Global Mustard Seed Market Size, Share, Trends & Growth Forecast Report Segmented By Type (White, Black, Sarepta), Application, Sales Channel, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Mustard Seed Market Size

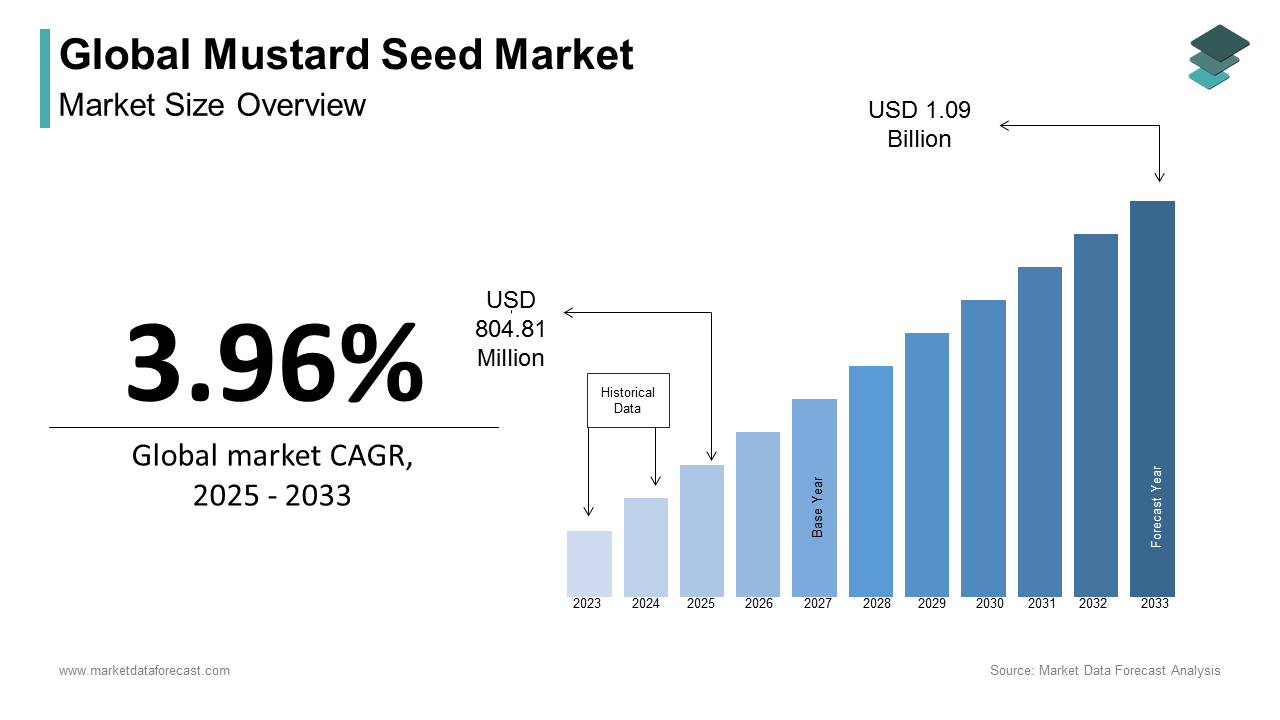

The global mustard seed market size was calculated to be USD 774.15 million in 2024 and is anticipated to be worth USD 1.09 billion by 2033 from USD 804.81 million In 2025, growing at a CAGR of 3.96% during the forecast period.

CURRENT SCENARIO OF THE GLOBAL MUSTARD SEED MARKET

Mustard seeds are essential in food and medicine industries worldwide. Nepal is the largest producer, contributing 27% of the global mustard seed supply as of 2022, followed by Russia with 27.28% and Canada with 19.69%. In 2023, Russia’s production increased by 8.45%, while Canada saw a 2.59% decline, showing the changing nature of mustard seed farming. Nutritionally, mustard seeds are rich in protein (26.08g per 100g), healthy fats (36.24g), and essential minerals like calcium (266mg), magnesium (370mg), and iron (9.21mg), which support bone health, muscle function, and immunity. They also contain about 30%–36% oil, making them valuable for edible oil production. Mustard oil is widely used in cooking, particularly in Asia, and has potential health benefits, including anti-inflammatory and antimicrobial properties. Additionally, bioactive compounds like glucosinolates and isothiocyanates in mustard seeds have been studied for their possible anticancer effects. Beyond nutrition, mustard farming contributes to sustainable agriculture by improving soil fertility, preventing erosion, and reducing pesticide use through its natural pest-repellent properties. Given its nutritional value, diverse applications, and role in eco-friendly farming, the mustard seed market is expected to grow as consumers prioritize health and sustainability, influencing future agricultural trends and global market dynamics.

MARKET DRIVERS

Nutritional Value and Health Benefits

Mustard seeds are packed with essential nutrients that support overall health. According to the United States Department of Agriculture (USDA), a 100-gram serving of ground mustard seed provides about 508 calories, making it a good source of energy. These seeds contain 26.08 grams of protein, which helps in muscle growth and repair, and 36.24 grams of healthy fats, which support heart health. Mustard seeds also have 28.09 grams of carbohydrates, providing energy for daily activities. They are rich in important minerals like calcium (266 mg) for strong bones, magnesium (370 mg) for nerve function, phosphorus (828 mg) for cell repair, and potassium (738 mg) for maintaining blood pressure. Additionally, mustard seeds contain iron (9.21 mg), which supports oxygen transport in the body, and zinc (6.08 mg), which strengthens the immune system. The 12.2 grams of dietary fiber in mustard seeds help in digestion and promote a healthy gut. Due to this impressive nutritional profile, mustard seeds are considered an excellent addition to a balanced diet.

Role in Sustainable Agriculture

Mustard plants play an important role in environmentally friendly farming. The Food and Agriculture Organization (FAO) highlights that mustard plants belong to the Brassicaceae family, which helps improve soil health and fertility. They grow quickly and spread dense foliage, which covers the soil, preventing erosion and controlling unwanted weeds. The deep roots of mustard plants break up hard soil layers, allowing better water absorption and air circulation. Some mustard species naturally release biofumigant compounds, which help reduce harmful soil bacteria, fungi, and pests without the need for chemical pesticides. This natural pest control ability makes mustard an eco-friendly crop. Using mustard plants in crop rotation improves soil conditions and reduces the overuse of chemical fertilizers, making farming more sustainable. By growing mustard alongside other crops, farmers can protect their land while ensuring healthy crop yields.

MARKET RESTRAINTS

Impact of Climate Change on Mustard Seed Production

Climate change is making mustard seed farming more difficult, especially in countries like India, which is one of the largest producers. The Indian Agricultural Research Institute conducted studies using the InfoCrop mustard model, which estimated that mustard yields would reduce by 2% by 2020 and could decrease by up to 15% by 2080 if no changes are made in farming practices. Rising temperatures and irregular rainfall affect the growth cycle of mustard plants, leading to lower production. If farmers do not adopt climate-resistant mustard varieties or improved irrigation systems, they may struggle with declining yields in the future. These challenges highlight the urgent need for climate adaptation strategies in mustard farming to sustain production levels.

Allergenic Potential of Mustard Seeds

Mustard seeds are one of the top food allergens, especially in Europe. The European Food Safety Authority (EFSA) states that mustard allergies affect between 1% and 7% of food-sensitive individuals. The allergenic proteins in mustard are resistant to heat and digestion, meaning that even after processing, mustard allergens remain strong and can trigger allergic reactions. This makes it difficult for food industries to eliminate mustard allergens from products. To ensure consumer safety, the European Union has strict labeling laws, requiring food manufacturers to clearly state mustard as an ingredient on packaging. These regulations help consumers avoid exposure to mustard allergens but also create additional challenges for the food industry in terms of compliance and production adjustments.

MARKET OPPORTUNITIES

Potential for Biofuel Production

Mustard seeds are emerging as a promising raw material for biodiesel production. The National Commodity & Derivatives Exchange Limited (NCDEX) reports that mustard seeds have an oil content of 33% to 46%, with an average oil recovery rate of 32% to 38%. This high oil content makes mustard seeds a suitable choice for biofuel manufacturing, as they can produce large quantities of renewable energy. Countries looking to reduce their dependence on fossil fuels and lower carbon emissions could benefit from using mustard seed oil as an alternative energy source. Additionally, mustard plants grow well in dry and semi-arid climates, meaning they can be cultivated on lands that are not suitable for food crops. Incorporating mustard seed oil into biofuel production could improve energy security while supporting environmentally friendly energy solutions.

Pharmaceutical and Nutraceutical Applications

Mustard seeds are packed with health-boosting compounds that can be used in medicine and nutrition. According to WebMD, mustard seeds contain glucosinolates and isothiocyanates, which have antimicrobial and anti-inflammatory properties. These compounds help fight harmful bacteria and reduce inflammation, making them useful for pharmaceutical applications. Mustard seeds are also a rich source of polyunsaturated fatty acids, which help maintain heart health, and dietary fiber, which aids digestion. With more consumers preferring natural health products, the demand for mustard seed extracts in functional foods, dietary supplements, and herbal medicines is increasing. This shift presents a significant opportunity for the mustard seed market to expand into the nutraceutical and pharmaceutical industries, providing natural health solutions.

MARKET CHALLENGES

Fluctuating Raw Material Prices

The price of mustard seeds constantly changes due to weather conditions, inconsistent crop yields, and supply chain disruptions. For example, Investing.com reported that in India, extreme heat during the planting season led to lower mustard seed production. A decrease in supply raises the price of mustard seeds, making it more expensive for manufacturers to produce mustard-based products. Additionally, global trade policies and import-export restrictions can impact mustard seed availability and pricing. This uncertainty affects businesses and consumers, leading to higher costs for mustard oil and mustard-based condiments. To overcome this challenge, researchers and farmers are working to develop heat-resistant mustard varieties and improve agricultural practices to maintain stable production levels.

Competition from Alternative Edible Oils

Mustard oil competes with other widely used edible oils, such as sunflower oil, groundnut oil, and flaxseed oil. Many consumers prefer these alternatives due to their milder flavors, nutritional benefits, and established popularity. India imported 2.5 million tonnes of sunflower oil in 2019-2020, highlighting the growing preference for other oils. The high import volume of competing edible oils puts pressure on mustard oil producers to differentiate their products by improving quality, marketing health benefits, and offering competitive pricing. To maintain market share, mustard oil producers need to educate consumers on its unique health benefits, such as its high omega-3 fatty acid content and antimicrobial properties. They also need to focus on sustainable sourcing and innovative product offerings to attract health-conscious buyers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.96% |

|

Segments Covered |

By Type, Application, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Cargill, Dalmia Continental, ITC, Kamani Oil Industries, Kaveri Seeds, McCormick & Company, Megha Corporation Organic Products, Pure Mustard Oil Industries, and Sakai Spice |

SEGMENTAL ANALYSIS

By Type Insights

The white or yellow segment accounted for a notable share of the global market share in 2024. The mild flavor, affordability, and widespread use in condiments like mayonnaise, salad dressings, and sauces are fuelling the growth of the white or yellow segment in the global market. According to FAOSTAT, the U.S. produces over 160,000 metric tons annually, accounting for nearly 30% of global mustard production. Additionally, white mustard's adaptability to diverse climates and high yield averaging 2.5 tons per hectare (FAO) further cements its leadership.

The black mustard seeds segment is another major segment in the global market and is estimated to grow at the highest CAGR of 6.8% over the forecast period owing to the rising demand in India, where black mustard is a key ingredient in traditional cuisines and oil production. The Indian Ministry of Agriculture reports that mustard production reached 9.8 million metric tons in 2022, bolstered by government support through Minimum Support Prices (MSP). Black mustard’s higher oil content (38-42%) makes it critical for edible oil manufacturing, a sector growing at 7% annually globally (International Food Policy Research Institute). Its role in Ayurvedic medicine also contributes to demand, supported by WHO studies on herbal remedies, which project a 9.5% annual growth in traditional medicine markets by 2030.

By Application Insights

The industrial segment dominated the mustard seed market by accounting for 45.9% of the global market share in 2024. The growth of the industrial segment is driven by the mustard seeds' high oil content (38-42%) and their widespread use in edible oil production, particularly in South Asia. Additionally, the International Energy Agency highlights that biofuel production has increased by 9% annually over the past decade, driven by government mandates for renewable energy. For example, India’s National Biofuel Policy aims to achieve 20% ethanol blending by 2025, boosting demand for mustard-based biofuels.

The household segment is a promising segment and is anticipated to register the highest CAGR of 6.5% over the forecast period owing to the increasing consumer preference for natural, low-calorie condiments. The World Health Organization reports that global consumption of healthier condiments has risen by 7% annually, with mustard gaining popularity due to its nutritional profile—low in fat and calories. Furthermore, the U.S. Department of Agriculture notes that household spending on organic foods reached $57.5 billion in 2021, reflecting a shift toward healthier eating habits. Mustard's versatility in home cooking, coupled with its gluten-free properties, drives adoption. According to study, sales of gluten-free products have grown by 10% annually, supported by rising awareness of dietary restrictions. These trends underscore mustard’s growing importance in household kitchens globally.

By Sales Channel Insights

The indirect segment dominated the mustard seed market by capturing 61.6% of the global market share in 2024. The dominance of indirect segment in the global market is driven by the efficiency of intermediaries such as wholesalers, distributors, and retailers in reaching a wider consumer base. According to the Food and Agriculture Organization (FAO), over 70% of agricultural commodities globally are distributed through indirect channels due to their established logistics networks. The global food retail market, valued at $8.1 trillion in 2022, relies heavily on intermediaries for product distribution, as reported by Statista. Indirect sales ensure scalability, making it the preferred choice for bulk mustard seed transactions.

The direct sales channel segment is projected to showcase a CAGR of 7.1% over the forecast period owing to the rise of e-commerce platforms and farm-to-consumer initiatives. The U.S. Department of Agriculture reports that online grocery sales grew by 23% annually between 2020 and 2022, with direct sales benefiting significantly. Additionally, the International Trade Centre highlights that small-scale farmers using direct sales models have seen a 12-15% increase in profitability due to reduced intermediary costs. Consumers increasingly value transparency, with NielsenIQ reporting that 68% of global consumers prefer products with traceable sourcing. Direct sales empower farmers while aligning with consumer demand for sustainability and authenticity.

REGIONAL ANALYSIS

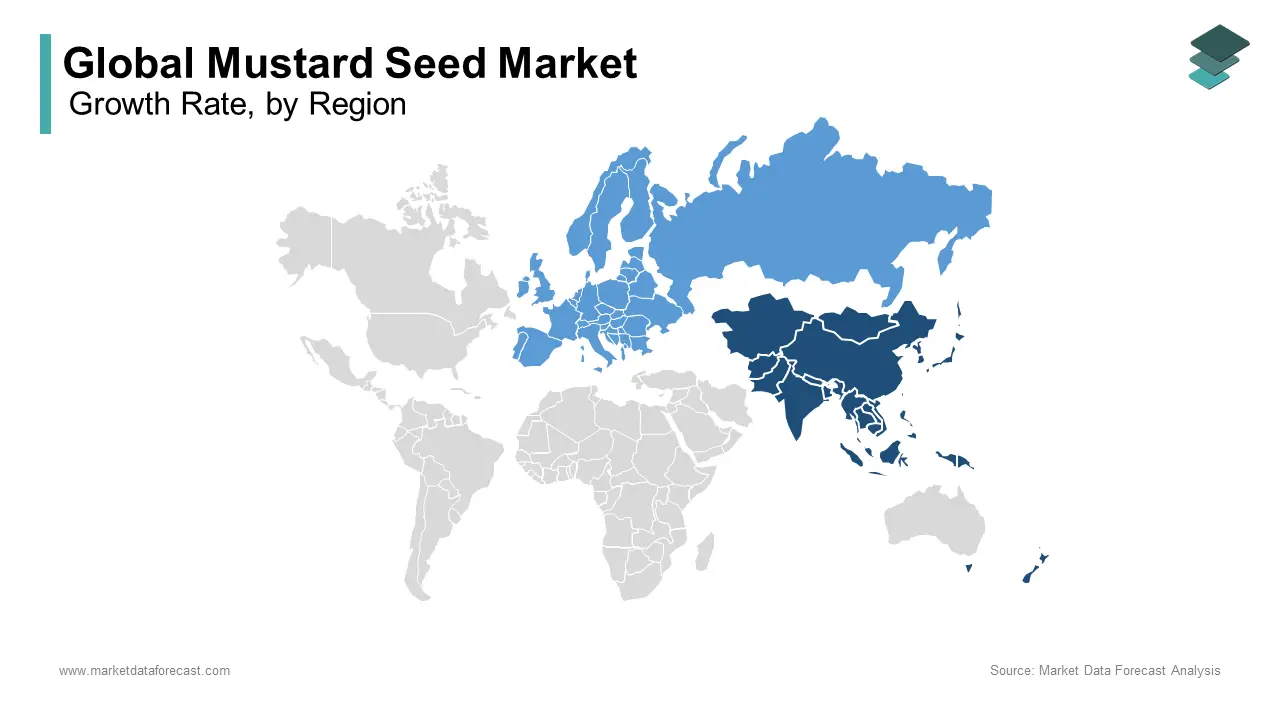

The Asia-Pacific region held the largest share of the global mustard seed market in 2024 due to the large-scale cultivation and widespread use of mustard seeds in countries like India and China. In India, mustard is one of the key oilseed crops, covering approximately 5.8 million hectares of farmland. The country produced around 6.3 million tonnes of mustard seeds during the 2014-2015 period, according to the Indian Council of Agricultural Research. The high demand for mustard oil in daily cooking, especially in India, makes it a staple in most households. Additionally, mustard is used in traditional medicines for its health benefits. Its importance in regional cuisines and alternative medicine makes Asia-Pacific the dominant region in the mustard seed market.

Europe is the fastest-growing region in the mustard seed market with an expected CAGR of 3.68% over the forecast period. The increasing demand for natural and organic food products is driving growth, particularly in France, Germany, and the United Kingdom. The European Food Safety Authority (EFSA) reports that more consumers are choosing mustard-based condiments because of their perceived health benefits and unique taste. The region’s strong food processing industry has contributed to the popularity of gourmet mustard varieties, such as Dijon mustard in France and wholegrain mustard in Germany. With a shift toward healthier eating habits and organic condiments, the mustard seed market in Europe is growing rapidly.

The mustard seed market in North America is expanding steadily. The United States is one of the key contributors, producing about 81.8 million pounds of mustard seeds in 2020, with an average yield of 895 pounds per acre, according to the Agricultural Marketing Resource Center. Meanwhile, Canada, another major player, harvested 218,600 hectares of mustard seeds in 2022, producing 161,781 tonnes, as per Statistics Canada. The demand for mustard seeds in North America comes from both culinary and industrial uses. Mustard is widely used in condiments like yellow mustard, which is a popular choice in American fast food, and in industrial applications, such as food preservation. With high production levels and diverse applications, North America remains a key market for mustard seeds.

The mustard seed market in Latin America is growing at a steady pace due to changing food preferences and the increasing use of mustard in local cuisines. While exact production figures for the region are not widely documented, the food processing industry is growing, and consumer interest in new flavors and condiments is increasing. Countries like Brazil and Mexico are witnessing a rise in the use of mustard-based products in cooking. This shift indicates that mustard is becoming a more popular ingredient in Latin American diets. As the demand for processed foods and international flavors continues to rise, the market for mustard seeds in Latin America is expected to grow in the coming years.

The Middle East and Africa region is also experiencing steady growth in the mustard seed market The increasing adoption of mustard in traditional Middle Eastern and African cuisines is one of the main reasons for this growth. Additionally, the food processing industry is expanding, leading to greater demand for mustard seeds in sauces, marinades, and packaged foods. With a growing population and evolving food habits, the demand for mustard seeds in this region is expected to continue increasing in the near future.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global mustard seed market include Archer Daniels Midland Company, Cargill, Dalmia Continental, ITC, Kamani Oil Industries, Kaveri Seeds, McCormick & Company, Megha Corporation Organic Products, Pure Mustard Oil Industries, and Sakai Spice

The mustard seed market is highly competitive, with both large multinational companies and smaller regional brands competing for market share. Leading companies such as McCormick & Company, Inc., Unilever (Colman’s), and Conagra Brands, Inc. (Gulden’s) dominate the industry due to their strong branding, wide distribution, and continuous innovation.

Several factors drive competition in this market, including pricing, product variety, global reach, and sustainability. Large companies use their scale to offer competitive pricing, while smaller brands focus on organic and specialty mustard varieties to attract niche consumers. Mergers and acquisitions also play a role, allowing companies to expand their product portfolios.

Regional competition is particularly strong in mustard-producing countries like Canada, India, and France. Government policies, trade restrictions, and fluctuating mustard production levels further influence market dynamics. With growing consumer interest in natural and organic mustard products, the competition is expected to increase, encouraging continuous product development and expansion efforts by major brands.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification

McCormick & Company, Inc. continuously drives product innovation by developing new mustard-based flavors and blends. With its extensive research and development (R&D) capabilities, the company ensures that it meets the evolving tastes of global consumers. By leveraging its expertise in spices and seasonings, McCormick integrates mustard seeds into innovative condiments, spice mixes, and sauces, expanding its consumer base.

Unilever, through its iconic Colman’s brand, focuses on diversifying its mustard offerings by introducing unique varieties such as Dijon, wholegrain, and English mustard blends. The company ensures that its mustard products align with modern culinary trends, incorporating premium and organic ingredients that appeal to health-conscious consumers.

Conagra Brands, Inc. leverages its well-established brand portfolio to expand its mustard product line. With brands like Gulden’s, Conagra introduces new mustard flavors and formulations to cater to regional preferences. Their commitment to innovation ensures they remain competitive in the condiment industry while maintaining consumer interest through product variety.

Emphasis on Health and Wellness

McCormick & Company, Inc. recognizes the increasing demand for natural and healthy food products. As mustard seeds are known for their anti-inflammatory and heart-health benefits, McCormick capitalizes on this by marketing its mustard-based condiments as a healthier alternative to synthetic or highly processed seasonings. The company focuses on using non-GMO, organic, and preservative-free mustard products to attract health-conscious consumers.

Unilever integrates its mustard products into its broader health and wellness initiatives. With an emphasis on reducing sodium and artificial additives, Unilever’s Colman’s mustard provides consumers with a natural and nutritious option. The company also invests in consumer education, promoting the health benefits of mustard through its digital and in-store marketing campaigns.

Conagra Brands, Inc. ensures that its mustard offerings align with the clean-label movement. By reducing artificial preservatives and focusing on natural ingredients, the company enhances its mustard products' appeal to consumers looking for healthier condiment choices. Their mustard-based products cater to both traditional and modern dietary preferences, including gluten-free and keto-friendly options.

Geographical Expansion and Market Penetration

McCormick & Company, Inc. continues its global expansion strategy by strengthening its distribution networks in emerging markets. With a growing demand for mustard-based condiments in Asia and Latin America, McCormick has increased its investments in local production facilities and partnerships with regional distributors. This expansion allows the company to cater to diverse consumer palates worldwide.

Unilever leverages its vast international presence to introduce mustard products into new markets. The company strategically launches mustard brands in regions where mustard consumption is growing, such as parts of Europe and North America. By tailoring its marketing approach and adjusting product flavors to suit local preferences, Unilever ensures a seamless expansion of its mustard product line.

Conagra Brands, Inc. focuses on strengthening its market penetration by enhancing retail partnerships and expanding its e-commerce presence. By collaborating with large retail chains and online grocery platforms, Conagra ensures that its mustard products reach a broader audience. This strategic approach allows them to gain a competitive advantage in both developed and emerging markets.

TOP 3 PLAYERS IN THE MARKET

McCormick & Company, Inc.

McCormick & Company, Inc. was founded in 1889 and is headquartered in Hunt Valley, Maryland. It is a global leader in the food and flavor, specializing in spices, seasoning mixes, and condiments. The company owns famous brands such as McCormick, French’s, Frank’s RedHot, Zatarain's, and Lawry's. McCormick’s products are sold in over 150 countries, catering to both home consumers and businesses. Their commitment to quality, innovation, and global reach has helped them become one of the most trusted names in the mustard seed market.

Unilever

Unilever is a British multinational company that produces consumer goods, including food and condiments. One of its most famous brands is Colman’s, which has been making mustard products since 1814. Colman’s mustard is widely recognized for its strong and unique flavor, making it a key part of Unilever’s mustard product range. The company's strong distribution network ensures that Colman’s mustard reaches customers across many countries, keeping it a popular choice for home and commercial use.

Conagra Brands, Inc.

Conagra Brands is a major packaged food company based in Chicago, Illinois. It produces a wide variety of food products, including condiments and sauces. One of its well-known mustard brands is Gulden’s, which has been a household favorite in the U.S. for over 100 years. Conagra focuses on quality and innovation, offering different mustard flavors to suit changing consumer tastes. Their ability to adapt and expand in the mustard seed market has helped them remain a strong competitor.

RECENT MARKET DEVELOPMENTS

- In January 2025, the Haryana State Cooperative Supply and Marketing Federation (HAFED) conducted an e-auction for the disposal of mustard seed procured during the Rabi Marketing Season (RMS) 2024. The auction was held on multiple platforms, including NeML, Star Agribazaar Technology Ltd. (Agribazaar), E-Tech, mjunction, and the HAFED portal.

- In July 2024, the Food Safety and Standards Authority of India (FSSAI) launched a provision for instant (Tatkal) issuance of licenses and registrations for certain categories of food businesses. This initiative aims to streamline the process for food business operators, including those dealing with mustard seed products.

- In October 2024, Stamp Seeds, a Canadian seed supplier, announced the availability of mustard seed pricing for the 2025 planting season. The company offered early pay discounts with a deadline of December 16, 2024. They also introduced new seed treatments, such as Buteo Start, to protect against flea beetles and cutworms, emphasizing the importance of early booking to ensure preferred choices.

MARKET SEGMENTATION

This research report on the global mustard seed market has been segmented and sub-segmented based on type, application, sales channel, and region.

By Type

- White or Yellow

- Black

- Sarepta

By Application

- Commercial

- Industrial

- Household

By Sales Channel

- Direct

- Indirect

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors drive the growth of the mustard seed market?

Factors such as increasing demand for organic and non-GMO mustard seeds, rising consumption of mustard-based products, and growing awareness of mustard’s health benefits drive market growth.

2. Who are the primary consumers of mustard seeds?

The primary consumers include the food and beverage industry, households, and the pharmaceutical and cosmetic industries for oil extraction and medicinal applications.

3. What are the major applications of mustard seeds?

Mustard seeds are used in condiments, cooking oils, spices, marinades, processed foods, and pharmaceuticals.

4. How is the mustard seed market expected to grow in the coming years?

The market is projected to grow steadily due to increasing health consciousness, expanding food processing industries, and rising demand for natural condiments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]