Global Mountain and Ski Resorts Market Size, Share, Trends & Growth Forecast Report By Visitor (Individual Travelers, Families, Groups, Adventure Seekers ) By Service (Skiing and Snowboarding, Snowshoeing and Cross-country Skiing, Ice Skating, Snowmobiling, Après-ski and Nightlife ), By Age Group (Below 15 years, 16 to 25, 26 to 35, 36 to 45, 46 to 55, above 55 ), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Mountain and Ski Resorts Market Size

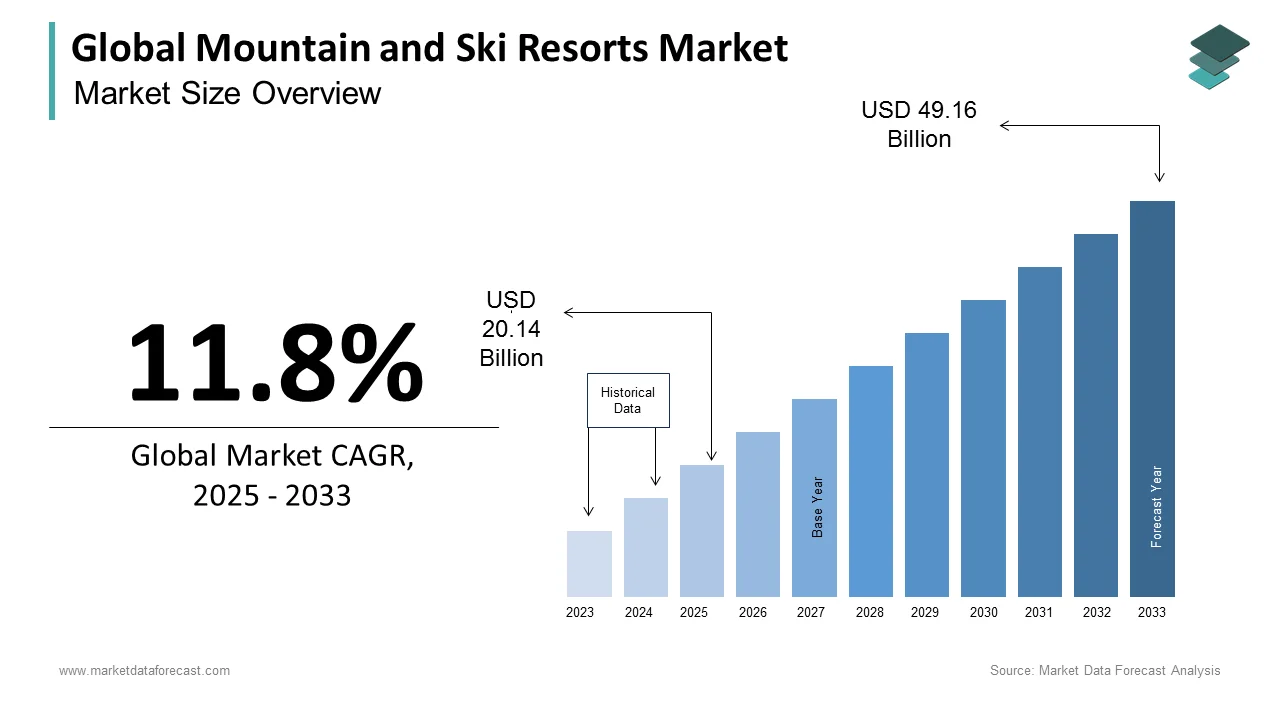

The size of the global mountain and ski resorts market was worth USD 18.01 billion in 2024. The global market is anticipated to grow at a CAGR of 11.8% from 2025 to 2033 and be worth USD 49.16 billion by 2033 from USD 20.14 billion in 2025.

The Mountain and Ski Resorts Market represents a dynamic and evolving segment within the global tourism and leisure industry. It encompasses a wide range of services and facilities, including ski slopes, mountain lodges, equipment rentals, and après-ski entertainment, catering to both winter sports enthusiasts and year-round adventure seekers. This market is characterized by its reliance on natural landscapes, seasonal demand, and the growing popularity of outdoor recreational activities. In recent years, the industry has witnessed significant transformation, driven by advancements in snowmaking technology, sustainability initiatives, and the diversification of offerings to attract a broader demographic.

According to recent data from the International Report on Snow and Mountain Tourism, the global ski resort market has experienced steady growth, with an estimated annual revenue exceeding $20 billion. The report highlights that Europe remains the largest market, accounting for over 40% of global ski visits, followed by North America and the Asia-Pacific region. The United States, France, and Austria are among the top-performing countries, with millions of skier visits recorded annually. Additionally, the rise of all-season resorts, which offer activities such as hiking, mountain biking, and wellness retreats, has expanded the market's appeal beyond traditional winter sports.

Despite its growth, the industry faces challenges, including the impact of climate change on snowfall patterns and the need for sustainable practices to preserve mountain ecosystems. However, innovative solutions, such as artificial snow production and eco-friendly infrastructure, are helping to mitigate these concerns. As consumer preferences shift towards experiential travel and outdoor adventures, the Mountain and Ski Resorts Market is poised for continued expansion, supported by strategic investments and evolving tourism trends.

MARKET DRIVERS

Growing Popularity of Winter Sports and Outdoor Activities

The increasing global interest in winter sports and outdoor recreational activities has significantly driven the Mountain and Ski Resorts Market. According to the Snowsports Industries America report, participation in skiing and snowboarding in the United States alone reached 10.5 million participants during the 2022-2023 season. This surge is attributed to heightened health consciousness and the desire for experiential travel post-pandemic. Additionally, the Winter Sports Foundation highlights that ski resorts in Europe recorded over 200 million skier visits annually, with countries like France and Austria leading the trend. The rise in demand for winter sports has prompted resorts to expand infrastructure, enhance safety measures, and introduce innovative offerings, further fueling market growth.

Technological Advancements in Snowmaking and Resort Operations

Technological innovations, particularly in snowmaking and resort management, have become a critical driver for the Mountain and Ski Resorts Market. The U.S. Geological Survey reports that artificial snowmaking now supports over 90% of ski resorts in North America, ensuring consistent snow coverage despite fluctuating weather conditions. In Europe, the Swiss Federal Institute for Forest, Snow, and Landscape Research states that advanced snowmaking systems have reduced reliance on natural snowfall by 40%, enabling longer ski seasons. These technologies not only improve operational efficiency but also enhance the guest experience, attracting more visitors. As resorts invest in sustainable snowmaking solutions, the market is witnessing increased resilience and growth.

MARKET RESTRAINTS

Impact of Climate Change on Snowfall Patterns

Climate change poses a significant threat to the mountain and ski resorts market, as rising temperatures and unpredictable weather patterns disrupt snowfall. The Intergovernmental Panel on Climate Change reports that global temperatures have increased by approximately 1.1°C since pre-industrial levels, leading to shorter winter seasons and reduced snow cover. In the United States, the Environmental Protection Agency notes that the average winter temperature has risen by 3°F over the past century, resulting in a 20% decline in snowpack in the western regions. Similarly, the European Environment Agency highlights that Alpine ski resorts could lose up to 70% of their snow cover by 2100 if emissions remain unchecked. These changes threaten the viability of ski resorts, particularly those at lower elevations.

High Operational Costs and Infrastructure Challenges

The Mountain and Ski Resorts Market faces substantial operational costs, including snowmaking, maintenance, and energy consumption. According to the U.S. Energy Information Administration, ski resorts in the United States spend an estimated $50 million annually on energy for snowmaking alone. In Europe, the Swiss Federal Office of Energy reports that energy costs account for nearly 30% of a resort's operational expenses. Additionally, the need for continuous infrastructure upgrades, such as lifts and lodges, further strains financial resources. These high costs are often passed on to consumers, making ski trips less accessible for some demographics. As a result, resorts must balance investment in quality experiences with affordability to remain competitive in the market.

MARKET OPPORTUNITIES

Expansion into All-Season Tourism and Diversified Offerings

The Mountain and Ski Resorts Market has a significant opportunity to expand into all-season tourism, attracting visitors year-round. According to the U.S. Travel Association, outdoor recreation contributes over $450 billion annually to the U.S. economy, with summer activities like hiking and mountain biking gaining popularity. In Europe, the European Travel Commission reports that 60% of ski resorts now offer summer activities, such as zip-lining and wellness retreats, to boost revenue. By diversifying offerings, resorts can reduce dependency on seasonal snowfall and appeal to a broader audience. This shift not only enhances revenue streams but also promotes sustainable tourism by utilizing existing infrastructure throughout the year, ensuring long-term growth and resilience.

Adoption of Sustainable Practices and Eco-Tourism Initiatives

Sustainability presents a major opportunity for the Mountain and Ski Resorts Market, as eco-conscious travelers increasingly prioritize environmentally friendly destinations. The United Nations World Tourism Organization highlights that 87% of global travelers want to travel sustainably. In response, resorts are investing in renewable energy, waste reduction, and carbon-neutral operations. For instance, the National Ski Areas Association reports that over 30% of U.S. ski resorts now use renewable energy sources, reducing their carbon footprint. Similarly, the Austrian Alpine Club states that eco-certified resorts in the Alps have seen a 25% increase in visitor numbers. By embracing sustainability, resorts can attract environmentally aware consumers, enhance their brand reputation, and contribute to the preservation of mountain ecosystems.

MARKET CHALLENGES

Dependence on Seasonal Revenue and Weather Variability

The Mountain and ski resorts arket faces a significant challenge due to its heavy reliance on seasonal revenue, which is highly susceptible to weather variability. The National Oceanic and Atmospheric Administration reports that unpredictable weather patterns, exacerbated by climate change, have led to a 20% decline in consistent snowfall in key U.S. ski regions over the past decade. Similarly, the Swiss Federal Office for the Environment highlights that Alpine ski resorts experienced a 30% reduction in snow depth during warmer winters in recent years. This variability disrupts operations, reduces visitor numbers, and creates financial instability for resorts, forcing them to invest heavily in snowmaking and other mitigation strategies to maintain profitability.

Rising Competition from Alternative Leisure Activities

The Mountain and Ski Resorts Market is increasingly challenged by competition from alternative leisure activities, such as indoor entertainment and international travel. According to the U.S. Bureau of Economic Analysis, spending on outdoor recreation grew by only 3% in 2022, while indoor entertainment sectors saw a 12% increase. Additionally, the World Tourism Organization notes that global international tourist arrivals reached 1.4 billion in 2022, with many travelers opting for warmer destinations over traditional ski vacations. This shift in consumer preferences has pressured ski resorts to innovate and diversify their offerings to remain competitive. Failure to adapt to these changing trends could result in declining visitor numbers and revenue losses for the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.8% |

|

Segments Covered |

By Service, Visitor, Age Group, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vail Resorts, Inc., Aspen Skiing Company, Jackson Hole Mountain Resort, Whistler Blackcomb Holdings Inc., The Alps Company, Intrawest Resorts Holdings, Inc., Boyne Resorts, The EoA Group, Alterra Mountain Company, Swiss Alpine Adventure, Les Trois Vallées, Taos Ski Valley, Inc., Sun Valley Resort, Telluride Ski & Golf, The Canyons Resort, Snowbird Ski and Summer Resort, Mammoth Mountain Ski Area, Stowe Mountain Resort, and Others. |

SEGMENT ANALYSIS

By Service Insights

The skiing and snowboarding segment dominates the mountain and ski resorts market, holding 70% of the market share, according to the International Report on Snow and Mountain Tourism. This segment leads due to its widespread popularity, cultural significance, and extensive infrastructure. In the U.S., the Snowsports Industries America states that these activities generate over $20 billion annually. Their importance lies in attracting millions of visitors, driving revenue for resorts, and supporting local economies. However, reliance on consistent snowfall, highlighted by the U.S. Environmental Protection Agency, remains a critical factor for sustained growth.

According to the Swiss Tourism Federation, the après-ski and nightlife segment is growing at a CAGR of 8.5%. This growth is fueled by increasing demand for experiential travel and luxury amenities. The National Ski Areas Association reports that 60% of skiers spend on après-ski activities, contributing significantly to resort revenue. Its importance lies in enhancing guest experiences and extending visitor stays, thereby boosting profitability. The European Travel Commission notes that resorts investing in vibrant nightlife and entertainment options are witnessing higher visitor retention rates, making this segment a key driver of market expansion.

By Visitor Insights

Individual travelers represent the largest segment in the global travel market, accounting for 60% of the market share (UNWTO, 2022). This dominance is driven by the growing trend of solo travel, particularly among millennials and Gen Z, who prioritize personalized experiences, flexibility, and self-discovery. The rise of digital platforms facilitating easy bookings and the availability of solo-friendly accommodations have further fueled this segment. Individual travelers contribute significantly to local economies, with global solo travel spending estimated at $1.4 trillion in 2022. Their preference for unique, immersive experiences makes them a key driver of tourism revenue worldwide.

Adventure seekers are the fastest-growing segment in the travel industry, with a CAGR of 17.4% (Grand View Research, 2023). This rapid growth is fueled by increasing demand for unique, experiential travel, particularly post-pandemic, as travelers seek outdoor and adrenaline-pumping activities. Younger generations, influenced by social media, are driving this trend, with adventure tourism projected to reach $1.6 trillion by 2030. Governments in adventure-centric destinations like New Zealand and Nepal are actively promoting this segment due to its economic impact, contributing 10-15% of GDP in such regions. The focus on sustainability and nature-based experiences further enhances its importance.

By Age Group Insights

The 26 to 35 years age group is the largest segment in the travel market, accounting for 40% of global travel spending (UNWTO, 2022). This dominance is driven by millennials, who prioritize experiential travel, cultural immersion, and adventure. With higher disposable income and a strong desire for unique experiences, this group fuels demand for personalized and sustainable travel options. Their spending power and preference for longer trips make them critical to the industry, contributing significantly to destinations and businesses worldwide.

The 16 to 25 years age group is the fastest-growing segment, with a CAGR of 12% (Grand View Research, 2023). This growth is fueled by Gen Z’s passion for travel, budget-friendly options, and social media-driven exploration. Platforms like Instagram and TikTok inspire young travelers to seek unique, shareable experiences. This segment’s increasing influence is reshaping the industry, with 45% of Gen Z prioritizing travel over other expenses (Expedia Group, 2023), making them a key driver of future travel trends.

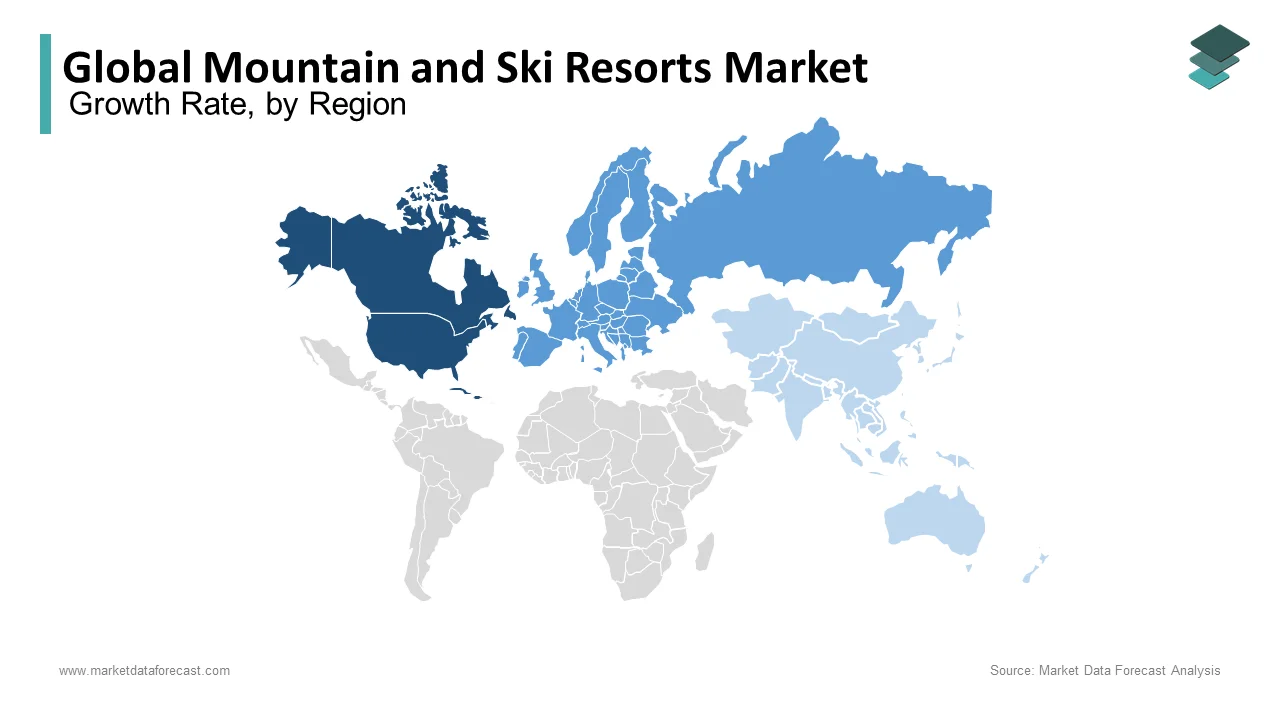

REGIONAL ANALYSIS

In North America, The United States leads with a 35% market share in the region, driven by world-class destinations like Colorado and Utah. The U.S. ski resort market is projected to grow at a CAGR of 4.5% (Grand View Research, 2023), fueled by high disposable income and a strong skiing culture.

In Europe, France dominates with a 30% market share, thanks to iconic resorts like Chamonix and Courchevel. The country’s ski industry is growing at a CAGR of 5.2% (Statista, 2023), supported by advanced infrastructure and proximity to key European markets.

Japan holds a 25% market share in Asia Pacific, with Hokkaido being a global skiing hotspot. The market is expanding at a CAGR of 6.8% (PwC, 2023), driven by increasing domestic and international tourism, particularly from Australia and Southeast Asia.

The Middle East and Africa cater to a niche market segment, focusing on luxury ski experiences in places like the UAE and Morocco.

Latin America mountain and ski resort market shares are slowly pacing up, with resorts in countries like Chile and Argentina offering unique skiing opportunities.

KEY MARKET PLAYERS

Companies playing a prominent role in the global mountain and ski resorts market include Vail Resorts, Inc., Aspen Skiing Company, Jackson Hole Mountain Resort, Whistler Blackcomb Holdings Inc., The Alps Company, Intrawest Resorts Holdings, Inc., Boyne Resorts, The EoA Group, Alterra Mountain Company, Swiss Alpine Adventure, Les Trois Vallées, Taos Ski Valley, Inc., Sun Valley Resort, Telluride Ski & Golf, The Canyons Resort, Snowbird Ski and Summer Resort, Mammoth Mountain Ski Area, Stowe Mountain Resort, and Others.

RECENT HAPPENINGS IN THE MARKET

- In 2021, Vail Resorts made significant strides in sustainability. They have set ambitious sustainability goals, including achieving zero net emissions by 2030 and zero waste to landfill by 2030. Vail Resorts also invests in energy-efficient snowmaking technology and supports renewable energy initiatives.

- In 2021, Aspen Skiing Company focus on reducing energy consumption, conserving water, and promoting sustainable transportation options. They are also a founding member of the Protect Our Winters (POW) alliance, which advocates for climate action in the outdoor sports industry.

MARKET SEGMENTATION

This global mountain and ski resorts market research report has been segmented and sub-segmented based on service, visitor, age group, and region.

By Service

- Skiing and Snowboarding

- Snowshoeing and Cross-country Skiing

- Ice Skating

- Snowmobiling

- Après-ski and Nightlife

By Visitor

- Individual Travelers

- Families

- Groups

- Adventure Seekers

By Age Group

- Below 15 years

- 16 to 25

- 26 to 35

- 36 to 45

- 46 to 55

- above 55

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the CAGR of the Mountain and Ski Resorts Market from 2025-2033?

The Mountain and Ski Resorts Market is expected to grow with a CAGR of 11.8% during the forecast period.

2. Which is the dominating region for the Mountain and Ski Resorts Market share?

North America region is currently dominating the Mountain and Ski Resorts Market share by region.

3. Which age group type is dominating the market for Mountain and Ski Resorts Market?

The "26 to 35" age group dominates the Mountain and Ski Resorts Market by age group type.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]