Global Municipal Solid Waste Management Market Research Report - Segmentation By Method (Recycling, Composting, Landfill and Incineration), By Source (Residential and Commercial), By Waste Type (Paper & Paperboard, Metal, Plastic, Food, Textile and Others) and By Region (North America, Europe, Asia Pacific, Latin America, & Middle East - Africa) – Industry Forecast 2024 to 2032.

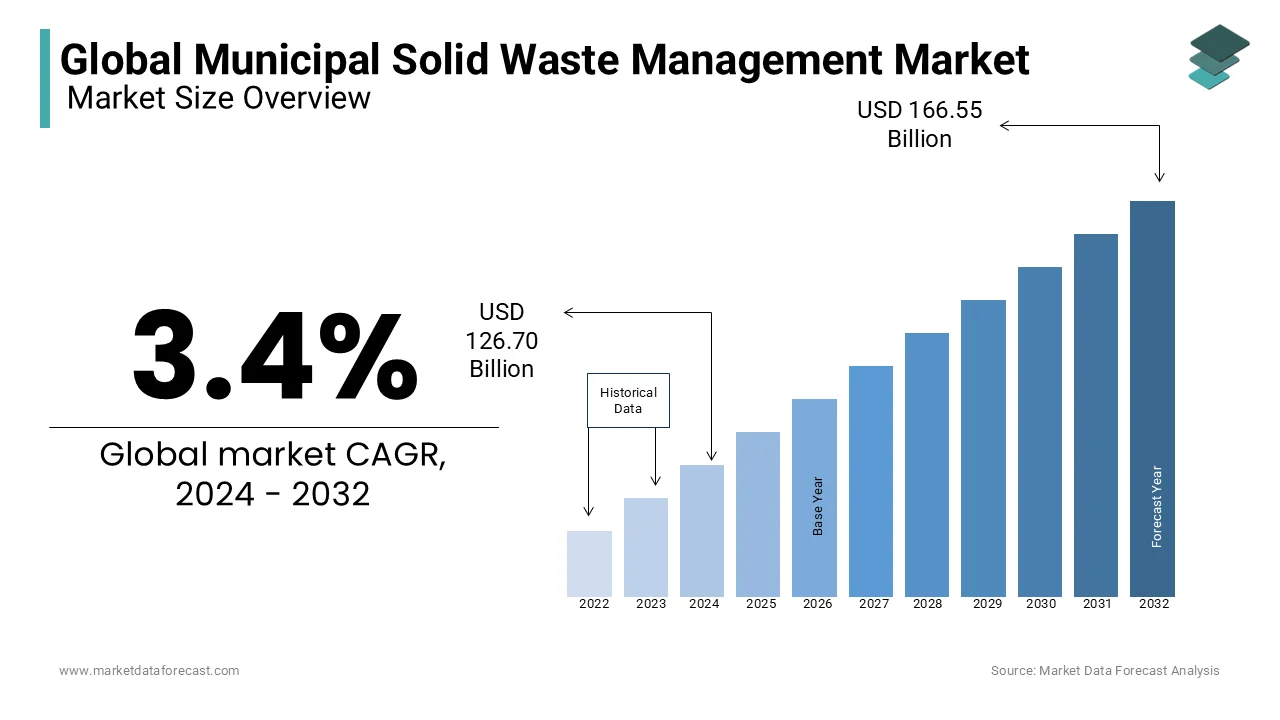

Global Municipal Solid Waste Management Market Size (2024 to 2032)

The size of the global municipal solid waste management market was worth USD 122.53 billion in 2023. The global market is anticipated to grow at a CAGR of 3.4% from 2024 to 2032 and be worth USD 166.55 billion by 2032 from USD 126.70 billion in 2024.

Current Scenario of the Global Municipal Solid Waste Management Market

Municipal solid waste, sometimes known as trash, garbage, or rubbish, is a sort of waste that consists primarily of everyday goods that are thrown by the general public. Municipal solid waste management (MSWM) entails the collection, recycling, and treatment of household and commercial solid waste in order to protect public health while also promoting economic growth. Solid garbage is accumulated and disposed of in landfills or incinerators in the majority of municipal solid waste management scenarios. The existing volume and weight of this rubbish will be reduced by 90% and 75%, respectively, if it is incinerated.

The expanding urbanization of the world's population has heightened worries about proper municipal solid waste management. However, widespread burning and landfilling are posing serious environmental risks around the world. As a result, governments are placing a greater emphasis on the implementation of various sustainable municipal solid waste management strategies, including recycling. The sorted garbage is then delivered to various reprocessing units, where it is efficiently converted into a variety of usable commodities. Over the projection period, ongoing resource recovery efforts will significantly boost municipal solid waste management market demand.

MARKET GROWTH

The need for municipal solid waste management is being driven by growth in the global population, fast urbanization, industrial boom, environmental effect, and an increase in the number of infrastructure-building activities around the world.

MARKET DRIVERS

Government initiatives to curb unlawful dumping are propelling the global municipal solid waste management market forward. Furthermore, the waste management industry is predicted to rise as more WTE incineration and recycling processes are adopted. The Resource Conservation and Recovery Act (RCRA) was enacted by the Environmental Protection Agency (EPA) with the goal of reducing open dumping and managing hazardous and non-hazardous waste. Additionally, population expansion and globalization have resulted in an increase in overall waste volume. The urban population generated over 1.3 billion tonnes of municipal solid waste (MSW) in 2012, which is expected to rise to 2.2 billion tonnes by 2025.

Furthermore, increased industrialization in developing economies like India, China, and Taiwan has resulted in the growth of chemical, oil and gas, automobile, and medical industries, all of which produce vast amounts of waste and contaminate the environment. Rising environmental consciousness about renewable waste management systems among people, as well as rising CO2 emissions globally, are likely to drive the waste management systems market forward. These factors are predicted to have a substantial impact on the global waste management market's growth.

MARKET RESTRAINTS

The market's expansion is projected to be hampered by the high cost of purchasing and operating waste management solutions. Furthermore, waste management is a labor-intensive industry that can consume a significant amount of money in wages. Similarly, trash transportation costs can eat up a significant portion of the budget, as they include the cost of collecting as well as transportation to landfills or recycling facilities. The cost recovery for trash services is highly dependent on income levels. As a result, the waste management market has become rather inflexible as a result of the expenditures made in the process, which has hampered market growth.

Due to the lockdown imposed by the coronavirus, trash production in the industrial and commercial sectors decreased dramatically, since factories and offices were partially or entirely shut down. Municipal waste, on the other hand, rose in residential neighborhoods. Furthermore, the decrease in new product production processes has resulted in a decrease in demand for recyclable materials like rubber and plastic. However, it is expected that the reopening of production facilities and the introduction of coronavirus vaccines will lead to the full-scale restart of waste management companies and the trash recycling industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.4% |

|

Segments Covered |

By Method, Source, Waste Type, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Biffa Plc, Clean Harbors, Inc., Covanta Holding Corporation, Daiseki Co. Ltd., Hitachi Zosen Corporation, Remondis Se & Co. Kg, Republic Services, Inc., Suez, Veolia Environnement, Waste Management Inc, and Others. |

SEGMENTAL ANALYSIS

Global Municipal Solid Waste Management Market Analysis By Method

Most developed economies are currently putting forth significant effort to increase their investments in regional recycling and composting business growth. Several other low-income countries, on the other hand, continue to rely on traditional landfill and incinerator procedures to dispose of municipal solid waste. Business trends have shifted toward sustainable techniques such as anaerobic digestion and recycling as a result of the implementation of severe sustainability regulations. This will have a significant impact on the global market outlook.

Global Municipal Solid Waste Management Market Analysis By Source

By 2026, the residential municipal solid waste management market is expected to surpass 2 billion tonnes (MT). Food scraps, product packaging, grass, newspapers, clippings, clothing, bottles, furniture, and appliances are all part of the current market trend. Typically, this waste comes from a variety of single and multi-family residential establishments. The spread of such businesses will have a substantial impact on municipal solid waste management statistics around the world.

Global Municipal Solid Waste Management Market Analysis By Waste Type

Government regulations aimed at discouraging the use of plastics have had a considerable impact on the use of paper and paperboard. The majority of these products are used as non-durable commodities or packaging materials. Newspapers, cups, paper plates, and tissue paper are examples of nondurable commodities. Containers and packaging, on the other hand, include items such as bags and sacks, milk cartons, and corrugated boxes. Paper and paperboards accounted for a significant portion of the global municipal solid waste management market in 2023. Because most of these wastes are easily recyclable, their application areas and market demand are expanding rapidly around the world.

REGIONAL ANALYSIS

The Asia Pacific area now dominates the worldwide municipal solid waste management industry, with a large number of projects underway due to the region's robust population growth. China and India are two of the region's leading nations, with governments that promote waste management regulations.

The regions that contribute the most to municipal waste are North America and Europe. The introduction of technological advances to effectively handle trash will boost market expansion in both areas.

During the projection period, Latin America, the Middle East, and Africa will all have a considerable share. The main reason for this is the region's developing economies, which have resulted in urbanization.

KEY PLAYERS IN THE GLOBAL MUNICIPAL SOLID WASTE MANAGEMENT MARKET

Companies playing a prominent role in the global municipal solid waste management market include Biffa Plc, Clean Harbors, Inc., Covanta Holding Corporation, Daiseki Co. Ltd., Hitachi Zosen Corporation, Remondis Se & Co. Kg, Republic Services, Inc., Suez, Veolia Environnement, Waste Management Inc, and Others.

RECENT HAPPENINGS IN THE GLOBAL MUNICIPAL SOLID WASTE MANAGEMENT MARKET

- At the Bharat Heavy Electricals Limited (BHEL) campus, a municipal solid waste combustor designed by the Indian Institute of Technology-Madras (IIT-M) was commissioned. The device, designed by researchers at IIT-National M's Centre for Combustion Research and Development (NCCRD), can handle up to one ton of MSW every day.

- In the Union Territory of Ladakh's Kargil district, a municipal solid waste management plant for trash conversion to energy, recycling, and composting will be built. The plant will be built at Kargil's Kurbathang. The solid waste treatment facility may separate solid waste into several components and turn it into useful products. The system is designed for handling dry, wet, and mixed garbage.

DETAILED SEGMENTATION OF THE GLOBAL MUNICIPAL SOLID WASTE MANAGEMENT MARKET IS INCLUDED IN THIS REPORT

This research report on the global municipal solid waste management market has been segmented and sub-segmented based on method, source, waste type and region.

By Method

- Recycling

- Composting

- Landfill

- Incineration

By Source

- Residential

- Commercial

By Waste Type

- Paper & Paperboard

- Metal

- Plastic

- Food

- Textile

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What can be the total Municipal Solid Waste Management market value?

The Global Municipal Solid Waste Management Market was worth USD 122.53 billion in 2023 and is anticipated to reach a valuation of USD 166.55 billion by 2032.

Mention the market which has the largest share in the Municipal Solid Waste Management market?

Asia Pacific region will have the largest market share of the global Municipal Solid Waste Management market.

At what rate is the Global Municipal Solid Waste Management market expected to grow?

The Global Municipal Solid Waste Management market is anticipated to grow with a CAGR of 3.4%.

What are the major driving factors in the global Municipal Solid Waste Management market?

Growth in global population, fast urbanisation, industrial boom, environmental effect, and an increase in the number of infrastructure-building activities are driving market growth.

What is the major source of municipal solid waste?

Most of the municipal solid waste is collected from residential apartments and complexes.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]