Global Multivitamins Market Size, Share, Trends & Growth Forecast Report Segmented By Application (Energy And Weight Management, General Health, Bone And Joint Health, Gastrointestinal Health, Immunity, Cardiac Health, Diabetes, Anti- Cancer, Others), Form, Distribution Channel, End User, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Multivitamins Market Size

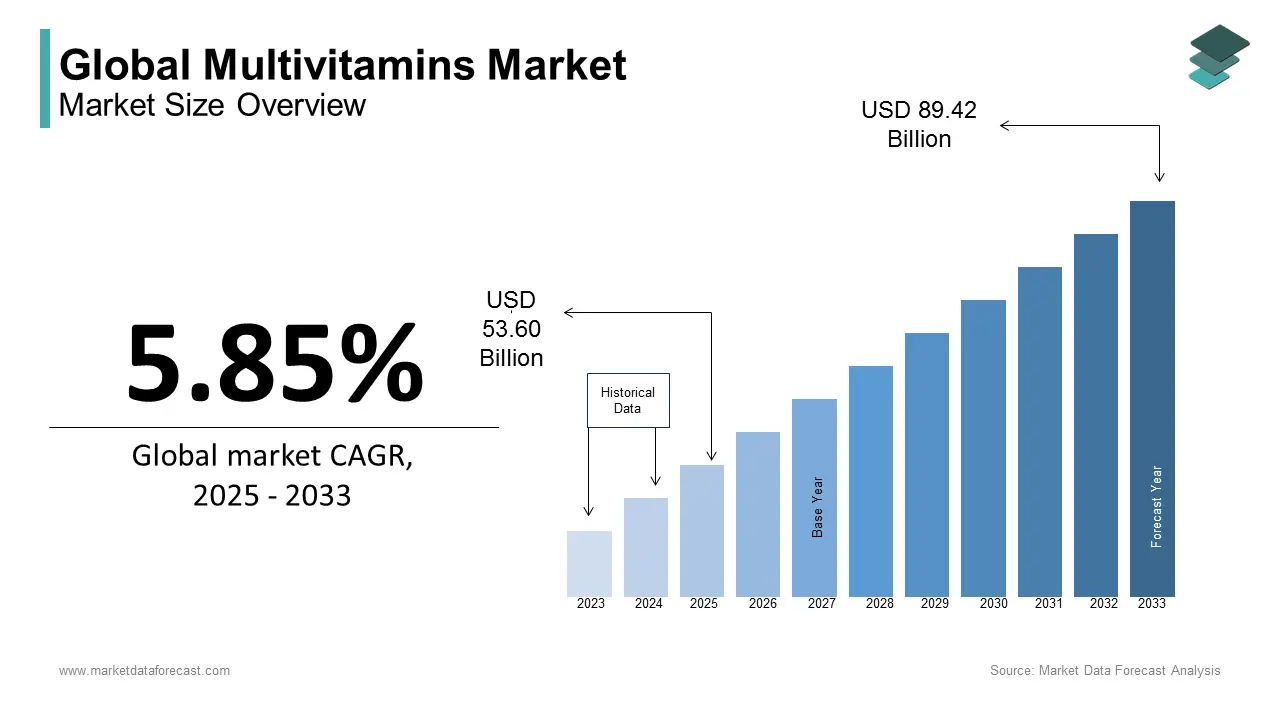

The global multivitamins market size was calculated to be USD 53.60 billion in 2024 and is anticipated to be worth USD 89.42 billion by 2033 from USD 56.74 billion In 2025, growing at a CAGR of 5.85% during the forecast period.

Multivitamins are dietary supplements focused on providing essential vitamins and minerals through combined formulations. These products are designed to bridge potential nutrient gaps in daily diets, contributing to overall health and wellness. Multivitamins typically include a variety of nutrients such as vitamin A, B-complex, C, D, E, and K, along with minerals like calcium, magnesium, and zinc, tailored to address specific health needs for various age groups and demographics.

The demand for multivitamins has significantly surged in recent years due to the increasing health-consciousness and rising awareness of preventive healthcare. This growth can be attributed to the increasing prevalence of chronic diseases, growing aging populations, and the rising trend of self-medication. Additionally, the COVID-19 pandemic has further bolstered the consumption of multivitamins as consumers increasingly prioritize immune health and preventive measures. For instance, a study by the Council for Responsible Nutrition found that 77% of American adults were taking dietary supplements in 2020, with multivitamins being the most popular choice. These trends underscore the robust potential and evolving dynamics of the multivitamins market in the coming years.

MARKET DRIVERS

One of the major drivers of the multivitamins market is the growing awareness of preventive healthcare. As individuals become more proactive about their health, multivitamins have emerged as a popular solution to fill nutritional gaps and support overall wellness. The U.S. National Institutes of Health (NIH) reports that over 70% of adults in the U.S. use dietary supplements, with multivitamins being among the most commonly consumed. This awareness is further fueled by increasing concerns regarding nutrient deficiencies, particularly in populations with limited access to balanced diets. According to the World Health Organization (WHO), deficiencies in vitamins and minerals are a global issue, affecting up to 2 billion people worldwide, thus driving the demand for multivitamins.

Another significant driver is the rising prevalence of chronic diseases and aging populations. Chronic conditions such as heart disease, diabetes, and osteoporosis are becoming more common, particularly among the elderly. The U.S. Centers for Disease Control and Prevention (CDC) notes that 6 in 10 adults have at least one chronic disease, which creates a higher demand for supplements that support health. As the global population ages, especially in regions like Europe and North America, the need for multivitamins to enhance immune function and mitigate age-related deficiencies is intensifying. The United Nations estimates that the proportion of people aged 60 and older will double by 2050, further boosting multivitamin consumption.

MARKET RESTRAINTS

A major restraint on the multivitamins market is the growing concern over the potential for overconsumption and toxicity. Excessive intake of certain vitamins, particularly fat-soluble ones like vitamins A, D, E, and K, can lead to toxicity, with detrimental health effects. The U.S. Food and Drug Administration (FDA) has set upper intake levels for several vitamins to prevent adverse effects. For instance, excessive vitamin A intake can cause liver damage and birth defects. According to the National Institutes of Health (NIH), around 3 million adults in the U.S. have experienced side effects from taking high doses of vitamins. Additionally, studies indicate that approximately 10% of adults have consumed more than the recommended daily intake of vitamins A and D, increasing the potential for toxicity. This growing awareness and caution surrounding vitamin overuse are limiting market growth, particularly in regions where self-prescribing and unregulated supplement use are common.

Another restraint is the increasing preference for natural or plant-based supplements over synthetic multivitamins. As consumers become more health-conscious and inclined toward organic products, the demand for synthetic multivitamins has faced challenges. The U.S. Department of Agriculture (USDA) reports that over 40% of consumers now prefer organic food, and the organic food market has grown by 10% annually over the past five years. Additionally, 61% of consumers are willing to pay more for products they perceive to be natural or free from synthetic additives, according to a study by the Organic Trade Association. As a result, multivitamin manufacturers must adapt by producing plant-based or organically certified supplements, which often come at a higher cost, further limiting market growth in some segments.

MARKET OPPORTUNITIES

A significant opportunity in the multivitamins market lies in the increasing demand for personalized nutrition. As consumers seek tailored health solutions, multivitamin formulations that address specific genetic, lifestyle, and health needs are gaining popularity. The National Institutes of Health (NIH) reports that the use of genetic testing to create personalized nutrition plans has risen by 40% over the past five years. Additionally, 30% of health-conscious consumers are now opting for personalized health products, according to a study by the American Dietetic Association (ADA). This trend is supported by advancements in biometric data, with nearly 25 million people in the U.S. alone having used some form of personalized health monitoring tools. This shift presents an opportunity for multivitamin manufacturers to innovate and offer customized products, tapping into a growing segment that values individualized health support.

The growing trend of online sales represents another major opportunity for the multivitamins market. As e-commerce continues to expand globally, more consumers are purchasing health and wellness products, including multivitamins, online. According to the U.S. Census Bureau, e-commerce sales in the United States reached approximately $870 billion in 2021, a 14.2% increase from the previous year. This shift has created a convenient purchasing channel for consumers, allowing multivitamin brands to reach a broader audience. The ability to easily compare products, read reviews, and access subscription models enhances customer engagement and provides a new avenue for growth in the multivitamin industry.

MARKET CHALLENGES

One of the major challenges faced by the multivitamins market is the lack of regulatory standardization across countries. While some governments have strict guidelines for supplement formulations, others have more lenient regulations, leading to disparities in quality and safety. The U.S. Food and Drug Administration (FDA) regulates multivitamin supplements under strict guidelines, requiring that over 50% of supplements undergo testing for safety and efficacy. However, this is not the case globally. The European Food Safety Authority (EFSA) enforces standards for the EU, but in regions like Africa and Southeast Asia, only 32% of countries have comprehensive regulations, leading to inconsistent product quality and potential safety concerns. These regulatory gaps contribute to 25% of market challenges, as companies face difficulties in complying with international standards, thereby hindering market growth.

Another challenge in the multivitamins market is the increasing concern regarding the effectiveness and scientific backing of multivitamin supplements. Several studies have cast doubt on the benefits of taking multivitamins for disease prevention, especially in healthy individuals. The National Institutes of Health (NIH) reports that while multivitamins can prevent deficiencies, only 39% of Americans take multivitamins for disease prevention, highlighting skepticism about their long-term benefits. A review by the U.S. Preventive Services Task Force suggests that multivitamins may not significantly impact the prevention of chronic diseases in healthy individuals, further reducing consumer confidence. This lack of consensus has led to 23% of supplement users opting for targeted, condition-specific vitamins rather than general multivitamin formulations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.85% |

|

Segments Covered |

By Application, Form, Distribution Channel, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Abbott Laboratories, Bayer AG, GlaxoSmithKline Plc, Nature's Bounty Co., Otsuka Holdings Co., Glanbia Plc, Usana Health Sciences Inc., Arkopharma, Nutramarks, and Pfizer Inc. |

SEGMENTAL ANALYSIS

By Application Insights

The general health segment commanded the multivitamins market by occupying the largest share of 35.3% in the global market in 2024. The growth of the general health segment is majorly propelled by the growing consumer focus on preventive healthcare and maintaining overall well-being. Moreover, the Centers for Disease Control and Prevention (CDC) highlights that over 50% of adults in developed countries use dietary supplements with multivitamins being the most popular choice for addressing nutritional gaps. Also, their importance lies in their accessibility, affordability, and versatility which is catering to a broad demographic seeking to enhance immunity, energy levels, and general vitality. This segment continues to play a pivotal role in shaping the global multivitamins market as awareness about the benefits of micronutrients grows

On the other hand, the immunity segment is projected to grow at a CAGR of 12.8% over the forecast period. The rapid growth of the immunity segment is fueled by increasing awareness about immune health, particularly post-pandemic, and the rising prevalence of respiratory illnesses globally. A report by the United Nations Children's Fund (UNICEF) notes that more than 60% of consumers now prioritize products that boost immunity, with multivitamins containing vitamin C, D, and zinc witnessing a 40% surge in demand since 2020. Additionally, aging populations and urban lifestyles have heightened susceptibility to infections and is further driving adoption. The segment’s alignment with preventive healthcare trends underscores its critical role in addressing public health challenges while offering significant growth opportunities for manufacturers.

By Form Insights

The tablets segment dominated the market by accounting for 42.6% of the global market share in 2024. The long-established preference for tablets due to their convenience, cost-effectiveness, and wide availability is majorly driving the tablets segment in the global market. Tablets are also considered highly stable, with longer shelf lives compared to other forms. The National Institutes of Health (NIH) reports that nearly 70% of U.S. adults regularly consume dietary supplements in tablet form, reflecting their strong preference. Their ease of storage and precise dosing also contribute to their popularity among consumers seeking reliable and standardized nutrition.

The gummies segment is progressing rapidly and is anticipated to witness a CAGR of 10.5% from 2025 to 2033. This growth is largely attributed to the increasing popularity of gummy vitamins among children and adults due to their appealing taste and chewable nature. According to the Centers for Disease Control and Prevention (CDC), approximately 13.7 million children in the U.S. are affected by obesity, which has spurred the increased use of gummy vitamins as a fun and accessible way to combat vitamin deficiencies. Additionally, the growing trend of wellness among millennials and Generation Z is propelling the demand for gummies, as they offer a more convenient and palatable alternative to traditional tablets and capsules.

By Distribution Channel Insights

The online sales segment is growing at a brisk pace and is expected to register a CAGR of 12.2% from 2025 to 2033. The shift toward e-commerce, especially during and after the COVID-19 pandemic, has greatly accelerated online shopping for health products, including multivitamins. A report by the U.S. Census Bureau shows a significant increase in e-commerce sales, which surged by over 30% in 2020 alone. The convenience of doorstep delivery, coupled with the ability to compare prices and read customer reviews, is driving consumers to prefer online platforms. This shift is expected to continue as digital penetration deepens across regions.

By End User Insights

The adults segment dominated the market by occupying a share of 52.4% in the global market in 2024. The dominance of adults segment in the global market is largely driven by the widespread use of multivitamins among adults to maintain overall health, prevent deficiencies, and manage chronic conditions. According to the National Institutes of Health (NIH), nearly 40% of U.S. adults regularly take multivitamins, reflecting their role in preventive health. The American Dietetic Association (ADA) indicates that one in three adults in the U.S. are at risk of vitamin D deficiency, leading to increased multivitamin consumption. Multivitamins are commonly used for immune support, energy maintenance, and to address age-related concerns, making the Adults segment the dominant force in driving multivitamin market growth.

The pregnant women segment of the multivitamin market is the rapidly expanding and is estimated to grow at a CAGR of 8.7% from 2025 to 2033. This growth is fueled by the increasing awareness of the importance of proper nutrition during pregnancy. According to the Centers for Disease Control and Prevention (CDC), up to 70% of pregnant women in the U.S. take prenatal vitamins to support fetal development, with folic acid reducing the risk of neural tube defects by up to 70%. Additionally, iron deficiency anemia affects approximately 25% of pregnant women globally, leading healthcare providers to recommend supplements to meet daily nutritional needs. This growing focus on maternal and fetal health has led to a steady rise in prenatal multivitamin consumption, contributing to the fast expansion of this market segment.

REGIONAL ANALYSIS

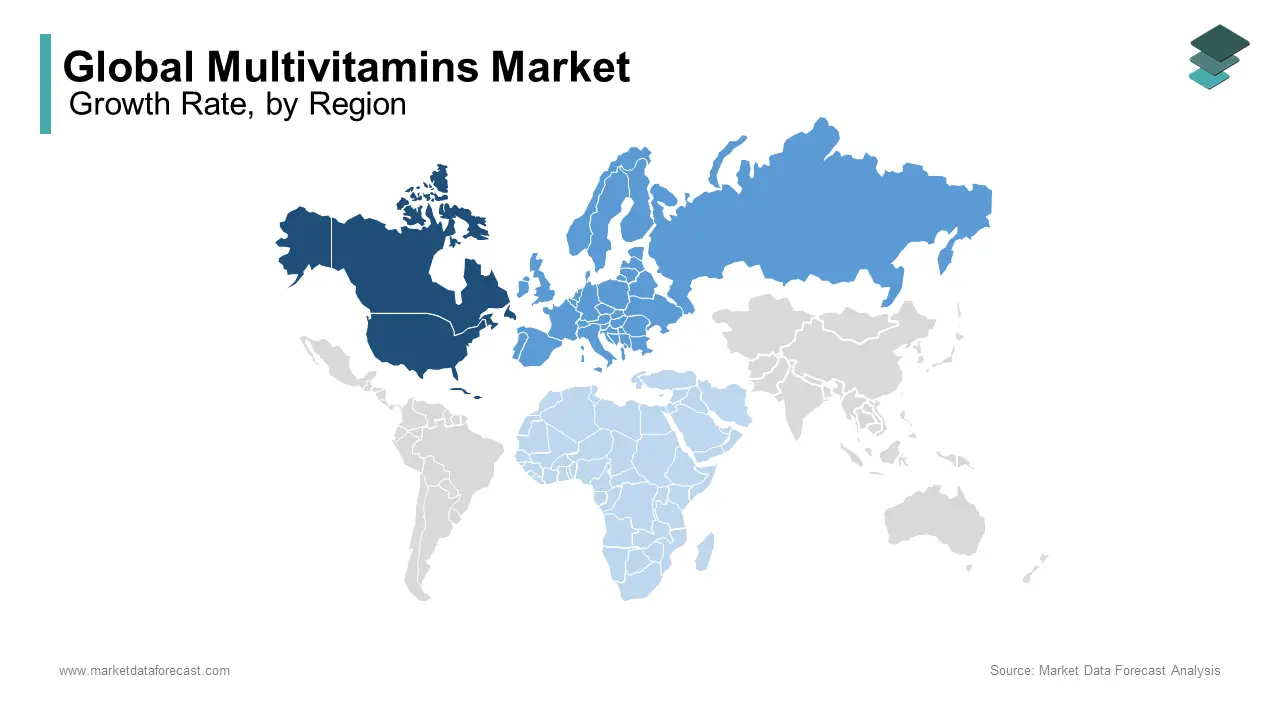

North America is currently the most dominating regional market for multivitamins worldwide and accounted for a significant share of 43.2% in the global market in 2024. This dominance can be attributed to the high levels of health consciousness and the widespread use of dietary supplements in the U.S. According to the National Institutes of Health (NIH), around 77% of U.S. adults take dietary supplements, with multivitamins being the most popular. Additionally, the region benefits from a strong retail infrastructure, including both online and offline channels, enabling easy access to multivitamins. As the aging population and prevalence of chronic diseases continue to rise, North America is expected to maintain its leading position.

The Asia-Pacific region is expected to grow at the fastest rate in the multivitamins market, with a projected CAGR of 10.5%. This growth is driven by an increasing awareness of health and wellness, particularly in countries like China and India. According to the World Health Organization (WHO), approximately 80% of the population in China and India now reports engaging in some form of health-related behavior, including the use of dietary supplements. The region also faces a significant rise in lifestyle-related diseases, with over 60 million people in India suffering from diabetes, prompting a surge in demand for preventive health products such as multivitamins. Additionally, the rising middle class, higher disposable income, and greater access to supplements are contributing factors.

In Europe, the multivitamin market is poised for steady growth, with a notable shift toward natural and organic products. The European Food Safety Authority (EFSA) reports that nearly 30% of European consumers prefer organic supplements over synthetic alternatives, particularly in countries like Germany and the UK. The demand for plant-based and personalized health solutions is rising, driven by an increasing focus on wellness. Additionally, over 20% of Europeans aged 65 and above are using dietary supplements regularly, with a notable rise in multivitamin consumption in countries with aging populations. This trend aligns with the region's growing awareness of preventive health and personalized nutrition.

In Latin America, the multivitamin market is expected to grow steadily, driven by increasing disposable income and greater awareness of preventive health. According to the World Health Organization (WHO), approximately 25% of adults in Latin America are affected by chronic diseases such as diabetes, which has created a demand for supplements aimed at managing these conditions. In countries like Brazil, the prevalence of obesity has risen by over 20% in the last decade, fueling interest in health and wellness products like multivitamins. The growing focus on lifestyle management and rising incomes in Mexico and Brazil are also key drivers of this market's growth.

The Middle East and Africa market is expected to grow at a slower pace. The region’s growth is driven by increasing health awareness, although challenges such as regulatory hurdles and access to supplements in rural areas remain. The World Health Organization (WHO) reports that approximately 40% of children under five years old in sub-Saharan Africa are stunted, primarily due to malnutrition, which has spurred demand for multivitamin supplementation. Furthermore, vitamin D deficiency is a common issue in the region, with an estimated 50-70% of the population affected, according to a study by the International Osteoporosis Foundation. As urbanization increases and income levels rise, the demand for multivitamins is likely to see gradual but steady growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global multivitamins market include Abbott Laboratories, Bayer AG, GlaxoSmithKline Plc, Nature's Bounty Co., Otsuka Holdings Co., Glanbia Plc, Usana Health Sciences Inc., Arkopharma, Nutramarks, and Pfizer Inc.

The competition in the global multivitamins market is intense with numerous well-established players vying for market share. Leading companies such as Nestlé, Herbalife Nutrition Ltd., DSM Nutritional Products, and Amway dominate the landscape, continuously expanding their product portfolios and introducing innovations to meet evolving consumer needs. These companies engage in constant product differentiation, focusing on specialized formulations for immunity, mental health, energy, and aging, often targeting specific consumer segments, such as athletes, the elderly, and health-conscious individuals.

Additionally, competition is driven by pricing strategies, distribution channels, and brand loyalty. Major players often leverage their extensive global distribution networks, including online retail platforms, health food stores, and pharmacies, to reach a broader audience. With increasing demand for organic, plant-based, and clean-label products, companies are shifting their strategies to offer natural alternatives, which adds another layer to the competitive dynamic.

The rise of direct-to-consumer brands and smaller niche players has also intensified competition. These emerging brands often differentiate themselves through personalized nutrition and subscription models, gaining traction among millennials and Gen Z consumers who prioritize wellness. Moreover, the ongoing trend of consumers becoming more knowledgeable about health supplements challenges companies to ensure their products are scientifically backed and safe, further escalating the competition within the multivitamins market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation: Leading companies continuously focus on innovating their product offerings to meet evolving consumer demands. This includes developing formulations that cater to specific health concerns, such as immunity, mental clarity, and aging, as well as introducing plant-based and organic alternatives to align with the growing preference for natural products. For instance, Nestlé has expanded its portfolio with specialized products under its Boost brand to target immunity and energy needs, while Herbalife Nutrition Ltd. offers personalized supplements tailored to individual health goals.

Strategic Partnerships and Acquisitions: Key players in the market often form partnerships with other organizations or acquire businesses to strengthen their product offerings and expand their consumer base. DSM Nutritional Products, for example, has collaborated with several global companies to provide high-quality vitamin solutions. Acquisitions also allow these players to diversify their product portfolios and enter new market segments. For instance, Nestlé’s acquisition of Atrium Innovations, a global leader in nutritional health, bolstered its position in the dietary supplement sector, especially in multivitamins.

Geographic Expansion: Expansion into emerging markets is another critical strategy to strengthen market presence. Companies like Herbalife focus on expanding their distribution networks in regions such as Asia-Pacific, where the demand for health supplements is growing rapidly. By leveraging their established direct-sales model and expanding their operations in high-growth regions, these companies can tap into untapped markets and increase their customer base.

TOP 3 PLAYERS IN THE MARKET

Nestle S.A., a leader in the global food and nutrition industry, is a major player in the multivitamin sector. The company’s Health Science division offers a wide range of dietary supplements, including multivitamins, to support overall health and wellness. Nestlé's well-established brands, such as Boost and One A Day, cater to a broad consumer base, focusing on products that target specific health concerns, such as immunity, heart health, and aging. Nestlé's global reach, coupled with its strong emphasis on research and development, positions it as a significant contributor to the multivitamin market. The company continuously innovates its product lines, offering tailored nutritional solutions that meet diverse consumer needs.

DSM Nutritional Products, a subsidiary of DSM, is another key player driving the growth of the multivitamins market. The company is a leading supplier of vitamins and other nutritional ingredients used in the production of multivitamin supplements. DSM's commitment to sustainability and scientific research has made it a crucial supplier to major brands worldwide. It collaborates with manufacturers to create high-quality multivitamins, leveraging its deep expertise in micronutrient solutions. DSM’s innovations in bioavailability, as well as its focus on clean label products, help it maintain a strong position in the multivitamin space. Their portfolio includes ingredients like vitamins A, D, E, and C, which are essential in multivitamin formulations.

Herbalife Nutrition Ltd. is another significant player known for its direct sales model and strong presence in the global multivitamins market. Herbalife provides a wide array of multivitamin and mineral supplements that target specific wellness goals, such as weight management, digestive health, and energy. The company has a loyal customer base and an extensive global distribution network, allowing it to reach millions of consumers across the world. Herbalife’s focus on personalized nutrition and the increasing trend toward wellness products in emerging markets has fueled its success. Its commitment to research and quality has earned it a solid reputation in the supplement industry.

RECENT MARKET DEVELOPMENTS

- In January 2025, Hildred Capital Management closed its latest institutional fund, Hildred Equity Partners III, raising $810 million. The firm plans to invest in small and midsize healthcare businesses, including sectors like commercial-stage pharmaceuticals and healthcare services.

- In July 2024, Blackstone agreed to sell Japanese supplement maker Alinamin Pharmaceutical to MBK Partners for approximately $2.2 billion.

MARKET SEGMENTATION

This research report on the global multivitamins market has been segmented and sub-segmented based on application, form, distribution channel, end user, and region.

By Application

- Energy and Weight Management

- General Health

- Bone and Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti- Cancer

- Others

By Form

- Tablets

- Capsules

- Powder

- Gummies

- Softgels

- Others

By Distribution Channel

- Online Sales

- Supermarkets and Hypermarkets

- Retail Pharmacies

- Others

By End User

- Adults

- Geriatric

- Pregnant Women

- Children

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Which factors contribute to the growth of the multivitamin market?

Increased health awareness, rising demand for immunity boosters, advancements in personalized nutrition, and e-commerce expansion are major growth drivers.

2. Who are the leading players in the multivitamins market?

Companies like Centrum, Nature Made, Garden of Life, and emerging direct-to-consumer brands are dominating the industry.

3. What impact has digitalization had on the multivitamin market?

Online sales, AI-driven personalized recommendations, and direct-to-consumer subscription models have reshaped the industry, making multivitamins more accessible.

4. How is consumer preference changing in the multivitamin market?

Consumers are shifting towards organic, non-GMO, sugar-free, and customized vitamin blends based on individual health needs.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]