous Immunoglobulins, Immunosuppressants and Corticosteroids), Treatment Modality & Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Report (2025 to 2033)

Global Myasthenia Gravis Treatment Market Size

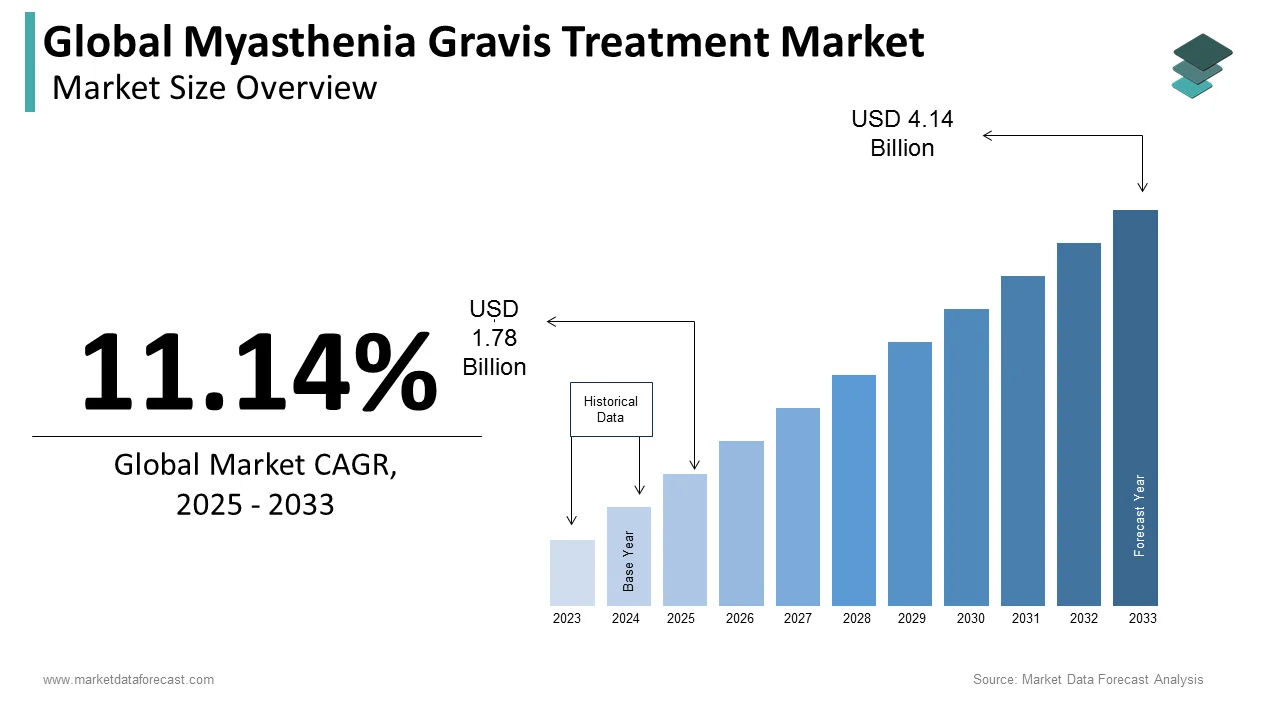

The size of the global myasthenia gravis treatment market was valued at USD 1.6 billion in 2024. The global market size is anticipated to grow from USD 4.14 billion by 2033 from USD 1.78 billion in 2025, growing at a CAGR of 11.14% from 2025 to 2033.

The myasthenia gravis (MG) treatment market is growing steadily owing to their better awareness, improved diagnosis, and new treatment options. Myasthenia gravis is a rare autoimmune disease that causes muscle weakness by disrupting communication between nerves and muscles. Current treatments help manage symptoms and include drugs that boost nerve-muscle communication, such as acetylcholinesterase inhibitors, as well as corticosteroids, immunosuppressants, and intravenous immunoglobulins (IVIG). In recent years, new therapies like monoclonal antibodies (e.g., eculizumab) have become available. These biologic treatments are designed for patients with severe or treatment-resistant MG and work by targeting specific parts of the immune system to help reduce symptoms more effectively. Research in gene therapy and other advanced treatments is also underway to provide longer-lasting relief.

MARKET TRENDS

Rise of Monoclonal Antibody Treatments

One of the biggest trends in the myasthenia gravis (MG) treatment market is the adoption of monoclonal antibodies (mAbs) for patients with severe or treatment-resistant forms. Eculizumab (Soliris), for example, specifically targets the complement system involved in autoimmune activity, reducing MG symptoms. For instance, the sales of eculizumab are expected to grow significantly, with a projected market expansion rate of over 10% annually in the coming years. By targeting immune pathways precisely, mAbs reduce the need for broad immunosuppressants and can lead to fewer side effects, making them a highly preferred option for certain patient groups.

Expanding Role of Immunosuppressants and IVIG

Immunosuppressants and intravenous immunoglobulins (IVIG) continue to be core treatments for MG, particularly in regions with limited access to newer therapies. IVIG usage was valued at over USD 3 billion in the global autoimmune market and provides temporary symptom relief, while corticosteroids and immunosuppressants help manage long-term symptoms. As MG diagnoses grow, demand for these therapies rises, especially in Asia-Pacific and Europe. These treatments are often less costly than biologics, making them accessible to broader patient populations and contributing to a market CAGR of 7% as the global MG treatment landscape evolves.

MARKET DRIVERS

Rising Cases of Myasthenia Gravis

The growing number of people diagnosed with myasthenia gravis (MG) is a major factor propelling the global market growth. For instance, MG affects about 15 to 20 people per 100,000, and this number is steadily rising each year due to better awareness and diagnosis tools. As more people are diagnosed, demand increases for effective treatments to manage symptoms. This growing patient base encourages the development of both traditional treatments like immunosuppressants and newer, more advanced therapies, contributing to the market expansion.

Development of Targeted Therapies like Biologics

Advances in biological treatments, especially targeted therapies like monoclonal antibodies, are transforming MG care. Medications such as eculizumab are designed specifically for MG and are especially helpful for patients who don’t respond well to older treatments. These biologics target the immune system more precisely and often come with fewer side effects. Demand for these new treatments is strong and expected to grow by about 10% annually, as they provide a promising alternative for managing MG symptoms effectively.

Increased Healthcare Spending and Government Support

Higher healthcare budgets worldwide and supportive government policies are making it easier for patients to access MG treatments. Healthcare spending is set to reach $10 trillion by 2025, and rare disease policies like the U.S. Orphan Drug Act encourage companies to develop treatments for conditions like MG. Government grants and patient assistance programs also help people afford medications. This supportive environment is motivating companies to develop more MG therapies, helping the market expand and making treatments more accessible.

MARKET RESTRAINTS

High Cost of Advanced Treatments

One of the key restraints in the myasthenia gravis (MG) treatment market is the high cost of advanced therapies, particularly biologics like monoclonal antibodies. For example, eculizumab, a leading biologic treatment, can cost over $500,000 per year per patient. These high costs make it difficult for many patients to access these drugs, even with insurance coverage. As a result, the affordability issue limits market growth, especially in lower-income regions. High prices may also lead patients to opt for older, less effective treatments, slowing the adoption of new, targeted therapies in the MG market.

Limited Awareness and Delayed Diagnoses

MG is a rare disease, and public awareness of it remains low, leading to delayed diagnoses in many cases. Studies show that many MG patients experience symptoms for over a year before receiving an accurate diagnosis. This delay can worsen symptoms and reduce treatment effectiveness when patients finally receive care. Additionally, lack of awareness and education among healthcare providers can lead to misdiagnosis. The result is a smaller pool of diagnosed patients, limiting the overall market size and slowing demand growth for MG-specific treatments.

Accessibility Challenges in Developing Regions

Access to specialized MG treatments is often limited in developing regions due to infrastructure and healthcare funding gaps. Many MG therapies, especially biologics, require highly specialized care that is available primarily in well-funded healthcare systems. For instance, in regions across Asia, Latin America, and Africa, MG patients may face limited access to advanced treatments or even basic immunosuppressants. This lack of accessibility restricts the market’s growth potential in these areas, keeping demand largely confined to North America, Europe, and other well-developed healthcare markets.

MARKET OPPORTUNITIES

Expansion of Biologic and Targeted Therapies

Biologic and targeted therapies present a significant opportunity for treating myasthenia gravis (MG), especially for patients unresponsive to traditional treatments. Research indicates that targeted therapies, such as monoclonal antibodies, can reduce MG symptoms by up to 70% in severe cases. This statistic is supported by a clinical study published in The New England Journal of Medicine, which showed significant symptom improvement in patients treated with eculizumab, a commonly used biologic for refractory MG. Success with these advanced therapies is spurring pharmaceutical interest and improving patient outcomes.

Increasing Focus on Personalized Medicine

Personalized medicine is a growing focus in MG treatment, as genetic differences can impact treatment responses. Studies indicate that 10-15% of MG patients have unique genetic markers that affect their response to standard therapies. This data comes from research by Frontiers in Neurology, highlighting the importance of individualized approaches for rare autoimmune diseases like MG. By applying genetic testing and biomarker analysis, healthcare providers can better match patients with effective treatments, minimizing adverse effects and improving quality of life.

Growth in Telemedicine and Remote Care Options

Telemedicine is revolutionizing access to specialist care for MG patients, particularly those in underserved regions. Research from the American Journal of Managed Care reports that approximately 60% of chronic disease patients benefit from faster, more frequent consultations via remote care options (AJMC, 2020). By reducing the need for in-person visits, telemedicine allows MG patients to stay on track with treatments and manage symptoms more effectively, leading to improved long-term health outcomes.

MARKET CHALLENGES

Lack of Specialized Care in Developing Regions

Access to specialized MG treatments remains a challenge in many developing regions due to infrastructure and resource limitations. According to the World Health Organization (WHO), specialized treatments are often limited to urban or well-funded areas, leaving rural populations underserved. This disparity restricts patient access to necessary therapies, especially advanced biologics and immunotherapies, which require specialized administration and monitoring. In regions across Asia, Latin America, and Africa, patients face limited treatment options, creating unequal access to care and ultimately hampering market expansion in these high-need areas.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.14% |

|

Segments Covered |

By Product, Type, Treatment Modality and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Astellas Pharma Inc., Astrazeneca, Abbvie Inc., Amyasthenia Gravisen Inc., Bausch Health Companies Inc., Bayer AG, Biogen, Bristol-Myers Squibb Co., CSL, Daiichi Sankyo Co. Ltd., F. Hoffmann-La Roche Ltd., Gilead Sciences Inc., GSK PLC., Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, Les Laboratoires Servier and Teva Pharmaceutical Industries Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The generalized myasthenia gravis (GMG) segment is the largest segment in the MG treatment market and accounted for 62.6% of the global market share in 2023. GMG affects multiple muscle groups, including respiratory and limb muscles, making it the most severe form of the disease and requiring more comprehensive treatment. This segment's market leadership is driven by the high prevalence of GMG cases, which make up the majority of myasthenia gravis diagnoses, and the need for long-term, symptom-managing therapies such as corticosteroids, immunosuppressants, and biologics. A study by the National Institute of Neurological Disorders and Stroke (NINDS) indicates that GMG affects about 85% of patients with MG at some point, underscoring the importance of treatments specifically for this condition.

The ocular myasthenia gravis (OMG) is the fastest-growing segment and is estimated to progress at a CAGR of 9.94% over the forecast period OMG primarily affects eye muscles, causing drooping eyelids and double vision, and is often an early stage of MG. The growth in this segment is largely due to improved diagnostic methods that catch the disease early, as well as increased patient awareness, leading to more OMG-specific diagnoses and treatment. According to the American Academy of Ophthalmology, up to 50% of OMG cases can progress to generalized MG if untreated, highlighting the need for targeted early intervention and specific treatment plans for OMG, which is driving market interest.

By Product Insights

The immunosuppressants segment led the myasthenia gravis (MG) treatment market and captured 36.6% of the global market share in 2023. These drugs are widely used to manage MG symptoms by suppressing the immune system's overactivity, which helps prevent muscle weakness. Immunosuppressants like azathioprine and mycophenolate mofetil are commonly prescribed because they are effective across various forms of MG and relatively affordable compared to newer therapies. According to the National Institutes of Health (NIH), immunosuppressants are effective for long-term symptom control in a majority of MG patients, making them the backbone of treatment for patients globally.

The monoclonal antibodies (mAbs) segment is predicted to be the fastest CAGR of 12.28% over the forecast period. This growth is driven by the introduction of targeted therapies, like eculizumab, designed specifically for severe and refractory MG cases. Monoclonal antibodies offer a targeted approach, focusing on specific components of the immune response, which can reduce the need for broad immunosuppression and decrease side effects. Research by The New England Journal of Medicine highlights that monoclonal antibodies can reduce symptom severity by up to 70% in patients with refractory MG, emphasizing their clinical importance and increasing adoption in the treatment landscape.

By Treatment Modality Insights

The medications segment was the largest segment in the myasthenia gravis (MG) treatment market and had the dominating share of 71.8% of the global market share in 2023. This segment is leading because medications like immunosuppressants, cholinesterase inhibitors, and monoclonal antibodies are the first-line treatments for most MG patients. These drugs help manage symptoms, improve muscle strength, and reduce autoimmune activity in the body. According to the National Institute of Neurological Disorders and Stroke (NINDS), medications remain essential for controlling the condition, particularly for generalized MG. The effectiveness of drugs like pyridostigmine (a cholinesterase inhibitor) and corticosteroids makes them integral to treatment, contributing to their dominant market share.

The intravenous therapy segment is projected to be the fastest-growing segment and is estimated to grow at a CAGR of 10.88% over the forecast period. This growth is driven by therapies such as intravenous immunoglobulin (IVIG) and plasmapheresis, which are used to treat acute exacerbations or severe cases of MG. Intravenous therapies provide rapid symptom relief and are critical for patients experiencing life-threatening complications, such as respiratory failure. According to The Journal of Clinical Neuromuscular Disease, IVIG can provide significant improvement in 60-80% of patients with severe MG symptoms. The increasing use of IVIG in hospital settings for acute flare-ups of MG is a key factor in its rapid market expansion.

REGIONAL INSIGHTS

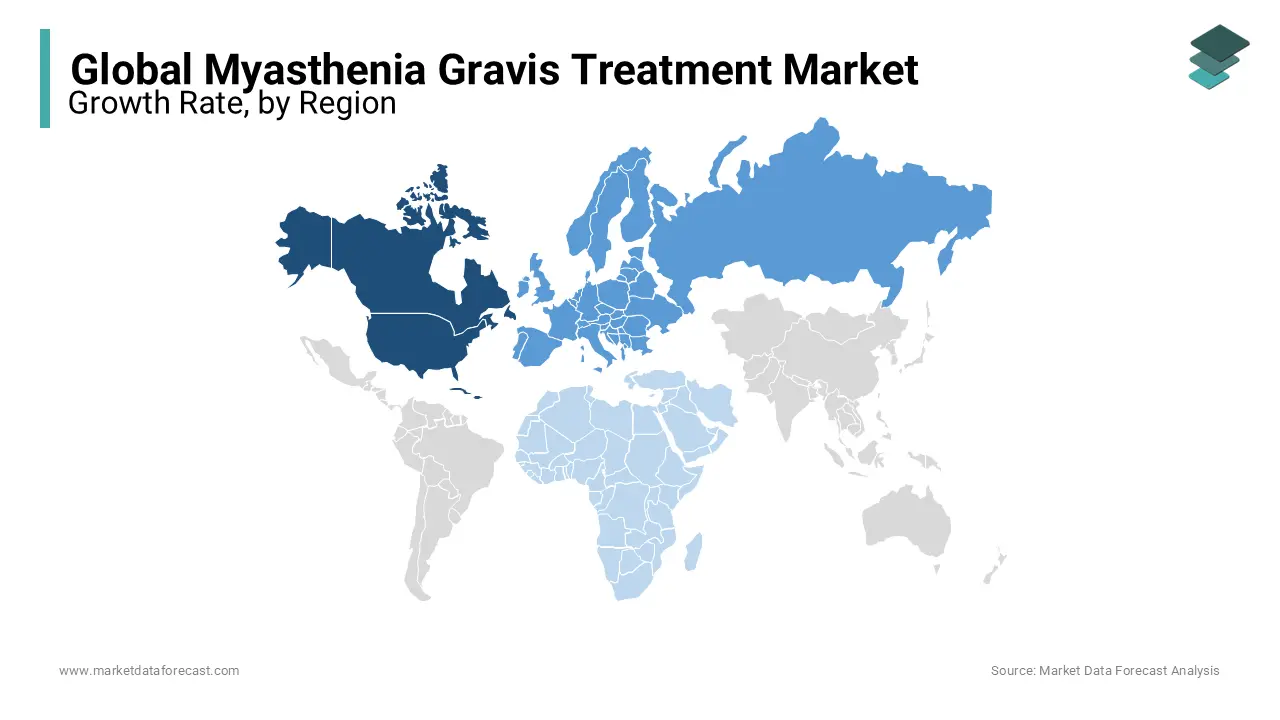

North America dominated the myasthenia gravis (MG) treatment market and accounted for 39.4% of the global market share in 2023. The leadership of North America in the global market is driven by a well-developed healthcare infrastructure, high awareness of MG, and strong adoption of advanced therapies. The U.S., in particular, dominates due to its large patient population and high access to biologics, such as monoclonal antibodies. Future growth is expected to be steady as new, innovative treatments enter the market and awareness increases. The U.S. is the top market in North America due to high healthcare spending and strong R&D investments. Canada also contributes to the market but on a smaller scale.

Europe is the second-largest region and is predicted to grow at a prominent CAGR over the forecast period. The market growth in Europe is supported by an established healthcare infrastructure and a high prevalence of MG cases, especially in Western Europe. The European Medicines Agency (EMA) has approved several MG treatments, which are widely available in countries like Germany, France, and the U.K. Future growth will be driven by increasing access to biologics and more streamlined MG diagnostic pathways. Germany, France, and the U.K. are the leading markets, with Germany being the largest due to its advanced healthcare system and focus on rare diseases.

Asia-Pacific is one of the fastest-growing regions and is estimated to register the highest CAGR over the forecast period. The Asia-Pacific market is expanding rapidly due to increasing awareness of MG, improving healthcare infrastructure, and growing investments in healthcare in countries like China and Japan. There is significant potential for market growth, particularly as biologics become more accessible and affordable in this region. Rising healthcare expenditure in countries such as China, Japan, and India is expected to drive further growth in MG treatments. Japan and China are the leading markets in the region, with Japan having a more established market for MG treatments. China is also emerging due to its large population and growing healthcare investments.

Latin America accounts for a moderate share of the global market. However, this regional market is expected to experience a healthy CAGR over the forecast period. The MG treatment market in Latin America is growing gradually as awareness increases and healthcare access improves. However, the limited availability of advanced treatments, such as monoclonal antibodies, restricts market growth. As healthcare systems develop and government initiatives support rare disease treatment, the market is expected to see steady growth in the coming years. Brazil and Mexico are the largest markets in Latin America due to their relatively advanced healthcare infrastructure and larger populations.

The market in the Middle East and Africa is expected to progress steadily over the forecast period. The market growth in the MEA region is limited by relatively low awareness of MG, limited access to advanced treatments, and economic constraints. However, increasing healthcare investments in the United Arab Emirates and Saudi Arabia are supporting market growth. As awareness and access to MG treatments improve, there is potential for gradual expansion in this market, particularly in wealthier Gulf Cooperation Council (GCC) countries. The UAE and Saudi Arabia are leading the MEA region, primarily due to their investments in healthcare infrastructure and growing focus on treating rare diseases.

KEY MARKET PLAYERS

Companies that play a key role in the global myasthenia gravis treatment market include Astellas Pharma Inc., AstraZeneca, Abbvie Inc., Amyasthenia Gravisen Inc., Bausch Health Companies Inc., Bayer AG, Biogen, Bristol-Myers Squibb Co., CSL, Daiichi Sankyo Co. Ltd., F. Hoffmann-La Roche Ltd., Gilead Sciences Inc., GSK PLC., Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, Les Laboratoires Servier and Teva Pharmaceutical Industries Ltd.

RECENT MARKET HAPPENINGS

- In March 2024, AstraZeneca acquired Alexion Pharmaceuticals to strengthen its portfolio in rare diseases, including treatments for myasthenia gravis.

- In April 2024, Novartis AG received FDA approval for a new monoclonal antibody therapy targeting generalized myasthenia gravis, expanding its neurology treatment offerings.

- In May 2024, Pfizer Inc. entered into a strategic partnership with a biotech firm to co-develop an innovative gene therapy for myasthenia gravis, aiming to provide a long-term solution for patients.

- In June 2024, Sanofi launched a global awareness campaign to educate healthcare professionals and patients about early diagnosis and treatment options for myasthenia gravis, reinforcing its commitment to rare diseases.

- In July 2024, Merck & Co. Inc. initiated a Phase III clinical trial for a novel oral medication designed to improve muscle strength in myasthenia gravis patients, demonstrating its dedication to advancing treatment options.

- In August 2024, GSK PLC expanded its research collaboration with academic institutions to explore new therapeutic targets for myasthenia gravis, aiming to develop more effective treatments.

- In September 2024, Biogen acquired a startup specializing in neuromuscular disorders, including myasthenia gravis, to bolster its pipeline of innovative therapies.

- In October 2024, F. Hoffmann-La Roche Ltd. launched a patient support program providing financial assistance and educational resources to individuals undergoing treatment for myasthenia gravis, enhancing patient access to care.

- In November 2024, Bristol-Myers Squibb Co. received European Medicines Agency approval for its latest biologic therapy targeting refractory myasthenia gravis, expanding its presence in the European market.

- In December 2024, AbbVie Inc. announced positive results from a Phase II trial of its investigational drug for myasthenia gravis, paving the way for further development and potential market entry.

MARKET SEGMENTATION

This research report on the global myasthenia gravis treatment market is segmented and sub-segmented based on type, product, treatment modality and region.

By Type

- Generalized Myasthenia Gravis

- Transient Neonatal Myasthenia Gravis

- Ocular Myasthenia Gravis

By Product

- Monoclonal Antibodies

- Cholinesterase Inhibitors

- Intravenous Immunoglobulins

- Immunosuppressants

- Corticosteroids

By Treatment Modality

- Medications

- Surgery

- Intravenous Therapy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the myasthenia gravis treatment market?

The global myasthenia gravis treatment market was worth USD 1.44 billion in 2023 and is expected to be as big as USD 4.14 bn by 2033.

What is the segmentation covered in this global myasthenia gravis treatment market report?

This research report on the global myasthenia gravis treatment market is segmented and sub-segmented based on type, product, treatment modality and region.

Which region dominated the myasthenia gravis treatment market in 2024?

North America captured the majority of the share of the global market in 2024.

Who are the key players in the myasthenia gravis treatment market?

Astellas Pharma Inc., AstraZeneca, Abbvie Inc., Amyasthenia Gravisen Inc., Bausch Health Companies Inc., Bayer AG, Biogen, Bristol-Myers Squibb Co., CSL, Daiichi Sankyo Co. Ltd., F. Hoffmann-La Roche Ltd., Gilead Sciences Inc., GSK PLC., Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi, Les Laboratoires Servier and Teva Pharmaceutical Industries Ltd are a few of the notable players in the myasthenia gravis treatment market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]